HIGHLIGHTS a Quarterly Update on World Seafood Markets

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Responsible Fish Trade and Food Security

RESPONSIBLE FISH TRADE AND FOOD SECURITY Toward understanding the relationship between international fish trade and food security Report of the study on the impact of international trade in fishery products on food security Conducted jointly by Food and Agriculture Organisation of the United Nations and the Royal Norwegian Ministry of Foreign Affairs RESPONSIBLE FISH TRADE AND FOOD SECURITY Toward understanding the relationship between international fish trade and food security Prepared by: John Kurien Fellow Centre for Development Studies Trivandrum, India With Inputs from: Sjef van Eijs (Nicaragua) José Augusto Negreiro Aragão and René Schärer (Brazil) Roberto de Andrade (Chile) Andrew Murray and Mamadou Mar Faye (Senegal) M.A.Mensah, K.A.Koranteng, D.Yeboah and A.Bortey (Ghana) Hopolang Phororo and Rehabeam Shilimela (Namibia) Richard O Abila (Kenya) Oscar Amarasinghe (Sri Lanka) Somying Piumsombun (Thailand) Cesar Allan C Vera Jr. (Philippines) V.R.Bidesi, N.Evans, J.Raj, J. Rajan and D.Williams (Fiji ); Nicole Franz and Paola Sabatini (FAO, Rome) Rome April 2004 ii iii CONTENTS Acknowledgements ix Abbreviations x Fact Sheet xi Executive Summary xii 1. Fish Trade and Food Security: 1 An Introductory Overview 1.1 Background 1 1.2 International fish trade in history 2 1.3 International fish trade today: some stylized facts 3 1.4 Fish for food security 5 1.5 For a greater understanding of food security 8 1.6 Food security as a human right 10 1.7 Fish trade and food security 11 1.8 Fish trade and food security: market, state and civil society 11 1.9 The way forward 12 2. -

The Outlaw Ocean Report

The Outlaw Ocean ii The Outlaw Ocean An Exploration of Policy Solutions to Address Illegal Fishing and Forced Labor in the Seafood Industry RESEARCH TEAMS IUU FISHING AND DATA POLICY Neil Nathan | MS Candidate, Earth Systems Hanna Payne | MA Candidate, Earth Systems Victor Xu | JD Candidate, Stanford Law School (SLS) IUU FISHING AND PORT ENTRY Laura Anderson | MA Candidate, Earth Systems Sadie Cwikiel | MS Candidate, Earth Systems Josheena Naggea | PhD Candidate, Emmett Interdisciplinary Program in Environment and Resources FORCED LABOR IN FISHERIES Nahla Achi | MA Candidate, Earth Systems Natasha Batista | MS Candidate, Earth Systems Trudie Grattan | BS Candidate, Human Biology Katelyn Masket | JD Candidate, SLS RESEARCH ASSISTANTS Shalini Iyengar | JSM, Fellow in the Stanford Program in International Legal Studies, SLS Hai Jin Park | JSD Candidate, SLS, PH.D. Minor, Computer Science Xiao Wang | LLM, Stanford Law School TEACHING TEAM Janet Martinez | Senior Lecturer, Director of Gould Negotiation and Mediation Program, SLS Jim Leape | Co-Director, Stanford Center for Ocean Solutions (COS) Annie Brett | André Hoffmann Fellow, COS Kevin Chand | Early Career Law and Policy Fellow, COS; Lecturer, Stanford dschool Eric Hartge | Research Development Manager, COS PROJECT ADVISORS Luciana Herman | Lecturer & Policy Lab Program Director, SLS Proposed Citation: Stanford Center for Ocean Solutions (COS) and the Stanford Law School (SLS). “The Outlaw Ocean: An Exploration of Policy Solutions to Address Illegal Fishing and Forced Labor in the Seafood -

89 the Country Is One of Fly-Fishing's Last Nirvanas, Offering Anglers Truly

Chile, a hot spot for trout The country is one of fly-fishing’s last nirvanas, offering anglers truly wild fisheries and enormous trout, says Nick Zoll. Photographs by Valentine Atkinson elations between Chile and over most of the 3,000-mile border between simply dividing the disputed lakes in half. to and i were nearing the end of a lengthy scout- motoring over lago General Carrera), we were Above: casting on a tributary of the Rio Aisén, argentina have always been argent ina and Chile rests on the ownership of this day several shared lakes have two names. ing tour of southern argentina’s finest fishing met by an officious-looking naval-grey launch one of Chile’s prolific trout rivers tetchy, with disputes, claims the vast glacial lakes nestling in the valleys of eighty-eight years after edward’s interven- and shooting estancias. With two days left and containing a Chilean border patrol unit. the and counter-claims over the andes and running along the frontier. tional masterstroke, i found myself in a small much already accomplished, we had swapped officers on board wore dark-blue uniforms argentinian, Us and Brazil ian passports all in re sources and land ownership, Heated discussion over which way the lakes boat heading for Chile across the choppy countries. De almeida had been given the nod and side-arms that spoke of trouble if we didn’t one day, or perhaps we enlivened an otherwise likeR petulant siblings arguing over playroom historically drained provoked bitter wran- waters of lago Buenos aires. My companions by a fishing friend that there was a river on the come quietly. -

Advances in Seafood Byproducts 43 Alaska Sea Grant College Program • AK-SG-03-01, 2003

Advances in Seafood Byproducts 43 Alaska Sea Grant College Program • AK-SG-03-01, 2003 Utilization of Fish Byproducts in Iceland Sigurjon Arason Icelandic Fisheries Laboratories, and University of Iceland, Department of Food Science, Reykjavik, Iceland Abstract Fisheries are the single most important industry in Iceland, and will con- tinue to play an important role in the economy of Iceland for a long time to come. In 2001 the total catch was around 2 million tons, accounting for 62% of the country’s merchandise exports. The living marine resources are, however, limited and it is important to utilize these resources in a sustainable way. It is also important to maximize their value by produc- ing high-priced products from the raw material, which is currently be- ing used for fish meal or simply discarded. For example, today all cod heads from land-based processing plants are being utilized and lately the freezing trawlers have begun freezing them onboard for processing on shore. Fortunately, most of the byproducts are no longer regarded as waste but are used as raw material for fish processing like roe, liver, mince, viscera, etc. The byproducts from salting, freezing, and canning fresh fish and other processes have different qualities and potentials. Therefore, quality management is important and new technologies are emerging that will allow a new range of products to be made from byproducts which will, for example, benefit the pharmaceutical, cosmetics, and food industries worldwide. Introduction The living marine resources in Icelandic waters are the most important natural resources in the country. In 2001, the total catch was around 2 million tons, (Fig. -

Optimal Fishing Mortality Assignment for Southern Hake Merluccius Australis in Chile

Latin American Journal of Aquatic Research, 48(4): 613-625, 2020 Fishing mortality assignment for southern hake, in Chile 613 DOI: 10.3856/vol48-issue4-fulltext-2283 Research Article Optimal fishing mortality assignment for southern hake Merluccius australis in Chile 1 1 2 Felipe López , Jorge Jimenez & Cristian Canales 1Departamento de Ingeniería Industrial, Facultad de Ingeniería Universidad de Concepción, Concepción, Chile 2Laboratorio Dinámica de Poblaciones Marinas y Modelamiento Estadístico (DIMARE) Escuela de Ciencias del Mar, Pontificia Universidad Católica de Valparaíso, Valparaíso, Chile Corresponding author: Felipe López ([email protected]) ABSTRACT. Since 1979, southern hake (Merluccius australis) has been exploited in Chile from the Bio Bio to the Magallanes regions, between the parallels 41°28.6'S and 57°S. There is evidence of a constant fishing effort and a sustained reduction of the fish population, consistent with a progressive decrease in total annual catches. Management strategies based on the maximum sustainable yield (MSY) and quota assignment/ distribution criteria have not been able to sustain acceptable biomass levels. A non-linear optimization model with two objective functions was proposed to determine an optimal total catch quota for more sustainable exploitation of this fishery. The first function maximizes the total catch over time in response to an optimal assignment of fishing mortality rates per fleet; the second function maximizes the total economic benefit associated with the total catch. The dynamics of the fish population were represented with the equations of a predictive age-structured model. Decision variables were fishing mortality rates and annual catch quotas per fleet, subject to constraints that guarantee a minimum level of biomass escape over a long-term period. -

Manual Turf Curvas

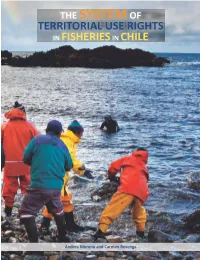

THE SYSTEM OF TERRITORIAL USE RIGHTS IN FISHERIES IN CHILE Manuela Wedgwood Editing Alejandra Chávez Design and Layout Andrea Moreno and Carmen Revenga Cover image: The Nature Conservancy Harvesting of Chilean abalone (Concholepas concholepas) in the fishing village of Huape, in Valdivia, Chile. © Ian Shive, July 2012. With analytical contributions on socio-economic analyses from: Hugo Salgado, Miguel Quiroga, Mónica Madariaga and Miguel Moreno, Citation: Department of Environmental and Natural Resource Economics, Moreno A. and Revenga C., 2014. The System of Territorial Use Rights in Fisheries in Chile, Universidad de Concepción Concepción - Chile The Nature Conservancy, Arlington, Virginia, USA. 88 pp. Copyright © The Nature Conservancy 2014 Published by the Nature Conservancy, Arlington, Virginia, USA Printed in Lima, Peru, on Cyclus Print paper, made from 100% recycled fiber. THE SYSTEM OF TERRITORIAL USE RIGHTS IN FISHERIES IN CHILE Manuela Wedgwood Editing Alejandra Chávez Design and Layout Andrea Moreno and Carmen Revenga Cover image: The Nature Conservancy Harvesting of Chilean abalone (Concholepas concholepas) in the fishing village of Huape, in Valdivia, Chile. © Ian Shive, July 2012. With analytical contributions on socio-economic analyses from: Hugo Salgado, Miguel Quiroga, Mónica Madariaga and Miguel Moreno, Citation: Department of Environmental and Natural Resource Economics, Moreno A. and Revenga C., 2014. The System of Territorial Use Rights in Fisheries in Chile, Universidad de Concepción Concepción - Chile The Nature Conservancy, Arlington, Virginia, USA. 88 pp. Copyright © The Nature Conservancy 2014 Published by the Nature Conservancy, Arlington, Virginia, USA Printed in Lima, Peru, on Cyclus Print paper, made from 100% recycled fiber. TABLE OF CONTENTS 4 FOREWORD 37 3.2.5. -

Insights from Dive Tourism in Territorial User Rights for Fisheries in Chile

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Digital.CSIC RESEARCH ARTICLE Potential Synergies between Nature-Based Tourism and Sustainable Use of Marine Resources: Insights from Dive Tourism in Territorial User Rights for Fisheries in Chile Duan Biggs1,2*, Francisca Amar3, Abel Valdebenito3, Stefan Gelcich3,4,5* 1 ARC Centre of Excellence for Environmental Decisions, Centre for Biodiversity & Conservation Science, University of Queensland, Brisbane, Queensland 4072, Australia, 2 Department of Conservation Ecology and Entomology, Stellenbosch University, Private Bag X1, Matieland 7602, South Africa, 3 Center of Applied Ecology and Sustainability (CAPES) & Centro de Conservación Marina, Departamento de Ecologia, Facultad de Ciencias Biológicas, Pontificia Universidad Católica de Chile, Santiago, Chile, 4 Laboratorio Internacional en Cambio Global, Consejo Superior de Investigaciones Cientificas, Instituto Mediterraneo de Estudios Avanzados, Esporles, Mallorca, Spain, 5 Bren School of environmental science and management, University of California Santa Barbara, Santa Barbara, California 93106, United States of America * [email protected] (DB); [email protected] (SG) OPEN ACCESS Abstract Citation: Biggs D, Amar F, Valdebenito A, Gelcich S Novel solutions to conserve biodiversity whilst allowing for resource harvesting are urgently (2016) Potential Synergies between Nature-Based needed. In marine systems, Territorial User Rights for Fisheries (TURFs) are promoted to Tourism and Sustainable Use of Marine Resources: Insights from Dive Tourism in Territorial User Rights enable sustainable use of resources. We investigate the potential for synergies between for Fisheries in Chile. PLoS ONE 11(3): e0148862. nature-based tourism and TURFs on Chile’s central coast. Of 135 recreational divers sur- doi:10.1371/journal.pone.0148862 veyed, 77% indicated that the fish species they preferred sighting were declining and 80% Editor: Stephanie S. -

Operational Interactions Between the South American Sea Lion Otaria

Revista de Biología Marina y Oceanografía Vol. 50, Nº3: 479-489, diciembre 2015 DOI: 10.4067/S0718-19572015000400007 ARTICLE Operational interactions between the South American sea lion Otaria flavescens and purse seine fishing activities in northern Chile Interacciones operacionales entre lobo marino común Otaria flavescens y actividades de pesca de cerco en el norte de Chile Andrés González1, Rodrigo Vega1 and Eleuterio Yáñez2 1Departamento de Evaluación de Pesquerías, División de Investigación Pesquera Instituto de Fomento Pesquero, Blanco 839, Valparaíso, Chile. [email protected] 2Escuela de Ciencias del Mar, Pontificia Universidad Católica de Valparaíso, P.O. Box 1020, Valparaíso, Chile Resumen.- Se analizan variables temporales, espaciales, ambientales, ecológicas y pesqueras que contribuyen a la variación del número de lobos marinos comunes (Otaria flavescens) que interactúan con las faenas de pesca de cerco industrial de la flota que opera en el norte de Chile (18°21’-24°00’S). Observadores científicos fueron embarcados en buques cerqueros entre febrero 2010 y diciembre 2011. Los datos fueron modelados usando modelos lineales generalizados (MLG) y modelos lineales generalizados mixtos (MLGM). Los resultados muestran que la variabilidad en el número de lobos marinos atraídos por las operaciones de pesca para alimentarse o intentar hacerlo, se explica por las variables: Hora del lance, Distancia a las colonias de lobos más cercanas, Temperatura superficial del mar, Especie objetivo del lance, Latitud y Número de aves marinas -

ABNJ Regional Leaders Program

ABNJ Regional Leaders Program 2015 – 2016 at the United Nations SUMMARY REPORT The ABNJ Regional Leaders Program promotes knowledge sharing and leadership development regarding marine areas beyond national jurisdiction (ABNJ) among regional and national ocean leaders Project Organizers and Sponsors Global Ocean University Forum of Delaware Additional Support From UN - Nippon Foundation PSIDS Fellowship on of Japan Fellowship Oceans and Seas Programme Republic of Korea Project Partners Convention on Biological Diversity Secretariat Natural Science Institute for Sustainable Development and International Relations (IDDRI, France) ABNJ Regional Leaders Program United Nations, New York OVERVIEW The marine areas beyond national jurisdiction (ABNJ), which comprise 64% of the ocean’s surface, contain ecosystems with marine resources and biodiversity of great ecological, socioeconomic, and cultural importance. A variety of human activities take place in ABNJ, including fishing, shipping, scientific research, and bioprospecting for genetic resources, in addition to new and emerging activities, such as carbon storage in the deep seabed and offshore energy exploitation. However, lack of knowledge of The ABNJ Regional Leaders Pro- Strengthening Global Capacity to marine biodiversity and ecosystems gram is designed to strengthen the Effectively Manage Areas Beyond in ABNJ, difficulties in enforce- capacity of leaders from developing National Jurisdiction, part of the ment of existing conservation and countries and small island develop- GEF/FAO Program on Global Sus- management measures, and dis- ing States (SIDS) at the regional and tainable Fisheries Management agreements over appropriate policy national levels to better understand and Biodiversity Conservation in responses, among other factors, and address issues in marine areas Areas Beyond National Jurisdiction have hindered the sustainable man- beyond national jurisdiction (ABNJ) (Common Oceans) (www.common- agement of ABNJ. -

TECHNOLOGY, ADAPTATION, and EXPORTS Public Disclosure Authorized

36800 Public Disclosure Authorized TECHNOLOGY, ADAPTATION, AND EXPORTS Public Disclosure Authorized How some developing countries got it right EDITED BY Public Disclosure Authorized VANDANA CHANDRA Public Disclosure Authorized Technology, Adaptation, and Exports Technology, Adaptation, and Exports how some developing countries got it right Vandana Chandra, Editor THE WORLD BANK Washington, DC © 2006 The International Bank for Reconstruction and Development / The World Bank 1818 H Street NW Washington DC 20433 Telephone: 202-473-1000 Internet: www.worldbank.org E-mail: [email protected] All rights reserved. 1234509080706 This volume is a product of the staff of the International Bank for Reconstruction and Development / The World Bank. The findings, interpretations, and conclusions expressed in this volume do not necessarily reflect the views of the Executive Directors of The World Bank or the governments they represent. The World Bank does not guarantee the accuracy of the data included in this work. The boundaries, colors, denominations, and other information shown on any map in this work do not imply any judgement on the part of The World Bank concerning the legal status of any territory or the endorsement or acceptance of such boundaries. Rights and Permissions The material in this publication is copyrighted. Copying and/or transmitting portions or all of this work without permission may be a violation of applicable law. The International Bank for Reconstruction and Development / The World Bank encourages dissemination of its work and will normally grant permission to reproduce portions of the work promptly. For permission to photocopy or reprint any part of this work, please send a request with complete information to the Copyright Clearance Center Inc., 222 Rosewood Drive, Danvers, MA 01923, USA; telephone: 978-750-8400; fax: 978- 750-4470; Internet: www.copyright.com. -

Fishing in Chile

bS U iness CHILE THE VOICE OF THE CHILEAN-AMERICAN CHAMBER OF COMMERCE N°282, AUGUST 2012 F ishing in Chile: A Race Against Time TRADE TESTIMONIAL HEALH T S PECIAL REPORT M ining Tools Made B ioequivalent Drugs: C hile's Wine Industry: in Chile Worth the Risk? A Premium on Quality CONTENTS bUSiness CHILE THE VOICE OF THE CHILEAN-AMERICAN CHAMBER OF COMMERCE N°282, AUGUST 2012 46 LIFE IN THE SLOW LANE 6 TRADE TESTIMONIAL 36 E CONOMIC SNAPSHOT M ining Tools Made to Order M exico: Time to Join the Rest of A Love-Hate Fishing in Chile: The Santiago-based mining Latin America? Relationship Mexico has not lived up to its A Race Against Time equipment manufacturer FMA Golf can be a frustrating TRADE TESTIMONIAL HEALTH SPECIAL REPORT Industrial produces custom-made, economic potential but, with the tide Mining Tools Made Bioequivalent Drugs: Chile's Wine Industry: in Chile Worth the Risk? A Premium on Quality safety-oriented mining tools for the shifting in its favor, this may be its game, but Santiago Eneldo mining industry. moment to catch up to the rest of thought he’d got his swing 12 the region. back until he lost his head Fishing in Chile: A Race (and his club) during a Against Time 8 H EALTH 38 B REAKFAST recent game. Chile’s fishing law expires B ioequivalent Drugs: The Economic Moment: in December and if the Worth the Risk? Chile and the World government fails to pass Chile’s recent decision to certify Former Chilean Finance Minister a new law that ensures and legalize bioequivalent Hernán Büchi discussed the the sustainability of the drugs aims to reduce costs uncertain world economic resource, it could be a for consumers by providing an situation at an AmCham breakfast perfect storm for the alternative to branded products. -

Marine Mammal Annot Bibliography

ANNOTATED BIBLIOGRAPHY OF JOURNAL ARTICLES, SCIENTIFIC ORGANIZATION REPORTS, AND TECHNICAL PAPERS. Prepared for NOAA Fisheries Office of International Affairs under Task Order for Technical Support. OAI Task Order IA-T0007. Author Name Date Title Target Species or Gear Fishing area/FAO Region Marine Mammal Species Key Issues Nations Discussed: product Statistical Area ACCOBAMS 2008 International workshop Various Driftnet, set gillnet, Area 37 Black Sea, Fin whale, minke whale, status overview; Individual nation on cetacean bycatch trammel nets, trawl, Mediterranean, sperm whale, pilot whale, protocols; agreement reports available: Italy, within ACCOBAMS longline, others Atlantic Cuvier's beaked whale, Spain, Greece, area killer whale, false killer Morocco, Romania, whale, Risso's dolphin, Montenegro, Israel. bottlenose dolphin, short- beaked common dolphin, striped dolphin, harbour porpoise, rough-toothed dolphin ACCOBAMS 2016 MOP6-Final Report Not identified Nets (driftnets? Purse Western Mediterranean bottlenose dolphins, killer Call for more research Morocco (Albania, seines?) Mediterranean whales on deterrents such as Algeria, Croatia, (Tangier, M'Diq, acoustic devices Cyprus, Egypt, France, Nador, AlHoceima) Georgia, Greece, Italy, Lebanon, Libya, Monaco, Montenegro, Portugal, Romania, Spain, Tunisia and Ukraine) Allen, Robin 2010 International yellowfin Purse seine IATTC managed Eastern Pacific Dolphins Tuna RFMOs. Review of Mexico, Venezuela management of tuna area Ocean all RFMOs; concludes fisheries: that no incentive for arrangements, cooperation between challenges and a way FAD nation coalition forward. FAO Fisheries and IATTC purse and Aquaculture seine/sets on dolphins Technical Paper. No. coalition because gear 536. Rome, FAO. 2010. types don't affect tuna 45p. catches of the other type. Benefit of cooperation less than benefit of competition.