Dynamic Currency Conversion at the Point of Sale

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

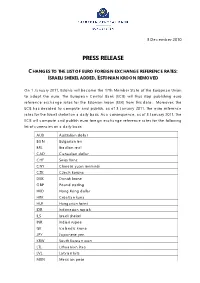

Press Release Changes to the List of Euro Foreign Exchange Reference

3 December 2010 PRESS RELEASE CHANGES TO THE LIST OF EURO FOREIGN EXCHANGE REFERENCE RATES: ISRAELI SHEKEL ADDED, ESTONIAN KROON REMOVED On 1 January 2011, Estonia will become the 17th Member State of the European Union to adopt the euro. The European Central Bank (ECB) will thus stop publishing euro reference exchange rates for the Estonian kroon (EEK) from this date. Moreover, the ECB has decided to compute and publish, as of 3 January 2011, the euro reference rates for the Israeli shekel on a daily basis. As a consequence, as of 3 January 2011, the ECB will compute and publish euro foreign exchange reference rates for the following list of currencies on a daily basis: AUD Australian dollar BGN Bulgarian lev BRL Brazilian real CAD Canadian dollar CHF Swiss franc CNY Chinese yuan renminbi CZK Czech koruna DKK Danish krone GBP Pound sterling HKD Hong Kong dollar HRK Croatian kuna HUF Hungarian forint IDR Indonesian rupiah ILS Israeli shekel INR Indian rupee ISK Icelandic krona JPY Japanese yen KRW South Korean won LTL Lithuanian litas LVL Latvian lats MXN Mexican peso 2 MYR Malaysian ringgit NOK Norwegian krone NZD New Zealand dollar PHP Philippine peso PLN Polish zloty RON New Romanian leu RUB Russian rouble SEK Swedish krona SGD Singapore dollar THB Thai baht TRY New Turkish lira USD US dollar ZAR South African rand The current procedure for the computation and publication of the foreign exchange reference rates will also apply to the currency that is to be added to the list: The reference rates are based on the daily concertation procedure between central banks within and outside the European System of Central Banks, which normally takes place at 2.15 p.m. -

Exchange Market Pressure on the Croatian Kuna

EXCHANGE MARKET PRESSURE ON THE CROATIAN KUNA Srđan Tatomir* Professional article** Institute of Public Finance, Zagreb and UDC 336.748(497.5) University of Amsterdam JEL F31 Abstract Currency crises exert strong pressure on currencies often causing costly economic adjustment. A measure of exchange market pressure (EMP) gauges the severity of such tensions. Measuring EMP is important for monetary authorities that manage exchange rates. It is also relevant in academic research that studies currency crises. A precise EMP measure is therefore important and this paper re-examines the measurement of EMP on the Croatian kuna. It improves it by considering intervention data and thresholds that ac- count for the EMP distribution. It also tests the robustness of weights. A discussion of the results demonstrates a modest improvement over the previous measure and concludes that the new EMP on the Croatian kuna should be used in future research. Key words: exchange market pressure, currency crisis, Croatia 1 Introduction In an era of increasing globalization and economic interdependence, fixed and pegged exchange rate regimes are ever more exposed to the danger of currency crises. Integrated financial markets have enabled speculators to execute attacks more swiftly and deliver devastating blows to individual economies. They occur when there is an abnormally large international excess supply of a currency which forces monetary authorities to take strong counter-measures (Weymark, 1998). The EMS crisis of 1992/93 and the Asian crisis of 1997/98 are prominent historical examples. Recently, though, the financial crisis has led to severe pressure on the Hungarian forint and the Icelandic kronor, demonstrating how pressure in the foreign exchange market may cause costly economic adjustment. -

Bahrain Country Report BTI 2012

BTI 2012 | Bahrain Country Report Status Index 1-10 5.89 # 56 of 128 Political Transformation 1-10 4.35 # 87 of 128 Economic Transformation 1-10 7.43 # 21 of 128 Management Index 1-10 4.18 # 91 of 128 scale: 1 (lowest) to 10 (highest) score rank trend This report is part of the Bertelsmann Stiftung’s Transformation Index (BTI) 2012. The BTI is a global assessment of transition processes in which the state of democracy and market economy as well as the quality of political management in 128 transformation and developing countries are evaluated. More on the BTI at http://www.bti-project.org Please cite as follows: Bertelsmann Stiftung, BTI 2012 — Bahrain Country Report. Gütersloh: Bertelsmann Stiftung, 2012. © 2012 Bertelsmann Stiftung, Gütersloh BTI 2012 | Bahrain 2 Key Indicators Population mn. 1.3 HDI 0.806 GDP p.c. $ - Pop. growth1 % p.a. 7.6 HDI rank of 187 42 Gini Index - Life expectancy years 75 UN Education Index 0.747 Poverty3 % - Urban population % 88.6 Gender inequality2 0.288 Aid per capita $ - Sources: The World Bank, World Development Indicators 2011 | UNDP, Human Development Report 2011. Footnotes: (1) Average annual growth rate. (2) Gender Inequality Index (GII). (3) Percentage of population living on less than $2 a day. Executive Summary Bahrain’s democratic reform process has come to a standstill since 2009, which marked the 10th anniversary of King Hamad bin Isa Al Khalifa’s accession to power. The positive developments in civil and political liberties observed with the start of the reform process in 2002 have in recent years been counteracted by repressive state tactics in which freedoms of expression and assembly have suffered most. -

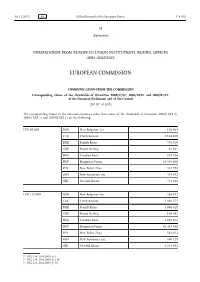

Corresponding Values of the Thresholds of Directives 2004/17/EC, 2004/18/EC and 2009/81/EC, of the European Parliament and of the Council (2015/C 418/01)

16.12.2015 EN Official Journal of the European Union C 418/1 II (Information) INFORMATION FROM EUROPEAN UNION INSTITUTIONS, BODIES, OFFICES AND AGENCIES EUROPEAN COMMISSION COMMUNICATION FROM THE COMMISSION Corresponding values of the thresholds of Directives 2004/17/EC, 2004/18/EC and 2009/81/EC, of the European Parliament and of the Council (2015/C 418/01) The corresponding values in the national currencies other than euros of the thresholds of Directives 2004/17/EC (1), 2004/18/EC (2) and 2009/81/EC (3) are the following: EUR 80 000 BGN New Bulgarian Lev 156 464 CZK Czech Koruna 2 184 400 DKK Danish Krone 596 520 GBP Pound Sterling 62 842 HRK Croatian Kuna 610 024 HUF Hungarian Forint 24 549 600 PLN New Polish Zloty 333 992 RON New Romanian Leu 355 632 SEK Swedish Krona 731 224 EUR 135 000 BGN New Bulgarian Lev 264 033 CZK Czech Koruna 3 686 175 DKK Danish Krone 1 006 628 GBP Pound Sterling 106 047 HRK Croatian Kuna 1 029 416 HUF Hungarian Forint 41 427 450 PLN New Polish Zloty 563 612 RON New Romanian Leu 600 129 SEK Swedish Krona 1 233 941 (1) OJ L 134, 30.4.2004, p. 1. (2) OJ L 134, 30.4.2004, p. 114. (3) OJ L 216, 20.8.2009, p. 76. C 418/2 EN Official Journal of the European Union 16.12.2015 EUR 209 000 BGN New Bulgarian Lev 408 762 CZK Czech Koruna 5 706 745 DKK Danish Krone 1 558 409 GBP Pound Sterling 164 176 HRK Croatian Kuna 1 593 688 HUF Hungarian Forint 64 135 830 PLN New Polish Zloty 872 554 RON New Romanian Leu 929 089 SEK Swedish Krona 1 910 323 EUR 418 000 BGN New Bulgarian Lev 817 524 CZK Czech Koruna 11 413 790 DKK -

WM/Refinitiv Closing Spot Rates

The WM/Refinitiv Closing Spot Rates The WM/Refinitiv Closing Exchange Rates are available on Eikon via monitor pages or RICs. To access the index page, type WMRSPOT01 and <Return> For access to the RICs, please use the following generic codes :- USDxxxFIXz=WM Use M for mid rate or omit for bid / ask rates Use USD, EUR, GBP or CHF xxx can be any of the following currencies :- Albania Lek ALL Austrian Schilling ATS Belarus Ruble BYN Belgian Franc BEF Bosnia Herzegovina Mark BAM Bulgarian Lev BGN Croatian Kuna HRK Cyprus Pound CYP Czech Koruna CZK Danish Krone DKK Estonian Kroon EEK Ecu XEU Euro EUR Finnish Markka FIM French Franc FRF Deutsche Mark DEM Greek Drachma GRD Hungarian Forint HUF Iceland Krona ISK Irish Punt IEP Italian Lira ITL Latvian Lat LVL Lithuanian Litas LTL Luxembourg Franc LUF Macedonia Denar MKD Maltese Lira MTL Moldova Leu MDL Dutch Guilder NLG Norwegian Krone NOK Polish Zloty PLN Portugese Escudo PTE Romanian Leu RON Russian Rouble RUB Slovakian Koruna SKK Slovenian Tolar SIT Spanish Peseta ESP Sterling GBP Swedish Krona SEK Swiss Franc CHF New Turkish Lira TRY Ukraine Hryvnia UAH Serbian Dinar RSD Special Drawing Rights XDR Algerian Dinar DZD Angola Kwanza AOA Bahrain Dinar BHD Botswana Pula BWP Burundi Franc BIF Central African Franc XAF Comoros Franc KMF Congo Democratic Rep. Franc CDF Cote D’Ivorie Franc XOF Egyptian Pound EGP Ethiopia Birr ETB Gambian Dalasi GMD Ghana Cedi GHS Guinea Franc GNF Israeli Shekel ILS Jordanian Dinar JOD Kenyan Schilling KES Kuwaiti Dinar KWD Lebanese Pound LBP Lesotho Loti LSL Malagasy -

Croatian Kuna: Money, Or Just a Currency? Evidence from the Interbank Market

Davor Mance, Bojana Olgic Drazenovic, and Stella Suljic Nikolaj. 2019. Croatian Kuna: Money, or just a Currency? Evidence from the Interbank Market. UTMS Journal of Economics 10 (2): 149–161. Original scientific paper (accepted November 6, 2019) CROATIAN KUNA: MONEY, OR JUST A CURRENCY? EVIDENCE FROM THE INTERBANK 1 MARKET Davor Mance2 Bojana Olgic Drazenovic Stella Suljic Nikolaj Abstract Modern sovereign money is accepted as an institution in virtue of the collective intentionality of the acceptance of the sovereign status function declaration it being the official currency of a country. A status function declaration may not create money it may only create a currency. How does one test the fact that an official currency also has all the properties of money? We propose a rather simple test based on the Granger causality of the acceptance of a currency in virtue of money if, and only if, the allocation function of its market interest rate is not rejected. This condition is fulfilled if the interest rate is its genuine allocator. This is the case if the changes in quantity cause the change in the interest rate as a price of money i.e. its true opportunity cost. We find that market interest rate changes are Granger caused by changes in quantities of traded euros on the overnight banking market but not by changes in the quantity of traded Croatian kuna. Thus, the Croatian kuna is only the domestic currency of Croatia, and the euro is its true money. Keywords: money functions, euroization, ZIBOR, Granger causality. Jel Classification: E31; E43; E47; E52; G17 INTRODUCTION The fact that we call something “money” is observer relative: it only exists relative to its users and relative to the users’ perspective considering something a money. -

Political Economy of Croatian Membership

O licencima - Creative Commons https://creativecommons.org/licenses/?lang=hr CC BY-ND Ova licenca dopušta redistribuiranje, komercijalno i nekomercijalno, dokle god se djelo distribuira cjelovito i u neizmijenjenom obliku, uz isticanje Vašeg autorstva. Pogledajte sažetak licence (Commons Deed) | Pogledajte Pravni tekst licence Imenovanje-Nekomercijalno CC BY-NC Ova licenca dopušta drugima da remiksiraju, mijenjaju i prerađuju Vaše djelo u nekomercijalne svrhe. Iako njihova nova djela bazirana na Vašem moraju Vas navesti kao autora i biti nekomercijalna, ona pritom ne moraju biti licencirana pod istim uvjetima. Pogledajte sažetak licence (Commons Deed) | Pogledajte Pravni tekst licence Imenovanje-Nekomercijalno-Dijeli pod istim uvjetima CC BY-NC-SA Lučev, J., et al.: Economic policy independence in EU member states: Political economy of Croatian membership Ova licenca dopušta drugima da remiksiraju, mijenjaju i prerađuju Vaše djelo u Josip Lučev Dario Cvrtila JEL: E580, E650,nekomercijalne H620, N140 svrhe, pod uvjetom da Vas navedu kao autora izvornog djela i University of Zagreb Libertas International University Review article Faculty of Political Science 10000 Zagreb, Croatia https://doi.org/10.51680/ev.34.1.17licenciraju svoja djela nastala na bazi Vašeg pod istim uvjetima. 10000 Zagreb, Croatia [email protected] [email protected] Received: February 13, 2020 Revision received:Pogledajte July 14, 2020 sažetak licence (Commons Deed) | Pogledajte Pravni tekst licence Accepted for publishing: August 31, 2020 This work is licensed under a Creative Commons Attribution- NonCommercial-NoDerivatives 4.0 International License Imenovanje-Nekomercijalno-Bez prerada CC BY-NC-ND ECONOMIC POLICY INDEPENDENCE IN EU MEMBER Ovo je najrestriktivnija od naših šest osnovnih licenci – dopušta drugima da STATES: POLITICAL ECONOMY5 od 6 26. -

Econometric Analysis of Croatia's Proclaimed

South East European Journal of Economics and Business Volume 10 (1) 2015, 7-17 DOI: 10.1515/jeb-2015-0001 ECONOMETRIC ANALYSIS OF CROATIA’S PROCLAIMED FOREIGN EXCHANGE RaTE Davor Mance, Saša Žiković, Diana Mance * Abstract The officially proclaimed foreign exchange policy of the Croatian National Bank (CNB) is a managed float with a discretionary right of intervention on the Croatian kuna/euro foreign exchange (FX) market in order to maintain price stability. This paper examines the validity of three monetary policy hypotheses: the stabil- ity of the nominal exchange rate, the stability of exchange rate changes, and the exchange rate to inflation pass-through effect. The CNB claims a direct FX to inflation rate pass-through channel for which we find no evidence, but we find a strong link between FX rate changes and changes in M4, as well as between M4 changes and inflation. Changes in foreign investment Granger cause changes in monetary aggregates that further Granger cause inflation. Changes in FX rate Granger cause a reaction in M4 that indirectly Granger causes a further rise in inflation. Vector Autoregression Impulse Response Functions of changes in FX rate, M1, M4, and CPI confirm the Granger causalities in the established order. Keywords: central bank policies, monetary transmission effects, inflation targeting JEL classification: C22, E52, E58, F42 INTRODUCTION * Davor Mance, MA The Croatian National Bank (CNB) has recently Assistant changed its official policy from a free floating to a University of Rijeka, Faculty of Economics managed floating exchange regime (CNB 2013, CNB [email protected] 2014). The CNB reserves the right to intervene on the currency markets and it did so more than 200 times in Žiković, Saša, PhD an 18 years period (1997-2014). -

FAO Country Name ISO Currency Code* Currency Name*

FAO Country Name ISO Currency Code* Currency Name* Afghanistan AFA Afghani Albania ALL Lek Algeria DZD Algerian Dinar Amer Samoa USD US Dollar Andorra ADP Andorran Peseta Angola AON New Kwanza Anguilla XCD East Caribbean Dollar Antigua Barb XCD East Caribbean Dollar Argentina ARS Argentine Peso Armenia AMD Armeniam Dram Aruba AWG Aruban Guilder Australia AUD Australian Dollar Austria ATS Schilling Azerbaijan AZM Azerbaijanian Manat Bahamas BSD Bahamian Dollar Bahrain BHD Bahraini Dinar Bangladesh BDT Taka Barbados BBD Barbados Dollar Belarus BYB Belarussian Ruble Belgium BEF Belgian Franc Belize BZD Belize Dollar Benin XOF CFA Franc Bermuda BMD Bermudian Dollar Bhutan BTN Ngultrum Bolivia BOB Boliviano Botswana BWP Pula Br Ind Oc Tr USD US Dollar Br Virgin Is USD US Dollar Brazil BRL Brazilian Real Brunei Darsm BND Brunei Dollar Bulgaria BGN New Lev Burkina Faso XOF CFA Franc Burundi BIF Burundi Franc Côte dIvoire XOF CFA Franc Cambodia KHR Riel Cameroon XAF CFA Franc Canada CAD Canadian Dollar Cape Verde CVE Cape Verde Escudo Cayman Is KYD Cayman Islands Dollar Cent Afr Rep XAF CFA Franc Chad XAF CFA Franc Channel Is GBP Pound Sterling Chile CLP Chilean Peso China CNY Yuan Renminbi China, Macao MOP Pataca China,H.Kong HKD Hong Kong Dollar China,Taiwan TWD New Taiwan Dollar Christmas Is AUD Australian Dollar Cocos Is AUD Australian Dollar Colombia COP Colombian Peso Comoros KMF Comoro Franc FAO Country Name ISO Currency Code* Currency Name* Congo Dem R CDF Franc Congolais Congo Rep XAF CFA Franc Cook Is NZD New Zealand Dollar Costa Rica -

List of Currencies of All Countries

The CSS Point List Of Currencies Of All Countries Country Currency ISO-4217 A Afghanistan Afghan afghani AFN Albania Albanian lek ALL Algeria Algerian dinar DZD Andorra European euro EUR Angola Angolan kwanza AOA Anguilla East Caribbean dollar XCD Antigua and Barbuda East Caribbean dollar XCD Argentina Argentine peso ARS Armenia Armenian dram AMD Aruba Aruban florin AWG Australia Australian dollar AUD Austria European euro EUR Azerbaijan Azerbaijani manat AZN B Bahamas Bahamian dollar BSD Bahrain Bahraini dinar BHD Bangladesh Bangladeshi taka BDT Barbados Barbadian dollar BBD Belarus Belarusian ruble BYR Belgium European euro EUR Belize Belize dollar BZD Benin West African CFA franc XOF Bhutan Bhutanese ngultrum BTN Bolivia Bolivian boliviano BOB Bosnia-Herzegovina Bosnia and Herzegovina konvertibilna marka BAM Botswana Botswana pula BWP 1 www.thecsspoint.com www.facebook.com/thecsspointOfficial The CSS Point Brazil Brazilian real BRL Brunei Brunei dollar BND Bulgaria Bulgarian lev BGN Burkina Faso West African CFA franc XOF Burundi Burundi franc BIF C Cambodia Cambodian riel KHR Cameroon Central African CFA franc XAF Canada Canadian dollar CAD Cape Verde Cape Verdean escudo CVE Cayman Islands Cayman Islands dollar KYD Central African Republic Central African CFA franc XAF Chad Central African CFA franc XAF Chile Chilean peso CLP China Chinese renminbi CNY Colombia Colombian peso COP Comoros Comorian franc KMF Congo Central African CFA franc XAF Congo, Democratic Republic Congolese franc CDF Costa Rica Costa Rican colon CRC Côte d'Ivoire West African CFA franc XOF Croatia Croatian kuna HRK Cuba Cuban peso CUC Cyprus European euro EUR Czech Republic Czech koruna CZK D Denmark Danish krone DKK Djibouti Djiboutian franc DJF Dominica East Caribbean dollar XCD 2 www.thecsspoint.com www.facebook.com/thecsspointOfficial The CSS Point Dominican Republic Dominican peso DOP E East Timor uses the U.S. -

Currency Buy Back Form

Currency Buy Back Form It’s easy to send your leftover foreign banknotes to us: 1. Collect all your foreign currency banknotes together 2. Fill in the form below 3. Post your completed form and your notes to us securely 4. Wait 5-10 working days for us to receive your delivery, process it and complete the bank transfer You can fill out this form electronically or by hand using BLOCK CAPITALS with black or blue ink. Key Information Below is an overview of our currency purchase product terms, these should be read carefully, alongside our full terms and conditions available here (section 8): www.iceplc.com/legal-information/home-delivery-terms-conditions Who can use the ICE buy-back service? ● You don’t have to be an ICE customer to sell your travel money to us. ● We can only pay money into a valid UK bank account, belonging to the owner of the money, no-one else’s. ● Like all foreign exchange companies, we may require additional proof of identity to process some orders – we will contact you with more details if this is required. What can I exchange? ● We only accept bank notes – not coins. The currencies we accept are listed in Step C of this form. ● Notes must not be damaged or invalid. ● Notes must have an individual value less than 100GBP. ● We don’t accept notes which are out of circulation or are due to be removed from circulation within 6 months. What rate will I receive? ● Currency rates can move substantially day-to-day and hour-to-hour. -

Bahrain's Fiscal Position and Regional Lifelines by Muizz Alaradi

II. Analysis Unveiling of Bahrain’s Fiscal Balance Program on 4 October 2018 in Manama, Bahrain. Finance Ministers of Kuwait, Saudi Arabia and the UAE pledged to support the program with a $10 billion aid package. Till Debt Do Us Part: Bahrain’s Fiscal Position and Regional Lifelines by Muizz Alaradi n June 2018, Saudi Arabia, Kuwait and the United Arab Emirates announced that they were in talks I with authorities in Bahrain to provide financial support which would “enable the kingdom of Bahrain to support its economic reforms and fiscal stability.”1 This announcement was prompted by a selloff of Bah- raini government bonds by international hedge funds and investors and pressure on its dinar currency due to concerns about the country’s rising public debt levels and weakened fiscal position.2 This situation has been at least a decade in the making, first exposed by the 2008 global financial crisis and recession. Looking back Like its GCC peers, Bahrain’s public revenues are primarily generated from hydrocarbons. Based on the Final Accounts between 2007-2017, oil and gas made up, on average, 82.9% of total government reve- nues.3 However, unlike its peers, oil production is relatively small. During that same period, Bahrain’s oil output mainly ranged between 180,000 - 200,000 barrels per day (bpd),4 meaning that any fluctuation in international oil prices directly corresponded to movements in public income. It is also worth noting that approximately one quarter of the country’s oil output (23% in 2017) is generated from its onshore Finance in the GCC: Policy & Developments | Summer 2019 7 II.