THA Newsletter 2016.Q4 Iot Final.Pptx

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

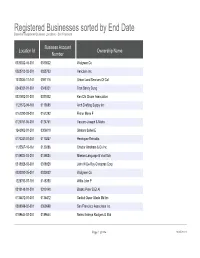

Registered Businesses Sorted by End Date Based on Registered Business Locations - San Francisco

Registered Businesses sorted by End Date Based on Registered Business Locations - San Francisco Business Account Location Id Ownership Name Number 0030032-46-001 0030032 Walgreen Co 0028703-02-001 0028703 Vericlaim Inc 1012834-11-141 0091116 Urban Land Services Of Cal 0348331-01-001 0348331 Tran Sandy Dung 0331802-01-001 0331802 Ken Chi Chuan Association 1121572-09-161 0113585 Arch Drafting Supply Inc 0161292-03-001 0161292 Fisher Marie F 0124761-06-001 0124761 Vaccaro Joseph & Maria 1243902-01-201 0306019 Shatara Suheil E 0170247-01-001 0170247 Henriquez Reinaldo 1125567-10-161 0130286 Chador Abraham & Co Inc 0189884-03-001 0189884 Mission Language & Vocl Sch 0318928-03-001 0318928 John W De Roy Chiroprac Corp 0030032-35-001 0030032 Walgreen Co 1228793-07-191 0148350 Willis John P 0310148-01-001 0310148 Blasko Peter B Et Al 0135472-01-001 0135472 Saddul Oscar Allado Md Inc 0369698-02-001 0369698 San Francisco Associates Inc 0189644-02-001 0189644 Neirro Erainya Rodgers G Etal Page 1 of 984 10/05/2021 Registered Businesses sorted by End Date Based on Registered Business Locations - San Francisco DBA Name Street Address City State Source Zipcode Walgreens #15567 845 Market St San Francisco CA 94103 Vericlaim Inc 500 Sansome St Ste 614 San Francisco CA 94111 Urban Land Services Of Cal 1170 Sacramento St 5d San Francisco CA 94108 Elizabeth Hair Studio 672 Geary St San Francisco CA 94102 Ken Chi Chuan Association 3626 Taraval St Apt 3 San Francisco CA 94116 Arch Drafting Supply Inc 10 Carolina St San Francisco CA 94103 Marie Fisher Interior -

Grey Lodge Occult Review™ Is Licensed Under a Creative Commons Attribution-Noncommercial-Share Alike 3.0 License

C O N T E N T S M.O.R.C. Immediatism: Radio Sermonettes +Audio (mp3) with Hakim Bey By The Moorish Orthodox Radio Crusade The Audio with Hakim Bey Descent Into Hell By Thom Metzger Simulations (Excerpts) By Jean Baudrillard New Dimensions Time - Precognition - Ghosts - Exobiology By Lyall Watson (pdf) (From: SUPERNATURE: A Natural History of the Supernatural) Reality Is a Shared Hallucination By Howard Bloom (pdf) What Makes Mainstream Media Mainstream By Noam Chomsky (pdf) The Covert News Network By Greg Bishop (pdf) R. A. Lafferty: Effective Arcanum By Don Webb The Symbolic Power of Cultural Heritage Mickey Mouse as curator and town architect By Lennart Runesson The Art of Honest Deception By Vincent H. Gaddis (pdf) A history of cuban counter-revolution while we're still on the subject of Cuba... By Michael Moore L00p (pdf) Contents: Altered States of America By Richard Stratton The Original Captain Trips By Todd Brendan Fahey Timothy Leary: The Far Gone Interview By Todd Brendan Fahey and.. Adventuring in Time The Hippocampus, Memory, Time-Lining and the NLP Practitioner Home GLORidx Close Window Except where otherwise noted, Grey Lodge Occult Review™ is licensed under a Creative Commons Attribution-Noncommercial-Share Alike 3.0 License The M.O.R.C. Collective: Peter Lamborn Wilson, The Army of Smiths (Dave, Sidney, Immediatism Max), Hakim Bey, Jake Rabinowitz, Thom Metzger (The Moorish Science Monitor), The Tong Dave Mandl (design and typography), James Koehnline (front cover). Special thanx & Immediatism vs Capitalism a tip of the fez to WBAI-FM, Pacifica Radio, the Semiotext(e)/Autonomedia Involution Collective ("Vernissage"), and the Libertarian Book Club (who would like to note that Imagination the word "libertarian" here does not refer to "LibertarianISM" or the Libertarian Party; Lascaux the L.B.C. -

Telecommunications Provider Locator

Telecommunications Provider Locator Industry Analysis & Technology Division Wireline Competition Bureau February 2003 This report is available for reference in the FCC’s Information Center at 445 12th Street, S.W., Courtyard Level. Copies may be purchased by calling Qualex International, Portals II, 445 12th Street SW, Room CY- B402, Washington, D.C. 20554, telephone 202-863-2893, facsimile 202-863-2898, or via e-mail [email protected]. This report can be downloaded and interactively searched on the FCC-State Link Internet site at www.fcc.gov/wcb/iatd/locator.html. Telecommunications Provider Locator This report lists the contact information and the types of services sold by 5,364 telecommunications providers. The last report was released November 27, 2001.1 All information in this report is drawn from providers’ April 1, 2002, filing of the Telecommunications Reporting Worksheet (FCC Form 499-A).2 This report can be used by customers to identify and locate telecommunications providers, by telecommunications providers to identify and locate others in the industry, and by equipment vendors to identify potential customers. Virtually all providers of telecommunications must file FCC Form 499-A each year.3 These forms are not filed with the FCC but rather with the Universal Service Administrative Company (USAC), which serves as the data collection agent. Information from filings received after November 22, 2002, and from filings that were incomplete has been excluded from the tables. Although many telecommunications providers offer an extensive menu of services, each filer is asked on Line 105 of FCC Form 499-A to select the single category that best describes its telecommunications business. -

Northern Sierra Broadband (“ORGANIZATION”) and Is Effective As of April 27, 2021 (“Effective Date”)

NEVADA COUNTY LAST-MILE BROADBAND GRANT FY 20/21 and FY 2021/22 GRANT AGREEMENT THIS GRANT AGREEMENT is made and entered into as of the 27th day of April, 2021 by and between the COUNTY OF NEVADA, a political subdivision of the State of California (“COUNTY”), and Northern Sierra Broadband (“ORGANIZATION”) and is effective as of April 27, 2021 (“Effective Date”). RECITALS: A. The Nevada County Board of Supervisors adopted Resolution 18-324 supporting broadband expansion; and in 2021 made Broadband a Board Objective to: “Equitably expand broadband to support economic development, distance-learning, telework, telemedicine, and general quality of life for all residents by championing the implementation of Nevada County Broadband Strategy Plan policies and last-mile infrastructure PROJECTs.” B. The Nevada County Board of Supervisors approved $250,000 to fund the second round of the Last-Mile Broadband Grants Program and allocated another $250,000 from the PG&E Settlement Funds for a total of $500,000 for FY 20/21. C. The Nevada County Board of Supervisors has a Professional Services Agreement with the Sierra Business Council (PROJECT ADMINISTRATOR), which includes the solicitation, facilitation, and administration of the Nevada County Last-Mile Broadband Grant. D. County staff and PROJECT ADMINISTRATOR conducted a competitive application process and determined that ORGANIZATION is qualified and able to ensure timely and successful completion of the proposed project (“PROJECT”) as submitted to PROJECT ADMINISTRATOR for the FY 20/21 and FY 21/22 Last-Mile Broadband Grant Program (incorporated herein as Exhibit A). E. The Nevada County Board of Supervisors approved the recommendation from County staff and PROJECT ADMINISTRATOR to award $120,000 to ORGANIZATION and directed staff to enter into grant agreements with the ORGANIZATION. -

Telecommunications Provider Locator

Telecommunications Provider Locator Industry Analysis & Technology Division Wireline Competition Bureau January 2010 This report is available for reference in the FCC’s Information Center at 445 12th Street, S.W., Courtyard Level. Copies may be purchased by contacting Best Copy and Printing, Inc., Portals II, 445 12th Street S.W., Room CY-B402, Washington, D.C. 20554, telephone 800-378-3160, facsimile 202-488-5563, or via e-mail at [email protected]. This report can be downloaded and interactively searched on the Wireline Competition Bureau Statistical Reports Internet site located at www.fcc.gov/wcb/iatd/locator.html. Telecommunications Provider Locator This report lists the contact information, primary telecommunications business and service(s) offered by 6,493 telecommunications providers. The last report was released March 13, 2009.1 The information in this report is drawn from providers’ Telecommunications Reporting Worksheets (FCC Form 499-A). It can be used by customers to identify and locate telecommunications providers, by telecommunications providers to identify and locate others in the industry, and by equipment vendors to identify potential customers. Virtually all providers of telecommunications must file FCC Form 499-A each year.2 These forms are not filed with the FCC but rather with the Universal Service Administrative Company (USAC), which serves as the data collection agent. The pool of filers contained in this edition consists of companies that operated and collected revenue during 2007, as well as new companies that file the form to fulfill the Commission’s registration requirement.3 Information from filings received by USAC after October 13, 2008, and from filings that were incomplete has been excluded from this report. -

ABSTRACT AWA Review Wireless Comes of Age on the West Coast1

Lee AWA Review Wireless Comes of Age on the West Coast1 !2011 Bartholomew Lee ABSTRACT This is a story primarily about young men and what they accomplished in a remarkable Radio as we know it time, the fi rst two decades of the 20th Century, had many fathers. Cali- and in remarkable places – especially in Cali- fornia enjoyed unique fornia in the Western United States. Guglielmo circumstances that gave (William) Marconi, in his early twenties, elec- rise to independent de- trifi ed the technical world of the late 19th Cen- velopment. Young men tury with his successes using Hertzian electro- explored and advanced magnetic waves to communicate at distance, devices and means of what we now call “radio.” He did this without communication as soon the wired connections to which the world had as they read about ear- turned with enthusiasm earlier in the century. lier advances, especially The telegraph, including undersea cables, and Marconi’s use of wireless the telephone, needed wire, and lots of it. Com- spark systems. The arc munication without such wires, at fi rst wireless as a generator of high telegraphy, opened new vistas. This was par- power continuous wave ticularly so looking out to the world’s oceans. energy for communica- Communication with ships at sea (Marconi’s tions came to California primary initial interest) was now possible. Then, and then the world. Doc a challenge to the expensive cable monopolies Herrold began the fi rst could be mounted. This was so because the new regular broadcasting to a “wireless” meant exactly that: no expensive, known audience around capital-intensive investments in cables, only 1912 in California, using in terminal stations. -

The Electromagnetic Telegraph Alexander J

Santa Clara University Scholar Commons Economics Leavey School of Business 2001 The Regulatory History of a New Technology: The Electromagnetic Telegraph Alexander J. Field Santa Clara University, [email protected] Follow this and additional works at: https://scholarcommons.scu.edu/econ Part of the Economics Commons, and the Law Commons Recommended Citation Field, Alexander J. 2001. “The Regulatory History of a New Technology: The Electromagnetic Telegraph.” Michigan State University Law Review 2: 245-253. Copyright © 2001 the author. This Article is brought to you for free and open access by the Leavey School of Business at Scholar Commons. It has been accepted for inclusion in Economics by an authorized administrator of Scholar Commons. For more information, please contact [email protected]. THE REGULATORY HISTORY OF A NEW TECHNOLOGY: ELECTROMAGNETIC TELEGRAPHY* Alexander J. Field" 2001 L. REv. M.S.U.-D.C.L. 245 Attitudes toward economic regulation in the United States have, since colonial times, been influenced by an almost schizophrenic oscillation between dirigiste and laissez-faire ideology. The laissez-faire tradition maintains that within a legal system providing elementary guarantees against force and fraud, business enterprise should be allowed the maximum possible freedom. The dirigiste tradition, on the other hand, recommends government intervention in a variety of situations, including those where the social return may exceed the private rate of return to research and development spending, in cases of natural monopoly, or where a firm has erected barriers to entry that give it effective control over bottlenecks and the ability to extract rents from them. Direct government economic influence on the telegraph industry over its roughly fourteen decade history reflects this schizophrenia. -

Capital Improvements Plan

Capital Improvements Plan 207 of 574 This page left intentionally blank 208 of 574 FY 2021 Capital Improvements Plan Expenditure Summary by Fund and Department Row Labels FY 2021 FY 2022 FY 2023 FY 2024 FY 2025 FY 2026 Total, 2021 ‐ 2026 Fund 301$ 700,000 $ 733,000 $ 830,000 $ 761,000 $ 922,000 $ 772,000 $ 4,718,000 Fredericksburg City Public Schools$ 700,000 $ 733,000 $ 830,000 $ 761,000 $ 922,000 $ 772,000 $ 4,718,000 Buses, Technology, Equipment & Capital Maintenance $ 550,000 $ 733,000 $ 750,000 $ 761,000 $ 772,000 $ 772,000 $ 4,338,000 Enrollment Projections$ ‐ $ ‐ $ 80,000 $ ‐ $ 80,000 $ ‐ $ 160,000 James Monroe Library$ ‐ $ ‐ $ ‐ $ ‐ $ ‐ $ ‐ $ ‐ James Monroe Track Conditioning$ ‐ $ ‐ $ ‐ $ ‐ $ 70,000 $ ‐ $ 70,000 Learning Cottages (HMES & WGMS)$ 150,000 $ ‐ $ ‐ $ ‐ $ ‐ $ ‐ $ 150,000 Fund 302$ 14,096,000 $ 34,863,000 $ 4,439,000 $ 1,762,000 $ 1,706,500 $ 1,266,000 $ 58,132,500 Public Works$ 2,066,000 $ 14,133,000 $ 1,564,000 $ 1,762,000 $ 1,706,500 $ 1,266,000 $ 22,497,500 Asphalt & Concrete Repair Program$ 850,000 $ 920,000 $ 850,000 $ 850,000 $ 850,000 $ 850,000 $ 5,170,000 Culvert Replacement$ 350,000 $ 1,800,000 $ 250,000 $ 450,000 $ 250,000 $ 250,000 $ 3,350,000 Gateway Enhancement & Wayfinding Signs$ ‐ $ 80,000 $ 80,000 $ 80,000 $ 80,000 $ 80,000 $ 400,000 Great Oaks Acid Soil Remediation$ ‐ $ 125,000 $ ‐ $ ‐ $ ‐ $ ‐ $ 125,000 Historic Assets$ ‐ $ 36,000 $ 36,000 $ 36,000 $ 36,000 $ 36,000 $ 180,000 Historic District Improvements$ ‐ $ 100,000 $ 100,000 $ 100,000 $ 190,500 $ ‐ $ 490,500 Neighborhood Enhancements $ ‐ $ 50,000 -

Services for Seniors and Adults with Disabilities

Resources for Older Adults, People with Disabilities, Caregivers and Agencies Serving Seniors and Adults with Disabilities Services for Seniors and Adults with Disabilities Prepared by the City and County of San Francisco Department of Aging and Adult Services Intake Program Table of Contents Services for Seniors and Adults with Disabilities ............................................................. 1 Information and Referral Services Information Referral and Assistance ................................................................................... 2 Other Information and Referral Hotlines ............................................................................ 5 Services for Seniors and Adults with Disabilities Aging and Disability Resource Centers of San Francisco (ADRC) ........................................ 7 Abuse ................................................................................................................................. 11 Adult Day Health Care/Community Based Adult Services (CBAS) .................................... 13 Adult Social Day Care ......................................................................................................... 16 Advocacy ............................................................................................................................. 17 Assistive Devices ............................................................................................................... 21 Caregiver Support ............................................................................................................. -

![History of Telegraphy World in the Eighteenth and Early Nineteenth Centuries [1]](https://docslib.b-cdn.net/cover/8206/history-of-telegraphy-world-in-the-eighteenth-and-early-nineteenth-centuries-1-4548206.webp)

History of Telegraphy World in the Eighteenth and Early Nineteenth Centuries [1]

)%4()34/29/&4%#(./,/'93%2)%3 3ERIES%DITORS$R""OWERS $R#(EMPSTEAD (ISTORYOF 4ELEGRAPHY /THERVOLUMESINTHISSERIES 6OLUME 4HEHISTORYOFELECTRICWIRESANDCABLES2-"LACK 6OLUME 4ECHNICALHISTORYOFTHEBEGINNINGSOFRADAR333WORDS 6OLUME "RITISHTELEVISIONTHEFORMATIVEYEARS27"URNS 6OLUME 6INTAGETELEPHONESOFTHEWORLD0*0OVEYAND2%ARL 6OLUME 4HE'%#RESEARCHLABORATORIESp2*#LAYTONAND*!LGAR 6OLUME -ETRESTOMICROWAVES%"#ALLICK 6OLUME !HISTORYOFTHEWORLDSEMICONDUCTORINDUSTRY02-ORRIS 6OLUME 7IRELESSTHECRUCIALDECADEp'"USSEY 6OLUME !SCIENTISTSWARpTHEDIARYOF3IR#LIFFORD0ATERSONp2*#LAYTON AND*!LGAR%DITORS 6OLUME %LECTRICALTECHNOLOGYINMININGTHEDAWNOFANEWAGE!6*ONESAND 204ARKENTER 6OLUME #URIOSITYPERFECTLYSATISÙED&ARADAYlSTRAVELSIN%UROPE ""OWERSAND,3YMONDS%DITORS 6OLUME -ICHAEL&ARADAYlSk#HEMICAL.OTES (INTS 3UGGESTIONSAND/BJECTSOF 0URSUITlOF2$4WENEYAND$'OODING%DITORS 6OLUME ,ORD+ELVINHISINÚUENCEONELECTRICALMEASUREMENTSANDUNITS 04UNBRIDGE 6OLUME (ISTORYOFINTERNATIONALBROADCASTING VOLUME*7OOD 6OLUME 4HEEARLYHISTORYOFRADIOFROM&ARADAYTO-ARCONI'2-'ARRATT 6OLUME %XHIBITINGELECTRICITY+'"EAUCHAMP 6OLUME 4ELEVISIONANINTERNATIONALHISTORYOFTHEFORMATIVEYEARS27"URNS 6OLUME (ISTORYOFINTERNATIONALBROADCASTING VOLUME*7OOD 6OLUME ,IFEANDTIMESOF!LAN$OWER"LUMLEIN27"URNS 6OLUME !HISTORYOFTELEGRAPHYITSTECHNOLOGYANDAPPLICATION+'"EAUCHAMP 6OLUME 2ESTORING"AIRDlSIMAGE$&-C,EAN 6OLUME *OHN,OGIE"AIRDTELEVISIONPIONEER27"URNS 6OLUME 3IR#HARLES7HEATSTONE NDEDITION""OWERS 6OLUME 2ADIOMANTHEREMARKABLERISEANDFALLOF#/3TANLEY-&RANKLAND 6OLUME %LECTRICRAILWAYS p-#$UFFY 6OLUME #OMMUNICATIONSANINTERNATIONALHISTORYOFTHEFORMATIVEYEARS -

44Th Annual S4 Social Science Student Symposium

44th Annual S4 Social Science Student Symposium Program __________________________ San Francisco State University Seven Hills Conference Center and Towers Conference Center May 2, 2019 ________________________ Supported by Office of the Chancellor, California State University San Francisco State University’s College of Liberal & Creative Arts, College of Health & Social Sciences, Department of Political Science If you drive to campus then park in the main parking garage, which is close to the 7-Hills Conference Center where we will begin our day (see map). Parking there is $8 for the day. You can use a credit card or cash (bills, no coins). Drive in and park (NOT in lot 19 or on the roof – you’ll get a ticket. Instead, park in Lot 20 on one of the floors). Go to one of the machines and buy a ticket that you place on your dashboard. 44th Annual S4 SSRIC Social Science Student Symposium San Francisco State University May 2, 2019 Symposium Schedule Overview 8:00 – 8:50 Checking in and Continental Breakfast, Seven Hills Conference Center 8:50 – 9:20 Welcome and Opening Remarks, Seven Hills Main Room 9:30 – 10:50 Session I (5 concurrent panels) in Seven Hills (2) and The Towers (3) 11:00 – 12:20 Session II (5 concurrent panels) in Seven Hills (2) and The Towers (3) 12:30 – 1:50 Luncheon and Keynote Address, Seven Hills Main Room Keynote speaker: Jim Wunderman, President and CEO of the Bay Area Council and alumnus of the SF State Department of Political Science 2:00 – 3:20 Session III (4 concurrent panels) in Seven Hills (1) and The Towers (3) 3:30 – 4:15 Awards presentation, Snacks, Closing Remarks, Seven Hills Main Room 8:00 – 8:50 Checking in and Breakfast, Seven Hills Conference Center 8:50 – 9:20 Welcoming Statements Dr. -

Cyprus Quiet but Uneasy

Weather DISTRIBUTION 7 fern, temperature 1t, Partly TODAY CtowJy today and toaizbt Higb & THEDAILY the 70f tt<Uy, low tonight In the 24,150 «s. Tomorrow, warm, humid, chance of late afternoon thunder- Red Bank Area showers. Thursday, fair, cooler. I 7 DIAL 741-0010 See weather, page 2. NORTHERN MONMOUTH'S HOME NEWSPAPER 1>sueii dally VOL. 87. NO 32 ' Mtrad>y through Friday. Second Clasn Postati TUESDAY, AUGUST 11, 1964 7c PER COPY PAGE ONE ' Paid it Hed Sank uid it Additional Milling OlflcM. Cyprus Quiet But Uneasy NICOSIA, Cyprus (AP) — A shaky peace re- split, possibly impairing the political strength of result of a delay in transmission of orders to some urned to Cyprus today as Turkey and the Greek Archbishop Makarios, Greek Cypriot president. Right- Turkish air bases. The Greek Cypriots claimed 10 Cypriot government accepted a UN cease-fire. But ists and leftists in the cabinet exchanged anpry persons were wounded when the jets strafed the vil- Cyprus remained jittery as Turkish air force jets con- words over whether to count on Greece or the Soviet lage square. tinued reconnaissance flights. Union for help, informants said. A Turkish government spokesman denied the UN headquarters said Turkish planes flew over Both factions were disappointed by the loss than planes had opened fire. He said they flew over an area south of the village of Alevga, near the scene wholehearted support Uiey received from Greece and Cyprus because the Greek Cypriots broke an unof- of the recent fighting, for 25 minutes this morning the Soviet Union. ficial truce by resuming their attack on Kokkina, but did not open fire.