Mexican Healthcare System 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Chiapas Earthquake, Mexico 2017

GEOFILE Extension 781 The Chiapas earthquake, Mexico 2017 By Philippa Simmons Synopsis Links This Geofile will explore the causes and impacts of Exam board Link to specification the Chiapas earthquake that occurred in Mexico in AQA September 2017, as well as the responses to it. Mexico AS Component 1 Physical Geography 3.3.1.4 is situated where the Cocos plate converges with the Seismic hazards p18 pdf version North American plate – one of the most tectonically Click here active regions in the world, with up to 40 earthquakes A2 Component 1 Physical Geography 3.1.5.4 a day. The state of Chiapas is located along the Seismic hazards p15 pdf version Click here southern shore of Mexico and borders Guatemala, it is in a subduction zone and is at risk of strong Edexcel AS 1.4c and 1.5c Social and economic impacts of earthquakes. At 23.49 local time on 7 September 2017 tectonic hazards p18 pdf version an earthquake of magnitude 8.2 struck off the coast of Click here Mexico. This was the strongest earthquake to be A2 1.4c and 1.5c Social and economic impacts of recorded globally in 2017, resulting in it being the tectonic hazards p15 pdf version Click here second strongest ever in Mexico. OCR AS Topic 2.5 Hazardous Earth 4b Range of impacts Key terms on people as a result of earthquake activity – Tectonic, tectonic hotspot, plate boundary, case studies convergent boundary, aftershock, magnitude, + 5b Strategies – case studies tsunami, vulnerability. p39 pdf version Click here Learning objectives A2 Topic 3.5 Hazardous Earth 4b There is a range -

Becle, S.A.B. De C.V

[Translation for informational purposes only] ANNUAL REPORT FILED IN ACCORDANCE WITH THE GENERAL PROVISIONS APPLICABLE TO ISSUERS OF SECURITIES AND TO OTHER PARTICIPANTS IN THE SECURITIES MARKET, FOR THE YEAR ENDED DECEMBER 31, 2018. BECLE, S.A.B. DE C.V. Guillermo González Camarena No.800-4, Col. Zedec Santa Fe, C.P. 01210, Mexico City, Mexico “CUERVO” Securities Representing the Capital Stock of the Issuer Characteristics Market in which they are registered Single Series Shares of Common Stock Bolsa Mexicana de Valores, S.A.B. de C.V. The securities of the issuer referred to above are registered in the National Securities Registry (Registro Nacional de Valores). Registration in the National Securities Registry (Registro Nacional de Valores) does not certify the soundness of the securities or the solvency of the issuer, or the accuracy or veracity of the information contained in the prospectus, and it does not validate the actions that, as applicable, have been performed in contravention of applicable law. [Translation for informational purposes only] TABLE OF CONTENTS 1) Overview 4 A) GLOSSARY OF TERMS AND DEFINITIONS 4 B) EXECUTIVE SUMMARY 7 C) RISK FACTORS 22 D) OTHER SECURITIES 42 E) MATERIAL CHANGES TO THE RIGHTS OF SECURITIES REGISTERED IN THE NATIONAL SECURITIES REGISTRY 43 F) PUBLIC DOCUMENTS 44 2) THE COMPANY 45 A) HISTORY AND DEVELOPMENT OF THE COMPANY 45 B) BUSINESS DESCRIPTION 49 i) Main Activity 49 ii) Distribution Channels 61 iii) Patents, licenses, brands and other agreements 63 iv) Main customers 64 v) Applicable law -

UNIVERSITY of CALIFORNIA RIVERSIDE Medical Migration

UNIVERSITY OF CALIFORNIA RIVERSIDE Medical Migration: Strategies for Affordable Care in an Unaffordable System A Dissertation submitted in partial satisfaction of the requirements for the degree of Doctor of Philosophy in Anthropology by Jennifer Catherine Miller-Thayer December 2010 Dissertation Committee: Dr. Juliet McMullin, Co-Chairperson Dr. Carlos Velez-Ibanez, Co-Chairperson Dr. Thomas C. Patterson Dr. Christine Gailey Copyright by Jennifer Catherine Miller-Thayer 2010 The Dissertation of Jennifer Catherine Miller-Thayer is approved: Committee Co-Chairperson Committee Co-Chairperson University of California, Riverside AKNOWLEDGEMENTS I am grateful to UC-MEXUS, the Ernesto Galarza Applied Research Center (EGARC), the University of California, Riverside Humanities Grant, University of California, Riverside Anthropology Department and the Eugene Cota-Robles Fellowship for providing financial support through grants, fellowships and wages. I would like to thank Juliet McMullin, Carlos Velez-Ibanez, Thomas C. Patterson, Christine Gailey, Michael Kearney, Jim Bell, Joye Sage, Andrea Kaus, Martha Ponce, Kara Oswood, Professor Shea, Augustine J. Kposowa, Kathy Sorenson, Alison Lee, Darcy Wiewall, Alison and Ira Lipsky, Deanna Brewer, Carmen, Dr. Lopez, Dr. Mendez and Dra. Arreola, Dr. Quintero, Jorge Arrendondo, Dr. Valdez-Hernandez, Dr. Ceja, Loreen, Lisa, Joe, my husband Thomas Thayer Senior and our children, all of my family, and the Transnational Medical Consumers, community members, medical personnel and care providers in Los Algodones -

Latin America Healthcare System Overview a Comparative Analysis of Fiscal Space in Healthcare

Latin America Healthcare System Overview A comparative analysis of fiscal space in healthcare Panos Kanavos, Georgia Colville Parkin, Bregtje Kamphuis, Jennifer Gill August 2019 Latin America Healthcare System Overview: A comparative analysis of fiscal space in healthcare This report is commissioned via LSE Consulting which was set up by the London School of Economics and Political Science to enable and facilitate the application of its academic expertise and intellectual resources. LSE Enterprise Ltd, trading as LSE Consulting, is a wholly owned subsidiary of the London School of Economics and Political Science. The LSE trade mark is used under licence from the London School of Economics and Political Science. LSE Consulting LSE Enterprise Ltd London School of Economics and Political Science Houghton Street London, WC2A 2AE (T) +44 (0)20 7106 1198 (E) [email protected] (W) lse.ac.uk/consultancy Latin America Healthcare System Overview: A comparative analysis of fiscal space in healthcare TABLE OF CONTENTS Executive Summary i Introduction 1 Rising healthcare costs and the concept of fiscal space 2 Enhancing the fiscal space through indirect and earmarked taxation without endangering fiscal sustainability 3 Report aims and objectives 4 Conceptual framework 7 Methods 8 Study countries 8 Secondary data collection 9 Primary data collection 10 Analysis 11 What are the key organizational and financial factors in Latin American healthcare systems? 16 Key challenges 16 Health expenditure 16 Health systems in the study countries 20 Universal -

How to Drink Tequila and Mezcal Like a Grown-Up

7/9/2018 How to drink tequila and mezcal like a grown-up, Food News & Top Stories - The Straits Times THE STRAITS TIMES Taiwanese Go-Jek's What Does actress food Your Celia delivery Health Central Zhang says offshoot h id G F d Sponsored Recommended by How to drink tequila and mezcal like a grown-up Lime, salt and a shot glass? Not with the good tequila and mezcal, please. PHOTOS: WASHINGTON POST PUBLISHED JUL 8, 2018, 12:09 PM SGT M. Carrie Allan https://www.straitstimes.com/lifestyle/food/how-to-drink-tequila-and-mezcal-like-a-grown-up 1/9 7/9/2018 How to drink tequila and mezcal like a grown-up, Food News & Top Stories - The Straits Times (WASHINGTON POST) - There’s something about tequila that activates the revelry gland, whatever part of the American brain it is that responds to a bottle of Cuervo by bawling “PAAAAARRRTY!” No one bawls “PAAAAARRRTY!” when they see a bottle of Glenlivet. Is it some dormant memory of Cancun, Mexico vacations past? Did we all come of age in a Texas honky-tonk, where swallowing the worm at the bottom of a bottle was a means to prove we had hair on our chests? Me, I don’t want hair on my chest. I want to have a good cocktail. I want to sip good spirits. And if you’re offering me a drink that requires me to first salt my palate, knock back a shot with my eyes closed, then suck on a lime to get rid of the taste.. -

Addressing the General and Reproductive Health of Women In

Addressing the General and Reproductive Health of Women in Global Supply Chains Supported by: The David and Lucile Packard Foundation October 2002 Table of Contents Introduction ................................................................................................................... 1 Project Methodology.......................................................................................................................2 Report Organization .......................................................................................................................2 Executive summary .......................................................................................................4 Major Findings.................................................................................................................................4 Reproductive Health...................................................................................................................4 Nutrition.......................................................................................................................................5 Self-Esteem ..................................................................................................................................5 General Occupational Health....................................................................................................6 Options for Effective Reproductive Health Programs..............................................................7 China..............................................................................................................................8 -

IRC Needs Assessment Report: Mexico-Northern Border

NEEDS ASSESSMENT REPORT Mexico: Northern Border March 25, 2019 Sectors: Violence Prevention and Response; Health; Economic Recovery and Development Contacts: Bobi Morris, Assessment Lead, [email protected] Edgardo Zunia, Operations Lead, [email protected] Data Collection: March 12 – 22 (10 days) Locations in Mexico: Nogales, Sonora; Juarez, Chihuahua; Nuevo Laredo, Tamaulipas INTRODUCTION AND JUSTIFICATION For the first time, Mexico was featured in the International Rescue Committee (IRC) 2019 Watchlist, signaling that IRC’s crisis analysis team believes multiple risk factors in country are combining to increase the likelihood of humanitarian crises. One of those factors is the increasing rates of mixed-migration both through Mexico (originating from Northern Triangle countries, and others) and from Mexico – towards the United States. To better understand the humanitarian needs at the border, a decision was taken to assess to determine: 1) what assistance others (including civil society and Mexican government) are providing 2) what the largest needs are, of mixed-migrants at the border 3) modalities of assistance that would maximize IRC’s value-add to meet the delta between current assistance and needs. Context Overview The border between the U.S. and Mexico spans 1,969 miles and has more than 20 checkpoints along its route.1 The border fence between the two countries covers much of the area between Tijuana/San Diego in the east, and Juarez/El Paso in the center. The border fence has driven many people east towards the more porous border in Texas.2 All along the border, but particularly in the east, organized crime controls the majority of the border areas which are plagued by crime and violence including trafficking of drugs, weapons, money, and people.3 Recent changes in U.S. -

Measuring Corruption in Mexico

MEASURING CORRUPTION IN MEXICO Jose I. Rodriguez-Sanchez, Ph.D. Postdoctoral Research Fellow in International Trade, Mexico Center December 2018 © 2018 by the James A. Baker III Institute for Public Policy of Rice University This material may be quoted or reproduced without prior permission, provided appropriate credit is given to the author and the James A. Baker III Institute for Public Policy. Wherever feasible, papers are reviewed by outside experts before they are released. However, the research and views expressed in this paper are those of the individual researcher(s) and do not necessarily represent the views of the James A. Baker III Institute for Public Policy. Jose I. Rodriguez-Sanchez, Ph.D. “Measuring Corruption in Mexico” Measuring Corruption in Mexico Introduction Corruption is a complex problem affecting all societies, and it has many different causes and consequences. Its consequences include negative impacts on economic growth and development, magnifying effects on poverty and inequality, and corrosive effects on legal systems and governance institutions. Corruption in the form of embezzlement or misappropriation of public funds, for example, diverts valuable economic resources that could be used on education, health care, infrastructure, or food security, while simultaneously eroding faith in the government. Calculating and measuring the impact of corruption and its tangible and intangible costs are essential to combating it. But before corruption can be measured, it must first be defined. Decision-makers have often resorted to defining corruption in a certain area or location by listing specific acts that they consider corrupt. Such definitions, however, are limited because they are context-specific and depend on how individual governments decide to approach the problem. -

Waiting Times for Surgical and Diagnostic Procedures in Public Hospitals in Mexico

Waiting times for elective care in Mexico ARTÍCULO ORIGINAL Waiting times for surgical and diagnostic procedures in public hospitals in Mexico David Contreras-Loya, MSc,(1) Octavio Gómez-Dantés, MD, MPH,(1) Esteban Puentes, DVM, MPH,(2) Francisco Garrido-Latorre, MD, PhD,(2) Manuel Castro-Tinoco, BA, MPH,(1) Germán Fajardo-Dolci, MD.(3) Contreras-Loya D, Gómez-Dantés O, Puentes E, Contreras-Loya D, Gómez-Dantés O, Puentes E, Garrido-Latorre F, Castro-Tinoco M, Fajardo-Dolci G. Garrido-Latorre F, Castro-Tinoco M, Fajardo-Dolci G. Waiting times for surgical and diagnostic Tiempos de espera para procedimientos quirúrgicos procedures in public hospitals in Mexico. y diagnósticos en hospitales públicos de México. Salud Publica Mex 2015:57:29-37. Salud Publica Mex 2015:57:29-37. Abstract Resumen Objective. A retrospective evaluation of waiting times for Objetivo. Se llevó a cabo una evaluación retrospectiva de elective procedures was conducted in a sample of Mexican los tiempos de espera para procedimientos electivos en una public hospitals from the following institutions: the Mexican muestra de hospitales públicos en México de las siguientes Institute for Social Security (IMSS), the Institute for Social instituciones: Instituto Mexicano del Seguro Social (IMSS), Security and Social Services for Civil Servants (ISSSTE) and Instituto de Seguridad y Servicios Sociales de los Trabajadores the Ministry of Health (MoH). Our aim was to describe cur- del Estado (ISSSTE) y Secretaría de Salud (SS). El propósito rent waiting times and identify opportunities to redistribute era describir la situación actual en materia de tiempos de service demand among public institutions. Materials and espera e identificar oportunidades de redistribución de la methods. -

Mexico Country Guide

MEXICO An everyday guide to expatriate life and work. MEXICO COUNTRY GUIDE Contents Overview 2 Employment Quick Facts 1 The job market 7 Income tax 7 Getting Started Retirement 7 Climate and weather 3 Business etiquette 7 Visas 3 Accommodation 3 Finance Schools 3 Currency 7 Culture Banking 8 Language 3 Cost of living 7 Social etiquette 5 Health Eating 5 Private medical insurance 8 Drinking 6 Emergencies 8 Holidays 6 Pharmacies 8 Health Risks 8 Getting In Touch Telephone 6 Internet 6 Postal services 6 Quick facts1 Capital: Mexico City Population: 128 million Major language: Spanish Major religion: Christianity (Roman Catholic) Currency: Mexican Peso (MXN) Time zone: Four time zones in Mexico: GMT -6, -7 and -8 with daylight savings; and the state of Sonora is GMT -7 year-round. Emergency number: 066 (police and general emergencies), 065 (ambulance) and 068 (fire) Electricity: 130 volts, 60Hz. Standard plugs in Mexico are two-pin, flat-blade attachments. Drive on the: Right 1 http://www.expatarrivals.com/mexico/essential-info-for-mexico Overview With sunny skies, beautiful beaches and a relaxed and affordable lifestyle, Mexico is an attractive prospect for expats, and has become especially popular with international retirees. Mexico is a country of contrasts, where indigenous traditions have blended with European values and busy, modern cities are surrounded by quaint rural communities. Although a conservative society, the laidback attitude to life and welcoming, friendly people have added a distinct flavor to this fascinating North American gem, where expats are sure to have a culturally rich experience. Despite the negative reputation often portrayed in the media when it comes to crime and violence, much of this is concentrated in pockets of the country and expats are unlikely to be directly affected. -

The Effects of Acculturation on Healthcare in the Mexican-Origin Community

University of Texas at El Paso DigitalCommons@UTEP Open Access Theses & Dissertations 2010-01-01 The ffecE ts Of Acculturation On Healthcare In The Mexican-Origin Community: El Paso County, Texas Aurelio Saldana University of Texas at El Paso, [email protected] Follow this and additional works at: https://digitalcommons.utep.edu/open_etd Part of the Latin American Languages and Societies Commons, Latin American Studies Commons, and the Sociology Commons Recommended Citation Saldana, Aurelio, "The Effects Of Acculturation On Healthcare In The exM ican-Origin Community: El Paso County, Texas" (2010). Open Access Theses & Dissertations. 2581. https://digitalcommons.utep.edu/open_etd/2581 This is brought to you for free and open access by DigitalCommons@UTEP. It has been accepted for inclusion in Open Access Theses & Dissertations by an authorized administrator of DigitalCommons@UTEP. For more information, please contact [email protected]. THE EFFECTS OF ACCULTURATION ON HEALTHCARE IN THE MEXICAN- ORIGIN COMMUNITY: EL PASO COUNTY, TEXAS AURELIO SALDAÑA, JR. Department of Sociology and Anthropology APPROVED: Josiah McC. Heyman, Ph.D., Chair Howard Campbell, Ph.D. Hector Balcazar, Ph.D. Patricia D. Witherspoon, Ph.D. Dean of the Graduate School Copyright © by Aurelio Saldaña, Jr. 2010 Dedication Para mi familia, mis padres Aurelio y Yolanda Saldaña, mis hermanos Jorge, Cristina, Claudia, y Abel; y mis sobrinos Isaiah, Jorgito y Abelito. Sin ustedes este humilde soñador no es nadie… THE EFFECTS OF ACCULTURATION ON HEALTHCARE IN THE MEXICAN- ORIGIN COMMUNITY: EL PASO COUNTY, TEXAS by AURELIO SALDAÑA JR., B.A. THESIS Presented to the Faculty of the Graduate School of The University of Texas at El Paso in Partial Fulfillment of the Requirements for the Degree of MASTER OF ARTS Department of Sociology and Anthropology THE UNIVERSITY OF TEXAS AT EL PASO December 2010 TABLE OF CONTENTS TABLE OF CONTENTS ............................................................................................................... -

(Re)Constructing Professional Journalistic Practice in Mexico

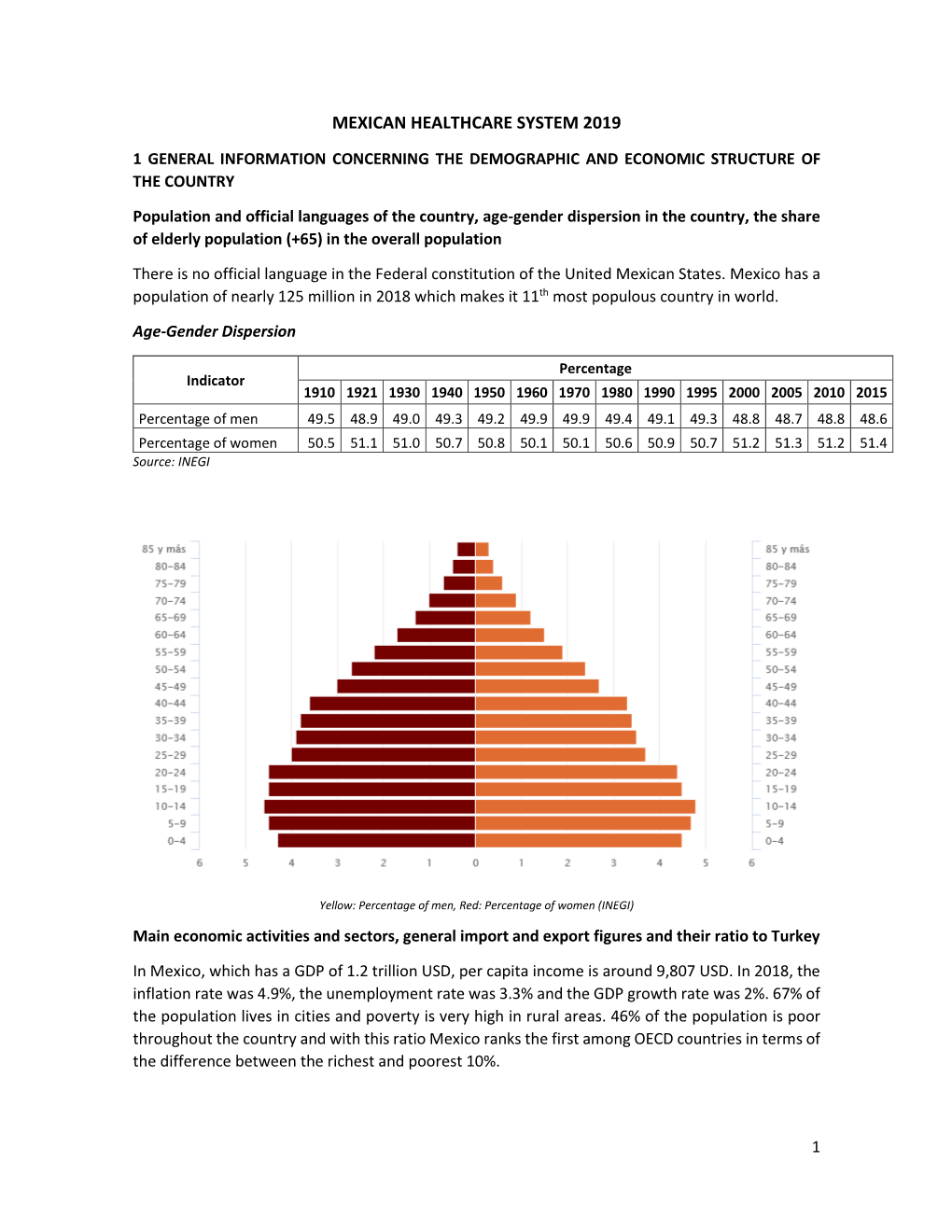

International Journal of Communication 13(2019), 2596–2619 1932–8036/20190005 (Re)constructing Professional Journalistic Practice in Mexico: Verificado’s Marketing of Legitimacy, Collaboration, and Pop Culture in Fact-Checking the 2018 Elections NADIA I. MARTÍNEZ-CARRILLO Roanoke College, USA DANIEL J. TAMUL Virginia Tech, USA Although fact-checking websites for political news such as FactCheck.org, Politifact, and ProPublica are common in the United States, they are new in Mexico. Using textual analysis, this study examines the strategies used by Verificado 2018, a crowdsourced political fact-checking initiative generated during the largest election in Mexican history by news organizations, universities, and tech companies. Verificado 2018 emphasized legitimacy, collaboration, and critical humor to promote and engage users in fact- checking and viralizing reliable information. Keywords: Verificado, misinformation, Mexico, elections, fact-checking Presenting accurate depictions of news has always been central to journalism (see Schudson, 2011). However, modern journalists are trained to present competing statements as “equally viable truth claims” (Durham, 1998, p. 124). This practice can create a “flight from the truth” in service of objectivity and balance (Muñoz-Torres, 2012; Rosen, 1993, p. 4949). Although both strategies serve to legitimize news outlets by making them appear impartial (McChesney, 2004), fact-checking organizations operate within a separate institutional logic, necessitating journalists to judge the veracity of public statements (see Lowrey, 2017, for a review). Lowrey (2017) contends this violates traditional journalistic norms, eroding the legitimacy of fact-checking. With this context in mind, we examine the case of Verificado 2018—a temporary, collaborative, and decentralized fact-checking newsroom—and its communication strategy in the run-up to the 2018 Mexican campaign season.