2016 RHI Amended DIS January

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Extinguishment of Agency General Condition Revocation Withdrawal Of

Extinguishment of Agency General condition Revocation Withdrawal of agent Death of the Principal Death of the Agent CASES Republic of the Philippines SUPREME COURT Manila FIRST DIVISION G.R. No. L-36585 July 16, 1984 MARIANO DIOLOSA and ALEGRIA VILLANUEVA-DIOLOSA, petitioners, vs. THE HON. COURT OF APPEALS, and QUIRINO BATERNA (As owner and proprietor of QUIN BATERNA REALTY), respondents. Enrique L. Soriano for petitioners. Domingo Laurea for private respondent. RELOVA, J.: Appeal by certiorari from a decision of the then Court of Appeals ordering herein petitioners to pay private respondent "the sum of P10,000.00 as damages and the sum of P2,000.00 as attorney's fees, and the costs." This case originated in the then Court of First Instance of Iloilo where private respondents instituted a case of recovery of unpaid commission against petitioners over some of the lots subject of an agency agreement that were not sold. Said complaint, docketed as Civil Case No. 7864 and entitled: "Quirino Baterna vs. Mariano Diolosa and Alegria Villanueva-Diolosa", was dismissed by the trial court after hearing. Thereafter, private respondent elevated the case to respondent court whose decision is the subject of the present petition. The parties — petitioners and respondents-agree on the findings of facts made by respondent court which are based largely on the pre-trial order of the trial court, as follows: PRE-TRIAL ORDER When this case was called for a pre-trial conference today, the plaintiff, assisted by Atty. Domingo Laurea, appeared and the defendants, assisted by Atty. Enrique Soriano, also appeared. A. -

25/03/13 Travelife Magazine's Suitcase Tales: Forever Barolo -- Lunch and Paolo Scavino Wines at Masseto

25/03/13 Travelife Magazine's Suitcase Tales: Forever Barolo -- lunch and Paolo Scavino wines at Masseto Condividi 0 Altro Blog successivo» Crea blog Entra www.travelifemagazine.com/2012/06/forever-barolo-lunch-with-paolo-scavino.html 1/40 25/03/13 Travelife Magazine's Suitcase Tales: Forever Barolo -- lunch and Paolo Scavino wines at Masseto SUBSCRIBE TO TRAVELIFE ONLINE S A T U R D A Y , J U N E 9 , 2 0 1 2 NOW Forever Barolo -- lunch and Paolo Scavino wines at Masseto 2 TRAVELIFE'S ULTIMATE FOOD ISSUE It was the perfect day for a long wine lunch as we'd just closed Travelife Magazine's June-July 2012 issue in time for release on June 15 and so it already felt like a weekend. In addition, the venue was Masseto, one of my favorite restaurants in Manila, and I was lunching with a couple of friends. On sale everywhere now The lunch was hosted by Jojo Madrid, one of the partners behind Premium Wine Exchange and Masseto, as well as a board member of Travelife Magazine and a good friend; and the guest of honor was Elisa Scavino, daughter and one of the two heiresses (along with her sister) to the Barolo TRAVELIFE Magazine winery Paolo Scavino in northwest Italy, a winery known for its modernist outlook in a pretty traditional industry. Travelife is one of Southeast Asia's leading travel and lifestyle publications. It also has a television show and an A LOCAL LEGEND online blog. Contact us via [email protected] View my complete profile CATCH THE DIPLOMATIC TRAVELIFE www.travelifemagazine.com/2012/06/forever-barolo-lunch-with-paolo-scavino.html 2/40 25/03/13 Travelife Magazine's Suitcase Tales: Forever Barolo -- lunch and Paolo Scavino wines at Masseto COLUMN EVERY SUNDAY IN BUSINESS MIRROR CONNECT WITH US ON FACEBOOK TRAVELIFE MAGAZINE The Paolo Scavino winery is named after the founder, Elisa's grandfather, who established the winery in 1921 in Castiglione Falleto, one of the towns in the Barolo region, near Alba, a place particularly noted for its white truffles. -

April 17, 2020 SECURITIES and EXCHANGE COMMISSION Secretariat Building, PICC Complex, Roxas Boulevard, Pasay City, 1307 Re

April 17, 2020 SECURITIES AND EXCHANGE COMMISSION Secretariat Building, PICC Complex, Roxas Boulevard, Pasay City, 1307 Re: Notice of Postponement and New Schedule of the Annual Stockholders’ Meeting________________ Dear Sir or Madam: Roxas Holdings, Inc. (the “Company”), through the undersigned, would like to inform the Securities and Exchange Commission (the “Commission”) that the Annual Stockholders’ Meeting (“ASM”) of the Company originally scheduled on March 18, 2020 at the Turf Room, Manila Polo Club, McKinley Road, Forbes Park, Makati City, Metro Manila, was postponed due to the exigent conditions surrounding the spread of the corona virus disease (COVID-19). The Board of Directors made this decision and the same was immediately disclosed to the Commission in a letter dated March 12, 2020, which was filed with the Commission on the same day. The date of the Company’s ASM per its By-laws is every 2nd Wednesday of March of each year. In compliance to the requirement provided in Section 2 of the SEC Memorandum Circular No. 9, Series of 2020, the Board of Directors of the Company has decided to tentatively set the ASM to May 13, 2020 in the same venue provided above, subject to further directives from the National Government and this Honorable Commission on the appropriate actions which must be done to address the COVID-19 pandemic, especially on the regulation of any mass gathering, and restriction on the movement of persons. In this regard, a clarificatory letter was electronically sent to the Commission yesterday (through MSRD COVID19 [email protected]) and the Company is awaiting response to its query. -

Banquet Rate Sheet

MANILA POLO CLUB BANQUET RATE SHEET BANQUET AREA CONSUMABLE SECURITY FIREWORKS DISPLAY PACKAGE EQUIPMENT FOR RENT FEE (PhP) DEPOSIT DELUXE PACKAGE : 2 to 3 minute - display PhP 40,000.00 BASIC SOUND SYSTEM (Speakers, 4 wired mics, technician, mixer) P5,500.00 MAIN LOUNGE 230,000 60,000 PREMIUM PACKAGE : 4 to 5 minute - display PhP 55,000.00 MOBILE DISCO (12units LED par, 2 units moving heads 12,000.00 WEST LOUNGE 40,000 10,000 PYROMUSICAL SHOW : 3 to 5 minutes - display PhP 125,000.00 4 wired microphones, 2 speakers, technician, playback, mixer) EAST LOUNGE (Non-Exclusive) 30,000 8,000 In case of cancellation two (2) weeks prior to the event, a fee of P12,500 will be charged. MICROPHONE (wired) 800.00 EAST TERRACE 50,000 13,000 Sparktacular Silver Fountain Creator (2pcs.) * PhP 10,000.00 MICROPHONE - Lapel, Wireless, Head 3,000.00 TURF ROOM WHOLE 150,000 40,000 Price per unit afterwards Php 3,000.00 MAGIC SING WITH SOUND SYSTEM 10,000.00 TURF PRE-FUNCTION (Non-Exclusive) NA NA Confetti Blast Cannon - Japanesse paper load * Php 4,000.00 PROJECTOR (4000A) 3,000.00 TURF ROOM A 75,000 20,000 Confetti Blast Cannon - Mylar load * Php 4,500.00 PROJECTOR (4000A) W/ 6X8FT SCREEN 8,500.00 TURF ROOM B 75,000 20,000 Inclusive of permits; For execution at the Enrique Zobel Field before 9pm; PROJECTOR (4500A) W/ 9X12FT SCREEN 15,000.00 BANYAN GARDEN 50,000 13,000 * Outdoor display with option for indoor execution. PROJECTOR (6500A-HIGH DEFINITION) 18,000.00 MCKINLEY ROOM WHOLE 140,000 35,000 W/ 9X12FT SCREEN MCKINLEY PRE-FUNCTION (Non-Exclusive) NA -

Africa Asia & Oceania

www.tokyoamericanclub.org Renovation Asia & Oceania Seoul Club (Korea): Sep 2019 for 6-7 months Shanghai International Tennis Center (China) China Asia-Pacific International Club Closed Favorview Palace, Wushan, Tianhe District Jurong Country Club (Singapore) Guangzhou 510620 China Pittsburgh Athletic Association (USA) Tel: 86-20-3829-8788 Fax: 86-20-3829-8365 Removed Minneapolis Lifetime Athletic Club (USA) [email protected] San Francisco Bay Club (USA) www.apic-gz.com Surf Club (USA) Beijing American Club 28F/ 29F, China Resources Building, No.8 Africa North Avenue, Jianguomen, Dongcheng District Beijing 100005 China Egypt Tel: 86-10-8519-2888 Palm Hills Club Fax: 86-10-8519-2800 6th of October City [email protected] Giza, Egypt www.americanclubbeijing.com Tel: 202- 3886- 0103-04 [email protected] Beijing Riviera Country Club No. 1 Xiang Jiang Beilu Road, Chao Yang District Kenya Beijing 100103 China Muthaiga Country Club Tel: 86-10-6435-9505 P.O. Box 16526 Fax:86-10-8450-6999 Nairobi 00620 Kenya Tel: 254-20-232-6651 [email protected] Fax: 254-20-260-3693 www.bjriviera.com [email protected] www.mcc.co.ke Shanghai International Tennis Center *renovation 516 Hengshan Rd South Africa Shanghai 200040 China Bryanston Country Club Tel: 86-21-6415-5588 P.O. Box 67066, Bryanston 2021 Fax: 86-21-6445-3620 Johannesburg, South Africa [email protected] Tel: 27-11-706-1361 [email protected] Fax: 27-11-706-3309 [email protected] www.regalhotel.com www.bryanstoncc.co.za 2-1-2 Azabudai Minato-ku Tokyo -

SEC Form 17-A Annual Report

COVER SHEET SEC Registration Number 6 2 8 9 3 Company Name R O C K W E L L L A N D C O R P O R A T I O N A N D S U B S I D I A R I E S Principal Office (No./Street/Barangay/City/Town/Province) 2 F , 8 R O C K W E L L , H I D A L G O D R I V E R O C K W E L L C E N T E R , M A K A T I C I T Y Form Type Department requiring the report Secondary License Type, If Applicable 1 7 - A N / A COMPANY INFORMATION Company’s Email Address Company’s Telephone Number/s Mobile Number [email protected] 7-793-0088 N/A Annual Meeting Fiscal Year No. of Stockholders Month/Day Month/Day 46,263 (as of 31 MAY 2020) August 28, 2020 December 31 CONTACT PERSON INFORMATION The designated contact person MUST be an Officer of the Corporation Name of Contact Person Email Address Telephone Number/s Mobile Number Ms. Ellen V. Almodiel [email protected] 7-793-0088 N/A Contact Person’s Address Ground Floor, East Podium, Joya Lofts & Towers, 28 Plaza Drive, Rockwell Center, Makati City 1200 Note: In case of death, resignation or cessation of office of the officer designated as contact person, such incident shall be reported to the Commission within thirty (30) calendar days from the occurrence thereof with information and complete contact details of the new contact person designated. -

GUEST of HONOR and SPEAKER (Ret.) Lt.Gen. CARDOZO M. LUNA

1 Official Newsletter of Rotary Club of Manila 0 balita No. 3723, December 7, 2017 THE ROTARY CLUB OF MANILA GUEST OF HONOR AND SPEAKER BOARD OF DIRECTORS and Executive Officers 2017-2018 JIMMIE POLICARPIO President TEDDY OCAMPO Immediate Past President BABE ROMUALDEZ (Ret.) Lt.Gen. CARDOZO M. LUNA, M.A. CHITO ZALDARRIAGA Vice President Undersecretary for National Defense Operations Department of National Defense BOBBY JOSEPH Republic of the Philippines ISSAM ELDEBS LANCE MASTERS KABALITA CALOY REYES SUSING PINEDA Now that the embers of a war-torn Marawi has seen its final glow, Directors the time to rebuild has arrived. Let the foremost Vanguard of ALVIN LACAMBACAL Operations restore Marawi to its pristine conditions as he updates Secretary us on this arduous task. NICKY VILLASEÑOR What’s Inside Program 2-3 Treasurer Presidential Timeline 4-6 Guest of Honor & Speaker’s Profile 7-8 DAVE REYNOLDS Preview of forthcoming Thursday meetings 9 The Week that was 10-13 Sergeant-At-Arms RCM Weekly Birthday Celebrants/Music Comm. 14 The Road to 100 15 AMADING VALDEZ Past Presidents Council Meeting 16 New Generations Service 17 Board Legal Adviser One Rotary One Philippines One for Marawi 18-19 District 3810 TRF Recognition Night 20 RENE POLICARPIO 2017 RCC District Assembly 21-22 On to Toronto/ Centennial 23-28 Assistant Secretary International Relations 29-33 Consular Corps Charity Ball 34-36 NER LONZAGA Governors Elect Training Seminar 37-44 Assistant Treasurer Fellowship 45-48 Interclub Activity 49-50 2017 Taipei Rotary Institute 51-52 Secretariat Speakers Bureau/ In the mailbox 53 ANNA KUN TOLEDO Obituary 54 Cogs in the Wheel 55-57 News Release 57 Public Health Nutrition and Child Care 58 Advertisement 59-61 2 PROGRAM RCM’s 22nd for Rotary Year 2017-2018 December 7, 2017, Thursday, 12Noon, New World Makati Hotel Officer-In-Charge/ Program Moderator RCM PVP “Roy” Golez P R O G R A M TIMETABLE “A Joint Meeting Between Rotary Club of Manila and Rotary Club of Forbes Park” 11:30 AM Registration & Cocktails (WINES courtesy of RCM Dir.-elect/Dir. -

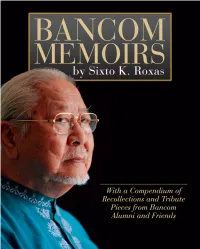

With a Compendium of Recollections and Tribute Pieces from Bancom Alumni and Friends

The ebook version of this book may be downloaded at www.xBancom.com This Bancom book project was made possible by the generous support of mr. manuel V. Pangilinan. The book launching was sponsored by smart infinity copyright © 2013 by sixto K. roxas Bancom memoirsby sixto K. roxas With a Compendium of Recollections and Tribute Pieces from Bancom Alumni and Friends Edited by eduardo a. Yotoko Published by PLDT-smart Foundation, inc and Bancom alumni, inc. (BaLi) contents Foreword by Evelyn R. Singson 5 Foreword by Francis G. Estrada 7 Preface 9 Prologue: Bancom and the Philippine financial markets 13 chapter 1 Bancom at its 10th year 24 chapter 2 BTco and cBTc, Bliss and Barcelon 28 chapter 3 ripe for investment banking 34 chapter 4 Founding eDF 41 chapter 5 organizing PDcP 44 chapter 6 childhood, ateneo and social action 48 chapter 7 my development as an economist 55 chapter 8 Practicing economics at central Bank and PnB 59 chapter 9 corporate finance at Filoil 63 chapter 10 economic planning under macapagal 71 chapter 11 shaping the development vision 76 chapter 12 entering the money market 84 chapter 13 creating the Treasury Bill market 88 chapter 14 advising on external debt management 90 chapter 15 Forming a virtual merchant bank 103 chapter 16 Functional merger with rcBc 108 chapter 17 asean merchant banking network 112 chapter 18 some key asian central bankers 117 chapter 19 asia’s star economic planners 122 chapter 20 my american express interlude 126 chapter 21 radical reorganization and BiHL 136 chapter 22 Dewey Dee and the end of Bancom 141 chapter 23 The total development company components 143 chapter 24 a changed life-world 156 chapter 25 The sustainable development movement 167 chapter 26 The Bancom university of experience 174 chapter 27 summing up the legacy 186 Photo Folio 198 compendium of recollections and Tribute Pieces from Bancom alumni and Friends 205 4 Bancom memoirs Bancom was absorbed by union Bank in 1981. -

Rockwell Land Corporation

SEC Number: 62893 PSE Number: File Number: ROCKWELL LAND CORPORATION (Company’s Full Name) 2F 8 Rockwell, Hidalgo Drive, Rockwell Center, Makati City (Company’s Address) (632) 793-0088 (Telephone Number) December 31, 2018 (Year Ending) SEC Form 17-A Annual Report (Form Type) 1 TABLE OF CONTENTS Part I BUSINESS Item 1 Business Item 2 Properties Item 3 Legal Proceedings Item 4 Submission of Matters to a Vote of Security Holders Part II SECURITIES OF REGISTRANT Item 5 Market for Issuer’s Common Share Equity and Related Stockholders Part III FINANCIAL INFORMATION Item 6 Management Discussion and Analysis and Results of Operations Item 7 Financial Statements Item 8 Information of Independent Accountant and Other Related Matters Part IV MANAGEMENT AND CERTAIN SECURITY HOLDERS Item 9 Directors and Executive Officers of the Issuer Item 10 Executive Compensation Item 11 Security and Ownership of Certain Beneficial Owners and Management Item 12 Certain Relationships and Related Transactions Part V CORPORATE GOVERNANCE Item 13 Compliance with leading practice on corporate governance Part VI EXHIBITS AND SCHEDULES Item 14 Exhibits and Reports on SEC Form 17-C 3 PART I – BUSINESS AND GENERAL INFORMATION Item 1 BUSINESS Background Rockwell Land Corporation (the “Company” or “Rockwell Land” ) is a premier property developer for residential and commercial projects that cater to the high-end and upper-mid markets mainly in Metro Manila. It is primarily engaged in the residential development of high-rise condominiums as well as in retail and office leasing. Starting in 2013, the Company offered horizontal and mid-rise residential development projects not only in Metro Manila but in Cebu City as well; and launched its first venture in the Hotel and Leisure segment with the launch of Aruga Serviced Apartments within the Rockwell Center in Makati City. -

Sustainable Development of Metro Manila's New Urban Core

Ten Principles for Sustainable Development of Metro Manila’s New Urban Core NorthPhilippines Asia Ten Principles for Sustainable Development of Metro Manila’s New Urban Core NorthPhilippines Asia About ULI About ULI Asia Pacific and Japan The Urban Land Institute is a 501(c) (3) nonprofit research and Across Asia Pacific and Japan, the Institute has nearly 1,000 education organization supported by its members. Founded in members, with a particularly strong presence in Japan, 1936, the Institute now has nearly 30,000 members worldwide Greater China, Southeast Asia, and Australia. The regional representing the entire spectrum of land use and real estate office of ULI Asia Pacific Japan is headquartered in Hong development disciplines, working in private enterprise and Kong, with satellite offices in Tokyo and Singapore. ULI APJ public service. As the preeminent, multidisciplinary real estate brings together industry leaders with a common commitment forum, ULI facilitates the open exchange of ideas, informa- to improving professional standards, seeking the best use of tion, and experience among local, national, and international land, and following excellent practices. By engaging experts industry leaders and policy makers dedicated to creating from various disciplines, the Institute can arrive at respon- better places. sible answers to problems that would be difficult to achieve independently. ULI APJ shares its knowledge through various The mission of the Urban Land Institute is to provide leader- discussion forums, research, publications, and electronic ship in the responsible use of land and in creating and sus- media. ULI’s activities in the region are aimed at providing taining thriving communities worldwide. -

Hilton Manila New Fact Sheet

Hilton Manila is an upscale urban oasis forming an integral AT A GLANCE part of Resorts World Manila, the largest integrated resort • 357 guest rooms and suites in the Philippines. Strategically located, the hotel enjoys • 3 dining outlets and 2 bars direct access to and from the Ninoy Aquino International • 6 meetings and events spaces, Airport 3 via Runway Manila’s pedestrian skybridge and is including the Ballroom highly-accessible from the Makati Central Business District • Executive Floors and Lounge via the Metro Manila Skyway. Hilton Manila is the perfect • Resort-style free-form pool, address for business and leisure travellers, oering a range fitness centre and kids’ play areas of well-appointed guest rooms and suites, innovative dining • Digital Check-In/keyless entry choices, versatile meetings and events spaces and an excellent selection of recreational facilities. HILTON MANILA hiltonmanila.com 1 Newport Boulevard I Newport City Pasay I Manila I 1309 I Philippines T: +63 2239 7788 I F: +63 2239 7789 E: [email protected] 11071537_HILTON_MANILA_FACTSHEET_210X297H_11.indd 1 01/08/2018 11:07 EAT AND DRINK MADISON LOUNGE + BAR Showcasing the pulsating urban vibe of New York City, Madison Lounge + Bar features an airy café in the morning, with a selection of artisanal coffees and grab & go items. In the evening, it transitions to a sophisticated bar, offering innovative signature drinks, fine wines, tempting bar bites and share plates. OUR ROOMS HUA TING – BRASSERIE CHINOISE COMFORT IN STYLE Inspired by the popular Hua Ting Road Rest and relax in the hotel’s well-furnished 357 guest rooms and suites. -

The American Colonial and Contemporary Traditions

THE AMERICAN COLONIAL AND CONTEMPORARY TRADITIONS The American tradition in Philippine architecture covers the period from 1898 to the present, and encompasses all architectural styles, such as the European styles, which came into the Philippines during the American colonial period. This tradition is represented by churches, schoolhouses, hospitals, government office buildings, commercial office buildings, department stores, hotels, movie houses, theaters, clubhouses, supermarkets, sports facilities, bridges, malls, and high-rise buildings. New forms of residential architecture emerged in the tsalet, the two-story house, and the Spanish-style house. The contemporary tradition refers to the architecture created by Filipinos from 1946 to the present, which covers public buildings and private commercial buildings, religious structures, and domestic architecture like the bungalow, the one-and-a-half story house, the split-level house, the middle-class housing and the low-cost housing project units, the townhouse and condominium, and least in size but largest in number, the shanty. History The turn of the century brought, in the Philippines, a turn in history. Over three centuries of Spanish rule came to an end, and five decades of American rule began. The independence won by the Philippine Revolution of 1896 was not recognized by Spain, nor by the United States, whose naval and military forces had taken Manila on the pretext of aiding the revolution. In 1898 Spain ceded the Philippines to the United States, and after three years of military rule the Americans established a civil government. With a new regime came a new culture. The English language was introduced and propagated through the newly established public school system.