The History and Development of Canada's Personal

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Canadian Official Historians and the Writing of the World Wars Tim Cook

Canadian Official Historians and the Writing of the World Wars Tim Cook BA Hons (Trent), War Studies (RMC) This thesis is submitted in fulfillment of the requirements for the degree of Doctor of Philosophy School of Humanities and Social Sciences UNSW@ADFA 2005 Acknowledgements Sir Winston Churchill described the act of writing a book as to surviving a long and debilitating illness. As with all illnesses, the afflicted are forced to rely heavily on many to see them through their suffering. Thanks must go to my joint supervisors, Dr. Jeffrey Grey and Dr. Steve Harris. Dr. Grey agreed to supervise the thesis having only met me briefly at a conference. With the unenviable task of working with a student more than 10,000 kilometres away, he was harassed by far too many lengthy emails emanating from Canada. He allowed me to carve out the thesis topic and research with little constraints, but eventually reined me in and helped tighten and cut down the thesis to an acceptable length. Closer to home, Dr. Harris has offered significant support over several years, leading back to my first book, to which he provided careful editorial and historical advice. He has supported a host of other historians over the last two decades, and is the finest public historian working in Canada. His expertise at balancing the trials of writing official history and managing ongoing crises at the Directorate of History and Heritage are a model for other historians in public institutions, and he took this dissertation on as one more burden. I am a far better historian for having known him. -

THE ECONOMY of CANADA in the NINETEENTH CENTURY Marvin Mcinnis

2 THE ECONOMY OF CANADA IN THE NINETEENTH CENTURY marvin mcinnis FOUNDATIONS OF THE NINETEENTH- CENTURY CANADIAN ECONOMY For the economy of Canada it can be said that the nineteenth century came to an end in the mid-1890s. There is wide agreement among observers that a fundamental break occurred at about that time and that in the years thereafter Canadian economic development, industrialization, population growth, and territorial expansion quickened markedly. This has led economic historians to put a special emphasis on the particularly rapid economic expansion that occurred in the years after about 1896. That emphasis has been deceptive and has generated a perception that little of consequence was happening before 1896. W. W. Rostow was only reflecting a reasonable reading of what had been written about Canadian economic history when he declared the “take-off” in Canada to have occurred in the years between 1896 and 1913. That was undoubtedly a period of rapid growth and great transformation in the Canadian economy and is best considered as part of the twentieth-century experience. The break is usually thought to have occurred in the mid-1890s, but the most indicative data concerning the end of this period are drawn from the 1891 decennial census. By the time of the next census in 1901, major changes had begun to occur. It fits the available evidence best, then, to think of an early 1890s end to the nineteenth century. Some guidance to our reconsideration of Canadian economic devel- opment prior to the big discontinuity of the 1890s may be given by a brief review of what had been accomplished by the early years of that decade. -

(And Re-Writing) of Canadian National History Jennifer Hamel

A Brief History of the Writing (and Re-Writing) of Canadian National History By Jennifer Hamel A Thesis Submitted in Partial Fulfillment of the Requirements for the Degree of MASTER OF ARTS in The College of Graduate Studies and Research (Department of History, University of Saskatchewan) University of Saskatchewan 24 July 2009 © Jennifer Leigh Hamel, 2009. All Rights Reserved. i Permission to Use In presenting this thesis in partial fulfillment of the requirements for a Masters of Arts Degree from the University of Saskatchewan, I agree that the Libraries of this University may make it freely available for inspection. I further agree that permission for copying of this thesis in any manner, in whole or in part, for scholarly purposes may be granted by the professor or professors who supervised my thesis work or, in their absence, by the Head of the Department or the Dean of the College in which my thesis work was done. It is understood that any copying, publication, or use of this thesis or parts thereof for financial gain shall not be allowed without my written permission. It is also understood that due recognition shall be given to me and to the University of Saskatchewan in any scholarly use which may be made of any material in my thesis. Requests for permission to copy or to make other use of material in this thesis in whole or in part should be addressed to: Head of the Department of History University of Saskatchewan Saskatoon, Saskatchewan, S7N 5A5 ii Abstract Canadian historians periodically reassess the state of their craft, including their role as conveyors of the past to the Canadian public. -

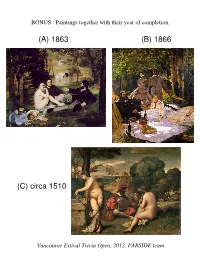

1866 (C) Circa 1510 (A) 1863

BONUS : Paintings together with their year of completion. (A) 1863 (B) 1866 (C) circa 1510 Vancouver Estival Trivia Open, 2012, FARSIDE team BONUS : Federal cabinet ministers, 1940 to 1990 (A) (B) (C) (D) Norman Rogers James Ralston Ernest Lapointe Joseph-Enoil Michaud James Ralston Mackenzie King James Ilsley Louis St. Laurent 1940s Andrew McNaughton 1940s Douglas Abbott Louis St. Laurent James Ilsley Louis St. Laurent Brooke Claxton Douglas Abbott Lester Pearson Stuart Garson 1950s 1950s Ralph Campney Walter Harris John Diefenbaker George Pearkes Sidney Smith Davie Fulton Donald Fleming Douglas Harkness Howard Green Donald Fleming George Nowlan Gordon Churchill Lionel Chevrier Guy Favreau Walter Gordon 1960s Paul Hellyer 1960s Paul Martin Lucien Cardin Mitchell Sharp Pierre Trudeau Leo Cadieux John Turner Edgar Benson Donald Macdonald Mitchell Sharp Edgar Benson Otto Lang John Turner James Richardson 1970s Allan MacEachen 1970s Ron Basford Donald Macdonald Don Jamieson Barney Danson Otto Lang Jean Chretien Allan McKinnon Flora MacDonald JacquesMarc Lalonde Flynn John Crosbie Gilles Lamontagne Mark MacGuigan Jean Chretien Allan MacEachen JeanJacques Blais Allan MacEachen Mark MacGuigan Marc Lalonde Robert Coates Jean Chretien Donald Johnston 1980s Erik Nielsen John Crosbie 1980s Perrin Beatty Joe Clark Ray Hnatyshyn Michael Wilson Bill McKnight Doug Lewis BONUS : Name these plays by Oscar Wilde, for 10 points each. You have 30 seconds. (A) THE PAGE OF HERODIAS: Look at the moon! How strange the moon seems! She is like a woman rising from a tomb. She is like a dead woman. You would fancy she was looking for dead things. THE YOUNG SYRIAN: She has a strange look. -

Accession No. 1986/428

-1- Liberal Party of Canada MG 28 IV 3 Finding Aid No. 655 ACCESSION NO. 1986/428 Box No. File Description Dates Research Bureau 1567 Liberal Caucus Research Bureau Briefing, Book - British Columbia, Vol. I July 1981 Liberal Caucus Research Bureau Briefing, Book - Saskatchewan, Vol. I and Sept. 1981 II Liberal Caucus Research Bureau Briefing, Book - Alberta, Vol. II May 20, 1981 1568 Liberal Caucus Research Bureau Briefing, Book - Manitoba, Vols. II and III 1981 Liberal caucus Research Bureau Briefing, Book - British Columbia, Vol. IV 1981 Elections & Executive Minutes 1569 Minutes of LPC National Executive Meetings Apr. 29, 1979 to Apr. 13, 1980 Poll by poll results of October 1978 By-Elections Candidates' Lists, General Elections May 22, 1979 and Feb. 18, 1980 Minutes of LPC National Executive Meetings June-Dec. 1981 1984 General Election: Positions on issues plus questions and answers (statements by John N. Turner, Leader). 1570 Women's Issues - 1979 General Election 1979 Nova Scotia Constituency Manual Mar. 1984 Analysis of Election Contribution - PEI & Quebec 1980 Liberal Government Anti-Inflation Controls and Post-Controls Anti-Inflation Program 2 LIBERAL PARTY OF CANADA MG 28, IV 3 Box No. File Description Dates Correspondence from Senator Al Graham, President of LPC to key Liberals 1978 - May 1979 LPC National Office Meetings Jan. 1976 to April 1977 1571 Liberal Party of Newfoundland and Labrador St. John's West (Nfld) Riding Profiles St. John's East (Nfld) Riding Profiles Burin St. George's (Nfld) Riding Profiles Humber Port-au-Port-St. -

Towards a Historiography of Canadian Defence Research During the Second World War Jason S

Document generated on 09/27/2021 12:36 p.m. International Journal of Canadian Studies Revue internationale d’études canadiennes Emergence: Towards a Historiography of Canadian Defence Research during the Second World War Jason S. Ridler Canadian Challenges Article abstract Les défis canadiens The Second World War forced Canada to become a nation with effective Number 37, 2008 defence research assets, and these assets were among the nation's many contributions to victory in 1945. The historical literature on these URI: https://id.erudit.org/iderudit/040798ar developments has been slow to develop though it is now becoming an DOI: https://doi.org/10.7202/040798ar increasingly popular field of study. This premier historiography attempts to chart how and why the writings on Canada's defence research efforts during the Second World War have grown, its various forms of discourse, and its See table of contents major themes, controversies, and deficiencies. Publisher(s) Conseil international d'études canadiennes ISSN 1180-3991 (print) Explore this journal Cite this article Ridler, J. S. (2008). Emergence: Towards a Historiography of Canadian Defence Research during the Second World War. International Journal of Canadian Studies / Revue internationale d’études canadiennes, (37), 139–164. https://doi.org/10.7202/040798ar Tous droits réservés © Conseil international d'études canadiennes, 2008 This document is protected by copyright law. Use of the services of Érudit (including reproduction) is subject to its terms and conditions, which can be viewed online. https://apropos.erudit.org/en/users/policy-on-use/ This article is disseminated and preserved by Érudit. Érudit is a non-profit inter-university consortium of the Université de Montréal, Université Laval, and the Université du Québec à Montréal. -

New France (Ca

New France (ca. 1600-1770) Trade silver, beaver, eighteenth century Manufactured in Europe and North America for trade with the Native peoples, trade silver came in many forms, including ear bobs, rings, brooches, gorgets, pendants, and animal shapes. According to Adam Shortt,5 the great France, double tournois, 1610 Canadian economic historian, the first regular Originally valued at 2 deniers, the system of exchange in Canada involving Europeans copper “double tournois” was shipped to New France in large quantities during occurred in Tadoussac in the early seventeenth the early 1600s to meet the colony’s century. Here, French traders bartered each year need for low-denomination coins. with the Montagnais people (also known as the Innu), trading weapons, cloth, food, silver items, and tobacco for animal pelts, especially those of the beaver. Because of the risks associated with In 1608, Samuel de Champlain founded transporting gold and silver (specie) across the the first colonial settlement at Quebec on the Atlantic, and to attract and retain fresh supplies of St. Lawrence River. The one universally accepted coin, coins were given a higher value in the French medium of exchange in the infant colony naturally colonies in Canada than in France. In 1664, became the beaver pelt, although wheat and moose this premium was set at one-eighth but was skins were also employed as legal tender. As the subsequently increased. In 1680, monnoye du pays colony expanded, and its economic and financial was given a value one-third higher than monnoye needs became more complex, coins from France de France, a valuation that held until 1717 when the came to be widely used. -

A Brief History of Fisheries in Canada

AFS 150TH ANNIVERSARY CELEBRATION A Brief History of Fisheries in Canada Rowshyra A. Castañeda | University of Toronto, Department of Ecology and Evolutionary Biology, Toronto, ON M5S 3B2, Canada | University of Toronto Scarborough, Department of Biological Sciences, Toronto, ON, Canada. E-mail: [email protected] Colleen M. M. Burliuk | Queen’s University, Department of Biology, Kingston, ON, Canada John M. Casselman | Queen’s University, Department of Biology, Kingston, ON, Canada Steven J. Cooke | Carleton University, Department of Biology and Institute of Environmental and Interdisciplinary Science, Ottawa, ON, Canada Karen M. Dunmall | Fisheries and Oceans Canada, Winnipeg, MB, Canada L. Scott Forbes | The University of Winnipeg, Department of Biology, Winnipeg, MB, Canada Caleb T. Hasler | The University of Winnipeg, Department of Biology, Winnipeg, MB, Canada Kimberly L. Howland | Fisheries and Oceans Canada, Winnipeg, MB, Canada Jeffrey A. Hutchings | Dalhousie University, Department of Biology, Halifax, NS, Canada | Institute of Marine Research, Flødevigen Marine Research Station, His, Norway | University of Agder, Department of Natural Sciences, Kristiansand, Norway Geoff M. Klein | Manitoba Agriculture and Resource Development, Winnipeg, MB, Canada Vivian M. Nguyen | Carleton University, Department of Biology and Institute of Environmental and Interdisciplinary Science, Ottawa, ON, Canada Michael H. H. Price | Simon Fraser University, Department of Biological Sciences, Earth to Ocean Research Group, Burnaby, BC, Canada Andrea J. Reid | Carleton University, Department of Biology and Institute of Environmental and Interdisciplinary Science, Ottawa, ON, Canada James D. Reist | Fisheries and Oceans Canada, Winnipeg, MB, Canada John D. Reynolds | Simon Fraser University, Department of Biological Sciences, Earth to Ocean Research Group, Burnaby, BC, Canada Alexander Van Nynatten | University of Toronto Scarborough, Department of Biological Sciences, Toronto, ON, Canada Nicholas E. -

THE JESUIT MISSION to CANADA and the FRENCH WARS of RELIGION, 1540-1635 Dissertation P

“POOR SAVAGES AND CHURLISH HERETICS”: THE JESUIT MISSION TO CANADA AND THE FRENCH WARS OF RELIGION, 1540-1635 Dissertation Presented in Partial Fulfillment of the Requirements for the Degree Doctor of Philosophy in the Graduate School of The Ohio State University By Joseph R. Wachtel, M.A. Graduate Program in History The Ohio State University 2013 Dissertation Committee: Professor Alan Gallay, Adviser Professor Dale K. Van Kley Professor John L. Brooke Copyright by Joseph R. Wachtel 2013 Abstract My dissertation connects the Jesuit missions in Canada to the global Jesuit missionary project in the late sixteenth and early seventeenth centuries by exploring the impact of French religious politics on the organizing of the first Canadian mission, established at Port Royal, Acadia, in 1611. After the Wars of Religion, Gallican Catholics blamed the Society for the violence between French Catholics and Protestants, portraying Jesuits as underhanded usurpers of royal authority in the name of the Pope—even accusing the priests of advocating regicide. As a result, both Port Royal’s settlers and its proprietor, Jean de Poutrincourt, never trusted the missionaries, and the mission collapsed within two years. After Virginia pirates destroyed Port Royal, Poutrincourt drew upon popular anti- Jesuit stereotypes to blame the Jesuits for conspiring with the English. Father Pierre Biard, one of the missionaries, responded with his 1616 Relation de la Nouvelle France, which described Port Royal’s Indians and narrated the Jesuits’ adventures in North America, but served primarily as a defense of their enterprise. Religio-political infighting profoundly influenced the interaction between Indians and Europeans in the earliest years of Canadian settlement. -

The D E F ENCE TEAM

EDIT DRDC-RDDC-2015-P120 Canada’s defence establishment is a unique organization, comprising two distinct E MAY 2015 D BY: institutions: the civilian-led Department of National Defence (DND), headed by the Deputy Minister of National Defence, and the military-led Canadian Armed Forces GOLDENBER (CAF), headed by the Chief of the Defence Staff. In practice, however, civilian and military personnel – collectively referred to as the Defence Team – work side by side in a variety of contexts, including on bases, on operations, in military academic settings, and at National Defence Headquarters. G , FEBBRARO & These highly integrated workforces allow Canada’s defence establishment to draw on the complementary expertise of military and civilian personnel. Nonetheless, some fundamental differences exist between the military and civilian institutions, most notably separate personnel management systems and distinct cultures that reflect the D different histories, values, roles and policies of Defence civilians and CAF members. EAN Understanding the unique benefits and challenges associated with this integrated workforce is therefore critical to optimal military-civilian personnel collaboration. THE This volume presents conceptual, empirical and historical analyses of the key contextual, organizational and interpersonal factors that influence collaboration between civilian and military personnel in DND and the CAF. The volume will appeal to a diverse audience, including Defence Team personnel, senior leaders in DND and the CAF, human resource professionals, military managers of civilian D personnel and civilian managers of military personnel, and a more general audience interested in workgroup and organizational diversity. The volume furthers our E understanding of military-civilian partnerships and will contribute to the discourse F on the evolution of the Defence Team within Canada. -

Grade 11 History of Canada Framework Chart

Grade 11 History of Canada How has Canada’s history shaped the Canada of today? Beginnings 1763 1867 1931 1982 Present First Peoples and British Becoming a Achievements and Defining Nouvelle-France North America Sovereign Nation Challenges Contemporary Canada (before 1763) (1763 – 1867) (1867 – 1931) (1931 – 1982) (1982 – Present) 1.0: What is history, 2.1: How did British 3.1: Why did the Métis 4.1: How did Canada 5.1: How has Canada and why do we study it? colonial rule change resist the westward seek to establish been shaped by the during this period, and expansion of Canada, economic security and Canadian Charter of what was its impact on and what were the social justice from the Rights and Freedoms, life in North America? consequences? period of the cultural diversity, and Depression to the demographic and 1.1: Who were the patriation of the technological change? First Peoples, and how Constitution? did they structure their world? 2.2: How did the fur 3.2: How did territorial trade, European expansion, immigration, settlement, and the rise and industrialization 5.2: How has the of the Métis nation change life for men and 4.2: How did the question of national transform life for the women in Canada? establishment of unity influenced 1.2: Why did the peoples of the national institutions federalism, French and other Northwest? contribute to defining constitutional debate, Europeans come to Canadian identity? and political change? North America, and how did they interact with 3.3: How did Canada’s First Peoples? relationship with First -

The Liberal Third Option

The Liberal Third Option: A Study of Policy Development A Thesis Submitted to the Faculty of Graduate Studies and Research in Partial Fuliiment of the Requirements for the Degree of Master of Arts in Political Science University of Regina by Guy Marsden Regina, Saskatchewan September, 1997 Copyright 1997: G. W. Marsden 395 Wellington Street 395, rue Wellington Ottawa ON KI A ON4 Ottawa ON KIA ON4 Canada Canada Your hie Votre rdtérence Our ME Notre référence The author has granted a non- L'auteur a accordé une licence non exclusive licence allowing the exclusive permettant à la National Library of Canada to Bibliothèque nationale du Canada de reproduce, loan, distibute or sell reproduire, prêter, distribuer ou copies of this thesis in microform, vendre des copies de cette thèse sous paper or electronic formats. la forme de microfiche/nlm, de reproduction sur papier ou sur format électronique. The author retains ownership of the L'auteur conserve la propriété du copyright in this thesis. Neither the droit d'auteur qui protège cette thèse. thesis nor substanîial extracts fiom it Ni la thèse ni des extraits substantiels may be printed or otherwise de celle-ci ne doivent être imprimés reproduced without the author's ou autrement reproduits sans son permission. autorisation. This study presents an analysis of the nationalist econornic policies enacted by the federal Liberal government during the 1970s and early 1980s. The Canada Development Corporation(CDC), the Foreign Investment Review Agency(FIRA), Petro- Canada(PetroCan) and the National Energy Prograrn(NEP), coliectively referred to as "The Third Option," aimed to reduce Canada's dependency on the United States.