Supplement of 2

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

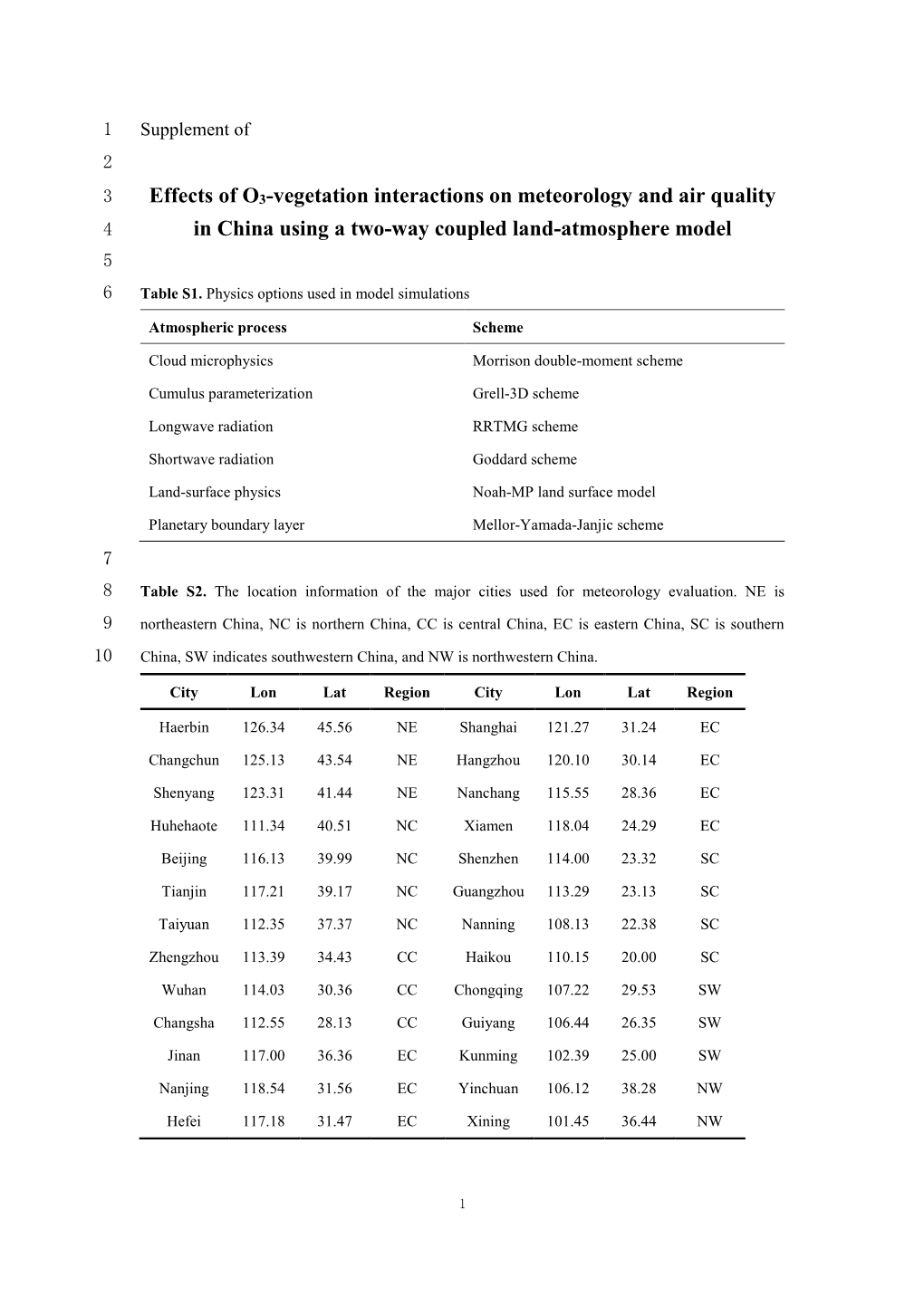

Changchun–Harbin Expressway Project

Performance Evaluation Report Project Number: PPE : PRC 30389 Loan Numbers: 1641/1642 December 2006 People’s Republic of China: Changchun–Harbin Expressway Project Operations Evaluation Department CURRENCY EQUIVALENTS Currency Unit – yuan (CNY) At Appraisal At Project Completion At Operations Evaluation (July 1998) (August 2004) (December 2006) CNY1.00 = $0.1208 $0.1232 $0.1277 $1.00 = CNY8.28 CNY8.12 CNY7.83 ABBREVIATIONS AADT – annual average daily traffic ADB – Asian Development Bank CDB – China Development Bank DMF – design and monitoring framework EIA – environmental impact assessment EIRR – economic internal rate of return FIRR – financial internal rate of return GDP – gross domestic product ha – hectare HHEC – Heilongjiang Hashuang Expressway Corporation HPCD – Heilongjiang Provincial Communications Department ICB – international competitive bidding JPCD – Jilin Provincial Communications Department JPEC – Jilin Provincial Expressway Corporation MOC – Ministry of Communications NTHS – national trunk highway system O&M – operations and maintenance OEM – Operations Evaluation Mission PCD – provincial communication department PCR – project completion report PPTA – project preparatory technical assistance PRC – People’s Republic of China RRP – report and recommendation of the President TA – technical assistance VOC – vehicle operating cost NOTE In this report, “$” refers to US dollars. Keywords asian development bank, development effectiveness, expressways, people’s republic of china, performance evaluation, heilongjiang province, jilin province, transport Director Ramesh Adhikari, Operations Evaluation Division 2, OED Team leader Marco Gatti, Senior Evaluation Specialist, OED Team members Vivien Buhat-Ramos, Evaluation Officer, OED Anna Silverio, Operations Evaluation Assistant, OED Irene Garganta, Operations Evaluation Assistant, OED Operations Evaluation Department, PE-696 CONTENTS Page BASIC DATA v EXECUTIVE SUMMARY vii MAPS xi I. INTRODUCTION 1 A. -

The First Real-Estate Development by Japanese Developers in Changchun, Jilin Province, China Marubeni Coporation and Mitsubishi Jisho Residence Co., Ltd

July 18, 2013 Marubeni Corporation Mitsubishi Jisho Residence Co., Ltd. The First Real-Estate Development by Japanese Developers in Changchun, Jilin Province, China Marubeni Coporation and Mitsubishi Jisho Residence Co., Ltd. set off the Joint Development –“Changchun Jingyue Project (Tentative)” <Perspective of the project> Marubeni Corporation (“Marubeni”) and Mitsubishi Jisho Residence Co., Ltd. (“Mitsubishi Jisho Residence”), as the first Japanese developers, plan to implement a real-estate development project with Jilin Weifeng Industry Co., Ltd. (“Weifeng”), a local Chinese developer, in Changchun, China. This project, as our first project in Changchun, with an area of 130,000 square meters, is located in Changchun Jingyue National High-tech Industrial Development Zone (“Jingyue DZ”), concentrating on Town House and Residential. The Project Company, Changchun Top Chance Property Development Co., Ltd. (“Changchun Top Chance”) owned by Marubeni (40%), Weifeng (35%) and Mitsubishi Jisho Residence (25%), has started the construction for the release this coming fall. Changchun is the capital of Jilin Province, also a core city in the northeastern part of China, with a population of 7,620,000. It is administered as one of 15 sub-provincial cities which are independent and equivalent to provinces. Having a solid industrial basis including automobile manufacturing as typified by FAW (First Automotive Works) Group, along with manufacturing transportation facilities and processing agricultural products, Changchun is continuing double digit economic growth, which is higher than the national average. Jingyue DZ is a national-level development zone approved by the State Council in August, 2012, with an area of 479 square kilometers, of which about half of the area, 243 square kilometers, consists of forest and a lake. -

Appendix 1: Rank of China's 338 Prefecture-Level Cities

Appendix 1: Rank of China’s 338 Prefecture-Level Cities © The Author(s) 2018 149 Y. Zheng, K. Deng, State Failure and Distorted Urbanisation in Post-Mao’s China, 1993–2012, Palgrave Studies in Economic History, https://doi.org/10.1007/978-3-319-92168-6 150 First-tier cities (4) Beijing Shanghai Guangzhou Shenzhen First-tier cities-to-be (15) Chengdu Hangzhou Wuhan Nanjing Chongqing Tianjin Suzhou苏州 Appendix Rank 1: of China’s 338 Prefecture-Level Cities Xi’an Changsha Shenyang Qingdao Zhengzhou Dalian Dongguan Ningbo Second-tier cities (30) Xiamen Fuzhou福州 Wuxi Hefei Kunming Harbin Jinan Foshan Changchun Wenzhou Shijiazhuang Nanning Changzhou Quanzhou Nanchang Guiyang Taiyuan Jinhua Zhuhai Huizhou Xuzhou Yantai Jiaxing Nantong Urumqi Shaoxing Zhongshan Taizhou Lanzhou Haikou Third-tier cities (70) Weifang Baoding Zhenjiang Yangzhou Guilin Tangshan Sanya Huhehot Langfang Luoyang Weihai Yangcheng Linyi Jiangmen Taizhou Zhangzhou Handan Jining Wuhu Zibo Yinchuan Liuzhou Mianyang Zhanjiang Anshan Huzhou Shantou Nanping Ganzhou Daqing Yichang Baotou Xianyang Qinhuangdao Lianyungang Zhuzhou Putian Jilin Huai’an Zhaoqing Ningde Hengyang Dandong Lijiang Jieyang Sanming Zhoushan Xiaogan Qiqihar Jiujiang Longyan Cangzhou Fushun Xiangyang Shangrao Yingkou Bengbu Lishui Yueyang Qingyuan Jingzhou Taian Quzhou Panjin Dongying Nanyang Ma’anshan Nanchong Xining Yanbian prefecture Fourth-tier cities (90) Leshan Xiangtan Zunyi Suqian Xinxiang Xinyang Chuzhou Jinzhou Chaozhou Huanggang Kaifeng Deyang Dezhou Meizhou Ordos Xingtai Maoming Jingdezhen Shaoguan -

'Premiumization' Strategy: Longitudinal Findings from the ITC China Surveys

Tob Control: first published as 10.1136/tobaccocontrol-2017-054193 on 29 August 2018. Downloaded from Research paper Impact of China National Tobacco Company’s ‘Premiumization’ Strategy: longitudinal findings from the ITC China Surveys (2006–2015) Steve Shaowei Xu,1 Shannon Gravely,1 Gang Meng,1 Tara Elton-Marshall,2,3,4,5,6 Richard J O’Connor,7 Anne C K Quah,1 Guoze Feng,8 Yuan Jiang,8 Grace J Hu,1 Geoffrey T Fong1,5,9 ► Additional material is ABStract 300 million people in China smoke (including about published online only. To view Background In 2009, the China National Tobacco half of all men), which represents one–third of please visit the journal online Company (CNTC) began their Premiumization Strategy, the world’s smokers, and approximately 1 million (http:// dx. doi. org/ 10. 1136/ 2 tobaccocontrol- 2017- 054193). designed to encourage smokers to trade up to more tobacco-attributable deaths occur every year. expensive brands, mainly by promoting the concept that China’s cigarette market is vast, with a total of 1Department of Psychology, higher class cigarettes are better quality and less harmful. 2.4 trillion cigarettes consumed each year. Chinese University of Waterloo, Waterloo, This study is the first evaluation of the strategy’s impact smokers consume more cigarettes than smokers in Ontario, Canada 3 2Institute for Mental Health on: (1) prevalence of premium brand cigarettes (PBC), all other low/middle-income countries combined. Policy Research, Centre for mid-priced brand cigarettes (MBC) and discount brand Without effective measures to reduce tobacco use, Addiction and Mental Health, cigarettes (DBC) over 9 years, from 3 years pre-strategy the number of annual tobacco-related deaths in London, Ontario, Canada 4 3 (2006) to 6 years post-strategy (2015); and (2) changes China is projected to reach 3 million by 2050. -

Sales of Yakult to Commence in Xining, Qinghai Province, China

Sales of Yakult to Commence in Xining, Qinghai Province, China Yakult Honsha Co., Ltd. (President: Takashige Negishi) today announced that Yakult (China) Corporation would start sales of the Yakult and Yakult Light fermented milk drinks in Xining, Qinghai Province, China, from April 1, 2021. The neighboring Lanzhou Branch, in Gansu Province, will supply the products for sale in Xining. Xining is the capital city of Qinghai Province, located in northwestern China and has a population of around 2 million people. Recent years have seen both local hypermarkets and major national retail chains opening stores in the city and it is regarded as a promising market. The sales plan in Xining as well as the profiles of Yakult (China) Corporation and the Lanzhou Branch are as follows: 1. Sales plan in Xining, Qinghai Province (1) Start of sales: April 1, 2021 (2) Sales channel: Supermarkets and other retail stores (3) Sales plan: 5,000 bottles per day in fiscal year 2021 (from April to December 2021) 7,000 bottles per day in fiscal year 2022 (from January to December 2022) 2. Profile of Yakult (China) Corporation (1) Name: Yakult (China) Corporation (2) Location: Shanghai, People’s Republic of China (3) Representative: Susumu Hirano (4) Established: April 12, 2005 (5) Capitalization: US$219.72 million (wholly owned by Yakult Honsha Co., Ltd.) (6) Employees: 3,040 (as of the end of December 2020) 3. Profile of Lanzhou Branch of Yakult (China) Corporation (1) Location: Lanzhou, Gansu Province (2) Branch manager: Gao Hai Tao (3) Established: March 5, -

Broadening of SLR Network in Chinese Mainland

13-Po07 Broadening of SLR Network in Chinese Mainland Li-ping JI Satellite Observatory, Chinese Academy of Surveying & Mapping (E-mail: [email protected]) A b s t r a c t Chinese mainland should broaden its SLR network ,to determine and check up the orbits of its Compass/Beidou satellites. At least 3 new stations should be located in west China's Urumqi, Xining and Lhasa. Three broadening plans of SLR network can be thought about ,and more mobile systems may be designed .Three methods can be used in overcoming its main difficulty. Satellite laser ranging, as a space technology to achieve the highest absolute accuracy of the distance measurement , has developed nearly half a century . In mainland China , geodesy, geodynamics , seismology and astronomy research departments , satellite laser ranging technology sustained attention to nearly four decades .In the distribution of China, satellite laser ranging stations , relative to its vast recovery , it is too sparse .This situation not only restricted the use of satellite laser ranging technology and development in these sectors , but also stagnated others’ technology sector pace. In Yousaf Butt’s literature(2007), China has five fixed stations and two mobile stations . Unfortunately , their operation is not entirely. In mainland China, the development of satellite laser ranging technology, on the last number , there are ups and downs and volatility , its rate of expansion and global positioning technology can not be in the same breath . Relative lack of talent, relatively backward technology, and economic constraints of the amount invested , are not conducive to widespread use of this technology. -

Argus China Petroleum News and Analysis on Oil Markets, Policy and Infrastructure

Argus China Petroleum News and analysis on oil markets, policy and infrastructure Volume XII, 1 | January 2018 Yuan for the road EDITORIAL: Regional gasoline The desire to avoid tax has been a far more significant factor underlying imports markets are so far unmoved by a of mixed aromatics than China’s octane deficit. potential fall in Chinese exports The government has announced plans to make it impossible to buy or sell owing to stricter tax enforcement gasoline without producing a complete invoice chain showing that consumption tax has been paid, from 1 March. And gasoline refining margins shot to nearly $20/bl, their highest since mid-2015. Of course, Beijing has tried to stamp out tax evasion in the gasoline market many times before. But, if successful, this poses Mixed aromatics imports 2017 an existential threat — to trading companies and the blending firms that use ’000 b/d Mideast mixed aromatics to produce gasoline outside the refining system, largely avoiding US Gulf 4.39 the Yn2,722/t ($51/bl) tax collected on gasoline produced by refineries. Around 22.59 300,000 b/d of gasoline is produced this way. And that has caused the surplus that forces state-owned firms to market their costlier fuel overseas. Europe But there is little panic outside south China, where most blending takes place. 77.69 The Singapore market is discounting any threat that a crackdown on tax avoidance might choke off Chinese exports — gasoline crack spreads fell this month. China’s prices are now above those in Singapore, yet its gasoline exports show no sign of letting up. -

Global Automotive Suppliers in China Aisin Seiki Co

Global automotive suppliers in China Aisin Seiki Co. Tianjin Office, 1st Floor, Aster Plaza, No. 32 Taierzhuang Road, Heping District, Tianjin 300040, P.R. China (86) 22-2303-3582, www.aisin.com Top executive: Fumio Ochiai, general manager Plant Name City, State/Province Products Zhejiang Aisin Hongda Automobile Parts Co. Taizhou, Zhejiang Fan couplings, oil pumps, water pumps, cylinder heads cover, timing chain covers, oil pans Tangshan Aisin Gear Co. Tangshan, Hebei Manual transmissions Tianjin Aisin Automobile Parts Co. Tianjin Tandem master cylinders, brake assist boosters, clutch covers, clutch discs Aisin Tianjin Body Parts Co. Tianjin Door latches, window regulators, door hinges, hood latches, hood hinges, inside handle, outside handles Aisin Seiki Foshan Automotive Parts Co. Shunde, Guangdong Crankcases, timing chain covers Fengai Automotive Seat Parts Co. Guangzhou, Guangdong Seat backs, seat cushions, seat tracks, seat frames Aisin Seiki Foshan Body Parts Co. Xiaotang, Guangdong Sunroofs, motor housing for power seats Tangshan Aisin Automotive Parts Co. Tangshan, Hebei Timing chain cases, crankcases, automatic transmission cases Tianjin Feng Ai Automotive Seat Parts., Tianjin Seat frames, seat adjusters, rails Takaoka Lioho Industries Co. Tianjin Machinings Tianjin AW Automotic Transmission Co. Tianjin Automatic transmissions Advics Tianjin Automobile Parts Co. Tianjin Brake components and systems Advics Guangzhou Automobile Parts Co. Guangzhou, Guangdong Brake components and systems Hosie (Fuzhou) Brake Industry Co. Fuzhou, Fujian Brake components and systems Autoliv No. 820 Gao Tai Road, Shanghai 201821, P.R. China (86) 21-6916-9699, www.autoliv.com Top executive: George Chang, president China Operations Plant Name City, State/Province Products Autoliv (Shanghai) Vehicle Safety Systems Co. -

Gwadar: China's Potential Strategic Strongpoint in Pakistan

U.S. Naval War College U.S. Naval War College Digital Commons CMSI China Maritime Reports China Maritime Studies Institute 8-2020 China Maritime Report No. 7: Gwadar: China's Potential Strategic Strongpoint in Pakistan Isaac B. Kardon Conor M. Kennedy Peter A. Dutton Follow this and additional works at: https://digital-commons.usnwc.edu/cmsi-maritime-reports Recommended Citation Kardon, Isaac B.; Kennedy, Conor M.; and Dutton, Peter A., "China Maritime Report No. 7: Gwadar: China's Potential Strategic Strongpoint in Pakistan" (2020). CMSI China Maritime Reports. 7. https://digital-commons.usnwc.edu/cmsi-maritime-reports/7 This Book is brought to you for free and open access by the China Maritime Studies Institute at U.S. Naval War College Digital Commons. It has been accepted for inclusion in CMSI China Maritime Reports by an authorized administrator of U.S. Naval War College Digital Commons. For more information, please contact [email protected]. August 2020 iftChina Maritime 00 Studies ffij$i)f Institute �ffl China Maritime Report No. 7 Gwadar China's Potential Strategic Strongpoint in Pakistan Isaac B. Kardon, Conor M. Kennedy, and Peter A. Dutton Series Overview This China Maritime Report on Gwadar is the second in a series of case studies on China’s Indian Ocean “strategic strongpoints” (战略支点). People’s Republic of China (PRC) officials, military officers, and civilian analysts use the strategic strongpoint concept to describe certain strategically valuable foreign ports with terminals and commercial zones owned and operated by Chinese firms.1 Each case study analyzes a different port on the Indian Ocean, selected to capture geographic, commercial, and strategic variation.2 Each employs the same analytic method, drawing on Chinese official sources, scholarship, and industry reporting to present a descriptive account of the port, its transport infrastructure, the markets and resources it accesses, and its naval and military utility. -

Noticing Cigarette Health Warnings and Support for New Health Warnings

Li et al. BMC Public Health (2017) 17:476 DOI 10.1186/s12889-017-4397-2 RESEARCH ARTICLE Open Access Noticing cigarette health warnings and support for new health warnings among non-smokers in China: findings from the International Tobacco Control project (ITC) China survey Zejun Li1, Tara Elton Marshall2,3,4, Geoffrey T. Fong5,6,7, Anne Chiew Kin Quah5, Guoze Feng8, Yuan Jiang8 and Sara C. Hitchman9,10,11* Abstract Background: Health warnings labels (HWLs) have the potential to effectively communicate the health risks of smoking to smokers and non-smokers, and encourage smokers to quit. This study sought to examine whether non-smokers in China notice the current text-only HWLs and whether they support adding more health information and including pictures on HWLs. Methods: Adult non-smokers (n = 1324) were drawn from Wave 4 (September 2011–November 2012) of the International Tobacco Control (ITC) China Survey. The proportion of non-smokers who noticed the HWLs, and supported adding more health information and pictures to the HWLs was examined. Additionally, the relation between non-smokers’ demographic characteristics, including whether they had a smoking partner, their number of smoking friends, and noticing the HWLs and support for adding health information and pictures was examined. Because the HWLs changed during the survey period (April 2012), differences between non-smokers who completed the survey before and after the change were examined. Results: 12.2% reported they noticed the HWLs often in the last month. The multivariate model, adjusting for demographics showed that respondents with a smoking partner (OR = 2.41, 95% CI 1.42–4.13, p = 0.001) noticed the HWLs more often. -

Best-Performing Cities: China 2018

Best-Performing Cities CHINA 2018 THE NATION’S MOST SUCCESSFUL ECONOMIES Michael C.Y. Lin and Perry Wong MILKEN INSTITUTE | BEST-PERFORMING CITIES CHINA 2018 | 1 Acknowledgments The authors are grateful to Laura Deal Lacey, executive director of the Milken Institute Asia Center, Belinda Chng, the center’s director for policy and programs, and Ann-Marie Eu, the Institute’s senior associate for communications, for their support in developing this edition of our Best- Performing Cities series focused on China. We thank the communications team for their support in publication as well as Kevin Klowden, the executive director of the Institute’s Center for Regional Economics, Minoli Ratnatunga, director of regional economic research at the Institute, and our colleagues Jessica Jackson and Joe Lee for their constructive comments on our research. About the Milken Institute We are a nonprofit, nonpartisan think tank determined to increase global prosperity by advancing collaborative solutions that widen access to capital, create jobs, and improve health. We do this through independent, data-driven research, action-oriented meetings, and meaningful policy initiatives. About the Asia Center The Milken Institute Asia Center promotes the growth of inclusive and sustainable financial markets in Asia by addressing the region’s defining forces, developing collaborative solutions, and identifying strategic opportunities for the deployment of public, private, and philanthropic capital. Our research analyzes the demographic trends, trade relationships, and capital flows that will define the region’s future. About the Center for Regional Economics The Center for Regional Economics promotes prosperity and sustainable growth by increasing understanding of the dynamics that drive job creation and promote industry expansion. -

The Mineral Industry of China in 1997

THE MINERAL INDUSTRY OF CHINA By Pui-Kwan Tse The economic crisis in Asia seemed like a storm passing over the however, not imminent yet. Unlike banks in the Republic of Korea entire region, but China’s economy appeared relatively unaffected and Thailand, Chinese banks have a much smaller exposure to because the exchange rate was firm and there was no sign of foreign debt. Therefore, banks in China will not be as easily hit by instability. The main reason for the firm exchange rate was that the an external payment imbalance. Chinese banks funded their assets renminbi was not yet convertible under capital accounts. Therefore, mainly through large domestic savings, which average more than it was difficult, if not impossible, for funds to flow in and out of the 40% of the country’s GDP (Financial Times, 1997b; Financial country’s stock markets. Compared with other countries in Asia and Times, 1998a). In June 1997, the Government forbade banks to the Pacific region, China’s economy performed well with inflation finance the purchase stock in the stock markets by state enterprises. continuing to drop and foreign exchange reserves increasing sharply. The Government planned to overhaul its PBC, to increase its Preliminary statistics indicated that the gross domestic product regulatory powers and to allow it to shut down hundreds of poorly (GDP) grew by 8.8% and the retail price index rose by 2.8% in capitalized non-bank financial institutions that are threatening the 1997, compared with those of 1996 (China Daily, 1998c; China banking system (Asian Wall Street Journal, 1998a).