Van Zonnestroom Naar Thermische Opslag: Duroplan Bestormt De Markt

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DKASC Array Cleaning

1st Clean 2nd Clean (where required) SITE # Technology Date Time Date Time 1A Large Scale Trackers, DEGERenergie Thursday 21/11/2019 5.55am - 6.15am 1B Large Scale Trackers, DEGERenergie Thursday 21/11/2019 5.55am - 6.15am 2 Large Scale Tracking, ADES Not cleaned -in stall mode 3 Roof Mounted Polycrystalline, BP Solar Monday 18/11/2019 9.10am - 9.45am 4 Solar Forest Hydraulic Trackers, Kyocera Monday 18/11/2019 6.45am - 7.15am 5 Solar Forest 1 Axis Trackers, Kyocera Sunday 17/11/2019 6.55pm - 7.15pm Monday 18/11/2019 5.40am - 6.25am 6 Solar Forest 2 Axis Trackers, Kyocera Sunday 17/11/2019 6.55pm - 7.15pm Monday 18/11/2019 5.40am - 6.25am 7 CdTe Thin Film, First Solar Sunday 17/11/2019 6.10pm - 6.55pm 8 Amorphous Silicon, Kaneka Sunday 17/11/2019 8.25am - 9.30am Sunday 17/11/2019 5.50pm - 6.10pm 9A CIGS Thin Film, Solibro Hanergy Sunday 17/11/2019 7.05am - 7.35am 9B TBD (has old CIGS Thin Film modules) Sunday 17/11/2019 7.45am - 8.05am 10 Monocrystalline Silicon, SunPower (215W) Sunday 17/11/2019 8.10am - 8.25am 11 Polycrystalline Silicon, BP Solar Sunday 17/11/2019 5.30pm - 5.50pm 12 Monocrystalline Silicon, BP Solar Sunday 17/11/2019 6.10am - 7.00am 13 Monocrystalline Silicon, Trina Saturday 16/11/2019 6.10pm - 6.35pm 14 Polycrystalline Silicon, Kyocera Saturday 16/11/2019 5.15pm - 6.05pm 15 Solar Water System, Trunz Saturday 16/11/2019 6.05pm - 6.10pm 16 Solar Compass, BP Solar Thursday 21/11/2019 6.40pm - 7.15pm 17 HIT Hybrid Silicon, Sanyo Monday 18/11/2019 7.15am - 7.45am 18 Monocrystalline Silicon, SunPower (238W) Monday 18/11/2019 -

JA Solar Module

JA Solar Overview Protect the one Earth we all share, for this and future generations. Company Profile Headquarters Shanghai, China (with EU, US & Japan Offices) Founded / IPO May 2005 / February 2007 Business c-Si solar module & cell supplier Shipments 1.69GW in 2011 Attributes World class quality, efficiency, and cost structure Capacity (Annual) 3GW Cell, 2.0 GW Module, 1.0 GW Wafer Ticker Symbol JASO (NASDAQ) Employees ~12,000 2 JA Solar Holdings Co., Ltd. (Module) 2012 Optimized Vertical Integration Model SILICON SILICON WAFERS CELL MODULE SYSTEMS Solar Wafers Solar Cells PV Modules EPC • Low-cost, high-quality • One of the world’s largest • High-quality product with • Partnering with top-tier production manufacturers high-quality BOM developers in China • Recognized for top tech at • Additional channel for • Leading the industry in low cost product distribution • Cooperation with global high-efficiency wafer • High-performance mono- • Working with leading leading IPPs on utility research and multi-crystalline solar brands on OEM modules scale projects cells JA Solar Holdings Co., Ltd. (Module) 2012 JA SOLAR Nationwide Production Plant Lianyungang Wafer Facility 500MW Capacity Yanjiao Wafer Facility 500MW Capacity Ningjin Cell Facility 1200MW Capacity Shanghai Head Quarter Yangzhou Cell Facility Hefei Solar Products Facility 1800MW Capacity Fengxian Module Facility 3GW Capacity (Started from Y11) State-of-the-art PV R&D Center 1500MW Capacity Current Module Capacity 500MW Above data will be valid until Q4, 2012. JA Solar Holdings Co., Ltd. (Module) 2012 Featured Projects Partnership with world leading independent power producers for utility scale PV projects Macy’s, New Jersey, USA Lingwu, Ningxia, China Giuliano, Italy 1.1 MW Project 40 MW Project 20.4 MW Project JA Solar Holdings Co., Ltd. -

Q2/Q3 2020 Solar Industry Update

Q2/Q3 2020 Solar Industry Update David Feldman Robert Margolis December 8, 2020 NREL/PR-6A20-78625 Executive Summary Global Solar Deployment PV System and Component Pricing • The median estimate of 2020 global PV system deployment projects an • The median residential quote from EnergySage in H1 2020 fell 2.4%, y/y 8% y/y increase to approximately 132 GWDC. to $2.85/W—a slower rate of decline than observed in any previous 12- month period. U.S. PV Deployment • Even with supply-chain disruptions, BNEF reported global mono c-Si • Despite the impact of the pandemic on the overall economy, the United module pricing around $0.20/W and multi c-Si module pricing around States installed 9.0 GWAC (11.1 GWDC) of PV in the first 9 months of $0.17/W. 2020—its largest first 9-month total ever. • In Q2 2020, U.S. mono c-Si module prices fell, dropping to their lowest • At the end of September, there were 67.9 GWAC (87.1 GWDC) of solar PV recorded level, but they were still trading at a 77% premium over global systems in the United States. ASP. • Based on EIA data through September 2020, 49.4 GWAC of new electric Global Manufacturing generating capacity are planned to come online in 2020, 80% of which will be wind and solar; a significant portion is expected to come in Q4. • Despite tariffs, PV modules and cells are being imported into the United States at historically high levels—20.6 GWDC of PV modules and 1.7 • EIA estimates solar will install 17 GWAC in 2020 and 2021, with GWDC of PV cells in the first 9 months of 2020. -

Solar PV Technology Development Report 2020

EUR 30504 EN This publication is a Technical report by the Joint Research Centre (JRC), the European Commission’s science and knowledge service. It aims to provide evidence-based scientific support to the European policymaking process. The scientific output expressed does not imply a policy position of the European Commission. Neither the European Commission nor any person acting on behalf of the Commission is responsible for the use that might be made of this publication. For information on the methodology and quality underlying the data used in this publication for which the source is neither Eurostat nor other Commission services, users should contact the referenced source. The designations employed and the presentation of material on the maps do not imply the expression of any opinion whatsoever on the part of the European Union concerning the legal status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries. Contact information Name: Nigel TAYLOR Address: European Commission, Joint Research Centre, Ispra, Italy Email: [email protected] Name: Maria GETSIOU Address: European Commission DG Research and Innovation, Brussels, Belgium Email: [email protected] EU Science Hub https://ec.europa.eu/jrc JRC123157 EUR 30504 EN ISSN 2600-0466 PDF ISBN 978-92-76-27274-8 doi:10.2760/827685 ISSN 1831-9424 (online collection) ISSN 2600-0458 Print ISBN 978-92-76-27275-5 doi:10.2760/215293 ISSN 1018-5593 (print collection) Luxembourg: Publications Office of the European Union, 2020 © European Union, 2020 The reuse policy of the European Commission is implemented by the Commission Decision 2011/833/EU of 12 December 2011 on the reuse of Commission documents (OJ L 330, 14.12.2011, p. -

Solar Is Driving a Global Shift in Electricity Markets

SOLAR IS DRIVING A GLOBAL SHIFT IN ELECTRICITY MARKETS Rapid Cost Deflation and Broad Gains in Scale May 2018 Tim Buckley, Director of Energy Finance Studies, Australasia ([email protected]) and Kashish Shah, Research Associate ([email protected]) Table of Contents Executive Summary ......................................................................................................... 2 1. World’s Largest Operational Utility-Scale Solar Projects ........................................... 4 1.1 World’s Largest Utility-Scale Solar Projects Under Construction ............................ 8 1.2 India’s Largest Utility-Scale Solar Projects Under Development .......................... 13 2. World’s Largest Concentrated Solar Power Projects ............................................... 18 3. Floating Solar Projects ................................................................................................ 23 4. Rooftop Solar Projects ................................................................................................ 27 5. Solar PV With Storage ................................................................................................. 31 6. Corporate PPAs .......................................................................................................... 39 7. Top Renewable Energy Utilities ................................................................................. 44 8. Top Solar Module Manufacturers .............................................................................. 49 Conclusion ..................................................................................................................... -

Solar Power Initiative Using Caltrans Right-Of-Way Final Research Report

STATE OF CALIFORNIA • DEPARTMENT OF TRANSPORTATION TECHNICAL REPORT DOCUMENTATION PAGE DRISI-2011 (REV 10/1998) 1. REPORT NUMBER 2. GOVERNMENT ASSOCIATION NUMBER 3. RECIPIENT'S CATALOG NUMBER CA20-3177 4. TITLE AND SUBTITLE 5. REPORT DATE Solar Power Initiative Using Caltrans Right-of-Way 12/09/2020 Final Research Report 6. PERFORMING ORGANIZATION CODE 7. AUTHOR 8. PERFORMING ORGANIZATION REPORT NO. Sarah Kurtz, Edgar Kraus, Kristopher Harbin, Brianne Glover, Jaqueline Kuzio, William Holik, Cesar Quiroga 9. PERFORMING ORGANIZATION NAME AND ADDRESS 10. WORK UNIT NUMBER University of California, Merced School of Engineering and Material Science 11. CONTRACT OR GRANT NUMBER 5200 North Lake Road 65A0742 Merced, CA 95343 12. SPONSORING AGENCY AND ADDRESS 13. TYPE OF REPORT AND PERIOD COVERED California Department of Transportation Final Report Division of Research, Innovation and System Information June 2019 - December 2020 P.O. Box 942873 14. SPONSORING AGENCY CODE Sacramento, CA 94273 15. SUPPLEMENTARY NOTES 16. ABSTRACT Provide guidance to the California Department of Transportation (Caltrans) on the installation of utility-scale solar electrical generation facilities in its right-of-way. Explores the current rules, regulations, and policies from regulatory agencies external to Caltrans and California utilities that affect Caltrans’ ability to install solar within its right-of-way. Determines best practices that other state departments of transportation have developed based on their experience with the deployment of solar generation facilities within their right-of-way. Outlines best practices of how to develop solar generation sites within Caltrans right-of-way. Summarizes design-build-own strategies that Caltrans could use as part of a public-private partnership to finance the installation and/or maintenance of solar sites within the Caltrans right-of-way. -

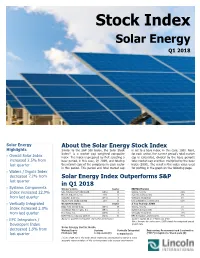

Solar Energy Stock Index Q1 2

Stock Index Solar Energy Q1 2018 Solar Energy About the Solar Energy Stock Index Highlights Similar to the S&P 500 Index, the Solar Stock is set to a base index, in this case, 1000. Next, (1) Index is a market cap weighted composite for each sector, the current period’s total market Overall Solar Index index. The index is prepared by first selecting a cap is calculated, divided by the base period’s increased 2.5% from base period, in this case, Q1 2009, and totaling total market cap and then multiplied by the base last quarter the market caps of the companies in each sector index (1000). The result is the index value used in this period. This period and total market cap for plotting in the graph on the following page. Wafers / Ingots Index decreased 7.2% from Solar Energy Index Outperforms S&P last quarter in Q1 2018 Systems Components Winner’s Circle Sector EBITDA Margins Index increased 22.9% GCL-Poly Energy Holdings Ltd. (26%) W Wafers / Ingots 28% Motech Industries, Inc. 21% S Systems Components 6% from last quarter Canadian Solar Inc. (27%) I Vertically Integrated 8% Azure Power Global Limited 31% D EPC Integrators / Developers 55% Vertically Integrated Worst Performers Sector 3 Year Revenue CAGR Daqo New Energy Corp. (68%) W Wafers / Ingots 5% Index increased 2.0% SolarEdge Technologies, Inc. (59%) S Systems Components 0% from last quarter First Solar, Inc. (60%) I Vertically Integrated 13% BCPG Public Company Limited (52%) D EPC Integrators / Developers 71% Based on quarter-over-quarter share price performance Source: Capital -

Expanding the Photovoltaic Supply Chain in the United States: Opportunities and Challenges

Expanding the Photovoltaic Supply Chain in the United States: Opportunities and Challenges Brittany L. Smith and Robert Margolis NREL is a national laboratory of the U.S. Department of Energy Technical Report Office of Energy Efficiency & Renewable Energy NREL/TP-6A20-73363 Operated by the Alliance for Sustainable Energy, LLC July 2019 This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications. Contract No. DE-AC36-08GO28308 Expanding the Photovoltaic Supply Chain in the United States: Opportunities and Challenges Brittany L. Smith and Robert Margolis Suggested Citation Smith, Brittany L., and Robert Margolis. (2019). Expanding the Photovoltaic Supply Chain in the United States: Opportunities and Challenges. Golden, CO: National Renewable Energy Laboratory. NREL/TP-6A20-73363. https://www.nrel.gov/docs/fy19osti/73363.pdf. NREL is a national laboratory of the U.S. Department of Energy Technical Report Office of Energy Efficiency & Renewable Energy NREL/TP-6A20-73363 Operated by the Alliance for Sustainable Energy, LLC July 2019 This report is available at no cost from the National Renewable Energy National Renewable Energy Laboratory Laboratory (NREL) at www.nrel.gov/publications. 15013 Denver West Parkway Golden, CO 80401 Contract No. DE-AC36-08GO28308 303-275-3000 • www.nrel.gov NOTICE This work was authored by the National Renewable Energy Laboratory, operated by Alliance for Sustainable Energy, LLC, for the U.S. Department of Energy (DOE) under Contract No. DE-AC36- 08GO28308. Funding provided by the U.S. Department of Energy Office of Energy Efficiency and Renewable Energy Solar Energy Technologies Office. -

H2 2020: Solar Industry Update

H2 2020 Solar Industry Update David Feldman Robert Margolis April 6, 2021 NREL/PR-7A40-79758 Executive Summary Global Solar Deployment • Though 2020 U.S. solar and wind installations collectively achieved record levels, EIA expects 2021 to far exceed these levels, with 21 GW of PV and • Eight of the leading PV markets collectively installed 93 GWAC of PV in 2020, AC 16 GW of wind. up from 69 GWAC in 2019. AC – The three leading markets were China (48 GWAC), the United States (15 • The United States installed approximately 3.5 GWh, 1.5 GWAC of energy GWAC), and Vietnam (8 GWAC). storage onto the electric grid in 2020, up 214% y/y. U.S. PV Deployment PV System and Component Pricing • In 2020, PV represented approximately 40% of new U.S. electric generation • Mono c-Si PV module prices rose 6% in Q1 2021, with mono-crystalline PV capacity, compared to 4% in 2010. modules being slightly higher than they were a year ago ($0.22/W). – Over 30 GWAC of renewable energy and storage capacity was installed in the United States in 2020. • Polysilicon was up 33% in Q1 2021 and 76% y/y to $15.6/kg at the end of • Solar represented only 6.6% of net summer capacity and 3.3% of annual March. generation in 2020. • In Q4 2020, U.S. mono c-Si module prices fell, dropping to their lowest – However, 11 states generated more than 5% of their electricity from recorded level, but they were still trading at a 55% premium over global ASP. -

Reshuffling of the Market

PHOTOVOLTAICS SILICON AND WAFER MANUFACTURERS Reshuffling of the market Japan. “In 2010, the region arrived at a market share of 11 %. That share will increase to 16 % by the end of 2011 and reach the 26 % mark by 2015.” Profit warning in Europe Meanwhile, the first solar companies in the wafer segment are reacting to the new trend. In particular, the manufacturers with production locations in Europe have been attracting attention with their an- nouncements. One example is the UK-based PV Crystalox Solar, a silicon and wafer manufacturer, which recently published a profit warning for the sec- ond half of 2011. PV Crystalox Solar warned that op- erative losses could occur as a result of the meagre supply situation in the second half of the year, which had been considerable lower than expected in May. On the level of the end consumer, the demand has In the wafer segment, the companies meanwhile greatly decreased, says the company. tend to pair the expansion of their When compared to the previous year, the installed PV capacities with an increased level of capacities in Germany alone have dropped by 50 % vertical integration. Photo: REC Group between March and May. Shortly after the profit warn- ing was published, the price for PV Crystalox Solar shares took a sharp tumble. Similar news arrived from Norway. Towards the end of the second quarter, The global PV market is finding a new balance. While the REC Group announced that it would curb its produc- tion on a temporary basis. According to REC’s Inves- traditional European core markets are faced with a tor Relations Analyst Peder Poulsson, the reason for tumbling demand, other parts of the world such as Asia the measure must be seen in the weak sales situation in Europe and the falling wafer and module prices. -

China Solar Sector Research Analysts INITIATION Gary Zhou, CFA 852 2101 6648 [email protected] the Two New Trends

30 June 2017 Asia Pacific/China Equity Research Utilities China Solar Sector Research Analysts INITIATION Gary Zhou, CFA 852 2101 6648 [email protected] The two new trends Dave Dai, CFA 852 2101 7358 [email protected] Figure 1: Expanding market share of distributed solar and rising Gloria Yan demand for mono-Si solar components 852 2101 7369 80% 71% 74% [email protected] 60% 50% 50% Distributed solar as % of 40% 45% 32% 40% 25% 30% China's annual solar 18% installations 20% 9% 12% 0% Market share of mono-Si 2015 2016 2017E 2018E 2019E 2020E Source: NDRC, Credit Suisse estimates ■ Mono-Si gaining share on the upstream. Despite global solar market likely growing by single digits in the next few years, we expect demand for Mono-Silicon (mono-Si) solar components to more than double during 2016-20, driven by market share expansion (from 25% to 50%) due to its superior cost efficiency over competing multi-silicon (multi-Si) technology. Such a trend should benefit mono-Si wafer manufacturers (led by LONGi) with strong volume and earnings growth, while multi-Si rivals (such as GCL Poly) may suffer from shrinking demand. ■ Rising distributed solar in China. For China's solar operator market, another major change we expect is the shift from ground-mounted solar farms to distributed solar (largely rooftops). Such a trend is warranted by a lower land requirement, limited power curtailment and lucrative returns for distributed solar (an equity IRR of >15% vs 10% for solar farms). We believe that the forecasted 55% capacity CAGR (60GW target by 2020) during 2016-20 for distributed solar should help to drive up demand for mono-Si products (extra 100-200 bp IRR gains). -

ADA-ES, Inc. a D

Clean Technology and Renewables Conference Company Fact Sheet Headquarters ADA-ES, Inc.Third Annual Clean Technology and RenewablesADES Conference 8100 SouthPark Way February 20, 2008 Littleton, CO 80120 303 34-12 Company Description Analysts www.adaes.com ADA-ESADA-ES, Inc. Inc.provides air pollution control systems, ADES Charles J. Fishman Senior Research Analyst specialty chemicals and consulting services to utility and Management industrial customers. The air pollution control business 314 963-9702 Company Description CEO:[email protected] Michael D. Durham focuses on mercury emissions control for coal-fired ADA-ES Inc. provides air pollution control systems, specialty CFO: Mark H. McKinnies boilerschemicals, while and the consulting specialty servicchemicalses to utilitysegment and industrialaddresses Elaine S. Kwei fluecustomers. gas conditioning, The air pollution problems control with business coal switching focuses on and mercury Research Analyst fluxing additives. The company offers consulting services 415 277-1511 emissions control for coal-fired boilers while the specialty to improve baghouse and electrostatic precipitator [email protected] chemicals segment addresses flue gas conditioning, problems performance.with coal switching, The mercury and fluxin controlsg additives. business The company accounts offers for roughlyconsulting 90% services of revenues to improve with baghouseflue gas andconditioning electrostatic and otherprecipitator activities performance. contributing The to mercury the balance. controls business accounts Headquarters for roughly 90% of revenues with flue gas conditioning and other 8100 SouthPark Way Source:activities Company contributing reports, to the Piper balance. Jaffray Littleton, CO 80120 303 734-1727 Source: Company reports, Piper Jaffray www.adaes.com Management CEO: Michael D. Durham CFO: Mark H.