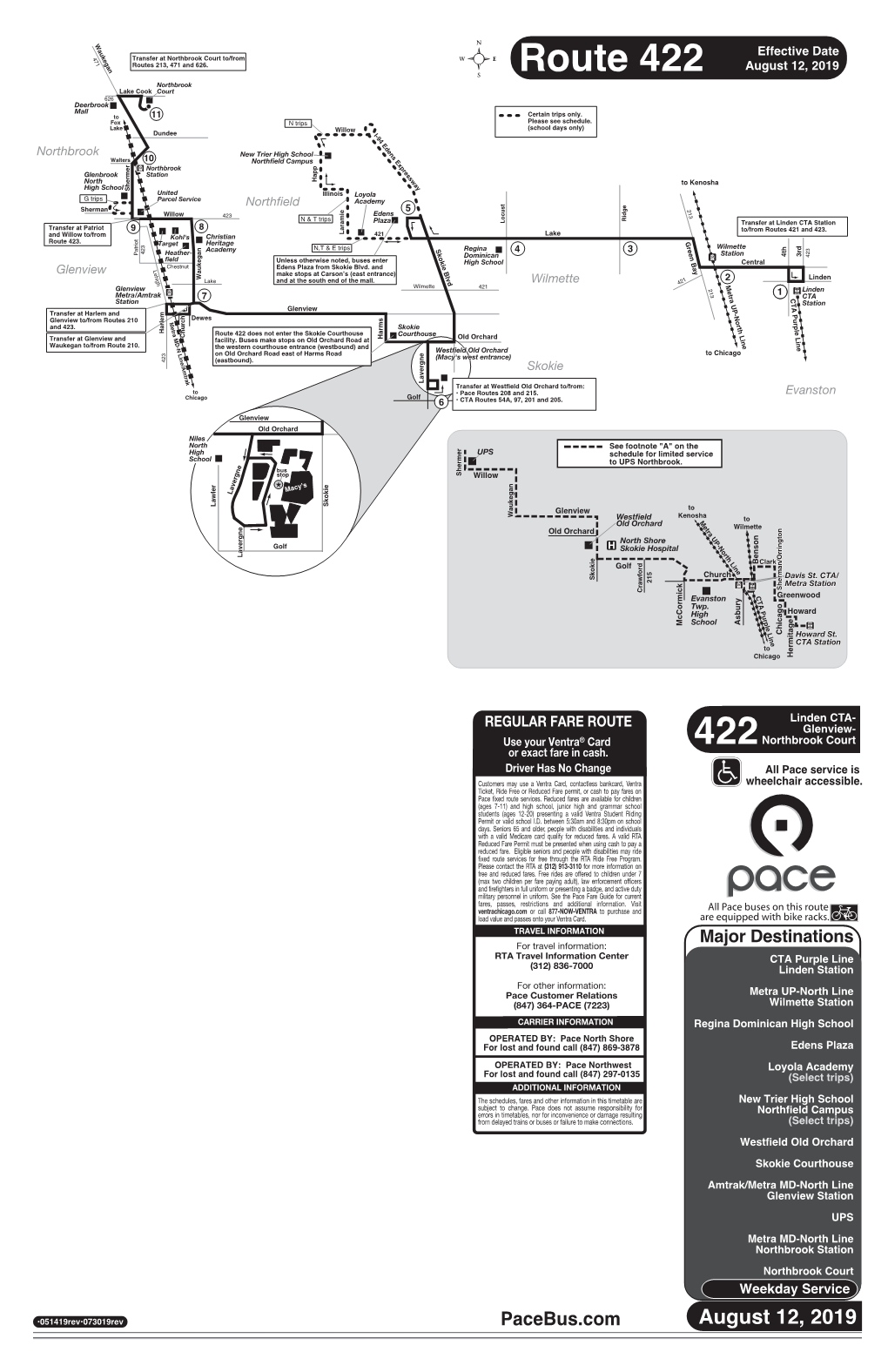

Route 422 Schedule.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

June 2020 Project Management Oversight Report

Project Management Oversight June 2020 REPORT ON PROJECT MANAGEMENT OVERSIGHT – JUNE 2020 Executive Summary This semi‐annual Report on Project Management Oversight details Service Board efforts in implementing their capital programs. Included are details on all state‐funded projects, regardless of budget, and all systemwide projects with budgets of $10 million or more, regardless of funding source. Information in this report was collected by direct interviews, project meetings, and documented submissions from Service Board project management teams. The RTA’s 2018‐2023 Regional Transit Strategic Plan, Invest in Transit, highlights $30 billion of projects that are needed to maintain and modernize the region’s transit network. To maintain and preserve the current system in a State of Good Repair (SGR), as well as address the backlog of deferred SGR projects, requires a capital investment of $2 to $3 billion per year. The Rebuild Illinois funding is planned to expedite overdue repair and replacement projects, reduce the backlog of deferred improvements, and move the system toward a state of good repair. It nearly doubles the previous five‐year regional capital program of $4.3 billion. The new funds enable real progress on the state of good repair, by allowing improvements and in some cases replace aging system assets. Due to the current events, there is a level of uncertainty around the PAYGO and State Bond funding, which is dependent on revenues that may not reach the previously projected levels in the current economy. At this time the Service Boards are continuing with the implementation of their capital programs and working through the grant application process for the Rebuild Illinois funding. -

June 2019 Project Management Oversight Report

REPORT ON PROJECT MANAGEMENT OVERSIGHT – JUNE 2019 Executive Summary This semi‐annual Report on Project Management Oversight details Service Board efforts in implementing their capital programs. Included are details on all state‐funded projects, regardless of budget, and all systemwide projects with budgets of $10 million or more, regardless of funding source. Information in this report was collected by direct interviews, project meetings, and documented submissions from Service Board project management teams. The RTA’s 2018‐2023 Regional Transit Strategic Plan, “Invest in Transit,” highlights $30 billion of projects that are needed to maintain and modernize the region’s transit network. To maintain and preserve the current system in a State of Good Repair (SGR), as well as address the backlog of deferred SGR projects, requires a capital investment of $2 to $3 billion per year. After nearly a decade without a State of Illinois capital program, transit in the RTA region will get a much‐needed infusion from the Rebuild Illinois bill passed on June 1, 2019 by the General Assembly. The RTA is looking forward to the implementation of this new state capital plan however there is a concern that the proposed funding for transit does not meet the current needs as identified in “Invest in Transit.” The 55 projects detailed in this report together represent $5,712,260,030 worth of construction, maintenance, and procurement. Many of these projects address outstanding capital needs, while others are directed toward compliance with federal requirements or enhancing customer experience, safety, and security. All of the state funded projects are within budget. -

A PDF of the February 2015 FULL

to cities throughout Illinois 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Regional Transportation Sheridan r LaSalle er D 270 and United States. Many of s C ent 421 Edens Plaza Division Division Authority es 619 272 Lake 213 sin ood u D 423 422 422 B w Clark/Division Antioch y Central these routes, combined with e Forest 423 151 a WILMETTE The Regional Transportation amie ville s n r 800W 600W 200W nonstop between Michigan/Delaware to 422 0 E/W P w GLENVIEW eeha Preserve 620 Wilmette C 421Union Pacific/North Line3rd 143 l Forest F e La Baha’i Temple Elm oll and Stockton/Arlington (2500N) a D 4th v Green Glenview Thruway buses, connect Glenview n T e k i o r Authority (RTA) provides l l s r n 626 l r l 210 Preserve o l nonstop between Michigan/Delaware bard to Waukegan, Kenosha Linden Evanston a a e l vice Dewes b e b 421 146 s r Wilmette Foster S and Lake Shore/Belmont (3200N) 35 Illinois cities. For more Dea Mil C a a 221 W financial oversight, funding, and R Glenview Rd 94 Hi 422 e w L e i-State Cedar i Chicago nonstop between Delaware/Michigan Downtown Rand r v Emerson D 221 Oakton 270 Central au e Hill T e 70 147 information, visit www. Ryan Field & Welsh-Ryan Arena b and Marine/Foster (5200N) r k Cook Co regional transit planning for the a Comm ee okie 213 Central r k Courts Central 213 r nonstop between Delaware/Michigan 93 Sheridan College a Amtrak.com Presence 422 S Gross 201 H C 148 Old Orchard 206 C L Bellevue and Marine/Irving Park (4000N) Dee three public transit operations in yman Northwestern Univ Huber Central St/ o r 270 Point o -

December 2020 Project Management Oversight Report

Project Management Oversight December 2020 REPORT ON PROJECT MANAGEMENT OVERSIGHT – DECEMBER 2020 Executive Summary This semi‐annual Report on Project Management Oversight details Service Board efforts in implementing their capital programs. Included are details on all state‐funded projects, regardless of budget, and all systemwide projects with budgets of $10 million or more, regardless of funding source. Information in this report was collected by direct , interviews project meetings, and documented submissions from Service Board project management teams. The RTA’s 2018‐2023 Regional Transit Strategic Plan, Invest in Transit, highlights $30 billion of projects that are needed to maintain and modernize the region’s transit network. To maintain and preserve the current system in a State of Good Repair (SGR), as well as address the backlog of deferred SGR projects, requires a capital investment of $2 to $3 billion per year. The Rebuild Illinois funding is planned to expedite overdue repair and replacement projects, reduce the backlog of deferred improvements, and move the system toward a state of good repair. It nearly doubles the previous five‐year regional capital program of $4.3 billion. The funds enable real progress on the state of good repair, by allowing improvements and in some cases replace aging system assets. Although this has been a difficult year due to operating funding shortfalls related to COVID‐19, the Service Boards are continuing with the implementation of their capital programs. This report includes, for the first time, 13 Rebuild Illinois projects representing $655 million in Rebuild Illinois funding. The 13 projects reported on have begun during this reporting period and have ongoing activities. -

June 2018 Project Management Oversight Report

June 2018 Project Management Oversight Prepared by the Department of Finance, Innovation & Technology REPORT ON PROJECT MANAGEMENT OVERSIGHT – JUNE 2018 Executive Summary This semi‐annual Report on Project Management Oversight details Service Board efforts in implementing their capital programs. Included are details on all state‐funded projects, regardless of budget, and all systemwide projects with budgets of $10 million or more, regardless of funding source. Information in this report was collected by direct interviews, project meetings, and documented submissions from Service Board project management teams. The State of Good Repair backlog for the region currently stands at $19.4 billion, and the 10‐ year capital need for normal reinvestment is $18.3 billion, which results in total 10‐year capital need of $37.7 billion. The 60 projects detailed in this report together represent $3,861,547,183 worth of construction, maintenance, and procurement. Many of these projects will address outstanding capital needs, while others are directed to compliance with federal requirements or enhancing customer experience, safety, and security. The majority of state funded projects are within budget, one project is under budget. 80% of the state funded projects are on schedule. Regarding change orders, some of the added budget came from decisions by the Service Boards to add value to projects or comply with federal requirements. Other change orders were mostly for unforeseen conditions, and a minimal amount was due to errors and omissions. There were also change orders that provided credit for value engineering and for unused allowance and deleted work. Although the progress being made on these projects is significant, current capital funding will not support much needed renewal of the region’s aging transit infrastructure. -

List of Appendices

Pace/Metra NCS Shuttle Service Feasibility Study March 2005 List of Appendices Appendix A – Employer Database Appendix B – Pace Existing Service Appendix C – Pace Vanpools Appendix D – Employer Private Shuttle Service Appendix E – Letter, Flyer and Survey Appendix F – Survey Results Appendix G – Route Descriptions 50 Pace/Metra NCS Shuttle Service Feasibility Study March 2005 Appendix A Employer Database Business Name Address City Zip Employees A F C Machining Co. 710 Tower Rd. Mundelein 60060 75 A. Daigger & Co. 620 Lakeview Pkwy. Vernon Hills 60061 70 Aargus Plastics, Inc. 540 Allendale Dr. Wheeling 60090 150 Abbott Laboratories 300 Tri State Intl Lincolnshire 60069 300 Abbott-Interfast Corp. 190 Abbott Dr. Wheeling 60090 150 ABF Freight System, Inc 400 E. Touhy Des Plaines 60018 50 ABN AMRO Mortgage Group 1350 E. Touhy Ave., Ste 280-W Des Plaines 60018 150 ABTC 27255 N Fairfield Rd Mundelein 60060 125 Acco USA, Inc 300 Tower Pkwy Lincolnshire 60069 700 Accuquote 1400 S Wolf Rd., Bldg 500 Wheeling 60090 140 Accurate Transmissions, Inc. 401 Terrace Dr. Mundelein 60060 300 Ace Maintenance Service, Inc P.O. Box 66582 Amf Ohare 60666 70 Acme Alliance, LLC 3610 Commercial Ave. Northbrook 60062 250 ACRA Electric Corp. 3801 N. 25th Ave. Schiller Park 60176 50 Addolorata Villa 555 McHenry Rd Wheeling 60090 200+ Advance Mechanical Systems, Inc. 2080 S. Carboy Rd. Mount Prospect 60056 250 Advertiser Network 236 Rte. 173 Antioch 60002 100 Advocate Lutheran General Hospital 1775 Dempster St. Park Ridge 60068 4,100 Advocate, Inc 1661 Feehanville Dr., Ste 200 Mount Prospect 60056 150 AHI International Corporation 6400 Shafer Ct., Ste 200 Rosemont 60018 60 Air Canada P.O. -

Melaniphy & Associates Retail Market Study & Store Strategy Analysis

RETAIL MARKET STUDY AND STORE STRATEGY ANALYSIS VERNON HILLS, ILLINOIS Prepared For: VILLAGE OF VERNON HILLS VERNON HILLS, ILLINOIS FEBRUARY, 2019 John C. Melaniphy email: [email protected] President February 25, 2019 Mr. Mike Atkinson Building Commissioner Village of Vernon Hills 290 Evergreen Vernon Hills, Illinois 60061 In re: Retail Market Study and Store Strategy Hawthorn Center and Retail Sites Vernon Hills, Illinois Dear Mr. Atkinson: We have completed our Market Feasibility Study and Store Strategy Analysis to determine the appropriate strategy for Hawthorn center and to direct the mix of restaurants, retailers, entertainment venues, residential, and guide the overall success of the envisioned mixed-use redevelopment. We have also completed our review of the Village’s development sites to determine their overall market potential and the types of retailers best suited to meet market demand. We sincerely appreciate the opportunity to assist the Village of Vernon Hills and in the orderly redevelopment of Hawthorn Center and Village’s retail base. MELANIPHY & ASSOCIATES, INC. 6348 North Milwaukee Avenue, #198, Chicago, Illinois 60646 (773) 467-1212 TABLE OF CONTENTS Section Number Title Page Number I ASSIGNMENT 1 Objectives 1 Assumptions 3 II EXECUTIVE SUMMARY 5 Department Stores 5 Retail Bankruptcies and Store Closings 6 Hawthorn Center 7 Core Mall Markets 8 Top 20 Suburbs 8 Internet Sales 8 Shopping Center Construction 9 Chicago Metropolitan Area Retail Vacancy 11 Rental Rates 12 National, Regional, and Local Retail Trends 12 Expanding Retailers 14 Socioeconomic and Demographic Characteristics 15 Vernon Hills Retail Sales Experience 15 Major Mall, Stores, Big Boxes, and Other Sales Tax Generators 17 Trade Area Delineation 18 Vernon Hills Market Penetration 20 Vernon Hills Retail Sales Forecast 22 Retail Market Strategy 22 ◼ Hawthorn Mall – NWC Milwaukee Ave. -

2014 Budget Recommendations

MODERNIZING TRANSIT FOR THE FUTURE PRESIDENT’S 2014 BUDGET RECOMMENDATIONS (THIS PAGE INTENTIONALLY LEFT BLANK) CTA FY14 Budget Table of Contents Letter from the President ........................................................................................................................................ 1 CTA Organizational Chart ........................................................................................................................................ 5 Executive Summary ................................................................................................................................................... 7 2013 Operating Budget Performance 2012 Operating Budget Performance Summary ........................................................................................ 25 2012 Operating Budget Schedule ..................................................................................................................... 34 President’s 2014 Proposed Operating Budget President’s 2013 Proposed Operating Budget Summary ....................................................................... 35 President’s 2013 Proposed Operating Budget Schedule ......................................................................... 42 President’s 2015-2016 Proposed Operating Financial Plan President’s 2015-2016 Proposed Operating Financial Plan Summary ............................................. 43 President’s 2015-2016 Proposed Operating Financial Plan Schedule .............................................. 47 2014-2018 Capital -

Chicago Transit Authority (CTA)

06JN023apr 2006.qxp 6/21/2006 12:37 PM Page 1 All Aboard! Detailed Fare Information First Bus / Last Bus Times All CTA and Pace buses are accessible X to people with disabilities. This map gives detailed information about Chicago Transit # ROUTE & TERMINALS WEEKDAYS SATURDAY SUNDAY/HOL. # ROUTE & TERMINALS WEEKDAYS SATURDAY SUNDAY/HOL. # ROUTE & TERMINALS WEEKDAYS SATURDAY SUNDAY/HOL. Authority bus and elevated/subway train service, and shows Type of Fare* Full Reduced Reduced fares are for: You can use this chart to determine days, hours and frequency of service, and Fare Payment Farareboebox Topop where each route begins and ends. BROADWAY DIVISION ILLINOIS CENTER/NORTH WESTERN EXPRESS Pace suburban bus and Metra commuter train routes in the 36 70 Division/Austin east to Division/Clark 4:50a-12:40a 5:05a-12:40a 5:05a-12:40a 122 CASH FARE Accepted on buses only. $2 $1 Devon/Clark south to Polk/Clark 4:00a-12:10a 4:20a-12:00m 4:20a-12:15a Canal/Washington east to Wacker/Columbus 6:40a-9:15a & CTA service area. It is updated twice a year, and available at CTA Children 7 through 11 BUSES: CarCardsds It shows the first and last buses in each direction on each route, traveling Polk/Clark north to Devon/Clark 4:55a-1:20a 4:55a-1:05a 4:50a-1:15a Division/Clark west to Division/Austin 5:30a-1:20a 5:40a-1:20a 5:45a-1:20a 3:40p-6:10p Exact fare (both coins and bills accepted). No cash transfers available. years old. -

Regional ADA Paratransit Plan for Persons with Disabilities

Regional ADA Paratransit Plan for Persons with Disabilities Prepared by Regional Transportation Authority Chicago Transit Authority Pace Suburban Bus Service January 2006 RTA Main Offi ce 175 West Jackson Boulevard, Suite 1550 Chicago, lllinois 60604 (312) 913-3200 www.rtachicago.com Chicago Transit Authority (CTA) 567 West Lake Street Chicago, Illinois 60661 (312) 681-4610 www.transitchicago.com Pace 550 West Algonquin Road Arlington Heights, lllinois 60005 (847) 228-4261 www.pacebus.com ACKNOWLEDGEMENTS The Regional ADA Paratransit Plan for Persons with Disabilities is the culmination of extensive cooperation between the following agencies: Regional Transportation Authority (RTA) Chicago Transit Authority (CTA) Pace Suburban Bus Service Federal Transit Administration (FTA) Chicago Area Transportation Study (CATS) Illinois Department of Transportation (IDOT) In addition, the Transition Committee and Ad Hoc Committee assisted throughout the development of the Plan and their respective roles are described herein. The RTA thanks those individuals who took the time out of their busy schedules to assist in this process. CONTACT INFORMATION Mailing address and contact information for representatives of the Regional Transportation Authority (RTA), Chicago Transit Authority (CTA) and Pace Suburban Bus Service are as follows: Jay M. Ciavarella Program Manager, Regional Services Regional Transportation Authority (RTA) 175 West Jackson Boulevard, Suite 1550 Chicago, Illinois 60604 Phone: (312) 913-3252 Fax: (312) 913-3123 Terry Levin Vice President, Paratransit Operations Chicago Transit Authority (CTA) 567 West Lake Street Chicago, Illinois 60661 Phone: (312) 681-4610 Fax: (312) 681-4615 Melinda Metzger Deputy Executive Director, Revenue Services Pace Suburban Bus Service 550 West Algonquin Road Arlington Heights, Illinois 60005 Phone: (847) 228-2302 Fax: (847) 228-2309 SECTION 1: INTRODUCTION................................................................................................................ -

Y Court for the District of Delaware

Case 16-10527-MFW Doc 2243 Filed 06/22/16 Page 1 of 30 UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE In re: Chapter 11 SPORTS AUTHORITY HOLDINGS, INC., et al.,1 Case No. 16-10527 (MFW) Debtors. (Jointly Administered) DECLARATION OF DISINTERESTEDNESS OF ELISE S. FREJKA I, Elise S. Frejka, pursuant to 28 U.S.C. § 1746, hereby declare that the following is true to the best of my knowledge, information and belief: 1. I am a member of the law firm of Frejka PLLC (the “Firm”) and admitted to practice law in the State of New York. 2. I submit this Declaration to establish that I am a “disinterested person” as that term is defined in 11 U.S.C. § 101(14) in connection with my appointment as Fee Examiner (Docket No. 2204) in the above-captioned chapter 11 cases of Sports Authority Holdings, Inc. and its affiliated debtors (collectively, the “Debtors”). 3. Unless otherwise stated in this Declaration, I have personal knowledge of the facts set forth herein. 4. With respect to my “disinterestedness” under Section 101(14) of the Bankruptcy Code, I provide the following information: a. Neither the Firm nor I is, and has not been, during the pendency of these chapter 11 cases, a creditor, equity security holder or insider of any of the Debtors. 1 The Debtors and the last four digits of their respective taxpayer identification numbers are as follows: Sports Authority Holdings, Inc. (9008); Slap Shot Holdings, Corp. (8209); The Sports Authority, Inc. (2802); TSA Stores, Inc. (1120); TSA Gift Card, Inc. -

I Commuting in Context: a Qualitative Study of Transportation Challenges for Disadvantaged Job Seekers in Chicago, IL May 4, 20

Commuting in Context: A Qualitative Study of Transportation Challenges for Disadvantaged Job Seekers in Chicago, IL May 4, 2020 Chelsie Coren & Kate Lowe University of Illinois at Chicago Acknowledgements: This report is a joint project of Equiticity, the Metropolitan Planning Council, and the authors. A grant to Equiticity from the Chicago Community Trust supported this research. Sylvia Escarcega led most focus groups and Adam Glueckart assisted with data collection and analysis. The authors revised the draft based on comments from: Audrey Wennink, Jesus Barajas, Beverly Scott, and Jacky Grimshaw. i Executive Summary In Chicago and elsewhere, access to employment opportunities varies dramatically across individuals, racial groups, and neighborhoods. While quantitative studies have demonstrated important commute disparities by income and race, less is known about how social contexts, transportation systems, and employment dynamics interact to produce transportation barriers to employment for disadvantaged job seekers. This study adopts a qualitative approach to identify transportation barriers and potential solutions from the perspectives of disadvantaged job seekers, as well as job coaches who work directly with them to obtain employment. In 2019, the research team conducted focus groups and brief surveys with job seekers (n=82) and job coaches (n=42) at employment centers on the South and West sides of Chicago. Most job seeker respondents were Black (78%) and did not have a four-year college degree (81%). Results demonstrate that disadvantaged workers experience a complex web of transportation and intersecting barriers that make it difficult to travel to and retain employment. In fact, almost three- quarters of respondents indicated that transportation was a barrier to getting or keeping a job.