2021 Agfunder Agrifoodtech Investment Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

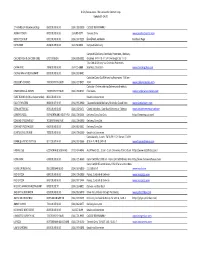

Lobbyist, Employer, Client Combinations

Lobbyist Data - Lobbyist, Employer, Client Combinations Year LOBBYIST_ID EMPLOYER_ID CLIENT_ID 2020 25061 25383 48207 2020 4007 24958 11602 2020 24801 25113 47662 2020 24800 25112 47661 2020 24797 25112 47661 2020 24796 25112 47661 2020 24795 25112 47661 2020 4074 7430 47659 2020 24798 25112 47661 2020 24799 25112 47661 2020 3753 23665 47997 2020 4126 21049 48208 2020 24803 15421 28642 2020 18181 24923 47650 2020 4094 24950 47665 2020 12721 17803 46864 2020 4094 24950 42966 2020 4094 24950 13737 2020 4094 24950 47664 Page 1 of 1000 09/29/2021 Lobbyist Data - Lobbyist, Employer, Client Combinations LOBBYIST_SALUTATION LOBBYIST_FIRST_NAME MS. VINCENZA MR. JOHN RALSTON SHARONYA ADAM STACY LINDSAY MR. TERRY JESSICA BEN MR. LANGDON MR. MICHAEL MRS. AMY MR. JOHN MS. DANIELLE JORDAN MS. DANIELLE MS. DANIELLE MS. DANIELLE Page 2 of 1000 09/29/2021 Lobbyist Data - Lobbyist, Employer, Client Combinations LOBBYIST_MIDDLE_INITIAL LOBBYIST_LAST_NAME LOBBYIST_SUFFIX M RAINERI J KELLY JR. KING SIMON MARSHAND MOORE SEMPH W TEELE SULLIVAN-WILSON LOCKE D NEAL A ALVAREZ BARRY R DALEY CASSEL MATYAS CASSEL CASSEL CASSEL Page 3 of 1000 09/29/2021 Lobbyist Data - Lobbyist, Employer, Client Combinations EMPLOYER_NAME CLIENT_NAME VINCENZA RAINERI JOINT CIVIC COMMITTEE OF ITALIAN AMERICANS ALL-CIRCO, INC. KATTEN MUCHIN ROSENMAN LLP CAPITAL ONE FINANCIAL CORPORATION CAPITAL ONE FINANCIAL CORPORATION EDUCATORS FOR EXCELLENCE EDUCATORS FOR EXCELLENCE EDUCATORS FOR EXCELLENCE EDUCATORS FOR EXCELLENCE EDUCATORS FOR EXCELLENCE EDUCATORS FOR EXCELLENCE EDUCATORS FOR EXCELLENCE -

We Have a Head Start Over Rivals in Rapid Grocery Delivery Market, Says Deliveroo Founder Will Shu

We have a head start over rivals in rapid grocery delivery market, says Deliveroo founder Will Shu D eliveroo‘s co-founder Will Shu believes his firm has a “head start” over rivals in the race to dominate the UK’s speedy grocery delivery market, which is seeing intensifying competition. The fast-growing sector has exploded in 2021, with the likes of Getir, Zapp and Weezy all vying alongside Deliveroo and Uber Eats to be Londoners‘ app of choice for last-minute vegetable and snack deliveries. Adverts for all have popped up everywhere from Instagram to the Tube in recent months, many offering at least £10 off a first order. Most promise to deliver your oat milk within 15 minutes. The sector is estimated to be worth over £14 billion in the UK alone. Deliveroo, which revealed its half-year results on Wednesday, is spending on growth in the space and said it had made “further traction” in the first six months of 2021. Grocery delivery now makes up over 10% of Deliveroo’s UK revenues, and the firm said it had around 1,800 grocery sites live with major partners by July – up from 1,200 at the end of 2020. It offers food from stores including Co-op, Aldi, Waitrose and Whole Foods. READ MORE Tesla sales crash as Chinese choose domestic brands over Musk’s models Battle for Vectura cools as Carlyle pulls plug on bidding war Morrisons makes rare move to close its supermarkets on Boxing Day SPONSORED How the Government’s Plan for Jobs can help Kickstart your career Former investment banker Shu, 41, co-founded the food delivery firm in London in 2013. -

Key Takeaways Across Multiple Sectors

SEPTEMBER 2020 COVID-19 – Impacts on Cities and suburbs Key Takeaways Across Multiple Sectors urbanismnext.org Acknowledgements This report was written by: Grace Kaplowitz Urbanism Next/UO Nico Larco, AIA Urbanism Next /UO Amanda Howell Urbanism Next/UO Tiffany Swift Urbanism Next/UO Graphic design by: Matthew Stoll Urbanism Next/UO URBANISM NEXT CENTER The Urbanism Next Center at the University of Oregon focuses on understanding the impacts that new mobility, autonomous vehicles, e-commerce, and urban delivery are having and will continue to have on city form, design, and development. The Center does not focus on the emerging technologies themselves, but instead on the multi-level impacts — how these innovations are affecting things like land use, urban design, building design, transportation, and real estate and the implications these impacts have on equity, health and safety, the economy, and the environment. We work directly with public and private sector leaders to devise strategies to take advantage of the opportunities and mitigate the challenges of emerging technologies. Urbanism Next brings together experts from a wide range of disciplines including planning, design, development, business, and law and works with the public, private, and academic sectors to help create positive outcomes from the impending changes and challenges confronting our cities. Learn more at www.urbanismnext.org. Intro In early 2020 Urbanism Next turned its attention This paper summarizes the landscape of towards the COVID-19 pandemic and the major, COVID-19 disruptions to date on Urbanism Next long-term disruptions it would likely cause to topics and highlights the longer-term questions the way we live. -

Delivery Options 送貨渠道: Business Name 商家: Business Type商家類型

Last Updated: 4/3/20 Delivery Options 更新時間:2020年 4月3日 送貨渠道: Business Name Business Type商 Business Address Phone Number 商家: 家類型: 地址: 電話號碼: Chowbus: Grubhub: DoorDash: Postmates: Uber Eats: Order online at pick up at site: www.elixrpickup.com Elixr Coffee Roasters Beverage 飲料 315 N 12th St (239) 404-1730 提前在網上訂購,在商店拿取:www.elixrpickup.com Order online at pick up at site: www.lovecitybrewing.com Love City Brewing Beverage 飲料 1023 Hamilton St (215) 398-1900 提前在網上訂購,在商店拿取:www.lovecitybrewing.com Triple Bottom Brewing Order online at pick up at site: www.triplebottombrewing.com Company Beverage 飲料 915 Spring Garden St (267) 764-1994 提前在網上訂購,在商店拿取:www.triplebottombrewing.com Shennong Acupuncture & Oriental Medicine Chinese Medicine 神農中醫藥中心 中藥 926 Arch St (215) 627-2220 Grocery/Produce S.Mart 超市 224 N. 10th St (215) 627-9777 Yes Asia Fresh Grocery Grocery/Produce 家和超市 超市 138 N. 10th St Heng Fa Food Market Grocery/Produce 恒发超市 超市 130 N. 10th St Serving restaurants and individuals, please call ahead for curbside pick-ups in front of store at loading zone: (215) 440-0388 Bennies Poultry Grocery/Produce 歡迎餐館或私人電話訂購,公司門口到取。上落貨非常方便,門口提供上落貨停 怡東雞鴨肉食 超市 208 N 9th St (215) 440-0388 車位: (215) 440-0388 Grocery/Produce Order Through the App Chowbus 超市 用手機應用 Yes Tuck Hing Grocery Grocery/Produce 德馨中西雜貨 超市 218 N. 10th St (215) 627-2079 QQ Live Poultry Grocery/Produce QQ鸡栏 超市 1120 Spring Garden St (215) 763-0230 Yes Arch Pharmacy 費城華埠大藥房 Pharmacy 藥房 933 Arch St (215) 925-9666 Neff Surgical Pharmacy 立福西药房 Pharmacy 藥房 222 N. -

Gig Companies Are Facing Dozens of Lawsuits Over Workplace Violations

FACT SHEET | AUGUST 2019 Gig Companies Are Facing Dozens of Lawsuits Over Workplace Violations At work, we should all expect to make enough to live and thrive; care for our families, ourselves, and our communities; and work together to improve our working conditions. Laws regulating the workplace provide a basic foundation on which to build. Workers Are Suing to Defend Their Rights Some companies that use technology to dispatch workers to short-term jobs (often called the public relations teams, want to convince workers and policymakers that workers are better off without core workplace protections. “gig economy”), together with their lobbyists and Many of these companies assert that their workers are happy with jobs that provide no say in the terms and conditions of their employment simply because their workers have some minimum wage, no protection against discrimination, no workers’ compensation, and no — degree of “flexibility” to determine their own schedules. Legal claims filed against the companies tell a different story. Our review of litigation filed against just eight companies Uber, Lyft, Handy, Doordash, Instacart, Postmates, Grubhub, and Amazon finds that these companies have been sued at least 70 times by workers — claiming protection under state and federal labor laws. The claims cover underpayment of — wages, tip-stealing, unfair shifting of business costs onto workers, discrimination, and unfair labor practices meant to keep workers from joining together to improve conditions. Plainly, these workers are not happy with -

The Customer Genome – the Secret Weapon of the Last Mile Delivery War What If Apple Started a Delivery Company?

The Customer Genome – the secret weapon of the last mile delivery war What if Apple started a delivery company? What if it took all of its data-driven, platform-enabled creative power and turned it toward package delivery? Imagine how that would transform the user experience. Gone would be the days of hard to use tools and inconvenient deliveries. The new experience would be intuitive, user-centric and digitally powered. Suddenly, the old way of receiving packages would seem as dated as mobiles without touchscreens. A new delivery paradigm is just around the corner Our research indicates that we The new paradigm is centered are on the brink of a new on a data-driven, predictive and delivery model – driven not by personalized user experience Apple, but by dozens of retailers, – something consumers have marketplaces and digital come to expect from other start-ups. They view the last mile sectors. These capabilities are market as ripe for disruption, just beginning to emerge in much improvement and reinvention – of the last mile delivery industry. where services will be cheaper, Yet they are core strengths for better and more consumer– a growing list of innovative, friendly. digitally superior new entrants. Digital natives are transforming last mile delivery Deliv, for example, ofers a same-day service that customers love and a software that seamlessly interfaces with retailer websites and local stores. The model has proven successful in several major cities, helping Deliv to attract over $40 million in funding, including a major investment from UPS.1 Several similar services are growing (e.g. -

The Challenges of Online Grocery

EARLY SIGNS OF COST CHALLENGES TO ONLINE GROCERY. JANUARY 2018 THE CHALLENGES OF ONLINE GROCERY JANUARY 2018 On Friday, November 3, 2017, Amazon Fresh according to Bloomberg’s Ellen Huet. She elaborates customers in “select zip codes” across the US that once the higher cost structure is accounted for, received the news that their delivery service would “…it’s unclear where the margin comes from.”8 be terminated. Jack O’Leary of Planet Retail RNG noted, “AmazonFresh has always been an COMPOSITION OF ADDED COSTS OF ONLINE GROCERY economically challenging program to operate without scale,” and, “That scale is tough to reach in (% OF TOTAL) Grocery Home many areas.”1 Rival services such as Peapod and Store Delivery Mailed Instacart have encountered similar struggles to date. Curbside From Meal Kit Cost Driver Pickup Warehouse Service In fact, Peapod was only profitable in three of its 12 markets in 2016 and, on a recent conference call, Jeff Added 14.0% 11.2% Carr, the CFO of Peapod’s parent company Ahold Warehousing Delhaize, remarked, “We’re not happy with Peapod’s Store Shopping 28.9% performance, but we feel confident we’ll be able to Labor improve that performance.”2, 3 Meanwhile, Instacart, Order Assembly 50.4% which delivers groceries from a network of Expenses independent physical stores, is “unit profitable” in Home Delivery 39.5% ten of their 19 markets, meaning that an average Expenses order is profitable in ten markets and unprofitable in Other 71.1% 46.5% 38.4% the other nine.4 This is before overhead expenses Expenses such as corporate administration, marketing, and Source: Sinha, Amithabh and Paul Weitzel. -

Youth in Europe Face the Fourth Industrial Revolution: Tactics for Success Overview Content

The Pineapple Report Youth in Europe Face the Fourth Industrial Revolution: Tactics for Success Overview content Tactics State of Play • An International Convention on Digital Rights • A Grand Project for Youth - The Co-Design of e-Government and Social Projection Systems • Update Educational Curricula to Place the Fourth Industrial Revolution in Historical Civic Context • Provide Access to Bandwidth and Interfaces via Digital Inclusion Intelligence • Update Competition Doctrine to Break Up Platform Monopolies and Incentivise Young Page 7 Entrepreneurs • Protect Labour Standards in the Gig Economy to Avoid a Looming Welfare Crisis • Inoculation Theory • Nudge Theory • Transparency of Media Ownership • Professional Self-Regulation / Name and Shame Appendix: Fourth Emotional • Clarify Platforms’ Role in Political Marketing Intelligence • Address the Economics of Manipulation Youth, Europe, Industrial • Civic Education in Formal and Non-Formal Educational Settings Page 17 and Emerging Revolution • Intergenerational Dialogues • Digital Speed Bumps Tech • An Anthropomorphisation Tax • Invest in Research on the Impact of Digital Technologies on Youth Health and Wellness • Boost Consumer and Labour Protections for Digital Products and Services - Regulate Physical Persuasive Design and ‘Dark Patterns’ Intelligence • Regulation on Environmental Impact of Digital Technologies Page 24 • Endorse Intersectionality • Don’t Just Educate, Inspire Creative • Embrace Creative Tools for Digital-Participatory Democracy • Stimulate the Artisan Economy Intelligence • A Basic Income for All Citizens Page 33 Page 3 / 53 The Pineapple Report The Pineapple Report surveys proposals for how young people in Europe can flourish in the emerging Fourth Industrial Revolution.1 Executive Summary In emoji, means, “It’s complicated.” The icon evokes a reminder that certain opportunities, like this one, require a holistic Since the term ‘digital native’ is true for only a select, priv- rather than reductive plan of action. -

Magna News Aug 2021

AUGUST up.to.date 2021 WHAT HAPPENS ON THE INTERNET EVERY MINUTE IN 2021 ACCORDING TO THE DATA, THE MAJORITY OF AN AVERAGE 1 MINUTE SPENT ONLINE WAS DOMINATED BY WIDELY POPULAR SOCIAL MEDIA APPS. 60 seconds on the internet in 2021 consist of 200,000 people tweeting, 695,000 stories shared on Instagram, 1.4 million scrolling on Facebook, and 3.4 million snaps created on Snapchat. According to the infographic, the number of app downloads through Google Play and the App Store per minute in 2021 has reached 414,764. Per a recent analysis, first-time Google Play app downloads climbed 6 percent year-over-year to 56.2 billion in the first half of 2021 from 53 billion in the year-ago period. Global mobile app downloads through Google Play and the App Store surpassed 36.6 billion in the first quarter of 2021 with an 8.7% YOY increase. READ MORE The Power of Employee Why a creative veteran is bullish on Global CPM, CPC prices up due to Advocacy, and How to Establish next-generation customer iOS 14.5 and data privacy changes Your EA Program [Infographic] experiences Does your brand have an established Following a decade at award-winning shop R/GA, Global cost per click (CPC) and cost per mille (CPM) employee advocacy program? David DeCheser recently became Valtech's first prices keep going up largely due to data privacy senior vice president, executive creative director for changes and Apple’s iOS 14.5 update which brought It could be an important consideration - with North America. -

Active Business List COVID Status March 2020.Xlsx

U City Restaurants ‐ Not Located in Delmar Loop Updated 3‐24‐20 2 THUMBS UP‐0Sandwich Shop 8502 OLIVE BLVD (314) 282‐1000 CLOSED TEMPORARILY ASIAN KITCHEN 8423 OLIVE BLVD 314‐989‐9377 Takeout Only www.asiankitchenmo.com BOOGYZ DONUT 6951 OLIVE BLVD (314) 337‐5123 DoorDash, curbside Facebook Page CATE ZONE 8148 OLIVE BLVD 314‐738‐9923 Carryout & Delivery Carryout & Delivery‐Doordash, Postmates, Ubereats, CHICAGO FISH & CHICKEN GRILL 6707 VERNON (314) 898‐3002 Grubhub M‐TH 10‐11 SA 10‐midnight SU 11‐10 Take Out & Delivery via Grubhub, Postmates, CHINA KING 7848 OLIVE BLVD 314‐725‐6888 Seamless, Doordash www.chinakingolive.com CHONG WAH VI RESTAURANT 8208 OLIVE BLVD (314) 993‐8481 Curbside/Carry Out/Delivery by Postmates 7:30 am ‐ COLLEEN'S COOKIES 7337 FORSYTH BLVD (314) 727‐8427 2 pm www.colleenscookies.com Curbside ‐ Online ordering Delivery via Grubhub, CRAZY BOWLS & WRAPS 7353 FORSYTH BLVD (314) 783‐9727 Postmates, www.crazybowlsandwraps.com CUBE TEA INC (In Olive Supermarket) 8041 OLIVE BLVD Unable to Determine DAO TIEN BISTRO 8600 OLIVE BLVD (314) 995‐6960 Takeout/curbside/delivery/Grubhub Closed Mon. www.daotienbistro.com DEPALM TREE LLC 8631 OLIVE BLVD (314) 432‐5171 Closed Mondays. DoorDash Delivery or Takeout. www.depalmtreerestaurant.com DEWEY`S PIZZA 559 NORTH AND SOUTH RD (314) 726‐3434 Delivery/Carry Out Only https://deweyspizza.com/ DOMINO`S PIZZA #1587 7018 PERSHING AVE (314) 726‐3030 Delivery/Carry Out DOMINO'S PIZZA #1593 6963 OLIVE BLVD (314) 862‐3031 Delivery/Carry Out ELMO'S LOVE LOUNGE 7828 OLIVE BLVD (314) 726‐2660 -

Home Bistro, Inc. (Otc – Hbis)

Investment and Company Research Opportunity Research COMPANY REPORT January 28, 2021 HOME BISTRO, INC. (OTC – HBIS) Sector: Consumer Direct Segment: Gourmet, Ready-Made Meals www.goldmanresearch.com Copyright © Goldman Small Cap Research, 2021 Page 1 of 16 Investment and Company Research Opportunity Research COMPANY REPORT HOME BISTRO, INC. Pure Play Gourmet Meal Delivery Firm Making All the Right Moves Rob Goldman January 28, 2021 [email protected] HOME BISTRO, INC. (OTC – HBIS - $1.25) COMPANY SNAPSHOT INVESTMENT HIGHLIGHTS Home Bistro provides high quality, direct-to- Home Bistro is a pure play gourmet meal consumer, ready-made gourmet meals delivery firm enjoying outsized growth and could at www.homebistro.com, which includes meals emerge as one of the stars of the multi-billion- inspired and created by celebrity “Iron Chef” Cat dollar industry. HBIS’s approach and model Cora. The Company also offers restaurant quality represent a major differentiator and should drive meats and seafood through its Prime enviable sales and profit, going forward. Chop www.primechop.co and Colorado Prime brands. The HBIS positioning as the go-to, high-end, high quality provider is further enhanced via its KEY STATISTICS exclusive relationship with celebrity Iron Chef Cat Cora. HBIS now offers meals inspired and created by Cat alongside its world class chef- Price as of 1/27/21 $1.25 prepared company entrees. $6.0147 - 52 Week High – Low $0.192 M&A of HBIS competitors illustrates the Est. Shares Outstanding 11.4M underlying value for the Company and its Market Capitalization $24,3M segment. Nestle bought a competitor for up to $1.5 Average Volume 1,136 billion to get a footprint in the space. -

The Asia Food Challenge Report

Alexandra Health FOREWORD 2 Foreword The Asia Food Challenge report Rabobank reflects a shared view within It is our shared responsibility and our three organisations that the interest to help accelerate the shift significant challenges facing to a more sustainable agri-food Asia’s agri-food industry create economy through climate-smart an outsized opportunity for ecosystems. With our strong innovation. Simply put, Asia is global network and growing a at a crossroads: huge growth in better world together mission, demand creates an attractive Rabobank strongly believes that opportunity for investment; but partnerships are an essential collective action is required to link in the innovation process in unlock this opportunity. solving Asia’s food challenges. In a nutshell, our shared ideals, shared PwC knowledge and ability to work Now is the time to take concrete together is key to creating a strong steps to address the major food sustainable agri-food chain. challenges we are facing; an issue that hits close to home Diane Boogaard and is central to PwC’s purpose Chief Executive Officer, to build trust in society and Asia, Rabobank solve important problems. Asia is poised to take advantage of Temasek this "perfect storm" although With the growth of the middle- investment currently lags income population in Asia, we behind other markets like the at Temasek see a corresponding United States and parts of demand for more safe, nutritious Europe. Greater collaboration and sustainable food sources. between governments, the We can put our capital to private sector, innovators, good use across the whole financial investors and academia agri-food value chain, from across the food and agriculture increasing farm yields, reducing industry can turn the tide, and the environmental impact of ignite this game-changing farming, to improving the safety, opportunity for all of Asia.