2020 BCG Tech Challengers

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

GETİR Girişim Sermayesi Yatırım Fonu

RE-PIE Gayrimenkul ve Girişim Sermayesi Portföy Yönetimi A.Ş. GETİR Girişim Sermayesi Yatırım Fonu Fon Kurucusu Fon Yatırımı FON YATIRIM TEMASI RE-PIE Gayrimenkul ve Girişim Sermayesi Portföy Yönetimi A.Ş. GETİR Girişim Sermayesi Yatırım Fonu SPK DENETİMİ PROFESYONEL OPERASYON ÖLÇEK VERGİ MAL VARLIĞI ALTINDA YÖNETİM KOLAYLIĞI EKONOMİSİ AVANTAJLARI AYRILIĞI 7/24 1.000’den fazla ürünün 10 dakikadan az sürede dağıtıldığı dünyadaki ilk ve tek iş modeli Aylık yaklaşık %10 büyüme (Son 12 ay) Sermaye artışı yöntemi ile Ankara, İzmir, Antalya ve Bursa’ya giriş (ortak satışı yok) İstanbul B ve C segment başarısı ile Anadolu’ya hızlı ve cesaretli giriş Dört büyük denetim ve değerleme şirketinden birinin değerleme rakamına göre yaklaşık %15 iskontolu yatırım Halka arz veya stratejik satış olursa çıkış hakkı 7 senelik yatırım süresi sonunda yıllık (enflasyon + %3) artış ile şirkete satım hakkı Şahıs ise : Fon pay satışı %10 stopaj, kar payında 1/2 gelir vergisi muafiyeti Vergi avantajı Şirket ise : Kar payında 0 vergi, yatırım miktarı kadar indirilebilir kurumlar vergisi GSYF İŞLEYİŞ ŞEMASI RE-PIE Gayrimenkul ve Girişim Sermayesi Portföy Yönetimi A.Ş. GETİR Girişim Sermayesi Yatırım Fonu ÖZET TABLO RE-PIE Gayrimenkul ve Girişim Sermayesi Portföy Yönetimi A.Ş. GETİR Girişim Sermayesi Yatırım Fonu Strateji Getir Perakende ve Lojistik A.Ş’den %10’a kadar hisse almak Yatırım Komitesi Dr.M.Emre Çamlıbel | Mehmet Ali Ergin | Caner Bingöl | Hasan Bayhan Referans Kur TL Fon Süresi 7 yıl (5 + 2 yıl tasfiye dönemi) Yönetim Ücreti %2 yıllık Hedef Yıllık Getiri -

RIDE? S Ardcliaffmsialice. Ther

f;. l e r s I; ^ i Boucax. : PaW COCK. ■NO. 3 0 2 1 iISLSS? M. »#C ««srtor. \ r, S3EPTEMBE R 11, 1915. HBJBFBOfTE ..M ,,, AX),:HA8TIN08. {■ iin. } ON E P EN N Y sy am oant for OMk. cu’sTcLOTHJNG aM f lankHf. CoitaiDi. au<i 1X09.1 iOid Gold. 6ilr«r : pirompt remittaBo«. Summer Wear wiH rlequire that r putcPaoen eaubot <U» INISH |wMch is ithe HALL MARK of our wbirk A l^ SerftaW fieglv V Ectabiiabed JZt Tajia 3iE Y * LtDok^ V IULA, BAT. •'AHpS, will gtT« . boat teotl^niBo'ft, and Child. ic N otices. JE?rAllKL lUDRESS. of ererr d ^ xlionk Hhuold be m i NOTICE OF BEMOTAL. Kll St. Iieonardt. P to Uiaianoe no (jrAiETY T h e a t r e , H a s t in x is . •R. A br a m , f .r.c .o ., -ad Ies’ Establishments. (Orgntttfi of the Ghuroh of St. Mary StwT'Ofdh^Sei^. Bluaifr: MU H \V noti-LVM' of 13m Organ, I Pianoterte and Siagint. ' 'i ^ lir.l.ltlt Mbi MR. C. £ . SCCflT. •B- liayxDony. and OompoaitieD, etc., hae reanored^to 4, ST. [EI,EN’B PABK liOiU). HASTINGS, wh«e NTT BOROUGH OF HASTING^ MICHAEL'S PKSTABATaMT t OPEN'S at .111-1 frm- pLEICTRICALj & RTipLES FOR I EI.. I'll lICXil OKB'I ^ will •«ramc hie ProfeMioiial dnbee ba MOND^*. EDUCATION COMMITTEE. SCHOOL. a t ?!s3 SK PT O -tEU 79Uj. ^ ^ rtOJIA,'’ iNATcnnAY:. s>) ITEMBEU rtfh , ^and . IJB. BAM alM Ttfite pnpila « i their owa Be^i* j^ UNDS CBtiENTLY NEEDED fiir oarryiag on, and 3ik CH ARLES ROAD. -

Gig Economy and Processes of Information, Consultation, Participation and Collective Bargaining"

Paper on the European Union co-funded project VS/2019/0040 "Gig economy and processes of information, consultation, participation and collective bargaining". By Davide Dazzi (translation from Italian to English by Federico Tani) Updated the 20th of July 2020 Sommario Introduction ....................................................................................................................................................... 2 Gig Economy : a defining framework ................................................................................................................. 2 Platforms and Covid-19 ..................................................................................................................................... 6 GIG workers: a quantitative dimension ........................................................................................................... 10 On line outsourcing ..................................................................................................................................... 11 Crowdworkers and Covid-19 ....................................................................................................................... 14 Working conditions of GIG workers ................................................................................................................ 17 Covid 19 laying bare the asymmetry of social protections ............................................................................. 21 Towards a protection system for platform workers .................................................................................. -

Winterize Auction

•'■'k a- . tr iE S D A ^ m S b c B B R 8.1949 3.':^ TlteW tedlwt Avw ifs DslV Nri Prsss Baa a ( D. {' cil of Parent-Teaohere Aaeoda- .Fsc -Rw Moaai eC Oetobar, 1S4S ^ Fair tola .The Men’a Club of the tln l^ Kart Schweiger wW conduct a tlone is lending ite eptauUd oor- Methodiat church of Bolton^ prayer meeting Tburaday evening Chosen Chairman To Co-Operate pmration by sponsoring a taa dur aad Thnmteyi ( U t t o w n give a box aodal and enteiwn- at eight o'clock at toe home of ing toe hours mentioned. Mrs. 9 , 7 4 S tia dmage la Mrs. Rudolph Ht^ner, 87 Chest B r ■?- ment Saturday evening at 7:80. R. C. Bchalier is chairman of toe day. nut street. On Book Week V af «*a AoSIt ^ an a ntw^rtkA* tor con- The.women will proyWe toe ooxm P. T. A. group aerring as hoateas- and their partnere will be adnUl- aa. io4( Manchester^A CUy of Village Charm I and b7>Uwa win ba talnn Unne Lodge, No. 78, KnighU of V r > ■ » E%«t « meattof o< Monch^ Ud free. The children will have their own Pythias, will meet tomorrow night Mary Cheney Library opportunity to “Make Friend* Btor No. lirTo. A. V.. to b« Emanuel Lutheran Brotherhood at eight o’clock In Orange haU. (THIRTY PAGES—IN TWO SECTIONS) PRICE FOUR CBNTB _olght o’clock at the Silver And PTA to Unite With Books” by seeing free mov (ClaaaUM ASvartMag On Page FIttaaa) MANCHESTER, CONN„ WEDNESDAY, NOVEMBER 9, 1949 of Hartford will be gueoU of the ies at the library, all schoola be __>'C(ii]UDuntty Houee. -

Elektronik Ticaretve Rekabet Hukuku Kapsaminda Çok Tarafli Pazaryerleri

ELEKTRONİK TİCARETVE REKABET HUKUKU KAPSAMINDA ÇOK TARAFLI PAZARYERLERİ Tuğba Çelik 141102111 YÜKSEK LİSANS TEZİ Özel Hukuk Anabilim Dalı Özel Hukuk Yüksek Lisans Programı Danışman: Dr. Öğr. Üyesi Mete Tevetoğlu İstanbul T.C. Maltepe Üniversitesi Sosyal Bilimler Enstitüsü Ağustos 2019 i JÜRİ VE ENSTİTÜ ONAYI ii ETİK İLKE VE KURALLARA UYUM BEYANI iii TEŞEKKÜR Tüm bu süreçte desteğini esirgemeyen başta babam Celal Çelik ve annem Selda Çelik olmak üzere, tez danışmanım Dr. Öğr. Üyesi Mete Tevetoğlu’na, tüm dostlarıma ve yol arkadaşıma en içten teşekkürlerimi sunuyorum. Tuğba Çelik Ağustos 2019 iv ÖZ ELEKTRONİK TİCARET VE REKABET HUKUKU KAPSAMINDA ÇOK TARAFLI PAZARYERLERİ Tuğba Çelik Yüksek Lisans Tezi Özel Hukuk Anabilim Dalı Özel Hukuk Yüksek Lisans Programı Danışman: Dr. Öğr. Üyesi Mete Tevetoğlu Maltepe Üniversitesi Sosyal Bilimler Enstitüsü, 2019 İnternet ortamındaki gelişmelere bağlı olarak, ulusal ve uluslararası ekonomi çevrelerinde, hızla artan bir biçimde ağırlığını hissettiren elektronik ticaret ve elektronik pazaryerleri kavramının, kapsamı ve genel olarak ekonomik etkileri açısından önemi her geçen gün artmaktadır. Bu gelişmeler ile birlikte, elektronik pazaryerlerinde üreticiler, satıcılar ve alıcılar gibi talep sahiplerinin karşılıklı arz ve taleplerini kısa sürede ve daha avantajlı şartlarda buluşturan platformlar yani aracı hizmet sağlayıcıları, önemli bir figür olarak karşımıza çıkmaktadır. Aracılık hizmetleri sağlayan bu platformlar, regülâsyonlara ve özellikle de rekabet kurallarına uyum sağlama sürecinde bazı yapısal, -

UNO Template

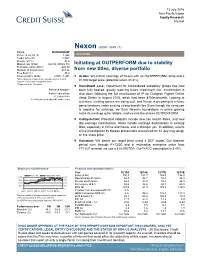

13 July 2016 Asia Pacific/Japan Equity Research Internet Nexon (3659 / 3659 JT) Rating OUTPERFORM* Price (12 Jul 16, ¥) 1,444 INITIATION Target price (¥) 1,900¹ Chg to TP (%) 31.6 Market cap. (¥ bn) 629.93 (US$ 6.10) Initiating at OUTPERFORM due to stability Enterprise value (¥ bn) 440.12 Number of shares (mn) 436.24 from new titles, diverse portfolio Free float (%) 35.0 52-week price range 2,065 - 1,401 ■ Action: We initiate coverage of Nexon with an OUTPERFORM rating and a *Stock ratings are relative to the coverage universe in each ¥1,900 target price (potential return 31.6%). analyst's or each team's respective sector. ¹Target price is for 12 months. ■ Investment case: Impairment for consolidated subsidiary gloops has now Research Analysts been fully booked, greatly reducing future impairment risk. Amortization is Keiichi Yoneshima also down following the full amortization of IP for Dungeon Fighter Online 81 3 4550 9740 (Arad Senki) in August 2015, which had been ¥700mn/month. Looking at [email protected] revenues, existing games are doing well, and Nexon is preparing to release game iterations under existing strong brand titles. Even though the rising yen is negative for earnings, we think Nexon’s foundations in online gaming make its earnings quite reliable, and we rate the shares OUTPERFORM. ■ Catalysts/risk: Potential catalysts include new title launch dates, and new title earnings contributions. Risks include earnings deterioration in existing titles, especially in China and Korea, and a stronger yen. In addition, results of the investigation by Korean prosecutors announced on 12 July may weigh on the share price. -

EA SPORTSTM FIFA Online 3 M Tops 3 Million Downloads in Korea

June 20, 2014 EA SPORTSTM FIFA Online 3 M Tops 3 Million Downloads in Korea Mobile app fully synced with PC-based FIFA Online 3 continues to gain popularity TOKYO – June 20, 2014 – NEXON Co., Ltd. (“Nexon”) (3659.TO), a worldwide leader in free- to-play online games, today announced that EA SPORTSTM FIFA Online 3 M, developed by EA Seoul Studio (Electronic Arts Seoul Studio LLC) and published by Nexon’s wholly-owned subsidiary, NEXON Korea Corporation, surpassed 3 million downloads in Korea on June 17th. FIFA Online 3 M is the latest instalment of the world’s bestselling sports videogame franchise, EA SPORTSTM FIFA. FIFA Online 3 M was launched on March 27, 2014 on the Naver App Store and later launched on Google Play on May 29th. Fully synced with its PC counterpart, FIFA Online 3 M offers players functional team management in a high-quality graphic mobile environment using team and player data, in- game points and other data saved on players’ PC game version. The game also features exclusive mobile-only content to further enhance players’ mobile experience. EA SPORTSTM FIFA Online 3 M EA SPORTS and the EA SPORTS logo are trademarks of Electronic Arts Inc. Official FIFA licensed product. © The FIFA name and OLP Logo are copyright or trademark protected by FIFA. All rights reserved. Manufactured under license by Electronic Arts Inc. The use of real player names and likenesses is authorized by FIFPro Commercial Enterprises BV. About NEXON Co., Ltd. http://company.nexon.co.jp/ NEXON Co., Ltd. (“Nexon”) (3659.TO) is a worldwide leader in free-to-play online games. -

EA SPORTS FIFA Online 3 Comes to China

July 24, 2013 EA SPORTS FIFA Online 3 Comes to China Tencent Games and EA Announce Publishing Agreement SHANGHAI--(BUSINESS WIRE)-- EA SPORTS™FIFA Online 3, the new PC online soccer game from the world's most popular sports videogame franchise, is coming to Chinese gamers and soccer fans. Tencent Games, under Tencent Group as the leading internet service provider in China, and Electronic Arts Inc. (NASDAQ: EA), a global leader in digital interactive entertainment, today announced an agreement through which FIFA Online 3 will be published in mainland China by Tencent Games. The first testing is expected to begin in the fourth quarter of calendar 2013. FIFA Online 3, with the exclusive license from FIFA, delivers the best technologies and all the realism and authenticity of the world's best-selling sports game franchise from EA. Players will experience improved gameplay and strategies, enhanced graphics, the latest rosters, and extensive use of official licenses, including close to 15,000 real world players from 30 leagues and 40 national teams. The game adds new techniques and features, improved artificial intelligence, enhanced animation and dynamic 5-on-5 multiplayer competition. The game is developed by EA Seoul Studio. EA SPORTS FIFA Online 3 holds the number 2 spot in Korean PC café rankings according to Gametrics. The game will also operate in Thailand and Vietnam. Steven Ma, Vice President of Tencent, said, "Tencent Games' agreement with EA is a cooperation between the leading online game company in China and the world's top sports game developer and franchise. The launch of FIFA Online 3 will provide strong momentum for the development of e-sports in China and create a true ‘virtual world of sports' for all Chinese users." Steven Ma also said, "The partnership with EA is an important milestone in Tencent Games' strategy of internationalization. -

The Asia Food Challenge Report

Alexandra Health FOREWORD 2 Foreword The Asia Food Challenge report Rabobank reflects a shared view within It is our shared responsibility and our three organisations that the interest to help accelerate the shift significant challenges facing to a more sustainable agri-food Asia’s agri-food industry create economy through climate-smart an outsized opportunity for ecosystems. With our strong innovation. Simply put, Asia is global network and growing a at a crossroads: huge growth in better world together mission, demand creates an attractive Rabobank strongly believes that opportunity for investment; but partnerships are an essential collective action is required to link in the innovation process in unlock this opportunity. solving Asia’s food challenges. In a nutshell, our shared ideals, shared PwC knowledge and ability to work Now is the time to take concrete together is key to creating a strong steps to address the major food sustainable agri-food chain. challenges we are facing; an issue that hits close to home Diane Boogaard and is central to PwC’s purpose Chief Executive Officer, to build trust in society and Asia, Rabobank solve important problems. Asia is poised to take advantage of Temasek this "perfect storm" although With the growth of the middle- investment currently lags income population in Asia, we behind other markets like the at Temasek see a corresponding United States and parts of demand for more safe, nutritious Europe. Greater collaboration and sustainable food sources. between governments, the We can put our capital to private sector, innovators, good use across the whole financial investors and academia agri-food value chain, from across the food and agriculture increasing farm yields, reducing industry can turn the tide, and the environmental impact of ignite this game-changing farming, to improving the safety, opportunity for all of Asia. -

ELECTRONIC ARTS INC. (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-Q þ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Quarterly Period Ended September 30, 2018 OR ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Transition Period from to Commission File No. 000-17948 ELECTRONIC ARTS INC. (Exact name of registrant as specified in its charter) Delaware 94-2838567 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 209 Redwood Shores Parkway Redwood City, California 94065 (Address of principal executive offices) (Zip Code) (650) 628-1500 (Registrant’s telephone number, including area code) Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES þ NO ¨ Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). YES þ NO ¨ Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. -

ELECTRONIC ARTS Q3 FY14 PREPARED COMMENTS January 28, 2014

ELECTRONIC ARTS Q3 FY14 PREPARED COMMENTS January 28, 2014 ROB: Thank you. Welcome to EA’s fiscal 2014 third quarter earnings call. With me on the call today are Andrew Wilson, our CEO, and Blake Jorgensen, our CFO. Peter Moore, our COO, and Patrick Söderlund, our EVP of EA Studios, will be joining us for the Q&A portion of the call. Please note that our SEC filings and our earnings release are available at ir.ea.com. In addition, we have posted earnings slides to accompany our prepared remarks. Lastly, after the call, we will post our prepared remarks, an audio replay of this call, and a transcript. This presentation and our comments include forward-looking statements regarding future events and the future financial performance of the Company. Actual events and results may differ materially from our expectations. We refer you to our most recent Form 10-Q for a discussion of risks that could cause actual results to differ materially from those discussed today. Electronic Arts makes these statements as of January 28, 2014 and disclaims any duty to update them. During this call unless otherwise stated, the financial metrics will be presented on a non-GAAP basis. Our earnings release and the earnings slides provide a reconciliation of our GAAP to non-GAAP measures. These non-GAAP measures are not intended to be considered in isolation from, as a substitute for, or superior to our GAAP results. We encourage investors to consider all measures before making an investment decision. All comparisons made in the course of this call are against the same period in the prior year unless otherwise stated. -

Electronic Arts Reports Q2 Fy11 Financial Results

ELECTRONIC ARTS REPORTS Q2 FY11 FINANCIAL RESULTS Reports Q2 Non-GAAP Revenue and EPS Ahead of Expectations Reaffirms Full-Year Non-GAAP EPS and Net Revenue Guidance FIFA 11 Scores With 8.0 Million Units Sold In Need For Speed Hot Pursuit with Autolog, Ships November 16 REDWOOD CITY, CA – November 2, 2010 – Electronic Arts Inc. (NASDAQ: ERTS) today announced preliminary financial results for its second fiscal quarter ended September 30, 2010. “We had another strong quarter, beating expectations both top and bottom line,” said John Riccitiello, Chief Executive Officer. “We credit our results to blockbusters like FIFA 11 and to innovative digital offerings like The Sims 3 Ambitions and Madden NFL 11 on the iPad.” “EA reaffirms its FY11 non-GAAP guidance,” said Eric Brown, Chief Financial Officer. “EA is the world’s #1 publisher calendar year-to-date and our portfolio is focused on high- growth platforms -- high definition consoles, PC, and mobile.” Selected Quarterly Operating Highlights and Metrics: EA is the #1 publisher on high-definition consoles with 25% segment share calendar year-to date, two points higher than the same period a year ago. In North America and Europe, the high-definition console software market is growing strongly with the combined PlayStation®3 and Xbox 360® segments up 23% calendar year-to-date. The PlayStation 3 software market is up 36% calendar year-to-date. EA is the #1 PC publisher with 27% segment share at retail calendar year-to-date and strong growth in digital downloads of full-game software. For the quarter, EA had six of the top 20 selling games in Western markets with FIFA 11, Madden NFL 11, NCAA® Football 11, NHL®11, Battlefield: Bad Company™ 2 and FIFA 10.