2015 PUF Detailed Schedule of Investments

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

KOREA Morning Focus

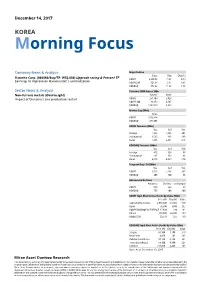

December 14, 2017 KOREA Morning Focus Company News & Analysis Major Indices Close Chg Chg (%) Hanwha Corp. (000880/Buy/TP: W56,000) Upgrade rating & Present TP ' KOSPI 2,480.55 19.55 0.79 Earnings to improve on Hanwha E&C s normalization KOSPI 200 326.18 2.11 0.65 KOSDAQ 772.22 11.82 1.55 Sector News & Analysis Turnover ('000 shares, Wbn) Non-ferrous metals (Overweight) Volume Value Impact of Glencore’s zinc production restart KOSPI 251,104 5,028 KOSPI 200 89,459 4,107 KOSDAQ 1,131,049 5,394 Market Cap (Wbn) Value KOSPI 1,613,324 KOSDAQ 274,605 KOSPI Turnover (Wbn) Buy Sell Net Foreign 1,443 1,648 -205 Institutional 1,585 886 698 Retail 1,945 2,461 -515 KOSDAQ Turnover (Wbn) Buy Sell Net Foreign 412 324 88 Institutional 285 192 93 Retail 4,695 4,869 -174 Program Buy / Sell (Wbn) Buy Sell Net KOSPI 1,513 1,206 307 KOSDAQ 206 120 86 Advances & Declines Advances Declines Unchanged KOSPI 566 244 67 KOSDAQ 733 408 100 KOSPI Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value Samsung Electronics 2,566,000 -39,000 570 Hynix 76,800 -1,000 265 KODEX KOSDAQ150 LEVERAGE 17,680 280 191 NCsoft 488,000 22,000 189 KODEX 200 32,670 255 160 KOSDAQ Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value SillaJen 89,100 1,100 319 New Pride 4,850 145 263 Celltrion Healthcare 93,100 6,100 231 TissueGene(Reg.S) 54,100 4,300 225 Celltrion 210,000 4,400 205 Note: As of December 13, 2017 Mirae Asset Daewoo Research Hanwha Corp. -

UNIVERSITY of CALIFORNIA, IRVINE Measurement of Online

UNIVERSITY OF CALIFORNIA, IRVINE Measurement of Online Social Networks DISSERTATION submitted in partial satisfaction of the requirements for the degree of DOCTOR OF PHILOSOPHY in Networked Systems by Minas Gjoka Dissertation Committee: Athina Markopoulou, Chair Carter T. Butts Scott Jordan 2010 c 2010 Minas Gjoka TABLE OF CONTENTS Page LIST OF FIGURES v LIST OF TABLES x ACKNOWLEDGMENTS xi CURRICULUM VITAE xii ABSTRACT OF THE DISSERTATION xiii 1 Introduction 1 1.1 Motivation ................................... 1 1.1.1 Overview of Online Social Networks ................ 1 1.1.2 Why study Online Social Networks? ................. 3 1.1.3 Why sample Online Social Networks? ................ 5 1.2 Contributions ................................. 6 1.2.1 Social graph sampling ........................ 6 1.2.2 Multigraph sampling ......................... 7 1.2.3 Crawlers ............................... 7 1.2.4 Facebook applications ........................ 8 1.3 Thesis Outline ................................. 8 2 Related Work 9 2.1 Graph sampling techniques .......................... 9 2.2 Characterization studies of OSNs ....................... 13 3 Crawling Online Social Networks 17 3.1 What is crawling? ............................... 17 3.2 Data Collection ................................ 18 3.2.1 Legal Considerations ......................... 19 3.2.2 Challenges .............................. 19 3.2.3 Implementation ............................ 21 3.3 Summary ................................... 24 ii 4 Social graph sampling 26 4.1 Overview -

FTSE Korea 30/18 Capped

2 FTSE Russell Publications 19 August 2021 FTSE Korea 30/18 Capped Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) Alteogen 0.19 KOREA Hyundai Engineering & Construction 0.35 KOREA NH Investment & Securities 0.14 KOREA AmoreG 0.15 KOREA Hyundai Glovis 0.32 KOREA NHN 0.07 KOREA Amorepacific Corp 0.65 KOREA Hyundai Heavy Industries 0.29 KOREA Nong Shim 0.08 KOREA Amorepacific Pfd. 0.08 KOREA Hyundai Marine & Fire Insurance 0.13 KOREA OCI 0.17 KOREA BGF Retail 0.09 KOREA Hyundai Merchant Marine 1.02 KOREA Orion 0.21 KOREA BNK Financial Group 0.18 KOREA Hyundai Mipo Dockyard 0.15 KOREA Ottogi 0.06 KOREA Celltrion Healthcare 0.68 KOREA Hyundai Mobis 1.53 KOREA Paradise 0.07 KOREA Celltrion Inc 2.29 KOREA Hyundai Motor 2.74 KOREA Posco 1.85 KOREA Celltrion Pharm 0.24 KOREA Hyundai Motor 2nd Pfd. 0.33 KOREA Posco Chemical 0.32 KOREA Cheil Worldwide 0.14 KOREA Hyundai Motor Pfd. 0.21 KOREA Posco International 0.09 KOREA CJ Cheiljedang 0.3 KOREA Hyundai Steel 0.33 KOREA S1 Corporation 0.13 KOREA CJ CheilJedang Pfd. 0.02 KOREA Hyundai Wia 0.13 KOREA Samsung Biologics 0.92 KOREA CJ Corp 0.11 KOREA Industrial Bank of Korea 0.22 KOREA Samsung C&T 0.94 KOREA CJ ENM 0.15 KOREA Kakao 3.65 KOREA Samsung Card 0.08 KOREA CJ Logistics 0.12 KOREA Kangwon Land 0.23 KOREA Samsung Electro-Mechanics 0.81 KOREA Coway 0.36 KOREA KB Financial Group 1.78 KOREA Samsung Electronics 25.36 KOREA Daewoo Engineering & Construction 0.12 KOREA KCC Corp 0.12 KOREA Samsung Electronics Pfd. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Hyundai Steel (004020 KS /Buy )

Hyundai Steel (004020 KS /Buy ) Stake sale likely to lead to lower interest expenses Steel and higher dividend payout Issue Comment Following the merger between Hyundai Glovis and Hyundai Mobis’s spun-off businesses, March 29, 2018 Hyundai Steel is expected to sell its stake in Hyundai Mobis for roughly W1.13tr. Cash proceeds are estimated at W820bn (factoring in capital gains taxes). If the proceeds from the sale are used to repay debt, annual interest expenses would Mirae Asset Daewoo Co., Ltd. decrease and dividend payouts would likely expand. [ Metals & Mining ] Jaekwang Rhee Planning to sell Hyundai Mobis stake following merger +822 -3774 -6022 th [email protected] On March 28 , Hyundai Steel disclosed that it would sell its stake in Hyundai Mobis (012330 KS/Buy/TP: W300,000/CP: W261,000) to Hyundai Motor Group (HMG) chairman Chung Mong-koo and vice chairman Chung Eui-sun, once the merger between Hyundai Glovis (086280 KS/Buy/TP: W210,000/CP: W173,500) and Hyundai Mobis’s spun-off businesses is completed. Meanwhile, the firm will retain its stake in Hyundai Glovis. th Based on the March 28 closing price of Hyundai Mobis, we estimate the value of Hyundai Steel’s stake at W1.13tr, and actual cash proceeds from the sale (factoring in capital gains taxes) at W820bn. The actual sale price will be confirmed within two months of Hyundai Mobis’s listing change (slated for July 30 th ). Stake sale to lead to lower interest expenses and higher dividends Assuming that the spin-off and merger progress smoothly, Hyundai Steel is likely to use the proceeds from the sale of its stake in Hyundai Mobis for debt repayment. -

Strong Foundations Healthy Performance

STRONG FOUNDATIONS HEALTHY PERFORMANCE 2019 ANNUAL REPORT 2019 ANNUAL REPORT CONTENTS Anadolu Isuzu continues its Introduction 2 CORPORATE PROFILE operations in line with its growth 4 2019 FINANCIAL AND OPERATIONAL HIGHLIGHTS 6 HIGHLIGHTS IN 2019 strategy without interruption with 12 MESSAGE FROM THE CHAIRMAN OF THE BOARD OF DIRECTORS the market diversity its product 14 MESSAGE FROM THE PRESIDENT OF THE AUTOMOTIVE GROUP 16 MESSAGE FROM THE GENERAL MANAGER portfolio provides, its marketing 20 ANADOLU ISUZU FROM PAST TO PRESENT 22 SHAREHOLDERS OF ANADOLU ISUZU competencies and the support of 26 ANADOLU ISUZU’S PRODUCT PORTFOLIO its shareholders in the light of its 42 THE ECONOMY IN TURKEY AND THE WORLD 43 OVERVIEW OF THE SECTOR strengthening financial structure. In 2019 Tuğrul Arıkan 46 IN SUMMARY General Manager 47 EXPORT ACTIVITIES 53 MARKETING AND DEALER NETWORK DEVELOPMENT ACTIVITIES 55 AFTER-SALES SERVICES 56 SUPPLY CHAIN AT ANADOLU ISUZU 58 R&D AT ANADOLU ISUZU 62 PRODUCTION 64 ANADOLU ISUZU AND THE ENVIRONMENT 67 INDUSTRY 4.0 AND DIGITALIZATION PROJECTS 69 IM GLOBAL LEADER COMPANY 71 ENERGY PERFORMANCE OF ANADOLU ISUZU 72 HUMAN RESOURCES 78 OHS/EMPLOYEE SAFETY 79 SOCIAL AWARENESS PROJECTS AT ANADOLU ISUZU Corporate Governance 82 BOARD OF DIRECTORS 87 SENIOR MANAGEMENT 90 ORGANIZATION CHART 92 INDEPENDENT AUDIT REPORT 94 OTHER INFORMATION ABOUT ACTIVITIES 102 2019 AFFILIATE REPORT 103 CORPORATE GOVERNANCE Financial Information 125 CONSOLIDATED FINANCIAL STATEMENTS FOR THE PERIOD 31 DECEMBER 2019 AND INDEPENDENT AUDITOR’S REPORT FOR -

Annual Report DBX ETF Trust

May 31, 2021 Annual Report DBX ETF Trust Xtrackers Eurozone Equity ETF (EURZ) Xtrackers International Real Estate ETF (HAUZ) Xtrackers Japan JPX-Nikkei 400 Equity ETF (JPN) DBX ETF Trust Table of Contents Page Shareholder Letter ....................................................................... 1 Management’s Discussion of Fund Performance ............................................. 3 Performance Summary Xtrackers Eurozone Equity ETF ......................................................... 4 Xtrackers International Real Estate ETF .................................................. 6 Xtrackers Japan JPX-Nikkei 400 Equity ETF .............................................. 8 Fees and Expenses ....................................................................... 10 Schedules of Investments Xtrackers Eurozone Equity ETF ......................................................... 11 Xtrackers International Real Estate ETF .................................................. 16 Xtrackers Japan JPX-Nikkei 400 Equity ETF .............................................. 25 Statements of Assets and Liabilities ........................................................ 30 Statements of Operations ................................................................. 31 Statements of Changes in Net Assets ....................................................... 32 Financial Highlights ...................................................................... 34 Notes to Financial Statements ............................................................. 36 Report -

China Equity Strategy

June 5, 2019 09:40 AM GMT MORGAN STANLEY ASIA LIMITED+ China Equity Strategy | Asia Pacific Jonathan F Garner EQUITY STRATEGIST [email protected] +852 2848-7288 The Rubio "Equitable Act" - Our Laura Wang EQUITY STRATEGIST [email protected] +852 2848-6853 First Thoughts Corey Ng, CFA EQUITY STRATEGIST [email protected] +852 2848-5523 Fran Chen, CFA A new bill sponsored by US Senator Marco Rubio has the EQUITY STRATEGIST potential to cause significant change in the listing domains of [email protected] +852 2848-7135 Chinese firms. After the market close in the US yesterday 4th June the Wall Street Journal published an Op-Ed by US Senator Marco Rubio in which he announced that he intends to sponsor the “Equitable Act” – an acronym for Ensuring Quality Information and Transparency for Abroad-Based Listings on our Exchanges. At this time the text of the bill has not been published and we are seeking additional information about its contents and likelihood of passing. However, our early reaction is that this has the potential to cause significant changes in the domain for listings of Chinese firms going forward with the potential for de- listing of Chinese firms on US exchanges and re-listing elsewhere (most likely Hong Kong). More generally we see this development as part of an increased escalation of tensions between China and the US on multiple fronts which should cap the valuation multiple for China equities, in particular in the offshore index constituents and US-listed parts of the universe. We provide a list of the potentially impacted China / HK names with either primary or secondary listings on Amex, NYSE or Nasdaq. -

STOXX Asia 100 Last Updated: 03.07.2017

STOXX Asia 100 Last Updated: 03.07.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) KR7005930003 6771720 005930.KS KR002D Samsung Electronics Co Ltd KR KRW Y 256.2 1 1 JP3633400001 6900643 7203.T 690064 Toyota Motor Corp. JP JPY Y 128.5 2 2 TW0002330008 6889106 2330.TW TW001Q TSMC TW TWD Y 113.6 3 3 JP3902900004 6335171 8306.T 659668 Mitsubishi UFJ Financial Group JP JPY Y 83.5 4 4 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 77.2 5 5 JP3436100006 6770620 9984.T 677062 Softbank Group Corp. JP JPY Y 61.7 6 7 JP3735400008 6641373 9432.T 664137 Nippon Telegraph & Telephone C JP JPY Y 58.7 7 8 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 58.2 8 6 TW0002317005 6438564 2317.TW TW002R Hon Hai Precision Industry Co TW TWD Y 52.6 9 12 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 52.0 10 10 JP3890350006 6563024 8316.T 656302 Sumitomo Mitsui Financial Grou JP JPY Y 48.3 11 15 INE040A01026 B5Q3JZ5 HDBK.BO IN00CH HDFC Bank Ltd IN INR Y 45.4 12 13 JP3854600008 6435145 7267.T 643514 Honda Motor Co. Ltd. JP JPY Y 43.3 13 14 JP3435000009 6821506 6758.T 682150 Sony Corp. JP JPY Y 42.3 14 17 JP3496400007 6248990 9433.T 624899 KDDI Corp. JP JPY Y 42.2 15 16 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 41.1 16 19 JP3885780001 6591014 8411.T 625024 Mizuho Financial Group Inc. -

Essel Ar 09-10(Final)-Single Pgs.Qxp

4SMWIHXSHIPMZIV %RRYEP6ITSVX 1IWWEKIJVSQXLI'LEMVQER 1IWWEKIJVSQ:MGI'LEMVQER 1EREKMRK(MVIGXSV &SEVHSJ(MVIGXSVW (MVIGXSVW 6ITSVX 1EREKIQIRX(MWGYWWMSR %REP]WMW 'SVTSVEXI+SZIVRERGI6ITSVX *MRERGMEP7XEXIQIRXW7XERHEPSRI *MRERGMEP7XEXIQIRXW'SRWSPMHEXIH Poised to Deliver The last few years have presented challenges and We are working to improve our cost opportunities. competitiveness and shrink the debt on our Balance Sheet. Challenges that shook the world and took profits away from global businesses like ours. Opportunities that We are now prepared to embark upon a steady growth allowed us to dominate our space, increase efficiency, to trajectory, our focus on the quality of growth that challenge and change, to consolidate and grow. enhances margins and return on capital. At Essel Propack, we moulded the challenges into We are a new Essel Propack. opportunities. With renewed vigour. With renewed focus. With fresh In 2009-2010, we turned around swiftly and surely. We energy. With fresh aggression. reported a Net Profit of Rs. 599 million for the fifteen And a new world to cater to. A world where Asia will months period ending 31st March, 2010 against a loss of grow. And USA and Europe will stabilise. Rs. 883 million in the year 2008. A world where players who are cost conscious and close We divested our medical devices business in 2009 to to the customer will enhance their market share and focus on growing our core tubing business better their margins. globally. We look at the future with a lot of promise and We are building strong customer relationships confidence. based on our reliable and superior delivery model. We feel that the next few years belong to companies like We are aggressively driving growth in Asia to us that have a solid reputation with the customers, significantly add volumes and build scale. -

Financial Services Sector in Turkey

Financial Services Sector in Turkey June 2016 Investment Support and Promotion Agency of Turkey 1 Glossary of Terms Acronym Definition Acronym Definition ATM Automated Teller Machine Insurance Claims Follow-up and HAYMER AUM Assets Under Management Monitoring System BIST Borsa Istanbul IMF International Monetary Fund BKM Interbank Card Center Banking Regulation and Supervision N/D No Data BRSA Agency NPL Non-Performing Loan CAGR Compound Annual Growth Rate O/N Overnight Organization for Economic Cooperation CAR Capital Adequacy Ratio OECD CBRT Central Bank of the Republic of Turkey and Development CEO Chief Executive Officer Q Quarter CMB Capital Markets Board of Turkey ROA Return on Assets ROE Return on Equity CRD Capital Requirements Directive Health Insurance Information and European Bank of Reconstruction and SAGMER EBRD Monitoring Center Development SME Small and Medium Enterprises EGM Pension Monitoring Center TBB Turkish Bank Association EIU Economist Intelligence Unit TL Turkish Lira EU European Union TSRB Insurance Association of Turkey FCI Factors Chain International The Association of Capital Market TSPAKB FDI Foreign Direct Investment Intermediary Institutions of Turkey FİDER Turkish Leasing Agency GDP Gross Domestic Product Life Insurance Information and Monitoring HATMER Center Investment Support and Promotion Agency of Turkey 2 Table of Contents Executive Summary 4 C. Turkey’s Competitive Landscape 54-67 A. Turkish Financial Services 5-48 i. Turkey’s Macroeconomic Outlook i. An Overview of Turkish Financial Industry ii. Favorable Demographics ii. The Banking Sector in Turkey iii. Skilled and Cost-Competitive Labor Force iii. Insurance and Pension Funds in Turkey iv. Investment Environment & Stakeholders iv. Financial Leasing in Turkey v. -

Abstract: the Purpose of This Paper Is to Investigate

THE ECONOMIC COST OF NUCLEAR THREATS: A NORTH KOREA CASE STUDY. Abstract: The purpose of this paper is to investigate how public announcements of a nation’s nuclear programme development influence neighbouring countries’ stock markets. The countries examined in this case study are North and South Korea. To test this relationship I conducted an event study using MacKinlay’s market model. Six announcement days were studied comprising out of three nuclear tests and three missile and satellite related tests. The findings of this research are in contrast to prior research. Empirical researches on the economic effects of terrorism suggest that acts of terrorism create large impacts on economic activity. The results of our event study show that the announcements caused both negative and positive reactions on the market. Author: Ryan McKee Student number: 6181066 Supervisor: Shivesh Changoer Date: 8th of Jan, 2014 ETCS: 12 INTRODUCTION Stock prices represent investor’s expectations about the future. News announcements effect these expectations on a day to day basis. Terrorist attacks, military invasions, nuclear threats or any other ambivalent events can alter investor’s expectations and so allow the prices of stocks and bonds to deviate from their fundamental value. Once such events have taken place investors often defer from the market in search of safer, more secure financial investments which can lead to panic and chaos on the markets (Chen and Siems, 2004). Such chaos can also be caused by threats from other neighbouring countries. A perfect example of this is the relationship between North and South Korea. Ever since the division of North and South Korea on September 8, 1945 the two bordering nations have had a strenuous relationship, ultimately leading to the Korean war of 1950-1953.