0218 Exclusive Deliveryf2.Indd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Food Delivery Brands Head-To-Head the Ordering Operation

FOOD DELIVERY BRANDS HEAD-TO-HEAD THE ORDERING OPERATION Market context: The UAE has a well-established tradition of getting everything delivered to your doorstep or to your car at the curb. So in some ways, the explosion of food delivery brands seems almost natural. But with Foodora’s recent exit from the UAE, the acquisition of Talabat by Rocket Internet, and the acquisition of Foodonclick and 24h by FoodPanda, it seemed the time was ripe to put the food delivery brands to the test. Our challenge: We compared six food delivery brands in Dubai to find the most rewarding, hassle-free ordering experience. Our approach: To evaluate the complete customer experience, we created a thorough checklist covering every facet of the service – from signing up, creating accounts, and setting up delivery addresses to testing the mobile functionality. As a control sample, we first ordered from the same restaurant (Maple Leaf, an office favorite) using all six services to get a taste for how each brand handled the same order. Then we repeated the exercise, this time ordering from different restaurants to assess the ease of discovering new places and customizing orders. To control for other variables, we placed all our orders on weekdays at 1pm. THE JUDGING PANEL 2 THE COMPETITIVE SET UAE LAUNCH OTHER MARKETS SERVED 2011 Middle East, Europe 2015 12 countries, including Hong Kong, the UK, Germany 2011 UAE only 2010 Turkey, Lebanon, Qatar 2012 GCC, including Bahrain, Kuwait, Qatar, Saudi Arabia 2015 17 countries, including India, the USA, the UK THE REVIEW CRITERIA: • Attraction: Looks at the overall design, tone of voice, community engagement, and branding. -

Global Delivery and Takeaway Food Market

+44 20 8123 2220 [email protected] Global Delivery and Takeaway Food Market Report 2021 https://marketpublishers.com/r/GD9E8CD81AE5EN.html Date: March 2021 Pages: 122 Price: US$ 2,350.00 (Single User License) ID: GD9E8CD81AE5EN Abstracts At the beginning of 2020, COVID-19 disease began to spread around the world, millions of people worldwide were infected with COVID-19 disease, and major countries around the world have implemented foot prohibitions and work stoppage orders. Except for the medical supplies and life support products industries, most industries have been greatly impacted, and Delivery and Takeaway Food industries have also been greatly affected. In the past few years, the Delivery and Takeaway Food market experienced a growth of XXX, the global market size of Delivery and Takeaway Food reached XXX million $ in 2020, of what is about XXX million $ in 2015. From 2015 to 2019, the growth rate of global Delivery and Takeaway Food market size was in the range of xxx%. At the end of 2019, COVID-19 began to erupt in China, Due to the huge decrease of global economy; we forecast the growth rate of global economy will show a decrease of about 4%, due to this reason, Delivery and Takeaway Food market size in 2020 will be XXX with a growth rate of xxx%. This is xxx percentage points lower than in previous years. As of the date of the report, there have been more than 20 million confirmed cases of CVOID-19 worldwide, and the epidemic has not been effectively controlled. Therefore, we predict that the global epidemic will be basically controlled by the end of 2020 and the global Delivery and Takeaway Food market size will reach XXX million $ in 2025, with a CAGR of xxx% between 2020-2025. -

MUNCHERY, INC., Debtor. Case No

UNITED STATES BANKRUPTCY COURT NORTHERN DISTRICT OF CALIFORNIA SAN FRANCISCO DIVISION In re: Case No. 19-30232 (HLB) MUNCHERY, INC., Chapter 11 Debtor. FIRST AMENDED JOINTLY PROPOSED COMBINED CHAPTER 11 PLAN OF LIQUIDATION AND TENTATIVELY APPROVED DISCLOSURE STATEMENT DATED AS OF JUNE 10, 2020 INTRODUCTION This is the First Amended Jointly Proposed Combined Chapter 11 Plan of Liquidation and Disclosure Statement (the “Plan”), which is being proposed by Munchery, Inc. (the “Debtor”) and the Official Committee of Unsecured Creditors of the Debtor (the “Committee”) in the above- captioned chapter 11 case (the “Chapter 11 Case”) pending before the United States Bankruptcy Court for the Northern District of California, San Francisco Division (the “Bankruptcy Court”). The Plan identifies the classes of creditors and describes how each class will be treated if the Plan is confirmed. The treatment of many of the classes of creditors is intended to be consistent with a Restructuring Support Plan and Term Sheet (the “Settlement Term Sheet”), which was previously approved by the Bankruptcy Court. Part 1 contains the treatment of secured claims. Part 2 contains the treatment of general unsecured claims. Part 3 contains the treatment of administrative and priority claims. Part 4 contains the treatment of executory contracts and unexpired leases. Part 5 contains the effect of confirmation of the Plan. Part 6 contains creditor remedies if the Debtor defaults on its obligations under the Plan. Part 7 contains general provisions of the Plan. Creditors in impaired classes are entitled to vote on confirmation of the Plan. Completed ballots must be received by counsel to the Debtor, and objections to confirmation must be filed and served, no later than August 7, 2020 at 5:00 p.m. -

The Four Horsemen of the Restaurant Apocalypse?

The Four Horsemen of the Restaurant Apocalypse? How lessons from the travel industry’s response to online travel agencies may enable restaurants to survive (and hopefully thrive) in a delivery-heavy future. by Zach Goldstein, CEO and Founder, Thanx The Original Mel’s diner is a Northern California legend. Now at 22 locations, the classic drive-up service is long-gone, just one of many necessary adaptations for a restaurant that celebrated its 70-year anniversary two years ago. The latest evolution may be most challenging yet. “In our first two years on the delivery platforms, revenue went up 20% year-over-year. It was the largest top-line growth we’ve experienced in two decades,” said Tony Bendana, restaurant industry veteran and current Chief Operating Officer of The Original Mel’s which is listed in four third-party delivery apps today — Doordash, Uber Eats, Grubhub, and Postmates. “But when we looked at how much profit we were making, it hadn’t moved.” Tony Bendana, COO at The Original Mel’s What follows is an in-depth study of the massive disruption facing restaurants today, broken into the following sections: Restaurants Are Digitizing 04 More than $200B in restaurants sales will come through digital channels (including third-party marketplaces) by 2022 The Question of Incrementality 05 Because of high take-rates, many restaurants are questioning whether delivery marketplaces are friend or foe We’ve Seen This Story Before: Hotels and Online Travel Agencies 08 OTAs grew rapidly and ultimately stole share from hotels themselves The -

Track Screen Ads on Swiggy Overview of Swiggy

Track Screen Ads on Swiggy Overview of Swiggy Swiggy ( www.swiggy.com) is an online food ordering and delivery platform that allows customers to order food from restaurants near them. Presence in ~ 12 - 14 MM transacting 200+ cities pan India users visiting every month 40 MM orders / month pan ~50%* market share in India food delivery Double digit MOM growth PAN India 100K+ transacting restos ~25% on board conversion rate Top 7 cities of Swiggy * Market Share nos. are as per reports shared by RedSeer Consulting Why customers love Swiggy ? Swiggy’s Growth Story Swiggy ( www.swiggy.com) has grown phenomenally over the past 24 months (clocking ~11X growth). With expansions in new geographies & more verticals, Swiggy’s growth story is poised to become stronger ~11X Growth Reach the audience that matters to you, at scale Monthly transacting base of ~10 mn users High stickiness on the platform, with an average ordering frequency of 3+ per user Young (18-44MF) Urban Digitally active & Engaged (Top 50 cities) Transacting users Users Food & Beverage context Hyperlocality Strategic post-transaction video ad units to ensure higher engagement • Non-skip, Autoplay, Clickable video unit • Average Monthly Reach: 10mn+ • Average Monthly impressions on track screen: 30mn+ • Average completion rate: 70% • Avg. CTR: 0.2- 0.4% Video unit in Landscape Mode Video unit in Portrait Mode Reinforce brand message or drive performance with display ad units • Display units in standalone as well as carousal format to create the full brand story • Average Monthly Reach: 10mn+ • Average Monthly impressions on track screen: 30mn+ • Avg. CTR on Display: 0.3 – 0.5% Brands across categories have seen results with Swiggy’s in-app ad units BFSI E-commerce Auto / OTT (Customer Acquisition) (Sale / Offer Awareness) (Launch Amplification) Thank You Annexure 1: Display Unit specifications • Card dimensions: 1280 x 1000px • No CTA button on the creative • Carousal Title: Upto 30 characters (incl. -

Chinese Investments in India

CHINESE INVESTMENTS IN INDIA Amit Bhandari, Fellow, Energy & Environment Studies Programme, Blaise Fernandes, Board Member, Gateway House and President & CEO, The Indian Music Industry & Aashna Agarwal, Former Researcher Report No. 3, Map No. 10 | February 2020 Disclaimer: While every effort has been made to ensure that data is accurate and reliable, these maps are conceptual and in no way claim to reflect geopolitical boundaries that may be disputed. Gateway House is not liable for any loss or damage whatsoever arising out of, or in connection with the use of, or reliance on any of the information from these maps. Published by Gateway House: Indian Council on Global Relations 3rd floor, Cecil Court, M.K.Bhushan Marg, Next to Regal Cinema, Colaba, Mumbai 400 039 T: +91 22 22023371 E: [email protected] W: www.gatewayhouse.in Gateway House: Indian Council on Global Relations is a foreign policy think tank in Mumbai, India, established to engage India’s leading corporations and individuals in debate and scholarship on India’s foreign policy and the nation’s role in global affairs. Gateway House is independent, non-partisan and membership-based. Editors: Manjeet Kripalani & Nandini Bhaskaran Cover Design & Map Visualisation: Debarpan Das Layout: Debarpan Das All rights reserved. No part of this publication may be reproduced, stored in or introduced into a retrieval system, or transmitted, in any form or by any means (electronic, mechanical, photocopying, recording or otherwise), without prior written permission of the publisher. © Copyright 2020, Gateway House: Indian Council on Global Relations. Methodology Our preliminary research indicated that the focus of Chinese investments in India is in the start-up space. -

Response: Just Eat Takeaway.Com N. V

NON- CONFIDENTIAL JUST EAT TAKEAWAY.COM Submission to the CMA in response to its request for views on its Provisional Findings in relation to the Amazon/Deliveroo merger inquiry 1 INTRODUCTION AND BACKGROUND 1. In line with the Notice of provisional findings made under Rule 11.3 of the Competition and Markets Authority ("CMA") Rules of Procedure published on the CMA website, Just Eat Takeaway.com N.V. ("JETA") submits its views on the provisional findings of the CMA dated 16 April 2020 (the "Provisional Findings") regarding the anticipated acquisition by Amazon.com BV Investment Holding LLC, a wholly-owned subsidiary of Amazon.com, Inc. ("Amazon") of certain rights and minority shareholding of Roofoods Ltd ("Deliveroo") (the "Transaction"). 2. In the Provisional Findings, the CMA has concluded that the Transaction would not be expected to result in a substantial lessening of competition ("SLC") in either the market for online restaurant platforms or the market for online convenience groceries ("OCG")1 on the basis that, as a result of the Coronavirus ("COVID-19") crisis, Deliveroo is likely to exit the market unless it receives the additional funding available through the Transaction. The CMA has also provisionally found that no less anti-competitive investors were available. 3. JETA considers that this is an unprecedented decision by the CMA and questions whether it is appropriate in the current market circumstances. In its Phase 1 Decision, dated 11 December 20192, the CMA found that the Transaction gives rise to a realistic prospect of an SLC as a result of horizontal effects in the supply of food platforms and OCG in the UK. -

Investor Book (PDF)

INVESTOR BOOK EDITION OCTOBER 2016 Table of Contents Program 3 Venture Capital 10 Growth 94 Buyout 116 Debt 119 10 -11 November 2016 Old Billingsgate PROGRAM Strategic Partners Premium Partners MAIN STAGE - Day 1 10 November 2016 SESSION TITLE COMPANY TIME SPEAKER POSITION COMPANY Breakfast 08:00 - 10:00 CP 9:00 - 9:15 Dr. Klaus Hommels Founder & CEO Lakestar CP 9:15 - 9:30 Fabrice Grinda Co-Founder FJ Labs 9:35 - 9:50 Dr. Klaus Hommels Founder & CEO Lakestar Fabrice Grinda Co-Founder FJ Labs Panel Marco Rodzynek Founder & CEO NOAH Advisors 9:50 - 10:00 Chris Öhlund Group CEO Verivox 10:00 - 10:10 Hervé Hatt CEO Meilleurtaux CP Lead 10:10 - 10:20 Martin Coriat CEO Confused.com Generation 10:20 - 10:30 Andy Hancock Managing Director MoneySavingExpert K 10:30 - 10:45 Carsten Kengeter CEO Deutsche Börse Group 10:45 - 10:55 Carsten Kengeter CEO Deutsche Börse Group FC Marco Rodzynek Founder & CEO NOAH Advisors CP 10:55 - 11:10 Nick Williams Head of EMEA Global Market Solutions Credit Suisse 11:10 - 11:20 Talent 3.0: Science meets Arts CP Karim Jalbout Head of the European Digital Practice Egon Zehnder K 11:20 - 11:50 Surprise Guest of Honour 11:50 - 12:10 Yaron Valler General Partner Target Global Mike Lobanov General Partner Target Global Alexander Frolov General Partner Target Global Panel Shmuel Chafets General Partner Target Global Marco Rodzynek Founder & CEO NOAH Advisors 12:10 - 12:20 Mirko Caspar Managing Director Mister Spex 12:20 - 12:30 Philip Rooke CEO Spreadshirt CP 12:30 - 12:40 Dr. -

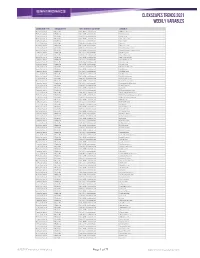

Clickscapes Trends 2021 Weekly Variables

ClickScapes Trends 2021 Weekly VariableS Connection Type Variable Type Tier 1 Interest Category Variable Home Internet Website Arts & Entertainment 1075koolfm.com Home Internet Website Arts & Entertainment 8tracks.com Home Internet Website Arts & Entertainment 9gag.com Home Internet Website Arts & Entertainment abs-cbn.com Home Internet Website Arts & Entertainment aetv.com Home Internet Website Arts & Entertainment ago.ca Home Internet Website Arts & Entertainment allmusic.com Home Internet Website Arts & Entertainment amazonvideo.com Home Internet Website Arts & Entertainment amphitheatrecogeco.com Home Internet Website Arts & Entertainment ancestry.ca Home Internet Website Arts & Entertainment ancestry.com Home Internet Website Arts & Entertainment applemusic.com Home Internet Website Arts & Entertainment archambault.ca Home Internet Website Arts & Entertainment archive.org Home Internet Website Arts & Entertainment artnet.com Home Internet Website Arts & Entertainment atomtickets.com Home Internet Website Arts & Entertainment audible.ca Home Internet Website Arts & Entertainment audible.com Home Internet Website Arts & Entertainment audiobooks.com Home Internet Website Arts & Entertainment audioboom.com Home Internet Website Arts & Entertainment bandcamp.com Home Internet Website Arts & Entertainment bandsintown.com Home Internet Website Arts & Entertainment barnesandnoble.com Home Internet Website Arts & Entertainment bellmedia.ca Home Internet Website Arts & Entertainment bgr.com Home Internet Website Arts & Entertainment bibliocommons.com -

Just Eat Annual Report & Accounts 2017

Just Eat plc Annual Report & Accounts 2017 Annual Report Creating the world’s greatest food community Annual Report & Accounts 2017 WorldReginfo - f5b0c721-e5d8-4dfc-a2c6-df7579591a37 Delivering more choice and convenience to create the world’s greatest food community WorldReginfo - f5b0c721-e5d8-4dfc-a2c6-df7579591a37 Introduction Our vision is to create the world’s greatest food community For our Customers, it is about offering them >> Read more about our the widest choice – whatever, whenever Customers on page 7 and wherever they want to eat. For our Restaurant Partners, we help them >> Read more about our Restaurant Partners on to reach more Customers, support their page 21 businesses and improve standards in the industry. >> Read more about our For our People, it is being part of an People on page 37 amazing global team, helping to connect 21.5 million Active Customers with our 82,300 Restaurant Partners. Strategic report Corporate governance Financial statements 2 Highlights 44 Corporate governance report 84 Independent auditor’s report 4 At a glance 46 Our Board 90 Consolidated income statement 8 Chairman’s statement 48 Report of the Board 91 Consolidated statement of other 10 Chief Executive Officer’s review 56 Report of the Audit Committee comprehensive income 14 Our business model 61 Report of the Nomination Committee 92 Consolidated balance sheet 16 Our markets 65 Report of the Remuneration 93 Consolidated statement of changes 18 Our strategy Committee in equity 19 Our key performance indicators 67 Annual report on remuneration -

List of Brands

Global Consumer 2019 List of Brands Table of Contents 1. Digital music 2 2. Video-on-Demand 4 3. Video game stores 7 4. Digital video games shops 11 5. Video game streaming services 13 6. Book stores 15 7. eBook shops 19 8. Daily newspapers 22 9. Online newspapers 26 10. Magazines & weekly newspapers 30 11. Online magazines 34 12. Smartphones 38 13. Mobile carriers 39 14. Internet providers 42 15. Cable & satellite TV provider 46 16. Refrigerators 49 17. Washing machines 51 18. TVs 53 19. Speakers 55 20. Headphones 57 21. Laptops 59 22. Tablets 61 23. Desktop PC 63 24. Smart home 65 25. Smart speaker 67 26. Wearables 68 27. Fitness and health apps 70 28. Messenger services 73 29. Social networks 75 30. eCommerce 77 31. Search Engines 81 32. Online hotels & accommodation 82 33. Online flight portals 85 34. Airlines 88 35. Online package holiday portals 91 36. Online car rental provider 94 37. Online car sharing 96 38. Online ride sharing 98 39. Grocery stores 100 40. Banks 104 41. Online payment 108 42. Mobile payment 111 43. Liability insurance 114 44. Online dating services 117 45. Online event ticket provider 119 46. Food & restaurant delivery 122 47. Grocery delivery 125 48. Car Makes 129 Statista GmbH Johannes-Brahms-Platz 1 20355 Hamburg Tel. +49 40 2848 41 0 Fax +49 40 2848 41 999 [email protected] www.statista.com Steuernummer: 48/760/00518 Amtsgericht Köln: HRB 87129 Geschäftsführung: Dr. Friedrich Schwandt, Tim Kröger Commerzbank AG IBAN: DE60 2004 0000 0631 5915 00 BIC: COBADEFFXXX Umsatzsteuer-ID: DE 258551386 1. -

YELP INC. (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2018 OR ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number: 001-35444 YELP INC. (Exact name of Registrant as specified in its charter) Delaware 20-1854266 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 140 New Montgomery Street, 9 th Floor San Francisco, California 94105 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (415) 908-3801 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered Common Stock, par value $0.000001 per share New York Stock Exchange LLC Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES x NO ¨ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.