11 Electric Vehicle Stocks to Buy for 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Auto Retailing: Why the Franchise System Works Best

AUTO RETAILING: WHY THE FRANCHISE SYSTEM WORKS BEST Q Executive Summary or manufacturers and consumers alike, the automotive and communities—were much more highly motivated and franchise system is the best method for distributing and successful retailers than factory employees or contractors. F selling new cars and trucks. For consumers, new-car That’s still true today, as evidenced by some key findings franchises create intra-brand competition that lowers prices; of this study: generate extra accountability for consumers in warranty and • Today, the average dealership requires an investment of safety recall situations; and provide enormous local eco- $11.3 million, including physical facilities, land, inventory nomic benefits, from well-paying jobs to billions in local taxes. and working capital. For manufacturers, the franchise system is simply the • Nationwide, dealers have invested nearly $200 billion in most efficient and effective way to distribute and sell automo- dealership facilities. biles nationwide. Franchised dealers invest millions of dollars Annual operating costs totaled $81.5 billion in 2013, of private capital in their retail outlets to provide top sales and • an average of $4.6 million per dealership. These service experiences, allowing auto manufacturers to concen- costs include personnel, utilities, advertising and trate their capital in their core areas: designing, building and regulatory compliance. marketing vehicles. Throughout the history of the auto industry, manufactur- • The vast majority—95.6 percent—of the 17,663 ers have experimented with selling directly to consumers. In individual franchised retail automotive outlets are locally fact, in the early years of the industry, manufacturers used and privately owned. -

Going Public Production Company Through Its a Shares

Co-published section: United Kingdom About NWR • A pure play hard-coal-mining and coke Going public production company through its A Shares. • A leading supplier of hard coal in the fastest growing region in Europe. Partial exits can benefit PE firms, as a £3.5 billion Czech IPO • Owns five established mines and two coking facilities in northeast Czech shows. Adam Levin and Claudine Ang of Dechert explain Republic. It is pursuing opportunities in n May 2008, the shares of New World cant minority stake, following which RPG Poland and elsewhere. Resources NV (NWR), a Dutch-incor- Industries acquired that majority investor (in • One of the largest industrial groups in the porated company (formerly a 2004) and took OKD private (in 2005), after Czech Republic in terms of assets and wholly-owned subsidiary of RPG a squeeze-out of minority interests. It was one revenues. IIndustries SE) with mining operations in the of the largest leveraged finance transactions in • Second largest private employer in the Czech Republic, were admitted to trading on Central Europe at that time. country with approximately 18,341 the London, Prague and Warsaw stock The restructuring that followed shows the employees and 3,563 contractors. exchanges. The offering, after exercise of the focus that private equity houses can bring to a greenshoe option, was approximately £1.3 business. This included: the consolidation of the billion (approximately $2.5 billion) resulting mining businesses within one entity, OKD, the Mining Division or its assets. The IPO was in a market capitalisation of about £3.5 bil- rather than the five entities within which the only with respect to the A Shares. -

ELECTRIC VEHICLES MARKET IS POWERING up an Industry Snapshot

Investment and Company Research Opportunity Research INDUSTRY SNAPSHOT July 2, 2020 ELECTRIC VEHICLES MARKET IS POWERING UP An Industry Snapshot Featured Companies: Tesla (NASDAQ - TSLA); Nikola (NASDAQ – NKLA); Workhorse Group (NASDAQ – WKHS); Alternet Systems (OTC – ALYI) www.goldmanresearch.com Copyright © Goldman Small Cap Research, 2020 Page 1 of 8 Investment and Company Research Opportunity Research INDUSTRY SNAPSHOT OUR THESIS: As of this writing, shares of Tesla (NASDAQ – TSLA), the undisputed bellwether stock for the electric vehicle market trades at $1121 per share. At current prices, the market cap is over $207 billion, representing over 5 estimated 2021 sales and a whopping 98x next year’s EPS. In many investors’ minds, where Tesla goes, so goes the industry segment, especially as it relates to the capital markets. While TSLA is the industry’s most important company, it is the exact mid-point of 2020, not 2016, and therefore is not the only pubco in the space. In fact, some under the radar firms with exposure to the space offer major upside that may rival TSLA, with varying risk profiles and share prices. Instead of making the case for the industry and its constituents in the lithium, fuel cell, and other segments, we have elected to focus on the vehicle producers, where we believe the greatest attention and upside exist. THE EV MARKET: A BRIEF HISTORY We began writing about the EV market in 2015/2016 and while going over our old reports and blogs, we came across some striking information. In 2016, Bloomberg New Energy Finance (now billed as Bloomberg NEF) projected that by 2040, EV passenger sales will reach 41 million units. -

LIVK Merger Announcement with Agilethought Press Release

AgileThought, a pure-play digital solutions provider that delivers high-end software development at scale, to list on Nasdaq through a business combination with LIV Capital Acquisition Corp. • AgileThought is a leading pure play provider of agile-first software, end-to-end digital transformation and consulting services to Fortune 1000 customers with diversity across end-markets and industry verticals • AgileThought delivers high-end software development at scale under a uniquely competitive onshore and nearshore business model that leverages talent from the U.S., Mexico and other Latin American countries to serve U.S. corporations • The business combination between AgileThought and LIV Capital Acquisition Corp. (“LIVK”) (the “Transaction”) values the combined company at a proforma enterprise value of approximately $482 million and is expected to provide approximately $124 million in primary gross proceeds to AgileThought, including $81 million of cash held in LIVK’s trust account (assuming no redemptions in connection with the Transaction), and a fully committed $43 million investment by PIPE investors and LIV Capital at $10.00 per share. The fully committed investment will, at funding, satisfy the minimum cash requirement to close the Transaction • The Transaction will enhance AgileThought’s position at the forefront of the more than $750 billion digital transformation services market in the U.S., offering one of a kind, agile software development capabilities with onshore and nearshore delivery • The Transaction is expected to close in the third quarter of 2021 subject to LIVK’s shareholders approval and other customary conditions. Following the closing of the Transaction, the combined company will remain listed on Nasdaq under the new ticker symbol AGIL • AgileThought and LIVK will host a joint investor conference call to discuss the details of the proposed Transaction on May 10, 2021 at 11:00 AM EST. -

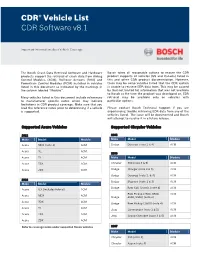

V8.1 Supported Vehicle List

® CDR Vehicle List CDR Software v8.1 Important Information about Vehicle Coverage The Bosch Crash Data Retrieval Software and Hardware Bosch takes all reasonable actions to ensure the CDR products support the retrieval of crash data from Airbag product supports all vehicles (US and Canada) listed in Control Modules (ACM), Roll-over Sensors (ROS) and this and other CDR product documentation. However, Powertrain Control Modules (PCM) installed in vehicles there may be some vehicles listed that the CDR system listed in this document as indicated by the markings in is unable to retrieve EDR data from. This may be caused the column labeled ‘‘Module’’. by (but not limited to) information that was not available to Bosch at the time the product was developed or, EDR Many vehicles listed in this document include references retrieval may be available only on vehicles with to manufacturer specific notes which may indicate particular options. limitations in CDR product coverage. Make sure that you read the reference notes prior to determining if a vehicle Please contact Bosch Technical Support if you are is supported. experiencing trouble retrieving EDR data from any of the vehicles listed. The issue will be documented and Bosch will attempt to resolve it in a future release. Supported Acura Vehicles Supported Chrysler Vehicles 2012 2005 Make Model Module Make Model Module Acura MDX (note 1) ACM Dodge Durango (note 2 & 4) ACM Acura RL ACM 2006 Acura TL ACM Make Model Module Acura TSX ACM Chrysler 300 (note 3 & 5) ACM Acura ZDX ACM Dodge Charger (note -

Advanced Technology Equipment Manufacturers*

Advanced Technology Equipment Manufacturers* Revised 04/21/2020 On-Road (Medium/Heavy Duty, Terminal Tractors) OEM Model Technology Vocations GVWR Type Altec Industries, Inc Altec 12E8 JEMS ePTO ePTO ePTO, Utility > 33,000, 26,001 - 33,000 New Altec Industries, Inc Altec JEMS 1820 and 18E20 ePTO ePTO ePTO, Utility > 33,000, 26,001 - 33,000 New Altec Industries, Inc Altec JEMS 4E4 with 3.6 kWh Battery ePTO ePTO, Utility 16,001-19,500, 19,501-26,000 New Altec Industries, Inc Altec JEMS 6E6 with 3.6 kWh Battery ePTO ePTO, Utility 16,001-19,500, 19,501-26,000 New Autocar Autocar 4x2 and 6x4 Xpeditor with Cummins-Westport ISX12N Engine Near-Zero Engine Truck > 33,001 New Autocar Autocar 4x2 and 6x4 Xpeditor with Cummins-Westport L9N Engine Near-Zero Engine Refuse > 33,001 New Blue Bird Blue Bird Electric Powered All American School Bus Zero Emission Bus, School Bus > 30,000 New Blue Bird Blue Bird Electric Powered Vision School Bus 4x2 Configuration Zero Emission Bus, School Bus > 30,000 New BYD Motors BYD 8Y Electric Yard Tractor Zero Emission Terminal Truck 81,000 New BYD Motors BYD C10 45' All-Electric Coach Bus Zero Emission Bus 49,604 New BYD Motors BYD C10MS 45' All-Electric Double-Decker Coach Bus Zero Emission Transit Bus 45' New BYD Motors BYD C6 23' All-Electric Coach Bus Zero Emission Bus 18,331 New BYD Motors BYD K11 60' Articulated All-Electric Transit Bus Zero Emission Bus 65,036 New BYD Motors BYD K7M 30' All-Electric Transit Bus Zero Emission Bus, Transit Bus 30' New BYD Motors BYD K9 40' All-Electric Transit Bus Zero Emission -

Mobile Air Conditioner Leakage Rates Model Year 2016 (Alphabetical List)

Mobile Air Conditioner Leakage Rates Model Year 2016 (Alphabetical List) Leakage Rate AC Charge Size Percentage loss per Make Model (MY 2016) Type of Vehicle (grams/year) (grams) year Ford Fusion 1.6L GDTI Passenger Car 7.8 570 1.4 Ford Fusion 2.5L iVCT Passenger Car 8.7 680 1.3 Ford Escape 1.6L GTDI SUV 8.4 680 1.2 Ford Escape 2.5L SUV 8.0 680 1.2 Ford Police Interceptor Sedan 3.5 GTDI Passenger Car 9.6 740 1.3 Ford Police Interceptor Sedan 3.5L/3.7L TiVCT Passenger Car 9.8 650 1.5 Ford Ford Focus RS 2.3L GDTI RS Passenger Car 7.4 600 1.2 Ford Mustang Shelby GT500 5.2L Passenger Car 7.1 650 1.1 Ford Transit 3.5L GTDI V6 148" wheelbase ext body (dual) Van 8.1 1190 0.7 Ford Transit 3.5L GTDI V6 148" wheelbase (dual) Van 8.0 1190 0.7 Ford Transit 3.5L GTDI V6 130" wheelbase (dual) Van 7.9 1190 0.7 Ford Transit 3.7L TIVCT V6 148" wheelbase ext body (dual) Van 8.1 1110 0.7 Ford Transit 3.7L TIVCT V6 148" wheelbase (dual) Van 8.0 1110 0.7 Ford Transit 3.7L TIVCT V6 130" wheelbase (dual) Van 7.9 1110 0.7 Ford Trainsit 3.7L TIVCT And 3.5L GTDI V6 Van 7.2 790 0.9 Ford Transit 3.2L Diesle I5, 148" wheelbase ext body (dual) Van 8.3 1110 0.7 Ford Transit 3.2L Diesel I5, 148" wheelbase (dual) Van 8.2 1110 0.7 Ford Transit 3.2L Diesel I5, 130" wheelbase (dual) Van 8.1 1110 0.7 Ford Transit 3.2L Diesel I5 Van 7.4 790 0.9 Ford Fiesta 1.0L TiVCT GDTI Passenger Car 7.4 680 1.1 Ford Fiesta 1.6L TiVCT GDTI Passenger Car 7.4 680 1.1 Ford Fiesta 1.6L TiVCT Passenger Car 7.4 600 1.2 Ford Transit Connect 2.5L (Dual) Van 7.8 880 0.9 Ford Transit Connect 2.5L Van 7.3 680 1.1 Ford Transit Connect 1.6L GTDI (Dual) Van 7.9 880 0.9 Ford Transit Connect 1.6L GTDI Van 7.4 680 1.1 Ford Edge 3.5L V6 TiVCT SUV 8.4 680 1.2 Ford MKX 3.7L V6 TiVCT SUV 8.4 680 1.2 Ford Edge 2.0L I4 GTDI SUV 8.7 680 1.3 Ford Police Interceptor Utility 3.5L GTDI SUV 10.3 960 1.1 Ford Police Interceptor utility 3.7L TiVCT SUV 10.4 740 1.4 Minnesota Pollution Control Agency • 520 Lafayette Rd. -

The Most Important Chart in Sustainable Finance?

fAGF. AGF SUSTAINABLE MARKET INSIGHT The Most Important Chart in Sustainable Finance? By Martin Grosskopf and Andy Kochar AGF SUSTAINABLE fAGF. A great deal has been written in the last few All financial assets and in fact all investment theses have years about the rise of sustainability in the some aspect of duration embedded in their valuation and premiums. For equities, duration can be considered as the financial sector – often either on sustainability time it takes to recoup one’s initial investment through itself (corporate or policy objectives) or on the future cash flows. An estimation of today’s equity market opportunity and risks for financial markets duration is provided in Figure 1. The idea is that long- duration equity investments have a significant proportion (stock prices and fund flows). As we all know, of their intrinsic value tied to their terminal value, thereby the COVID-19 crisis accelerated this movement, making them susceptible to drawdowns when interest with sustainability-linked products taking the rate volatility picks up on a cyclical basis. lion’s share of new fund flows, and with many As one can see from this estimation, the duration of the sustainability-linked themes significantly U.S. equity market has until very recently been increasing since the Great Financial Crisis, thanks to falling interest outperforming in 20201. rates and the significant, growing presence of long- However, 2021 has brought some significant rotation duration sectors such as Information Technology and away from companies with the most to benefit from Health Care. On the other hand, although the fixed capital inflows and the most to offer over the long income market has had its share of duration extensions term – for example, pure EV and battery companies, as well, S&P 500 equities have stretched to a duration of renewables, and so on. -

COMISIÓN NACIONAL DEL MERCADO DE VALORES Madrid

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO CANADA, AUSTRALIA, SOUTH AFRICA OR JAPAN OR ANY OTHER JURISDICTION IN WHICH THE DISTRIBUTION OR RELEASE WOULD BE UNLAWFUL. COMISIÓN NACIONAL DEL MERCADO DE VALORES These materials are not an offer for sale of securities in the United States. The securities have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”) and may not be sold in the United States absent registration or an exemption from registration under the Securities Act. Madrid, 7 de junio de 2021 Muy Sres. nuestros: Dear Sirs, En cumplimiento de lo dispuesto en el Pursuant to the provisions of Art. 227 of Art. 227 del texto refundido de la Ley del the consolidated text of the Securities Mercado de Valores, ACCIONA, S.A. Market Act, ACCIONA, S.A. (“Acciona” (“Acciona” o la “Sociedad”), comunica lo or the “Company”), reports the following, siguiente INFORMACIÓN RELEVANTE MATERIAL INFORMATION Como continuación de las comunicaciones As a follow-up to the Insider Information de Información Privilegiada publicadas el statements published on 18 February 2021 18 de febrero de 2021 (IP número de (IP number 724 and 728), Acciona registro 724 y 728), Acciona informa informs of its intention to proceed with sobre su intención de realizar la Oferta the Initial Public Offering (“IPO”) Pública de Venta (“Oferta”) de las relating to the shares of its subsidiary and acciones de su filial Corporación Acciona head of the Energy division of the Group, Energías Renovables, S.A. Unipersonal Corporación Acciona Energías (“Acciona Energía”), cabecera de la Renovables, S.A. -

AALA2009 Percentages R1.Xls 8/7/2009

Page 1 AALA2009 Percentages_r1.xls 8/7/2009 Passenger car Other Vehicle Type Manufactured in: Manufactured in: Percent Content US/ US/ US/ Manufacturers Makes Carlines Models Canada Canada Outside Canada Outside American Honda Acura RL 0% X American Honda Acura TSX 0% X American Honda Honda Fit 0% X American Honda Honda S2000 0% X American Suzuki Motor Suzuki Grand Vitara 0% X American Suzuki Motor Suzuki SX4 0% X 612 Scaglietti, Scaglietti F1 & 599 GTB Fiat Ferrari Fiorano/F1 0% X F430/F430 F1, F430 Spider, F430 Spider F1, 430 Scuderia & Fiat Ferrari Scuderia Spider 16M 0% X Fuyi Heavy Industries Subaru Forester 0% X Fuyi Heavy Industries Subaru Impreza 0% X Lotus Lotus Elise/Exige0%X Mazda Motor Corp. Mazda CX-7 0% X Mazda3 - 4D Sedan & Mazda Motor Corp. Mazda Hatchback 0% Mazda Motor Corp. Mazda Mazda5 0% X Mazda Motor Corp. Mazda MX-5 Miata 0% X Mazda Motor Corp. Mazda RX-8 0% X Mercedes Benz Mercedes C-Class 0% X Mercedes Benz Mercedes CL & CLS 0% X CLK-Class, Mercedes Benz Mercedes Cabriolet/Coupe 0% X Mercedes Benz Mercedes E-Class 0% X Mercedes Benz Mercedes G-Class 0% X Mercedes Benz Mercedes Maybach 0% X Mercedes Benz Mercedes S & SL Class 0% X Mercedes Benz Mercedes SLK-Class 0% X Mercedes Benz Mercedes SLR 0% X Mitsubishi Motors Mitsubishi Lancer 0% X Mitsubishi Motors Mitsubishi Outlander 0% X Nissan North America Infiniti EX35 0% X Nissan North America Infiniti FX35/50 0% X G37 Sedan, Coupe, Nissan North America Infiniti Convertible 0% X Nissan North America Infiniti M35/45 0% X Nissan North America Nissan 350Z Convertible -

In Vitro Diagnostic Market Insight: Continued Growth and Consolidation

MARKET INSIGHTS In Vitro Diagnostic Market Insight: Continued Growth and Consolidation Craig Steger Senior Vice President, Outcome Capital Oded Ben-Joseph, Ph.D., MBA Managing Director, Outcome Capital Echoe M. Bouta, Ph.D. Associate, Outcome Capital Driven by a multitude of factors including the ageing population, Introduction increasing burden of chronic and infectious diseases, mounting demand for early diagnosis, emergence of personalized medicine and higher demand for testing in the developing world, the global In Vitro Diagnostics (IVD) market is projected to grow at 5.2% CAGR from $68 billion in 2018 to $88 billion in 20231. We examined recent IVD market dynamics between 2016 and Q3/2019 including financing events, merger and acquisitions (M&As) and initial public offerings (IPOs). We analyzed these dynamics to assess the overall activity of the segment to provide management teams and boards with a market-aligned perspective. Mature Market Marked by million, three private equity (PE) Danaher’s acquisition of Cepheid, Intense Consolidation financings over $200 million, and Abbott’s acquisition of Alere, four acquisitions over $1 billion and PerkinElmer’s acquisition of The rapid growth of the (Table 1). With respect to the Euroimmun. Roche’s acquisition of IVD market has attracted more financing events, both transactions Foundation Medicine is expected to than a 100 players2, resulting in supported growth capital to close in late 2019. Roche acquired numerous M&As over the past commercialize and expand 56% of Foundation Medicine in several years. This has resulted product offering and to propel 2015 for approximately $1 billion in consolidation as players have revenue generation, allowing and has now decided to lock-up made two or more acquisitions these companies to become large that investment by acquiring the over this relatively short time players in the segment. -

Toyota in the World 2011

"Toyota in the World 2011" is intended to provide an overview of Toyota, including a look at its latest activities relating to R&D (Research & Development), manufacturing, sales and exports from January to December 2010. It is hoped that this handbook will be useful to those seeking to gain a better understanding of Toyota's corporate activities. Research & Development Production, Sales and Exports Domestic and Overseas R&D Sites Overseas Production Companies North America/ Latin America: Market/Toyota Sales and Production Technological Development Europe/Africa: Market/Toyota Sales and Production Asia: Market/Toyota Sales and Production History of Technological Development (from 1990) Oceania & Middle East: Market/Toyota Sales and Production Operations in Japan Vehicle Production, Sales and Exports by Region Overseas Model Lineup by Country & Region Toyota Group & Supplier Organizations Japanese Production and Dealer Sites Chronology Number of Vehicles Produced in Japan by Model Product Lineup U.S.A. JAPAN Toyota Motor Engineering and Manufacturing North Head Office Toyota Technical Center America, Inc. Establishment 1954 Establishment 1977 Activities: Product planning, design, Locations: Michigan, prototype development, vehicle California, evaluation Arizona, Washington D.C. Activities: Product planning, Vehicle Engineering & Evaluation Basic Research Shibetsu Proving Ground Establishment 1984 Activities: Vehicle testing and evaluation at high speed and under cold Calty Design Research, Inc. conditions Establishment 1973 Locations: California, Michigan Activities: Exterior, Interior and Color Design Higashi-Fuji Technical Center Establishment 1966 Activities: New technology research for vehicles and engines Toyota Central Research & Development Laboratories, Inc. Establishment 1960 Activities: Fundamental research for the Toyota Group Europe Asia Pacific Toyota Motor Europe NV/SA Toyota Motor Asia Pacific Engineering and Manfacturing Co., Ltd.