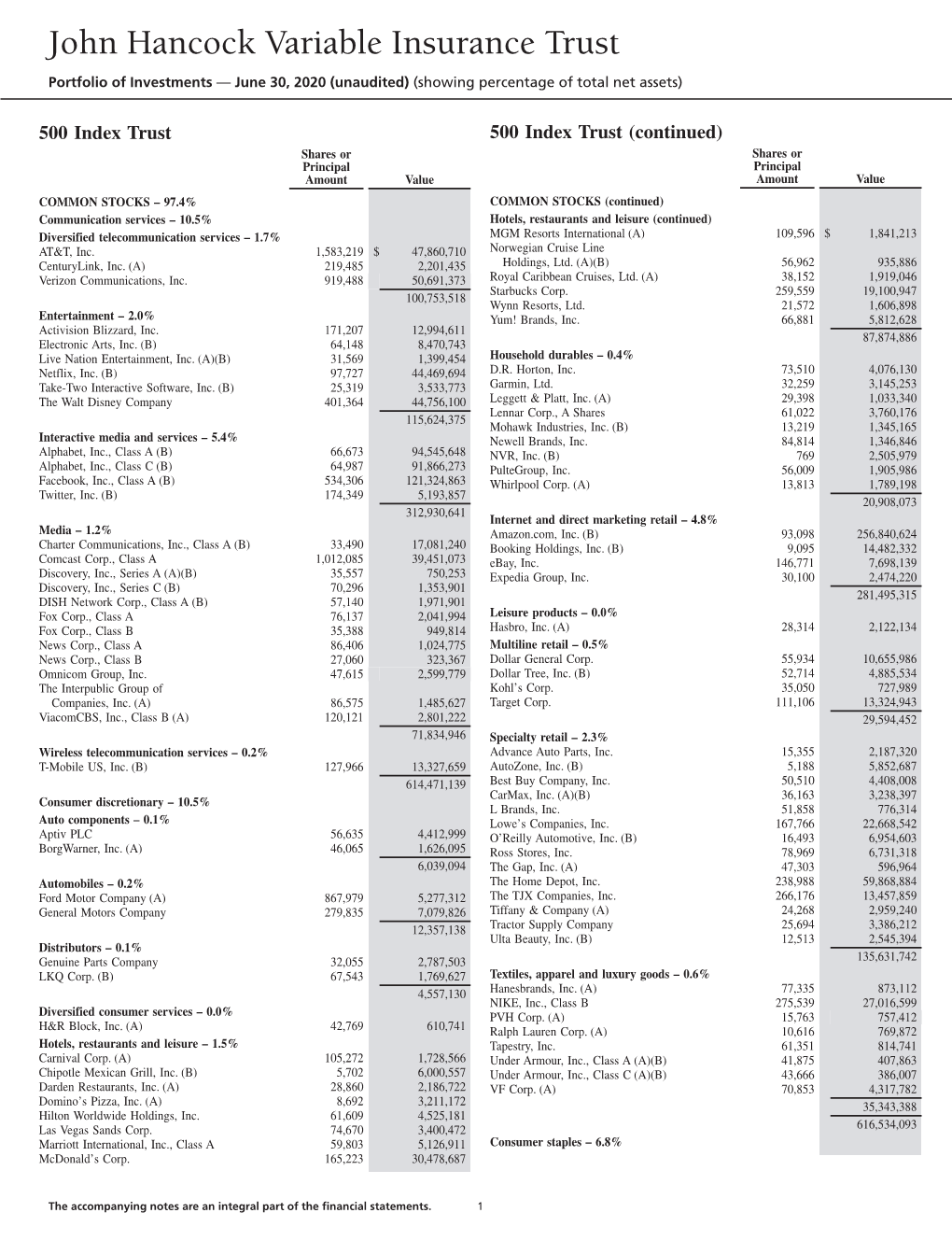

JHVIT Quarterly Holdings 6.30.2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Remote Control Code List

Remote Control Code List MDB1.3_01 Contents English . 3 Čeština . 4 Deutsch . 5 Suomi . 6 Italiano . 7. Nederlands . 8 Русский . .9 Slovenčina . 10 Svenska . 11 TV Code List . 12 DVD Code List . 25 VCR Code List . 31 Audio & AUX Code List . 36 2 English Remote Control Code List Using the Universal Remote Control 1. Select the mode(PVR, TV, DVD, AUDIO) you want to set by pressing the corresponding button on the remote control. The button will blink once. 2. Keep pressing the button for 3 seconds until the button lights on. 3. Enter the 3-digit code. Every time a number is entered, the button will blink. When the third digit is entered, the button will blink twice. 4. If a valid 3-digit code is entered, the product will power off. 5. Press the OK button and the mode button will blink three times. The setup is complete. 6. If the product does not power off, repeat the instruction from 3 to 5. Note: • When no code is entered for one minute the universal setting mode will switch to normal mode. • Try several setting codes and select the code that has the most functions. 3 Čeština Seznam ovládacích kódů dálkového ovladače Používání univerzálního dálkového ovladače 1. Vyberte režim (PVR, TV, DVD, AUDIO), který chcete nastavit, stisknutím odpovídajícího tlačítka na dálkovém ovladači. Tlačítko jednou blikne. 2. Stiskněte tlačítko na 3 sekundy, dokud se nerozsvítí. 3. Zadejte třímístný kód. Při každém zadání čísla tlačítko blikne. Po zadání třetího čísla tlačítko blikne dvakrát. 4. Po zadání platného třímístného kódu se přístroj vypne. -

2020 Information Circular

GLACIER MEDIA INC. NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS December 18, 2020 TO THE SHAREHOLDERS OF GLACIER MEDIA INC. Take notice that the annual general meeting of the shareholders of Glacier Media Inc. (“Glacier” or the “Corporation”) will be held at 2500 – 700 West Georgia Street, Vancouver, British Columbia on Friday, December 18, 2020 at the hour of 11:00 a.m. (Vancouver time) for the following purposes: 1. To receive and consider the consolidated financial statements of Glacier for the fiscal year ended December 31, 2019, together with the auditor’s report thereon; 2. To elect directors for the ensuing year; 3. To appoint auditors for the ensuing year at a remuneration to be fixed by the Directors; 4. To consider, and if deemed appropriate, approve the non-binding advisory resolution to accept the Corporation’s approach to executive compensation; and 5. To transact such other business as may properly come before the meeting or any adjournment thereof. The Corporation intends to hold the meeting in person. However, due to the COVID-19 pandemic, the Corporation requests that shareholders do not attend the meeting in person in order to mitigate the risk to the health and safety of our shareholders, directors and employees, as well as to the greater community at large. The Corporation strongly encourages shareholders to instead vote their shares in advance of the meeting by proxy. If any shareholder does wish to attend the meeting in person, please contact the Chief Financial Officer at [email protected] in order for arrangements to be made that comply with all health recommendations, regulations, guidance and orders. -

Condensed Interim Consolidated Financial Statements

Fto CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS Three months ended March 31, 2021 and 2020 (Unaudited) TABLE OF CONTENTS Management’s Discussion & Analysis .................................................................................................................. 1-18 Interim Consolidated Statements of Operations ..................................................................................................... 19 Interim Consolidated Statements of Comprehensive Income (Loss) ...................................................................... 20 Interim Consolidated Balance Sheets ...................................................................................................................... 21 Interim Consolidated Statements of Changes in Equity .......................................................................................... 22 Interim Consolidated Statements of Cash Flows ..................................................................................................... 23 Notes to the Condensed Interim Consolidated Financial Statements .............................................................. 24-36 Corporate Information ............................................................................................................................................. 37 GLACIER MEDIA INC. MANAGEMENT’S DISCUSSION & ANALYSIS (“MD&A”) FIRST QUARTER 2021 MANAGEMENT’S DISCUSSION & ANALYSIS (“MD&A”) FORWARD-LOOKING STATEMENTS In this MD&A, Glacier Media Inc. and its subsidiaries are referred to collectively -

TCL 科技集团股份有限公司 TCL Technology Group Corporation

TCL Technology Group Corporation Annual Report 2019 TCL 科技集团股份有限公司 TCL Technology Group Corporation ANNUAL REPORT 2019 31 March 2020 1 TCL Technology Group Corporation Annual Report 2019 Table of Contents Part I Important Notes, Table of Contents and Definitions .................................................. 8 Part II Corporate Information and Key Financial Information ........................................... 11 Part III Business Summary .........................................................................................................17 Part IV Directors’ Report .............................................................................................................22 Part V Significant Events ............................................................................................................51 Part VI Share Changes and Shareholder Information .........................................................84 Part VII Directors, Supervisors, Senior Management and Staff .......................................93 Part VIII Corporate Governance ..............................................................................................113 Part IX Corporate Bonds .......................................................................................................... 129 Part X Financial Report............................................................................................................. 138 2 TCL Technology Group Corporation Annual Report 2019 Achieve Global Leadership by Innovation and Efficiency Chairman’s -

Dfa Investment Trust Co

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2004-10-27 | Period of Report: 2004-08-31 SEC Accession No. 0001104659-04-032148 (HTML Version on secdatabase.com) FILER DFA INVESTMENT TRUST CO Business Address 1299 OCEAN AVE CIK:896162| IRS No.: 000000000 | State of Incorp.:DE | Fiscal Year End: 1130 11TH FLOOR Type: N-Q | Act: 40 | File No.: 811-07436 | Film No.: 041100436 SANTA MONICA CA 90401 3103958005 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT INVESTMENT COMPANY Investment Company Act file number 811-7436 THE DFA INVESTMENT TRUST COMPANY (Exact name of registrant as specified in charter) 1299 Ocean Avenue, 11th Floor, Santa Monica, CA 90401 (Address of principal executive offices) (Zip code) Catherine L. Newell, Esquire, Vice President and Secretary The DFA Investment Trust Company, 1299 Ocean Avenue, 11th Floor, Santa Monica, CA 90401 (Name and address of agent for service) Registrant's telephone number, including area code: 310-395-8005 Date of fiscal year end: November 30 Date of reporting period: August 31, 2004 ITEM 1. SCHEDULE OF INVESTMENTS. The DFA Investment Trust Company Form N-Q August 31, 2004 (Unaudited) Table of Contents Schedules of Investments The U.S. Large Company Series The Enhanced U.S. Large Company Series The U.S. Large Cap Value Series The U.S. -

Registration Document

20 REGISTRATION DOCUMENT Including the annual financial report 17 GROUPE PSA - 2017 REGISTRATION DOCUMENT -1 ANALYSIS OF THE BUSINESS AND GROUP OPERATING RESULTS IN 2017 AND OUTLOOK Capital Expenditure in Research & Development 4.4.2. Banque PSA Finance, signature of a framework agreement with the BNP Paribas Group to form a car financing Partnership for Opel Vauxhall vehicles On 6 March 2017, when the Master Agreement was concluded with BNP Paribas Personal Finance, will from an accounting point of view General Motors, the Company simultaneously signed a Framework retain the current European platform and staff of GM Financial. The Agreement with BNP Paribas and BNP Paribas Personal Finance, to Opel Vauxhall finance companies will distribute financial and organise the joint purchase of Opel Vauxhall’s finance companies insurance products over a territory initially including the following and the setting up of a car financing partnership for Opel Vauxhall countries: Germany, United Kingdom, France, Italy, Sweden, Austria, vehicles. Ireland, Netherlands, Belgium, Greece and Switzerland. The The acquisition of Opel Vauxhall’s finance companies will be cooperation may potentially be extended thereafter to other completed through a holding company. This joint venture, owned in countries where Opel Vauxhall has a presence. equal shares and on the same terms by Banque PSA Finance and 4.5. CAPITAL EXPENDITURE IN RESEARCH & DEVELOPMENT Automotive Expertise to deliver useful technologies Innovation, research and development are powerful levers for Every year, Groupe PSA invests in research and development to developing competitive advantages by addressing the major stay ahead, technologically, of environmental and market changes. challenges faced in the automotive industry (environmental, safety, emerging mobility and networking needs, etc.). -

Building a Culture of Diversity, Equity & Inclusion

THE MONTHLY BUSINESS NEWS MAGAZINE OF THE LANSING REGIONAL CHAMBER OF COMMERCE • FEBRUARY 2021 Building a Culture of Diversity, Equity & Inclusion IN THIS ISSUE TECHSMITH ESTABLISHES NEW CORPORATE HEADQUARTERS SHYFT GROUP ANNOUNCES MAJOR JOB ADDITIONS FOCUS ON SMALL BUSINESS: NGAGE MANAGEMENT MESSAGE FROM THE CHAMBER Living Our Commitment to Diversity, Equity & Inclusion was a watershed moment in our nation’s history. It was a year of the unprecedented COVID-19 pandemic, great 2020 turmoil, and divisiveness, and a year that ripped at our souls over the civil unrest that erupted on multiple occasions. The pain of our nation’s failures to come to grips with social justice was felt throughout our communities and within all of our organizations. If there is good news to come out of the past 12 months, it has been in a renewed commitment to elevating the cause of diversity, equity, and inclusion (DE&I). This month’s Focus cover story features several organizations that have TIM DAMAN been among the leaders in DE&I for many years, in some cases, for decades. President and CEO We wanted to highlight the great work that is already being done and Lansing Regional showcase some of the best practices and challenges involved in building a Chamber of Commerce DE&I culture. As leaders, all of us need to be Not surprisingly, organizations that have established DE&I initiatives willing to be vulnerable and have utilized the past year’s civil unrest to strengthen their commitment face our shortcomings in the further. Leaders at the highest levels of these organizations conducted town hall meetings and listening tours where they heard first-hand the DE&I makes our organizations concerns that their team members feel about social injustice and how it impacts their everyday lives. -

Sparton Banks on Vanadium

EAGLE EAST DISCOVERY SHOWS PROMISE / 3 LUNDIN MINING: Geotech_Earlug_2016_Alt2.pdf 1 2016-06-24 4:27:20 PM IN FOCUS TECHNOLOGY METALS Vanadium, graphite, lithium, REEs and more / 7–9 VTEM™ | ZTEM™ | Gravity | Magnetics 905 841 5004 | geotech.ca JULY 18–24, 2016 / VOL. 102 ISSUE 23 / GLOBAL MINING NEWS · SINCE 1915 / $3.99 / WWW.NORTHERNMINER.COM Centerra Sparton banks on vanadium unveils TECHNOLOGY METALS | Junior commissions 8 MW hour vanadium battery for Chinese utility US$1.1B BY TRISH SAYWELL [email protected] bid for ver the course of his 54 years Thompson in the business, Canadian geologist and engineer Lee OBarker has had many rewarding Creek moments. In the early 1970s he recognized M&A | A gold mine in and staked the Montviel carbonate- Canada would lower hosted rare earth deposit in Quebec and in the 1980s found several firm's geopolitical risk gold discoveries in Ontario and Newfoundland, including the Fenn- BY MATTHEW KEEVIL Gibb deposit near Matheson, Ont., [email protected] with colleague Denis Villeneuve, VANCOUVER the Pine Cove deposit at Baie Verte in Newfoundland with Peter Dim- enterra Gold (TSX: CG; US- mell, and the Elmtree deposit in OTC: CAGDF) has been shop- the Bathurst area with Don Hoy ping for gold assets in Canada, and George Murphy. Cand on July 5 the company found a fit Diamond exploration took up in debt-heavy Thompson Creek Met- most of his time in the 1990s. Barker als (TSX: TCM; US-OTC: TCPTF) conducted the initial diamond and its Mount Milligan copper-gold exploration work at Diavik in the mine, 145 km northwest of Prince Northwest Territories for Aber George in central British Columbia. -

Technology Study on Consumer Energy Devices

Department of Trade and Industry Technology Study on Consumer Energy Devices Tender Ref # DTI/RSP/RMU 10/12-13 This document contains 1. The project’s Inception Report 2. The findings from Stage 1: International Best Practice Analysis 3. The findings from Stage 2: International EE Technology Scan 4. The findings from Stage 3: Local Manufacturing Capability Scan 5. The findings from Stage 4: Local Manufacturing Transition Analysis 6. The findings from Stage 5: Recommendations and Implementation Assistance 7. Addendum TABLE OF CONTENTS Inception Report ................................................................................................................................................... 4 1.1 Project Introduction ............................................................................................................................. 5 1.2 Project Objectives ................................................................................................................................ 5 1.3 Project Scope........................................................................................................................................ 6 1.4 Sources of the Literary Review ............................................................................................................. 6 1.5 High Level Project Approach to Project Analysis ................................................................................. 7 1.6 Detailed Methodology of the Primary Data Collection ....................................................................... -

2019 Annual Information Form

GLACIER MEDIA INC. Annual Information Form March 30, 2020 TABLE OF CONTENTS FORWARD LOOKING STATEMENTS .................................................................................... 1 CORPORATE STRUCTURE OF THE COMPANY ................................................................. 1 Name, Address and Incorporation ......................................................................................... 1 Intercorporate Relationships .................................................................................................. 1 GENERAL DEVELOPMENT OF THE BUSINESS ................................................................. 2 NARRATIVE DESCRIPTION OF THE COMPANY’S BUSINESS ....................................... 3 Overview ............................................................................................................................... 3 Investment Philosophy .......................................................................................................... 5 Environmental and property Information .............................................................................. 5 Operations, Products and Markets .................................................................................... 5 Revenues ........................................................................................................................... 6 Methods of Distribution and Marketing ........................................................................... 6 Employees ........................................................................................................................ -

Essel Ar 09-10(Final)-Single Pgs.Qxp

4SMWIHXSHIPMZIV %RRYEP6ITSVX 1IWWEKIJVSQXLI'LEMVQER 1IWWEKIJVSQ:MGI'LEMVQER 1EREKMRK(MVIGXSV &SEVHSJ(MVIGXSVW (MVIGXSVW 6ITSVX 1EREKIQIRX(MWGYWWMSR %REP]WMW 'SVTSVEXI+SZIVRERGI6ITSVX *MRERGMEP7XEXIQIRXW7XERHEPSRI *MRERGMEP7XEXIQIRXW'SRWSPMHEXIH Poised to Deliver The last few years have presented challenges and We are working to improve our cost opportunities. competitiveness and shrink the debt on our Balance Sheet. Challenges that shook the world and took profits away from global businesses like ours. Opportunities that We are now prepared to embark upon a steady growth allowed us to dominate our space, increase efficiency, to trajectory, our focus on the quality of growth that challenge and change, to consolidate and grow. enhances margins and return on capital. At Essel Propack, we moulded the challenges into We are a new Essel Propack. opportunities. With renewed vigour. With renewed focus. With fresh In 2009-2010, we turned around swiftly and surely. We energy. With fresh aggression. reported a Net Profit of Rs. 599 million for the fifteen And a new world to cater to. A world where Asia will months period ending 31st March, 2010 against a loss of grow. And USA and Europe will stabilise. Rs. 883 million in the year 2008. A world where players who are cost conscious and close We divested our medical devices business in 2009 to to the customer will enhance their market share and focus on growing our core tubing business better their margins. globally. We look at the future with a lot of promise and We are building strong customer relationships confidence. based on our reliable and superior delivery model. We feel that the next few years belong to companies like We are aggressively driving growth in Asia to us that have a solid reputation with the customers, significantly add volumes and build scale. -

Flexshares 2018 Semiannual Report

FlexShares® Trust Semiannual Report April 30, 2018 FlexShares® Morningstar US Market Factor Tilt Index Fund FlexShares® Morningstar Developed Markets ex-US Factor Tilt Index Fund FlexShares® Morningstar Emerging Markets Factor Tilt Index Fund FlexShares® Currency Hedged Morningstar DM ex-US Factor Tilt Index Fund FlexShares® Currency Hedged Morningstar EM Factor Tilt Index Fund FlexShares® US Quality Large Cap Index Fund FlexShares® STOXX® US ESG Impact Index Fund FlexShares® STOXX® Global ESG Impact Index Fund FlexShares® Morningstar Global Upstream Natural Resources Index Fund FlexShares® STOXX® Global Broad Infrastructure Index Fund FlexShares® Global Quality Real Estate Index Fund FlexShares® Real Assets Allocation Index Fund FlexShares® Quality Dividend Index Fund FlexShares® Quality Dividend Defensive Index Fund FlexShares® Quality Dividend Dynamic Index Fund FlexShares® International Quality Dividend Index Fund FlexShares® International Quality Dividend Defensive Index Fund FlexShares® International Quality Dividend Dynamic Index Fund FlexShares® iBoxx 3-Year Target Duration TIPS Index Fund FlexShares® iBoxx 5-Year Target Duration TIPS Index Fund FlexShares® Disciplined Duration MBS Index Fund FlexShares® Credit-Scored US Corporate Bond Index Fund FlexShares® Credit-Scored US Long Corporate Bond Index Fund FlexShares® Ready Access Variable Income Fund FlexShares® Core Select Bond Fund Table of Contents Statements of Assets and Liabilities ................................................ 2 Statements of Operations................................................................