US Bancorp Piper Jaffray

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Xbox Security

Xbox Security The Xbox is a sixth generation video game console produced by Microsoft Corporation. It was Microsoft's first foray into the gaming console market, and competed directly with Sony's PlayStation 2 and the Nintendo GameCube. It was released on November 15, 2001 in North America, February 22, 2002 in Japan, and March 14, 2002 in Europe and Australia. It is the predecessor to Microsoft's Xbox 360 console. The remarkable success of the upstart Sony PlayStation worried Microsoft in late 1990s. The growing video game market seemed to threaten the PC market which Microsoft had dominated and relied upon for most of its revenues. Additionally, a venture into the gaming console market would diversify Microsoft's product line, which up to that time had been heavily concentrated on software. The Xbox was Microsoft's first product that ventured into the video game console market, after having collaborated with Sega in porting Windows CE to the Dreamcast console. Notable launch titles for the console included Halo: Combat Evolved, Amped: Freestyle Snowboarding, Dead or Alive 3, Project Gotham Racing, and Oddworld: Munch's Oddysee. Development The Xbox was initially developed within Microsoft by a small team that included game developer Seamus Blackley (an agent with Creative Artists Agency representing video game creators). Microsoft repeatedly delayed the console, which was revealed at the end of 1999 following interviews of Microsoft CEO Bill Gates. Gates stated that a gaming/multimedia device was essential for multimedia convergence in the new times of digital entertainment. On March 10, 2000 the "X-box Project" was officially confirmed by Microsoft with a press release. -

22-23 October 2019 Bell Harbor Conference Center, Seattle

22-23 OCTOBER 2019 BELL HARBOR CONFERENCE CENTER, SEATTLE @gamesforum Day 1 – October 22nd GOLD SPONSOR 08:00 Registration 09:00 Opening Remarks and Welcome to Gamesforum Seattle 2019 Gamesforum will make some brief opening remarks about the conference, including an outline of what to expect from both days and some much needed housekeeping. John Speakman, CEO, Gamesforum SILVER SPONSORS 09:15 Keynote: State of the Industry Panel Our opening Keynote panel will take a look at the macro trends in the industry from the past 12 months and what’s on the horizon in 2020. Moderator, Ron Segev, Partner, Segev LLP Davd Bluhm, Managing Director, Agnitio Capital David Chang, EVP, Corporate Development, Asmodee 10:00 Morning Networking Break GAMES DESIGN AND GAMES MARKETING MONETIZATION DEVELOPMENT FORUM FORUM OPENS FORUM OPENS OPENS BRONZE SPONSORS 10:30 10 Years of Angry Birds 10:30 A Year of Spending 10:30 The Big Why: How to Mobile Games Dangerously Present Game Ideas and Get The first Angry Birds game was At last year’s Gamesforum, Nathan Sellyn Buy In launched in December 2009. 10 years spoke about ‘falling on your own harpoon,’ At the heart of every game pitch is a big and 17 mobile titles later, the Angry the process of his expensive evolution idea, but what’s the best way to help your Birds brand and games are still relevant into a whale in Nintendo’s Fire Emblem audience understand your idea the way and successful. What is needed from a Heroes. This year, he returns to present you do? Your first words in pitching your brand (and the team behind it) to live another set of lessons in core and casual idea can be the difference between selling and thrive for as long as there have F2P monetization - lessons he shamefully it in the room and losing your audience on been modern touch screen mobile learned the hard way, after a year that saw the first slide. -

Vintage Game Consoles: an INSIDE LOOK at APPLE, ATARI

Vintage Game Consoles Bound to Create You are a creator. Whatever your form of expression — photography, filmmaking, animation, games, audio, media communication, web design, or theatre — you simply want to create without limitation. Bound by nothing except your own creativity and determination. Focal Press can help. For over 75 years Focal has published books that support your creative goals. Our founder, Andor Kraszna-Krausz, established Focal in 1938 so you could have access to leading-edge expert knowledge, techniques, and tools that allow you to create without constraint. We strive to create exceptional, engaging, and practical content that helps you master your passion. Focal Press and you. Bound to create. We’d love to hear how we’ve helped you create. Share your experience: www.focalpress.com/boundtocreate Vintage Game Consoles AN INSIDE LOOK AT APPLE, ATARI, COMMODORE, NINTENDO, AND THE GREATEST GAMING PLATFORMS OF ALL TIME Bill Loguidice and Matt Barton First published 2014 by Focal Press 70 Blanchard Road, Suite 402, Burlington, MA 01803 and by Focal Press 2 Park Square, Milton Park, Abingdon, Oxon OX14 4RN Focal Press is an imprint of the Taylor & Francis Group, an informa business © 2014 Taylor & Francis The right of Bill Loguidice and Matt Barton to be identified as the authors of this work has been asserted by them in accordance with sections 77 and 78 of the Copyright, Designs and Patents Act 1988. All rights reserved. No part of this book may be reprinted or reproduced or utilised in any form or by any electronic, mechanical, or other means, now known or hereafter invented, including photocopying and recording, or in any information storage or retrieval system, without permission in writing from the publishers. -

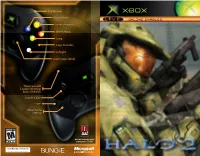

Score Pause Game Settings Fire Weapon Reload/Action Switch Weapo

Fire Weapon Reload/Action ONLINE ENABLED Switch Weapons Melee Attack Jump Swap Grenades Flashlight Zoom Scope (Click) Throw Grenade E-brake (Warthog) Boost (Vehicles) Crouch (Click) Score Pause Game Settings Get the strategy guide primagames.com® ® 0904 Part No. X10-96235 SAFETY INFORMATION TABLE OF CONTENTS About Photosensitive Seizures Secret Transmission ........................................................................................... 2 A very small percentage of people may experience a seizure when exposed to certain visual images, including flashing lights or patterns that may appear in video games. Even people who Master Chief .......................................................................................................... 3 have no history of seizures or epilepsy may have an undiagnosed condition that can cause these Breakdown of Known Covenant Units ......................................................... 4 “photosensitive epileptic seizures” while watching video games. These seizures may have a variety of symptoms, including lightheadedness, altered vision, eye or Controller ............................................................................................................... 6 face twitching, jerking or shaking of arms or legs, disorientation, confusion, or momentary loss of awareness. Seizures may also cause loss of consciousness or convulsions that can lead to injury from Mjolnir Mark VI Battle Suit HUD ..................................................................... 8 falling down or striking -

Oral History of Ed Fries

Oral History of Ed Fries Interviewed by: Dag Spicer Recorded: May 6, 2014 Mountain View, California CHM Reference number: X7162.2014 © 2014 Computer History Museum Oral History of Ed Fries Dag Spicer: So we're here today on May 6, 2014, with Ed Fries from Microsoft, and various other ventures, but [now] in [his] post-Microsoft life. And, Ed, welcome to the Computer History Museum. Ed Fries: Thanks. It's good to be here. Spicer: Really glad to have you here today. Can you tell us a bit about your early years, where you grew up, where you went to school, that kind of thing? Fries: Yeah, sure. So I grew up outside Seattle, [a] town called Bellevue. My mom and dad both moved out from the East Coast to work for Boeing, so Bellevue is kind of the engineer’s town at Boeing. So everything was Boeing back then. It was the biggest employer. And so, yeah, that's where I grew up. Spicer: Were your parents technically oriented or-- Fries: Yeah, they're both technical. Yeah. My dad was an electrical engineer, and my mom was a chemical engineer. Spicer: Wow. Fries: Yeah, so they met at Bucknell [University] and then both ended up getting hired by Boeing and moving out here. Spicer: That's great. So tell me how they influenced you, then. Having two engineers as parents must have had some kind of influence. Fries: Yeah, it gets worse actually, because my mom quit her job when she had the kids, and then when I was in sixth grade, she went back to school, back [to the] University of Washington, and got a master's [degree] in computer science and then went to work at DEC, Digital Equipment Corporation, as you know. -

Express Evaluate Exhibit Engage

Middle School Modules engage express evaluate exhibit ModuleTable 1: This of Contents is Senseless Module 1: This is Senseless Table of Contents ABOUT THIS MODULE 3 ACADEMIC VOCABULARY 4 REQUIRED MATERIALS 6 EVENT PLANNER 11 MONDAY: SENSES IN THE WORKS 12 TUESDAY: SENSORYMANIA 30 WEDNESDAY: I’VE GOT A FEELING 47 THURSDAY: EXTRAORDINAIRY SENSES 63 FRIDAY: COMMUNITY SHARING EVENT 72 engage express exhibit evaluate2 2 of 40 Module 1: This is Senseless About This Module This module focuses on the human senses, both traditional and some that are lesser known. Throughout the week, topics will focus on how Objective the senses work in the body and how they can be adapted to our appliances. How do the senses detect energy? How can we make our senses stronger? What if our senses became interconnected so we could smell sounds or taste colors? Driving Questions What kind of sixth sense would you like to develop? Is there a technology that acts in place of eyes/mouth to prepare the sense? Products of the SENSOR’d Appliance Design Week Community SENSOR’d Appliance Expo Sharing Event Our bodies are equipped to sense all kinds of energy–we can feel electric shocks in our fingertips, hear how much energy a sound wave possesses, and even smell energy in the form of food. But how might we perceive energy differently if we had no senses, a sixth sense, or Introduction recombined the senses we already have? This week we’ll work in teams to explore this year’s theme of “Energy of the Future” and create ideas for new inventions that use our senses in ways we’ve never used them before. -

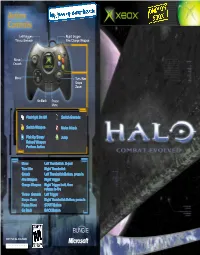

Halo: Combat Evolved

Left trigger: Right trigger: Throw Grenade Fire/Charge Weapon Move/ Crouch Move Turn/Aim Scope Zoom Go Back Pause Menu Flashlight On/Off Switch Grenade Switch Weapon Melee Attack Pick Up/Swap/ Jump Reload Weapon Perform Action Move Left Thumbstick, D-pad Turn/Aim Right Thumbstick Crouch Left Thumbstick Button, press in Fire Weapon Right Trigger Charge Weapon Right Trigger hold, then release to fire Throw Grenade Left Trigger Scope Zoom Right Thumbstick Button, press in Pause Menu START Button Go Back BACK Button 0901 Part No. X08-54602 m Safety Information CONTENTS About Photosensitive Seizures Using the Xbox Video Game System 2 A very small percentage of people may experience a seizure when exposed to certain visual images, including flashing lights or Using the Xbox Controller 3 patterns that may appear in video games. Even people who have Using the Xbox Controller 3 no history of seizures or epilepsy may have an undiagnosed condition that can cause these “photosensitive epileptic seizures” The Story So Far 4 while watching video games. The Main Screen 6 These seizures may have a variety of symptoms, including lightheadedness, altered vision, eye or face twitching, jerking or shaking of arms or legs, disorientation, confusion, or momentary Loading and Saving Games 7 loss of awareness. Seizures may also cause loss of consciousness or convulsions that can lead to injury from falling down or striking The Pillar of Autumn and Its Crew 8 nearby objects. Immediately stop playing and consult a doctor if you experience The Covenant 10 any of these symptoms. Parents should watch for or ask their children about the above symptoms—children and teenagers are Fighting the Enemy more likely than adults to experience these seizures. -

Washington Interactive Network Impact Study 2016

December 2016 Community Attributes Inc. tells data-rich stories about communities that are important to decision makers. Sponsored by President & CEO Chris Mefford OneRedmond City of Redmond Analysts City of Bellevue Spencer Cohen, PhD Economic Development Council of Seattle & King County Michaela Jellicoe City of Kirkland Alexandra Streamer Eric Viola Design Maureen McLennon Community Attributes Inc. 1411 Fourth Ave, Suite 1401 Seattle, Washington 98101 www.communityattributes.com EXECUTIVE SUMMARY In 2007, Community Attributes Inc. (CAI) was Cluster support industries include a distribution commissioned to conduct an Interactive Media network to deliver games to the consumer, professional Industry Assessment. The purpose of the original study services such as banking, financing, real estate, venture was to provide a knowledge foundation that could be capital, legal advising and information and used to grow businesses and economic activity within communications technology (ICT) infrastructure. Most the interactive media cluster throughout Washington importantly, the cluster is supported by a talented state. CAI updated this study in 2012, and again in workforce and the education and research institutions 2014 to assess the changes that had occurred over time. that back that workforce. In 2016 the Washington Interactive Network (WIN) commissioned an update to the previously conducted The cluster is comprised of an estimated 423 studies to assess the cluster’s growth in jobs and companies, including more than 40 companies working business, as well as new trends in the industry with a in the burgeoning virtual and augmented reality field. particular focus on the growing Virtual Reality (VR) Washington’s interactive media firms employed an and Augmented Reality (AR) segments of the cluster. -

Score Pause Game Settings Fire Weapon Reload/Action Switch Weapo

Fire Weapon Reload/Action ONLINE ENABLED Switch Weapons Melee Attack Jump Swap Grenades Active Camo Zoom Scope (Click) Throw Grenade E-brake (Warthog) Boost (Vehicles) Crouch (Click) Score Pause Game Settings Get the strategy guide ™ primagames.com® 0904 Part No. X10-73320 SAFETY INFORMATION TABLE OF CONTENTS About Photosensitive Seizures Report on the Atrocity at Halo ........................................................................ 2 A very small percentage of people may experience a seizure when exposed to certain visual Updated Intelligence on Human Weapons and Tactics ........................ 3 images, including flashing lights or patterns that may appear in video games. Even people who have no history of seizures or epilepsy may have an undiagnosed condition that can cause these Our Numbers Deployed on the Human World ......................................... 4 “photosensitive epileptic seizures” while watching video games. These seizures may have a variety of symptoms, including lightheadedness, altered vision, eye or Controller ............................................................................................................... 6 face twitching, jerking or shaking of arms or legs, disorientation, confusion, or momentary loss of Sangheili Battle Suit ........................................................................................... 8 awareness. Seizures may also cause loss of consciousness or convulsions that can lead to injury from falling down or striking nearby objects. Battle Tactics ......................................................................................................... -

Grabbed by the Ghoulies Is Split Into Chapters

l+r Auto-center Camera r Rotate Camera B Discard Temporary Weapon l Rotate Camera L Move APick Up Weapon/ Advance Text R Attack > Pause Game/Skip Story Get the strategy guide primagames.com® 0903 Part No. X09-93065 About Photosensitive Seizures A very small percentage of people may experience a seizure when The Story . 2 exposed to certain visual images, including flashing lights or patterns that may appear in video games. Even people who have no history of seizures or epilepsy may have an undiagnosed condition The Characters . 4 that can cause these “photosensitive epileptic seizures” while watching video games. These seizures may have a variety of symptoms, including Getting Started . 6 lightheadedness, altered vision, eye or face twitching, jerking or shaking of arms or legs, disorientation, confusion, or momentary loss of awareness. Seizures may also cause loss of consciousness or The Controller . 8 convulsions that can lead to injury from falling down or striking nearby objects. Immediately stop playing and consult a doctor if you experience any Screen Display . 10 of these symptoms. Parents should watch for or ask their children about the above symptoms-children and teenagers are more likely than adults to experience these seizures. Playing the Game . 12 The risk of photosensitive epileptic seizures may be reduced by sitting farther from the television screen, using a smaller television screen, playing in a well-lit room, and not playing when you are Challenges . 18 drowsy or fatigued. If you or any of your relatives have a history of seizures or Items and Secrets . 20 epilepsy, consult a doctor before playing. -

Retro Game Programming Copyright © 2011 by Brainycode.Com

Retro Game Programming Copyright © 2011 by brainycode.com Retro Game Programming How this book got started? ................................................................................................. 4 Introduction ......................................................................................................................... 5 What is a retro game? ..................................................................................................... 6 What are we trying to do? ............................................................................................... 7 What do you need?.......................................................................................................... 8 What should you know?.................................................................................................. 9 What‘s the plan? ............................................................................................................. 9 Chapter 1: The Early History of Video Games ................................................................. 11 Just Having Fun ............................................................................................................ 12 A germ of an idea ...................................................................................................... 12 The First Pong Game ................................................................................................ 12 Spacewar! ................................................................................................................. -

Xbox on the Mind Microsoft Is Scoring Mind Share, but It Must Make One More Deal to Have a Shot at Winning the Console War

001-12_GIN _04.te.qxd 2/18/04 11:39 AM Page 1 VOLUME 1, ISSUE 4; FEBRUARY 20, 2004 Xbox on the Mind Microsoft is scoring mind share, but it must make one more deal to have a shot at winning the console war “People are acting like our desire to make to conferences, hand out fliers, talk to important it is for Microsoft to play well a profit on a product we sell is some sort influencers. There’s absolutely nothing with others in the console space than those of unforgivable sin.” organic about this.” in the PC space. Microsoft has bet heavily on online gaming as a strong selling point That’s a Microsoft executive whom But such PR campaigns are successful of the Xbox, and the company is making we’ve known since before Bill Gates made only if there’s an audience ready to accept steady progress in attracting subscribers, his first billion. He’s worked on all sorts of them. “People are throwing all sorts of but Xbox Live will not be sustainable until projects for Redmond since the 1980s, and money at our culture,” says Kevin Liles, Microsoft makes a deal to include the enor- he’s furious about the response to early who stepped down as president of hip-hop mously popular Electronic Arts games on news about Xbox Next. “People don’t even stalwart Def Jam earlier this month as part the system. Online isn’t the only key, know what it’s going to be, and already of the Lyor Cohen/L.A.