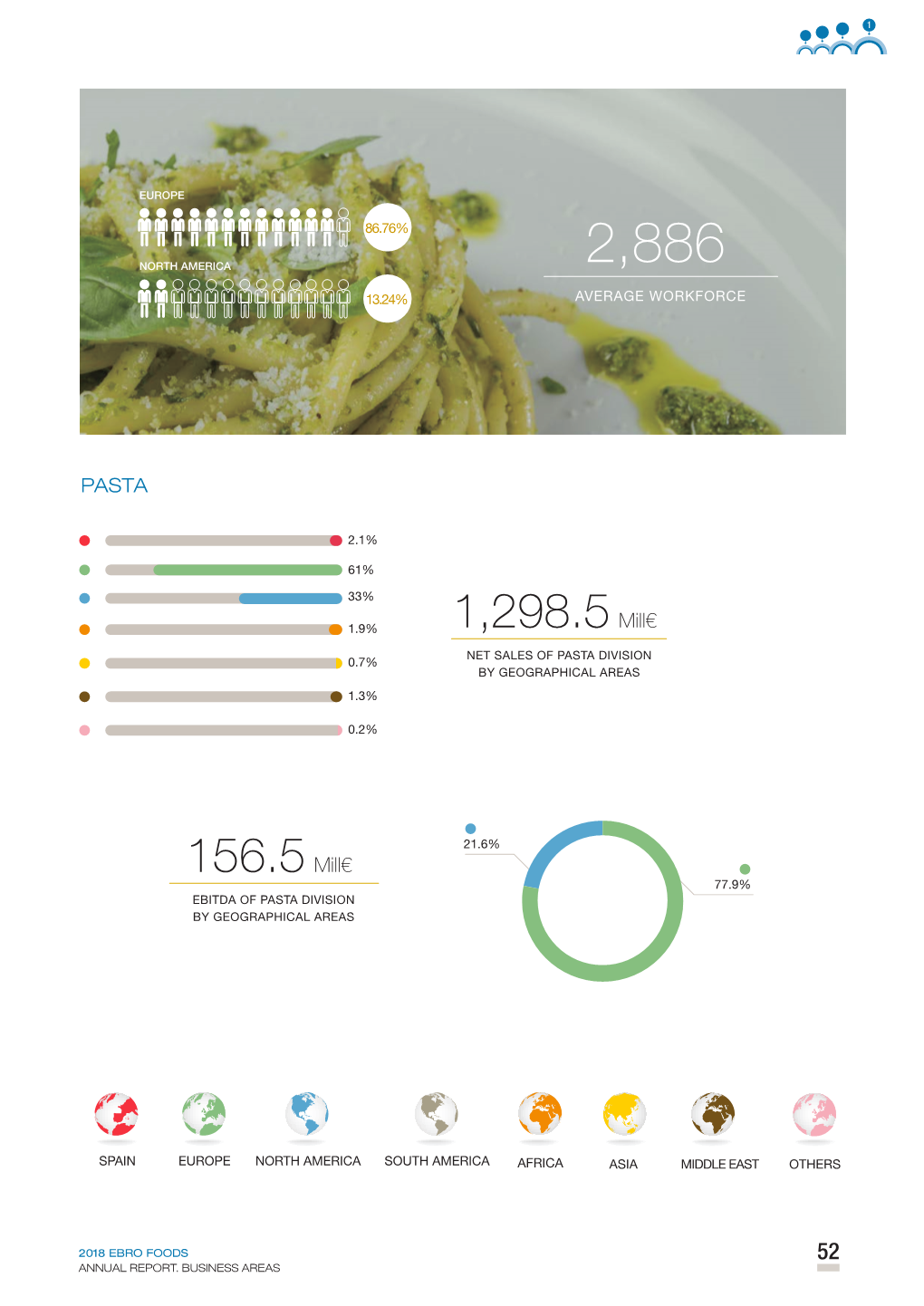

1,298.5 Mill€ 0.2% NET SALES of PASTA DIVISION 0.7% by GEOGRAPHICAL AREAS 1.3%

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TITOLO: Il Benefattore AUTORE: Capuana, Luigi TRADUTTORE: CURATORE: NOTE: Realizzato in Collaborazione Con Il Project Gutenberg

TITOLO: Il Benefattore AUTORE: Capuana, Luigi TRADUTTORE: CURATORE: NOTE: Realizzato in collaborazione con il Project Gutenberg <http://www.gutenberg.net/> tramite Distributed Proofreaders <http://www.pgdp.net/>. DIRITTI D'AUTORE: no LICENZA: questo testo è distribuito con la licenza specificata al seguente indirizzo Internet: http://www.liberliber.it/biblioteca/licenze/ TRATTO DA: da: "Il Benefattore" di Luigi Capuana Carlo Liprandi editore Milano 1901 CODICE ISBN: mancante 1a EDIZIONE ELETTRONICA DEL: 12 aprile 2003 INDICE DI AFFIDABILITA': 1 0: affidabilità bassa 1: affidabilità media 2: affidabilità buona 3: affidabilità ottima ALLA EDIZIONE ELETTRONICA HANNO CONTRIBUITO: Distributed Proofreaders, http://www.pgdp.net/ REVISIONE: Claudio Paganelli, [email protected] PUBBLICATO DA: Claudio Paganelli, [email protected] Stefania Ronci, [email protected] Livros Grátis http://www.livrosgratis.com.br Milhares de livros grátis para download. Luigi Capuana IL BENEFATTORE MILANO CARLO LIPRANDI, EDITORE 31 - Via Durini - 34 1901 Compiute le formalità prescritte dalla legge, i diritti di riproduzione e traduzione sono riservati. Si riterrà contraffatto qualunque esemplare di questa opera, che non porti la firma dell'autore. TIPOGRAFIA MARCOLLI E TURATI Milano - Corso Garibaldi, 20. IL BENEFATTORE I. Dal balcone centrale dell'Albergo del Gallo in piazza del Municipio a Settefonti, visto fermare la carrozza davanti al portoncino, l'albergatore era sceso giù in maniche di camicia, per dare il ben arrivato ai forestieri; e rimaneva un po' deluso, scorgendo che la carrozza ne conteneva uno solo. Il quale poi non si affrettava a smontare, ma restava rannicchiato in fondo al legno, con gli occhi socchiusi, quasi non avesse ancora avuto il tempo di svegliarsi interamente dal sonno fatto lungo la strada. -

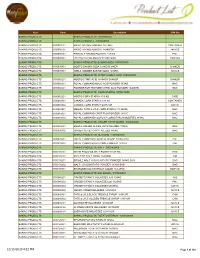

Crown Pacific Fine Foods 2019 Specialty Foods

Crown Pacific Fine Foods 2019 Specialty Foods Specialty Foods | Bulk Foods | Food Service | Health & Beauty | Confections Crown Pacific Fine Foods Order by Phone, Fax or Email 8809 South 190th Street | Kent, WA 98031 P: (425) 251-8750 www.crownpacificfinefoods.com | www.cpff.net F: (425) 251-8802 | Toll-free fax: (888) 898-0525 CROWN PACIFIC FINE FOODS TERMS AND CONDITIONS Please carefully review our Terms and Conditions. By ordering SHIPPING from Crown Pacific Fine Foods (CPFF), you acknowledge For specific information about shipping charges for extreme and/or reviewing our most current Terms and Conditions. warm weather, please contact (425) 251‐8750. CREDIT POLICY DELIVERY Crown Pacific Fine Foods is happy to extend credit to our You must have someone available to receive and inspect customers with a completed, current and approved credit your order. If you do not have someone available to receive your application on file. In some instances if credit has been placed order on your scheduled delivery day, you may be subject to a on hold and/or revoked, you may be required to reapply for redelivery and/or restocking fee. credit. RETURNS & CREDITS ORDER POLICY Please inspect and count your order. No returns of any kind When placing an order, it is important to use our item number. without authorization from your sales representative. This will assure that you receive the items and brands that you want. MANUFACTURER PACK SIZE AND LABELING Crown Pacific Fine Foods makes every effort to validate To place an order please contact our Order Desk: manufacturer pack sizes as well as other items such as Phone: 425‐251‐8750 labeling and UPC’s. -

12/15/2019 4:22 PM Page 1 of 120

Item Code Description U/M Set BAKING PRODUCTS BAKING PRODUCTS - 0300000000 BAKING PRODUCTS BAKING POWDER - 0300080000 BAKING PRODUCTS 0300080101 MAGIC BAKING POWDER 1X2.5KG CONTAINER BAKING PRODUCTS 0300080102 MAGIC BAKING POWDER 24X450GR 24X1CS BAKING PRODUCTS 0300080201 PINNACLE BAKING POWDER 1X5 KG PAIL BAKING PRODUCTS 0300080301 LIEVITO BAKING POWDER 100X16GR 100X1CS BAKING PRODUCTS BAKING PRODUCTS: BAKING SODA -0300030000 BAKING PRODUCTS 0300030401 MOSTO BAKING SODA 1X1KG SHAKER SHAKER BAKING PRODUCTS 0300030501 ARM & HAMMER BAKING SODA 12X2KG 12X1CS BAKING PRODUCTS BAKING PRODUCTS: CITRIC & MALIC ACID -0300060000 BAKING PRODUCTS 0300060201 MOSTO CITRIC ACID 1X454GR SHAKER SHAKER BAKING PRODUCTS 0300060301 ROYAL COMMAND MALIC ACID POWDER 1X1KG BAG BAKING PRODUCTS 0300060401 POWDER FOR TEXTURE CITRIC ACID POWDER 1X400GR BAG BAKING PRODUCTS BAKING PRODUCTS: CORN STARCH -0300010000 BAKING PRODUCTS 0300010201 MOSTO CORN STARCH 1X5 KG CASE BAKING PRODUCTS 0300010301 CANADA CORN STARCH 1X1 KG CONTAINER BAKING PRODUCTS 0300010302 CANADA CORN STARCH 6X454GR 6X1CS BAKING PRODUCTS 0300010501 MEOJEL TATE & LYLE CORN STARCH 1X 50LBS BAG BAKING PRODUCTS 0300010601 ROYAL COMMAND CRISP FILM POWDER 1X1KG BAG BAKING PRODUCTS 0300010602 ROYAL COMMAND COLFO 67 CORNSTARCH MODIFIED 1X1KG BAG BAKING PRODUCTS BAKING PRODUCTS: GINGER CRYSTALIZED - 0300050000 BAKING PRODUCTS 0300050301 MOSTO GINGER SLICES CRYSTALLIZED 1X1KG BAG BAKING PRODUCTS 0300050302 GINGER SLICES CRYSTALLIZED 1X5KG BAG BAKING PRODUCTS BAKING PRODUCTS: GLUCOSE - 0300020000 BAKING PRODUCTS -

Gazzetta Ufficiale Del Regno D'italia N. 074 Del 27 Marzo 1941 Supplemento Ordinario

Conto corrento con la Posta ordinario " 27 1941-XIX Supplemento alla Gazzetta Uniciale ,, n. 74 del marzo GAZZETTA UFFICIALE ' - - DEL REGNO - D I TAL IA PARTE PRIMA swayryggy- DIREZIONE E REDAZIONE PRESSO IL MINISTERO DI CRAZIA E CIUSTIZIA - UFFICIO PUBBLICAZIONE DELLE LECCI - TELEFONI: 50-107 - 50-033 - 53-914 MINISTERO DELUEDUCAZIONE NAZIONALE Elenco delle persone che nell'anno scola- stico 1939-40-XVIII hanno conseguito l'abili- tazione all'esercizio professionale dell'insegna- mento negli Istituti medi d'istruzione classica, scientifica e magistrale. Ipplemento ordinario alla GAZZETTA UFFTCIALE n. 14 del 27 marzo 1911 XIX g con 63 -- su 75 62. Broccoli Maria . punti a 63- » E COMUNICATI 03. Cardinali Gabriella. DISPOSIZIONI e 63- a 64. Cogliani Helda . a a 65. Costanzo Adriana. 63- 66. De Caris Maria Antonietta a 63 - a a 63- a 67. Egi Natalina . a 63- a MINISTERO 68. Fantini Eugenia . a 63 - a 69. Fossati Maria . » 63 a » DELL'EDUCAZION1|| NAZIONALE 70. Giordano Lanza Vers . 71. Masci Andreaina » 63 - a a - » Pieriboni Lietta . 63 che nell'anno scolastico 1939•40•XVIII hanno 72. Elenco delle persone » 63- a Iris . l'abilitazione all'esercizio professionale dell'inse. 73. SPerben conseguito a 63- » Istituti medi d'istruzione classica, scientifica 74. Squatriti Elsa . gnamento negli » 63- a 75. Valo Ada . e magistrale. 76. Vistosi Maria Antonietta » 03- a » 63- a 77. Zoboli Maria Anna . Concorsi ed esami di abilitazione » a 78. Pinto Anna . 62,99 banditi con decreto Ministeriale 27 ottobre 1939-XVII. » a . 62,50 79. Mascolo Anna .. » a . *. 80. Maturi Renato . 02,50 e letteratura italiana e latina » » Lingua . -

Da Un Calvario All'altro

Sede: Via Vittorio Emanuele, 9 – 55032 Castelnuovo G. ORARI SPORTELLI AL PUBBLICO COMUNITÀ MONTANA Tel. 0583 644911 – Fax 0583 644901 Catasto, sportello cartografico e Vincolo Idrogeologico: Sito: www.cm-garfagnana.lu.it lunedì e mercoledì dalle ore 8.45 alle 12.30; giovedì dalle ore DELLA GARFAGNANA E-mail: [email protected] 8.45 alle 12.30 e dalle 15 alle 17. Tel Eliporto: 0583 666680 – Tel Vivaio Forestale: 0583 618726 SUAP: lunedì e giovedì dalle ore 8.45 alle ore 12.30 e dalle Comuni componenti: Camporgiano, Careggine, Castelnuovo di Servizio Antincendi Boschivi e Protezione Civile 0583 641308 ore 15 alle 17. Garfagnana, Castiglione di Garfagnana, Fosciandora, Gallicano, Orario di apertura al pubblico degli uffici Camera di Commercio: lunedì e giovedì dalle ore 8.45 alle Lunedì e mercoledì dalle ore 8.45 alle ore 12.30; ore 12; primo e terzo venerdì del mese dalle ore 9 alle ore 12. Giuncugnano, Minucciano, Molazzana, Piazza al Serchio, Pieve giovedì dalle ore 8.45 alle ore 12.30 e dalle 15 alle 17 Difensore Civico della Comunità Montana e dei Comuni Fosciana, San Romano Garfagnana, Sillano, Vagli Sotto, Vergemoli, Banca dell’Identità e della Memoria aderenti: giovedì dalle ore 10.30 alle ore 12.30 previo Villa Collemandina Centro di documentazione del territorio appuntamento telefonico (0583 644911). Mensile indipendente di Attualità - Informazione - Relazioni con l’Estero fondato nel 1881 “Spedizione in a.p. - 45% - art. 2 comma 20/b legge 662/96 - Filiale di Lucca” ABBONAMENTI 2008 Direz. Redaz.: Tel. e Fax (0583) 644354 ITALIA: Ordinario ¤ 20,00 - Sostenitore ¤ 25,00 - Benemerito ¤ 50,00. -

Northeast Product Catalog

PRODUCT CATALOG NORTHEAST chefswarehouse.com BAKING AND PASTRY PIES AND TARTS ..........................11 BEVERAGES, CHEDDAR...................................19 CHARCUTERIE FILLING ........................................4 BAKED/PREPARED BREADS .......11 COFFEE AND TEA CREAM CHEESE .........................19 FATBACK AND LARD ..................26 BREAD CRUMBS .........................11 ETHNIC ........................................19 GLAZE .........................................4 BAR MIXERS ................................15 PANCETTA ...................................26 CRACKERS..................................11 FETA.............................................19 TECHNICAL BAKING ..................4 BITTERS .........................................15 PATE .............................................26 FROZEN/RTB BREAD ...................11 FONTINA .....................................19 DÉCOR ........................................4 COCONUT MILK .........................15 PROSCIUTTO ...............................26 PIZZA SHELLS ...............................11 GOAT CHEESE ............................20 BAKING MIXES ............................4 CORDIAL ....................................15 SALAMI AND CURED MEATS .....26 TORTILLAS/WRAPS......................11 GOUDA.......................................20 SAUCE, PASTE .............................6 JUICE ...........................................15 WAFERS.......................................11 HAVARTI.......................................20 FLAVORING COMPOUNDS .......6 -

TGM Curbside Flyer

410-263-1324 [email protected] HEREC AREU SOMRE OFB OURS MOISTD POPUELAR PPRODUICCTS TOK GETU YOUP STA RTED, IF YOU ARE LOOKING FOR SOMETHING THAT YOU DON’T SEE ON THIS LIST, JUST ASK! PLACE YOUR ORDER BETWEEN 11AM - 5PM, 7 DAYS A WEEK PICKUP: WE WILL CALL YOU WHEN YOUR ORDER IS READY PICKUP HOURS: 12PM - 4PM PASTA ESSENTIALS BAKING ESSENTIALS Rustichella Penne King Arthur All Purpose Flour Rustichella Spaghetti King Arthur Bread Flour Rustichella Linguine Red Star Dry Active Yeast Rustichella Pappardelle Eggs Rustichella Squid Ink Spaghetti Butter Rustichella Whole Wheat Spaghetti Heavy Cream & Half n Half Anfosso Trofie Mancini Bucantini BREAD Baguette Bertagni 4 Cheese Tortellini (fresh) 8-pack Fusette rolls Bertagni Ricotta & Spinach Ravioli (fresh) 6-pack Green olive rolls Mamma Emma Mini Gnocchi 4-pack Ciabatta rolls Brioche Whole, Sliced, Rolls Anfosso Basil Pesto Anfosso Red Pepper Pesto PANTRY ESSENTIALS Anfosso Sundried Tomato Pesto Du Puy Lentils Casina Rosa Puttanesca Dry Beans Italianvera Basil Pomodoro Aneto Broths Arrabbiata Crackers, Cookies Canned Italian Tomatoes 28oz Dried Fruits, Nuts Mustards, Jams, Honeys Olive Oils and Vinegars 410-263-1324 [email protected] FEATURED PREPARED FOODS QUICHES whole/half SANDWICHES Lorraine Mini Ham & Brie Parisian Mini Salami & Provolone Roasted Vegetable & Goat Cheese The Parisian Potato Leek Roast Beef Roast Turkey SALADS Muffalata Tastings House Salad Pancetta, Fig Jam, & Brie Greek Salad Poached Pear with Blue Cheese BAKERY Croissant Chicken Caesar Salad Pain au Chocolat Chocolate Chunk Cookies & Mini Bag SOUPS Bindi Italian Desserts Available in Quarts & Pints, ask for daily selections FOCACCIA We make focaccia daily and sell by the GOURMET SALADS pound. -

Il Mercato Italia Della Pasta Fresca: Produzione, Distribuzione, Consumo

PL Percorsi di lettura Periodico di economia a marketing sulla filiera dei beni di consumo Reg. Trib. Mi. n. 268 del 24/04/08 Tamburino - www.largoconsumo.info Documento in versione interattiva: www.largoconsumo.info/122008/PL-1208-002.pdf PASTA FRESCA Costi del Percorso di lettura: Per ordini: [email protected] 126,00 (comprensivo iva) - non abbonati Aggiornato a: Largo Consumo 12/08 e supplementi 76,50 (comprensivo iva) - abbonati Rif: PL-1208-002 Clicca qui per i costi dei singoli titoli Aggiornamenti: Verifica la disponibilità di un'edizione più aggiornata di questo Percorso di lettura. Se non sai cosa sia un Percorso di lettura, trovi una spiegazione alla pagina www.largoconsumo.info/percorsi LE FONTI DI QUESTO PERCORSO DI LETTURA E SUGGERIMENTI PER L'APPROFONDIMENTO DEI TEMI: Mercato Italia - Agroalimentare Osservatorio D'Impresa Rapporto sullo stato delle imprese Leggi le case history di I risultati finanziari delle principali imprese nazionali, la produzione industriale e comunicazioni d'impresa le esportazioni, i consumi interni e principali competitor internazionali di questo di Aziende e organismi comparto. attivi nei mercati considerati in questo Mercato & Imprese Percorso di lettura Opinioni e prospettive dall'industria del largo consumo selezionati da Ogni anno, Mercato & Imprese ospita interviste ad alcuni fra i più accreditati Largo Consumo esponenti di aziende di primo piano dell'industria alimentare e grocery non food. I contenuti giornalistici sono sviluppati in forma di interviste, tante quanti -

La Responsabilità Sociale Delle Imprese: La Prospettiva Euro- Pea, Di Marina Monaco E Claudio Stanzani

SOCIOLOGIA DEL LAVORO n. 106-107 SOCIOLOGIA DEL LAVORO diretta da Michele La Rosa Comitato direttivo: Giuseppe Bonazzi, Federico Butera, Domenico De Masi, Michele La Rosa Consiglio di direzione: Aris Accornero, Leonardo Altieri, Giuseppe Bonazzi, Federico Butera, Carlo Car- boni, Vanni Codeluppi, Michele Colasanto, Domenico De Masi, Giampaolo Fa- bris, Michele La Rosa, Everardo Minardi, Enzo Mingione, Francesco Novara, Massimo Paci, Angelo Pichierri, Emilio Reyneri, Adriana Signorelli, Mino Via- nello, Luciano Visentini, Paolo Zurla Corrispondenti per l’estero: Juan Josè Castillo (Madrid), Pierre Dubois (Nanterre), Claude Durand (Paris), Bryn Jones (Bath), Jean-Louis Laville (Paris), Roger Penn (Lancaster), Pierre Rolle (Paris), Gert Schmidt (Stuttgart), Bengt Starrin (Karlstad), Vladimir Ruka- viscnikov (Mosca), Eugheni Novosselov (Mosca) e Vil Savbanovic Bakirov (Kharkov), George Tsobanoglou (Univ. Aegeen, Grecia) Segreteria redazionale: Vando Borghi (mercoledì 11-13, tel. 051-2092866) ([email protected]) (coordinatore) Roberto Rizza ([email protected]) Federico Chicchi ([email protected]) Mauro Ferraresi ([email protected]) Sociologia del lavoro ha un accordo di collaborazione con Sociologie du Travail, trimestrale francese pubblicato dall’Associazione per lo sviluppo della sociologia del lavoro, con sede in Parigi. Analogo accordo di collaborazione ha con Soziologhiceschie Issledovania (Studi Sociologici), mensile dell’Associazione Russa di Sociologia. Hanno collaborato alla stesura del presente volumee: Enzo Argante, -

QUICK GUIDE January 22–24, 2017 MOSCONE CENTER, San Francisco BEFORE SHE ENJOYS IT HERE

42ND WINTER FANCY FOOD SHOW QUICK GUIDE January 22–24, 2017 MOSCONE CENTER, San Francisco BEFORE SHE ENJOYS IT HERE SHOW DATES/ HOURS Sunday, Jan. 22 Monday, Jan. 23 10 a.m.–5 p.m. Tuesday, Jan. 24 10 a.m.–4 p.m.* *Gateway Ballroom opens at 9:30 a.m. You’ll DISCOVER it here #WFFS17 BROUGHT TO YOU BY FANCYFOODSHOWS.COM You’ll DISCOVER it here BROUGHT TO YOU BY WHERE DELICIOUS GETS ITS BIG BREAK Discover 1,500 exhibitors from around the world and 80,000 exciting specialty foods & beverages! New Brands on the Shelf What’s New, What’s Hot! Specialty Food South Hall | Front of the 4300 aisle Showcase Association Booth Get a close-up look at the North Building | Lower Lobby North Building | Lower Lobby products poised to take the This targeted showcase Check out the Specialty Food industry by storm with the features hundreds of products Association booth to discover Specialty Food Association’s following the hottest trends how the SFA partners with Member Candidates, who in new foods and beverages, producers and buyers to foster are showcasing dozens of gift ideas, and natural and growth in the specialty food niche and artisanal specialties. organic products. industry year-round. Education Program: sofi Winner Showcases Learn from the Experts North Building | Lower Lobby Discover powerful seminars that The sofi Awards are the specialty will leave you with ideas and food industry’s most prestigious inspiration from some of the honor, celebrating the best of the industry’s top thought leaders. best in specialty food. -

"Col Tempo E Con La Paglia Maturano Le Nespo «/TRARNO Chiod" class="text-overflow-clamp2"> COLÔNIA "«¦^^M-P ___$ ¦___**• **-.// (ALÇADOS VÍÊ 5*__^> "Col Tempo E Con La Paglia Maturano Le Nespo «/TRARNO Chiod

ANNO XVII SanPaoío 7 Febbraio ÍWVTOREÍ (Brasile) 1925 NUM. 899 -¦"•r:s\ A. '• Jfk. V--.^-.£.V.,-."C^*4"_;4.^ K _______¦ SsmE* '^^iHi _________1 ______________P**M_*_____^-_u___fÍF?__-____?yj'* i**X »í_k ^4 N_______*-_____.**^^M^MMm4^ -"''' ^*HH »__•*_r_BS__&f **- r'-<_i,v_9»»ftiç—a «*•*isl F-STíS ^ I ^V7___Í____P^__L_BL_ Jja£ss. ,I ^S_____P*'_r Vtnrw_k__F ,_r^BH_r ff&lmw °_ Mh_Es 1____1íTít>fi Sif9 "3 m ¦_______¦bB-TC -V ' <"n 7 MEilçj aa\ COLÔNIA "«¦^^M-P ___$_¦___**• **-.// (ALÇADOS VÍÊ_5*__^> "Col tempo e con la paglia maturano le nespo «/TRARNO ChiOD. Uffici: Tres de Dezembro, Abbonamento annuo. ls$ooo R. KAíÇA ANTÔNIO PSUM-C; tt N.o 5 - l.o and. (Antica Bôa HAft-P0i*£l£6ANTB Un semestre . 8$ooo Vista) — Caixa, 927 »¦ ¦ æei I ¦¦.__.___ B-wwu_nwn_w ¦_» ¦_¦** •_«-_. -—.apa¦¦ iftwcw..ea— i. *:•¦__ *«•- i C »"-¦•" tj t. _-_v_k.-t E ____*«»_ r"-"**r m» ..J r____*" mknM. B M*-»- i j-"--»»_a !wwmw__I | )í r_S1-_3F__.^Fdpdp^^ La guerra al Marocco si prolunga per aiüti MACCHIAVELLICA misteriosi- 1 li R(Dai giornali). 7_ illilf!iH'«J^J_ 7.caFa_s_-____-_____-TO-_u__i__^^*c~~-°ii_3aSi__B__BJB*iaí^^llí.il TÍ /í^^tK1 Ü /°1ÈÍa&íl !s B&¦ .».¦."«¦• a_al-2_ ^___5S_-„_£5*__>__-USl I 1 ^7%SL>^ / / £A% O:ll ]r^w^j?3* -j&fcs^vL is___»a__^íS _^®3i^^v^ 1"íâ n 5 ,^k^^ 1 J IIw: 1/ -|^W<^p*w«!*^*¦'^^^,^ jl 11fi^_^*v_á^__11 ¦¦ ____¦t. -

POLITECNICO DI TORINO Corso Di Laurea Magistrale in Engineering and Management

POLITECNICO DI TORINO Corso di Laurea Magistrale In Engineering and Management Tesi di Laurea Magistrale European and Italian Pasta Industry: recent trends and firms performance Relatore Candidato Prof. Luigi Benfratello Vittorio Grimaldi Matr. 232569 Index 0. ABSTRACT .............................................................................................................................................. 4 1. HISTORY, BACKGROUND AND PRODUCT FEATURES ................................................................. 5 1.1 Historical background........................................................................................................................ 5 1.2 Product feature ................................................................................................................................... 8 2. PRODUCTION STRUCTURE OF THE PASTARIAN INDUSTRY ............................................................. 19 2.1 The role of the pasta industry in the wheat supply chain................................................................. 19 2.2 Product flows in the wheat supply chain ......................................................................................... 22 2.3 Organization of pasta production .................................................................................................... 23 2.4 Dry pasta production process - Process cycle for dry pasta production .......................................... 29 3. MARKET STRUCTURE IN ITALY .....................................................................................................