Departure Punctuality - Jul-17

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

EGNOS Implementation Status

EGNOS implementation status H2020 BlueGNSS Final meeting Katerina Strelcova, Aviation Market Development Innovation Officer, Project officer of H2020BlueGNSS project 18 July 2018 @ENAV, Rome Table of Content • GSA introduction • EGNOS implementation status • Airspace user capabilities • GSA support to foster EGNOS implementation 2 European GNSS Agency Mission: Resourcing: Gateway to Services • Galileo & EGNOS Operations and Service Provision 160 21 Staff Nationalities • Market Development of the applications and the receivers Gatekeeper of security • Security Accreditation Prague, Cz Rep – HQ St. Germain en Laye, FR – GSMC • Operation of Galileo Security Swanwick, UK – GSMC (tbc) Monitoring Centre, governmental Torrejon, ES – GSC Noordwijk, NL – GRC service (PRS) activities Toulouse, FR – EGNOS Brussels, BE – COMM 4 1. How GSA fits in the EU structure he GSA: governance summary Political Oversight Council and European Parliament Programme Management European GNSS Programme Committee EuropeanEuropean CommissionCommission Delegation Delegation and assistance European Space Agency Working Arrangement Administrative Board Security Accreditation Board Market Development Security GSMC operation GNSS exploitation European Satellite Navigation Programmes • Global Navigation Satellite System (GNSS) • Satellite Based Augmentation System (SBAS) • Worldwide coverage • Continental coverage • 22 Satellites constellation today • Increased accuracy and integrity over GPS • Full Operational Capability by 2020 • Next version will augment Galileo 5 EGNOS -

International Scientific Journal Theoretical & Applied Science

ISRA (India) = 1.344 SIS (USA) = 0.912 ICV (Poland) = 6.630 ISI (Dubai, UAE) = 0.829 РИНЦ (Russia) = 0.179 Impact Factor: GIF (Australia) = 0.356 ESJI (KZ) = 1.042 JIF = 1.500 SJIF (Morocco) = 2.031 SOI: 1.1/TAS DOI: 10.15863/TAS Ali J. Dawood Assistant Lecturer International Scientific Journal Aircraft Engineering Branch Theoretical & Applied Science Mechanical Engineering Department Baghdad University of Technology, p-ISSN: 2308-4944 (print) e-ISSN: 2409-0085 (online) Iraq [email protected] Year: 2015 Issue: 09 Volume: 29 Published: 30.09.2015 http://T-Science.org SECTION 31. Economic research, finance, innovation, risk management. USE LOW COST CARRIER STRATEGY AS SOLUTION TO REDUCE AIRCRAFT TICKET PRICE IN IRAQ Abstract: Air transport is one of the most important sectors growing in Iraq, especially after 2003 and the removal of all restrictions that were imposed for the movement of people prior to this date also air transport are predicted to take advanced place in Iraqi economic. Iraq has the magnificent site in the heart of Middle East and this region which connecting Continents of the world. Iraq has seen a significant growth in the number of airports across his territory also increase of international airlines that work in Iraq but high prices of airline tickets is one of the most prominent problems of the aviation sector in Iraq compared to other airlines in the world prices for same distances, Knowing that most of the companies trying to lower the price in order to attract larger numbers of travelers. Using of low cost carrier is one of the best solutions that ensure reduced ticket prices and this strategy has succeeded in a lot of areas in the world Key words: Low cost carrier, Airline, Airplane, Iraqi Airways, Iraq, Baghdad. -

Performance Monitoring Report 2018/19 Date of Issue: 31 July 2019

Performance monitoring report 2018/19 Date of issue: 31 July 2019 Gatwick Airport Limited 1. Introduction This report provides an update on performance at Gatwick in the financial year 2018/19, ending 31 March 2019. Gatwick Airport is continuing to perform very well for passengers and airlines and has delivered consistently good service performance in nearly all areas, achieving 100% of its monthly Core Service Standards for the second year in a row. All of the data in this report have been made available to airline users during 2018/19. In publishing this report, Gatwick Airport welcomes feedback from airlines users, passenger representatives and the CAA. 1 2. Traffic Gatwick Airport served 46.4 million passengers in the financial year 2018/19. This was an increase of 1.6% over the previous year. Driving this growth was an increase in long haul routes, increasing by 1.1 million passengers or 14.3%, while short haul and domestic traffic passenger numbers were 0.4 million below prior year, mainly as a result of the loss of Monarch Airlines in October 2017, and the slow utilisation of Monarch’s previous slot allocation. Table 1: Traffic data 2017/18 2018/19 % change Passenger traffic (m) 45.7 46.4 1.6% Air Transport Movements - 280.8 281.7 0.3% flights (k) Seats per ATM 187.4 191.0 1.9% Load factor (%) 86.3% 86.8% 0.5ppt Passengers per ATM 162.7 164.8 1.3% Additional information on our traffic trends is available in our monthly traffic updates1. 1 http://www.gatwickairport.com/business-community/about-gatwick/our-performance/monthly-traffic-figures/ 2 3. -

Paper 3: Investigating Business in a Competitive Environment

Please check the examination details below before entering your candidate information Candidate surname Other names Pearson Edexcel Centre Number Candidate Number Level 3 GCE Friday 7 June 2019 Morning (Time: 2 hours) Paper Reference 9BS0/03 Business Advanced Paper 3: Investigating business in a competitive environment You must have: Total Marks Insert (enclosed) Instructions • Use black ink or ball-point pen. • Fill in the boxes at the top of this page with your name, centre number and candidate number. • Answer all questions. • Answer the questions in the spaces provided – there may be more space than you need. Information • The total mark for this paper is 100. • The marks for each question are shown in brackets – use this as a guide as to how much time to spend on each question. • You may use a calculator. Advice • Read each question carefully before you start to answer it. • Try to answer every question. • Check your answers if you have time at the end. Turn over P56802A ©2019 Pearson Education Ltd. *P56802A0128* 1/1/1/1/1/1 Answer ALL questions. SECTION A Read the following extracts (A to D) before answering Question 1. Write your answers in the spaces provided. Extract A UK holiday trends for 2017 Research by the Association of British Travel Agents (ABTA) shows an increase in bookings for all-inclusive holidays. For consumers seeking value for money, ease of travel and a stress-free break, all-inclusive holidays provide the best solution. With the UK £ sterling exchange rate and its economy both remaining uncertain, all-inclusive holidays, to destinations such as Mexico and South Africa, are easier to budget for. -

Appendix 25 Box 31/3 Airline Codes

March 2021 APPENDIX 25 BOX 31/3 AIRLINE CODES The information in this document is provided as a guide only and is not professional advice, including legal advice. It should not be assumed that the guidance is comprehensive or that it provides a definitive answer in every case. Appendix 25 - SAD Box 31/3 Airline Codes March 2021 Airline code Code description 000 ANTONOV DESIGN BUREAU 001 AMERICAN AIRLINES 005 CONTINENTAL AIRLINES 006 DELTA AIR LINES 012 NORTHWEST AIRLINES 014 AIR CANADA 015 TRANS WORLD AIRLINES 016 UNITED AIRLINES 018 CANADIAN AIRLINES INT 020 LUFTHANSA 023 FEDERAL EXPRESS CORP. (CARGO) 027 ALASKA AIRLINES 029 LINEAS AER DEL CARIBE (CARGO) 034 MILLON AIR (CARGO) 037 USAIR 042 VARIG BRAZILIAN AIRLINES 043 DRAGONAIR 044 AEROLINEAS ARGENTINAS 045 LAN-CHILE 046 LAV LINEA AERO VENEZOLANA 047 TAP AIR PORTUGAL 048 CYPRUS AIRWAYS 049 CRUZEIRO DO SUL 050 OLYMPIC AIRWAYS 051 LLOYD AEREO BOLIVIANO 053 AER LINGUS 055 ALITALIA 056 CYPRUS TURKISH AIRLINES 057 AIR FRANCE 058 INDIAN AIRLINES 060 FLIGHT WEST AIRLINES 061 AIR SEYCHELLES 062 DAN-AIR SERVICES 063 AIR CALEDONIE INTERNATIONAL 064 CSA CZECHOSLOVAK AIRLINES 065 SAUDI ARABIAN 066 NORONTAIR 067 AIR MOOREA 068 LAM-LINHAS AEREAS MOCAMBIQUE Page 2 of 19 Appendix 25 - SAD Box 31/3 Airline Codes March 2021 Airline code Code description 069 LAPA 070 SYRIAN ARAB AIRLINES 071 ETHIOPIAN AIRLINES 072 GULF AIR 073 IRAQI AIRWAYS 074 KLM ROYAL DUTCH AIRLINES 075 IBERIA 076 MIDDLE EAST AIRLINES 077 EGYPTAIR 078 AERO CALIFORNIA 079 PHILIPPINE AIRLINES 080 LOT POLISH AIRLINES 081 QANTAS AIRWAYS -

Global Leaders in Innovative Full Service Airline Training

Global Leaders in Innovative Full Service Airline Training committed to excellence Welcome At CTC we are proud of the reputation that we have built over time as worldwide providers of innovative training solutions. This reputation is founded on the delivery of our core values: expertise, quality, innovation and flexibility. With our state-of-the-art Crew Training Centres across the globe and specialist training personnel, we are able to provide our client airlines with every element of airline crew training. We offer a wide range of training options from basic CPL/IR licence through to Type Rating on the most popular commercial aircraft today including Boeing and Airbus, and onwards to training airline instructors and examiners. From crew selection through to crew supply and from CRM courses to Command Training, CTC can deliver all your needs; we are truly a ‘full service’ airline training specialist. To do this we enjoy comprehensive Joint Aviation Authority approvals as a Type-Rating Training Organisation and Flight Training Organisation and we have received approvals from many other regulatory authorities around the world. Equally as important, we enjoy the trust and loyalty of many of the world’s leading airlines – whether it be for the supply of a standalone training course, or for the outsourcing of all of their crew training needs. These factors make CTC your first choice partner to provide specialist aviation training and support – worldwide – for all your aircrew requirements. We look forward to being of service to you. Captain Chris Clarke Group Chairman CTC Aviation Group plc 1 WELCOME ‘CTC has supported us throughout our growth. -

Monthly OTP July 2019

Monthly OTP July 2019 ON-TIME PERFORMANCE AIRLINES Contents On-Time is percentage of flights that depart or arrive within 15 minutes of schedule. Global OTP rankings are only assigned to all Airlines/Airports where OAG has status coverage for at least 80% of the scheduled flights. Regional Airlines Status coverage will only be based on actual gate times rather than estimated times. This July result in some airlines / airports being excluded from this report. If you would like to review your flight status feed with OAG pleas [email protected] MAKE SMARTER MOVES Airline Monthly OTP – July 2019 Page 1 of 1 Home GLOBAL AIRLINES – TOP 50 AND BOTTOM 50 TOP AIRLINE ON-TIME FLIGHTS On-time performance BOTTOM AIRLINE ON-TIME FLIGHTS On-time performance Airline Arrivals Rank No. flights Size Airline Arrivals Rank No. flights Size SATA International-Azores GA Garuda Indonesia 93.9% 1 13,798 52 S4 30.8% 160 833 253 Airlines S.A. XL LATAM Airlines Ecuador 92.0% 2 954 246 ZI Aigle Azur 47.8% 159 1,431 215 HD AirDo 90.2% 3 1,806 200 OA Olympic Air 50.6% 158 7,338 92 3K Jetstar Asia 90.0% 4 2,514 168 JU Air Serbia 51.6% 157 3,302 152 CM Copa Airlines 90.0% 5 10,869 66 SP SATA Air Acores 51.8% 156 1,876 196 7G Star Flyer 89.8% 6 1,987 193 A3 Aegean Airlines 52.1% 155 5,446 114 BC Skymark Airlines 88.9% 7 4,917 122 WG Sunwing Airlines Inc. -

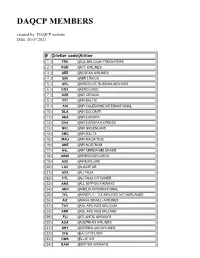

DAQCP MEMBERS Created By: DAQCP Website Date: 20.07.2021

DAQCP MEMBERS created by: DAQCP website Date: 20.07.2021 # 3-letter code Airline 1 FRH ACE BELGIUM FREIGHTERS 2 RUN ACT AIRLINES 3 AEE AEGEAN AIRLINES 4 EIN AER LINGUS 5 AFL AEROFLOT RUSSIAN AIRLINES 6 BOX AEROLOGIC 7 KZR AIR ASTANA 8 BTI AIR BALTIC 9 ACI AIR CALEDONIE INTERNATIONAL 10 DLA AIR DOLOMITI 11 AEA AIR EUROPA 12 OVA AIR EUROPA EXPRESS 13 GRL AIR GREENLAND 14 AMC AIR MALTA 15 MAU AIR MAURITIUS 16 ANE AIR NOSTRUM 17 ASL AIR SERBIA BELGRADE 18 ABW AIRBRIDGECARGO 19 AXE AIREXPLORE 20 LAV ALBASTAR 21 AZA ALITALIA 22 CYL ALITALIA CITYLINER 23 ANA ALL NIPPON AIRWAYS 24 AEH AMELIA INTERNATIONAL 25 TFL ARKEFLY - TUI AIRLINES NETHERLANDS 26 AIZ ARKIA ISRAELI AIRLINES 27 TAY ASL AIRLINES BELGIUM 28 ABR ASL AIRLINES IRELAND 29 FLI ATLANTIC AIRWAYS 30 AUA AUSTRIAN AIRLINES 31 AHY AZERBAIJAN AIRLINES 32 CFE BA CITYFLYER 33 BMS BLUE AIR 34 BAW BRITISH AIRWAYS 35 BEL BRUSSELS AIRLINES 36 GNE BUSINESS AVIATION SERVICES GUERNSEY LTD 37 CLU CARGOLOGICAIR 38 CLX CARGOLUX AIRLINES INTERNATIONAL S.A 39 ICV CARGOLUX ITALIA 40 CEB CEBU PACIFIC 41 BCY CITYJET 42 CFG CONDOR FLUGDIENST GMBH 43 CTN CROATIA AIRLINES 44 CSA CZECH AIRLINES 45 DLH DEUTSCHE LUFTHANSA 46 DHK DHL AIR LTD. 47 EZE EASTERN AIRWAYS 48 EJU EASYJET EUROPE 49 EZS EASYJET SWITZERLAND 50 EZY EASYJET UK 51 EDW EDELWEISS AIR 52 ELY EL AL 53 UAE EMIRATES 54 ETH ETHIOPIAN AIRLINES 55 ETD ETIHAD AIRWAYS 56 MMZ EUROATLANTIC 57 BCS EUROPEAN AIR TRANSPORT 58 EWG EUROWINGS 59 OCN EUROWINGS DISCOVER 60 EWE EUROWINGS EUROPE 61 EVE EVELOP AIRLINES 62 FIN FINNAIR 63 FHY FREEBIRD AIRLINES 64 GJT GETJET AIRLINES 65 GFA GULF AIR 66 OAW HELVETIC AIRWAYS 67 HFY HI FLY 68 HBN HIBERNIAN AIRLINES 69 HOP HOP! 70 IBE IBERIA 71 ICE ICELANDAIR 72 ISR ISRAIR AIRLINES 73 JAL JAPAN AIRLINES CO. -

Operational Performance Reporting Manchester Airport January 2018

Operational Performance Reporting Manchester Airport January 2018 Departure Punctuality - Jan-18 Last Month Last Year % Change Target Var to Target First Wave 89.7% 85.2% 4.5% 85.0% 4.7% Not First Wave 77.7% 76.3% 1.4% 85.0% -7.3% Grand Total 80.2% 78.3% 1.8% 85.0% -4.8% Departure Punctuality - Last 12 Months This Year Prev Year % Change Target Var to Target First Wave 82.5% 84.3% (1.7%) 82.0% 0.5% Not First Wave 70.8% 75.0% (4.2%) 82.0% -11.2% Grand Total 73.3% 77.1% (3.8%) 82.0% -8.7% ATMs and Passenger Volumes MTD YTD Last Year Change Last Year Change Last Year Change Last Year Change Terminal Flight Passengers Passengers % Movements Movements % Passengers Passengers % Movements Movements % Arriving 413,069 372966 11% 2681 2505 7% 5,776,415 5129198 13% 34665 32205 8% Terminal 1 Departing 380,761 341712 11% 2675 2485 8% 5,734,288 5072183 13% 34618 32139 8% Terminal 1 793,830 714678 11% 5356 4990 7% 11,510,703 10201381 13% 69283 64344 8% Total Arriving 150,070 190197 -21% 703 985 -29% 2,697,622 2756734 -2% 13450 14019 -4% Terminal 2 Departing 141,257 169277 -17% 691 973 -29% 2,676,828 2708295 -1% 13306 13984 -5% Terminal 2 291,327 359474 -19% 1394 1958 -29% 5,374,450 5465029 -2% 26756 28003 -4% Total Arriving 296,088 306835 -4% 3070 3138 -2% 3,662,711 3502730 5% 35171 33713 4% Terminal 3 Departing 282,123 283528 -0% 3074 3131 -2% 3,644,398 3443729 6% 35170 33682 4% Terminal 3 578,211 590363 -2% 6144 6269 -2% 7,307,109 6946459 5% 70341 67395 4% Total Grand Total 1,663,368 1664515 -0% 12894 13217 -2% 24,192,262 22612869 7% 166380 159742 -

Monarch Airlines Collapsed and Entered Administration

Find our latest analyses and trade ideas on bsic.it The Final Mayday Call: Monarch Airlines Collapsed and Entered Administration About Monarch Airlines Monarch Airlines was a British low-cost airline that mainly operated in the Mediterranean. It was the UK’s fifth largest airline and the largest ever to collapse. In 1967 two British businessmen, backed by the financing provided by the Italian-Swiss Mantegazza family, founded Monarch to promote air travels to ordinary families rather than being directed solely towards wealthier clients. Its activity reached the highest level in the early 2000s when the company managed to be the UK’s second greatest airline by number of passengers in many airports, the most important of which was Manchester. However, its potential did not materialize afterwards. In fact, in 2004, following the success of the low-costs carriers such as EasyJet, Monarch tried to adopt a low-cost model too, but that switch turned out to be destructive to the existent value. From a financial perspective, in 2009, after many years of profitably, Monarch reported a pre-tax loss of £32.3m. This event led to a cash injection of £45m from the Mantegazza family. The reason for this unexpected result was a change in the company focus. From being mainly a charter airline, its business model was turned into that of a scheduled flights airline, with a target of 80% of its business being scheduled, 4x higher compared to the 20% target determined in 2005. Other events aggravated the situation. Among those, we remember that in 2011 high jet fuel prices increased the airline’s annual fuel bill by £50m and caused a £45m pre-tax loss for the same year. -

Gatwick Airport (LGW)

Gatwick Airport (LGW) Summer 2019 (S19) Initial Coordination Report Report Date: Thu 08-Nov-2018 Headlines S19 Init Coord vs. S18 Init Coord vs. S19 Hist (SHL) Total Air Transport Movements (Passenger & Freight) 194,135 4.8% 1.2% Total Passenger Air Transport Movements 194,135 4.8% 1.2% Total Passenger Air Transport Movement Seats 38,259,185 5.4% 3.9% Average Seats per Passenger Air Transport Movement 197.08 0.6% 2.7% Percentage of allocated slots cleared as requested (OK) 89.95% Contents Page Content 2 Runway Scheduling Limits 3 Coordinator's Report 4 Peak Week - Initial Coordination Analysis 5 ATM Allocation by Operator (Full season and Peak Week Comparison) 6 Peak Week - Allocation and Slot Adjustment Distribution by Operator 7 Significant Route Changes 8 Full Season - PATM Seats Analysis 9 Full Season - Terminal Analysis 10 Full Season - Aircraft Size Analysis 11 Full Season - Seasonality 12 Peak Week - Initial Hourly Runway Demand 13 Peak Week - Hourly Runway Allocation 14 Peak Week - Hourly Runway Allocation Comparison (S19 Init Coord vs. S18 Init Coord) 15 Peak Week - Hourly Runway Allocation Comparison (S19 Init Coord vs. S19 Hist (SHL)) 16 Peak Week Histogram - Departure Passengers (T60/30) - North Terminal - All Operators 17 Peak Week Histogram - Departure Passengers (T120/30) - North Terminal - All Operators 18 Peak Week Histogram - Arrival Passengers (T60/30) - North International - All Operators 19 Peak Week Histogram - Arrival Passengers (T60/15) - North Domestic - All Operators 20 Peak Week Histogram - Departure Passengers (T60/30) - South Terminal - All Operators 21 Peak Week Histogram - Departure Passengers (T120/30) - South Terminal - All Operators 22 Peak Week Histogram - Arrival Passengers (T60/30) - South International - All Operators 23 Peak Week Histogram - Arrival Passengers (T60/30) - South Domestic - All Operators 24 Glossary S18 scheduling season runs from Sun 25-Mar-2018 to Sat 27-Oct-2018 (217 days). -

Global Volatility Steadies the Climb

WORLD AIRLINER CENSUS Global volatility steadies the climb Cirium Fleet Forecast’s latest outlook sees heady growth settling down to trend levels, with economic slowdown, rising oil prices and production rate challenges as factors Narrowbodies including A321neo will dominate deliveries over 2019-2038 Airbus DAN THISDELL & CHRIS SEYMOUR LONDON commercial jets and turboprops across most spiking above $100/barrel in mid-2014, the sectors has come down from a run of heady Brent Crude benchmark declined rapidly to a nybody who has been watching growth years, slowdown in this context should January 2016 low in the mid-$30s; the subse- the news for the past year cannot be read as a return to longer-term averages. In quent upturn peaked in the $80s a year ago. have missed some recurring head- other words, in commercial aviation, slow- Following a long dip during the second half Alines. In no particular order: US- down is still a long way from downturn. of 2018, oil has this year recovered to the China trade war, potential US-Iran hot war, And, Cirium observes, “a slowdown in high-$60s prevailing in July. US-Mexico trade tension, US-Europe trade growth rates should not be a surprise”. Eco- tension, interest rates rising, Chinese growth nomic indicators are showing “consistent de- RECESSION WORRIES stumbling, Europe facing populist backlash, cline” in all major regions, and the World What comes next is anybody’s guess, but it is longest economic recovery in history, US- Trade Organization’s global trade outlook is at worth noting that the sharp drop in prices that Canada commerce friction, bond and equity its weakest since 2010.