Annual Report 2008 Key Figures

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Development of Radio and Radio Research Perspectives Towards a New Order

The Development of Radio and Radio Research Perspectives Towards a New Order PENTTI KEMPPAINEN In the past, broadcasting was controlled late an analytic model of what is happen- and regulated by the state and most radio ing today, they end up examining the com- channels were reserved for public service merce driven change. They choose a per- broadcasting. Today, all European count- spective which highlights two main featu- ries allow private radio and tv. Within this res of current change: firstly the degree to change public service broadcasting has which it is externally driven; second, the ele- been going through a crisis. Radio research ment of conflict between old and new play- methods relevant in the times of mono- ers over the establishment of the New poly radio are less effective in understand- Order. The authors state that ing this rapid development. When choos- ing the perspective for studying present The new politics is clearly very much concerned and future development of radio becomes with industrial and commercial matters, just as necessary to put greater attention on the the old politics was primarily cultural and ideo- industrial-commercial aspect. logical. The new is supranationally oriented, The new situation has become familiar while the old was almost exclusively national. with media researchers. For instance Den- The new is less dominated by established politi- nis McQuail and the Euromedia Research cal parties and a broadcasting elite. Group have described the shift from the Old Order to the New Order. While Later a third feature of change is added: trying to look at the evidently new media fragmentation (McQuail, de Rosario, Tapper possibilities It only gradually became ap- 1992, 15) to the toolbag of the New Or- parent that something different and per- der radio research. -

Viewing the Future U2

Annual Report 2011 Viewing the Future U2 VIEWING THE FUTURE 14 BROADCASTING GERMAN-SPEAKING 42 BROADCASTING INTERNATIONAL 128 DIGITAL & ADJACENT 214 CONTENT PRODUCTION & GLOBAL SALES R EPORTS FROM CONSOLIDATED THE EXECUTIVE FINANCIAL AND SUPER- STATEMENTS VISORY BOARD 130 I ncome Statement 131 S tatement of Comprehensive Income 16 LETTER FROM THE CEO 132 S tatement of Financial Position 18 M EMBERS OF THE EXECUTIVE BOARD 133 C ash flow Statement 20 REPORT OF THE SUPERVISORY BOARD 134 S tatement in Changes in Equity 26 P roposed Allocation of Profits 135 N otes 26 M anagement Declaration and Corporate Governance Report 211 R esponsibility Statement of the Executive Board G ROUP MANAGE- 212 A uditor‘s Report MENT REPORT 44 T HE YEAR 2011 AT A GLANCE 46 B usiness Operations and Business ADDITIONAL Conditions 60 T- V HIGHLIGHTS 2011 INFORMATION 62 B usiness Performance 80 S egment Reporting 216 Key Figures: Multi-Year-Overview 83 E mployees 217 Finance Glossary 88 T o he Pr SiebenSat.1 Share 218 M edia Glossary 92 N on-Financial Performance 219 I ndex of Figures and Tables Indicators 221 E ditorial Information 98 PB U LIC VALUE 222 Financial Calendar 100 E vents after the Reporting Period 101 R isk Report 116 O utlook 120 P ROGRAMMING OUTLOOK FOR 2012 Klapper vorne innen U2 PROSIEBENSAT.1 AT A GLANCE The ProSiebenSat.1 Group was established in 2000 as the largest TV company in Germany. Today, we are present with 28 TV stations in 10 countries and rank among Europe‘s leading media groups. -

Converged Markets

Converged Markets - Converged Power? Regulation and Case Law A publication series of the Market power becomes an issue for European and media services and enabling services, platforms and European Audiovisual Observatory national law makers whenever market players acquire a converged services, and fi nally distribution services. degree of power which severely disturbs the market balance. In this sense, the audiovisual sector is no The eleven countries were selected for this study because exception. But this sector is different in that too much they either represented major markets for audiovisual market power may not only endanger the competitive media services in Europe, or because they developed out- parameters of the sector but may also become a threat side the constraints of the internal market, or because they had some interesting unique feature, for example to the freedom of information. It is this latter aspect the ability to attract major market players despite lacking which turns market power into a particularly sensitive an adequately sized market. issue for the audiovisual sector. National legislators and regulators backed by national courts seek solutions The third part brings in the economic background in the adapted to this problem. form of different overviews concerning audience market shares for television and video online. This data puts the This IRIS Special issue is deals with the regulation of legal information into an everyday context. market power in the audiovisual sector in Europe. The fourth and fi nal part seeks to tie together the common The fi rst part of this IRIS Special explores the European threads in state regulation of media power, to work Union’s approach to limiting media power, an approach out the main differences and to hint to some unusual still dominated by the application of competition law. -

Towards Streamlined Broadcasting: the Changing Music Cultures of 1990 Finnish Commercial Radio

Journal of the International Association for the Study of Popular Music doi:10.5429/2079-3871(2010)v1i1.8en Towards Streamlined Broadcasting: The Changing Music Cultures of 1990 Finnish Commercial Radio Heikki Uimonen [email protected] Dept. of Music Anthropology, University of Tampere Abstract The deregulation of broadcasting in 1985 Finland introduced competition between the European public service tradition and American commercial radio. Musically diverse and almost uncontrolled programme policies of the mid-1980s were replaced by the American-style format radio in the 1990s. The article focuses on how the process of music selection and radio music management changed. What were the economic, technological, organisational and cultural constraints that regulated the radio business and especially music? The question will be answered by empirical data consisting of interviews with the radio station personnel and music copyright reports supported by printed archive material. Key words: radio music, deregulation, music programming, play lists, music selection. Introduction Yleisradio (The Finnish Broadcasting Company, YLE) was founded in 1926. Right from the beginning music had an important role accounting for nearly 70 percent of broadcast time. Soon the share was cut down but it still remained around 50 percent. Publicly funded radio broadcast live; recordings were used very seldom. It seems that the YLE had two main guidelines in their programme policy: firstly to provide serious and uplifting popular education and information to the public and secondly to meet the listeners’ needs for entertainment. In practice this meant more highbrow than folksy style amusement (Kurkela, 2010, pp. 72– 73). In the early 1960s the YLE policy was challenged when the pirate stations started to broadcast off the coast of Stockholm. -

Annual Report 2007 Prosiebensat.1 Group: Key Figures 2007 20071 20064 Change

Group The power of television Annual Report 2007 ProSiebenSat.1 Group: Key figures 2007 20071 20064 Change Euro m Euro m Revenues 2,702.5 2,095.1 29% Recurring EBITDA2 661.9 485.6 36% EBITDA 521.3 482.9 8% EBIT 384.3 442.8 -13% Financial loss -135.5 -57.5 -136% Profit before taxes 248.8 385.3 -35% Consolidated net profit 89.4 240.7 -63% Underlying net income3 272.8 243.9 12% Earnings per share of preferred stock (in EUR) 0.42 1.11 -62% Underlying earnings per share of preferred stock (in EUR) 1.26 1.12 13% Cash flow from operating activities 1,593.6 1.272.0 25% Cash flow from investing activities -3,269.0 -979.6 - / - Free cash-flow -1,675.4 292.4 - / - 12/31/20071 12/31/2006 Change Total assets 5,998.8 1,932.1 210% Shareholders´ equity 1,062.3 1,240.5 -14% Equity ratio 18% 64% -72% Programming assets 1,317.7 1,056.3 25% Net financial debt 3,328.4 121.8 - / - 1 Consolidation of SBS Broadcasting Group since July 2007, figures for 2006 are not adjusted 2 Recurring EBITDA: EBITDA before non-recurring items 3 Adjusted consolidated net profit: Consolidated net profit before effects of purchase price allocation and (2007 only) FCO fine 4 Prior-year figures adjusted to reflect recognition of PSP as a discontinued operation OurOur MissionMission StatementStatement TheThe powerpower ofof televisiontelevision TheThe ProSiebenSat.1 Group Group is is a aleading leading pan-european pan-European media media company. -

The Information of the Citizen in the Eu: Obligations for the Media and the Institutions Concerning the Citizen's Right to Be Fully and Objectively Informed

Directorate-General Internal Policies Policy Department C CITIZENS' RIGHTS AND CONSTITUTIONAL AFFAIRS THE INFORMATION OF THE CITIZEN IN THE EU: OBLIGATIONS FOR THE MEDIA AND THE INSTITUTIONS CONCERNING THE CITIZEN'S RIGHT TO BE FULLY AND OBJECTIVELY INFORMED STUDY ID. N°: IPOL/C/IV/2003/04/01 AUGUST 2004 PE 358.896 EN Thisstudy wasrequested by: the European Parliament'sCommittee on Civil Liberties, Justice and Home Affairs Thispaper ispublished in the following languages: EN (original) and DE Author: Deirdre Kevin, Thorsten Ader, Oliver Carsten Fueg, Eleftheria Pertzinidou, Max Schoenthal European Institute for the Media, Düsseldorf Responsible Official: Mr Jean-Louis ANTOINE-GRÉGOIRE Policy Unit Directorate C Remard 03 J016 - Brussels Tel: 42753 Fax: E-mail: [email protected] Manuscript completed in August 2004. Paper copiescan be obtained through: - E-mail: [email protected] - Site intranet: http://ipolnet.ep.parl.union.eu/ipolnet/cms/pid/438 Brussels, European Parliament, 2005 The opinionsexpressed in thisdocument are the sole responsibility of the author and do not necessarily represent the official position of the European Parliament. Reproduction and translation for non-commercial purposesare authorized, provided the source is acknowledged and the publisher isgiven prior notice and sent a copy. 2 PE 358.896 EN Table of Contents Acknowledgements 3 Abstract 4 Executive Summary 5 Part I Introduction 8 Part II: Country Reports Austria 15 Belgium 25 Cyprus 35 Czech Republic 42 Denmark 50 Estonia 58 Finland 65 France -

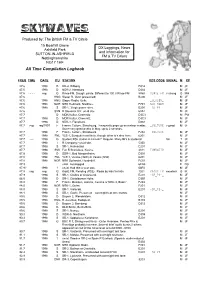

All Time Compilation Logbook by Date/Time

SKYWAVES Produced by: The British FM & TV Circle 15 Boarhill Grove DX Loggings, News Ashfield Park and Information for SUTTON-IN-ASHFIELD FM & TV DXers Nottinghamshire NG17 1HF All Time Compilation Logbook FREQ TIME DATE ITU STATION RDS CODE SIGNAL M RP 87.6 1998 D BR-4, Dillberg. D314 M JF 87.6 1998 D NDR-2, Hamburg. D382 M JF 87.6 - - - - reg G Rinse FM, Slough. pirate. Different to 100.3 Rinse FM 8760 RINSE_FM v strong GMH 87.6 HNG Slager R, Gyor (presumed) B206 M JF 87.6 1998 HNG Slager Radio, Gyšr. _SLAGER_ MJF 87.6 1998 NOR NRK Hedmark, Nordhue. F701 NRK_HEDM MJF 87.6 1998 S SR-1, 3 high power sites. E201 -SR_P1-_ MJF 87.6 SVN R Slovenia 202, un-id site. 63A2 M JF 87.7 D MDR Kultur, Chemnitz D3C3 M PW 87.7 1998 D MDR Kultur, Chemnitz. D3C3 M JF 87.7 1998 D NDR-4, Flensburg. D384 M JF 87.7 reg reg/1997 F France Culture, Strasbourg. Frequently pops up on meteor scatter. _CULTURE v good M JF Some very good peaks in May, up to 2 seconds. 87.7 1998 F France Culture, Strasbourg. F202 _CULTURE MJF 87.7 1998 FNL YLE-1, Eurajoki most likely, though other txÕs also here. 6201 M JF 87.7 ---- 1998 G Student RSL station in Lincoln? Regular. Many ID's & students! fair T JF 87.7 1998 I R Company? un-id site. 5350 M JF 87.7 1998 S SR-1, Halmastad. E201 M JF 87.7 1998 SVK Fun R Bratislava, Kosice. -

MAPPING DIGITAL MEDIA: NETHERLANDS Mapping Digital Media: Netherlands

COUNTRY REPORT MAPPING DIGITAL MEDIA: NETHERLANDS Mapping Digital Media: Netherlands A REPORT BY THE OPEN SOCIETY FOUNDATIONS WRITTEN BY Martijn de Waal (lead reporter) Andra Leurdijk, Levien Nordeman, Thomas Poell (reporters) EDITED BY Marius Dragomir and Mark Thompson (Open Society Media Program editors) EDITORIAL COMMISSION Yuen-Ying Chan, Christian S. Nissen, Dusˇan Reljic´, Russell Southwood, Michael Starks, Damian Tambini The Editorial Commission is an advisory body. Its members are not responsible for the information or assessments contained in the Mapping Digital Media texts OPEN SOCIETY MEDIA PROGRAM TEAM Meijinder Kaur, program assistant; Morris Lipson, senior legal advisor; and Gordana Jankovic, director OPEN SOCIETY INFORMATION PROGRAM TEAM Vera Franz, senior program manager; Darius Cuplinskas, director 12 October 2011 Contents Mapping Digital Media ..................................................................................................................... 4 Executive Summary ........................................................................................................................... 6 Context ............................................................................................................................................. 10 Social Indicators ................................................................................................................................ 12 Economic Indicators ........................................................................................................................ -

Annual Report 2010 // Key Figures at a Glance

// fascinating people Annual Report 2010 // Key fiGureS at a Glance ProSiebenSat.1 Group: Key figures for 2010 EUR m Q4 2010 Q4 2009 Q4 20089) Q4 20078) Q4 2006 Revenue 954.1 880.4 876.8 989.3 657.2 Total costs 654.5 651.8 915.8 772.3 471.6 Recurring costs1) 599.9 576.2 621.6 695.1 460.3 Consumption of programming assets 311.2 290.1 327.5 395.6 264.2 Recurring EBITDA2) 358.6 307.2 279.3 296.9 200.8 Recurring EBITDA margin (in %) 37.6 34.9 31.9 30.0 30.6 EBITDA 338.9 293.0 251.7 281.1 200.2 Non-recurring items3) -19.7 -14.2 -27.6 -15.8 -0.6 EBIT 304.2 239.2 3.5 222.1 189.4 Financial result -65.1 -67.3 -133.3 -79.6 -11.0 Profit/loss before income taxes 239.0 171.9 -128.0 142.5 178.4 Consolidated net profit/loss (after non-controlling interests)4) 181.5 113.4 -170.0 39.5 113.4 Underlying net income5) 194.3 137.1 78.2 75.3 114.4 Investments in programming assets 279.6 267.8 329.3 366.9 261.1 EUR m 2010 2009 20089) 20078) 2006 Revenue 3,000.0 2,760.8 3,054.2 2,710.4 2,104.6 Total costs 2,341.7 2,310.7 2,851.0 2,341.9 1,672.4 Recurring costs1) 2,105.2 2,077.5 2,413.1 2,063.1 1,629.7 Consumption of programming assets 1,077.7 1,068.6 1,247.1 1,145.8 946.0 Recurring EBITDA2) 905.9 696.5 674.5 662.9 487.0 Recurring EBITDA margin (in %) 30.2 25.2 22.1 24.5 23.1 EBITDA 807.6 623.0 618.3 522.3 484.3 Non-recurring items3) -98.3 -73.5 -56.2 -140.6 -2.7 EBIT 669.6 475.1 263.5 385.3 444.3 Financial result -240.5 -242.47) -334.9 -135.5 -57.6 Profit/loss before income taxes 429.0 233.17) -68.4 249.8 386.7 Consolidated net profit/loss (after non-controlling -

BR IFIC N° 2675 Index/Indice

BR IFIC N° 2675 Index/Indice International Frequency Information Circular (Terrestrial Services) ITU - Radiocommunication Bureau Circular Internacional de Información sobre Frecuencias (Servicios Terrenales) UIT - Oficina de Radiocomunicaciones Circulaire Internationale d'Information sur les Fréquences (Services de Terre) UIT - Bureau des Radiocommunications Part 1 / Partie 1 / Parte 1 Date/Fecha 10.08.2010 Description of Columns Description des colonnes Descripción de columnas No. Sequential number Numéro séquenciel Número sequencial BR Id. BR identification number Numéro d'identification du BR Número de identificación de la BR Adm Notifying Administration Administration notificatrice Administración notificante 1A [MHz] Assigned frequency [MHz] Fréquence assignée [MHz] Frecuencia asignada [MHz] Name of the location of Nom de l'emplacement de Nombre del emplazamiento de 4A/5A transmitting / receiving station la station d'émission / réception estación transmisora / receptora 4B/5B Geographical area Zone géographique Zona geográfica 4C/5C Geographical coordinates Coordonnées géographiques Coordenadas geográficas 6A Class of station Classe de station Clase de estación Purpose of the notification: Objet de la notification: Propósito de la notificación: Intent ADD-addition MOD-modify ADD-ajouter MOD-modifier ADD-añadir MOD-modificar SUP-suppress W/D-withdraw SUP-supprimer W/D-retirer SUP-suprimir W/D-retirar No. BR Id Adm 1A [MHz] 4A/5A 4B/5B 4C/5C 6A Part Intent 1 110073638 ARG 235.7500 PTO IGUAZU ARG 54W34'25'' 25S35'48'' FX 1 ADD 2 110072771 -

Concentratie En Pluriformiteit Van De Nederlandse Media 2007 |||||

mediaconcentratie in beeld mediaconcentratie mediaconcentratie in beeld concentratie en pluriformiteit van de nederlandse media 2007 ||||| concentratie en pluriformiteit van de nederlandse media 2007 en pluriformiteit van concentratie commissariaat voor de media Hoge Naarderweg 78 lllll 1217 AH Hilversum lllll Postbus 1426 lllll 1200 BK Hilversum lllll T 035 773 77 00 lllll F 035 773 77 99 lllll [email protected] lllll www.cvdm.nl lllll mediaconcentratie in beeld CONCENTRATIE EN PLURIFORMITEIT VAN DE NEDERLANDSE MEDIA 2007 © september 2008 Commissariaat voor de Media Colofon Het rapport Mediaconcentratie in Beeld is een uitgave van het Commissariaat voor de Media. Redactie Marcel Betzel Edmund Lauf Rini Negenborn Jan Vosselman Bosch Vormgeving Studio FC Klap MediagraphiX Druk Roto Smeets GrafiServices Commissariaat voor de Media Hoge Naarderweg 78 lllll 1217 AH Hilversum Postbus 1426 lllll 1200 BK Hilversum T 035 773 77 00 lllll F 035 773 77 99 lllll [email protected] lllll www.cvdm.nl lllll www.mediamonitor.nl ISSN 1874-0111 inhoud Voorwoord 4 Samenvatting 5 1. Trends 13 2. Mediabedrijven 17 2.1 Uitgevers en omroepen 19 2.2 Kabel- en telecomexploitanten 28 3. Mediamarkten 35 3.1 Dagbladen 35 3.2 Opiniebladen 42 3.3 Televisie 43 3.4 Radio 49 3.5 Internet 54 3.6 Reclame 58 4. Nieuwsgebruik in Nederland 61 4.1 Nieuwsmedia 62 4.2 Nieuwstitels 64 4.3 Nieuwsaanbieders 67 4.4 Nieuwsmarkt en Tijdelijke wet 69 5. De betekenis van zoekmachines in de informatiesamenleving 71 Annex 83 A. Begrippen 83 B. Methodische verantwoording 85 C. Overige informatie 92 voorwoord Voor de zevende keer publiceert het Commissariaat zijn Mediamonitor. -

ED 267 – Arts & Médias

UNIVERSITÉ DE PARIS 3 – SORBONNE NOUVELLE ED 267 – Arts & Médias Thèse pour l'obtention du titre de Docteur en Sciences de l'Information et de la Communication par Alexandre JOLIN sous la direction de Madame Chantal DUCHET Convergence numérique et convergence des stratégies de groupe des éditeurs de chaînes de télévision traditionnels en Europe : vers une redéfinition des modèles d'affaires des éditeurs de services de médias audiovisuels historiques. Soutenue publiquement le 21 janvier 2016 devant le jury composé de : Philippe BOUQUILLION Professeur HDR en Sciences de l’Information et Rapporteur de la Communication Université Paris13 Laurent CRETON Professeur HDR en Sciences de l’Information et Président de la Communication Université Sorbonne Nouvelle - Paris 3 Chantal DUCHET Professeur HDR en Sciences de l’Information et Directrice de thèse de la Communication Université Sorbonne Nouvelle - Paris 3 Thomas PARIS Professeur affilié à HEC School of Management Rapporteur Chargé de Recherches au CNRS RESUMÉ TITRE: Convergence numérique et convergence des stratégies de groupe des éditeurs de chaînes de télévision traditionnels en Europe : vers une redéfinition des modèles d'affaires des éditeurs de services de médias audiovisuels historiques Nous étudions les stratégies de groupe des éditeurs de chaînes de télévision gratuites et payantes historiques, contraintes par les évolutions rapides et structurelles induites par la convergence numérique. Nous structurons notre démonstration en quatre grandes parties suivant une approche stratégique de tradition descriptive, principalement inspirée par l'école de l'environnement. Au cours des trois premières parties, nous exposerons et débâterons des mutations d’un environnement général que nous aborderons à travers trois dimensions : une dimension technologique, une dimension sociale et une dimension économique et réglementaire qui sera également l’occasion d’étudier les effets de l’environnement général sur les sphères industrielles et concurrentielles.