ESSEL PROPACK A

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Essel Ar 09-10(Final)-Single Pgs.Qxp

4SMWIHXSHIPMZIV %RRYEP6ITSVX 1IWWEKIJVSQXLI'LEMVQER 1IWWEKIJVSQ:MGI'LEMVQER 1EREKMRK(MVIGXSV &SEVHSJ(MVIGXSVW (MVIGXSVW 6ITSVX 1EREKIQIRX(MWGYWWMSR %REP]WMW 'SVTSVEXI+SZIVRERGI6ITSVX *MRERGMEP7XEXIQIRXW7XERHEPSRI *MRERGMEP7XEXIQIRXW'SRWSPMHEXIH Poised to Deliver The last few years have presented challenges and We are working to improve our cost opportunities. competitiveness and shrink the debt on our Balance Sheet. Challenges that shook the world and took profits away from global businesses like ours. Opportunities that We are now prepared to embark upon a steady growth allowed us to dominate our space, increase efficiency, to trajectory, our focus on the quality of growth that challenge and change, to consolidate and grow. enhances margins and return on capital. At Essel Propack, we moulded the challenges into We are a new Essel Propack. opportunities. With renewed vigour. With renewed focus. With fresh In 2009-2010, we turned around swiftly and surely. We energy. With fresh aggression. reported a Net Profit of Rs. 599 million for the fifteen And a new world to cater to. A world where Asia will months period ending 31st March, 2010 against a loss of grow. And USA and Europe will stabilise. Rs. 883 million in the year 2008. A world where players who are cost conscious and close We divested our medical devices business in 2009 to to the customer will enhance their market share and focus on growing our core tubing business better their margins. globally. We look at the future with a lot of promise and We are building strong customer relationships confidence. based on our reliable and superior delivery model. We feel that the next few years belong to companies like We are aggressively driving growth in Asia to us that have a solid reputation with the customers, significantly add volumes and build scale. -

Flexshares 2018 Semiannual Report

FlexShares® Trust Semiannual Report April 30, 2018 FlexShares® Morningstar US Market Factor Tilt Index Fund FlexShares® Morningstar Developed Markets ex-US Factor Tilt Index Fund FlexShares® Morningstar Emerging Markets Factor Tilt Index Fund FlexShares® Currency Hedged Morningstar DM ex-US Factor Tilt Index Fund FlexShares® Currency Hedged Morningstar EM Factor Tilt Index Fund FlexShares® US Quality Large Cap Index Fund FlexShares® STOXX® US ESG Impact Index Fund FlexShares® STOXX® Global ESG Impact Index Fund FlexShares® Morningstar Global Upstream Natural Resources Index Fund FlexShares® STOXX® Global Broad Infrastructure Index Fund FlexShares® Global Quality Real Estate Index Fund FlexShares® Real Assets Allocation Index Fund FlexShares® Quality Dividend Index Fund FlexShares® Quality Dividend Defensive Index Fund FlexShares® Quality Dividend Dynamic Index Fund FlexShares® International Quality Dividend Index Fund FlexShares® International Quality Dividend Defensive Index Fund FlexShares® International Quality Dividend Dynamic Index Fund FlexShares® iBoxx 3-Year Target Duration TIPS Index Fund FlexShares® iBoxx 5-Year Target Duration TIPS Index Fund FlexShares® Disciplined Duration MBS Index Fund FlexShares® Credit-Scored US Corporate Bond Index Fund FlexShares® Credit-Scored US Long Corporate Bond Index Fund FlexShares® Ready Access Variable Income Fund FlexShares® Core Select Bond Fund Table of Contents Statements of Assets and Liabilities ................................................ 2 Statements of Operations................................................................ -

CORPORATE ZEE 30 06 06.Qxp 03/806 11:26 AM Page 36

CORPORATE ZEE 30 06 06.qxp 03/806 11:26 AM Page 36 Corporate The zest in Zee Through a series of changes, Zee Telefilms has moved rapidly ahead. Ryan Rodrigues reports few years ago the average Telefilms, softer changes were introduced. benefit from the increased management viewer in India had written off The traditional rectangular Zee logo was focus on respective businesses," it says. Zee Telefilms as a potential given a contemporary look, with bends and Next was a Merrill Lynch report. "Zee TV A No 1. A media and entertain- curves to target a younger audience. has finally overtaken Star Plus in the 9-10 ment company, it had been a market leader Headquarters shifted from the suburbs to a pm band in the first week of June with its in the Indian television space for long. But swanky building in the centre of the city. shows beating Star Plus after six years," it stiff competition had started to take its toll. Today behind the glass walls of this says. "Developments reinforce our view At its offices in Mumbai, senior managers two-storey structure, executives buzz that improving content and platforms will would walk in - and then they walked out. around with purpose in their feet. be key triggers to sustain Zee's premium One successful show on rival Star TV, fol- The verdict first came from TAM valuations." lowed by a serial onslaught, had whittled Ratings in June. The industry's audience Stock analysts' now stick their necks down homegrown Zee from prime position measurement system lists 10 Zee shows in out for Zee; the company has become a to No 3. -

USCIS - H-1B Approved Petitioners Fis…

5/4/2010 USCIS - H-1B Approved Petitioners Fis… H-1B Approved Petitioners Fiscal Year 2009 The file below is a list of petitioners who received an approval in fiscal year 2009 (October 1, 2008 through September 30, 2009) of Form I-129, Petition for a Nonimmigrant Worker, requesting initial H- 1B status for the beneficiary, regardless of when the petition was filed with USCIS. Please note that approximately 3,000 initial H- 1B petitions are not accounted for on this list due to missing petitioner tax ID numbers. Related Files H-1B Approved Petitioners FY 2009 (1KB CSV) Last updated:01/22/2010 AILA InfoNet Doc. No. 10042060. (Posted 04/20/10) uscis.gov/…/menuitem.5af9bb95919f3… 1/1 5/4/2010 http://www.uscis.gov/USCIS/Resource… NUMBER OF H-1B PETITIONS APPROVED BY USCIS IN FY 2009 FOR INITIAL BENEFICIARIES, EMPLOYER,INITIAL BENEFICIARIES WIPRO LIMITED,"1,964" MICROSOFT CORP,"1,318" INTEL CORP,723 IBM INDIA PRIVATE LIMITED,695 PATNI AMERICAS INC,609 LARSEN & TOUBRO INFOTECH LIMITED,602 ERNST & YOUNG LLP,481 INFOSYS TECHNOLOGIES LIMITED,440 UST GLOBAL INC,344 DELOITTE CONSULTING LLP,328 QUALCOMM INCORPORATED,320 CISCO SYSTEMS INC,308 ACCENTURE TECHNOLOGY SOLUTIONS,287 KPMG LLP,287 ORACLE USA INC,272 POLARIS SOFTWARE LAB INDIA LTD,254 RITE AID CORPORATION,240 GOLDMAN SACHS & CO,236 DELOITTE & TOUCHE LLP,235 COGNIZANT TECH SOLUTIONS US CORP,233 MPHASIS CORPORATION,229 SATYAM COMPUTER SERVICES LIMITED,219 BLOOMBERG,217 MOTOROLA INC,213 GOOGLE INC,211 BALTIMORE CITY PUBLIC SCH SYSTEM,187 UNIVERSITY OF MARYLAND,185 UNIV OF MICHIGAN,183 YAHOO INC,183 -

Investment Portfolio 2016

INVESTMENT PORTFOLIOS June 30, 2016 Teachers’ Retirement System of the City of New York Contents Introduction . .1 Statement of Total Investments for the Pension Fund . .3 Statement of Total Investments for the Diversified Equity Fund . .7 Statement of Total Investments for the Bond Fund . .103 Statement of Total Investments for the International Equity Fund . .111 Statement of Total Investments for the Inflation Protection Fund . .137 Statement of Total Investments for the Socially Responsive Equity Fund . .141 Summar y of Investment Managers . .145 Introduction The Teachers’ Retirement System of the City of New York (TRS) is pleased to present you with our Investment Portfolios publication for the fiscal year ended June 30, 2016. This publication lists the name and value of each investment that TRS held in its six investment programs at the closing of the fiscal year. Cash, receivables, and collateral from securities-lending transactions are assets of TRS but not of the investment programs; therefore, they are not included in this report. TRS’ investments are described briefly below: The Pension Fund consists of U.S. and international equities and fixed-income instruments, with smaller allocations made to private equity and real estate investments. It contains the City’s contributions toward TRS members’ retirement allowances (pension reserves) and members’ contributions to the Qualified Pension Plan (QPP). It also includes the assets of the Fixed Return Fund, an investment option for members that provides a fixed rate of return, determined by the New York State Legislature in accordance with applicable laws. The Diversified Equity Fund invests primarily in the stocks of U.S. -

Essel Propack (ESSPAC) |185 Target : | 198 Target Period : 12 Months Lower Realisation Hits Revenue Growth… Potential Upside : 7%

Result Update May 2, 2016 Rating matrix Rating : Hold Essel Propack (ESSPAC) |185 Target : | 198 Target Period : 12 months Lower realisation hits revenue growth… Potential Upside : 7% • Essel Propack’s sales growth remained under pressure in Q4FY16, as What’s Changed? Amesa revenues continued to decline due to divestment of its Target Changed from | 165 to | 198 flexible business. EAP and America regions revenue were largely hit EPS FY17E Changed from | 13.9 to | 13.6 by lower realisation and currency devaluation. However, capacity EPS FY18E Changed from | 15.1 to | 15.8 addition coupled with good traction of non oral care products have Rating Changed from Buy to Hold helped the Europe region to grow ~8% YoY • Benefit of lower raw material prices was partially offset by higher Quarterly Performance other expenses and employee expenses. As result, the EBITDA Q4FY16 Q4FY15 YoY (%) Q3FY16 QoQ (%) margin improved only 100 bps YoY. However, for FY16, margins Revenue 561.4 611.7 -8.2 513.4 9.3 recorded sharp growth of 230 bps YoY due to higher gross margin EBITDA 103.1 106.2 -2.9 102.8 0.3 and hiving off of the lower margin business. Additionally, improved EBITDA (%) 18.4 17.4 101bps 20.0 -165bps utilisation in the European region further added to EBITDA margins PAT 41.5 45.4 -8.7 42.9 -3.5 • Despite a margin improvement and reduction in interest outgo by 21% YoY (due to debt reduction), PAT recorded a decline of ~9% Key Financials YoY mainly due to exceptional loss of | 11 crore | Crore FY15 FY16E FY17E FY18E Net Sales 2,323 2,185 2,430 2,727 Revival in European region - key trigger for future growth EBITDA 396.2 423.9 459.3 515.4 The European region contributes ~18% to the consolidated topline (lower Net Profit 140.6 182.1 213.4 247.7 than other regions) largely due to ongoing expansion in that region. -

John Hancock Funds II

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2009-01-29 | Period of Report: 2008-11-30 SEC Accession No. 0000928816-09-000117 (HTML Version on secdatabase.com) FILER John Hancock Funds II Mailing Address Business Address 601 CONGRESS STREET 601 CONGRESS STREET CIK:1331971| IRS No.: 000000000 | State of Incorp.:MA | Fiscal Year End: 1031 BOSTON MA 02210 BOSTON MA 02210 Type: N-Q | Act: 40 | File No.: 811-21779 | Film No.: 09554713 617-663-2166 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT INVESTMENT COMPANY Investment Company Act file number: 811-21779 JOHN HANCOCK FUNDS II (Exact name of registrant as specified in charter) 601 CONGRESS STREET, BOSTON, MA 02210 (Address of principal executive offices) (Zip code) GORDON M. SHONE, 601 CONGRESS STREET, BOSTON, MA 02210 (Name and address of agent for service) Registrants telephone number, including area code: 617-663-2168 Date of fiscal year end: August 31 Date of reporting period: November 30, 2008 Item 1. Schedule of Investments. Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document JOHN HANCOCK FUNDS II PORTFOLIO OF INVESTMENTS - November 30, 2008 (Unaudited) (showing percentage of total net assets) Floating Rate Income Fund Shares or Principal Amount Value TERM LOANS - 88.74% Aerospace - 2.00% Dubai Aerospace Enterprise, Term Loan Strip 8.45% due 07/31/2014 (b) $ 5,979,195 $ 3,408,141 Transdigm, Term Loan B Copyright © 2012 www.secdatabase.com. -

JHVIT Quarterly Holdings 6.30.2020

John Hancock Variable Insurance Trust Portfolio of Investments — June 30, 2020 (unaudited) (showing percentage of total net assets) 500 Index Trust 500 Index Trust (continued) Shares or Shares or Principal Principal Amount Value Amount Value COMMON STOCKS – 97.4% COMMON STOCKS (continued) Communication services – 10.5% Hotels, restaurants and leisure (continued) Diversified telecommunication services – 1.7% MGM Resorts International (A) 109,596 $ 1,841,213 AT&T, Inc. 1,583,219 $ 47,860,710 Norwegian Cruise Line CenturyLink, Inc. (A) 219,485 2,201,435 Holdings, Ltd. (A)(B) 56,962 935,886 Verizon Communications, Inc. 919,488 50,691,373 Royal Caribbean Cruises, Ltd. (A) 38,152 1,919,046 Starbucks Corp. 259,559 19,100,947 100,753,518 Wynn Resorts, Ltd. 21,572 1,606,898 Entertainment – 2.0% Yum! Brands, Inc. 66,881 5,812,628 Activision Blizzard, Inc. 171,207 12,994,611 87,874,886 Electronic Arts, Inc. (B) 64,148 8,470,743 Live Nation Entertainment, Inc. (A)(B) 31,569 1,399,454 Household durables – 0.4% Netflix, Inc. (B) 97,727 44,469,694 D.R. Horton, Inc. 73,510 4,076,130 Take-Two Interactive Software, Inc. (B) 25,319 3,533,773 Garmin, Ltd. 32,259 3,145,253 The Walt Disney Company 401,364 44,756,100 Leggett & Platt, Inc. (A) 29,398 1,033,340 Lennar Corp., A Shares 61,022 3,760,176 115,624,375 Mohawk Industries, Inc. (B) 13,219 1,345,165 Interactive media and services – 5.4% Newell Brands, Inc. 84,814 1,346,846 Alphabet, Inc., Class A (B) 66,673 94,545,648 NVR, Inc. -

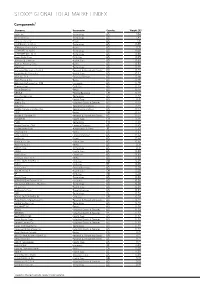

Stoxx® Global Total Market Index

STOXX® GLOBAL TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) Apple Inc. Technology US 1.84 Microsoft Corp. Technology US 1.47 Amazon.com Inc. Retail US 1.31 FACEBOOK CLASS A Technology US 0.89 JPMorgan Chase & Co. Banks US 0.71 ALPHABET CLASS C Technology US 0.68 ALPHABET INC. CL A Technology US 0.66 Exxon Mobil Corp. Oil & Gas US 0.65 Johnson & Johnson Health Care US 0.63 Bank of America Corp. Banks US 0.53 Intel Corp. Technology US 0.49 Samsung Electronics Co Ltd Personal & Household Goods KR 0.49 UnitedHealth Group Inc. Health Care US 0.47 VISA Inc. Cl A Financial Services US 0.46 Wells Fargo & Co. Banks US 0.46 Berkshire Hathaway Inc. Cl B Insurance US 0.46 Chevron Corp. Oil & Gas US 0.45 Home Depot Inc. Retail US 0.44 NESTLE Food & Beverage CH 0.44 Cisco Systems Inc. Technology US 0.42 Pfizer Inc. Health Care US 0.41 Boeing Co. Industrial Goods & Services US 0.40 AT&T Inc. Telecommunications US 0.39 Verizon Communications Inc. Telecommunications US 0.37 HSBC Banks GB 0.37 Procter & Gamble Co. Personal & Household Goods US 0.37 NOVARTIS Health Care CH 0.36 TSMC Technology TW 0.35 MasterCard Inc. Cl A Financial Services US 0.35 Toyota Motor Corp. Automobiles & Parts JP 0.35 Citigroup Inc. Banks US 0.33 Coca-Cola Co. Food & Beverage US 0.32 Netflix Inc. Retail US 0.32 Merck & Co. Inc. Health Care US 0.32 Walt Disney Co. Media US 0.31 NVIDIA Corp. -

Victory Portfolios Schedule of Portfolio Investments Victory RS International Fund September 30, 2020 (Unaudited)

Victory Portfolios Schedule of Portfolio Investments Victory RS International Fund September 30, 2020 (Unaudited) Security Description Shares Value Common Stocks (95.6%) Australia (5.7%): Financials (1.3%): Macquarie Group Ltd. 48,034 $ 4,162,931 Health Care (1.5%): CSL Ltd. 23,928 4,941,706 Materials (2.0%): BHP Group Ltd. 250,230 6,463,004 Real Estate (0.9%): Scentre Group 1,850,629 2,945,867 18,513,508 Belgium (0.9%): Information Technology (0.9%): Melexis NV 37,110 2,887,013 China (2.1%): Communication Services (1.2%): Tencent Holdings Ltd. 57,500 3,883,870 Financials (0.9%): China Merchants Bank Co. Ltd., Class H 629,500 2,987,336 6,871,206 Denmark (1.4%): Consumer Staples (1.4%): Royal Unibrew A/S 43,853 4,520,904 France (9.4%): Consumer Discretionary (4.2%): Cie Generale des Etablissements Michelin SCA 30,130 3,233,984 Faurecia SE 80,697 3,477,968 LVMH Moet Hennessy Louis Vuitton SE 14,821 6,933,902 13,645,854 Energy (1.7%): Gaztransport Et Technigaz SA 23,471 2,237,981 TOTAL SE 93,104 3,197,036 5,435,017 Information Technology (1.8%): Capgemini SE 46,184 5,924,464 Materials (1.7%): Arkema SA 52,318 5,546,293 30,551,628 Germany (8.9%): Financials (1.6%): Allianz SE 27,192 5,218,312 Industrials (2.9%): Siemens AG, Registered Shares 57,049 7,203,779 Washtec AG (a) 50,742 2,200,140 9,403,919 Information Technology (2.7%): SAP SE 55,553 8,649,547 Real Estate (1.5%): Vonovia SE 69,438 4,759,596 Victory Portfolios Schedule of Portfolio Investments — continued Victory RS International Fund September 30, 2020 (Unaudited) Security Description Shares Value Utilities (0.2%): Siemens Energy AG (a) 27,607 $ 744,355 28,775,729 Hong Kong (2.1%): Financials (1.1%): AIA Group Ltd. -

Sr. No. Select Corporates 1 3 I Infotech Ltd. 2 3M India Ltd. 3 a and E India Pvt. Ltd. 4 a Plus Education Solutions Private Limited 5 Aarti Drugs Ltd

SR. NO. SELECT CORPORATES 1 3 I INFOTECH LTD. 2 3M INDIA LTD. 3 A AND E INDIA PVT. LTD. 4 A PLUS EDUCATION SOLUTIONS PRIVATE LIMITED 5 AARTI DRUGS LTD. 6 AARTI INDUSTRIES LTD 7 AARTI INTERNATIONAL LTD. 8 AARTI STEELS LTD. 9 AB MAURI INDIA PRIVATE LIMITED 10 ABB LIMITED 11 ABBOTT INDIA LTD 12 ABC BEARINGS LTD. 13 ABIR INFRASTRUCTURE PRIVATE LIMITED 14 ACB (INDIA) LTD. 15 ACCEL FRONTLINE LIMITED 16 ACCENTURE SERVICES PRIVATE LTD 17 ACE CALDERYS LTD 18 ACER INDIA PRIVATE LIMITED 19 ACKRUTI CITY LIMITED 20 ADANI POWER LTD. 21 ADANI WILMAR LIMITED 22 ADECCO INDIA PRIVATE LIMITED 23 ADIDAS INDIA PRIVATE LIMITED 24 ADM AGRO INDUSTRIES INDIA PRIVATE LIMITED 25 ADM AGRO INDUSTRIES KOTA & AKOLA PRIVATE LIMITED 26 ADOR WELDING LIMITED 27 ADP PRIVATE LIMITED 28 AECOM INDIA PRIVATE LIMITED 29 AEGIS LOGISTICS LTD 30 AEON CREDIT SERVICE INDIA PRIVATE LIMITED 31 AFCONS INFRASTRUCTURE LTD 32 AIR LIQUIDE ENGINEERING INDIA PRIVATE LIMITED 33 AIR LIQUIDE MEDICAL SYSTEMS PRIVATE LIMITED 34 AIRCEL CELLULAR LTD. 35 AIRCEL LTD. 36 AIRCHECK INDIA PRIVATE LIMITED 37 AISIN NTTF PRIVATE LIMITED 38 AJANTA PHARMA LTD 39 ALEMBIC LTD 40 ALKEM LABORATORIES LIMITED 41 ALLANASONS LTD. 42 ALLCARGO GLOBAL LOGISTICS LIMITED 43 ALLERGAN INDIA PRIVATE LIMITED 44 ALLIED DIGITAL SERVICES LTD 45 ALOK INDUSTRIES LTD. 46 ALSTOM INDIA LIMITED 47 ALSTOM TRANSPORT INDIA LIMITED 48 AMAR REMEDIES LIMITED 49 AMARA RAJA BATTERIES LTD. 50 AMARCHAND & MANGALDAS & SURESH A SHROFF & CO 51 AMAZON DEVELOPMENT CENTRE (INDIA) PRIVATE LIMITED 52 AMBUJA CEMENTS LTD. 53 AMD RESEARCH & DEVELOPMENT CENTER INDIA PRIVATE LIMITED 54 AMDOCS DEVELOPMENT CENTRE INDIA PRIVATE LIMITED 55 AMERICAN EXPRESS BANKING CORP. -

Sl. No. COMPANY NAME

Sl. No. COMPANY NAME 1 3 GLOBAL SVCS PVT LTD 2 3i INFOTECH (ICICI INFOTECH LTD) 3 3M INDIA 4 4L IT SERVICES PRIVATE LTD 5 77 BANK 6 A C NIELSON 7 AAREAL BANK 8 AARTI DRUGS 9 AARTI INDUSTRIES 10 AARTI STEELS 11 AARVEE DENIM 12 AB MAURI INDIA PRIVATE LTD 13 ABAN LOYD CHILES 14 ABB 15 ABBOTT INDIA 16 ABBOTT LABORATORIES 17 ABERCROMBIE & FITCH 18 ABERTIS 19 ABHISHEK INDUSTRIES 20 ABITIBI CONSOLIDATED 21 ABN-AMRO HOLDING 22 ABSA GROUP 23 ACC 24 ACC RIO TINTO EXPLORATION LI 25 Accelrys Software solutions India Pvt Ltd 26 ACCENTURE 27 ACCIONA 28 ACCOR 29 ACE 30 ACER 31 ACERINOX 32 ACNIELSEN ORG-MARG PVT LTD 33 ACOM 34 ACS GROUP 35 ADANI EXPORTS 36 ADANI WILMAR 37 ADECCO 38 ADIDAS-SALOMON 39 ADLABS FILMS 40 ADOBE SYSTEMS 41 ADOR WELDING 42 ADVANCE AUTO PARTS 43 ADVANCED FIREFIGHTING TECH 44 ADVANCED INFO SERVICE 45 ADVANCED MICRO 46 ADVANTEST 47 AEGIS LOGISTICS 48 AEGON 49 AEM 50 AEON 51 AES 52 AETNA 53 AFFILIATED COMPUTER 54 AFLAC 55 AFTEK INFOSYS 56 AG EDWARDS 57 AG INDUSTRIES PVT LTD 58 AGCO 59 Agere systems India pvt ltd 60 AGFA-GEVAERT 61 AGGREGATE INDUSTRIES 62 AGILENT TECHNOLOGIES 63 AGRICULTURAL BANK GREECE 64 AGRIUM 65 AHMEDNAGAR FORGE 66 AHOLD 67 AICHI BANK 68 AIFUL 69 AIOI INSURANCE 70 AIR CHINA 71 AIR FRANCE-KLM GROUP 72 AIR INDIA . 73 AIR LINK INDIA 74 AIR LIQUIDE GROUP 75 AIR PRODS & CHEMS 76 AIRCEL DIGILINK INDIA LTD 77 AIRPORTS AUTHORITY OF INDIA 78 AISIN SEIKI 79 AJINOMOTO 80 AK STEEL HOLDING 81 Akamai Technologies 82 AKBANK 83 AKER 84 AKITA BANK 85 AKZO NOBEL GROUP 86 ALBERTO-CULVER 87 ALBERTSONS 88 ALCAN 89 ALCATEL 90 ALCOA 91 ALEMBIC 92 ALEXANDER FORBES 93 ALFA LAVAL (I) 94 ALFRESA HOLDINGS 95 ALITALIA AIRWAYS 96 ALITALIA GROUP 97 ALL NIPPON AIRWAYS 98 ALLAHABAD BANK 99 ALLEGHENY ENERGY 100 ALLERGAN 101 ALLIANCE & LEICESTER ALLIANCE CAPITAL ASSET 102 MANAGEMENT (INDIA) PVT.