Orange's Modern Slavery and Human Trafficking

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Why Youtube Buffers: the Secret Deals That Make—And Break—Online Video When Isps and Video Providers Fight Over Money, Internet Users Suffer

Why YouTube buffers: The secret deals that make—and break—online video When ISPs and video providers fight over money, Internet users suffer. Lee Hutchinson has a problem. My fellow Ars writer is a man who loves to watch YouTube videos— mostly space rocket launches and gun demonstrations, I assume—but he never knows when his home Internet service will let him do so. "For at least the past year, I've suffered from ridiculously awful YouTube speeds," Hutchinson tells me. "Ads load quickly—there's never anything wrong with the ads!—but during peak times, HD videos have been almost universally unwatchable. I've found myself having to reduce the quality down to 480p and sometimes even down to 240p to watch things without buffering. More recently, videos would start to play and buffer without issue, then simply stop buffering at some point between a third and two-thirds in. When the playhead hit the end of the buffer—which might be at 1:30 of a six-minute video—the video would hang for several seconds, then simply end. The video's total time would change from six minutes to 1:30 minutes and I'd be presented with the standard 'related videos' view that you see when a video is over." Hutchinson, a Houston resident who pays Comcast for 16Mbps business-class cable, is far from alone. As one Ars reader recently complained, "YouTube is almost unusable on my [Verizon] FiOS connection during peak hours." Another reader responded, "To be fair, it's unusable with almost any ISP." Hutchinson's YouTube playback has actually gotten better in recent weeks. -

Separation of Telstra: Economic Considerations, International Experience

WIK-Consult Report Study for the Competitive Carriers‟ Coalition Separation of Telstra: Economic considerations, international experience Authors: J. Scott Marcus Dr. Christian Wernick Kenneth R. Carter WIK-Consult GmbH Rhöndorfer Str. 68 53604 Bad Honnef Germany Bad Honnef, 2 June 2009 Functional Separation of Telstra I Contents 1 Introduction 1 2 Economic and policy background on various forms of separation 4 3 Case studies on different separation regimes 8 3.1 The Establishment of Openreach in the UK 8 3.2 Functional separation in the context of the European Framework for Electronic Communication 12 3.3 Experiences in the U.S. 15 3.3.1 The Computer Inquiries 15 3.3.2 Separate affiliate requirements under Section 272 17 3.3.3 Cellular separation 18 3.3.4 Observations 20 4 Concentration and cross-ownership in the Australian marketplace 21 4.1 Characteristics of the Australian telecommunications market 22 4.2 Cross-ownership of fixed, mobile, and cable television networks 27 4.3 The dominant position of Telstra on the Australian market 28 5 An assessment of Australian market and regulatory characteristics based on Three Criteria Test 32 5.1 High barriers to entry 33 5.2 Likely persistence of those barriers 35 5.3 Inability of other procompetitive instruments to address the likely harm 38 5.4 Conclusion 38 6 The way forward 39 6.1 Regulation or separation? 40 6.2 Structural separation, or functional separation? 42 6.3 What kind of functional separation? 44 6.3.1 Overview of the functional separation 44 6.3.2 What services and assets should be assigned to the separated entity? 47 6.3.3 How should the separation be implemented? 49 Bibliography 52 II Functional Separation of Telstra Recommendations Recommendation 1. -

Moldova Mobile ID Case Study, Washington, DC: World Bank License: Creative Commons Attribution 3.0 IGO (CC by 3.0 IGO)

Public Disclosure Authorized Public Disclosure Authorized Moldova Mobile ID Public Disclosure Authorized Case Study id4d.worldbank.org Public Disclosure Authorized 44540_Moldova_CVR.indd 3 5/23/19 10:49 AM © 2018 International Bank for Reconstruction and Development/The World Bank 1818 H Street, NW, Washington, D.C., 20433 Telephone: 202-473-1000; Internet: www.worldbank.org Some Rights Reserved This work is a product of the staff of The World Bank with external contributions. The findings, interpretations, and conclusions expressed in this work do not necessarily reflect the views of The World Bank, its Board of Executive Directors, or the governments they represent. The World Bank does not guarantee the accuracy of the data included in this work. The boundaries, colors, denominations, and other information shown on any map in this work do not imply any judgment on the part of The World Bank concerning the legal status of any territory or the endorsement or acceptance of such boundaries. Nothing herein shall constitute or be considered to be a limitation upon or waiver of the privileges and immunities of The World Bank, or of any participating organization to which such privileges and immunities may apply, all of which are specifically reserved. Rights and Permission This work is available under the Creative Commons Attribution 3.0 IGO license (CC BY 3.0 IGO) http:// creativecommons.org/licenses/by/3.0/igo. Under the Creative Commons Attribution license, you are free to copy, distribute, transmit, and adapt this work, including for commercial purposes, under the following conditions: Attribution—Please cite the work as follows: World Bank. -

Stellungnahme Der Deutsche Telekom AG Zum Entwurf Einer Neuen Förderrichtlinie „Mobilfunkförderung“ Des Bundes Vom 22.07.2020

Stellungnahme der Deutsche Telekom AG zum Entwurf einer neuen Förderrichtlinie „Mobilfunkförderung“ des Bundes vom 22.07.2020 Der Mobilfunkausbau in Deutschland wird von den privatwirtschaftlichen Ausbauplänen der Mobilfunkbetreiber getragen. Die Telekom ist einer der wesentlichen Akteure dieses Ausbaus. Die Telekom investiert jedes Jahr über EUR 5 Mrd. in den Netzausbau in Deutsch- land – deutlich mehr als alle Wettbewerber. Dazu gehört der Bau von tausenden neuer Mobilfunkstandorte pro Jahr und Upgrades bestehender Masten. Zur Verbesserung der Netzabdeckung auch gerade in weißen Flecken kooperiert die Telekom auch mit den ande- ren beiden Mobilfunknetzbetreibern Vodafone und Telefónica. Hinzu kommt der bundes- weite Ausbau von Glasfasernetzen im Festnetz. Dieser privatwirtschaftliche Netzausbau ist im Kern wettbewerblich getrieben. Die Tele- kom betreibt bereits heute ein hochleistungsfähiges Mobilfunknetz, mit ausgezeichneter Übertragungsqualität und einer Netzabdeckung der Bevölkerung mit LTE von bundesweit über 98 %. Die ambitionierte Ausbaupläne der Telekom verfolgen unter der Maßgabe „5G bis 2025“ das Ziel, diese Spitzenposition im deutschen Mobilfunkmarkt zu halten und 99% der Haushalte und 90% der Fläche mit 5G zu versorgen und so sowohl die Coverage unseres Netzes zu erhöhen als auch den stetig steigenden Erwartungen unserer Kunden an mobile Datenmengen und Übertragungsqualitäten zu genügen.1 Zusätzlich zu diesen wettbewerblichen Anreizen hat sich die Telekom, wie die anderen Mo- bilfunknetzbetreiber, zu hohen Versorgungsauflagen verpflichtet, die der Frequenzauktion 2019 zugrunde lagen. Im Mobilfunkgipfel 2018 haben sich die Mobilfunknetzbetreiber zu- dem zu einem Netzausbau verpflichtet, der sogar noch über diese Auflagen hinausgeht: Die TDG wird zusammen mit Vodafone und Telefónica bis Ende 2020 99% der Haushalte bun- desweit und bis Ende 2021 99% der Haushalte in jedem Bundesland erschließen. -

Orange Annual Report 2015

a letter from the Chairman As an immediate translation of our strategy’s key pillars, roughly JD a letter from the CEO providing a new, more personalized shop experience. Moreover, 200 million has already been invested in providing the best network and in alignment with Orange Group support, we also refreshed and in the Kingdom, which has led to the full-scale launch of our 4G relaunched the Orange brand, focusing on our customers through network, covering 82% of the local population. We also renewed commitments to availability, connectivity, adaptation and simplicity. our 2G and 3G networks, offering multiple connectivity options In the same way that we spent 2015 enriching the experience and innovative services for both individual and corporate clients, of our individual customers, we also continued to accompany while providing exceptional speed and quality. Additionally, we the transformation and growth of our enterprise customers. By inaugurated the first phase of the Regional Cable Network (RCN) forging and maintaining long-term strategic partnerships with key project. This is one of the region’s most vital telecommunications organizations across the nation, becoming a trusted partner to projects; we collaborated with a group of regional operators to additional valuable portfolios of public and private entities, such as Jordan’s recent hotels: Rotana and Ramada Dead sea; the Qatar successfully implement this massive undertaking. and United Arab Emirates’ embassies and chemical industry Our commitments were not limited to our customers, but also leaders JAFCCO (Jordan Abyad Fertilizers & Chemical Co.). targeted our internal work environment and our employees, to We look forward to providing these partners with the telecom whom we owe our success. -

Pdf 8 Methodology Development, Ranking Digital Rights

SMEX is a Beirut-based media development and digital rights organization working to advance self-regulating information societies. Our mission is to defend digital rights, promote open culture and local content, and encourage critical engagement with digital technologies, media, and networks through research, knowledge-sharing, and advocacy. Design, illustration concept, and layout are by Salam Shokor, with assistance from David Badawi. Illustrations are by Ahmad Mazloum and Salam Shokor. www.smex.org A 2018 Publication of SMEX Kmeir Building, 4th Floor, Badaro, Beirut, Lebanon © Social Media Exchange Association, 2018 This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License. Acknowledgments Afef Abrougui conceptualized this research report and designed and oversaw execution of the methodology for data collection and review. Research was conducted between April and July 2017. Talar Demirdjian and Nour Chaoui conducted data collection. Jessica Dheere edited the report, with proofreading assistance from Grant Baker. All errors and omissions are strictly the responsibility of SMEX. This study would not have been possible without the guidance and feedback of Rebecca Mackinnon, Nathalie Maréchal, and the whole team at Ranking Digital Rights (www.rankingdigitalrights.org). RDR works with an international community of researchers to set global standards for how internet, mobile, and telecommunications companies should respect freedom of expression and privacy. The 2017 Corporate Accountability Index ranked 22 of the world’s most powerful such companies on their disclosed commitments and policies that affect users' freedom of expression and privacy. The methodology developed for this research study was based on the RDR/ CAI methodology. We are also grateful to EFF’s Katitza Rodriguez and Access Now’s Peter Micek, both of whom shared valuable insights and expertise into how our research might be transformed and contextualized for local campaigns. -

US and Plaintiff States V. Deutsche Telekom AG, Et

Case 1:19-cv-02232 Document 1 Filed 07/26/19 Page 1 of 13 UNITED STATES DISTRICT COURT FOR THE DISTRICT OF COLUMBIA UNITED STATES OF AMERICA, Department of Justice, Antitrust Division 450 5th Street, N.W. Washington, D.C. 20530 STATE OF KANSAS, 120 S.W. 10th Avenue, 2nd Floor Topeka, Kansas 66612-1597 STATE OF NEBRASKA, Case No. 2115 State Capitol Lincoln, Nebraska 68509 Filed: STATE OF OHIO, 150 East Gay Street, 22nd Floor Columbus, Ohio 43215 STATE OF OKLAHOMA, 313 N.E. 21st Street Oklahoma City, Oklahoma 73105-4894 and STATE OF SOUTH DAKOTA, 1302 E. Highway 14, Suite 1 Pierre, South Dakota 57501-8501 Plaintiffs, v. DEUTSCHE TELEKOM AG, Friedrich-Ebert-Allee 140 Bonn, Germany 53113 T-MOBILE US, INC., 12920 SE 38th Street Bellevue, Washington 98006 SOFTBANK GROUP CORP. 1-9-1 Higashi-shimbashi, Minato-ku, Tokyo, Japan 105-7303 Case 1:19-cv-02232 Document 1 Filed 07/26/19 Page 2 of 13 and SPRINT CORPORATION 6200 Sprint Parkway, Overland Park, Kansas 66251-4300 Defendants. COMPLAINT The United States of America and the States of Kansas, Nebraska, Ohio, Oklahoma, and South Dakota (“Plaintiff States”) bring this civil antitrust action to prevent the merger of T- Mobile and Sprint, two of the four national facilities-based mobile wireless carriers in the United States. The United States and Plaintiff States allege as follows: I. NATURE OF THE ACTION 1. Mobile wireless service is an integral part of modern American life. The average American household spends over $1,000 a year on mobile wireless service, not including the additional costs of wireless devices, applications, media content, and accessories. -

Anticipated Acquisition by BT Group Plc of EE Limited

Anticipated acquisition by BT Group plc of EE Limited Appendices and glossary Appendix A: Terms of reference and conduct of the inquiry Appendix B: Industry background Appendix C: Financial performance of companies Appendix D: Regulation Appendix E: Transaction and merger rationale Appendix F: Retail mobile Appendix G: Spectrum, capacity, and speed Appendix H: Fixed-mobile bundles Appendix I: Wholesale mobile: total foreclosure analysis Appendix J: Wholesale mobile: partial foreclosure analysis Appendix K: Mobile backhaul: input foreclosure Appendix L: Retail fixed broadband: Market A Appendix M: Retail broadband: superfast broadband Glossary APPENDIX A Terms of reference and conduct of the inquiry Terms of reference 1. In exercise of its duty under section 33(1) of the Enterprise Act 2002 (the Act) the Competition and Markets Authority (CMA) believes that it is or may be the case that: (a) arrangements are in progress or in contemplation which, if carried into effect, will result in the creation of a relevant merger situation in that: (i) enterprises carried on by, or under the control of, BT Group plc will cease to be distinct from enterprises currently carried on by, or under the control of, EE Limited; and (ii) section 23(1)(b) of the Act is satisfied; and (b) the creation of that situation may be expected to result in a substantial lessening of competition within a market or markets in the United Kingdom (the UK) for goods or services, including the supply of: (i) wholesale access and call origination services to mobile virtual network operators; and (ii) fibre mobile backhaul services to mobile network operators. -

Orange Annual Report 2011

contents 2011 financial highlights 9 best of 2011 17 disclosure schedule report 27 consolidated financial statements 41 His Majesty King Abdullah II “In economic policy, our focus is on jobs-rich growth, innovation, and new enterprise. National investments in infrastructure and education are continuing - and we are seeing results in the success of sectors like ICT”. 3 a letter from the Chairman sectors. We have also worked toward were crowned by the two regional network boosting internet penetration throughout the projects, the Regional Cable Network (RCN) Kingdom, particularly within governorates — a multi-terabit cable system extending beyond the Capital — an endeavor in which from the UAE through Saudi Arabia, Jordan we are trendsetters. We also introduced a and Syria, all the way into Europe — and wide variety of special offers at competitive the JADI Link cable system — a fiber optic prices, making our services more accessible link that will pass through Jeddah, Amman, to various segments of the community. Damascus, and Istanbul, serving as a robust, more reliable alternative route to existing As for customer care and services, what Mediterranean and Red Sea cable systems set 2011 apart was the launch of “Emtiyaz”, for data traffic between Europe, the Middle a program that aims to bolster customer East and Asia. satisfaction across various touch points throughout our operations. This landmark This is in addition to the continued program stems from our unwavering investments by France Telecom in the commitment to our subscribers and to Technocentre Amman — the Group’s first the remarkable customer services that we Technocentre outside Europe, which is based provide — which include an explicit guarantee at our headquarters in Amman and serves as innovation continues: of addressing any technical problem logged an unmatched innovation department that more investments, more achievements on our fixed or ADSL lines within 72 hours develops unique technology solutions bearing — whether through this program or through the Orange brand. -

COVID-19 Response and Recovery Monthly Bulletin March 2021

COVID-19 Response and Recovery Monthly Bulletin March 2021 The Office of the United Nations Resident Coordinator / United Nations Moldova can be contacted at the following email address [email protected] or phone number (+373 22) 220 045 1 COVID-19 Epi and Health situation update (Data as at 31 March unless stated otherwise) The total number of COVID-19 cases in the country The number of new cases has grown substantially has continued to accelerate and reached 230,241 at during March and reached a 7-day average of the end of March. The number increased further on 1,465 at the end of March compared to 1,291 at the first day of April and now stands at 231,756. the beginning of the month. The number of active cases increased for the first The 7-day average for the number of deaths increased few weeks of March and started to decrease substantially in March and currently stands at 42.71. towards the end of the Month. The number of The total number of deaths was 4,960 at the end of active cases at the end of March stood at 17,429. March and exceeded 5,000 on the first day of April. United Nations in the Republic of Moldova UN Moldova Monthly Bulletin - March 2021 | 2 The average number of very serious cases Overall, fifty-nine percent of all cases have been increased steadily in March, reaching 345 during recorded among women and 41% among men. the week of March 22-28. The total number of However, the proportion of all deaths between hospitalized patients with COVID-19 at the end of the two groups are approximately equal (50% the month was 4,167, out of which 331 were in each). -

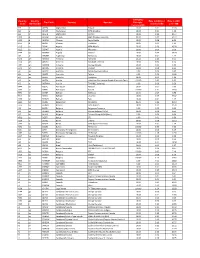

Country Code Country ISO Number Tap Code Country Operator

Charging Country Country Rate in USD per Rate in USD Tap Code Country Operator Principle Code ISO Number increment kb per 1 MB increment kb +93 af AFGEA Afghanistan Etisalat 10.00 0.11 11.18 +93 af AFGAR Afghanistan MTN (Areeba) 10.00 0.01 1.30 +93 af AFGTD Afghanistan Roshan 10.00 0.10 10.27 +355 al ALBAM Albania AMC (Telekom Albania) 50.00 0.49 10.13 +355 al ALBEM Albania Eagle Mobile 10.00 0.08 8.02 +355 al ALBVF Albania Vodafone 10.00 0.01 1.13 +213 dz DZAA1 Algeria ATM-Mobilis 20.00 0.20 10.28 +213 dz DZAWT Algeria Wataniya 10.00 0.00 0.30 +244 ao AGOMV Angola Movicel 10.00 0.14 13.99 +54 ar ARGTM Argentina Telefonica 10.00 0.01 1.42 +374 am ARM01 Armenia Armentel 10.24 0.10 9.65 +374 am ARMKT Armenia Karabakh Telecom 10.00 0.08 8.24 +374 am ARMOR Armenia Orange (Ucom) 10.00 0.01 1.09 +374 am ARM05 Armenia VivaCell 10.00 0.08 8.24 +61 au AUSOP Australia Optus Communications 1.00 0.00 0.33 +61 au AUSTA Australia Telstra 1.00 0.02 21.02 +61 au AUSVF Australia Vodafone 10.00 0.01 1.10 +43 at AUTCA Austria Hutchison Drei Austria GmbH (Connect- One/ Orange) 100.00 0.83 8.53 +43 at AUTMM Austria T MOBILE (telering) 1.00 0.00 0.58 +994 az AZEAC Azerbaijan Azercell 10.00 0.07 7.00 +994 az AZEBC Azerbaijan Bakcell 100.00 1.71 17.50 +973 bh BHRBT Bahrain BATELCO 10.00 0.07 6.98 +973 bh BHRST Bahrain Viva STC 10.00 0.19 19.02 +973 bh BHRMV Bahrain Zain 10.00 0.01 1.17 +880 bd BGDBL Bangladesh Banglalink 50.00 0.49 10.10 +375 by BLRMD Belarus MDC Velcom 10.00 0.12 12.78 +32 be BELTB Belgium Belgacom-Proximus 1.00 0.00 0.62 +32 be BELMO Belgium -

Performance of Multinational Company

Masaryk University Faculty of Economics and Administration Field of study: Business Management PERFORMANCE OF MULTINATIONAL COMPANY Diploma thesis Thesis Supervisor: Author: Ing. Bc. Sylva ŽAKOVA TALPOVA, Ph.D Lilia TUGULEA Brno, 2016 Masaryk University Faculty of Economics and Administration Department of Corporate Economy Academic year 2015/2016 ASSIGNMENT OF DIPLOMA THESIS For: TUGULEA, Lilia Field: Business management Title: Performance of Multinational Company P r i n c i p l e s o f t h e s i s w r i t i n g: Objective of the thesis: The aim of the thesis is to thesis is to develop and analyze the balance scorecard in a subsidiary in order to measure performance. Approach and methods used: 1. Literature review of relevant concepts for the purpose of the thesis 2. Practical part with the analysis and the steps for developing the framework 3. Discussions and conclusions. Methods: Analysis, deductive and exploratory. The extent of graphical works: according to the supervisor's guidelines The thesis length without appendices: 60 – 80 pages ii List of specialist literature: DERESKY, Helen. International management: managing across borders and cultures: text and cases. 8thed., Pearson Education Limited, 2014. 480 p., ISBN: 9780273787051. KAPLAN, Robert and NORTON, David. The balanced scorecard: translating strategy into action. Boston: Harvard Business School Press, 1996, 322 p., ISBN: 0875846513. NIVEN, Paul. Balanced Scorecard step-by-step: maximizing performance and maintaining results.2nd ed., John Wiley & Sons, Inc., 2006. 317 p., ISBN: 9780471780496. Diploma thesis supervisor: Ing. Bc. Sylva Žáková Talpová, Ph.D. Date of diploma thesis assignment: ... Submission deadline for Diploma thesis and its entry in the IS MU is provided in the valid Time schedule of the academic year.