Amh-Fy14-Annual-Report-Eng.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

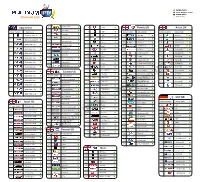

S.No. Channel Name S/L Service Name S/L Channel Name S/L Channel Name 1 CTVN 1 CTVN 1 SITI Bhakti Bangla 1 SITI Bhakti Bangla 2

ICNCL - FTA Pack - West Bengal - Site 1 ICNCL - FTA Pack - West Bengal - Site 2 ICNCL - FTA Top-up - West Bengal - Site 1 ICNCL - FTA Top-up - West Bengal - Site 2 S.No. Channel Name S/L Service Name S/L Channel Name S/L Channel Name 1 CTVN 1 CTVN 1 SITI Bhakti Bangla 1 SITI Bhakti Bangla 2 Naaptol Bangla[V] 2 Naaptol Bangla[V] 2 SITI Music 2 SITI Music 3 DD Bangla 3 DD Bangla 3 SITI Events 3 SITI Events 4 Sangeet Bangla 4 Sangeet Bangla 4 SITI Events 2 4 SITI Events 2 5 Music F 5 Music F 5 Channel Vision 5 Channel Vision 6 Orange TV 6 Orange TV 6 Sristi TV 6 Sristi TV 7 Kolkata Live 7 Kolkata Live 7 Sonar Bangla 7 Sonar Bangla 8 Khushboo Bangla 8 Khushboo Bangla 8 Sristi Plus 8 Sristi Plus 9 R Plus 9 R Plus 9 Globe TV 9 Globe TV 10 Calcutta News 10 Calcutta News 10 Tara TV 10 Tara TV 11 Kolkata TV 11 Kolkata TV 11 Music Bangla 11 Music Bangla 12 Home Shop 18 12 Home Shop 18 12 SITI Cinema 12 SITI Cinema 13 DD India 13 DD India 13 SITI Tollywood 13 SITI Tollywood 14 DD National 14 DD National 14 S NEWS 14 S NEWS 15 DD Bharati 15 DD Bharati 15 High News 15 High News 16 DD Kisan 16 DD Kisan 16 Artage News 16 Artage News 17 WOW Cinema 17 WOW Cinema 17 Uttorer Khobor 17 Uttorer Khobor 18 NT1 18 NT1 18 Jayatu Bangla 18 Jayatu Bangla 19 Cinema TV 19 Cinema TV 19 Channel 10 19 SDTV Prime 20 ABP News 20 ABP News 20 SDTV Prime 20 Metro 21 India TV 21 India TV 21 Metro 21 SDTV Plus 22 JK 24x7 News 22 LS TV 22 SDTV Plus 22 Home TV 23 LS TV 23 RS TV 23 Home TV 23 Express News 24 RS TV 24 DD News 24 Express News 24 Vision 24 25 DD News 25 Republic -

High Court of Delhi Advance Cause List

HIGH COURT OF DELHI ADVANCE CAUSE LIST LIST OF BUSINESS FOR TH THURSDAY, THE 11 FEBRUARY 2016 INDEX PAGES 1. APPELLATE JURISDICTION 01 TO 51 2. COMPANY JURISDICTION 52 TO 56 3. ORIGINAL JURISDICTION 57 TO 67 4. REGISTRAR GENERAL/ 68 TO 84 REGISTRAR(ORGL.)/ REGISTRAR (ADMN.)/ JOINT REGISTRARS(ORGL). 11.02.2016 1 (APPELLATE JURISDICTION) 11.02.2016 [Note : Unless otherwise specified, before all appellate side courts, fresh matters shown in the supplementary lists will be taken up first.] COURT NO. 1 (DIVISION BENCH-I) HON'BLE THE CHIEF JUSTICE HON'BLE MR.JUSTICE JAYANT NATH FOR ADMISSION _______________ 1. W.P.(C) 12030/2015 M K SINGH PET. IN PERSON,GYAN PRAKASH CM APPL. 31897/2015 Vs. CHANCELLOR,RASHTRIYA AND NEERAJ,APOORV KURUP,GYAN SANSKRIT SANSTHAN AND ORS. PRAKASH,GYANPRAKASH AFTER NOTICE MISC. MATTERS ____________________________ 2. LPA 723/2015 KIRAN ABNASHI CHAWLA AND ANR PRIME LEGAL INDIA,PEEYOOSH CM APPL. 24036/2015 Vs. MARGUERITE CHAWLA KALRA CM APPL. 24038/2015 3. W.P.(C) 6393/2015 RAJ NARAYAN VIKRAM V. MINHAS,PRASHANT CM APPL. 11651/2015 Vs. UNION OF INDIA AND ORS. BHUSHAN,ARUN BHARDWAJ,R.V. SINHA,R.K. GUPTA,KAMAL GUPTA 4. W.P.(C) 9626/2015 RESIDENTS WELFARE ASSOCIATION ARUN SUKHIJA,CHHETRI AND CM APPL. 22821/2015 VILLAGE AALI R.W.A. (REGD.) CHHETRI,ANIL MITTAL,HARSHITA CM APPL. 27383/2015 Vs. THE POLICE COMMISSIONER KUMAR SINGH,SANJAY DELHI AND ORS. GHOSE,RAJEEV CHHETRI,RAHUL MEHRA,VIKAS SHOKEEN 5. W.P.(C) 407/2016 KIND HEARTED INCLUSIVE M. RAIS FAROOQUI AND S A ABDI CM APPL. -

IPR2013 Bahasa Malaysia.Pdf

KEPERLUAN STATUTORI Mengikut Bahagian V, Bab 15, Seksyen 123-125 Akta Komunikasi dan Multimedia 1998, dan Bahagian II, Seksyen 6 Akta Perkhidmatan Pos 2012, Suruhanjaya Komunikasi dan Multimedia Malaysia dengan ini menerbitkan dan menghantar kepada Menteri Komunikasi dan Multimedia salinan Laporan Prestasi Industri (IPR) bagi tahun berakhir 31 Disember 2013. 2 SURUHANJAYA KOMUNIKASI DAN MULTIMEDIA MALAYSIA (MCMC), 2014 Maklumat atau bahan dalam penerbitan ini dilindungi di bawah hak cipta dan, kecuali jika dinyatakan sebaliknya, boleh disalin semula untuk kegunaan bukan perdagangan dengan syarat ianya disalin dengan tepat dan tidak digunakan dalam konteks yang mengelirukan. MCMC sebagai sumber bahan, hendaklah dikenalpasti dan taraf hakcipta diperakui bagi mana-mana bahan yang perlu disalin semula. Kebenaran untuk menyalin tidak merangkumi mana-mana maklumat atau hak cipta yang dimiliki oleh individu, organisasi atau pihak ketiga. Kebenaran atau menyalin semula makumat atau bahan tersebut hendaklah diperolehi daripada pemilik hak cipta berkenaan. Semua kerja ini adalah berdasarkan sumber-sumber yang boleh dipercayai, tetapi MCMC tidak menjamin ketepatan atau kesempurnaan apa-apa maklumat untuk sebarang tujuan dan tidak boleh bertanggungjawab bagi apa-apa kesilapan atau ketinggalan yang ketara. Diterbitkan oleh: Suruhanjaya Komunikasi dan Multimedia Malaysia Off Persiaran Multimedia 63000 Cyberjaya, Selangor Darul Ehsan T: +603 8688 8000 F: +603 8688 1000 Talian Bebas Tol: 1- 800-888-030 Laman Sesawang: www.mcmc.gov.my ISSN 1823 – 3724 -

Recognising Perak Hydro's

www.ipohecho.com.my FREE COPY IPOH echoechoYour Voice In The Community February 1-15, 2013 PP 14252/10/2012(031136) 30 SEN FOR DELIVERY TO YOUR DOORSTEP – ISSUE ASK YOUR NEWSVENDOR 159 Malaysian Book Listen, Listen Believe in Royal Belum Yourself of Records World Drums and Listen broken at Festival 2013 Sunway’s Lost World of Tambun Page 3 Page 4 Page 6 Page 9 By James Gough Recognising Perak Hydro’s Malim Nawar Power Staion 2013 – adaptive reuse as a training Contribution to Perak and maintenance facility adan Warisan Malaysia or the Malaysian Heritage BBody, an NGO that promotes the preservation and conservation of Malaysia’s built Malim Nawar Power Station 1950’s heritage, paid a visit recently to the former Malim Nawar Power Station (MNPS). According to Puan Sri Datin Elizabeth Moggie, Council Member of Badan Warisan Malaysia, the NGO had forwarded their interest to TNB to visit MNPS to view TNB’s effort to conserve their older but significant stations for its heritage value. Chenderoh Dam Continued on page 2 2 February 1-15, 2013 IPOH ECHO Your Voice In The Community “Any building or facility that had made a significant contribution to the development of the country should be preserved.” – Badan Warisan Malaysia oggie added that Badan Warisan was impressed that TNB had kept the to the mining companies. buildings as is and practised adaptive reuse of the facility with the locating of Its standard guideline was MILSAS and REMACO, their training and maintenance facilities, at the former that a breakdown should power station. not take longer than two Moggie added that any building or facility that had made a significant contribution hours to resume operations to the development of the country should be preserved for future generations to otherwise flooding would appreciate and that power generation did play a significant part in making the country occur at the mine. -

Liste Des Chaines

Available channel temporary unabled channel disabled channel Channels List channel replay Setanta Sport 46 92 Gold Family UK Asian UK 47 Box Nation channel number channel name 93 Dave channel number channel name channel number channel name 48 ESPN HD 1 beIN Sports News HD 94 Alibi 104 SKY ONE 158 Zee tv UK 49 Eurosport UK 95 E4 105 Sky Two UK 159 Zee cinema UK 2 Bein Sports Global HD 50 Eurosport 2 UK 96 More 4 106 Sky Living 160 Zee Punjabi UK 3 BEIN SPORT 1 HD 51 Sky Sports News 97 Dmax 107 Sky Atlantic UK 161 Zing UK 52 At The Races 4 BEIN SPORT 2 HD 98 5 STAR 108 Sky Arts1 162 Star Gold UK 53 Racing UK 5 BEIN SPORT 3 HD 99 3E 109 Sky Real Lives UK 163 Star Jalsha UK 54 Motor TV 100 Magic 110 Fox UK 164 Star Plus UK 6 BEIN SPORT 4 HD 55 Manchester United Tv 101 TV 3 111 Comedy Central UK 165 Star live UK 7 BEIN SPORT 5 HD 56 Chealsea Tv 102 Film 4 121 Comedy Central Extra UK 166 Ary Digital UK 57 Liverpool Tv 8 BEIN SPORT 6 HD 103 Flava 125 Nat Geo UK 167 Sony Tv UK 113 Food Network 126 Nat Geo Wild uk 168 Sony Sab Tv UK 9 BEIN SPORT 7 HD Cinema Uk 114 The Vault 127 Discovery UK 169 Aaj Tak UK 10 BEIN SPORT 8 HD channel number channel name 115 CBS Reality 128 Discovery Science uk 170 Geo TV UK 60 Sky Movies Premiere UK 11 BEIN SPORT 9 HD 116 CBS Action 129 Discovery Turbo UK 171 Geo news UK 61 Sky Select UK 12 BEIN SPORT 10 HD 130 Discovery History 172 ABP news Uk 62 Sky Action UK 117 CBS Drama 131 Discovery home UK 13 BEIN SPORT 11 HD 63 Sky Modern Great UK 118 True Movies 132 Investigation Discovery 64 Sky Family UK 119 True Movies -

Table of Contents

TABLE OF CONTENTS PAGE Introduction ANANDA KRISHNAN PROFILE AND BACKGROUND 3 - 8 MAXIS COMMUNICATION COMPANY PROFILE 9 - 12 ASTRO COMPANY PROFILE 13 - 20 STYLE OF LEADERSHIP 21 - 24 LEADERSHIP THEORY ADAPTATION 25 Conclusion 26 References 27 1 (a) Background of the leader: the aim of this section is to know and understand the leader as a person and the bases for his/her success. The data and information should be taken from any published sources such as newspapers, company reports, magazines, journals, books etc. INTRODUCTION ANANDA KRISHNAN Who is Ananda Krishnan? According to a report then by Bernama News Agency, the grandfathers of Tan Sri T. Ananda Krishnan and Tan Sri G. Gnanalingam had been brought to Malaysia from Jaffna by British colonial rulers to work in Malaysia¶s Public Works Department, a common practice then as Jaffna produced some of the most educated people in the whole country. Tan Sri Gnanalingam himself told one of our ministers that he wants to put something back into this country because his grandfather was Sri Lankan," Deputy Director-General of Sri Lanka's Board of Investment (BOI) Santhusht Jayasuriya had told a a group of visiting Malaysian journalists then, 2 according to the Bernama 2003 story. Gnanalingam, executive chairman of Malaysia's Westport, held talks with Prime Minister Ranil Wickremesinghe during a visit to Malaysia in 2003 and the former followed up with a visit to Colombo. In the same year a Memorandum of Understanding was formalized in March this year between 'Westport' and the Sri Lanka Ports Authority (SLPA). Westport is keen to invest in Sri Lanka but no formal process has begun. -

S.NO CHANNEL NAME 1 SUN TV 2 KTV 3 Adithya TV 4 Sun Music 5

DIGICON TAMIL MAXX - Rs.101.99+GST S.NO CHANNEL NAME 1 SUN TV 2 KTV 3 Adithya TV 4 Sun Music 5 Chutti TV 6 Sun News 7 SUN Life 8 Vijay TV 9 Vijay Super 10 Star Sports 1 Tamil 11 Star Sports 2 12 Star Sports 3 13 Star Sports First 14 National Geographic 15 Nat Geo Wild 16 CNN News 18 17 Colors Tamil 18 FY1 TV18 19 The History Channel 20 News 18 Tamil Nadu 21 News 18 Urdu 22 NICK 23 NICK JR 24 SONIC 25 VH 1 26 Zee Action 27 Zee News 28 Zee Hindustan 29 Living Foodz 30 Zee ETC 31 WION 32 Zee Tamil 33 Zee Keralam 34 Raj TV 35 Raj Digital Plus 36 Raj News 37 Raj Musix 38 Mega TV 39 Mega Musiq 40 Mega 24 41 Jaya TV 42 Jaya Plus 43 Jaya Max 44 J Movies DIGICON TAMIL BASIC - Rs.70+GST S.NO CHANNEL NAME 1 ADITHYA TV 2 CHUTTI TV 3 COLORS TAMIL 4 K TV 5 NEWS18 TN 6 SUN LIFE 7 SUN MUSIC 8 SUN NEWS 9 SUN TV 10 STAR TAMIL 11 WION 12 ZEE ACTION 13 ZEE ETC 14 ZEE HINDUSTAN 15 ZEE KERALAM 16 ZEE NEWS 17 ZEE TAMIL DIGICON FAMILY PACK-Rs.126+GST S.NO CHANNEL NAME 1 AAJ TAK 38 SONIC 2 AAJ TAK TEZ 39 SONY BBC EARTH 3 ADITHYA TV 40 SONY YAY 4 BBC 41 SUN LIFE 5 CARTOON NETWORK 42 SUN MUSIC 6 CHUTTI TV 43 SUN NEWS 7 CNN 44SUN TV 8 CNN NEWS 18 45 TIMES NOW 9 COLORS TAMIL 46 VH1 10 DISNEY 47 VIJAY 11 DISNEY HD 48 WB 12 DISNEY JUNIOR 49 WION 13 DISNEY XD 50 ZEE ACTION 14 ET NOW 51 ZEE ETC 15 FYI 52 ZEE HINDUSTAN 16 HBO 53 ZEE KERALAM 17 HISTORY 54 ZEE NEWS 18 HUNGAMA 55 ZEE TAMIL 19 INDIA TODAY 56 ZOOM 20 K TV 21 MEGA 24 22 MEGA MUSIQ 23 MEGA TV 24 MIRROR NOW 25 MNX 26 MOVIES NOW 27 MTV BEATS HD 28 NEWS 18 TAMIL 29 NEWS 18 URDU 30 NICK 31 NICK JUNIOR 32 POGO 33 -

Astro Case Study

Case Study ASTRO RADIO: VIRTUAL CONSOLE TECHNOLOGY MALAYSIA’S LARGEST BROADCASTER REINVENTS RADIO STUDIOS WITH LAWO VIRTUAL MIXING Case Study VIRTUAL MIXING AT ASTRO RADIO “A RADICAL RE-IMAGINING OF WHAT AN ON-AIR STUDIO COULD LOOK LIKE.” Astro Radio, headquartered in Kuala Lumpur, has become one of Southeast Asia‘s most influential broadcasters since their inception in 1996. With 11 radio formats in multiple languages, including the popular Era, Sinar, Gegar, My, Hitz and other channels, Astro Radio reaches over 15.8 million listeners every week in Malaysia alone. Astro began operations in 1996 and immediately became known for their technological excellence, employing a cutting-edge audio routing system and digital broadcast consoles custom manufactured to meet their technical requirements. But by 2006, Astro needed more capabilities and simpler studio workflows, so that on-air talent could focus on content creation rather than technical duties. “Around 2015, we picked up on the touchscreen trend,” says Bala Murali Subramaney, Astro Radio’s Chief Technology Officer. “We envisioned a full-blown radio broadcast console - on a touchscreen. Not a ‘lite’ console with only some console features nor a touchscreen with a console ‘simulation’.” Astro Radio Broadcast Center, Kuala Lumpur The virtual console Astro engineers envisioned would be a true radio broadcast console, with all the features and functionalities of the professional broadcast consoles they relied on. “We took the best features of our first console, analyzed common operator mistakes and asked for improvement suggestions, then we condensed this data into a comprehensive document and presented it as our mandate to Lawo – whose response was the Zirkon-2s modular broadcast console,” says Bala. -

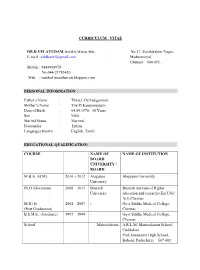

[email protected] Maduravoyal, Chennai – 600 095. Mobile : 9444908979 No.044-23783420 Web : Makkal Maruthuvan.Blogspot.Com

CURRICULUM VITAE DR.D.VELAYUDAM, B.S.M.S.,M.D.(S).,PhD., No:57, Varalakshmi Nagar, E-mail : [email protected] Maduravoyal, Chennai – 600 095. Mobile : 9444908979 No.044-23783420 Web : makkal maruthuvan.blogspot.com PERSONAL INFORMATION : Father’s Name : Thiru,L.Deivasigamani Mother’s Name : Tmt.D.Kangampujam Date of Birth : 04.04.1976; 38 Years Sex : Male Marital Status : Married. Nationality : Indian Languages known : English, Tamil EDUCATIONAL QUALIFICATION: COURSE NAME OF NAME OF INSTITUTION BOARD UNIVERSITY / BOARD M.B.A. (H.M). 2010 – 2012 Alagappa Alagappa University University Ph.D (Doctorate) 2008 – 2011 Bharath Bharath institute of Higher University education and research.(Est.UGC Act),Chennai. M.D.(S) 2004 – 2007 - Govt.Siddha Medical College, (Post Graduation) Chennai. B.S.M.S., (Graduate) 1993 – 1999 - Govt.Siddha Medical College, Chennai. School Matriculation A.R.L.M. Matriculation School, Cuddalore Prof.Annusamy High School, Bahour, Puducherry – 607 402. CURRENT POSITION: Chairman : Tamizh Maruthuva Kazhagam Vice-President : IMPCOPS Ltd. (The Indian Medical Practitioners’ Co-op. Pharmacy & Stores Ltd., ) Editor : Siddhan Kural, Monthly Health Joournal WORK EXPERIENCE: Asso.Prof. (Reader) : Sivaraj Siddha Medical College. Medical Officer (S) : National Institute of Siddha, Chennai, Govt. of India. Lecturer : Sriram Siddha Medical College, Chennai Research Officer : Health India Foundation (An Integrated Medical National Organisation) Chief Medical Officer (S) : Avizhtham Siddha Hospital, Virugampakkam, Chennai-93. -

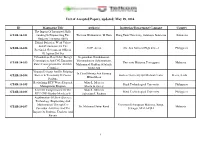

List of Accepted Papers, Updated: May 19, 2014

List of Accepted Papers, updated: May 19, 2014 ID Manuscript Title Author(s) Institution/ Department/ Company Country The Impact Of Integrated-Skills GTAR-14-101 Grading In Empowering The Theresia Widihartanti, M.Hum Hang Tuah University, Surabaya, Indonesia Indonesia Students’ Language Skills Ethical Behavior, Work Values And Performance Of The GTAR-14-102 Jed P. Acero Sta. Ana National High School Philippines Provincial Government Officers Of Agusan Del Sur Urbanization, Renewable Energy Loganathan, Nanthakumar, Consumption And CO2 Emission: Thirunaukarasu Subramaniam, GTAR-14-103 Universiti Malaysia Terengganu Malaysia Panel Cointegration For ASEAN Muhammad Shahbaz &Suhaila Countries Abdul Jalil Vitamin D Status And Its Relating In Cheol Hwang And Kyoung GTAR-14-104 Factors In Terminally Ill Cancer Gachon University Gil Medical Center Korea, South Hwan Moon Patients Revitalizing RTU Waste Disposal Julius L. Meneses GTAR-14-105 Rizal Technological University Philippines Management Program Marita G. Geroy Level Of Competencies Of The Julius L. Meneses GTAR-14-106 Rizal Technological University Philippines RTU-CED Faculty Members In Salvacion J. Pachejo Acculturation Of Stem (Science, Technology, Engineering And Mathematics) Through Co- Universiti Kebangsaan Malaysia, Bangi, GTAR-14-107 Dr. Mohamad Sattar Rasul Malaysia Curricular Activities And The Selangor, MALAYSIA Impact On Students, Teachers And Parents 1 Exploring Polytechnic Automotive Design And Manufacturing Universiti Kebangsaan Malaysia, Bangi, GTAR-14-108 Engineering Wbl Program -

MAXIS BERHAD (Company No.: 867573-A) (Incorporated in Malaysia Under the Companies Act, 1965)

MAXIS BERHAD (Company No.: 867573-A) (Incorporated in Malaysia under the Companies Act, 1965) NOTICE OF EXTRAORDINARY GENERAL MEETING NOTICE IS HEREBY GIVEN that an Extraordinary General Meeting of Maxis Berhad (“Maxis” or “the Company”) will be held at Company, AVEA İletişim Hizmetleri A.Ş., SEBIT Egitim ve Bilgi Teknolojileri Anonim Sirketi and Viva Bahrain BSC (C) as specified in Part A of Appendix I of the the Ballroom 1, Level 3, Kuala Lumpur Convention Centre, Kuala Lumpur City Centre, 50088 Kuala Lumpur on Wednesday, 7 Company’s Circular to Shareholders dated 9 April 2014, provided that such transactions are necessary for day-to-day operations of the Company and/or its subsidiaries and are carried out in the ordinary course of business on normal commercial terms and on terms which are not more favourable to the parties with which May 2014 at 4.00 p.m. or immediately after the conclusion or adjournment (as the case may be) of the Fifth Annual General such recurrent transactions are to be entered into than those generally available to the public and which are not detrimental to the non-interested shareholders of Meeting of the Company which will be held at the same venue and on the same day at 2.15 p.m. or any adjournment of the the Company, Extraordinary General Meeting, whichever is later, for the purpose of considering and, if thought fit, passing with or without AND THAT the mandate conferred by this resolution shall continue to be in force until: modifications the following resolutions: (a) the conclusion of the next annual -

On ASTRO Star World

Complaints Bureau Orders 2007- 2017 A Decade of Decisions Communications and Multimedia Content Forum of Malaysia Forum Kandungan Komunikasi dan Multimedia Malaysia Published by Communications and Multimedia Content Forum of Malaysia (CMCF) March 2021 Copyright © 2021 Communications and Multimedia Content Forum of Malaysia (CMCF). e ISBN: 978-967-19397-0-3 e ISBN 978-967-19397-0-3 9789671939703 All rights reserved. No part of this work may be reproduced or transmitted in any form or by any means electronic or mechanical, including photocopying or web distribution, without the written permission of the publisher. EDITOR Dr. Manjit Kaur Ludher While every effort is made to ensure that accurate information is disseminated through this publication, CMCF makes no representation about the content and suitability of this information for any purpose. CMCF is not responsible for any errors or omissions, or for the results obtained from the use of the information in this publication. In no event will CMCF be liable for any consequential, indirect, special or any damages whatsoever arising in connection with the use or reliance on this information. PUBLISHER Communications and Multimedia Content Forum of Malaysia (CMCF) Forum Kandungan Komunikasi dan Multimedia Malaysia Unit 1206, Block B, Pusat Dagangan Phileo Damansara 1 9 Jalan 16/11, Off Jalan Damansara, 46350 Petaling Jaya Selangor Darul Ehsan, MALAYSIA Website: www.cmcf.my This book is dedicated in loving memory of Communications and Multimedia Content Forum’s founding Chairman Y. Bhg. Dato’