Q2 2020 Quarterly Trends Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Key Takeaways Across Multiple Sectors

SEPTEMBER 2020 COVID-19 – Impacts on Cities and suburbs Key Takeaways Across Multiple Sectors urbanismnext.org Acknowledgements This report was written by: Grace Kaplowitz Urbanism Next/UO Nico Larco, AIA Urbanism Next /UO Amanda Howell Urbanism Next/UO Tiffany Swift Urbanism Next/UO Graphic design by: Matthew Stoll Urbanism Next/UO URBANISM NEXT CENTER The Urbanism Next Center at the University of Oregon focuses on understanding the impacts that new mobility, autonomous vehicles, e-commerce, and urban delivery are having and will continue to have on city form, design, and development. The Center does not focus on the emerging technologies themselves, but instead on the multi-level impacts — how these innovations are affecting things like land use, urban design, building design, transportation, and real estate and the implications these impacts have on equity, health and safety, the economy, and the environment. We work directly with public and private sector leaders to devise strategies to take advantage of the opportunities and mitigate the challenges of emerging technologies. Urbanism Next brings together experts from a wide range of disciplines including planning, design, development, business, and law and works with the public, private, and academic sectors to help create positive outcomes from the impending changes and challenges confronting our cities. Learn more at www.urbanismnext.org. Intro In early 2020 Urbanism Next turned its attention This paper summarizes the landscape of towards the COVID-19 pandemic and the major, COVID-19 disruptions to date on Urbanism Next long-term disruptions it would likely cause to topics and highlights the longer-term questions the way we live. -

Gig Companies Are Facing Dozens of Lawsuits Over Workplace Violations

FACT SHEET | AUGUST 2019 Gig Companies Are Facing Dozens of Lawsuits Over Workplace Violations At work, we should all expect to make enough to live and thrive; care for our families, ourselves, and our communities; and work together to improve our working conditions. Laws regulating the workplace provide a basic foundation on which to build. Workers Are Suing to Defend Their Rights Some companies that use technology to dispatch workers to short-term jobs (often called the public relations teams, want to convince workers and policymakers that workers are better off without core workplace protections. “gig economy”), together with their lobbyists and Many of these companies assert that their workers are happy with jobs that provide no say in the terms and conditions of their employment simply because their workers have some minimum wage, no protection against discrimination, no workers’ compensation, and no — degree of “flexibility” to determine their own schedules. Legal claims filed against the companies tell a different story. Our review of litigation filed against just eight companies Uber, Lyft, Handy, Doordash, Instacart, Postmates, Grubhub, and Amazon finds that these companies have been sued at least 70 times by workers — claiming protection under state and federal labor laws. The claims cover underpayment of — wages, tip-stealing, unfair shifting of business costs onto workers, discrimination, and unfair labor practices meant to keep workers from joining together to improve conditions. Plainly, these workers are not happy with -

The Customer Genome – the Secret Weapon of the Last Mile Delivery War What If Apple Started a Delivery Company?

The Customer Genome – the secret weapon of the last mile delivery war What if Apple started a delivery company? What if it took all of its data-driven, platform-enabled creative power and turned it toward package delivery? Imagine how that would transform the user experience. Gone would be the days of hard to use tools and inconvenient deliveries. The new experience would be intuitive, user-centric and digitally powered. Suddenly, the old way of receiving packages would seem as dated as mobiles without touchscreens. A new delivery paradigm is just around the corner Our research indicates that we The new paradigm is centered are on the brink of a new on a data-driven, predictive and delivery model – driven not by personalized user experience Apple, but by dozens of retailers, – something consumers have marketplaces and digital come to expect from other start-ups. They view the last mile sectors. These capabilities are market as ripe for disruption, just beginning to emerge in much improvement and reinvention – of the last mile delivery industry. where services will be cheaper, Yet they are core strengths for better and more consumer– a growing list of innovative, friendly. digitally superior new entrants. Digital natives are transforming last mile delivery Deliv, for example, ofers a same-day service that customers love and a software that seamlessly interfaces with retailer websites and local stores. The model has proven successful in several major cities, helping Deliv to attract over $40 million in funding, including a major investment from UPS.1 Several similar services are growing (e.g. -

The Challenges of Online Grocery

EARLY SIGNS OF COST CHALLENGES TO ONLINE GROCERY. JANUARY 2018 THE CHALLENGES OF ONLINE GROCERY JANUARY 2018 On Friday, November 3, 2017, Amazon Fresh according to Bloomberg’s Ellen Huet. She elaborates customers in “select zip codes” across the US that once the higher cost structure is accounted for, received the news that their delivery service would “…it’s unclear where the margin comes from.”8 be terminated. Jack O’Leary of Planet Retail RNG noted, “AmazonFresh has always been an COMPOSITION OF ADDED COSTS OF ONLINE GROCERY economically challenging program to operate without scale,” and, “That scale is tough to reach in (% OF TOTAL) Grocery Home many areas.”1 Rival services such as Peapod and Store Delivery Mailed Instacart have encountered similar struggles to date. Curbside From Meal Kit Cost Driver Pickup Warehouse Service In fact, Peapod was only profitable in three of its 12 markets in 2016 and, on a recent conference call, Jeff Added 14.0% 11.2% Carr, the CFO of Peapod’s parent company Ahold Warehousing Delhaize, remarked, “We’re not happy with Peapod’s Store Shopping 28.9% performance, but we feel confident we’ll be able to Labor improve that performance.”2, 3 Meanwhile, Instacart, Order Assembly 50.4% which delivers groceries from a network of Expenses independent physical stores, is “unit profitable” in Home Delivery 39.5% ten of their 19 markets, meaning that an average Expenses order is profitable in ten markets and unprofitable in Other 71.1% 46.5% 38.4% the other nine.4 This is before overhead expenses Expenses such as corporate administration, marketing, and Source: Sinha, Amithabh and Paul Weitzel. -

Magna News Aug 2021

AUGUST up.to.date 2021 WHAT HAPPENS ON THE INTERNET EVERY MINUTE IN 2021 ACCORDING TO THE DATA, THE MAJORITY OF AN AVERAGE 1 MINUTE SPENT ONLINE WAS DOMINATED BY WIDELY POPULAR SOCIAL MEDIA APPS. 60 seconds on the internet in 2021 consist of 200,000 people tweeting, 695,000 stories shared on Instagram, 1.4 million scrolling on Facebook, and 3.4 million snaps created on Snapchat. According to the infographic, the number of app downloads through Google Play and the App Store per minute in 2021 has reached 414,764. Per a recent analysis, first-time Google Play app downloads climbed 6 percent year-over-year to 56.2 billion in the first half of 2021 from 53 billion in the year-ago period. Global mobile app downloads through Google Play and the App Store surpassed 36.6 billion in the first quarter of 2021 with an 8.7% YOY increase. READ MORE The Power of Employee Why a creative veteran is bullish on Global CPM, CPC prices up due to Advocacy, and How to Establish next-generation customer iOS 14.5 and data privacy changes Your EA Program [Infographic] experiences Does your brand have an established Following a decade at award-winning shop R/GA, Global cost per click (CPC) and cost per mille (CPM) employee advocacy program? David DeCheser recently became Valtech's first prices keep going up largely due to data privacy senior vice president, executive creative director for changes and Apple’s iOS 14.5 update which brought It could be an important consideration - with North America. -

Prop 22 Leaves Workers Vulnerable to COVID-19

Rigging the Gig How Uber, Lyft, and DoorDash’s Ballot Initiative Would Put Corporations Above the Law and Steal Wages, Benefits, and Protections from California Workers Prop 22 Leaves Workers Vulnerable to COVID-19 For many, work is a source of dignity, identity, and purpose—a way to provide for a family and support a community. All work should be safe, be free from discrimination, and provide a fair wage, benefits, and the ability for workers to join together and bargain with their employer for more stability and security. Yet, on Election Day in November, California voters will be presented with an unprecedented and dangerous ballot initiative—Proposition 22—that would put workers further from that goal.1 Advanced by Uber, Lyft, DoorDash, Instacart, and Postmates,2 Prop 22 aims to strip workers of core protections such as overtime pay, unemployment insurance, and paid sick leave—benefits required by law but which these companies have flouted.3 As the COVID-19 pandemic continues to devastate California, Prop 22 means that workers, their families, and whole communities will lose important safety and security protections. In order to defeat the virus, we must ensure that all of us have workplace safety and income protections, so that none of us is forced to risk our lives just to pay the bills. Many Californians have righty expressed deep appreciation and support for the drivers and delivery people who have played a critical role in sustaining families. These workers were designated as essential in California in April.4 But gig companies have a different view, expressed in Prop 22. -

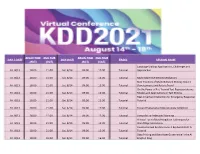

End Tme (Pdt) Day (Sgt) Begin Time

BEGIN TIME END TME BEGIN TIME END TIME DAY / DATE DAY (SGT) TRACK SESSION NAME (PDT) (PDT) (SGT) (SGT) Language Scaling: Applications, Challenges and Fri. 8/13 18:00 21:00 Sat. 8/14 09:00 12:00 Tutorial Approaches Fri. 8/13 18:00 21:00 Sat. 8/14 09:00 12:00 Tutorial ...Multi-Objective.................................................. Recommendations............................................., . ................., ....., .. ..., .. .........., ..................., ....., .. ...,: New Frontiers of Multi-Network Mining: Recent Fri. 8/13 18:00 21:00 Sat. 8/14 09:00 12:00 Tutorial Developments and Future Trend On the Power of Pre-Trained Text Representations: Fri. 8/13 18:00 21:00 Sat. 8/14 09:00 12:00 Tutorial Models and Applications in Text Mining Real-time Event Detection for Emergency Response Fri. 8/13 18:00 21:00 Sat. 8/14 09:00 12:00 Tutorial Tutorial ··················································································································1 Fri. 8/13 18:00 21:00 Sat. 8/14 09:00 12:00 Tutorial Toward Explainable Deep Anomaly Detection Fri. 8/13 18:00 21:00 Sat. 8/14 09:00 12:00 Tutorial Towards Fair Federated Learning A Visual Tour of Bias Mitigation Techniques for Fri. 8/13 18:00 21:00 Sat. 8/14 09:00 12:00 Tutorial Word Representations Counterfactual Explanations in Explainable AI: A Fri. 8/13 18:00 21:00 Sat. 8/14 09:00 12:00 Tutorial Tutorial Data Pricing and Data Asset Governance in the AI Fri. 8/13 18:00 01:00 Sat. 8/14 09:00 16:00 Tutorial Era (Full Day) Deep Learning on Graphs for Natural Language Fri. 8/13 18:00 21:00 Sat. -

Place Your Order Meal Prep and Delivery Services

I’ll take my shipping free with a side of unlimited movies Acxiom offers an audience of likely Amazon Prime subscribers. Tap into this lucrative pool of savvy online shoppers who also take advantage of exclusive access to movies and TV shows, ad-free music and more. Looking for those who want it fresh and fast? From those who want fresh ingredients waiting on the doorstep to those who want their food hot and ready from a restaurant, Acxiom introduces audiences including: • Those likely to order fresh food for meal preparation using an online service like Blue Apron, Plated or Hello Fresh • Those with a propensity to order groceries via an online service like Amazon Fresh, Fresh Direct or Instacart • Consumers who order restaurant deliveries from an online service like GrubHub or Eat24 • Consumers likely to make restaurant reservations online using services like OpenTable Meal Kit Delivery Hello Fresh, Plated, Blue Apron, Omaha Steaks This industry is growing fast, even among non-retail companies, such as the New York Times launching its own service in partnership with startup Chef’d, which sends subscribers meal kits that sync up with recipes posted on the Times’ cooking site. Grocery Delivery AmazonFresh, Instacart, Fresh Direct Shopping online is now a standard in most households. Consumers who want fresh food and convenient home delivery are becoming a threat to local brick-and-mortar stores. The three major online grocery plans are Instacart, FreshDirect and AmazonFresh. Restaurant Local Delivery Grubhub, Eat24, Chef Shuttle, Seamless, All Menus $210 billion worth of food is ordered for delivery or takeout each year in the U.S.; $11 billion of that is online delivery, with non-pizza online deliveries totaling $4 billion. -

Instacart Shoppers—Part-Time Employees Flags the Error

2 E the Instacart shoppers—part-time employees flags the error. (Customers and shoppers can who work with no minimum-hour requirement also communicate through the app (D).) Once (Boston alone has more than 400 shoppers)— the list is completed, the shopper checks out. have dedicated apps that notify them of new If they’re in a store with a dedicated Instacart orders. Each order is sent to a specific shopper, station (E), the cashier will confirm that the items and the app’s algorithm tries to provide the most match the order. Orders are packed into bags, efficient way to navigate the store to fill (B)it . which are then labeled, numbered, and held The shopper scans the barcode of each item. If for delivery. (Temperature-sensitive bags sit in it matches the customer’s request, it’s marked Instacart refrigerators and freezers until they’re The app-fueled, farmer-friendly, totally delicious plan to kill the supermarket. as found (C); if, say, the shopper scans 2 percent ready to go.) Instacart pays for the groceries ADD CART milk when the customer ordered skim, the app then gets reimbursed by the customer. THERE IS NO greater temple to our industrialized food system than the American supermarket. With its bins of megafarmed produce, attention-seeking boxes of processed foods, and generous, if anonymous, cuts of meat, it is a place of comforting predictability and one-stop convenience. And like the American waistline, it’s also huge: A typical supermarket is 46,000 square feet and carries some 42,000 products. -

Instant Deliveries’ in European Cities Laetitia Dablanc, Eléonora Morganti, Niklas Arvidsson, Johan Woxenius, Michael Browne, Neila Saidi

The Rise of On-Demand ’Instant Deliveries’ in European Cities Laetitia Dablanc, Eléonora Morganti, Niklas Arvidsson, Johan Woxenius, Michael Browne, Neila Saidi To cite this version: Laetitia Dablanc, Eléonora Morganti, Niklas Arvidsson, Johan Woxenius, Michael Browne, et al.. The Rise of On-Demand ’Instant Deliveries’ in European Cities. Supply Chain Forum: An International Journal, Kedge Business School, 2017, 10.1080/16258312.2017.1375375. hal-01589316 HAL Id: hal-01589316 https://hal.archives-ouvertes.fr/hal-01589316 Submitted on 18 Sep 2017 HAL is a multi-disciplinary open access L’archive ouverte pluridisciplinaire HAL, est archive for the deposit and dissemination of sci- destinée au dépôt et à la diffusion de documents entific research documents, whether they are pub- scientifiques de niveau recherche, publiés ou non, lished or not. The documents may come from émanant des établissements d’enseignement et de teaching and research institutions in France or recherche français ou étrangers, des laboratoires abroad, or from public or private research centers. publics ou privés. Forthcoming in Supply Chain Forum – an International Journal The Rise of On-Demand ‘Instant Deliveries’ in European Cities Laetitia Dablanc,a and d, 1 Eleonora Morganti,b Niklas Arvidsson,c Johan Woxenius,d Michael Browne,d Neïla Saidie aIFSTTAR-University of Paris-East, 14 Bd Newton, 77455 Marne la Vallée, France bUniversity of Leeds, Leeds, LS2 9JT, United Kingdom cRISE Viktoria Research Institute, Lindholmspiren 3A, SE-417 56, Gothenburg, Sweden dUniversity of Gothenburg, Box 610, SE-405 30 Gothenburg, Sweden eArchitectural School of Marne la Vallée, University of Paris-East, 10 avenue Blaise Pascal, 77455 Marne la Vallée, France Abstract This exploratory paper contributes to a new body of research that investigates the potential of digital market places to disrupt transport and mobility services. -

Food Delivery Options

FOOD DELIVERY OPTIONS SFAI Street Address: 1600 St. Michael’s Drive, Building #31, Santa Fe, NM 87505 Driver Instructions: Enter former SFUAD campus from St. Michael’s Drive. Pass the welcome booth and at the T-intersection, turn right onto Alumni Drive. As you pass New Mexico Bank and Trust (on your right), the road will veer to the left (southwest). Continue straight (heading southwest) past Greer Garson Theater (Building #1), then a large parking lot, and finally the Visual Arts Center (Building #30). SFAI is the next building (#31) on your left, it has three pyramid shaped towers. If you pass the traffic circle you have gone too far. Park between the Visual Arts Center and SFAI and call (your phone #) and I will meet you outside. Groceries & Various Restaurants DoorDash.com https://www.doordash.com/food-delivery/santa-fe-nm-restaurants/ Use the DoorDash website or app to browse 71 Santa Fe restaurants, order, and securely pay. Delivered in under one hour. You can schedule deliveries in advance and track your deliveries. Fetch.com https://fetch.com/ Need to download the app first to browse available restaurants, grocery stores, convenience stores, pharmacies, and more. Delivery available 7am to 11pm daily. GrubHub.com https://www.grubhub.com/delivery/nm-santa_fe Go to the website, type in our street address and browse from 195 restaurants in Santa Fe. Instacart.com https://www.instacart.com/grocery-delivery/nm/near-me-in-santa-fe-nm Same day delivery of groceries in as little as an hour. Order Online from: · Albertsons · Food King · Market Street · Natural Grocers · Sam’s Club · Smith’s · Sprouts SANTA FE ART INSTITUTE / SFAI.ORG 1 Kuane’s Neighborhood Market https://www.kaunes.com/delivery.html Deliver Monday – Friday. -

Grocery Delivery Options

Grocery Delivery Options Winter is heading our way, and if you find it difficult to grocery shop, there is an ever-expanding list of delivery options in the area. COVID-19 has also made getting groceries more difficult, and many grocery services will offer non-contact delivery to lessen the risk. Here is a breakdown of the most common services and how to use them. Meal and Grocery Delivery St. Anthony Park Area Seniors uses volunteers to do grocery delivery for seniors in their service area (St. Anthony Park, Lauderdale and Falcon Heights west of Cleveland Avenue). Call the SAPAS office at 651-642-9052 to get a volunteer to do shopping within the next week. Tim and Tom’s Speedy Market is located on Como Avenue. They offer free grocery delivery for SAPAS members if you are unable to shop for yourself. They offer phone ordering and delivery on Fridays. Tim and Tom’s will accept payment by check or credit card. More information is available by calling the SAPAS office at (651) 642-9052. Schwan’s will deliver frozen foods, and orders can be placed online or by phone at 1-888-74- 9267. They often have coupon codes available for first-time orders as well as AARP members. Orders placed for over $50 are delivered for free; those under $50 have a small fee attached that varies by how you order. Their website is www.schwans.com. Meals on Wheels delivers hot meals for a fee that is based on your need. Meals are delivered weekdays, and if you have a health condition, they can work with you to prepare meals that meet your requirements.