KAVAR Canvas the Science of Investing

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Here Any Question When a Cut and a Slice Are Just the Same

Architectural Association The Slice: School of Architecture Cutting to See A cut and a slice is there any question when a cut and a slice are just the same. A cut and a slice has no particular exchange it has such a strange exception to all that which is different. A cut and only slice, only a cut and only a slice, the remains of a taste may remain and tasting is accurate. A cut and an occasion, a slice and a substitute a single hurry and a circumstance that shows that, all this is so reasonable when every thing is clear. — Gertrude Stein, What Happened: A Play (1922) Seeing is a matter of surfaces. It’s for this a secret order, spill lurid innards and open reason that both vision and representation new views. The convention of the architec- are continually haunted by the problem tural cross-section here finds its parallel of insides and outsides – the relationship in the physical sectioning of histological between the external and what lies within. specimens. The pleasures of the Paris- A merely perceptual matter? If only. It has ian voyeur meet the dutiful labours of the crept on us: the ocular paradigm of post- lumberjack. The earth itself, like an onion, Cartesian metaphysics gradually sublimed reveals its hidden structure. So take a look. this pervasive visual anxiety, creating in But remember, cutting to see is an object the process our basic metaphors for critical lesson in the violence of vision. The world inquiry itself: ‘superficial’ propositions, looks different when you wield an edge. -

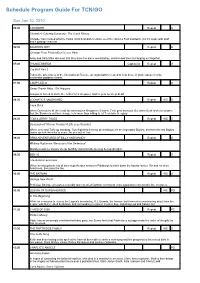

Program Guide Report

Schedule Program Guide For TCN/GO Sun Jan 10, 2010 06:00 CHOWDER Repeat G Chowder's Catering Company / The Catch Phrase Chowder has created what he thinks is his best dish creation ever! He calls it a Foof sandwich, but it's made with stuff that's garbage material. 06:30 SQUIRREL BOY Repeat G Stranger Than Friction/Don't Cross Here Andy and Salty Mike discover that they have the same weird hobby, which leads them to hanging out together. 07:00 THUNDERBIRDS Captioned Repeat G Cry Wolf Part 2 Follow the adventures of the International Rescue, an organisation created to help those in grave danger in this marionette puppetry classic. 07:30 CAMP LAZLO Repeat G Sweet Dream Baby / Dirt Nappers Lumpus is forced to invite the Jellies for a sleepover and he gets no sleep at all! 08:00 LOONATICS UNLEASHED Repeat WS G Cape Duck When Duck takes all the credit for catching the Shropshire Slasher, Tech gets annoyed. But when Duck starts to suspect that the Slasher is out for revenge, he's more than willing to let Tech take the glory. 08:30 TOM & JERRY TALES Repeat WS G Sasquashed/ Xtreme Trouble/ A Life Less Guarded When Jerry and Tuffy go camping, Tom frightens them by pretending to be the legendary Bigfoot, but then the real Bigfoot teams up with the mice to scare the wits out of Tom. 09:00 GRIM ADVENTURES OF BILLY AND MANDY Repeat G Waking Nightmare / Because of the Undertoad Mandy needs her beauty sleep, but Billy risks his hide to keep her up all night. -

CS4102 Algorithms Summer 2020 Warm Up

CS4102 Algorithms Summer 2020 Warm Up How many arithmetic operations are required to multiply a 푛 × 푚 Matrix with a 푚 × 푝 Matrix? (don’t overthink this) 푝 푚 푚 푛 × 1 Warm Up How many arithmetic operations are required to multiply a 푛 × 푚 Matrix with a 푚 × 푝 Matrix? (don’t overthink this) 푝 푝 푚 푛 × 푚 = 푛 • 푚 multiplications and additions per element • 푛 ⋅ 푝 elements to compute • Total cost: 푚 ⋅ 푛 ⋅ 푝 2 Dynamic Programming • Requires Optimal Substructure – Solution to larger problem contains the (optimal) solutions to smaller ones • Idea: 1. Identify the recursive structure of the problem • What is the “last thing” done? 2. Save the solution to each subproblem in memory 3. Select a good order for solving subproblems • “Top Down”: Solve each recursively • “Bottom Up”: Iteratively solve smallest to largest 3 Matrix Chaining • Given a sequence of Matrices (푀1, … , 푀푛), what is the most efficient way to multiply them? 푐4 푐2 푐 1 푐3 푟 × 푟 푀 × 푀 푟1 푀1 × 2 푀2 3 3 푟4 4 4 Order Matters! 푐2 푐3 푐1 = 푟2 푐1 푐2 = 푟3 푟 × 푟 푟1 푀1 × 2 푀2 3 푀3 푐2 푟1 • 푀1 × 푀2 × 푀3 – uses 푐1 ⋅ 푟1 ⋅ 푐2 + c2 ⋅ 푟1 ⋅ 푐3 operations 5 Order Matters! 푐2 푐3 푐1 = 푟2 푐1 푐2 = 푟3 푟 × 푟 푟1 푀1 × 2 푀2 3 푀3 푐3 푟2 • 푀1 × (푀2 × 푀3) – uses c1 ⋅ r1 ⋅ 푐3 + (c2 ⋅ 푟2 ⋅ 푐3) operations 6 Order Matters! 푐1 = 푟2 푐2 = 푟3 • 푀1 × 푀2 × 푀3 – uses 푐1 ⋅ 푟1 ⋅ 푐2 + c2 ⋅ 푟1 ⋅ 푐3 operations 푀1 = 7 × 10 – 10 ⋅ 7 ⋅ 20 + 20 ⋅ 7 ⋅ 8 = 2520 푀2 = 10 × 20 • 푀1 × (푀2 × 푀3) 푀3 = 20 × 8 – uses 푐1 ⋅ 푟1 ⋅ 푐3 + (c2 ⋅ 푟2 ⋅ 푐3) operations 푐1 = 10 푐2 = 20 – 10 ⋅ 7 ⋅ 8 + 20 ⋅ 10 ⋅ 8 = 2160 푐3 = 8 푟1 = 7 푟2 = 10 푟3 = 20 7 Dynamic Programming • Requires Optimal Substructure – Solution to larger problem contains the solutions to smaller ones • Idea: 1. -

Sydney Program Guide

6/19/2020 prtten04.networkten.com.au:7778/pls/DWHPROD/Program_Reports.Dsp_ELEVEN_Guide?psStartDate=05-Jul-20&psEndDate=11-… SYDNEY PROGRAM GUIDE Sunday 05th July 2020 06:00 am Toasted TV G Toasted TV Sunday 2020 163 Want the lowdown on what's hot in the playground? Join the team for the latest in pranks, movies, music, sport, games and other seriously fun stuff! Featuring a variety of your favourite cartoons. 06:05 am Dora The Explorer (Rpt) G Baby Bongo's Big Music Show Dora and Boots take Baby Bongo on a musical adventure as they race to the Big Music Show in time for Baby Bongo's first performance. 06:25 am Toasted TV G Toasted TV Sunday 2020 164 Want the lowdown on what's hot in the playground? Join the team for the latest in pranks, movies, music, sport, games and other seriously fun stuff! Featuring a variety of your favourite cartoons. 06:30 am Blaze And The Monster Machine (Rpt) G The Jungle Horn Stripes loves his jungle horn, a special instrument that can summon all the animals in the jungle, but when a jealous Crusher steals it, Blaze & Stripes must speed after him in a chase to get it back. 06:55 am Toasted TV G Toasted TV Sunday 2020 165 Want the lowdown on what's hot in the playground? Join the team for the latest in pranks, movies, music, sport, games and other seriously fun stuff! Featuring a variety of your favourite cartoons. 07:00 am The Bureau Of Magical Things (Rpt) CC G Forces Of Attraction Ruksy, Imogen and Lily venture into the dangerous Restricted Section of the Library in search of the truth about Kyra's new magical powers. -

Sydney Program Guide

9/4/2020 prtten04.networkten.com.au:7778/pls/DWHPROD/Program_Reports.Dsp_ELEVEN_Guide?psStartDate=06-Sep-20&psEndDate=19-… SYDNEY PROGRAM GUIDE Sunday 06th September 2020 06:00 am Toasted TV G Toasted TV Sunday 2020 217 Want the lowdown on what's hot in the playground? Join the team for the latest in pranks, movies, music, sport, games and other seriously fun stuff! Featuring a variety of your favourite cartoons. 06:05 am Teenage Mutant Ninja Turtles (Rpt) G Four Turtles And A Baby The Turtles are given the responsibility of safeguarding the infant daughter of two Neutrinos as their home planet comes under attack from Krang's forces. 06:25 am Toasted TV G Toasted TV Sunday 2020 218 Want the lowdown on what's hot in the playground? Join the team for the latest in pranks, movies, music, sport, games and other seriously fun stuff! Featuring a variety of your favourite cartoons. 06:30 am Blaze And The Monster Machines (Rpt) G Stuntmania Darington has built the ultimate stunt-track for Stuntmania and every Monster Machine in town is coming to see the show, which incites jealousy in Crusher and leads him to play a trick on Darington. 06:55 am Toasted TV G Toasted TV Sunday 2020 219 Want the lowdown on what's hot in the playground? Join the team for the latest in pranks, movies, music, sport, games and other seriously fun stuff! Featuring a variety of your favourite cartoons. 07:00 am Paw Patrol (Rpt) G Pups Pit Crew / Pups Fight Fire The PAW Patrol have to rescue Alex when he takes off on his new trike. -

23 Novembre 2005 1,25$ + T.P.S

Une affaire de coeur avec nos lecteurs depuis 1976 ! À L’INTÉRIEUR Jean-Serge Bordeleau....HA2 Sur la scène poli- cière..............HA11 Champagne avec Gatineau.....HA23 Vol. 30 No 36 Hearst On ~ Le mercredi 23 novembre 2005 1,25$ + T.P.S. PenséePensée Pensée Tout amuse quand on y metP dee lan persévérance:sée l'homme qui apprendrait par coeur un dictionnairePens finiraitée par Py trouveren dus éplaisir.e PeFlaubertnsée Juste pour rire! Un fermier trouve deux policiers enterrés dans son Pompiers, policiers et ambu- champ. - Mais qu’est-ce lanciers ont été dépêchés à l’École secondaire catholique de Hearst que vous faites là? - Nous jeudi dernier à l’occasion d’une étions en train de pour- simulation d’une catastrophe. L’exercice a pour but de vérifier suivre un le fonctionnement des services voleur, mais il d’urgence de la communauté. L’explosion de la salle de classe de nous a semés ! soudure a fait trois victimes et Tiré du livre Nouvelle plusieurs blessés, rôles joués par Histoire drôles, publié aux les membres du cours de théâtre. Édition Héritage jeunesse. Photo Le Nord/CP Le Conseil des services sociaux revient sur sa décision MÉTÉO On retire les avis de mises à pied pour MERCREDI les ambulanciers Faible neige HEARST(AB) – Le personnel durée. les mises à pied ont été retirées, 30 à 19 h 30 le samedi et le Min -17; Max -5 PdP 80% ambulancier de l’Hôpital Notre- Toutefois, lundi matin, on promet toutefois de continuer dimanche. De 19 h 30 à 7 h 30, JEUDI Dame de Hearst s’est vu accordé l’Hôpital Notre-Dame retirait les à lutter dans ce dossier puisque les deux ambulanciers travaille- une forme de sursis la semaine avis de mises à pied prévues pour selon la nouvelle entente propo- ront sur appel. -

Three Drugs Are Required to Cure Lung Infection

THE INDEPENDENT | Ashland | Kentucky TV & ADVICE Monday, April 30, 2012 B5 Absence of TONIGHT'S TELEVISION APRIL 30, 2012 7 PM 7:30 8 PM 8:30 9 PM 9:30 10 PM 10:30 11 PM 11:30 12 AM 12:30 manners BROADCAST CHANNELS WSAZ Wheel of Jeopardy! The Voice The final two members of the coaches' Smash "Tech" (N) WSAZ :35 The Tonight Show :35 NBC Fortune teams perform in the hopes of moving forward. News With Jay Leno (N) LateNight turns dinner WLPX Cold Case "Cargo" Cold Case "The Good Cold Case "8:03 AM" Criminal Minds "The Criminal Minds "Our Criminal Minds "The ION Death" Internet Is Forever" Darkest Hour" Longest Night" Buy a Dog - Sell a Hog Lift Up America: Ambassadors of Compassion Paid Paid Fearless Music Mix ! Out of Bounds (2003) to disaster TV-10 Program Program Music USA Sophia Myles. WCHS Judge Judy Entertainm Dancing With the Stars (N) Castle "Undead Again" Eyewitness :35 News Jimmy Kimmel Live ABC ent Tonight (N) News Nightline Dear Abby: My 11-year-old niece, “Nina,” has no table manners. I WVAH Two and a Big Bang Bones "The Family in the House "The C-Word" (N) Eyewitness News at 10 The Excused Loves Ray Paid was surprised at her inappropriate FOX Half Men Theory Feud" (N) p.m. Simpsons "Slave" Program behavior because her parents are WOWK 13 News at Inside Met Your 2 Broke Two and a Mike & Hawaii Five-0 "Pa Make 13 News :35 The Late Show With :35 The Late well-educated people who were CBS 7:00 p.m. -

Monday Bestbets

Saturday, June 28, 2014 • Waynesboro, VA • THE NEWS VIRGINIAN 11 MONDAY EVENING JUNE 30, 2014 Monday 6 PM 6:30 7 PM 7:30 8 PM 8:30 9 PM 9:30 10 PM 10:30 11 PM 11:30 DISH DTV TV-3 News ABC WoRld Wheel of JeopaRdy! The BacheloRette (N) MistResses 'Playing With TV-3 News (:35) Kimmel WHSV (3) (3) 3 3 at 6 News FoRtune Fire' (N) at 11 (N) bestbets NBC 29 NBC Nightly Wheel of JeopaRdy! Last Comic Standing AmeRican Ninja WaRRioR 'Miami Qualifying' Miami, NBC 29 (:35) Jimmy WVIR (4) - - News News FoRtune 'Challenge 1- Sketch' Fla., is the next stop foR competitors. (N) News Fallon FOX 5 News TMZ ModeRn ModeRn MasteRchef 'Top 16 24: AnotheR Day '8:00 FOX 5 News Champions News Edge TMZ WTTG (5) (5) - - at 6 p.m. Family Family Compete' (N) p.m. - 9:00 p.m.' (N) Among Us CBS 6 News CBS Evening CBS 6 News Access 2 BRoke Mom The Big The Big UndeR the Dome 'Heads CBS 6 News (:35) David WTVR (6) - - News at 7 p.m. Hollywood GiRls Bang TheoRy Bang TheoRy Will Roll' (SP) (N) LetteRman 9 News at 6 CBS Evening 9 News at 7 EnteRtainm- 2 BRoke Mom The Big The Big UndeR the Dome 'Heads 9 News at (:35) David WUSA (9) (9) 9 9 p.m. News p.m. ent Tonight GiRls Bang TheoRy Bang TheoRy Will Roll' (SP) (N) 11 pm LetteRman WSLS 10 at NBC Nightly WSLS 10 at Inside Last Comic Standing AmeRican Ninja WaRRioR 'Miami Qualifying' Miami, WSLS 10 at (:35) Jimmy WSLS (10) - - 6 p.m. -

Dependents Schools (DOD), Washington, D.C

0 DOCUMENT RESUME ED 112 021 CE 004 768. TITLE Career: Secondary School Career Education. .INSTITUTION Dependents Schools (DOD), Washington, D.C. Pacific Area. PUB DATE Nov 74 NOTE 598p.; Available in Microfiche only due to marginal legibility of original copy. For related elementary school handbook, see CH 004 767 EDRS PRICE MF-$1.08 Plus Postage. HC Not Available from EDRS. DESCRIPTORS *Career Education; Classroom Materials; Curriculum Guides; *Instructional Materials; Integrated Curriculum; *Learning Activities; Occupational Clusters; Resource Guides; *Secondary Education; Teacher Developed Materials; *Units of Study (Subject Fields) ABSTRACT The purpose of the handbook isto provide a resource to teachers for integrating career education into secondary level subject areas in order to reveal to students the broad range of career possibilities and the relevance of subject matter to the world of work. The first 19 pages of the document discuss the broad objectives of the program, the articulation of career education goals, and an overview of the program's elements. The remaining 530 pages of the document consist of career education resource packets cf / learning activities for the following subjects: art (20 pages), business education (30 pages), foreign language (6 pages), home 'economics (170 pages), industrial arts (3 pages), language arts (123 pages), music (6 pages), physical education--health and leisure (19 pages), science (63 pages), social studies (67 pages), and transactional analysis (38 pages). Many of the packets include teaching suggestions and objectives and many offer forms, illustration testing, instruments, and resource guides.(BP) ( ********************************************************************** ** DoCument- acquired by ERIC include many informal unpublished * * materials nof available from other sources. -

Betabasicv3.0.Pdf

3 4 Scanned, Typed, OCR-ed, and PDF by Steve Parry-Thomas 25th July 2004. This PDF was created to preserve this Manual for the future. For all ZX Spectrum, Beta Basic And www.worldofspectrum.org users (PDF for Michael & Joshua) Please note if you find a mistake please leave a message on the www.worldofspectrum.org Forum, with the Error. So a new version can be made. 5 CONTENTS SUBJECT INTRODUCTION SUMMARY SECTIONS: EDITING PROCEDURES STRUCTURED PROGRAMMING STORAGE DATA HANDLING GRAPHICS TOOLKIT FEATURES ALTER alter screen attributes ALTER alter references in a program AUTO auto line numbering BREAK more powerful break CLEAR move RAMTOP without variable loss CLOCK digital clock CLS clear a window CONTROL CODES cursor and shape control COPY with arrays and strings CSIZE set character size DEFAULT set default variable values DEFAULT select SAVE/LOAD device DEF KEY define a key DEF PROC define a procedure DELETE delete program lines DELETE delete arrays and strings DO start a DO loop DPOKE double POKE DRAW TO draw TO a point EDIT edit a line EDIT edit a variable ELSE used with IF-THEN END PROC end a procedure EXIT IF jump out of a DO loop FILL fill an area GET get a key value GET get a screen area JOIN join program lines JOIN join arrays and strings KEYIN enter a string KEYWORDS control keyword listing/entry LET multiple LET LIST and LLIST list a block of lines LIST DATA list all variable values LIST VAL list numeric variable values LIST VAL$ list string variable values LIST DEF KEY list user key definitions LIST FORMAT control indented listings LIST PROC list procedures LIST REF list references in a program LOCAL local variables LOOP end a DO loop MERGE with auto-running programs MOVE MOVE all file types 6 ON select statement or line number. -

Financement Équitable Pour Les Ambulances

La francophonie nous tient à coeur ! 1976-2006 Vol. 30 No 49 Hearst On ~ Le mercredi 1er mars 2006 1,25$ + T.P.S. Du froid canadien à la chaleur de la Grèce...................HA9 À L’INTÉRIEUR Rencontres chez PenséeColumbia..................HA3Pensée Soirée cabaret pour les Penséepompiers..................HA5 Le bantam HLK est Penséechampion................HA22 Pensée PenséePensée L'humanité serait depuis Pensée longtemps heureuse, si toute l'énergie que les hommes mettent à réparer leurs bêtises, ils l'employaient à ne pas les commettre. Plus de 300 personnes ont assisté au Festival de musique de Hearst qui se tenait la semaine dernière. Autant les jeunes que les moins jeunes se sont retrouvés sous les réflecteurs alors qu’encore une fois on retrouvait George Bernard Shaw un volet compétitif et un autre non-compétitif. On en retrouvait pour tous les goûts. Annie Hébert et Dustin Mathieu se sont particulièrement signalés en remportant chacun deux honneurs au cours du festival. Et c’est à Marc Mathieu et Vic Granholm que fut remis l’honneur de clô- turer la soirée de jeudi. Le lendemain, plus de 200 personnes ont assisté au récital de la pianiste Marie-André Ostiguy. Photo disponible au journal Le Nord/CP 6 MERCREDI À compter de 2008 Généralement ensoleillé Min -21; Max -10 Financement équitable pour les ambulances PdP 0% HEARST(AB) - Plusieurs années dirigeants du Conseil d’adminis- part du financement du gouverne- nion du 15 décembre dernier, le JEUDI après avoir promis un finance- tration des services sociaux du ment provincial servira à rétablir service ambulancier à Hearst ment équitable, le gouvernement district de Cochrane (CSSDC) se le staut quo dans le service ambu- pourrait subir d’importantes Nuageux avec provincial annonce finalement montrent prudents, préférants lancier de Hearst. -

Council Supports Jail Request Feds for Sheriff Wants Control of Facility; County Oks 1St Reading

IN SPORTS: As Clemson starts over at quarterback, ACC title up for grabs B1 Morris College Freshman Orientation August 12, 2017 Fall Registration August 16, 2017 Contact Us Today! WEDNESDAY, AUGUST 9, 2017 | Serving South Carolina since October 15, 1894 $1.00 (803) 934-3225 WWW.MORRIS.EDU State sues Council supports jail request feds for Sheriff wants control of facility; county OKs 1st reading BY ADRIENNE SARVIS board voted to give support to Sheriff county with a variety of professional $100M [email protected] Anthony Dennis in his request to have backgrounds who were chosen by a control of Sumter-Lee Regional Deten- committee of sheriff’s office personnel On Tuesday, Sumter County Council tion Center given back to the sheriff’s and approved by Dennis himself. Seeks removal gave first reading of an ordinance to office during the group’s first meeting Board members include: chairwom- authorize a contract to allow the Sum- on Monday night. an Regina Tucker, vice chairman Rob- of plutonium ter County Sheriff to manage and op- The board was formed this year in ert Duby and Fred Fargan, Jose Parral, erate Sumter-Lee Regional Detention an effort for the sheriff’s office to Robert Davis, R. Mark Smith, Carlton BY MEG KINNARD Center, a matter that is supported by strengthen its connection with county Washington, Jacqueline Hughes and The Associated Press sheriff’s office’s newly formed citizens residents. Daniel Palumbo. advisory board. The advisory board consists of nine COLUMBIA — South Caroli- The sheriff’s office citizens advisory members from various regions of the SEE JAIL, PAGE A7 na said it had filed its largest lawsuit ever against the federal government, seeking to force the U.S.