Working Paper

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Introduction to Gentoo Linux

Introduction to Gentoo Linux Ulrich Müller Developer and Council member, Gentoo Linux <[email protected]> Institut für Kernphysik, Universität Mainz <[email protected]> Seminar “Learn Linux the hard way”, Mainz, 2012-10-23 Ulrich Müller (Gentoo Linux) Introduction to Gentoo Linux Mainz 2012 1 / 35 Table of contents 1 History 2 Why Gentoo? 3 Compile everything? – Differences to other distros 4 Gentoo features 5 Gentoo as metadistribution 6 Organisation of the Gentoo project 7 Example of developer’s work Ulrich Müller (Gentoo Linux) Introduction to Gentoo Linux Mainz 2012 2 / 35 /"dZEntu:/ Pygoscelis papua Fastest swimming penguin Source: Wikimedia Commons License: CC-BY-SA-2.5, Attribution: Stan Shebs Ulrich Müller (Gentoo Linux) Introduction to Gentoo Linux Mainz 2012 3 / 35 How I came to Gentoo UNIX since 1987 (V7 on Perkin-Elmer 3220, later Ultrix, OSF/1, etc.) GNU/Linux since 1995 (Slackware, then S.u.S.E.) Switched to Gentoo in January 2004 Developer since April 2007 Council Mai 2009–June 2010 and since July 2011 Projects: GNU Emacs, eselect, PMS, QA Ulrich Müller (Gentoo Linux) Introduction to Gentoo Linux Mainz 2012 4 / 35 Overview Based on GNU/Linux, FreeBSD, etc. Source-based metadistribution Can be optimised and customised for any purpose Extremely configurable, portable, easy-to-maintain Active all-volunteer developer community Social contract GPL, LGPL, or other OSI-approved licenses Will never depend on non-free software Is and will always remain Free Software Commitment to giving back to the FLOSS community, e.g. submit bugs -

Debian \ Amber \ Arco-Debian \ Arc-Live \ Aslinux \ Beatrix

Debian \ Amber \ Arco-Debian \ Arc-Live \ ASLinux \ BeatriX \ BlackRhino \ BlankON \ Bluewall \ BOSS \ Canaima \ Clonezilla Live \ Conducit \ Corel \ Xandros \ DeadCD \ Olive \ DeMuDi \ \ 64Studio (64 Studio) \ DoudouLinux \ DRBL \ Elive \ Epidemic \ Estrella Roja \ Euronode \ GALPon MiniNo \ Gibraltar \ GNUGuitarINUX \ gnuLiNex \ \ Lihuen \ grml \ Guadalinex \ Impi \ Inquisitor \ Linux Mint Debian \ LliureX \ K-DEMar \ kademar \ Knoppix \ \ B2D \ \ Bioknoppix \ \ Damn Small Linux \ \ \ Hikarunix \ \ \ DSL-N \ \ \ Damn Vulnerable Linux \ \ Danix \ \ Feather \ \ INSERT \ \ Joatha \ \ Kaella \ \ Kanotix \ \ \ Auditor Security Linux \ \ \ Backtrack \ \ \ Parsix \ \ Kurumin \ \ \ Dizinha \ \ \ \ NeoDizinha \ \ \ \ Patinho Faminto \ \ \ Kalango \ \ \ Poseidon \ \ MAX \ \ Medialinux \ \ Mediainlinux \ \ ArtistX \ \ Morphix \ \ \ Aquamorph \ \ \ Dreamlinux \ \ \ Hiwix \ \ \ Hiweed \ \ \ \ Deepin \ \ \ ZoneCD \ \ Musix \ \ ParallelKnoppix \ \ Quantian \ \ Shabdix \ \ Symphony OS \ \ Whoppix \ \ WHAX \ LEAF \ Libranet \ Librassoc \ Lindows \ Linspire \ \ Freespire \ Liquid Lemur \ Matriux \ MEPIS \ SimplyMEPIS \ \ antiX \ \ \ Swift \ Metamorphose \ miniwoody \ Bonzai \ MoLinux \ \ Tirwal \ NepaLinux \ Nova \ Omoikane (Arma) \ OpenMediaVault \ OS2005 \ Maemo \ Meego Harmattan \ PelicanHPC \ Progeny \ Progress \ Proxmox \ PureOS \ Red Ribbon \ Resulinux \ Rxart \ SalineOS \ Semplice \ sidux \ aptosid \ \ siduction \ Skolelinux \ Snowlinux \ srvRX live \ Storm \ Tails \ ThinClientOS \ Trisquel \ Tuquito \ Ubuntu \ \ A/V \ \ AV \ \ Airinux \ \ Arabian -

Free Gnu Linux Distributions

Free gnu linux distributions The Free Software Foundation is not responsible for other web sites, or how up-to-date their information is. This page lists the GNU/Linux distributions that are Linux and GNU · Why we don't endorse some · GNU Guix. We recommend that you use a free GNU/Linux system distribution, one that does not include proprietary software at all. That way you can be sure that you are. Canaima GNU/Linux is a distribution made by Venezuela's government to distribute Debian's Social Contract states the goal of making Debian entirely free. The FSF is proud to announce the newest addition to our list of fully free GNU/Linux distributions, adding its first ever small system distribution. Trisquel, Kongoni, and the other GNU/Linux system distributions on the FSF's list only include and only propose free software. They reject. The FSF's list consists of ready-to-use full GNU/Linux systems whose developers have made a commitment to follow the Guidelines for Free. GNU Linux-libre is a project to maintain and publish % Free distributions of Linux, suitable for use in Free System Distributions, removing. A "live" distribution is a Linux distribution that can be booted The portability of installation-free distributions makes them Puppy Linux, Devil-Linux, SuperGamer, SliTaz GNU/Linux. They only list GNU/Linux distributions that follow the GNU FSDG (Free System Distribution Guidelines). That the software (as well as the. Trisquel GNU/Linux is a fully free operating system for home users, small making the distro more reliable through quicker and more traceable updates. -

GNU/Linux Distro Timeline LEAF Version 10.9 Skolelinux Lindows Linspire Authors: A

1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Libranet Omoikane (Arma) Gibraltar GNU/Linux distro timeline LEAF Version 10.9 Skolelinux Lindows Linspire Authors: A. Lundqvist, D. Rodic - futurist.se/gldt Freespire Published under the GNU Free Documentation License MEPIS SimplyMEPIS Impi Guadalinex Clonezilla Live Edubuntu Xubuntu gNewSense Geubuntu OpenGEU Fluxbuntu Eeebuntu Aurora OS Zebuntu ZevenOS Maryan Qimo wattOS Element Jolicloud Ubuntu Netrunner Ylmf Lubuntu eBox Zentyal Ubuntu eee Easy Peasy CrunchBang gOS Kiwi Ubuntulite U-lite Linux Mint nUbuntu Kubuntu Ulteo MoLinux BlankOn Elive OS2005 Maemo Epidemic sidux PelicanHPC Inquisitor Canaima Debian Metamorphose Estrella Roja BOSS PureOS NepaLinux Tuquito Trisquel Resulinux BeatriX grml DeadCD Olive Bluewall ASLinux gnuLiNex DeMuDi Progeny Quantian DSL-N Damn Small Linux Hikarunix Damn Vulnerable Linux Danix Parsix Kanotix Auditor Security Linux Backtrack Bioknoppix Whoppix WHAX Symphony OS Knoppix Musix ParallelKnoppix Kaella Shabdix Feather KnoppMyth Aquamorph Dreamlinux Morphix ZoneCD Hiwix Hiweed Deepin Kalango Kurumin Poseidon Dizinha NeoDizinha Patinho Faminto Finnix Storm Corel Xandros Moblin MeeGo Bogus Trans-Ameritech Android Mini Monkey Tinfoil Hat Tiny Core Yggdrasil Linux Universe Midori Quirky TAMU DILINUX DOSLINUX Mamona Craftworks BluePoint Yoper MCC Interim Pardus Xdenu EnGarde Puppy Macpup SmoothWall GPL SmoothWall Express IPCop IPFire Beehive Paldo Source Mage Sorcerer Lunar eIT easyLinux GoboLinux GeeXboX Dragora -

Proyecto UTUTO

Proyecto UTUTO “Creando tecnología desde el tercer mundo, una alternativa para descentralizar el acceso al conocimiento” HHoollaa!! ¿Qué es el proyecto UTUTO? Objetivos: Proyecto social de desarrollo e implementación de tecnología. Uso del sofftware libre como herramiienta de poder para garantizar el libre acceso al conocimiento. Software como expresión culltural modernaa. Promover el libre acceso al conocimmientoo en igualdad de condicionees y sin restricciones. Desaarrolllo dee apllicaacioneess paara maaneejoo de iinfformmaccióón ddee mmanerara libre, responsable, respeetuosaa y solidaariaa. Investigación de tecnologia y su relación, impacto e incorporación en la sociedad. Repositorio de conocimientos a disposición de la sociedad. Crear,r, ccommo valor ffuunddamental ppara geneerar caapital sociial.. Ideas originales de UTUTO NNeecceessiiddaadd ddee uunnaa mmaatteerriiaa ddee llaa UUNNSSAA ((2200011)) CCrreeaaciióónn ddee uunn eessccrriittoorriioo ((22000033)) NNaacciiddoo,, mamanntteenniiddoo yy ggeessttiioonnaaddoo eenn LLaattiinnooaamméérriiccaa RReeppoossiittoorriioo ddeessddee ccóóddiiggoo ffuueennttee yy aapplliiccaacciioonneess pprrooppiiaass AAddaappttaacciióónn,, iimmpplleemmeennttaacciióónn yy ccrreeaacciióónn ddee pprrooggrraammaass,, sseerrvviicciiooss yy ccoonnttenniiddooss ccoonn ffuueerrttee ccoonnttrrooll eenn nnuueessttrraass mmaannooss.. PPrroopponneerr aa llooss ppaaiisseess ddeell tteerrcceerr mmuunnddoo ccoommoo pprroodduuccttoorreess ddee ssooffttwwaarree.. Organización del proyecto GGrruuppooss -

GNU Linux-Libre and the Prisoners’ Dilemma

1 GNU Linux-libre and the prisoners' dilemma http://linux-libre.fsfla.org/ Alexandre Oliva <lxoliva@fsfla.org> Twister, Pump.io: @lxoliva http://www.fsfla.org/~lxoliva/ Copyright 2009-2015 FSFLA (last changed November 2015) This work is licensed under the Creative Commons BY-SA 4.0 International License. http://www.fsfla.org/svn/fsfla/site/blogs/lxo/pres/linux-libre/ http://www.fsfla.org/blogs/lxo/pub/linux-libre GNU Linux-libre and the prisoners' dilemma Alexandre Oliva2 Summary • History • \Be Free!" campaign • Liberating Linux (again) • Next steps • Adoption • Challenges GNU Linux-libre and the prisoners' dilemma Alexandre Oliva3 History 1983 GNU 1991 Linux (non-Free) 1992 Linux (GNU GPLv2), Yggdrasil Linux/GNU/X 1996 Blobs in Linux (non-Free again) 2006 gNewSense: find-firmware and gen-kernel 2007 BLAG: deblob and Linux-libre 2008 FSFLA: deblob-check 2012 GNU Linux-libre GNU Linux-libre and the prisoners' dilemma Alexandre Oliva4 Be Free! • Promoting Free Software? • Promoting Software Freedom! • Social responsibility You must be the change you wish to see in the world. Mah¯atm¯aMohandas Karamchand Gandhi The more people resist [non-Free Software], the more people will be Free, and the more people will be free to be Free. Free Software Foundation Latin America http://fsfla.org/se-libre/ GNU Linux-libre and the prisoners' dilemma Alexandre Oliva5 But how could we \Be Free"? • GNU et al are Free, but Linux isn't! • Code without sources, various licenses This [GPLed] file contains firmware data derived from proprietary un- published source -

Introduzione Alle Distribuzioni Linux Matteo Pani

Introduzione alle Distribuzioni Linux Matteo Pani 22 ottobre 2016 Distribuzioni Linux "DistribuChe?" Cos’è una distribuzione Linux? Il mare magno delle distro Gestione del Software Panoramica delle più famose distro Ambienti Desktop LXDE Xfce GNOME KDE Unity Matteo Pani LinuxDay - 22 ottobre 2016 pagina 2 di 42 Distribuzioni Linux "DistribuChe?" Cos’è una distribuzione Linux? Definizione Una distribuzione (distro) Linux è un sistema operativo (SO), cioè l’insieme dei programmi di base e altri vari strumenti che permettono al computer di funzionare Matteo Pani LinuxDay - 22 ottobre 2016 pagina 3 di 42 Distribuzioni Linux "DistribuChe?" Cos’è una distribuzione Linux? Il Sistema Operativo È composto da vari componenti, come: I il bootloader I il kernel I i servizi (demoni) I la shell I server grafico I ambiente desktop (DE) Matteo Pani LinuxDay - 22 ottobre 2016 pagina 4 di 42 Distribuzioni Linux "DistribuChe?" Cos’è una distribuzione Linux? Un po’ di storia I 1984 - GNU Project (Richard Stallman) I SO libero: GNU I altri software I albori degli anni ’90 - GNU mancava ancora di un kernel I 1991 - kernel Linux (Linus Torvalds) I Linux era compatibile con GNU: nasce GNU/Linux! I serviva un modo sufficientemente pratico e automatizzato per installarlo e gestirlo: nascono le distribuzioni Matteo Pani LinuxDay - 22 ottobre 2016 pagina 5 di 42 Distribuzioni Linux "DistribuChe?" Cos’è una distribuzione Linux? (Ri)Definizione Una distribuzione (distro) Linux è un sistema operativo (SO) che usa Linux come kernel. Matteo Pani LinuxDay - 22 ottobre 2016 -

O Tux N˜Ao Nos Representa!

1 O Tux n~aonos representa! Anahuac de Paula Gil [email protected] Alexandre Oliva lxoliva@fsfla.org Copyright 2015 Anahuac de Paula Gil, Alexandre Oliva Esta obra est´alicenciada sob a Licen¸ca Creative Commons BY-SA 4.0 International. http://www.fsfla.org/svn/fsfla/ikiwiki/blogs/lxo/pres/detux/ O Tux n~aonos representa! Anahuac de Paula Gil e Alexandre Oliva 2 Resumo • Software Livre • Open Source • GNU Linux-libre • Liberdade de escolha • Distros Livres • #SemUbuntu O Tux n~aonos representa! Anahuac de Paula Gil e Alexandre Oliva 3 Liberdade de Software • Usu´ariocontrola suas computa¸c~oes • N~aoest´aimpedido de: { 0. executar; { 1. estudar (fontes) e adaptar; { 2. copiar e distribuir; { 3. melhorar e contribuir para... • ... todos os programas que usa O Tux n~aonos representa! Anahuac de Paula Gil e Alexandre Oliva 4 Maiores amea¸cas • Priva¸c~aode c´odigofonte • Licenciamento restritivo • Compatibilidade { Formatos e protocolos { Hardware • Computa¸c~ao na Nuvem • Usu´ariosdomados e adestrados O Tux n~aonos representa! Anahuac de Paula Gil e Alexandre Oliva 5 Movimento Software Livre • Desenvolver Software Livre • Compartilhar liberdade • Atrair usu´arios • Ensinar resist^encia • Eliminar software privativo • Libertar a humanidade O Tux n~aonos representa! Anahuac de Paula Gil e Alexandre Oliva 6 Pensamento OSI • Movimento contrarrevolucion´ario • Papel do Debian • N~aoao copyleft • Open Source, Linux, FOSS O Tux n~aonos representa! Anahuac de Paula Gil e Alexandre Oliva 7 GNU e Linux • GNU: porque usu´ariosmerecem liberdade • Linux: -

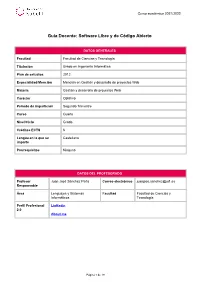

Software Libre Y De Código Abierto

Curso académico 2021/2022 Guía Docente: Software Libre y de Código Abierto DATOS GENERALES Facultad Facultad de Ciencias y Tecnología Titulación Grado en Ingeniería Informática Plan de estudios 2012 Especialidad/Mención Mención en Gestión y desarrollo de proyectos Web Materia Gestión y desarrollo de proyectos Web Carácter Optativo Período de impartición Segundo Trimestre Curso Cuarto Nivel/Ciclo Grado Créditos ECTS 6 Lengua en la que se Castellano imparte Prerrequisitos Ninguno DATOS DEL PROFESORADO Profesor Juan José Sánchez Peña Correo electrónico [email protected] Responsable Área Lenguajes y Sistemas Facultad Facultad de Ciencias y Informáticos Tecnología Perfil Profesional LinKedin 2.0 About.me Página 1 de 19 CONTEXTUALIZACIÓN Y JUSTIFICACIÓN DE LA ASIGNATURA Asignaturas de la Comercio Electrónico materia Diseño y Administración Avanzada de Bases de Datos Metodologías de Desarrollo Ágil Servicios y Aplicaciones Orientadas a la Web Servidores Web de Altas Prestaciones Software Libre y de Código Abierto Contexto y Hoy en día el software libre está siendo una alternativa tecnológica real, tanto a nivel sentido de la privado como público. Con esta asignatura se pretende definir qué es software libre, ya asignatura en la que es esencial para entender la asignatura. Asimismo se podrán extender los titulación y perfil conocimientos y competencias previos obtenidos en otras asignaturas al mundo de los profesional proyectos de software libre. Con esta asignatura el alumno conocerá el mundo del software libre, acercándose a su filosofía, estudiando las cuatro libertades que defiende y la legalidad en la que se justifica, su actualidad, su importancia en la empresa y los proyectos y herramientas más importantes en el día de hoy. -

Debian GNU/Linux Since 1995

Michael Meskes The Best Linux Distribution credativ 2017 www.credativ.com Michael • Free Software since 1993 • Linux since 1994 Meskes • Debian GNU/Linux since 1995 • PostgreSQL since 1998 credativ 2017 www.credativ.com Michael Meskes credativ 2017 www.credativ.com Michael • 1992 – 1996 Ph.D. • 1996 – 1998 Project Manager Meskes • 1998 – 2000 Branch Manager • Since 2000 President credativ 2017 www.credativ.com • Over 60 employees on staff FOSS • Europe, North America, Asia Specialists • Open Source Software Support and Services • Support: break/fix, advanced administration, Complete monitoring Stack • Consulting: selection, migration, implementation, Supported integration, upgrade, performance, high availability, virtualization All Major • Development: enhancement, bug-fix, integration, Open Source backport, packaging Projects ● Operating, Hosting, Training credativ 2017 www.credativ.com The Beginning © Venusianer@German Wikipedia credativ 2017 www.credativ.com The Beginning 2nd Try ©Gisle Hannemyr ©linuxmag.com credativ 2017 www.credativ.com Nothing is stronger than an idea whose Going time has come. Back On résiste à l'invasion des armées; on ne résiste pas à l'invasion des idées. In One withstands the invasion of armies; one does not withstand the invasion of ideas. Victor Hugo Time credativ 2017 www.credativ.com The Beginning ©Ilya Schurov Fellow Linuxers, This is just to announce the imminent completion of a brand-new Linux release, which I’m calling the Debian 3rd Try Linux Release. [. ] Ian A Murdock, 16/08/1993 comp.os.linux.development credativ 2017 www.credativ.com 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Libranet Omoikane (Arma) Quantian GNU/Linux Distribution Timeline DSL-N Version 12.10-w/Android Damn Small Linux Hikarunix Damn Vulnerable Linux A. -

Debian Une Distribution, Un Projet, Des Contributeurs

https://people.debian.org/~taffit/talks/2018/ Debian Une distribution, un projet, des contributeurs David Prévot <[email protected]> Mercredi 27 mars 2018 — Lycée Aorai Quelques dates ● Fondée par Ian Murdock (16 août 1993) ● Debian 1.1 Buzz (17 juin 1996) ● Principes du logiciel libre selon Debian (DFSG) (5 juillet 1997) ● Première DebConf à Bordeaux (5 juillet 2000) https://www.debian.org/doc/manuals/project-history/ This hostname is going in dozens of remote config files. Changing a kid’s name is comparatively easy! https://xkcd.com/910/ Quelques chiffres ● Plus de 50 000 paquets binaires ● Installateur disponible en 75 langues ● 10 architectures (amd64, i386, armel, armhf…) ● Des centaines de distributions dérivées (Tails, Ubuntu, etc.) ● Des milliers de contributeurs https://www.debian.org/News/2017/20170617 Répartition des développeurs https://www.debian.org/devel/developers.loc Distributions majeures et dérivées ● Une poignées de distributions Linux à la base : Debian, Red Hat Enterprise Linux, Slackware, Gentoo, Arch Linux, Android, etc. ● De nombreuses distributions sont dérivées des précédentes : Tails, Ubuntu ou Raspbian par exemple pour Debian 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Libranet Omoikane (Arma) Quantian GNU/Linux Distributions Timeline Damn Small Linux Version 17.10 Damn Vulnerable Linux KnoppMyth © Andreas Lundqvist, Donjan Rodic, Mohammed A. Mustafa Danix © Konimex, Fabio Loli and contributors https://github.com/FabioLolix/linuxtimeline -

The Following Distributions Match Your Criteria (Sorted by Popularity): 1. Linux Mint (1) Linux Mint Is an Ubuntu-Based Distribu

The following distributions match your criteria (sorted by popularity): 1. Linux Mint (1) Linux Mint is an Ubuntu-based distribution whose goal is to provide a more complete out-of-the-box experience by including browser plugins, media codecs, support for DVD playback, Java and other components. It also adds a custom desktop and menus, several unique configuration tools, and a web-based package installation interface. Linux Mint is compatible with Ubuntu software repositories. 2. Mageia (2) Mageia is a fork of Mandriva Linux formed in September 2010 by former employees and contributors to the popular French Linux distribution. Unlike Mandriva, which is a commercial entity, the Mageia project is a community project and a non-profit organisation whose goal is to develop a free Linux-based operating system. 3. Ubuntu (3) Ubuntu is a complete desktop Linux operating system, freely available with both community and professional support. The Ubuntu community is built on the ideas enshrined in the Ubuntu Manifesto: that software should be available free of charge, that software tools should be usable by people in their local language and despite any disabilities, and that people should have the freedom to customise and alter their software in whatever way they see fit. "Ubuntu" is an ancient African word, meaning "humanity to others". The Ubuntu distribution brings the spirit of Ubuntu to the software world. 4. Fedora (4) The Fedora Project is an openly-developed project designed by Red Hat, open for general participation, led by a meritocracy, following a set of project objectives. The goal of The Fedora Project is to work with the Linux community to build a complete, general purpose operating system exclusively from open source software.