2018 Integrated Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2-Veolia RDD-Approach (26-41)-E5 2/07/08 15:14 Page 26

2-Veolia RDD-Approach (26-41)-E5 2/07/08 15:14 Page 26 A 2-Veolia RDD-Approach (26-41)-E5 2/07/08 15:15 Page 27 APPROACH Veolia Environnement ••• Sustainable development report 2007 27 A Sustainable development is a source of opportunity and inspiration for our business. Across the entire company, it provides a challenge of responsibility and consistency, and must be applied by a coherent global governance system based on firm measures. 2-Veolia RDD-Approach (26-41)-E5 2/07/08 15:15 Page 28 Embedding our governance Effective long-term governance requires a committed approach and aims to anticipate risks and opportunities and integrate the major risks faced by the company in its internal control. Evaluation of good governance standards Good governance standards Situation on March 15 2008 Presence of at least 50% of independent directors within the board and on committees (Accounts, And Audit Board Accounts Nominations and Strategic of Directors and Audit Compensation research, Directors among Committee; Nominations and Compensation Committee; Strategic Research, Innovation and Sustainable Committee Committee innovation and themselves Development Committee) sustainable Development and in relation to Committee management • Definition of independence adopted by the internal regulations of the board of directors . 11/14 3/3 2/3 2/3 Average duration of a director's mandate of four years . six years (half renewed every three years, last done in 2006) Independence Statutory auditors Auditors cannot offer advisory services, except for services related to the audit . yes in relation to management Auditor - director meetings without the presence of management. yes Maximum five accumulated mandates . -

Veolia Acquires 29.9% of Suez's Capital from Engie and Confirms Its

Veolia acquires 29.9% of Suez’s capital from Engie and confirms its intention to acquire control Veolia acknowledges Engie’s decision to respond favorably to its offer to acquire a 29.9% stake in Suez. As a reminder, this proposal, submitted on August 30 and continuously improved since, presents in particular the following elements: ● a price of 18 euros per share (dividend included), i.e. a premium of 75% over the unaffected price of July 30, 2020, paid immediately in cash and paving the way for a public tender offer on the remaining share capital of Suez for all of its shareholders; ● the guarantee of 100% of jobs and social benefits for all Suez employees in France; ● the certainty of a French operation; ● the preservation of competition thanks to the takeover by French company Meridiam of the Water activity in France from Suez, Meridiam having committed to preserving all jobs and social benefits, to take over the R&D center of Suez and to double the investments planned and to inject 800 million euros into this new scope within 5 to 7 years. This decision marks a first decisive step in the construction in France of a world super champion of the ecological transformation making the trail in this strategic sector for at least 20 years. Antoine Frérot said: "I am very happy to lay the foundation stone in France today for a world super champion of the ecological transformation. This is a wonderful opportunity for the employees, customers and shareholders of both groups, and it is a project which serves France and the planet ". -

Pdf 8 Methodology Development, Ranking Digital Rights

SMEX is a Beirut-based media development and digital rights organization working to advance self-regulating information societies. Our mission is to defend digital rights, promote open culture and local content, and encourage critical engagement with digital technologies, media, and networks through research, knowledge-sharing, and advocacy. Design, illustration concept, and layout are by Salam Shokor, with assistance from David Badawi. Illustrations are by Ahmad Mazloum and Salam Shokor. www.smex.org A 2018 Publication of SMEX Kmeir Building, 4th Floor, Badaro, Beirut, Lebanon © Social Media Exchange Association, 2018 This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License. Acknowledgments Afef Abrougui conceptualized this research report and designed and oversaw execution of the methodology for data collection and review. Research was conducted between April and July 2017. Talar Demirdjian and Nour Chaoui conducted data collection. Jessica Dheere edited the report, with proofreading assistance from Grant Baker. All errors and omissions are strictly the responsibility of SMEX. This study would not have been possible without the guidance and feedback of Rebecca Mackinnon, Nathalie Maréchal, and the whole team at Ranking Digital Rights (www.rankingdigitalrights.org). RDR works with an international community of researchers to set global standards for how internet, mobile, and telecommunications companies should respect freedom of expression and privacy. The 2017 Corporate Accountability Index ranked 22 of the world’s most powerful such companies on their disclosed commitments and policies that affect users' freedom of expression and privacy. The methodology developed for this research study was based on the RDR/ CAI methodology. We are also grateful to EFF’s Katitza Rodriguez and Access Now’s Peter Micek, both of whom shared valuable insights and expertise into how our research might be transformed and contextualized for local campaigns. -

Draft Offer Document

KEY TERMS OF VEOLIA’S DRAFT OFFER DOCUMENT This press release does not constitute an offer to acquire securities The offer described below may only be opened once it has been declared compliant by the Autorité des marchés financiers PRESS RELEASE DATED FEBRUARY 8, 2021 FILIING OF THE PROPOSED CASH TENDER OFFER for the shares of : initiated by : presented by : Advising and presenting Bank and Advising and presenting Bank and Guarantor Guarantor Advising and presenting Bank Advising and presenting Bank Veolia is also advised by : TERMS OF THE OFFER 18 euros per share of Suez (cum dividend) OFFER PERIOD The timetable of this Offer will be set out by the AMF in accordance with its General Regulation This press release was prepared by Veolia and made available to the public pursuant to Article 231-16 of the AMF General Regulation THIS OFFER AND THE DRAFT OFFER DOCUMENT REMAIN SUBJECT TO REVIEW BY THE AMF 1 This press release does not constitute an offer to acquire securities The offer described below may only be opened once it has been declared compliant by the Autorité des marchés financiers IMPORTANT NOTICE In the event the number of shares not tendered in the Offer by the minority shareholders of Suez does not represent, following the Offer, or, if applicable, of the Reopened Offer, more than 10% of the share capital and voting rights of Suez, Veolia intends, within a period of ten (10) trading days from the publication of the notice announcing the result of the Offer or, if applicable, at the latest within three (3) months following the closing of the Reopened Offer, in accordance with Article L. -

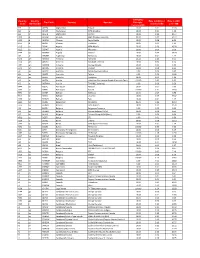

Country Code Country ISO Number Tap Code Country Operator

Charging Country Country Rate in USD per Rate in USD Tap Code Country Operator Principle Code ISO Number increment kb per 1 MB increment kb +93 af AFGEA Afghanistan Etisalat 10.00 0.11 11.18 +93 af AFGAR Afghanistan MTN (Areeba) 10.00 0.01 1.30 +93 af AFGTD Afghanistan Roshan 10.00 0.10 10.27 +355 al ALBAM Albania AMC (Telekom Albania) 50.00 0.49 10.13 +355 al ALBEM Albania Eagle Mobile 10.00 0.08 8.02 +355 al ALBVF Albania Vodafone 10.00 0.01 1.13 +213 dz DZAA1 Algeria ATM-Mobilis 20.00 0.20 10.28 +213 dz DZAWT Algeria Wataniya 10.00 0.00 0.30 +244 ao AGOMV Angola Movicel 10.00 0.14 13.99 +54 ar ARGTM Argentina Telefonica 10.00 0.01 1.42 +374 am ARM01 Armenia Armentel 10.24 0.10 9.65 +374 am ARMKT Armenia Karabakh Telecom 10.00 0.08 8.24 +374 am ARMOR Armenia Orange (Ucom) 10.00 0.01 1.09 +374 am ARM05 Armenia VivaCell 10.00 0.08 8.24 +61 au AUSOP Australia Optus Communications 1.00 0.00 0.33 +61 au AUSTA Australia Telstra 1.00 0.02 21.02 +61 au AUSVF Australia Vodafone 10.00 0.01 1.10 +43 at AUTCA Austria Hutchison Drei Austria GmbH (Connect- One/ Orange) 100.00 0.83 8.53 +43 at AUTMM Austria T MOBILE (telering) 1.00 0.00 0.58 +994 az AZEAC Azerbaijan Azercell 10.00 0.07 7.00 +994 az AZEBC Azerbaijan Bakcell 100.00 1.71 17.50 +973 bh BHRBT Bahrain BATELCO 10.00 0.07 6.98 +973 bh BHRST Bahrain Viva STC 10.00 0.19 19.02 +973 bh BHRMV Bahrain Zain 10.00 0.01 1.17 +880 bd BGDBL Bangladesh Banglalink 50.00 0.49 10.10 +375 by BLRMD Belarus MDC Velcom 10.00 0.12 12.78 +32 be BELTB Belgium Belgacom-Proximus 1.00 0.00 0.62 +32 be BELMO Belgium -

Consolidated Financial Statements 2020 2

Consolidated financial statements Year ended December 31, 2020 This document is a free translation into English of the yearly financial report prepared in French and is provided solely for the convenience of English speaking readers. Significant events 2020 Tax dispute Covid-19 IFRS 16 concerning Health crisis Lease term fiscal years 2005-2006 The effect of the health crisis on the In December 2019, IFRS IC issued On November 13, 2020, the Conseil Group’s business and performance, its final decision on the determination d'État issued a favorable decision on the judgments and assumptions of the enforceable period of leases. a tax dispute in respect of the years made, as well as the main effects of 2005-2006. the crisis on the Group’s consolidated financial statements are The effects of this decision on the presented in Note 3 “Impact of the Group are presented in Note 2.3 As at December 31, 2020, the health crisis linked to the Covid-19 “New standards and interpretations current tax expense includes tax pandemic”. applied from January 1, 2020”. income of 2,246 million euros. Note 3 Note 2.3.1 Note 11.2 Consolidated financial statements 2020 2 Table of contents 7.4 Executive compensation ......................................................... 64 Financial statements Note 8 Impairment losses and goodwill ................................... 64 8.1 Impairment losses................................................................... 64 Consolidated income statement................................................... 4 8.2 Goodwill ................................................................................. 65 Consolidated statement of comprehensive income ...................... 5 8.3 Key assumptions used to determine recoverable amounts ...... 65 Consolidated statement of financial position ................................ 6 8.4 Sensitivity of recoverable amounts .......................................... 67 Note 9 Fixed assets ............................................................... -

P Pres S Rel Ease E

Press release Paris, February 20, 2017 Access to water Veolia wins €1156 million contract and contributes to drinking water acccess in Sri Lanka By winning a €156 million contract from the Sri Lankan National Water Supply and Drainage Board, Veolia, through its subsidiaries OTV and SADE, will help provide access to water on a large scale in the Greater Matale area. Located in Sri Lanka’s Central Province, some 150 kilometers from the capital, Colombo, Greater Matale is a predominantly agricultural region. Veolia, through its subsidiary OTV, has just been appointed project manager for the construction of five new water treatment plants in the region along with 12 service reservoirs, five pumping stations and more 430 km of transmission and distribution pipes. This system will ensure drinking water quality and secure supply for more than 350,000 people. Clarification, settling and filtration, the Matale (30,000 m3/d), Ambanganga (18,000 m3/d), Ukuwela, Udatenna and Rattotta (9,000 m3/d each) water treatment plants will incorporate the Veolia solutions and technology that best suit local conditions. Another Veolia subsidiary, SADE will act as subcontractor to design and build the 433 km transmission and distribution network. This contract was made possible with the support of local French government services through a financial scheme combining export credit from a syndicate of banks (CACIB, Natixis, Unicredit and BNP Paribas), with a guarantee from the French Ministry of Finance and a local commercial loan from HNB bank and treasury bonds. “Access to water is a key factor in the growth of cities, their citizens and their economym ”, said Claude Laruelle, Director of Veolia’s Global Enterprises. -

Securities Purchased Under the CSPP Available For

Securities purchased under the CSPP available for securities lending as of 11/24/2017 after closing time,,, ISIN,ISSUER,COUPON,MATURITE FR0000471930,Orange S.A.,8.125,1/28/2033 FR0000475758,GIE ENGIE Alliance,5.75,6/24/2023 FR0000476087,La Poste,4.375,6/26/2023 FR0010033381,Veolia Environnement S.A.,6.125,11/25/2033 FR0010096941,La Poste,4.75,7/8/2019 FR0010199927,SNCF Mobilités,3.625,6/3/2020 FR0010212852,Bouygues S.A.,4.25,7/22/2020 FR0010261396,VEOLIA ENVIRONNEMENT,4.375,12/11/2020 FR0010327007,Compagnie Fin. Ind. Autoroutes,5,5/24/2021 FR0010474239,VEOLIA ENVIRONNEMENT,5.125,5/24/2022 FR0010491720,Autoroutes du Sud de la France,5.625,7/4/2022 FR0010586081,La Poste,4.5,2/27/2018 FR0010660043,RTE EDF TRANSPORT,5.125,9/12/2018 FR0010678185,ENGIE,6.875,1/24/2019 FR0010709451,ENGIE,6.375,1/18/2021 FR0010737882,Autoroutes du Sud de la France,7.375,3/20/2019 FR0010745976,Suez S.A.,6.25,4/8/2019 FR0010780528,Suez S.A.,5.5,7/22/2024 FR0010800540,ELECTRICITE DE FRANCE (EDF),4.625,9/11/2024 FR0010830034,Vivendi S.A.,4.875,12/2/2019 FR0010853226,Bouygues S.A.,4,2/12/2018 FR0010870949,ALSTOM,4.5,3/18/2020 FR0010883058,Autoroutes du Sud de la France,4.125,4/13/2020 FR0010891317,ELECTRICITE DE FRANCE (EDF),4.625,4/26/2030 FR0010908905,Air Liquide Finance,3.889,6/9/2020 FR0010913178,RTE EDF TRANSPORT,3.875,6/28/2022 FR0010913780,SUEZ,4.125,6/24/2022 FR0010948257,L'Air Liquide ‐ Société Anonyme pour l'Etude et l'Exploitation des Procédés Georges Claude,2.9 FR0010951806,SAGESS‐Soc.An.d.Gest.St.d.Sec.,3.125,10/21/2022 FR0010952770,ENGIE,3.5,10/18/2022 FR0010957662,Bouygues S.A.,3.641,10/29/2019 FR0010961540,ELECTRICITE DE FRANCE (EDF),4,11/12/2025 FR0010961581,ELECTRICITE DE FRANCE (EDF),4.5,11/12/2040 FR0010967216,DANONE,3.6,11/23/2020 FR0011033232,LVMH Moët Henn. -

Public Risks, Private Profits

PUBLIC RISKS, PRIVATE PROFITS VEOLIA ENVIRONNEMENT Profiles of Canada’s public-private partnership industry JUNE 2014 A JOINT PROJECT OF THE POLARIS INSTITUTE AND THE CANADIAN UNION OF PUBLIC EMPLOYEES INTRODUCTION This corporate profile is part of a series on the primary private water and wastewater services providers involved in the public- private partnership (P3) market in Canada. The companies profiled are identified by PPP Canada Inc. – the federal crown cor- poration created to promote P3s across the country – as likely market participants in Canadian water and wastewater P3 projects. They offer a diverse set of capabilities; some would be part of the design and build phase of a P3, others participate in the operate and finance portion. While some of the companies are specialty water and wastewater services firms, others are P3 financiers. The common thread is their desire to participate in and benefit from water and wastewater P3 projects in Canada. Given the success of recent efforts to oppose water and wastewater P3s in communities like Abbotsford, Whistler, and Metro Vancouver, B.C., public opposition is a key con- cern for the P3 industry in Canada.1 One way of protecting publicly owned and oper- ated water and wastewater services is to educate the public about the track records of private water services companies vying for contracts to design, build, finance, operate and maintain water and wastewater infrastructure. With intimate knowledge of these companies, municipal officials, city councillors and local supporters of publicly owned and operated water and wastewater services will gain important tools to challenge P3s in their communities. -

Reinventing Plastics

THE VEOLIA INSTITUTE REVIEW FACTS REPORTS 2019 REINVENTING PLASTICS In partnership with THE VEOLIA INSTITUTE REVIEW - FACTS REPORTS THINKING TOGETHER TO ILLUMINATE THE FUTURE THE VEOLIA INSTITUTE Designed as a platform for discussion and collective thinking, the Veolia Institute has been exploring the future at the crossroads between society and the environment since it was set up in 2001. Its mission is to think together to illuminate the future. Working with the global academic community, it facilitates multi-stakeholder analysis to explore emerging trends, particularly the environmental and societal challenges of the coming decades. It focuses on a wide range of issues related to the future of urban living as well as sustainable production and consumption (cities, urban services, environment, energy, health, agriculture, etc.). Over the years, the Veolia Institute has built up a high-level international network of academic and scientifi c experts, universities and research bodies, policymakers, NGOs, and international organizations. The Institute pursues its mission through high-level publications and conferences, and foresight working groups. Internationally recognized as a legitimate platform for exploring global issues, the Veolia Institute has official NGO observer status under the terms of the United Nations Framework Convention on climate change. THE FORESIGHT COMMITTEE Drawing on the expertise and international reputation of its members, the Foresight Committee guides the work of the Veolia Institute and steers its development. -

TOP PICKS Report

INDEPENDENT RESEARCH Top Picks 15th October 2013 Top Picks 4Q 2013 Top Picks ACCOR BUY EUR32 This is the fourth volume of our ‘Top Picks’ for 2013. As with those Last Price EUR32.89 Market Cap. EUR7,482m previously published, this list is not intended to be a model portfolio but ADIDAS GROUP BUY EUR93 Last Price EUR81.58 Market Cap. EUR17,067m simply a pure stock-picking exercise in our coverage universe. However ALTRAN TECHNOLOGIES BUY EUR7.3 it reflects a bias towards themes that we believe fit perfectly with the Last Price EUR6.27 Market Cap. EUR1,095m current macro and financial environment. FRESENIUS SE BUY EUR112 Emerging markets currencies have not been the right place to be since Fed Last Price EUR91.18 Market Cap. EUR13,188m LVMH BUY EUR165 chief Ben Bernanke signalled in May that the central bank was considering Last Price EUR144.8 Market Cap. EUR73,563m scaling back the $85 billion in bonds they are buying each month. As such, QIAGEN BUY EUR17 we have adopted a more cautious stance on EMs FX exposure and a Last Price EUR15.3 Market Cap. EUR3,667m greater exposure to Europe showing signs of stabilisation: Accor, Altran, SAINT GOBAIN BUY EUR40 Last Price EUR37.44 Market Cap. EUR20,709m Fresenius SE, Saint Gobain, Veolia, Axa & Allianz. SAP BUY EUR69 The Fed’s unconventional monetary policy is becoming more uncertain Last Price EUR53.8 Market Cap. EUR66,118m and although Janet Yellen should preserve the Fed’s dovish bias, current SODEXO BUY EUR75 Last Price EUR69.89 Market Cap. -

Livre RADD Orange EN.Indb

Corporate Social Responsibility 2013 complete report Corporate Social Responsibility complete report 2013 / Orange 2013 Corporate Social Responsibility contents editorial 4 vision and strategy 6 detailed CSR Report 8 1 CSR approach 9 1.1. our action priorities for 2014-2016 9 1.2. responsible governance 11 1.3. a process fuelled by dialogue 19 1.4. responsible purchasing policy 25 2 employees 33 2.1. establishing bonds between social performance and economic performance 33 2.2. building the Group’s future 39 2.3. promoting workplace diversity 43 3 customer support 47 3.1. becoming the customers’ choice 47 3.2. communicating with peace of mind 53 3.3. supporting families in the safe and responsible use of new technologies 57 4 society 61 4.1. combating the digital divide 61 4.2. supporting local development 69 4.3. responding to concerns about radio waves 75 5 environment 79 5.1. an ambitious environmental policy 79 5.2. combating climate change 81 5.3. optimising equipment life cycle and end-of-life 91 5.4. protecting biodiversity and rare resources 97 appendices 100 about this report 100 external opinion 104 environmental data 108 social data 116 Corporate Social Responsibility complete report 2013 / Orange 1 2013 Corporate Social Responsibility benchmarks 236 7,000 sales outlets millions customers 165,000 in 30 employees countries (1) more than 1.5 million used mobiles collected in 2013 in Europe 450,000 km of submarine cables 1,503,945 metric tons of CO2 emissions by the Group in 2013 (1) Non-Orange Business Services 2 Corporate Social