Teaser MMP ENG NAIP 2016 Final NAIP

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sauces Reconsidered

SAUCES RECONSIDERED Rowman & Littlefield Studies in Food and Gastronomy General Editor: Ken Albala, Professor of History, University of the Pacific ([email protected]) Rowman & Littlefield Executive Editor: Suzanne Staszak-Silva ([email protected]) Food studies is a vibrant and thriving field encompassing not only cooking and eating habits but also issues such as health, sustainability, food safety, and animal rights. Scholars in disciplines as diverse as history, anthropol- ogy, sociology, literature, and the arts focus on food. The mission of Row- man & Littlefield Studies in Food and Gastronomy is to publish the best in food scholarship, harnessing the energy, ideas, and creativity of a wide array of food writers today. This broad line of food-related titles will range from food history, interdisciplinary food studies monographs, general inter- est series, and popular trade titles to textbooks for students and budding chefs, scholarly cookbooks, and reference works. Appetites and Aspirations in Vietnam: Food and Drink in the Long Nine- teenth Century, by Erica J. Peters Three World Cuisines: Italian, Mexican, Chinese, by Ken Albala Food and Social Media: You Are What You Tweet, by Signe Rousseau Food and the Novel in Nineteenth-Century America, by Mark McWilliams Man Bites Dog: Hot Dog Culture in America, by Bruce Kraig and Patty Carroll A Year in Food and Beer: Recipes and Beer Pairings for Every Season, by Emily Baime and Darin Michaels Celebraciones Mexicanas: History, Traditions, and Recipes, by Andrea Law- son Gray and Adriana Almazán Lahl The Food Section: Newspaper Women and the Culinary Community, by Kimberly Wilmot Voss Small Batch: Pickles, Cheese, Chocolate, Spirits, and the Return of Artisanal Foods, by Suzanne Cope Food History Almanac: Over 1,300 Years of World Culinary History, Cul- ture, and Social Influence, by Janet Clarkson Cooking and Eating in Renaissance Italy: From Kitchen to Table, by Kath- erine A. -

GEORGIA Strengthening Conformity Assessment for Fruits and Vegetables

Wichtiger HINWEIS ! Innerhalb der Schutzzone (hellblauer Rahmen) darf kein anderes Element platziert werden! Ebenso darf der Abstand zu Format- resp. Papierrand die Schutzzone nicht verletzen! Hellblauen Rahmen der Schutzzone nie drucken! Siehe auch Handbuch „Corporate Design der Schweizerischen Bundesverwaltung“ Kapitel „Grundlagen“, 1.5 / Schutzzone www. cdbund.admin.ch G GLOBAL QUALITY AND STANDARDS PROGRAMME GEORGIA Strengthening conformity assessment for fruits and vegetables VALUE CHAIN STUDY 1 Value Chain Analysis of Fruits and Vegetables in Georgia with focus on quality and compliance infrastructure, economic, social and sustainability requirements ACKNOWLEDGMENTS This publication has been prepared by the United Nations Industrial Development Organization (UNIDO) within the framework of the Global Quality and Standards Programme (GQSP) under the overall guidance of the GQSP programme coordinator and project manager, Ms. Dorina Nati. Technical inputs were provided and coordinated by Ms. Nino Manvelidze, National Technical Advisor. The publication is based on the study of the Bern University of Applied Sciences (BFH). Special appreciation goes to the research team consisting of Dominic Blaettler, Ekaterine Burkadze, Pia Fehle, Salome Gelashvili, Phatima Mamardashvili, Sophie Marchesi, and Susan Zuelli. The development of this publication benefitted greatly from the valuable inputs, reviews and constructive comments received from all the main stakeholders of the project, particularly the Ministry of Environmental Protection and Agriculture (MEPA) of Georgia. Special thanks goes to all the people who shared their precious knowledge, experience and opinions in the frame of interviews, meetings and workshops. Publication design by Radhika Nathwani. We acknowledge the financial support to this mandate on part of the Swiss State Secretariat for Economic Affairs (SECO), and the institutional support on part of BFH-HAFL. -

Меню Тесто / Dough Salads and Appetizers Menu

САЛАТЫ И ЗАКУСКИ МЕНЮ ТЕСТО / DOUGH SALADS AND APPETIZERS MENU ДИЧЬ / GAME DISHES ХИНКАЛИ мин. 3 шт. / Khinkali min 3 pcs со свининой и говядиной / с бараниной 150 with pork and beef / lamb САЛАТ С КРЕВЕТКАМИ, САЛАТ С ВЯЛЕНОЙ ОЛЕНИНОЙ, 1100 АВОКАДО И ТОМАТАМИ ЧЕРРИ 890 с сыром и зеленью/ cheese and greens 100 грушей и кедровым орехом с креветками / with shrimps 220 Salad with shrimp, avocado and cherry tomatoes Sun-dried deer and pear salad БОЛЬШОЙ ЛИСТОВОЙ САЛАТ С АВОКАДО 750 САЛАТ С КОПЧЕНОЙ УТИНОЙ ГРУДКОЙ 750 КУТАБЫ, 2 шт. / Qutab, 2 pcs. Large leaf salad with avocado и рукколой с зеленью / with greens 250 c сыром / с мясом / with cheese / with meat 200 САЛАТ С АВОКАДО, МАНГО и тыквенными семечками 650 Salad with smoked duck breast and arugula Salad with avocado, mango and pumpkin seeds ПАШТЕТ ИЗ ПЕЧЕНИ ЗАЙЦА / Hare liver pate 570 ПЕЛЬМЕНИ / Dumplings ОВОЩНОЙ САЛАТ ПО-ГРУЗИНСКИ 620 ТАРТАР ИЗ ОЛЕНИНЫ / Tartar venison 950 с говядиной / with beef 500 Georgian vegetable salad с курицей / with chicken 400 РОСТБИФ ИЗ ОЛЕНИНЫ со свекольным соусом 1550 САЛАТ ИЗ СЛАДКИХ ТОМАТОВ с крымским луком 650 Tomato salad with crimean onion Roast beef deer with beetroot sauce ВАРЕНИКИ / Dumplings с картофелем и грибами with potatoes and mushrooms 350 СТРАЧАТЕЛЛА С ТОМАТАМИ и муссом из манго 900 с творогом, вишневым соусом и сметаной 350 Stracciatella with tomatoes and mango mousse БОЛОНЬЕЗЕ С ЛОСЯТИНОЙ 950 with cottage cheese, cherry sauce and sour cream Bolognese with moose БУРРАТА С ТОМАТАМИ 900 Burrata with tomatoes КАЗАРЕЧЧЕ С ОЛЕНИНОЙ И КРОЛИКОМ -

Kujunduse Kuj. Restoran & Baar Koopia Koopia

TRÜHVEL SNACKS MAIN COURSES sweet potato fries / ajika mayo SEAFOOD RISOTTO / TOMATO / PIKE-PERCH / KING 4 € PRAWNS / MUSSELS / GRANA PADANO CHEESE 13 € spicy hummus / garlic ciabatta 5 € PIKE-PERCH FILLET / BLACK PASTA / FENNEL / WHITEFISH ROE / ORANGE garlic bread à la trühvel / homemade bacon 16 € bread / garlic / smoked cheese 6 € GRILLED TUNA STEAK / ASPARAGUS / PEAS / HERB OIL / WASABI & YOGHURT SAUCE / SOY quality cheeses / cloudberry jam / olives / 16 € crisps 9 € BEEF BURGER / ONION JAM / AJIKA MAYO / SALTED CUCUMBER / SWEET POTATO FRIES quality hams & salamis / onion jam / olives / 14 € crisps 9 € VEGGIE BURGER / CHICKPEA & QUINOA CUTLET / ONION JAM / SALTED CUCUMBER / SWEET POTATO FRIES 14 € STARTERS BRAISED PORK CHEEK / PUMPKIN CREAM / ROASTED CABBAGE / MUSTARD SAUCE / BLOOD DUMPLING salted pike-perch / black bread / sour cream / 14 € whitefish roe / salted cucumber / herb oil 9 € SMOKED DUCK FILLET / ROASTED BEETROOT / BLACK QUINOA / PAK CHOI / WINE SAUCE tuna POKé bowl / wakame / black quinoa / 15 € cucumber / coriander / avocado / WASABI & yoghurt sauce BLUE MUSSELS / COCONUT MILK / LIME / CHILLI / GARLIC / 9,5 € CORIANDER 13 € Surf & Turf / king prawns / pork cheek / sesame / Ajika mayo / crisps 9 € DESSERTS spinach & mushroom ravioli / grana padano cheese / creamy mushroom sauce / nuts BAKLAVA À LA TRÜHVEL / GINGER ICE CREAM 9 € 6 € crispy goat cheese salad / cloudberry jam / OVEN-BAKED APPLE PIE / ALMOND ICE CREAM / pomegranate syrup / walnut CALVADOS SAUCE 9 € 6 € spicy seafood soup / pike-perch / king prawns / KAMA & CREAM CHEESE CAKE / BITTER CHOCOLATE ICE blue mussels / coriander / coconut milk / lime CREAM / PECAN NUTS 8 € 6 € HOMEMADE ICE CREAMS & SORBETS (ASK MORE FROM THE WAITER) NB! Please ask your waiter if you require any information regarding allergies or intolerances. -

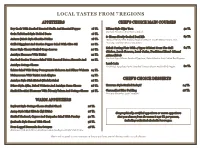

Local Tastes Menu from 7 Regions TR

LOCAL TASTES FROM 7 REGIONS APPETIZERS CHEF’S CHOICE MAIN COURSES Dry Cacık With Smoked Roasted Garlic And Roasted Pepper 18 TL Edirne Style Ciğer Tava 52 TL Smoked Tomatoes And Onions Salad Ordu Tableland Style Pickled Beets 18 TL 8- Hours Slowly Cooked Beef Rib 89 TL Ankara Çubuk Style Gherkin Pickles 18 TL ‘’Keşkek’’ Made With Başbaşı Region’s Wheat, Confit Shallot Onion And “Antakya Çömlek” Cheese Crumbles Grilled Eggplant And Garden Pepper Salad With Olive Oil 20 TL Kebab Tasting Plate With 4 Types Of Meat From The Grill 84 TL Saros Style Cherry Stuffed Grape Leaves 20 TL Chicken, Lamb Skewers, Lamb Cutles, Traditional Hand- Minced Antakya Hummus With Tahini 22 TL Adana Kebab Smoked Siyez Wheat, Smoked Eggplant, Baked Shallot And Grilled Red Peppers Smoked Garden Tomato Salad With Roasted Datca Almonds And 22 TL Lamb Loin Antakya Cottage Cheese FirikPilaf, Eggplant Purée, Smoked Tomato Sauce And Grilled Pepper 82 TL Zahter Salad With Hatay Pomegranate Molasses And Niksar Walnuts 24 TL Muhammara With Tahini And Allspice 24 TL Antakya Style Sürk (Dried Çökelek) Salad 26 TL CHEF’S CHOICE DESSERTS Düzce Style Ajika, Baked Walnuts And Antakya Carra Cheese 28 TL Erzurum Style Stuffed Kadayif 24 TL Stuffed Zucchini Blossoms With Ödemiş Tulum And Cottage Cheese 36 TL Caramelized Rice Pudding 28 TL Sessame Crunches And Crumbles WARM APPETIZERS Bayburt Style Cottage Cheese Stuffed Chard 26 TL Antep Style Mini Kibbeh (İçli Köfte) 28 TL Geographically certified appetizers or warm appetizers Stuffed Mackerel, Capers And Gazpacho Salad With Pursley 32 TL that you choose from the menu is 130 TL per person, Şanlıurfa Style Borani With Chard 38 TL including unlimited alcoholic beverages. -

DC Rest Week

kale & carrot pkhali, eggplant nigvzit, jonjoli, house-made & imported georgian cheeses, shotis puri GREEN LOBIO BAZHIT grilled green beans, walnut sauce ‘bazhe,’ pickled chilis, fresh herbs SOKO KETSE cremini mushroom tops, sulguni cheese MUSSELS POMODORIT p.e.i. mussels, tomato broth, mchadi crumble, walnut & lemon zest GEORGIAN SUMMER SALAD classic tomato-cucumber-walnut salad, red onion, mini peppers WATERMELON SALAD almonds, red onion, creamy ajika dressing, fresh herbs LOBIANI round, red bean lling, fresh herbs, charred onion, green ajika IMERULI round, sulguni cheese blend inside MEGRULI round, sulguni cheese blend inside & on top AJARULI boat-shaped, sulguni cheese blend & organic egg SOKOS sulguni cheese blend, mushroom, kakhetian guda, tarragon, basil KUBDARI round, pork & beef, garlic, svanuri salt KHINKALI (6) Georgia’s classic soup dumplings: your choice of pork & beef or imeruli cheese & mint VEGETABLE MTSVADI eggplant, zucchini, fennel, mini peppers, marinated in khmeli suneli, oil & vinegar, with guda dressing, roasted ajika, and satsebeli LOKO pan-seared blue cat sh, walnut sauce ‘bazhe,’ ojakhuri-style potatoes, grilled lemon, fresh herbs CHKMERULI whole roasted local young amish chicken, creamy garlic sauce BEEF MTSVADI strip loin marinated in red wine & ajika, roasted oyster & cremini, atbread, guda sauce LYULYA KEBAB ground lamb kebab, onion salad, grilled khachapuri-dough atbread, satsebeli TETRI PELAMUSHI white grape pudding, red grapes, pomegranate, walnut, caramel WALNUT CAKE blackberry & strawberry compote, tarragon-scented whipped cream HONEY GELATO walnut, sun ower & pumpkin seeds YOGURT MURABIT black walnut and cherry preserves, candied sun ower seeds, fresh basil & mint. -

Sky Grill a La Carte Menu

APPETIZERS Çoban Salad Variation 17.00 Complemented by Baku Herbs, Ismailli Cheese and Walnut PREMIUM STEAKS One side dish & sauce will be served as accompaniment Baku Herbs, Tomato & Cucumber 17.00 Seasonal Fragrant Baku Herb & Special Tomato, Cucumber US Black Angus Beef Sirloin Steak 220gr 30.00 Sky Caesar`s Salad with Chicken Breast 18.00 Tossed in a Mild Garlic Anchovy Dressing US Black Angus Beef Rib Eye Steak 220gr 32.00 Spicy Tandoori Chicken Salad 20.00 US Black Angus Beef Tenderloin 220gr 34.00 Avocado & Crispy Focaccia Bread Slow Roasted Crispy Duck Salad 22.00 Served with Baby Romaine Lettuce, Orange, Apple Coulis & Almond Orange Marinated Salmon Gravlax 23.00 SAUCES FOR PREMIUM MEATS Orange Fragrant Salmon, Capers Berries, Honey, Mustard Sauce on Herb Caviar Wild Mushroom Sauce International Cheese Selections 18.00 Bourbon BBQ Sauce With Fig Jam Pepper Sauce SOUPS Oak Smoked Eggplant Soup 13.00 Served with Eggplant Ratatouille & Crispy Eggplant FISH & SEAFOOD Gence Style Cold “Dovga” Soup 13.00 Traditional Yogurt Soup with Chervil, Chickpeas, Rice & Kever Herbs One side dish & sauce will be served as accompaniment Porcini Mushroom Cappuccino with Seared Scallop 16.00 Thyme and Lime Marinated Sea bass 220gr 29.00 Atlantic Salmon Steak 220gr 33.00 Grilled Tiger Prawns 220gr 28.00 MAINS Selection of Sky Grill Seafood 300gr 36.00 Warm Tomato Mozzarella Puff “Borek” 19.00 Sea bass, Atlantic Salmon, Scallops, Squid & Shrimps With Fresh Herbs & Salsa Verde Sauce Salmon “Tagliolini” Pasta with Arugula 20.00 With Caramelized Walnut, -

Kebabs: Kebabs

Kebabs: Kebabs: 200\60\30\50 Mutton kebab 200\50\50 Chicken with pita bread, onions and wings with barbecue Ajika ………….450 RUB Sauce………….300 RUB 200\60\30\50 Veal kebab 300\30 Sea bass baked with with pita bread, onions and Herbes de Provence, Ajika………….450 RUB served with mixed salad 200\60\30\50 Pork kebab and fresh tomato with pita bread, onions and sauce………….550 RUB ajika………….400 RUB 300\30 Gilthead sea bream 200\60\30\50 Chicken kebab baked with spicy with pita bread, onions and salsa…………..550 RUB Ajika…………320 RUB 200\60\30\50 Salmon steak 400\60\30\50 Assorted with pita bread, onions and kebabs (pork, mutton, beef, Ajika………….600 RUB chicken) with pita bread, 150\35\30Tiger prawn onions and ajika . 800 RUB skewers……….600 RUB 200\35\30Tiger prawn skewers……….700 RUB Side dishes: Sauces: 350 Fresh vegetables with greens 50 g Ketchup…………...50 RUB (tomatoes, cucumbers, bell pepper, radishes, dill, parsley, cilantro, 50 g Sour cream .............. 50 RUB spring onions)………..300 RUB 50 g Horseradish ............. 50 RUB 300\10 Homemade pickles (pickled cucumbers, tomatoes, sauerkraut 50 g Mayonnaise ............ 50 RUB with oil dressing)…….350 RUB 50 g Mustard…………...50 RUB 180 Grilled vegetables (tomatoes, bell peppers, eggplants, zucchinis, 50 g Tartar ...................... 55 RUB celery,and mushrooms)..200 RUB 150/30 French fries with 50 g Narsharab ............... 55 RUB Ketchup……………….150 RUB 30 g Soy sauce ................ 55 RUB 150 Potato wedges……150 RUB 10 ml Olive oil………….50 RUB 320 Potatoes baked in foil with sauce……………………150 RUB -

Celebrate the Festive Season with Us Celebrate the Festive Season with Us

CELEBRATE THE FESTIVE SEASON WITH US CELEBRATE THE FESTIVE SEASON WITH US This festive season we are inviting you to the JW Marriott Absheron Baku to enjoy gourmet cuisine and first-class service blended together to create a spectacular experience. Whether you are celebrating with family and friends or enjoying a night out with work colleagues our Thanksgiving, Christmas and New Year activities outlined in the following pages will be remembered in years to come. If you have any questions or would require assistance with planning your party please contact us by calling +994 12 499 88 88 or e-mail to [email protected] CONTENTS Thanksgiving at Fireworks 3 Dazzling New Year 9-15 Traditional Roast Goose 4 Private Banquet Party 17 Turkey to go 5 Merry Vouchers 18 Thanksgiving Desserts 5 Festive Sweets 19 Spice days of Christmas 6-8 Festive Hampers 20-21 2 HAPPY THANKSGIVING 24TH NOVEMBER! FIREWORKS URBAN KITCHEN SET DINNER MENU Jumbo prawn slider Zira tomatoes, sauce tartare *** Spiced pumpkin soup Hazelnut cream, coco dust *** Cherry smoked duck Seared plum, mix green, walnut brittle *** Ballotine of chicken Mushroom and onion stuffing, sautéed spinach, celeriac puree, marsala jus Or Pan fried sea bass Smoked pomme puree, sautéed baby vegetables, sauce hollandaise *** Warm pecan treacle tart Vanilla ice cream AZN 65 per person Price including a glass of mulled wine TRADITIONAL ROAST GOOSE Roasted goose Chestnut and sage stuffing Honey glazed carrots Duck fat roasted potatoes Fried brussels sprouts Braised red cabbage Giblet gravy Orange sauce For 5 people AZN 140 *48 hours advance notice is required. -

Best Recipes

2016 BEST RECIPES SIMPLE | VEGETARIAN | DELICIOUS OFFICE CUISINE CONTENT 3 EDITORIAL 4 WINTER 17 SPRING RECIPES RECIPES 21 SUMMER 27 AUTUMN RECIPES RECIPES EDITORIAL The “Office cuisine” blog is a YEE initiative for young people interested in a healthier lifestyle. The campaign was started from the belief that, as a youth environmental network, YEE could be a source of ideas and good practices on how to develop sustainable eating and cooking habits, for individuals as well as for organisations and their working environment. Throughout 2016, Office cuisine organised seasonal vegetarian recipe competitions. The competitions aimed to promote the significance of food diversity around the world and the intercultural value shared within YEE network. Winter, spring, summer, autumn - 4 competitions, 14 recipes, 9 countries; from a Spanish dessert and Albanian vegetable sauce, to a Georgian mezze dish and Italian lasagna rolls. We decided to put all these interesting and tasty recipes together in one publication and share them with all food lovers, vegetarians, office cooks and supporters of healthy eating. We therefore present to you "Best recipes", with which we hope to give you some answers to questions like “What to cook today?”, “Is there a new dish that I can try?” or “What could I prepare for my colleagues at work?”. Enjoy it and have good, healthy meals! If you like our initiative and you want to find out more about Office cuisine... FOLLOW US: facebook.com/officecuisine officecuisine.wordpress.com 3 WINTER RECIPES Adjapsandali Chickpea Vegetable Soup Asturian “pisto” Risotto with Red Chicory Beigli (walnut and poppy seeds rolls) Muesli bars “Tocinillo de cielo” (pudding made with egg yolk and syrup) 4 WINTER RECIPES ADJAPSANDALI Ingredients: - 600 g of potatoes - 800 g of aubergine - 4 large juicy tomatoes - 3 large white onions - 2 hot green peppers - 30 g of fresh green coriander - 30 g of fresh parsley - Salt; half a teaspoon of black ground pepper - 7 tablespoons of oil Steps: Chop the onions. -

Kvareli Food Eng.Pdf

& SPA * Vegetarian HOUSE SPECIAL “Kvareli Lake Resort”, served by Chef 60.00 vegetables and baked potatoes Veal ribs 25.00 Rosated veal ribs with “Ajika” and fried potatoes COLD COURSES Georgian cheese assortment 9.00 Megrelian “Sulguni”, cheese from Imereti Cheese Sulguni 10.00 Megrelian layered slightly salty soft cheese Cheese Imeruli 8.50 Slightly salty soft cheese from Imereti Cheese Guda 8.50 Kakhetian salty and hard cheese made from sheep milk Nadughi 5.00 Cottage cheese with mint Nadughi in sulguni layers 7.50 Nadughi wrapped in sulguni cheese layer * Black olives 5.00 * Green olives 5.00 * Fresh herbs selection 5.00 * Marinated selection 5.50 Capers, pepper, cucumber * Eggplant with walnuts 7.00 Fried eggplant with crushed walnut, spices and vinegar Mkhali selection 15.00 Boiled suckling pig with walnuts and ajika 22.00 Boiled suckling pig seasoned with walnuts, vinegar and Megrelian ajika Boiled veal shank 18.00 Boiled tender cut veal Boiled chicken 20.00 * Vegetarian Service fee SALADS * Georgian salad 9.00 Cucumber and tomato with herbs, pepper and onion * Georgian salad with walnuts 11.00 Cucumber and tomato seasoned with crushed walnuts, spices, herbs and onion Cheese salad 9.00 MInced lettuce, tomato, cheese Sulguni and mayonnaise Greek salad 14.00 Tomatoes, cucumber, onions, feta cheese and olives Caesar salad 12.00 Salad mix, roasted chicken, parmesan, garlic croutons, Caesar dressing Chicken salad 8.50 * Mushroom salad 9.00 mayonnaise SOUP Chikhirtma 6.00 Yogurt soup 6.00 Sour milk with cucumber, radish and greens * -

Dining Menu Salads & Starters Soups Grill Pasta

DINING MENU SALADS & STARTERS SOUPS GRILL PASTA & RISOTTO GUILTY PLEASURE BAR MENU SALADS & STARTERS ANTI -PASTE PLATE 520 38.00 SELECTION HAM & SALAMI, OLIVES, CHEESE, GRILLED PEPPER BRUSCHETTA 190 14.00 ROASTED CIABATTA, ITALIAN SALAMI, PECORINO, TAPENADE DUCK LEG CONFIT SAMOSA 190 18.00 PARSNIP VELOUTE, FORREST MUSHROOMS BEEF CARPACCIO 1600 21.00 BLUE CHEESE, RUCC OLA, CHERRY TOMATO SALAD TABLE PREPARED SALMON TATAR 220 26.00 DRANIKI, CREME FRAICHE, PICKLED BEETROOT CAESAR SALAD 280 18.00 ROMAINE LETTUCE, ANCHOVY DRESSING, CROUTONS, SHAVED PARMESAN, BACON CAESAR WITH ROASTED LEMON CHICKEN 350 22.00 CAESAR WITH SAUTEED PRAWNS 350 38.00 ROASTED VEGETABLE SALAD WITH QUIONA 220 21.00 BEETROOT AND WALNUT DRESSING, GOAT CHEESE BURATTA 250 29.00 RIPE TOMATO SALAD, PESTO LOBSTER & SCALLOP RAVIOLI 260 36.00 PUMPKIN, BISQUE SAUCE, SAGE QUICK SEARED TIGER PRAWNS 280 42.00 WASABI, ROUILLE, RED PEPPER CHEESE PLATTER 220 32.00 ASSORTED INTERNATIONAL CHEESE, SERVED WITH BREAD & JAM HALF DOZEN FINE DE CLAIRE OYSTERS NR.2, 600 65.00 MIGNONETTE* * AVAILABLE ONLY THURSDAY, FRIDAY & SATURDAY / PLEASE ASK SERVICE FOR AVAILABILITY SOUPS CAPPUCINO 250 12.00 CREAMY SOUP OF CHAMPIGNON BORSH 250 12.00 POACHED EGG, CRE ME FRAICHE MOROCCAN SOUP 250 12.00 WITH CHICKEN AND CHICKPEA GRILL DORADE FILET 180 31.00 SALMON FILET 180 34.00 SEA BAS FILET 180 38.00 PORK CHICHA 230 18.00 SKIRT STEAK 250 36.00 BEEF TENDRLOIN 220 75.00 RIB EYE 330 85.00 CHEESE BURGER 290 24.00 LAMB SCHASCHLIK 230 32.00 LEMON MARINATED CHICKEN 350 19.00 PLEASE, LET YOUR SERVER KNOW IF YOU HAVE ANY ALLERGIES.