The Next Generation Delivery Vehicle Congressional Reps Want

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ELECTRIC VEHICLES MARKET IS POWERING up an Industry Snapshot

Investment and Company Research Opportunity Research INDUSTRY SNAPSHOT July 2, 2020 ELECTRIC VEHICLES MARKET IS POWERING UP An Industry Snapshot Featured Companies: Tesla (NASDAQ - TSLA); Nikola (NASDAQ – NKLA); Workhorse Group (NASDAQ – WKHS); Alternet Systems (OTC – ALYI) www.goldmanresearch.com Copyright © Goldman Small Cap Research, 2020 Page 1 of 8 Investment and Company Research Opportunity Research INDUSTRY SNAPSHOT OUR THESIS: As of this writing, shares of Tesla (NASDAQ – TSLA), the undisputed bellwether stock for the electric vehicle market trades at $1121 per share. At current prices, the market cap is over $207 billion, representing over 5 estimated 2021 sales and a whopping 98x next year’s EPS. In many investors’ minds, where Tesla goes, so goes the industry segment, especially as it relates to the capital markets. While TSLA is the industry’s most important company, it is the exact mid-point of 2020, not 2016, and therefore is not the only pubco in the space. In fact, some under the radar firms with exposure to the space offer major upside that may rival TSLA, with varying risk profiles and share prices. Instead of making the case for the industry and its constituents in the lithium, fuel cell, and other segments, we have elected to focus on the vehicle producers, where we believe the greatest attention and upside exist. THE EV MARKET: A BRIEF HISTORY We began writing about the EV market in 2015/2016 and while going over our old reports and blogs, we came across some striking information. In 2016, Bloomberg New Energy Finance (now billed as Bloomberg NEF) projected that by 2040, EV passenger sales will reach 41 million units. -

Post Office Llv Shop Manual 2019

Post Office Llv Shop Manual 2019 If you are looking for the ebook Post office llv shop manual 2019 in pdf form, then you have come on to the loyal website. We present full option of this ebook in DjVu, PDF, ePub, doc, txt formats. You can read online Post office llv shop manual 2019 either download. Additionally, on our website you can reading the guides and another art eBooks online, or load theirs. We want to invite regard what our website does not store the book itself, but we give reference to the site wherever you may downloading either read online. If have must to downloading pdf Post office llv shop manual 2019, then you've come to the correct website. We own Post office llv shop manual 2019 doc, DjVu, PDF, ePub, txt forms. We will be glad if you return us again and again. online chevrolet llv service & repair manual - - Online Repair Manual Home > Chevrolet > LLV Online Chevrolet LLV Repair Manual Software This online repair manual software is easy to use and you are covered by grumman llv - wikipedia, the free encyclopedia - The Grumman Long Life Vehicle, also known as the LLV, is an American light transport truck. The Grumman LLV was designed for the United States Postal Service, which usps s latest solution for aging long - postal - LONG LIFE VEHICLE (LLV) There shall be a fully detailed service manual provided in some family member of the post office management that made this post office - At the Post Office our aim is to provide you with the things that are important to you Whether you pop into a branch or shop online, 1989 -

Advanced Technology Equipment Manufacturers*

Advanced Technology Equipment Manufacturers* Revised 04/21/2020 On-Road (Medium/Heavy Duty, Terminal Tractors) OEM Model Technology Vocations GVWR Type Altec Industries, Inc Altec 12E8 JEMS ePTO ePTO ePTO, Utility > 33,000, 26,001 - 33,000 New Altec Industries, Inc Altec JEMS 1820 and 18E20 ePTO ePTO ePTO, Utility > 33,000, 26,001 - 33,000 New Altec Industries, Inc Altec JEMS 4E4 with 3.6 kWh Battery ePTO ePTO, Utility 16,001-19,500, 19,501-26,000 New Altec Industries, Inc Altec JEMS 6E6 with 3.6 kWh Battery ePTO ePTO, Utility 16,001-19,500, 19,501-26,000 New Autocar Autocar 4x2 and 6x4 Xpeditor with Cummins-Westport ISX12N Engine Near-Zero Engine Truck > 33,001 New Autocar Autocar 4x2 and 6x4 Xpeditor with Cummins-Westport L9N Engine Near-Zero Engine Refuse > 33,001 New Blue Bird Blue Bird Electric Powered All American School Bus Zero Emission Bus, School Bus > 30,000 New Blue Bird Blue Bird Electric Powered Vision School Bus 4x2 Configuration Zero Emission Bus, School Bus > 30,000 New BYD Motors BYD 8Y Electric Yard Tractor Zero Emission Terminal Truck 81,000 New BYD Motors BYD C10 45' All-Electric Coach Bus Zero Emission Bus 49,604 New BYD Motors BYD C10MS 45' All-Electric Double-Decker Coach Bus Zero Emission Transit Bus 45' New BYD Motors BYD C6 23' All-Electric Coach Bus Zero Emission Bus 18,331 New BYD Motors BYD K11 60' Articulated All-Electric Transit Bus Zero Emission Bus 65,036 New BYD Motors BYD K7M 30' All-Electric Transit Bus Zero Emission Bus, Transit Bus 30' New BYD Motors BYD K9 40' All-Electric Transit Bus Zero Emission -

1999 GES Coding and Editing Manual 1999

U.S. Department of Transportation National Highway Traffic Safety Administration General Estimates System Coding And Editing Manual 1999 Table of Contents Variables/Questions are displayed in data entry order. Variable/Question Name Index .......................................... vi PAR A22 Police Jurisdiction ................................................1 A01 Date ...........................................................2 A02 Time ...........................................................3 A23 Stratum .........................................................5 PAR Configuration Questions A03 Number of Motor Vehicles ..........................................8 A04 Number of Non-Motorists ..........................................11 Events E01 Event Number -- NEW VARIABLE ...................................13 V01 Vehicle Number (This Vehicle) ......................................19 V24 Initial Point of Impact (This Vehicle) ..................................20 E02 Action -- NEW VARIABLE .........................................24 A06 First Harmful Event ..............................................27 V01 Vehicle Number (Other Vehicle) ....................................39 V24 Initial Point of Impact (Other Vehicle) .................................40 A07 Manner of Collision ..............................................44 Crash Data Questions A05 Land Use ......................................................47 A25 Work Zone .....................................................48 A21 School Bus Related ..............................................49 -

I!1'C[F&!) POSTAL RATE Commlsston WASHINGTON, DC

BEFORE THE i!1‘C[f&!) POSTAL RATE COMMlSStON ‘(3 Ii WASHINGTON, DC. 20266~661 5 2J, p/j 90, pw:,I fi,\iE c”, OFFICEOF r//C s;hkk,>,,,, POSTAL RATE AND FEE CHANGES,2001 i Docket No. R2001-1 RESPONSE OF UNITED STATES POSTAL SERVICE WITNESS TAYMAN TO INTERROGATORIES OF THE OFFICE OF THE CONSUMER ADVOCATE (OCA/USPS-T&l-21) The United States Postal Service hereby provides the responses of witness Tayman to the following interrogatories of the Office of the Consumer Advocate: OCA/USPS-T6-l-21, filed on October 3,200l. Each interrogatory is stated verbatim and is followed by the response. Respectfully submitted, UNITED STATES POSTAL SERVICE By its attorneys: Daniel J. Foucheaux, Jr. Chief Counsel, Ratemaking 475 L’Enfant Plaza West, S.W. Washington, D.C. 20260-l 137 (202) 266-2999; Fax -5402 October 17,200l RESPONSE OF UNITED STATES POSTAL SERVICE WITNESS TAYMAN TO INTERROGATORIES OF THE OFFICE OF THE CONSUMER ADVOCATE OCA/USPS-16-l. The following refer to the USPS FY 2001 and FY 2002 Operating Plans. (a) Please provide the FY 2001 Operating Plan and the most current USPS FY 2002 Operating Plan by accounting periods for Postal Service operating revenues, appropriations, investment income, expenses and volumes. 04 For each of the thirteen accounting periods presented in part “a” of this interrogatory, please provide the most current USPS Operating Plan with operating revenues broken out by mail class and subclass cost categories. RESPONSE: (a) The FY 2001 Operating Plan by accounting period is attached. The FY 2002 accounting period Operating Plan has not been finalized. -

11 Electric Vehicle Stocks to Buy for 2021

INVESTOR PLACE 11 ELECTRIC VEHICLE STOCKS TO BUY FOR 2021 LUKE LANGO How to turn the electric disruption of transportation into your million-dollar opportunity When it comes to identifying next-generation breakthrough investments that could rise 100%, 200%, 500%, or more, I always come back to one saying. Where there’s disruption, there’s opportunity. Case-in-point: The internet. Throughout the 1990s, the emergence of the internet rapidly disrupted how people across the globe worked, communicated, and played. For many, it was a scary time. Change is never easy. For many more, it was an exciting time, as the internet was unlocking a new world of possibilities. But… for investors… it was an opportunity. Specifically, it was a once-in-a-decade opportunity to invest early in emerging titans of the internet industry. Like Amazon (AMZN)… when it was a $438 million company in 1997… It’s a $1.6 TRILLION company today – representing a whopping 365,000% return. That means a mere $1,000 investment in Amazon in 1997 would be worth more than $3.6 million today. 2 Luke Lango’s Hypergrowth Investing Need I say more? Where there’s disruption, there’s opportunity – and the bigger the disruption, the bigger the opportunity. Right now, we are on the cusp of an enormous disruption. This disruption will fundamentally and entirely change the world’s multi-trillion-dollar transportation work. In its wake, it will create new hundred-billion-dollar titans of the auto industry – most of whom are just tiny companies today. What disruption am I talking about specifically? The shift toward electric vehicles. -

GM Sells Shuttered Ohio Assembly Plant to Electric Vehicle Startup by David Welch November 7, 2019, 3:10 PM EST

Hyperdrive GM Sells Shuttered Ohio Assembly Plant to Electric Vehicle Startup By David Welch November 7, 2019, 3:10 PM EST Lordstown Motors is still raising money for its plug-in pickup CEO Steve Burns says he hopes to start production in late 2020 rally-goers from selling their homes because of all the jobs he would bring back to the area. Democrats seized on the development as a symbol of unfulfilled promises made to voters in a key battleground state. Trump was so eager to endorse GM’s discussions to sell the Lordstown plant that he preempted the announcement of the talks in May by the largest U.S. automaker and Workhorse. But both companies are on shaky financial footing, with Workhorse totaling just $6,000 of revenue during its latest quarter. American flags fly in front of the GM plant in Lordstown, Ohio, in March. The automaker has sold the factory to Lordstown Motors. Lordstown Motors Corp., the electric-truck startup formed specifically to save a shuttered Ohio car factory, has acquired the highly politicized plant from General Motors Co. The acquisition that the two companies announced Thursday ends an era that began when GM opened the complex in 1966. The factory’s fate was largely sealed when the United Auto Workers union was unable to convince GM to keep it in the fold as part of a new labor contact ratified late last month. With the plant acquisition out of the way, Steve Burns, who Terms of the deal aren’t being disclosed. Workhorse Group used to lead Workhorse and is now chief executive officer Inc., which is affiliated with Lordstown Motors but doesn’t of Lordstown Motors, is turning his attention to phase two: share any ownership, soared 27% to close at $3.13 in New seeking cash to convert the Lordstown plant from making York trading. -

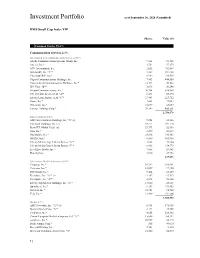

DWS Small Cap Index VIP

Investment Portfolio as of September 30, 2020 (Unaudited) DWS Small Cap Index VIP ______________________Shares Value ($) Common Stocks 98.6% Communication Services 2.3% Diversified Telecommunication Services 0.8% Alaska Communications Systems Group, Inc. 9,664 19,328 Anterix, Inc.* 1,751 57,275 ATN International, Inc. 2,052 102,887 Bandwidth, Inc. "A"* 3,387 591,268 Cincinnati Bell, Inc.* 8,969 134,535 Cogent Communications Holdings, Inc. 7,403 444,550 Consolidated Communications Holdings, Inc.* 12,394 70,522 IDT Corp. "B"* 3,076 20,240 Iridium Communications, Inc.* 20,284 518,865 Liberty Latin America Ltd. "A"* 8,472 69,894 Liberty Latin America Ltd. "C"* 27,483 223,712 Ooma, Inc.* 3,608 47,084 Orbcomm, Inc.* 12,899 43,857 Vonage Holdings Corp.* 39,742 _________406,561 2,750,578 Entertainment 0.2% AMC Entertainment Holdings, Inc. "A" (a) 9,254 43,586 Cinemark Holdings, Inc. (a) 19,171 191,710 Eros STX Global Corp* (a) 23,773 52,538 Gaia, Inc.* 2,099 20,633 Glu Mobile, Inc.* 24,816 190,463 IMAX Corp.* 8,860 105,966 Liberty Media Corp.-Liberty Braves "A"* 1,868 39,004 Liberty Media Corp.-Liberty Braves "C"* 6,415 134,779 LiveXLive Media, Inc.* 7,885 20,462 Marcus Corp. 3,616 _________27,952 827,093 Interactive Media & Services 0.4% Cargurus, Inc.* 14,792 319,951 Cars.com, Inc.* 12,057 97,420 DHI Group, Inc.* 9,464 21,389 Eventbrite, Inc. "A"* (a) 11,367 123,332 EverQuote, Inc. "A"* 2,494 96,368 Liberty TripAdvisor Holdings, Inc. -

Usef-I Q2 2021

Units Cost Market Value U.S. EQUITY FUND-I U.S. Equities 88.35% Domestic Common Stocks 10X GENOMICS INC 5,585 868,056 1,093,655 1ST SOURCE CORP 249 9,322 11,569 2U INC 301 10,632 12,543 3D SYSTEMS CORP 128 1,079 5,116 3M CO 11,516 2,040,779 2,287,423 A O SMITH CORP 6,897 407,294 496,998 AARON'S CO INC/THE 472 8,022 15,099 ABBOTT LABORATORIES 24,799 2,007,619 2,874,948 ABBVIE INC 17,604 1,588,697 1,982,915 ABERCROMBIE & FITCH CO 1,021 19,690 47,405 ABIOMED INC 9,158 2,800,138 2,858,303 ABM INDUSTRIES INC 1,126 40,076 49,938 ACACIA RESEARCH CORP 1,223 7,498 8,267 ACADEMY SPORTS & OUTDOORS INC 1,036 35,982 42,725 ACADIA HEALTHCARE CO INC 2,181 67,154 136,858 ACADIA REALTY TRUST 1,390 24,572 30,524 ACCO BRANDS CORP 1,709 11,329 14,749 ACI WORLDWIDE INC 6,138 169,838 227,965 ACTIVISION BLIZZARD INC 13,175 839,968 1,257,422 ACUITY BRANDS INC 1,404 132,535 262,590 ACUSHNET HOLDINGS CORP 466 15,677 23,020 ADAPTHEALTH CORP 1,320 39,475 36,181 ADAPTIVE BIOTECHNOLOGIES CORP 18,687 644,897 763,551 ADDUS HOMECARE CORP 148 13,034 12,912 ADOBE INC 5,047 1,447,216 2,955,725 ADT INC 3,049 22,268 32,899 ADTALEM GLOBAL EDUCATION INC 846 31,161 30,151 ADTRAN INC 892 10,257 18,420 ADVANCE AUTO PARTS INC 216 34,544 44,310 ADVANCED DRAINAGE SYSTEMS INC 12,295 298,154 1,433,228 ADVANCED MICRO DEVICES INC 14,280 895,664 1,341,320 ADVANSIX INC 674 15,459 20,126 ADVANTAGE SOLUTIONS INC 1,279 14,497 13,800 ADVERUM BIOTECHNOLOGIES INC 1,840 7,030 6,440 AECOM 5,145 227,453 325,781 AEGLEA BIOTHERAPEUTICS INC 287 1,770 1,998 AEMETIS INC 498 6,023 5,563 AERSALE CORP -

Workhorse Group, INC--The Small Cincinnati Company “Delivering” in the Electric Vehicle Race

June 2020 Will Brown Adam Eagleston CEO and Managing Partner CIO Workhorse Group, INC--The Small Cincinnati Company “Delivering” in the Electric Vehicle Race It is rare to find a company at the intersection of two major trends; it’s even more unusual that it is in your hometown. However, that is the case with the aptly named Workhorse Group, Inc. (ticker: WKHS) headquartered in Loveland, OH. Formidable Asset Management (“FAM”) recently established a position; following are the key pieces of our investment thesis: • Established technology and infrastructure • Marquee customers • Undervalued investments Overview Workhorse manufactures electric vehicles (both land-based and aerial), predominantly for use in deliveries (think Amazon, UPS, or the U.S. Postal Service). Despite its presence in this attractive niche, valuable intellectual property, and potentially transformative strategic partnerships, the company trades at a significant discount to our estimate of its intrinsic value. Established technology and infrastructure The company builds more than electric vehicles; it has developed an integrated platform to offer clients a holistic delivery solution that includes cost efficient ground vehicles, telematics to optimize deliveries, and unmanned aerial systems (UASs) for last mile delivery. In the company’s opinion, it is a first mover with a two-to-three year head start over its competitors, which is critically important. Once established, it is very difficult to displace an incumbent within the context of a vehicle fleet, especially one that is integrated. The company has seven (7) granted and four (4) pending patents. As we’ll see later, some of Workhorse’s core electric vehicle intellectual property is currently being licensed. -

USPS Looks for the Next Generation Delivery Vehicle He Long Life Vehicle Could Finally Be Approaching the End of Its Life

Carostal vehicles are partand of daily life for an vehiclesCarrier take on new meaning for the young and active letter carrier. A truck is just another the old, alike. tool, like a satchel or case, for doing our With the Postal Service looking to replace its ag- Pjobs. But postal vehicles are a familiar sym- ing fleet of vehicles, The Postal Record takes a look bol of the trust and reliability of the Postal Ser- forward at the design process for the postal vehicle vice—almost as recognizable as letter carriers. For of the future and a look back at postal vehicles that many, older postal vehicles are nostalgic remind- letter carriers used in the past, including some that ers of the old days. And as they evolve, postal have found new lives. Back in time with previous generations’ postal vehicles etter carriers have always enlisted some of the vehicles that city carriers wagons, which were used to transport the help of wheeled vehicles to bear have used throughout the history of mail between post offices and train Lthe load of mail and packages. The the U.S. Postal Service. stations in large cities from the 1870s vehicles they have used have changed When door-to-door mail delivery to the first decade of the 20th century. dramatically with carriers’ needs and became a popular service in the United The wagons were usually painted red, the technology available. From the States during the Civil War, postal white and blue with gold lettering. simple horse-drawn wagon of yester- employees used horse-drawn carts to By the late 1890s, regulation wagons year to today’s Long Life Vehicle (LLV) extend their range beyond the mail they began to be phased out in favor of to tomorrow’s Next Generation Postal could carry in a satchel or atop a horse. -

Heavy-Duty Vehicles & Freight Sector Baseline

Heavy-duty Vehicles & Freight Sector Baseline ALLIANCE 50X50 COMMISSION ON U.S. TRANSPORTATION SECTOR EFFICIENCY Report by the Heavy-duty Vehicles & Freight Technical Committee September 26, 2018 PREAMBLE The Alliance to Save Energy launched the 50x50 Commission on U.S. Transportation Sector Efficiency (the “50x50 Commission”) to lay out regulatory, policy, and investment pathways to significantly improve energy efficiency in the U.S. transportation sector. Comprising executives and decision makers from a range of key stakeholder groups— including vehicle manufacturers, utilities, federal and subnational governments, technology developers and providers, environmental advocates, and targeted customers— the 50x50 Commission established the goal to reduce energy consumption in the U.S. transportation sector by 50 percent by 2050 on a pump-to-wheel (PTW) basis, relative to a 2016 baseline. The 50x50 Commission work is complementary to that of the Alliance Commission on National Energy Efficiency Policy, which recommended energy efficiency policies and practices that could lead to a second doubling of energy productivity by 2030. As transportation represents roughly one-third of overall energy consumption in the U.S., the transportation sector offers enormous potential for gains in both energy efficiency and energy productivity. The outputs of the 50x50 Commission include a foundational white paper that outlines the goals and scope of the Commission’s work, a set of five “sector baseline” reports that assess the current state of energy efficiency within the transportation sector, and a suite of policy recommendations outlining the types of government support, at all levels, necessary to achieve the 50x50 goal. This report, Heavy-duty Vehicles & Freight, is one of the five sector baseline reports that identifies the general market trends for efficient transportation technologies and explores opportunities and challenges related to deploying those technologies.