Exchange Market Pressure on the Croatian Kuna

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

THE FOURTEEN DUBROVNIK ECONOMIC CONFERENCE Organized by the Croatian National Bank

THE FOURTEEN DUBROVNIK ECONOMIC CONFERENCE Organized by the Croatian National Bank LIST OF PARTICIPANTS 1. Mr. Mate Babić, Professor, Faculty of Economics - Zagreb 2. Mr. James Barth, Senior Fellow, Milken Institute 3. Mr. Nikola Bokan, Analyst, Croatian National Bank 4. Mr. Boris Borozan, Managing Director, Global Head Central Bank Group Sales, HSBC Securities Inc. 5. Mr. Josef Brada, Professor, Arizona State University, W.O. Carey School of Business 6. Mr. Hank Brouwer, Executive Director, The Netherlands Bank 7. Mr. Michael Burda, Professor, Humboldt-Universitaet zum Berlin 8. Mr. Saša Cerovac, Analyst, Croatian National Bank 9. Mr. Simon Commander, European Bank for Reconstruction and Development 10. Mr. Jeffrey R. Currie, Investment Research, Goldman Sachs 11. Ms. Andrijana Ćudina, Analyst, Croatian National Bank 12. Ms. Ana Maria Čeh, Analyst, Croatian National Bank 13. Mr. Ante Čičin Šain, Former Governor of the Croatian National Bank, Honorary Consul of Ireland 14. Ms. Biljana Dlab, Associate, Alpha Associates AG 15. Mr. Saša Drezgić, Faculty of Economics, University of Rijeka 16. Ms. Mirna Dumičić, Analyst, Croatian National Bank 17. Mr. Randall K. Filer, President, CERGE - EI Foundation 18. Mr. Jeffrey A. Frankel, Professor, Harvard University, Kennedy School of Business 19. Ms. Tatjana Frlužec, Associate, Croatian National Bank 20. Mr. André Geis, European Central Bank, Directorate General International and European Relations 21. Mr. Robert Gordon, Professor, Northwestern University 22. Mr. Iftekhar Hasan, Professor, Rensselaer Polytechnic Institute 23. Mr. Oleh Havrylyshyn, Visiting Scholar, University of Toronto 24. Mr. Alberto Heimler, Competition Authority of Italy 25. Ms. Sylvia Heuchemer, Professor, Cologne University of Applied Sciences, Faculty of Economics and Business Administration 26. -

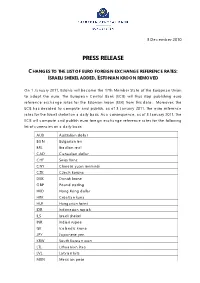

Press Release Changes to the List of Euro Foreign Exchange Reference

3 December 2010 PRESS RELEASE CHANGES TO THE LIST OF EURO FOREIGN EXCHANGE REFERENCE RATES: ISRAELI SHEKEL ADDED, ESTONIAN KROON REMOVED On 1 January 2011, Estonia will become the 17th Member State of the European Union to adopt the euro. The European Central Bank (ECB) will thus stop publishing euro reference exchange rates for the Estonian kroon (EEK) from this date. Moreover, the ECB has decided to compute and publish, as of 3 January 2011, the euro reference rates for the Israeli shekel on a daily basis. As a consequence, as of 3 January 2011, the ECB will compute and publish euro foreign exchange reference rates for the following list of currencies on a daily basis: AUD Australian dollar BGN Bulgarian lev BRL Brazilian real CAD Canadian dollar CHF Swiss franc CNY Chinese yuan renminbi CZK Czech koruna DKK Danish krone GBP Pound sterling HKD Hong Kong dollar HRK Croatian kuna HUF Hungarian forint IDR Indonesian rupiah ILS Israeli shekel INR Indian rupee ISK Icelandic krona JPY Japanese yen KRW South Korean won LTL Lithuanian litas LVL Latvian lats MXN Mexican peso 2 MYR Malaysian ringgit NOK Norwegian krone NZD New Zealand dollar PHP Philippine peso PLN Polish zloty RON New Romanian leu RUB Russian rouble SEK Swedish krona SGD Singapore dollar THB Thai baht TRY New Turkish lira USD US dollar ZAR South African rand The current procedure for the computation and publication of the foreign exchange reference rates will also apply to the currency that is to be added to the list: The reference rates are based on the daily concertation procedure between central banks within and outside the European System of Central Banks, which normally takes place at 2.15 p.m. -

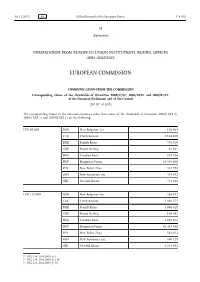

Corresponding Values of the Thresholds of Directives 2004/17/EC, 2004/18/EC and 2009/81/EC, of the European Parliament and of the Council (2015/C 418/01)

16.12.2015 EN Official Journal of the European Union C 418/1 II (Information) INFORMATION FROM EUROPEAN UNION INSTITUTIONS, BODIES, OFFICES AND AGENCIES EUROPEAN COMMISSION COMMUNICATION FROM THE COMMISSION Corresponding values of the thresholds of Directives 2004/17/EC, 2004/18/EC and 2009/81/EC, of the European Parliament and of the Council (2015/C 418/01) The corresponding values in the national currencies other than euros of the thresholds of Directives 2004/17/EC (1), 2004/18/EC (2) and 2009/81/EC (3) are the following: EUR 80 000 BGN New Bulgarian Lev 156 464 CZK Czech Koruna 2 184 400 DKK Danish Krone 596 520 GBP Pound Sterling 62 842 HRK Croatian Kuna 610 024 HUF Hungarian Forint 24 549 600 PLN New Polish Zloty 333 992 RON New Romanian Leu 355 632 SEK Swedish Krona 731 224 EUR 135 000 BGN New Bulgarian Lev 264 033 CZK Czech Koruna 3 686 175 DKK Danish Krone 1 006 628 GBP Pound Sterling 106 047 HRK Croatian Kuna 1 029 416 HUF Hungarian Forint 41 427 450 PLN New Polish Zloty 563 612 RON New Romanian Leu 600 129 SEK Swedish Krona 1 233 941 (1) OJ L 134, 30.4.2004, p. 1. (2) OJ L 134, 30.4.2004, p. 114. (3) OJ L 216, 20.8.2009, p. 76. C 418/2 EN Official Journal of the European Union 16.12.2015 EUR 209 000 BGN New Bulgarian Lev 408 762 CZK Czech Koruna 5 706 745 DKK Danish Krone 1 558 409 GBP Pound Sterling 164 176 HRK Croatian Kuna 1 593 688 HUF Hungarian Forint 64 135 830 PLN New Polish Zloty 872 554 RON New Romanian Leu 929 089 SEK Swedish Krona 1 910 323 EUR 418 000 BGN New Bulgarian Lev 817 524 CZK Czech Koruna 11 413 790 DKK -

Economic Growth in Croatia: What Have We Learned?

Report No. 48879- HR Public Disclosure Authorized CROATIA Croatia’s EU Convergence Report: Reaching and Sustaining Higher Rates of Economic Growth Public Disclosure Authorized (In two volumes) Vol. II: Full Report June 2009 Public Disclosure Authorized Europe and Central Asia Region Document of the World Bank Public Disclosure Authorized CURRENCY AND EQUIVALENT UNITS Currency Unit=Croatian kuna US$1 =HRK 5.6102 (As of April 30, 2009) FISCAL YEAR January 1 – December 31` WEIGHTS AND MEASURES Metric System ACRONYMS AND ABBREVIATIONS AAE Agency for Adult Education IEC International Electrotechnical Commission ADR Alternative Dispute Resolution ILAC International Laboratory Accreditation Cooperation AVET Agency for Vocational Education and ILO International Labor Organization Training CA Company Act IP Intellectual Property CARDS Community Assistance for Reconstruction, ISO International Organization for Standardization Development and Stabilization CEE Central and Eastern Europe OECD Organization for Economic Cooperation and Development CENLE European Committee for Electrotechnical LLL Life Long Learning C Standardization CES ??? MoSES Ministry of Science, Education and Sports CGPM General conference on Weights and MoELE Ministry of Economy, Labor & Measures Entrepreneurship ECA Europe and Central Asia MS&T Mathematics, Science & Technology FDI Foreign Direct Investment FE Fixed Effects NIS National Innovation System FINA Financial Agency PMR Product Market Regulation GDP Gross Domestic Product PPS Purchasing Power Standards GFCF Gross Fixed -

List of Certain Foreign Institutions Classified As Official for Purposes of Reporting on the Treasury International Capital (TIC) Forms

NOT FOR PUBLICATION DEPARTMENT OF THE TREASURY JANUARY 2001 Revised Aug. 2002, May 2004, May 2005, May/July 2006, June 2007 List of Certain Foreign Institutions classified as Official for Purposes of Reporting on the Treasury International Capital (TIC) Forms The attached list of foreign institutions, which conform to the definition of foreign official institutions on the Treasury International Capital (TIC) Forms, supersedes all previous lists. The definition of foreign official institutions is: "FOREIGN OFFICIAL INSTITUTIONS (FOI) include the following: 1. Treasuries, including ministries of finance, or corresponding departments of national governments; central banks, including all departments thereof; stabilization funds, including official exchange control offices or other government exchange authorities; and diplomatic and consular establishments and other departments and agencies of national governments. 2. International and regional organizations. 3. Banks, corporations, or other agencies (including development banks and other institutions that are majority-owned by central governments) that are fiscal agents of national governments and perform activities similar to those of a treasury, central bank, stabilization fund, or exchange control authority." Although the attached list includes the major foreign official institutions which have come to the attention of the Federal Reserve Banks and the Department of the Treasury, it does not purport to be exhaustive. Whenever a question arises whether or not an institution should, in accordance with the instructions on the TIC forms, be classified as official, the Federal Reserve Bank with which you file reports should be consulted. It should be noted that the list does not in every case include all alternative names applying to the same institution. -

Eu Cbs in Adria Region

Ipsos Croatia EU CBS IN ADRIA REGION Paris, Dec 2015 Ipsos 2012 1 EU CBS IN ADRIA REGION 1. Adria region 2. CBS in Adria region 3. MCD 4. Correlations 2 1. ADRIA REGION Name: • Adria or Adriatic region (business people) • West Balkan (politicians) 3 1. ADRIA REGION 8 Countries / 25M citizens 7 nations & 7 official languages 6 currencies 4 countries on the refugees route 3 big religions 2 letters 1 Nikola TESLA 4 1. ADRIA REGION Negative: • WW1 started in Sarajevo (Bosnia - 1914) • Last war in Europe took place there • Balkan refugee routes • Low GDP growth • High unemployment rate Positive: • Tennis, basketball, football, water ball, handball, … • Adriatic sea,….. 5 1. ADRIA REGION GDP per capita PPP 2012 2013 2014 % of EU EU 28 34.950 35.300 36.200 100% Albania 9.667 9.926 10.429 29% Bosna 9.370 9.550 9.923 27% Croatia 21.114 21.351 21.252 59% Kosovo* 8.388 8.613 8.804 24% Macedonia 11.874 12.468 13.142 36% Montenegro 13.589 14.136 14.323 40% Serbia 12.806 13.020 12.660 35% Slovenia 28.450 28.859 29.917 83% World Bank, Eurostat GDP per capita, PPP (current international $), *Est 2012, 2013 6 1. ADRIA REGION GDP growth (annual %) 2012 2013 2014 EU 28 -0,5 0,2 1,4 Slovenia -2,6 -1,0 2,6 Croatia -2,2 -0,9 -0,4 Kosovo -3,0 8,7 2,8 Macedonia -0,5 2,7 3,8 Montenegro -2,5 3,3 1,5 Serbia -1,0 2,6 -1,8 Albania 1,6 1,4 1,9 Bosnia & Herzegovina -1,2 2,5 1,2 World Bank - annual percentage growth rate of GDP at market prices based on constant local currency. -

University of Rijeka Faculty of Humanities and Social Sciences Department of English Translation from Croatian Into English Tran

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Repository of the University of Rijeka UNIVERSITY OF RIJEKA FACULTY OF HUMANITIES AND SOCIAL SCIENCES DEPARTMENT OF ENGLISH Filip Brdar TRANSLATION FROM CROATIAN INTO ENGLISH TRANSLATION AND ANALYSIS OF TEXTS OF DIFFERENT GENRES Submitted in partial fulfilment of the requirements for the B.A. in English Language and Literature and German Language and Literature at the University of Rijeka Supervisor: Nikola Tutek M.A. September 2015 ABSTRACT This B.A. thesis, of the undergraduate study of the English Language and Literature, is focused on the field of translation. The aim of this thesis and accompanying research is to choose three serious, relevant, scientific and academic articles in Croatian, translate and analyse them in English. The thesis is structured in the following way: after a brief introduction there is an article, i.e. a source text in Croatian, followed by the translation and an analysis of the translation. The purpose of the analyses is to explain the process of translating and to reveal different types of problems and challenges which were encountered. After the third translation analysis there is a conclusion, where the entire thesis is summed up and assessed. A bibliography, i.e. the sources, is included at the very end of the B.A. thesis. TABLE OF CONTENTS 1. SOURCE TEXT 1…………………………………………………………………2 1.1. TRANSLATION OF SOURCE TEXT 1…………………………………...................8 1.2. TRANSLATION ANALYSIS ……………………………………………………….14 2. SOURCE TEXT 2………………………………………………………………...16 2.1. TRANSLATION OF SOURCE TEXT 2……………………………………………..22 2.2 TRANSLATION ANALYSIS…………………………………………………………28 3. -

WM/Refinitiv Closing Spot Rates

The WM/Refinitiv Closing Spot Rates The WM/Refinitiv Closing Exchange Rates are available on Eikon via monitor pages or RICs. To access the index page, type WMRSPOT01 and <Return> For access to the RICs, please use the following generic codes :- USDxxxFIXz=WM Use M for mid rate or omit for bid / ask rates Use USD, EUR, GBP or CHF xxx can be any of the following currencies :- Albania Lek ALL Austrian Schilling ATS Belarus Ruble BYN Belgian Franc BEF Bosnia Herzegovina Mark BAM Bulgarian Lev BGN Croatian Kuna HRK Cyprus Pound CYP Czech Koruna CZK Danish Krone DKK Estonian Kroon EEK Ecu XEU Euro EUR Finnish Markka FIM French Franc FRF Deutsche Mark DEM Greek Drachma GRD Hungarian Forint HUF Iceland Krona ISK Irish Punt IEP Italian Lira ITL Latvian Lat LVL Lithuanian Litas LTL Luxembourg Franc LUF Macedonia Denar MKD Maltese Lira MTL Moldova Leu MDL Dutch Guilder NLG Norwegian Krone NOK Polish Zloty PLN Portugese Escudo PTE Romanian Leu RON Russian Rouble RUB Slovakian Koruna SKK Slovenian Tolar SIT Spanish Peseta ESP Sterling GBP Swedish Krona SEK Swiss Franc CHF New Turkish Lira TRY Ukraine Hryvnia UAH Serbian Dinar RSD Special Drawing Rights XDR Algerian Dinar DZD Angola Kwanza AOA Bahrain Dinar BHD Botswana Pula BWP Burundi Franc BIF Central African Franc XAF Comoros Franc KMF Congo Democratic Rep. Franc CDF Cote D’Ivorie Franc XOF Egyptian Pound EGP Ethiopia Birr ETB Gambian Dalasi GMD Ghana Cedi GHS Guinea Franc GNF Israeli Shekel ILS Jordanian Dinar JOD Kenyan Schilling KES Kuwaiti Dinar KWD Lebanese Pound LBP Lesotho Loti LSL Malagasy -

ZAGORAA Cultural/Historical Guide to the Zagora (Inland) Region of Split

A cultural/historical guide to the Zagora (inland) region of Split-Dalmatia County ZAGORA THE DALMATIAN ZAGORA (INLAND) Joško Belamarić THE DALMATIAN ZAGORA (INLAND) A cultural/historical guide to the Zagora (inland) region of Split-Dalmatia County 4 Zagora 14 Klis Zagora 24 Cetinska krajina 58 Biokovo, Imotski, Vrgorac 3 Zagora THE DALMATIAN ZAGORA (INLAND) A cultural/historical guide to the Zagora (inland) region of Split-Dalmatia County Here, from Klis onwards, on the ridge of the Dinara mountain chain, the angst of inland Dalmatia’s course wastelands has for centuries been sundered from the broad seas that lead to a wider world. The experience of saying one’s goodbyes to the thin line of Dalmatia that has strung itself under the mountain’s crest, that viewed from the sea looks like Atlas’ brothers, is repeated, not without poetic chills, by dozens of travel writers. To define the cultural denominators of Zagora, the Dalmatian inland, is today a difficult task, as the anthropological fabric of the wider Dalmatian hinterland is still too often perceived through the utopian aspect of the Renaissance ideal, the cynicism of the Enlightenment, or the exaggeration of Romanticism and the 18th century national revival. After the fall of medieval feudalism, life here has started from scratch so many times - later observers have the impression that the local customs draw their roots from some untroubled prehistoric source in which the silence of the karst on the plateau towards Promina, behind Biokovo, the gurgling of the living waters of the Zrmanja, Krka, Čikola and Cetina Ri- vers, the quivering of grain on Petrovo, Hrvatac and Vrgorac Fields, on 4 Zagora the fat lands along Strmica and Sinj, create the ide- al framework for the pleasant countenance, joyous heart and sincere morality of the local population of which many have written, each from their own point of view: from abbot Fortis and Ivan Lovrić during the Baroque period, Dinko Šimunović and Ivan Raos not so long ago to Ivan Aralica and, in his own way, Miljenko Jergović today. -

Croatian Kuna: Money, Or Just a Currency? Evidence from the Interbank Market

Davor Mance, Bojana Olgic Drazenovic, and Stella Suljic Nikolaj. 2019. Croatian Kuna: Money, or just a Currency? Evidence from the Interbank Market. UTMS Journal of Economics 10 (2): 149–161. Original scientific paper (accepted November 6, 2019) CROATIAN KUNA: MONEY, OR JUST A CURRENCY? EVIDENCE FROM THE INTERBANK 1 MARKET Davor Mance2 Bojana Olgic Drazenovic Stella Suljic Nikolaj Abstract Modern sovereign money is accepted as an institution in virtue of the collective intentionality of the acceptance of the sovereign status function declaration it being the official currency of a country. A status function declaration may not create money it may only create a currency. How does one test the fact that an official currency also has all the properties of money? We propose a rather simple test based on the Granger causality of the acceptance of a currency in virtue of money if, and only if, the allocation function of its market interest rate is not rejected. This condition is fulfilled if the interest rate is its genuine allocator. This is the case if the changes in quantity cause the change in the interest rate as a price of money i.e. its true opportunity cost. We find that market interest rate changes are Granger caused by changes in quantities of traded euros on the overnight banking market but not by changes in the quantity of traded Croatian kuna. Thus, the Croatian kuna is only the domestic currency of Croatia, and the euro is its true money. Keywords: money functions, euroization, ZIBOR, Granger causality. Jel Classification: E31; E43; E47; E52; G17 INTRODUCTION The fact that we call something “money” is observer relative: it only exists relative to its users and relative to the users’ perspective considering something a money. -

Illyrian Policy of Rome in the Late Republic and Early Principate

ILLYRIAN POLICY OF ROME IN THE LATE REPUBLIC AND EARLY PRINCIPATE Danijel Dzino Thesis submitted for the degree of Doctor of Philosophy in the Department of Classics University of Adelaide August 2005 II Table of Contents TITLE PAGE I TABLE OF CONTENTS II ABSTRACT V DECLARATION VI ACKNOWLEDGMENTS VII LIST OF FIGURES VIII LIST OF PLATES AND MAPS IX 1. Introduction, approaches, review of sources and secondary literature 1.1 Introduction 1 1.2 Rome and Illyricum (a short story) 2 1.3 Methodology 6 1.4.1 Illyrian policy of Rome in the context of world-system analysis: Policy as an interaction between systems 9 1.4.2 The Illyrian policy of Rome in the context of world-system analysis: Working hypothesis 11 1.5 The stages in the Roman Illyrian relationship (the development of a political/constitutional framework) 16 1.6 Themes and approaches: Illyricum in Roman historiography 18 1.7.1 Literature review: primary sources 21 1.7.2 Literature review: modern works 26 2. Illyricum in Roman foreign policy: historical outline, theoretical approaches and geography 2.1 Introduction 30 2.2 Roman foreign policy: Who made it, how and why was it made, and where did it stop 30 2.3 The instruments of Roman foreign policy 36 2.4 The place of Illyricum in the Mediterranean political landscape 39 2.5 The geography and ethnography of pre-Roman Illyricum 43 III 2.5.1 The Greeks and Celts in Illyricum 44 2.5.2 The Illyrian peoples 47 3. The Illyrian policy of Rome 167 – 60 BC: Illyricum - the realm of bifocality 3.1 Introduction 55 3.2 Prelude: the making of bifocality 56 3.3 The South and Central Adriatic 60 3.4 The North Adriatic 65 3.5 Republican policy in Illyricum before Caesar: the assessment 71 4. -

Finance & Photography

bulletin Finance & Photography 2021 eabh (The European Association for Banking and Financial History e.V.) Photograph: A projector with its lens from the Department of Polytheama and Photographic Mediums’ equipment. © National Bank of Greece eabh BULLETIN bulletin eabh bulletin KEY TITLE SUBMISSIONS eabh bulletin All submissions by email eabh - The European Association for EMAIL Banking and Financial History e.V. [email protected] DESIGN TEL Richard McBurney, grand-creative.com +49(0)69 36 50 84 650 EDITORS WEBSITE Carmen Hofmann, eabh Finance & bankinghistory.org Gabriella Massaglia, eabh Photography Hanauer Landstrasse 126-128, D-60314, ISSN Frankfurt am Main, Germany 2219-0643 LANGUAGE EDITOR LICENSE Chloe Colchester CC BY NC ND 2021 © eabh, Frankfurt am Main, 2021. All rights reserved. 3 INTRODUCTION Dear members and friends of eabh, Photographs are a key part of the archival collections of many financial institutions. Their emotional charge, their documentary power, their immediacy and universality set them apart from other archival documents. Used well, they provide an asset for any financial institution. This volume features articles from 17 financial institutions in eleven different countries. Almost 300 photographs provide glimpses of institutional practice over a span of 150 years. The photographs reveal stories about staff members, office buildings, and money; and they tell us about fashion, cultural movements, financial and industrial innovation, poverty, gender, colonization, leisure, and much more. This issue is the first of a series, and part of a wider project to explore the connections between finance and photography. eabh would like to invite its member and partner eabh institutions to join in by contributing to the second volume of the series.