Intershop Communications AG Sponsored Research

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Watch Instructions

INSTRUCTIONS AND CARE INDEX 1 CLEANING YOUR WATCH 2 RESIZING YOUR STRAP MESH BAND ADJUSTMENT SIZING A LINK STRAP 3 SETTING YOUR WATCH STANDARD MOVEMENT ONE HAND MULTIFUNCTION CHRONOGRAPH CHRONOGRAPH RESET 3 HAND DAY AND DATE SOLAR POWERED WORLD TIME/ALARM AUTOMATIC WATCH CARE SKAGEN suggests the following solutions for cleaning metal and crystal surfaces: 3:1 SOLUTION OF AMMONIA-BASED WINDOW CLEANER TO WATER OR 4:1 SOLUTION OF RUBBING ALCOHOL TO WATER *Do not use soap products, as soap will leave residue behind when dry. These suggested solutions will evaporate cleanly from metal and glass surfaces. TO CLEAN THE CASE AND CRYSTAL Moisten a soft cloth with one of the above solutions. Gently wipe the case and crystal clean. Be careful not to put too much stress on the crystal as you clean. Avoid immersing or soaking the case or crystal portion of the watch, regardless of water-resistance rating. TO CLEAN THE BAND OR STRAP METAL Dip a cotton swab into one of the above solutions and gently rub it on the unclean area of the band. For more intricate mesh bands, you may want to use a soft-bristle toothbrush or nailbrush. Be sure to cover the case of the watch during this process so as not to soak it. For stubborn dirt, you may want to take your watch in to the nearest SKAGEN location. SILICON, FELT AND CERAMIC Simply wipe the strap down with a damp, soft cloth. Avoid soaps and solvents as they may damage the material. LEATHER Simply wipe it clean with a damp cloth, using water only. -

Finding the Right Fit for Your Payments Omnichannel Payments for Salesforce Commerce Cloud

Finding the right fit for your payments Omnichannel payments for Salesforce Commerce Cloud Adyen, the global payments technology company, has been Features a Salesforce Commerce Cloud partner since 2010, supporting Accept 250+ payment methods top retailers. Full PCI compliance coverage As a Commerce Cloud LINK Technology Partner, Adyen is fully Credit Card Installments certified and integrated into the Commerce Cloud Commerce Solution. With Adyen’s LINK cartridge, Commerce Cloud Credit Card 3D Secure merchants can easily integrate with the global Adyen platform, Order details linked to Adyen platform and turn on payments anywhere in the world. Our team of payments experts has years of experience supporting retailers Refund in the Adyen backoffice as they’ve expanded into new markets and optimized in existing ones. Adyen integration benefits Adyen works with these Salesforce Commerce Cloud retailers As the only payments company in both the United States and Europe to have an integration with Commerce Cloud's Digital Store Solution (DSS), we provide a true global omnichannel solution that is simple and easy to implement. We develop, maintain, and support our platform, which means that we provide you regular new features and a rapid response to questions, while cutting out the complication of third parties. www.adyen.com “When expanding internationally, in order to maximize your customer reach in local markets and optimize their payment experience, you need to offer the preferred payment methods….Our overall authorization rate improved by 20% since we started with Adyen.” Martijn van Egmond, ecommerce manager at O'Neill Commerce Cloud users that work with Adyen can take advantage of: • A/B test your pages to compare what’s working and what’s • Adyen’s updated LINK cartridge developed in partnership with not on your payment pages. -

E-Commerce Business Models and Concepts

CHAPTER 2 E-commerce Business Models and Concepts LEARNING OBJECTIVES After reading this chapter, you will be able to: ■■ Identify the key components of e-commerce business models. ■■ Describe the major B2C business models. ■■ Describe the major B2B business models. ■■ Understand key business concepts and strategies applicable to e-commerce. Tweet Tweet: Twitter’s Business Model witter, the social network phenomenon based on 140-character text mes- Tsages, continues in the long tradition of Internet developments that appear to spring out of nowhere and take the world by storm. Twitter provides a platform for users to express themselves by creating content and sharing it with followers, who sign up to receive “tweets.” Twitter began as a Web-based version of popular text messaging ser- vices provided by cell phone carriers. The basic idea was to marry short text messaging on cell phones with the Web © Kennedy Photography / Alamy and its ability to create social groups. You start by establishing a Twitter account online. By typing a short message called a tweet online or to a code on your cell phone (40404), you can tell your followers what you are doing, your location, or whatever else you might want to say. You are limited to 140 characters, but there is no installation required and no charge. Coming up with solid numbers for Twitter is not easy. By 2013, Twitter had an esti- mated 550 million registered users worldwide, although it is not clear how many continue to actively use the service after signing up. According to Twitter itself, it had 200 million “active” users worldwide as of July 2013. -

2016 11 03 Intershop Communications AG

18 January 2017 Intershop Communications AG FIRST BERLIN Equity Research 18 Int Intershop Communications AG er RATING ADD GERMANY / Technology Reinitiation of Primary Exchange: Frankfurt PRICE TARGET €1.25 Bloomberg: ISH2 GR Coverage Return Potential 9.6% ISIN: DE000A0EPUH1 Risk Rating High RIDING THE B2B DIGITALISATION WAVE IN THE WHOLESALE SECTOR Karsten von Blumenthal, Tel. +49 (0)30 - 80 93 96 85 Intershop Communications AG is restructuring its operations to increase COMPANY PROFILE its efficiency, and regain growth momentum. The “Lighthouse 2020” plan Intershop is a leading independent provider of sets a 2020 revenue target of €50m at a 5% EBIT margin. I nvestments in omni-channel commerce solutions offering sales & marketing, a focus on t he wholesale sector, where digitalisation of high-performance packaged software for internet sales. The company also acts as a sales channels is a top priority, and a cooperation with Microsoft in the business process outsourcing provider, cloud business look set to increase revenues and margins from 2017E on. covering all aspects of online retailing. The We reinitiate coverage with an Add rating and a €1.25 price target. company has over 300 customers worldwide including HP, BMW, and Deutsche Telekom. Riding the B2B digitalisation wave in the wholesale sector Quick and professional digitalisation of sales channels is vital for wholesalers so that they can remain competitive and prevent themselves from being circumvented by MARKET DATA As of 1/17/2017 manufacturers’ own sale s channels. High scope for further digitalisation and Closing Price € 1.14 Intershop’s existing strong competitive position make the wholesale sector a Shares outstanding 31.68m natural focus for Intershop. -

Boston San Francisco Munich London

Internet & Digital Media Monthly August 2018 BOB LOCKWOOD JERRY DARKO Managing Director Senior Vice President +1.617.624.7010 +1.415.616.8002 [email protected] [email protected] BOSTON SAN FRANCISCO HARALD MAEHRLE LAURA MADDISON Managing Director Senior Vice President +49.892.323.7720 +44.203.798.5600 [email protected] [email protected] MUNICH LONDON INVESTMENT BANKING Raymond James & Associates, Inc. member New York Stock Exchange/SIPC. Internet & Digital Media Monthly TECHNOLOGY & SERVICES INVESTMENT BANKING GROUP OVERVIEW Deep & Experienced Tech Team Business Model Coverage Internet / Digital Media + More Than 75 Investment Banking Professionals Globally Software / SaaS + 11 Senior Equity Research Technology-Enabled Solutions Analysts Transaction Processing + 7 Equity Capital Markets Professionals Data / Information Services Systems | Semiconductors | Hardware + 8 Global Offices BPO / IT Services Extensive Transaction Experience Domain Coverage Vertical Coverage Accounting / Financial B2B + More than 160 M&A and private placement transactions with an Digital Media Communications aggregate deal value of exceeding $25 billion since 2012 E-Commerce Consumer HCM Education / Non-Profit + More than 100 public equities transactions raising more than Marketing Tech / Services Financial $10 billion since 2012 Supply Chain Real Estate . Internet Equity Research: Top-Ranked Research Team Covering 25+ Companies . Software / Other Equity Research: 4 Analysts Covering 40+ Companies RAYMOND JAMES / INVESTMENT BANKING OVERVIEW . Full-service firm with investment banking, equity research, institutional sales & trading and asset management – Founded in 1962; public since 1983 (NYSE: RJF) – $6.4 billion in FY 2017 revenue; equity market capitalization of approximately $14.0 billion – Stable and well-capitalized platform; over 110 consecutive quarters of profitability . -

Transforming Retail How the Cloud Supports Innovation at Sleepy’S, Pacsun and Crocs

AN RIS NEWS WHITEPAPER Transforming Retail How the Cloud Supports Innovation at Sleepy’s, PacSun and Crocs The consumerization of technology is having a To achieve these goals retailers have to dramatic impact on retail as consumers adopt overcome several challenges. One of digital devices as fast as they become available which are the problems caused by aging ranging from smart devices to self-empowered technology frameworks that were built shopping tools, such as in-store kiosks and in silos with many complex integration handheld digital devices. These web-based schemes. These silos are difficult to solutions allow shoppers to interact with their manage, maintain and upgrade and are a favorite brands at any time of the day and from choke point that paralyze retailers seeking anywhere there is a network connection. to add new solutions to meet consumer and competitive demands. To respond, retailers need to deliver a seamless and convenient shopping experience With a true cloud platform, retailers are across all channels. They must also nurture continuously optimized for the latest close relationships with shoppers that result in commerce features and consumer trends. deeper and more profitable engagements. PRODUCED BY RIS_Demadnware_wp_0514_Design2.indd 1 5/29/14 2:50 PM Transforming Retail CASE STUDY: Sleepy’s A good case in point is Sleepy’s, the largest mattress retailer in the country operating more than 900 locations and an eCommerce website. Sleepy’s had been using an on-premise eCommerce platform that became too difficult and costly to manage, especially as it tried to introduce consumer-facing upgrades necessary to support growth. -

Intershop at a Glance

Intershop Communications AG Sponsored Research Germany | Software & Computer Services Investment Research Company Flash Note Reason: Company results (post view) 2 August 2018 Accumulate Transition to the cloud takes its toll earlier than expected Recommendation unchanged Share price: EUR 1.75 Intershop cut its FY 2018 guidance due to lower than expected license closing price as of 01/08/2018 revenues. Although a decline in license revenues has been expected in light Target price: EUR 1.85 Target Price unchanged of the shift from an on-premise software provider to a cloud provider, the shift occurred sooner than initially expected. Also, the contract of board member Upside/Downside Potential 5.7% Mr Axel Köhler has not been extended. The cloud product seems to be Reuters/Bloomberg ISHG.DE/ISH2 GY accepted well, H1 order intake increasing by 214% yoy. We expect Market capitalisation (EURm) 61 accelerating momentum in the cloud / subscription business during the Current N° of shares (m) 35 second half of the year. We adjusted our forecasts for FY 2018, but leave our Free float 62% target price of EUR 1.85 and Accumulate rating unchanged. Daily avg. no. trad. sh. 12 mth 21 Daily avg. trad. vol. 12 mth (m) 19.21 Price high/low 12 months 1.54 / 2.23 Abs Perfs 1/3/12 mths (%) 5.74/0.29/2.58 After Q1 license revenues already declined by c. 60%, Intershop again faced Key financials (EUR) 12/17 12/18e 12/19e declining demand for its on-premise offering in Q2. Therefore, it has become Sales (m) 36 34 40 increasingly difficult to achieve its FY 2018 targets. -

Salesforce.Com, Inc. (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) x Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended January 31, 2017 OR ¨ Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Commission File Number: 001-32224 salesforce.com, inc. (Exact name of registrant as specified in its charter) Delaware 94-3320693 (State or other jurisdiction of (IRS Employer incorporation or organization) Identification No.) The Landmark @ One Market, Suite 300 San Francisco, California 94105 (Address of principal executive offices) Telephone Number (415) 901-7000 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, par value $0.001 per share New York Stock Exchange, Inc. Securities registered pursuant to section 12(g) of the Act: Not applicable Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨ Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of Act. Yes ¨ No ý Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes ý No ¨ Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). -

Hollywood, FL APRIL 4 – 6, 2016

APRIL 11, 2016 Hollywood, FL APRIL 4 – 6, 2016 This weeK, the FuNg Global Retail & TechNology team atteNded the Demandware XChange ’16 Conference in Hollywood, Florida. The annual show has become a techNology aNd cultural pheNomeNoN, growiNg every year aNd attractiNg capacity crowds. It brings together leadiNg retailers, iNNovative techNology compaNies, partNers and employees. This year, the emphasis was oN how to leverage uNified commerce to drive growth and transformation without disruption. DemaNdware, the iNdustry-leading provider of eNterprise cloud commerce solutioNs, now operates over 1,500 digital commerce sites for 331 customers aNd over 400 millioN shoppers worldwide. DemaNdware Commerce solutioNs supported 92 orders each secoNd this past holiday seasoN. Below, we recap the show, highlighting some of the excitiNg thiNgs we saw aNd heard. PREDICTIVE RECOMMENDATIONS Retailers looking to Keep up with consumer demand for individualized and seamless customer experiences have a New techNology optioN to coNsider. Demandware’s predictive recommendations and email intelligence technology is changing the relatioNship betweeN customer aNd braNd. The platform leverages data scieNce to deliver product recommendations that create personalized site experiences, while the predictive intelligence engine worKs with a retailer’s existing email solution to choose the optimal coNteNt for each email recipient. DEBORAH WEINSWIG, MANAGING DIRECTOR, FUNG GLOBAL RETAIL & TECHNOLOGY [email protected] US: 917 .655.6790 HK: 852.6119.1779 CN: 86.186.1420.3016 1 Copyright © 2016 The Fung Group. All rights reserved. APRIL 11, 2016 In additioN, Newly introduced merchaNdising eNhaNcemeNts eNable retailers to drag and drop products withiN category grids and provide advanced search and filter capabilities withiN products aNd categories. -

Democratization of Retail Anytime

INDUSTRY REPORT Democratization of Retail Anytime. Anywhere. Unified. Several disruptive forces are at work globally — fostering a new-age consumerism that is participative, fragmented and personal. The impact on retail is far reaching as the lines between commerce and engagement continue to blur, obliterating conventional practices and forcing retailers out of their comfort zone. Research Partners EKN 2 Democratization of Retail: With seemingly unlimited access, knowledge and power, connected consumers dictate and control the terms of retailer engagement. In this distributed, disruptive and democratized operating environment, retailers must effectively extend their unique brand experience beyond their physical and virtual four walls to wherever and whenever consumers demand. EKN 10 From desktop to mobile, social media to call centers, stores to search, messaging platforms to catalogs, marketplaces to shared economy applications, consumers have a wider selection of retail channels and business models than ever before. This proliferation of consumer choice, combined with the following trends, is reshaping retail. Consumers: Are Increasingly Value-Conscious driven by an expanding middle class in a still-recovering, new-normal global economy Inhabit a Portable, Digital World driven by ubiquitous high-speed, wireless Internet and high smartphone penetration Crave Immediacy and Instant Gratification driven by greater smartphone adoption, the associated app economy, one-click shopping, and next-day delivery experiences Seek Stronger Self-Expression -

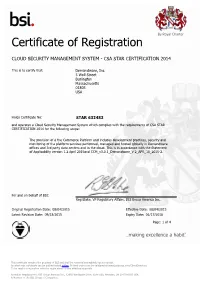

Certificate of Registration

Certificate of Registration CLOUD SECURITY MANAGEMENT SYSTEM - CSA STAR CERTIFICATION 2014 This is to certify that: Demandware, Inc. 5 Wall Street Burlington Massachusetts 01803 USA Holds Certificate No: STAR 632483 and operates a Cloud Security Management System which complies with the requirements of CSA STAR CERTIFICATION 2014 for the following scope: The provision of a the Commerce Platform and includes development practices, security and monitoring of the platform services performed, managed and hosted globally in Demandware offices and 3rd party data centers and in the cloud. This is in accordance with the Statement of Applicability version 1.2 April 2015and CCM_v3.0.1_Demandware_V 2_APR_10_2015-2. For and on behalf of BSI: Reg Blake, VP Regulatory Affairs, BSI Group America Inc. Original Registration Date: 08/04/2015 Effective Date: 08/04/2015 Latest Revision Date: 09/23/2015 Expiry Date: 06/17/2018 Page: 1 of 4 This certificate remains the property of BSI and shall be returned immediately upon request. An electronic certificate can be authenticated online. Printed copies can be validated at www.bsigroup.com/ClientDirectory To be read in conjunction with the scope above or the attached appendix. Americas Headquarters: BSI Group America Inc., 12950 Worldgate Drive, Suite 800, Herndon, VA 20170-6007 USA A Member of the BSI Group of Companies. Certificate No: STAR 632483 Location Registered Activities Demandware, Inc. The provision of a the Commerce Platform and includes 5 Wall Street development practices, security and monitoring of the Burlington platform services performed, managed and hosted globally in Massachusetts Demandware offices and 3rd party data centers and in the cloud. -

Developing Ecommerce Market Entry Strategies in Asia Pacific Advisory Report 2015 2 Developing Ecommerce Market Entry Strategies in Asia Pacific, Advisory Report 2015

Developing eCommerce Market Entry Strategies in Asia Pacific Advisory Report 2015 2 Developing eCommerce Market Entry Strategies in Asia Pacific, Advisory Report 2015 CONTENT FOREWORD 4 1 SNAPSHOT OF ECOMMERCE IN ASIA PACIFIC 5 2 KEY CHARACTERISTICS OF THE ASIA PACIFIC ECOMMERCE LANDSCAPE 9 2.1 Growing Internet Penetration Across All Markets 10 2.2 Growing Consumer Spending 11 2.3 Social Media a Driver for eCommerce 11 2.4 Mobile is Massive 13 2.5 Changing Trends in eCommerce Payment Solutions 14 2.6 Marketplaces Play a Dominant Role 15 2.7 Cross-Border Trade in the Region 15 3 HOW TO TAKE YOUR ECOMMERCE BUSINESS INTO ASIA PACIFIC 17 3.1 Planning and Strategizing Your Market Entry 18 3.2 Market Entry Strategies for eCommerce in Asia Pacific 19 4 ECOMMERCE BEST PRACTICES 22 5 CHOOSING AN ECOMMERCE SOLUTION AND PARTNER 25 5.1 Building Your eCommerce Digital Backbone 26 5.2 Leveraging Regional Expertise and a Strong End-to-End Partner 27 CONCLUSION 28 3 Developing eCommerce Market Entry Strategies in Asia Pacific, Advisory Report 2015 FOREWORD This report is a result of the collaborative strengths of two eCommerce leaders in Asia Pacific: Demandware, the category defining leader of enterprise cloud commerce solutions, empowers the world’s leading retailers to continuously innovate in our complex, consumer-driven world; and SingPost eCommerce, Asia Pacific’s leading full service eCommerce enabler, providing full service eCommerce solutions for global brands. The purpose of this report is to provide key insights and present the latest research findings on eCommerce in APAC, highlighting the region’s potential as well as the unique challenges present in its individual countries.