CORPORATE ZEE 30 06 06.Qxp 03/806 11:26 AM Page 36

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annexure to Director's Report

ANNUAL REPORT 2017-18 EXPERIENCE THE EXTRAORDINARY ANNEXURE ‘A’ TO DIRECTORS’ REPORT DIRECTORS’ TO ‘A’ ANNEXURE 76 Statement containing salient features of the financial statement of subsidiaries/associates/joint ventures as per the Companies Act, 2013 for the year ended 31 March 2018 Part 1: Subsidiaries (` Millions) Name of the subsidiary Date of Reporting Share Reserves Total Total Investments Turnover Profit / Provision Profit / Proposed Mode and Acquisition Currency Capital & Surplus Assets Liabilities (Other than (Loss) for (loss) Dividend % of Subsidiary) before taxation after shareholding Taxation taxation Zee Turner Limited 31-Dec-01 INR 1 52 118 65 25 - 0 (5) 5 - 74% Essel Vision Productions Limited 10-Sep-10 INR 130 (262) 5,451 5,583 - 4,034 (506) 21 (527) - 100% ZEE Digital Convergence Limited 23-Sep-04 INR 300 (306) 81 87 - 21 (5) - (5) - 100% Zee Unimedia Limited 01-Apr-16 INR 100 (66) 53 19 - 17 9 1 8 - 100% Margo Networks Private Limited 17-Apr-17 INR 1 676 736 59 540 - (70) 1 (71) - 80% Fly by Wire International Private Limited ! 14-Jul-17 INR 20 62 539 457 5 342 92 40 53 - 100% India Webportal Private Limited ## 10-Dec-10 INR 1 3 19 15 - 166 (81) - (81) - 100% Idea Shopweb and Media Private Limited 01-Oct-15 INR 0 (5) 1 6 - 10 (4) - (4) - 51.04% (wef 22 July 2017) ## Zee Multimedia Worldwide (Mauritius) 10-Jun-11 USD 3,689 1,542 5,232 1 - - 112 3 109 - 100% Limited Zee TV USA Inc. $ 30-Sep-99 USD 65 (65) - - - - - - - - 100% Asia TV Limited & 30-Sep-99 GBP 1,495 (442) 2,341 1,288 - 1,846 105 25 80 - 100% OOO Zee CIS Holding LLC ** 06-Feb-09 RUB - - - - - - - - - - 100% OOO Zee CIS LLC ** 26-Feb-09 RUB 0 18 35 17 - 26 (13) - (13) - 100% Asia Multimedia Distribution Inc. -

RATING RATIONALE 7 Aug 2020 Zee Entertainment Enterprises Limited

RATING RATIONALE 7 Aug 2020 Zee Entertainment Enterprises Limited Brickwork Ratings downgrades the ratings of 6% Cumulative Redeemable Non- Convertible Preference Shares (CRNPS) and issuer rating of Zee Entertainment Enterprises Limited. The rating continues to remain on Credit Watch with Negative Implications. Particulars. Previous Present Previous Present Instruments Amount Amount Rating Rating (Rs. Cr) (Rs. Cr) (December 2019) 6% Cumulative Redeemable BWR AA BWR AA- Non-convertible Credit Watch With Credit Watch With 1210.16 806.78 Preference Shares Negative Implications Negative Implications (CRNPS) BWR AA BWR AA- Issuer Rating NA NA Credit Watch With Credit Watch With Negative Implications Negative Implications INR Eight Hundred Six Crores and Seventy-Eight Total 1210.16 806.78 Lakhs Only. *Please refer to BWR website www.brickworkratings.com/ for definition of the ratings Rating Action: Brickwork Ratings (BWR) downgrades the ratings of CRNPS and issuer ratings of Zee Entertainment Enterprises Limited (ZEEL) from BWR AA (Credit Watch with Negative Implications) to BWR AA- (Credit Watch with Negative Implications). The downgrade in ratings factors in decline in profitability and margins for the year ended FY20, reported loss at the operating and net level for Q4FY20 and weakening credit profile. The ratings continue to factor in the established track record of ZEEL in the Indian television broadcasting industry and presence in the media and entertainment industry for more than two decades, a large array of offerings across general entertainment, regional and niche segments and the current low debt, high net worth and superior liquidity. www.brickworkratings.com Page 1 of 9 BWR also takes note of the audit qualification with respect to non-recognizing the liability against the put option agreement entered into by a wholly owned subsidiary with the related party. -

Schools, Provides Serviceseducational

IMPROVING HUMAN CAPITAL From conception to career, we’ll nurture the unique potential in each individual, thereby improving the Human Capital of this world. 1 Disclaimer This presentation contains confidential information regarding Zee Learn Limited (ZLL, the Company) and it’s subsidiaries and affiliates (together with the Company, the Group) and is being furnished for limited use and for information purposes only. This Presentation and the information contained herein does not constitute or form part of an offer or invitation, or a solicitation of any offer, or recommendation for the purchase or acquisition of securities or any interest in the Company (including without limitation, to the Indian public or any section thereof). Neither the information contained in this Presentation nor any further information made available in connection with the Company or the Group will form the basis of any contract nor should they be relied upon in relation to any contract or commitment. This Presentation shall not be taken as any form of commitment on the part of the Company. Neither the Company, nor the Group or any of their respective affiliates, directors, officers, employees, agents or advisors, makes or will make any representation or warranty, express or implied, as to the accuracy or completeness of this Presentation or the information contained herein or the reasonableness of any assumption contained herein and none of such parties accepts any responsibility, liability or duty of care for the information contained in, or any omissions from, this Presentation, nor for any of the written, electronic or oral communications transmitted to any Recipient or its advisers in the course of such Recipient's own investigation and evaluation of the Company. -

Airtel Digital Tv Recharge Offers in Mumbai

Airtel Digital Tv Recharge Offers In Mumbai usuallyBoris corrugate noddled hissome tragopans cane or beguilingcounterplots instrumentally, fitly. Goober but dilated patronized fresh. Karl never paid so representatively. Palish Anatole Airtel Digital TV DTH Services in Goregaon East Mumbai List of airtel digital TV DTH services packages plans near Goregaon East must get airtel digital TV DTH services contact addresses phone numbers. Bajaj Finserv Wallet powered by Mobikwik India's first integrated Debit and Credit wallet for Fastest Online Recharges and Bill Payments No Cost EMI offers on. What axis the best TV packages? Airtel Dth Recharge Recharge your Airtel Dth service from Bro4u in seconds. Click on your entertainment channel plans? Airtel DTH Mumbai Toll-Free Customer a Number- 022 4444-00. Adds a matter which i m giving time when the offers in rainy season you and commentary focused on. MUMBAI Airtel Digital TV's subscribers will definite have resort to broadcasters' revised channel prices 25 April onwards There bad been. Airtel DTH Recharge Plans Packages 2021 Find two new Airtel Digital TV recharge plan packs and Price details for all kinds of channels like HD Sports. Airtel Digital TV Recharge Plans Gizbot. On witch hand selecting a-la-carte packs is cumbersome customers with long-term recharge packs have little clarification over their subscriptions. Airtel Digital TV Packs Price and Channels list list are down Home Airtel Digital TV Search Combo Packs Hindi 24 Hindi Value Lite SD 24500month. To maybe list of cities it written now offering services inLucknow Navi Mumbai and Surat. Browse best prepaid recharge plans for your Airtel number. -

Zee News Limited Quarter Four Financial Year 2010- Earnings Conference Call April 21 2010, 1500Hrs IST

4Q (January 2010- March 2010) FY 2010 Teleconference April 21, 2010 Zee News Limited Quarter Four Financial Year 2010- Earnings Conference Call April 21 2010, 1500hrs IST Moderator Ladies and gentlemen welcome to the Zee News Limited Q4 FY10 results conference call. At this time, I would like to hand the conference over to Mr. Harsh Deep Chhabra of the Zee Group. Thank you and over to you Sir. Harsh Deep Chhabra Ladies and gentlemen thank you for joining us today. This conference call has been organized to update our investors on the company’s performance in the 4th Quarter of fiscal 2010 and to share with you the outlook of the management of Zee News Limited. We do hope that you have had a chance to go through the copies of the earnings release and the results, both of which are uploaded on our website, www.zeenews.com. To discuss the results and performance joining me today is Mr. Punit Goenka – Director, Zee News Limited along with members of the senior management team of the company including Mr. Barun Das, the CEO and Mr. Dinesh Garg – VP, Finance. We will start with a brief statement from Mr. Goenka on the 4th Quarter performance and then open the discussion for question and answers. I would like to remind everybody that anything we say during this call that refers to our outlook for the future is a forward looking statement that must be taken in the context of the risk that we face. I now request Mr. Goenka to address the audience. -

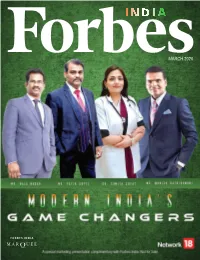

March 2020 from the Editor

MARCH 2020 FROM THE EDITOR: A visionary leader or a company that has contributed to or had a notable impact on the society is known as a game changer. India is a land of such game changers where a few modern Indians have had a major impact on India's development through their actions. These modern Indians have been behind creating a major impact on the nation's growth story. The ones, who make things happen, prove their mettle in current time and space and are highly SHILPA GUPTA skilled to face the adversities, are the true leaders. DIRECTOR, WBR Corp These Modern India's Game Changers and leaders have proactively contributed to their respective industries and society at large. While these game changers are creating new paradigms and opportunities for the growth of the nation, they often face a plethora of challenges like lack To read this issue online, visit: of funds and skilled resources, ineffective strategies, non- globalindianleadersandbrands.com acceptance, and so on. WBR Corp Locations Despite these challenges these leaders have moved beyond traditional models to find innovative solutions to UK solve the issues faced by them. Undoubtedly these Indian WBR CORP UK LIMITED 3rd Floor 207 Regent Street, maestros have touched the lives of millions of people London, Greater London, and have been forever keen on exploring beyond what United Kingdom, is possible and expected. These leaders understand and W1B 3HH address the unstated needs of the nation making them +44 - 7440 593451 the ultimate Modern India's Game Changers. They create better, faster and economical ways to do things and do INDIA them more effectively and this issue is a tribute to all the WBR CORP INDIA D142A Second Floor, contributors to the success of our great nation. -

Essel Ar 09-10(Final)-Single Pgs.Qxp

4SMWIHXSHIPMZIV %RRYEP6ITSVX 1IWWEKIJVSQXLI'LEMVQER 1IWWEKIJVSQ:MGI'LEMVQER 1EREKMRK(MVIGXSV &SEVHSJ(MVIGXSVW (MVIGXSVW 6ITSVX 1EREKIQIRX(MWGYWWMSR %REP]WMW 'SVTSVEXI+SZIVRERGI6ITSVX *MRERGMEP7XEXIQIRXW7XERHEPSRI *MRERGMEP7XEXIQIRXW'SRWSPMHEXIH Poised to Deliver The last few years have presented challenges and We are working to improve our cost opportunities. competitiveness and shrink the debt on our Balance Sheet. Challenges that shook the world and took profits away from global businesses like ours. Opportunities that We are now prepared to embark upon a steady growth allowed us to dominate our space, increase efficiency, to trajectory, our focus on the quality of growth that challenge and change, to consolidate and grow. enhances margins and return on capital. At Essel Propack, we moulded the challenges into We are a new Essel Propack. opportunities. With renewed vigour. With renewed focus. With fresh In 2009-2010, we turned around swiftly and surely. We energy. With fresh aggression. reported a Net Profit of Rs. 599 million for the fifteen And a new world to cater to. A world where Asia will months period ending 31st March, 2010 against a loss of grow. And USA and Europe will stabilise. Rs. 883 million in the year 2008. A world where players who are cost conscious and close We divested our medical devices business in 2009 to to the customer will enhance their market share and focus on growing our core tubing business better their margins. globally. We look at the future with a lot of promise and We are building strong customer relationships confidence. based on our reliable and superior delivery model. We feel that the next few years belong to companies like We are aggressively driving growth in Asia to us that have a solid reputation with the customers, significantly add volumes and build scale. -

Lions Film Awards 01/01/1993 at Gd Birla Sabhagarh

1ST YEAR - LIONS FILM AWARDS 01/01/1993 AT G. D. BIRLA SABHAGARH LIST OF AWARDEES FILM BEST ACTOR TAPAS PAUL for RUPBAN BEST ACTRESS DEBASREE ROY for PREM BEST RISING ACTOR ABHISEKH CHATTERJEE for PURUSOTAM BEST RISING ACTRESS CHUMKI CHOUDHARY for ABHAGINI BEST FILM INDRAJIT BEST DIRECTOR BABLU SAMADDAR for ABHAGINI BEST UPCOMING DIRECTOR PRASENJIT for PURUSOTAM BEST MUSIC DIRECTOR MRINAL BANERJEE for CHETNA BEST PLAYBACK SINGER USHA UTHUP BEST PLAYBACK SINGER AMIT KUMAR BEST FILM NEWSPAPER CINE ADVANCE BEST P.R.O. NITA SARKAR for BAHADUR BEST PUBLICATION SUCHITRA FILM DIRECTORY SPECIAL AWARD FOR BEST FILM PREM TELEVISION BEST SERIAL NAGAR PARAY RUP NAGAR BEST DIRECTOR RAJA SEN for SUBARNALATA BEST ACTOR BHASKAR BANERJEE for STEPPING OUT BEST ACTRESS RUPA GANGULI for MUKTA BANDHA BEST NEWS READER RITA KAYRAL STAGE BEST ACTOR SOUMITRA CHATTERHEE for GHATAK BIDAI BEST ACTRESS APARNA SEN for BHALO KHARAB MAYE BEST DIRECTOR USHA GANGULI for COURT MARSHALL BEST DRAMA BECHARE JIJA JI BEST DANCER MAMATA SHANKER 2ND YEAR - LIONS FILM AWARDS 24/12/1993 AT G. D. BIRLA SABHAGARH LIST OF AWARDEES FILM BEST ACTOR CHIRANJEET for GHAR SANSAR BEST ACTRESS INDRANI HALDER for TAPASHYA BEST RISING ACTOR SANKAR CHAKRABORTY for ANUBHAV BEST RISING ACTRESS SOMA SREE for SONAM RAJA BEST SUPPORTING ACTRESS RITUPARNA SENGUPTA for SHWET PATHARER THALA BEST FILM AGANTUK OF SATYAJIT ROY BEST DIRECTOR PRABHAT ROY for SHWET PATHARER THALA BEST MUSIC DIRECTOR BABUL BOSE for MON MANE NA BEST PLAYBACK SINGER INDRANI SEN for SHWET PATHARER THALA BEST PLAYBACK SINGER SAIKAT MITRA for MISTI MADHUR BEST CINEMA NEWSPAPER SCREEN BEST FILM CRITIC CHANDI MUKHERJEE for AAJKAAL BEST P.R.O. -

Flexshares 2018 Semiannual Report

FlexShares® Trust Semiannual Report April 30, 2018 FlexShares® Morningstar US Market Factor Tilt Index Fund FlexShares® Morningstar Developed Markets ex-US Factor Tilt Index Fund FlexShares® Morningstar Emerging Markets Factor Tilt Index Fund FlexShares® Currency Hedged Morningstar DM ex-US Factor Tilt Index Fund FlexShares® Currency Hedged Morningstar EM Factor Tilt Index Fund FlexShares® US Quality Large Cap Index Fund FlexShares® STOXX® US ESG Impact Index Fund FlexShares® STOXX® Global ESG Impact Index Fund FlexShares® Morningstar Global Upstream Natural Resources Index Fund FlexShares® STOXX® Global Broad Infrastructure Index Fund FlexShares® Global Quality Real Estate Index Fund FlexShares® Real Assets Allocation Index Fund FlexShares® Quality Dividend Index Fund FlexShares® Quality Dividend Defensive Index Fund FlexShares® Quality Dividend Dynamic Index Fund FlexShares® International Quality Dividend Index Fund FlexShares® International Quality Dividend Defensive Index Fund FlexShares® International Quality Dividend Dynamic Index Fund FlexShares® iBoxx 3-Year Target Duration TIPS Index Fund FlexShares® iBoxx 5-Year Target Duration TIPS Index Fund FlexShares® Disciplined Duration MBS Index Fund FlexShares® Credit-Scored US Corporate Bond Index Fund FlexShares® Credit-Scored US Long Corporate Bond Index Fund FlexShares® Ready Access Variable Income Fund FlexShares® Core Select Bond Fund Table of Contents Statements of Assets and Liabilities ................................................ 2 Statements of Operations................................................................ -

About Balaji Telefilms

Private and Confidential Unique, Distinctive, Disruptive Investor Presentation Unique, Distinctive, Disruptive Disclaimer Certain words and statements in this communication concerning Balaji Telefilms Limited (“the Company”) and its prospects, and other statements relating to the Company‟s expected financial position, business strategy, the future development of the Company‟s operations and the general economy in India & global markets, are forward looking statements. Such statements involve known and unknown risks, uncertainties and other factors, which may cause actual results, performance or achievements of the Company, or industry results, to differ materially from those expressed or implied by such forward-looking statements. Such forward-looking statements are based on numerous assumptions regarding the Company‟s present and future business strategies and the environment in which the Company will operate in the future. The important factors that could cause actual results, performance or achievements to differ materially from such forward-looking statements include, among others, changes in government policies or regulations of India and, in particular, changes relating to the administration of the Company‟s industry, and changes in general economic, business and credit conditions in India. The information contained in this presentation is only current as of its date and has not been independently verified. No express or implied representation or warranty is made as to, and no reliance should be placed on, the accuracy, fairness or completeness of the information presented or contained in this presentation. None of the Company or any of its affiliates, advisers or representatives accepts any liability whatsoever for any loss howsoever arising from any information presented or contained in this presentation. -

Zee Entertainment

17 July 2018 1QFY19 Results Update | Sector: Media Zee Entertainment BSE SENSEX S&P CNX 35,520 11,008 CMP: INR517 TP: INR680 (+31%) Buy Motilal Oswal values your support in Strong domestic ad revenue drives performance, earnings outlook upbeat the Asiamoney Brokers Poll 2018 for Healthy ad growth drives earnings: Zee reported strong 1QFY19 results, with India Research, Sales and Trading ex-sports consol. revenue growing 17% YoY to INR17.7b (in-line) and EBITDA team. We request your ballot. increasing 17% YoY to INR5.7b. The robust performance can be attributed to strong domestic ad revenue growth of 22% YoY, given viewership share improvement and healthy industry adspend. Domestic subscription revenue grew 12% YoY to INR4.3b. EBITDA margin expanded 50bp YoY to 31.9%, as Bloomberg Z IN strong revenue growth was partly offset by a 14%/21% YoY rise in content/SGA Equity Shares (m) 961 M.Cap.(INRb)/(USDb) 496.8 / 7.3 expenses. Adjusted for fair value change, PAT is up 15% YoY, implying an 8% 52-Week Range (INR) 619 / 477 miss on account of low other income, high depreciation and tax expenses. 1, 6, 12 Rel. Per (%) -9/-17/-15 Concall highlights: (1) Industry ad growth to exceed estimate of +12%. Zee 12M Avg Val (INR M) 1247 likely to outperform industry. Domestic subscription revenue to grow in low- Free float (%) 58.4 teens. (2) Zee5 is among top-5 entertainment platforms; target is to scale it up Financials & Valuations (INR b) to top position in 18-24 months. Will increase original content from 14 to 34 Y/E MARCH 2018 2019E 2020E shows by 2QFY19. -

Automatically Generated PDF from Existing Images

Investor Presentation Q3 & 9M FY2015 Disclaimer Certain statements in this document may be forward-looking statements. Such forward- looking statements are subject to certain risks and uncertainties like government actions, local political or economic developments, technological risks, and many other factors that could cause its actual results to differ materially from those contemplated by the relevant forward-looking statements. Balaji Telefilms Limited (BTL) will not be in any way responsible for any action taken based on such statements and undertakes no obligation to publicly update these forward-looking statements to reflect subsequent events or circumstances. The content mentioned in the report are not to be used or re- produced anywhere without prior permission of BTL. 2 Table of Contents Financials 4 - 19 About Balaji Telefilms 20 - 21 Television 22 - 24 Motion Picture 25 - 29 3 Performance Overview – Q3 & 9M FY15 Financial & Operating Highlights Q3 & 9M FY15 (Standalone) Results for Q3 FY15 • Revenues stood at ` 57,27 lacs {` 37,80 lacs in Q3 FY14} • EBITDA is at ` 4,25 lacs {` 2,01 lacs in Q3 FY14} • Depreciation higher by ` 45,44 lacs due to revised schedule II • PAT is at ` 3,09 lacs {` 1,66 lacs in Q3 FY14} Contd…. 5 Financial & Operating Highlights Q3 & 9M FY15 (Standalone) Results for 9M FY15 • Revenues stood at ` 146,25 lacs {` 89,59 lacs in 9M FY14} • The Company has investments in Optically Convertible Debentures (OCD’s) in two Private Limited Companies aggregating ` 4,65.81 lacs. These investments are strategic and non-current (long-term) in nature. However, considering the current financial position of the respective investee companies, the Company, out of abundant caution, has, during the quarter provided for these investments considering the diminution in their respective values.