THE ART MARKET in 2012 - a Dialogue Between East and West

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2020 Digital Catalog

CAP’S MISSION We support and empower all people living with or affected by HIV, reduce stigma, and provide compassionate healthcare to the LGBTQ+ REFLECTIONS ON 35 ON 35 REFLECTIONS YEARS OF SERVICE community & beyond. PRESENTING SPONSOR: WELLS FARGO AN EVENING BENEFITING GOLD SPONSORS: NIKE + ONPOINT COMMUNITY CREDIT UNION CAREOREGON + ONESOURCE STRATEGY CASCADE AIDS PROJECT HONORARY CHAIRS: DEB KEMP + MOLLY KING CAPARTAUCTION.ORG At a time when it can be difficult to feel celebratory amidst so much pain, turmoil and unrest, art gives us hope. When organizations like Cascade AIDS Project continue to respond in the moment with such compassion and collective action - they give us hope. We are so honored to be the chairs of this year’s CAP Art Auction and are proud to stand united for this cause, and together in community. We first learned of Cascade AIDS Project through our work with QDoc Film Fest, an annual LGBTQ+ documentary festival we now run. In addition to supporting and empowering folks living with or affected by HIV, Cascade AIDS Project has been a longtime community partner of hope you will be moved to do so as well. QDoc, helping us elevate the voices As Cascade AIDS Project continues to of marginalized groups through the support those they serve, let’s continue power of storytelling. We are grateful to support them. to reciprocate this relationship through our support of Cascade AIDS Project With love and pride, A WORD FROM A WORD FROM A OUR CO-CHAIRS OUR both personally and professionally and MOLLY KING & DEB KEMP SCHEDULE CAP SCHEDULEEVENING SCHEDULE ART AUCTION.ORG 6:30 PM Red carpet pre-show 7:00 PM Live event Poison Waters Red Carpet Host Johnna Lee Wells Auctioneer Dale Johannes Program Host ENTERTAINMENT ENTERTAINMENT We come together tonight to celebrate Cascade AIDS Project’s 35 years of service during a time when our country’s deep injustices are being again revealed. -

Joan Lebold Cohen Interview Transcript

www.china1980s.org INTERVIEW TRANSCRIPT JOAN LEBOLD COHEN Interviewer: Jane DeBevoise Date:31 Oct 2009 Duration: about 2 hours Location: New York Jane DeBevoise (JD): It would be great if you could speak a little bit about how you got to China, when you got to China – with dates specific to the ‘80s, and how you saw the 80’s develop. From your perspective what were some of the key moments in terms of the arts? Joan Lebold Cohen (JC): First of all, I should say that I had been to China three times before the 1980s. I went twice in 1972, once on a delegation in May for over three weeks, which took us to Beijing, Luoyang, Xi’an, and Shanghai and we flew into Nanchang too because there were clouds over Guangzhou and the planes couldn’t fly in. This was a period when, if you wanted to have a meal and you were flying, the airplane would land so that you could go to a restaurant (Laughter). They were old, Russian airplanes, and you sat in folding chairs. The conditions were rather…primitive. But I remember going down to the Shanghai airport and having the most delicious ‘8-precious’ pudding and sweet buns – they were fantastic. I also went to China in 1978. For each trip, I had requested to meet artists and to go to exhibitions, but was denied the privilege. However, there was one time, when I went to an exhibition in May of 1972 and it was one of the only exhibitions that exhibited Cultural Revolution model paintings; it was very amusing. -

Art Auction Sources Ingalls Library

Art Auction Sources Ingalls Library Going Once... Going Twice... Sold! 1 This bibliography was compiled by the Books about Auction Houses and Cleveland Museum of Art’s Ingalls the Auction Market Library reference staff to accompany a Faith, Nicholas. Sold: The Revolution in the series of three workshops on the auc- Art Market. London: Hamish Hamilton, tion market (fine arts, decorative arts, and 1985. prints and photographs) presented at the HF5477 .G74 S67 1985 Library. Given the scope and depth of A profile of Sotheby’s under the dynamic the Library’s collection, only the most leadership of Peter C. Wilson, the famous important titles, databases, and websites auctioneer, that provides an interesting are included. We hope this bibliography glimpse into the world of selling and col- will help you map a methodology for lecting works of art. researching objects. Lacey, Robert. Sotheby’s: Bidding for Class. For a history of the auction market, con- Boston: Little, Brown, 1998. sult the sources listed below as well as HF5477 .G74 G675 1998 the Grove Dictionary of Art entry under A gossipy history of the famous auction “Auction.” The Ingalls Library subscribes house. to many bibliographic databases which provide access to journal articles about McNulty, Tom. Art Market Research: A auctions, auction houses, etc. Guide to Methods and Sources. Jefferson, NC: McFarland, 2006. The bibliography is divided into eight N5200 .M39 2006 sections: “From the gallery to the auction house, • Books about Auction Houses and the this book explores the major venues of art Auction Market acquisition. It introduces basic terminology • Art Sales Sources for the Fine Arts for the art collector and covers the basics • Decorative and Applied Arts of artwork analysis and documentation, • Prints including a concise overview of database • Photographs researching methods and online resources.” • Auction House Publications and Websites Marquis, Alice Goldfarb. -

Modeling On-Line Art Auction Dynamics Using Functional Data

Statistical Science 2006, Vol. 21, No. 2, 179–193 DOI: 10.1214/088342306000000196 c Institute of Mathematical Statistics, 2006 Modeling On-Line Art Auction Dynamics Using Functional Data Analysis Srinivas K. Reddy and Mayukh Dass Abstract. In this paper, we examine the price dynamics of on-line art auc- tions of modern Indian art using functional data analysis. The purpose here is not just to understand what determines the final prices of art objects, but also the price movement during the entire auction. We identify several factors, such as artist characteristics (established or emerging artist; prior sales history), art characteristics (size; painting medium—canvas or paper), competition characteristics (current number of bidders; current number of bids) and auction design characteristics (opening bid; position of the lot in the auction), that explain the dynamics of price movement in an on-line art auction. We find that the effects on price vary over the duration of the auc- tion, with some of these effects being stronger at the beginning of the auc- tion (such as the opening bid and historical prices realized). In some cases, the rate of change in prices (velocity) increases at the end of the auction (for canvas paintings and paintings by established artists). Our analysis sug- gests that the opening bid is positively related to on-line auction price levels of art at the beginning of the auction, but its effect declines toward the end of the auction. The order in which the lots appear in an art auction is nega- tively related to the current price level, with this relationship decreasing to- ward the end of the auction. -

Śāntiniketan and Modern Southeast Asian

Artl@s Bulletin Volume 5 Article 2 Issue 2 South - South Axes of Global Art 2016 Śāntiniketan and Modern Southeast Asian Art: From Rabindranath Tagore to Bagyi Aung Soe and Beyond YIN KER School of Art, Design & Media, Nanyang Technological University, [email protected] Follow this and additional works at: https://docs.lib.purdue.edu/artlas Part of the Art Education Commons, Art Practice Commons, Asian Art and Architecture Commons, Modern Art and Architecture Commons, Other History of Art, Architecture, and Archaeology Commons, Other International and Area Studies Commons, and the South and Southeast Asian Languages and Societies Commons Recommended Citation KER, YIN. "Śāntiniketan and Modern Southeast Asian Art: From Rabindranath Tagore to Bagyi Aung Soe and Beyond." Artl@s Bulletin 5, no. 2 (2016): Article 2. This document has been made available through Purdue e-Pubs, a service of the Purdue University Libraries. Please contact [email protected] for additional information. This is an Open Access journal. This means that it uses a funding model that does not charge readers or their institutions for access. Readers may freely read, download, copy, distribute, print, search, or link to the full texts of articles. This journal is covered under the CC BY-NC-ND license. South-South Śāntiniketan and Modern Southeast Asian Art: From Rabindranath Tagore to Bagyi Aung Soe and Beyond Yin Ker * Nanyang Technological University Abstract Through the example of Bagyi Aung Soe, Myanmar’s leader of modern art in the twentieth century, this essay examines the potential of Śāntiniketan’s pentatonic pedagogical program embodying Rabindranath Tagore’s universalist and humanist vision of an autonomous modernity in revitalizing the prevailing unilateral and nation- centric narrative of modern Southeast Asian art. -

Damien Hirst E Il Mercato Dell'arte Contemporanea: La Carriera Di Un Young British Artist

Corso di Laurea magistrale (ordinamento ex D.M. 270/2004) in Economia e Gestione delle Arti e delle attività culturali Tesi di Laurea DAMIEN HIRST E IL MERCATO DELL'ARTE CONTEMPORANEA: LA CARRIERA DI UN YOUNG BRITISH ARTIST Relatore Prof. Stefania Portinari Laureanda Martina Pellizzer Matricola 816581 Anno Accademico 2012 / 2013 1 INDICE INTRODUZIONE p. 3 CAPITOLO 1 ALCUNE RIFLESSIONI SUL MERCATO DELL'ARTE CONTEMPORANEA: ISTITUZIONI E STRUTTURE DI PROMOZIONE E VENDITA 1 L'Evoluzione del sistema delle gallerie e della figura del gallerista p. 3 2. Il ruolo dei musei p. 19 3 Il ruolo dei collezionisti p. 28 4 Le case d'asta p. 36 CAPITOLO 2 DAMIEN HIRST: DA A THOUSAND YEARS (1990) A FOR THE LOVE OF GOD (2007) 1 Il sistema dell'arte inglese negli anni Novanta: gli Young British Artist …........p. 41 2 Damien Hirst una carriera in ascesa, da “Frezze” alla retrospettiva presso la Tate Modern p. 47 3 I galleristi di Damien Hirst p. 67 CAPITOLO 3 IL RUOLO DEL MERCATO DELL'ARTE NELLA CARRIERA DI DAMIEN HIRST 1 L'asta di Sotheby's: “Beautiful inside my head forever” p. 78 2 Rapporto tra esposizione e valore delle opere dal 2009 al 2012..............................p. 97 CONCLUSIONI p. 117 APPENDICE p. 120 BIBLIOGRAFIA p. 137 2 INTRODUZIONE Questa tesi di laurea magistrale si pone come obiettivo di analizzare la carriera dell'artista inglese Damien Hirst mettendo in evidenza il ruolo che il mercato dell'arte ha avuto nella sua carriera. Il primo capitolo, dal titolo “Alcuni riflessioni sul mercato dell'arte contemporanea”, propone una breve disanima sul funzionamento del mercato dell'arte contemporanea, analizzando in particolar modo il ruolo di collezionisti, galleristi, istituzioni museali e case d'asta, tutti soggetti in grado di influenzare notevolmente la carriera di un artista, anche se in maniera differente. -

China Daily 0803 D6.Indd

life CHINA DAILY CHINADAILY.COM.CN/LIFE FRIDAY, AUGUST 3, 2012 | PAGE 18 Li Keran bucks market trend The artist has become a favorite at auction and his works are fetching record prices. But overall, the Chinese contemporary art market has cooled, Lin Qi reports in Beijing. i Keran (1907-89) took center and how representative the work is, in addi- stage at the spring sales with tion to the art publications and catalogues it two historic works both cross- has appeared in.” ing the 100 million yuan ($16 Though a record was set by Wan Shan million) threshold. Hong Bian, two other important paintings by His 1974 painting of former Li were unsold, which came as no surprise for Lchairman Mao Zedong’s residence in Sha- art collectors like Yan An. oshan, the revolutionary holy land in Hunan “Both big players and new buyers are bid- province, fetched 124 million yuan at China ding for the best works of the blue-chip art- Guardian, in May. ists, while the market can’t provide as many Th ree weeks later his large-scale blockbust- top-notch artworks and provide the reduced er of 1964, Wan Shan Hong Bian (Th ousands risks that people expect. of Hills in a Crimsoned View), was sold for a “Th is is because in the face of an unclear personal record of 293 million yuan at Poly market, cautious owners would rather keep International Auction. those items, which achieved skyscraping Li, a prominent figure in 20th-century prices, rather than fl ip them at auction,” Yan Chinese art, is recognized for innovating the says. -

Jacques Derrida De La Grammatologie

DE LA GRAMMATOLOGIE DU MÊME AUTEUR Marges (Collection « Critique », 1972). Positions (Collection « Critique », 1972). chez d'autres éditeurs L'origine de la géométrie, de Husserl. Traduction et Intro- duction (P.U.F. Collection « Epiméthée », 1962). La voix et le phénomène (P.U.F. Collection « Épimé- thée », 1967). L'écriture et la différence (Éd. du Seuil, Collection « Tel Quel », 1967). La dissémination (Éd. du Seuil, Collection « Tel Quel », 1972). COLLECTION « CRITIQUE » JACQUES DERRIDA DE LA GRAMMATOLOGIE LES ÉDITIONS DE MINUIT © 1967 by LES ÉDITIONS DE MINUIT 7, rue Bernard-Palissy 75006 Paris Tous droits réservés pour tous pays ISBN 2-7073-0012-8 avertissement La première partie de cet essai, L'écriture avant la lettre 1, dessine à grands traits une matrice théorique. Elle indique cer- tains repères historiques et propose quelques concepts critiques. Ceux-ci sont mis à l'épreuve dans la deuxième partie, Nature, culture, écriture. Moment, si l'on veut, de l'exemple, encore que cette notion soit ici, en toute rigueur, irrecevable. De ce que par commodité nous nommons encore exemple il fallait alors, procédant avec plus de patience et de lenteur, justifier le choix et démontrer la nécessité. Il s'agit d'une lecture de ce que nous pourrions peut-être appeler /'époque de Rousseau. Lecture seulement esquissée : considérant en effet la nécessité de l'analyse, la difficulté des problèmes, la nature de notre des- sein, nous nous sommes cru fondé à privilégier un texte court et peu connu, /'Essai sur l'origine des langues. Nous aurons à expliquer la place que nous accordons à cette œuvre. -

Lucy Sparrow Photo: Dafydd Jones 18 Hot &Coolart

FREE 18 HOT & COOL ART YOU NEVER FELT LUCY SPARROW LIKE THIS BEFORE DAFYDD JONES PHOTO: LUCY SPARROW GALLERIES ONE, TWO & THREE THE FUTURE CAN WAIT OCT LONDON’S NEW WAVE ARTISTS PROGRAMME curated by Zavier Ellis & Simon Rumley 13 – 17 OCT - VIP PREVIEW 12 OCT 6 - 9pm GALLERY ONE PETER DENCH DENCH DOES DALLAS 20 OCT - 7 NOV GALLERY TWO MARGUERITE HORNER CARS AND STREETS 20 - 30 OCT GALLERY ONE RUSSELL BAKER ICE 10 NOV – 22 DEC GALLERY TWO NEIL LIBBERT UNSEEN PORTRAITS 1958-1998 10 NOV – 22 DEC A NEW NOT-FOR-PROFIT LONDON EXHIBITION PLATFORM SUPPORTING THE FUSION OF ART, PHOTOGRAPHY & CULTURE Art Bermondsey Project Space, 183-185 Bermondsey Street London SE1 3UW Telephone 0203 441 5858 Email [email protected] MODERN BRITISH & CONTEMPORARY ART 20—24 January 2016 Business Design Centre Islington, London N1 Book Tickets londonartfair.co.uk F22_Artwork_FINAL.indd 1 09/09/2015 15:11 THE MAYOR GALLERY FORTHCOMING 21 CORK STREET, FIRST FLOOR, LONDON W1S 3LZ TEL: +44 (0) 20 7734 3558 FAX: +44 (0) 20 7494 1377 [email protected] www.mayorgallery.com EXHIBITIONS WIFREDO ARCAY CUBAN STRUCTURES THE MAYOR GALLERY 13 OCT - 20 NOV Wifredo Arcay (b. 1925, Cuba - d. 1997, France) “ETNAIRAV” 1959 Latex paint on plywood relief 90 x 82 x 8 cm 35 1/2 x 32 1/4 x 3 1/8 inches WOJCIECH FANGOR WORKS FROM THE 1960s FRIEZE MASTERS, D12 14 - 18 OCT Wojciech Fangor (b.1922, Poland) No. 15 1963 Oil on canvas 99 x 99 cm 39 x 39 inches STATE_OCT15.indd 1 03/09/2015 15:55 CAPTURED BY DAFYDD JONES i SPY [email protected] EWAN MCGREGOR EVE MAVRAKIS & Friend NICK LAIRD ZADIE SMITH GRAHAM NORTON ELENA SHCHUKINA ALESSANDRO GRASSINI-GRIMALDI SILVIA BRUTTINI VANESSA ARELLE YINKA SHONIBARE NIMROD KAMER HENRY HUDSON PHILIP COLBERT SANTA PASTERA IZABELLA ANDERSSON POPPY DELEVIGNE ALEXA CHUNG EMILIA FOX KARINA BURMAN SOPHIE DAHL LYNETTE YIADOM-BOAKYE CHIWETEL EJIOFOR EVGENY LEBEDEV MARC QUINN KENSINGTON GARDENS Serpentine Gallery summer party co-hosted by Christopher Kane. -

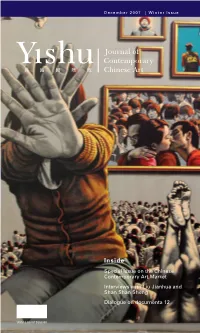

Inside Special Issue on the Chinese Contemporary Art Market Interviews with Liu Jianhua and Shan Shan Sheng Dialogue on Documenta 12

December 2007 | Winter Issue Inside Special Issue on the Chinese Contemporary Art Market Interviews with Liu Jianhua and Shan Shan Sheng Dialogue on documenta 12 US$12.00 NT$350.00 china square 1 2 Contents 4 Editor’s Note 6 Contributors 8 Contemporary Chinese Art: To Get Rich Is Glorious 11 Britta Erickson 17 The Surplus Value of Accumulation: Some Thoughts Martina Köppel-Yang 19 Seeing Through the Macro Perspective: The Chinese Art Market from 2006 to 2007 Zhao Li 23 Exhibition Culture and the Art Market 26 Yü Christina Yü 29 Interview with Zheng Shengtian at the Seven Stars Bar, 798, Beijing Britta Erickson 34 Beyond Selling Art: Galleries and the Construction of Art Market Norms Ling-Yun Tang 44 Taking Stock Joe Martin Hill 41 51 Everyday Miracles: National Pride and Chinese Collectors of Contemporary Art Simon Castets 58 Superfluous Things: The Search for “Real” Art Collectors in China Pauline J. Yao 62 After the Market’s Boom: A Case Study of the Haudenschild Collection 77 Michelle M. McCoy 72 Zhong Biao and the “Grobal” Imagination Paul Manfredi 84 Export—Cargo Transit Mathieu Borysevicz 90 About Export—Cargo Transit: An Interview with Liu Jianhua 87 Chan Ho Yeung David 93 René Block’s Waterloo: Some Impressions of documenta 12, Kassel Yang Jiechang and Martina Köppel-Yang 101 Interview with Shan Shan Sheng Brandi Reddick 109 Chinese Name Index 108 Yishu 22 errata: On page 97, image caption lists director as Liang Yin. Director’s name is Ying Liang. On page 98, image caption lists director as Xialu Guo. -

Authentication, Attribution and the Art Market: Understanding Issues of Art Attribution in Contemporary Indonesia

Authentication, Attribution and the Art Market: Understanding Issues of Art Attribution in Contemporary Indonesia Eliza O’Donnell, University of Melbourne, Australia Nicole Tse, University of Melbourne, Australia The Asian Conference on Arts & Humanities 2018 Official Conference Proceedings Abstract The widespread circulation of paintings lacking a secure provenance within the Indonesian art market is an increasingly prevalent issue that questions trust, damages reputations and collective cultural narratives. In the long-term, this may impact on the credibility of artists, their work and the international art market. Under the current Indonesian copyright laws, replicating a painting is not considered a crime of art forgery, rather a crime of autograph forgery, a loophole that has allowed the practice of forgery to grow. Despite widespread claims of problematic paintings appearing in cultural collections over recent years, there has been little scholarly research to map the scope of counterfeit painting circulation within the market. Building on this research gap and the themes of the conference, this paper will provide a current understanding of art fraud in Indonesia based on research undertaken on the Authentication, Attribution and the Art Market in Indonesia: Understanding issues of art attribution in contemporary Indonesia. This research is interdisciplinary in its scope and is grounded in the art historical, socio-political and socio-economic context of cultural and artistic production in Indonesia, from the early twentieth century to the contemporary art world of today. By locating the study within a regionally relevant framework, this paper aims to provide a current understanding of issues of authenticity in Indonesia and is a targeted response to the need for a materials- evidence based framework for the research, identification and documentation of questionable paintings, their production and circulation in the region. -

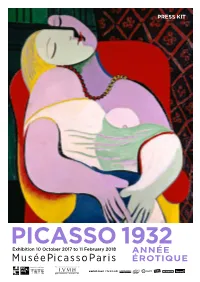

Pablo Picasso, Published by Christian Zervos, Which Places the Painter of the Demoiselles Davignon in the Context of His Own Work

PRESS KIT PICASSO 1932 Exhibition 10 October 2017 to 11 February 2018 ANNÉE ÉROTIQUE En partenariat avec Exposition réalisée grâce au soutien de 2 PICASSO 1932 ANNÉE ÉROTIQUE From 10 October to the 11 February 2018 at Musée national Picasso-Paris The first exhibition dedicated to the work of an artist from January 1 to December 31, the exhibition Picasso 1932 will present essential masterpieces in Picassos career as Le Rêve (oil on canvas, private collection) and numerous archival documents that place the creations of this year in their context. This event, organized in partnership with the Tate Modern in London, invites the visitor to follow the production of a particularly rich year in a rigorously chronological journey. It will question the famous formula of the artist, according to which the work that is done is a way of keeping his journal? which implies the idea of a coincidence between life and creation. Among the milestones of this exceptional year are the series of bathers and the colorful portraits and compositions around the figure of Marie-Thérèse Walter, posing the question of his works relationship to surrealism. In parallel with these sensual and erotic works, the artist returns to the theme of the Crucifixion while Brassaï realizes in December a photographic reportage in his workshop of Boisgeloup. 1932 also saw the museification of Picassos work through the organization of retrospectives at the Galerie Georges Petit in Paris and at the Kunsthaus in Zurich, which exhibited the Spanish painter to the public and critics for the first time since 1911. The year also marked the publication of the first volume of the Catalog raisonné of the work of Pablo Picasso, published by Christian Zervos, which places the painter of the Demoiselles dAvignon in the context of his own work.