ANNEX a to the 1998 FX and CURRENCY OPTION DEFINITIONS AMENDED and RESTATED AS of NOVEMBER 19, 2017 I

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Code List 11 Invoice Currency

Code list 11 Invoice currency Alphabetical order Code Code Alfa Alfa Country / region Country / region A BTN Bhutan ngultrum BOB Bolivian boliviano AFN Afghan new afghani BAM Bosnian mark ALL Albanian lek BWP Botswanan pula DZD Algerian dinar BRL Brazilian real USD American dollar BND Bruneian dollar AOA Angolan kwanza BGN Bulgarian lev ARS Argentinian peso BIF Burundi franc AMD Armenian dram AWG Aruban guilder AUD Australian dollar C AZN Azerbaijani new manat KHR Cambodian riel CAD Canadian dollar B CVE Cape Verdean KYD Caymanian dollar BSD Bahamian dollar XAF CFA franc of Central-African countries BHD Bahraini dinar XOF CFA franc of West-African countries BBD Barbadian dollar XPF CFP franc of Oceania BZD Belizian dollar CLP Chilean peso BYR Belorussian rouble CNY Chinese yuan renminbi BDT Bengali taka COP Colombian peso BMD Bermuda dollar KMF Comoran franc Code Code Alfa Alfa Country / region Country / region CDF Congolian franc CRC Costa Rican colon FKP Falkland Islands pound HRK Croatian kuna FJD Fijian dollar CUC Cuban peso CZK Czech crown G D GMD Gambian dalasi GEL Georgian lari DKK Danish crown GHS Ghanaian cedi DJF Djiboutian franc GIP Gibraltar pound DOP Dominican peso GTQ Guatemalan quetzal GNF Guinean franc GYD Guyanese dollar E XCD East-Caribbean dollar H EGP Egyptian pound GBP English pound HTG Haitian gourde ERN Eritrean nafka HNL Honduran lempira ETB Ethiopian birr HKD Hong Kong dollar EUR Euro HUF Hungarian forint F I Code Code Alfa Alfa Country / region Country / region ISK Icelandic crown LAK Laotian kip INR Indian rupiah -

ECONOMY of AZERBAIJAN 25 Years of Independence

ECONOMY OF AZERBAIJAN 25 Years of Independence Prof. Dr. Osman Nuri Aras Fatih University, Istanbul, Turkey Assoc. Prof. Dr. Elchin Suleymanov Qafqaz University, Baku, Azerbaijan Assoc. Prof. Dr. Karim Mammadov Western University, Baku, Azerbaijan DESIGN Sahib Kazimov PRINTING AND BINDERING “Sharg-Garb” Publishing House A§iq aiesgar kiig., No: 17, Xatai rayonu, Baki, Azarbaycan; Tel: (+99412) 374 83 43 ISBN: 978-9952*468-57-1 © Prof. Dr. Osman Nuri Aras. Baki, 2016 © Assoc. Prof. Dr. Elchin Suleymanov. Baki. 2016 © Assoc. Prof. Dr. Karim Mammadov. Baki. 2016 Foreword During every work, whether it is academic or professional, we interact, get assistance and are guided by certain group of people who value and assist us to achieve our targets. We are sure that the people who support us and provide valuable contribution to the English version of this book will not be limited in a short list, but we would like to mention, and in certain ways, express our acknowledgement to the people who enabled us to get on a track and deliver the book in a few months. Thanks to Turan Agayeva, Ulker Gurbaneliyeva, Khayala Mahmudiu and especially to Tural Hasanov for their help in preparing and delivering this book to your valuable consideration. GENERAL INFORMATION ABOUT AZERBAIJAN The Establishment of the Republic of Azerbaijan 28 May 1918 The independence Day 18 October 1991 Joining to the Organization for Security and Cooperation in Europe 30 January 1992 Joining to the United Nations 2 March 1992 Joining to the Commonweaith of independent States 19 September 1995 Joining to the Council of Europe 17 January2001 Area (thousand km^) 86.6 Population, (thousand person) (According to the beginning of 2015) 9593.0 Density of population in Ikm^(person) 111 Capital Baku Official Language Azerbaijan Currency Manat The course of Manat to Dollar (07.02.2016) 0.6389 The Head of State President ___ ________________________ ____ ______ ' .L-L; r - j = r . -

List 283 | October 2014

Stephen Album Rare Coins Specializing in Islamic, Indian & Oriental Numismatics P.O. Box 7386, Santa Rosa, CA. 95407, U.S.A. 283 Telephone 707-539-2120 — Fax 707-539-3348 [email protected] Catalog price $5.00 www.stevealbum.com 137187. SAFAVID: Muhammad Khudabandah, 1578-1588, AV ½ OCTOBER 2014 mithqal (2.31g), Mashhad, AH[9]85, A-2616.2, type A, with epithet imam reza, some flatness, some (removable) dirt Gold Coins on obverse, VF, R, ex. Richard Accola collection $350 137186. SAFAVID: Muhammad Khudabandah, 1578-1588, AV mithqal (4.59g), Qazwin, AH[9]89, A-2617.2, type B, some weakness Ancient Gold towards the rim, VF, R, ex. Richard Accola collection $450 137190. SAFAVID: Sultan Husayn, 1694-1722, AV ashrafi (3.47g), Mashhad, AH1130, A-2669E, local design, used only at Mashhad, 138883. ROMAN EMPIRE: Valentinian I, 364-375 AD, AV solidus the site of the tomb of the 8th Shi’ite Imam, ‘Ali b. Musa al-Reza, (4.47g), Thessalonica, bust facing right, pearl-diademed, no weakness, VF, RRR, ex. Richard Accola collection $1,000 draped & cuirassed / Valentinian & Valens seated, holding The obverse text is hoseyn kalb-e astan-e ‘ali, “Husayn, dog at together a globe, Victory behind with outspread wings, the doorstep of ‘Ali.,” with additional royal text in the obverse SMTES below, very tiny rim nick, beautiful bold strike, margin, not found on the standard ashrafis of type #2669. choice EF, R $1,200 By far the most common variety of this type is of the Trier 137217. AFSHARID: Shahrukh, 2nd reign, 1750-1755, AV mohur mint, with Constantinople also relatively common. -

Treasury Reporting Rates of Exchange As of December 31, 2018

TREASURY REPORTING RATES OF EXCHANGE AS OF DECEMBER 31, 2018 COUNTRY-CURRENCY F.C. TO $1.00 AFGHANISTAN - AFGHANI 74.5760 ALBANIA - LEK 107.0500 ALGERIA - DINAR 117.8980 ANGOLA - KWANZA 310.0000 ANTIGUA - BARBUDA - E. CARIBBEAN DOLLAR 2.7000 ARGENTINA-PESO 37.6420 ARMENIA - DRAM 485.0000 AUSTRALIA - DOLLAR 1.4160 AUSTRIA - EURO 0.8720 AZERBAIJAN - NEW MANAT 1.7000 BAHAMAS - DOLLAR 1.0000 BAHRAIN - DINAR 0.3770 BANGLADESH - TAKA 84.0000 BARBADOS - DOLLAR 2.0200 BELARUS - NEW RUBLE 2.1600 BELGIUM-EURO 0.8720 BELIZE - DOLLAR 2.0000 BENIN - CFA FRANC 568.6500 BERMUDA - DOLLAR 1.0000 BOLIVIA - BOLIVIANO 6.8500 BOSNIA- MARKA 1.7060 BOTSWANA - PULA 10.6610 BRAZIL - REAL 3.8800 BRUNEI - DOLLAR 1.3610 BULGARIA - LEV 1.7070 BURKINA FASO - CFA FRANC 568.6500 BURUNDI - FRANC 1790.0000 CAMBODIA (KHMER) - RIEL 4103.0000 CAMEROON - CFA FRANC 603.8700 CANADA - DOLLAR 1.3620 CAPE VERDE - ESCUDO 94.8800 CAYMAN ISLANDS - DOLLAR 0.8200 CENTRAL AFRICAN REPUBLIC - CFA FRANC 603.8700 CHAD - CFA FRANC 603.8700 CHILE - PESO 693.0800 CHINA - RENMINBI 6.8760 COLOMBIA - PESO 3245.0000 COMOROS - FRANC 428.1400 COSTA RICA - COLON 603.5000 COTE D'IVOIRE - CFA FRANC 568.6500 CROATIA - KUNA 6.3100 CUBA-PESO 1.0000 CYPRUS-EURO 0.8720 CZECH REPUBLIC - KORUNA 21.9410 DEMOCRATIC REPUBLIC OF CONGO- FRANC 1630.0000 DENMARK - KRONE 6.5170 DJIBOUTI - FRANC 177.0000 DOMINICAN REPUBLIC - PESO 49.9400 ECUADOR-DOLARES 1.0000 EGYPT - POUND 17.8900 EL SALVADOR-DOLARES 1.0000 EQUATORIAL GUINEA - CFA FRANC 603.8700 ERITREA - NAKFA 15.0000 ESTONIA-EURO 0.8720 ETHIOPIA - BIRR 28.0400 -

Bahrain Country Report BTI 2012

BTI 2012 | Bahrain Country Report Status Index 1-10 5.89 # 56 of 128 Political Transformation 1-10 4.35 # 87 of 128 Economic Transformation 1-10 7.43 # 21 of 128 Management Index 1-10 4.18 # 91 of 128 scale: 1 (lowest) to 10 (highest) score rank trend This report is part of the Bertelsmann Stiftung’s Transformation Index (BTI) 2012. The BTI is a global assessment of transition processes in which the state of democracy and market economy as well as the quality of political management in 128 transformation and developing countries are evaluated. More on the BTI at http://www.bti-project.org Please cite as follows: Bertelsmann Stiftung, BTI 2012 — Bahrain Country Report. Gütersloh: Bertelsmann Stiftung, 2012. © 2012 Bertelsmann Stiftung, Gütersloh BTI 2012 | Bahrain 2 Key Indicators Population mn. 1.3 HDI 0.806 GDP p.c. $ - Pop. growth1 % p.a. 7.6 HDI rank of 187 42 Gini Index - Life expectancy years 75 UN Education Index 0.747 Poverty3 % - Urban population % 88.6 Gender inequality2 0.288 Aid per capita $ - Sources: The World Bank, World Development Indicators 2011 | UNDP, Human Development Report 2011. Footnotes: (1) Average annual growth rate. (2) Gender Inequality Index (GII). (3) Percentage of population living on less than $2 a day. Executive Summary Bahrain’s democratic reform process has come to a standstill since 2009, which marked the 10th anniversary of King Hamad bin Isa Al Khalifa’s accession to power. The positive developments in civil and political liberties observed with the start of the reform process in 2002 have in recent years been counteracted by repressive state tactics in which freedoms of expression and assembly have suffered most. -

Center for Southeast Asian Studies, Kyoto University Southeast Asian Studies, Vol

https://englishkyoto-seas.org/ Shimojo Hisashi Local Politics in the Migration between Vietnam and Cambodia: Mobility in a Multiethnic Society in the Mekong Delta since 1975 Southeast Asian Studies, Vol. 10, No. 1, April 2021, pp. 89-118. How to Cite: Shimojo, Hisashi. Local Politics in the Migration between Vietnam and Cambodia: Mobility in a Multiethnic Society in the Mekong Delta since 1975. Southeast Asian Studies, Vol. 10, No. 1, April 2021, pp. 89-118. Link to this article: https://englishkyoto-seas.org/2021/04/vol-10-no-1-shimojo-hisashi/ View the table of contents for this issue: https://englishkyoto-seas.org/2021/04/vol-10-no-1-of-southeast-asian-studies/ Subscriptions: https://englishkyoto-seas.org/mailing-list/ For permissions, please send an e-mail to: english-editorial[at]cseas.kyoto-u.ac.jp Center for Southeast Asian Studies, Kyoto University Southeast Asian Studies, Vol. 49, No. 2, September 2011 Local Politics in the Migration between Vietnam and Cambodia: Mobility in a Multiethnic Society in the Mekong Delta since 1975 Shimojo Hisashi* This paper examines the history of cross-border migration by (primarily) Khmer residents of Vietnam’s Mekong Delta since 1975. Using a multiethnic village as an example case, it follows the changes in migratory patterns and control of cross- border migration by the Vietnamese state, from the collectivization era to the early Đổi Mới reforms and into the post-Cold War era. In so doing, it demonstrates that while negotiations between border crossers and the state around the social accep- tance (“licit-ness”) and illegality of cross-border migration were invisible during the 1980s and 1990s, they have come to the fore since the 2000s. -

Doing Business in Azerbaijan

Doing Business in Azerbaijan 2019 Tax and Legal kpmg.az Doing Business in Azerbaijan 2019 Tax and Legal www.kpmg.az 4 Doing Business in Azerbaijan 2019 Contents Contents 4 Foreign investment 21 Foreign investment 21 About KPMG 7 Investment promotion certificates 22 Introduction to Azerbaijan 9 Safeguards for foreign investors 22 Investment climate 9 Bilateral investment treaties 23 Living and working in Azerbaijan – useful tips 10 Licensing requirements 25 Starting a business 13 Land ownership and Overview of commercial legal entities 13 other related rights 29 Types of legal entities 13 Documents confirming rights over land 29 Representative offices and branches 13 Technology parks 31 Joint-stock company (“JSC”) 14 Foreign trade 31 - Open joint-stock companies 14 - Closed joint-stock companies 14 Banking 33 An Azerbaijani subsidiary 15 Secured transactions 35 Limited liability companies (“LLC”) 15 Litigation and arbitration 37 Additional liability companies (“ALC”) 15 Strategic road maps 41 Partnerships 15 State digital payments Cooperatives 15 expansion programme 43 - Membership of a cooperative 16 Special economic zones 45 Registration 16 Alat Free Economic Zone 46 - LLC 16 - JSC 16 Intellectual property 49 - Branches or representative offices 16 Introduction 49 De-registration of companies 17 - Stage 1 17 Legislation 49 - Stage 2 18 Trademarks 50 Registration of changes 19 Patent protection of inventions, industrial designs, and utility models 50 Copyright 51 © 2019 KPMG Azerbaijan Limited. All rights reserved. Doing Business in Azerbaijan -

Currencies Come in Pairs

Chapter 1.2 Currencies Come in Pairs 0 GETTING STARTED CURRENCIES COME IN PAIRS You know the advantages of trading forex, and you are excited to start Everything is relative in the forex market. The euro, by itself, is neither trading. Now you need to learn what this market is all about. How does it strong nor weak. The same holds true for the U.S. dollar. By itself, it is work? What makes currency pairs move up and down? Most importantly, neither strong nor weak. Only when you compare two currencies together how can you make money trading forex? can you determine how strong or weak each currency is in relation to the other currency. Every successful forex investor begins with a solid foundation of knowledge upon which to build. Let’s start with currency pairs—the For example, the euro could be getting stronger compared to the U.S. building blocks of the forex market—and how you will be using them in dollar. However, the euro could also be getting weaker compared to the your trading. British pound at the same time. In this first section, we will explain the following to get you ready to place Currencies always trade in pairs. You never simply buy the euro or sell the your first trade: U.S. dollar. You trade them as a pair. If you believe the euro is gaining strength compared to the U.S. dollar, you buy euros and sell U.S. dollars at What a currency pair is the same time. If you believe the U.S. -

Nagorno-Karabakh's

Nagorno-Karabakh’s Gathering War Clouds Europe Report N°244 | 1 June 2017 Headquarters International Crisis Group Avenue Louise 149 • 1050 Brussels, Belgium Tel: +32 2 502 90 38 • Fax: +32 2 502 50 38 [email protected] Preventing War. Shaping Peace. Table of Contents Executive Summary ................................................................................................................... i I. Introduction ..................................................................................................................... 1 II. Ongoing Risks of War ....................................................................................................... 2 A. Military Tactics .......................................................................................................... 4 B. Potential Humanitarian Implications ....................................................................... 6 III. Shifts in Public Moods and Policies ................................................................................. 8 A. Azerbaijan’s Society ................................................................................................... 8 1. Popular pressure on the government ................................................................... 8 2. A tougher stance ................................................................................................... 10 B. Armenia’s Society ....................................................................................................... 12 1. Public mobilisation and anger -

Recent Characteristics of FX Markets in Asia —A Comparison of Japan, Singapore, and Hong Kong SAR—

Bank of Japan Review 2020-E-3 Recent Characteristics of FX Markets in Asia —A Comparison of Japan, Singapore, and Hong Kong SAR— Financial Markets Department WASHIMI Kazuaki, KADOGAWA Yoichi July 2020 In recent years, turnovers of Foreign Exchange (FX) trading in Singapore and Hong Kong SAR have outweighed those of Japan, and the gap between the two cities and Japan continues to stretch. The two cities consolidate trading of G10 currencies by institutional investors and others by advancing electronic trading. Additionally, a number of treasury departments of overseas financial/non-financial firms are attracted to the two cities, contributing to the increasing trading of Asian currencies in tandem with expanding goods and services trades between China and the ASEAN countries. At this juncture, FX trading related to capital account transactions is relatively small in Asia partly due to capital control measures. However, in the medium to long term, capital account transactions could increase, which would positively affect FX trading. Thinking ahead on post-COVID-19, receiving such capital flows would positively impact on revitalizing the Tokyo FX market, thereby developing Japan’s overall financial markets including capital markets. to understand market structures and revitalize the Introduction Tokyo FX market, it would be beneficial to investigate recent developments in these centers. The Bank for International Settlements (BIS), in Based on above understanding, this paper compares cooperation with the world’s central banks, conducts the FX markets in Tokyo, Singapore, and Hong Kong the Triennial Central Bank Survey of Foreign SAR. The medium- to long-term outlook for Asian 1 Exchange and Over-the-counter Derivatives Markets . -

Currency Codes COP Colombian Peso KWD Kuwaiti Dinar RON Romanian Leu

Global Wire is an available payment method for the currencies listed below. This list is subject to change at any time. Currency Codes COP Colombian Peso KWD Kuwaiti Dinar RON Romanian Leu ALL Albanian Lek KMF Comoros Franc KGS Kyrgyzstan Som RUB Russian Ruble DZD Algerian Dinar CDF Congolese Franc LAK Laos Kip RWF Rwandan Franc AMD Armenian Dram CRC Costa Rican Colon LSL Lesotho Malati WST Samoan Tala AOA Angola Kwanza HRK Croatian Kuna LBP Lebanese Pound STD Sao Tomean Dobra AUD Australian Dollar CZK Czech Koruna LT L Lithuanian Litas SAR Saudi Riyal AWG Arubian Florin DKK Danish Krone MKD Macedonia Denar RSD Serbian Dinar AZN Azerbaijan Manat DJF Djibouti Franc MOP Macau Pataca SCR Seychelles Rupee BSD Bahamian Dollar DOP Dominican Peso MGA Madagascar Ariary SLL Sierra Leonean Leone BHD Bahraini Dinar XCD Eastern Caribbean Dollar MWK Malawi Kwacha SGD Singapore Dollar BDT Bangladesh Taka EGP Egyptian Pound MVR Maldives Rufi yaa SBD Solomon Islands Dollar BBD Barbados Dollar EUR EMU Euro MRO Mauritanian Olguiya ZAR South African Rand BYR Belarus Ruble ERN Eritrea Nakfa MUR Mauritius Rupee SRD Suriname Dollar BZD Belize Dollar ETB Ethiopia Birr MXN Mexican Peso SEK Swedish Krona BMD Bermudian Dollar FJD Fiji Dollar MDL Maldavian Lieu SZL Swaziland Lilangeni BTN Bhutan Ngultram GMD Gambian Dalasi MNT Mongolian Tugrik CHF Swiss Franc BOB Bolivian Boliviano GEL Georgian Lari MAD Moroccan Dirham LKR Sri Lankan Rupee BAM Bosnia & Herzagovina GHS Ghanian Cedi MZN Mozambique Metical TWD Taiwan New Dollar BWP Botswana Pula GTQ Guatemalan Quetzal -

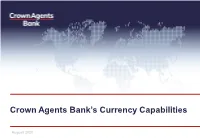

Crown Agents Bank's Currency Capabilities

Crown Agents Bank’s Currency Capabilities August 2020 Country Currency Code Foreign Exchange RTGS ACH Mobile Payments E/M/F Majors Australia Australian Dollar AUD ✓ ✓ - - M Canada Canadian Dollar CAD ✓ ✓ - - M Denmark Danish Krone DKK ✓ ✓ - - M Europe European Euro EUR ✓ ✓ - - M Japan Japanese Yen JPY ✓ ✓ - - M New Zealand New Zealand Dollar NZD ✓ ✓ - - M Norway Norwegian Krone NOK ✓ ✓ - - M Singapore Singapore Dollar SGD ✓ ✓ - - E Sweden Swedish Krona SEK ✓ ✓ - - M Switzerland Swiss Franc CHF ✓ ✓ - - M United Kingdom British Pound GBP ✓ ✓ - - M United States United States Dollar USD ✓ ✓ - - M Africa Angola Angolan Kwanza AOA ✓* - - - F Benin West African Franc XOF ✓ ✓ ✓ - F Botswana Botswana Pula BWP ✓ ✓ ✓ - F Burkina Faso West African Franc XOF ✓ ✓ ✓ - F Cameroon Central African Franc XAF ✓ ✓ ✓ - F C.A.R. Central African Franc XAF ✓ ✓ ✓ - F Chad Central African Franc XAF ✓ ✓ ✓ - F Cote D’Ivoire West African Franc XOF ✓ ✓ ✓ ✓ F DR Congo Congolese Franc CDF ✓ - - ✓ F Congo (Republic) Central African Franc XAF ✓ ✓ ✓ - F Egypt Egyptian Pound EGP ✓ ✓ - - F Equatorial Guinea Central African Franc XAF ✓ ✓ ✓ - F Eswatini Swazi Lilangeni SZL ✓ ✓ - - F Ethiopia Ethiopian Birr ETB ✓ ✓ N/A - F 1 Country Currency Code Foreign Exchange RTGS ACH Mobile Payments E/M/F Africa Gabon Central African Franc XAF ✓ ✓ ✓ - F Gambia Gambian Dalasi GMD ✓ - - - F Ghana Ghanaian Cedi GHS ✓ ✓ - ✓ F Guinea Guinean Franc GNF ✓ - ✓ - F Guinea-Bissau West African Franc XOF ✓ ✓ - - F Kenya Kenyan Shilling KES ✓ ✓ ✓ ✓ F Lesotho Lesotho Loti LSL ✓ ✓ - - E Liberia Liberian