Viewing the Future U2

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Inland & Coastal

September 2010 Alicantewww.thetraderonline.es - Valencia - Castellon • Tel 902733622 - Tarragona - Barcelona FREE! 1 Inland & Coastal rader Authorised Dealer SOUTH EDITION - SEPTEMBER 2010 Issue 143 www.thetraderonline.es Tel 902733633 T Want to save Money? See page 2 Buying and selling stuff at .com FIREWOOD PARRA Valencia province ablaze Be ready for Winter 2010-2011 FLAMES are licking almost every corner of the prov- Buy the logs now ince of Valencia as forest fi res that started early this week continue to burn with a vengeance. Thought Tel 962246486 696320315 to be the work of arsonists, the inferno sweeping across the south of the province shows no signs of www.lenasparra.com abating and has led to smoke-clouded skies within a 30-kilometre radius of each of the focal points of the fi res. The worst to date have been two fi res that FORMER UK MARSHALLS started almost simultaneously in Bocairent and On- REGISTERED CONTRACTOR tinyent. All homes outside the main hub of the town All aspects of building work and in Ontinyent were evacuated on Monday night, with hard landscaping many people’s houses just inches from the fl ames. Certifi cates & Portfolio availbale The blaze looked set to destroy everything their oc- cupants owned, but the wind changed in the early Tel Gary 962728195 678946301 hours of Tuesday morning, giving them a temporary reprieve. Further south, Simat de la Valldigna has turned into a raging inferno with a massive column The Magpies Is under new ownership. of smoke blocking out the sun, and even the fl ames David & Carol Welcome being visible from as far away as Oliva, at a dis- New & Old Customers tance of over 30 kilometres. -

The Development of Radio and Radio Research Perspectives Towards a New Order

The Development of Radio and Radio Research Perspectives Towards a New Order PENTTI KEMPPAINEN In the past, broadcasting was controlled late an analytic model of what is happen- and regulated by the state and most radio ing today, they end up examining the com- channels were reserved for public service merce driven change. They choose a per- broadcasting. Today, all European count- spective which highlights two main featu- ries allow private radio and tv. Within this res of current change: firstly the degree to change public service broadcasting has which it is externally driven; second, the ele- been going through a crisis. Radio research ment of conflict between old and new play- methods relevant in the times of mono- ers over the establishment of the New poly radio are less effective in understand- Order. The authors state that ing this rapid development. When choos- ing the perspective for studying present The new politics is clearly very much concerned and future development of radio becomes with industrial and commercial matters, just as necessary to put greater attention on the the old politics was primarily cultural and ideo- industrial-commercial aspect. logical. The new is supranationally oriented, The new situation has become familiar while the old was almost exclusively national. with media researchers. For instance Den- The new is less dominated by established politi- nis McQuail and the Euromedia Research cal parties and a broadcasting elite. Group have described the shift from the Old Order to the New Order. While Later a third feature of change is added: trying to look at the evidently new media fragmentation (McQuail, de Rosario, Tapper possibilities It only gradually became ap- 1992, 15) to the toolbag of the New Or- parent that something different and per- der radio research. -

Towards Streamlined Broadcasting: the Changing Music Cultures of 1990 Finnish Commercial Radio

Journal of the International Association for the Study of Popular Music doi:10.5429/2079-3871(2010)v1i1.8en Towards Streamlined Broadcasting: The Changing Music Cultures of 1990 Finnish Commercial Radio Heikki Uimonen [email protected] Dept. of Music Anthropology, University of Tampere Abstract The deregulation of broadcasting in 1985 Finland introduced competition between the European public service tradition and American commercial radio. Musically diverse and almost uncontrolled programme policies of the mid-1980s were replaced by the American-style format radio in the 1990s. The article focuses on how the process of music selection and radio music management changed. What were the economic, technological, organisational and cultural constraints that regulated the radio business and especially music? The question will be answered by empirical data consisting of interviews with the radio station personnel and music copyright reports supported by printed archive material. Key words: radio music, deregulation, music programming, play lists, music selection. Introduction Yleisradio (The Finnish Broadcasting Company, YLE) was founded in 1926. Right from the beginning music had an important role accounting for nearly 70 percent of broadcast time. Soon the share was cut down but it still remained around 50 percent. Publicly funded radio broadcast live; recordings were used very seldom. It seems that the YLE had two main guidelines in their programme policy: firstly to provide serious and uplifting popular education and information to the public and secondly to meet the listeners’ needs for entertainment. In practice this meant more highbrow than folksy style amusement (Kurkela, 2010, pp. 72– 73). In the early 1960s the YLE policy was challenged when the pirate stations started to broadcast off the coast of Stockholm. -

Milford Performance Center Boosts Charity, Economy

LOCAL POSTAL CUSTOMER Presort Std. Highest Circulation Newspaper in Milford and Orange U.S. Postage PAID When there’s better writing, there’s better reading. Permit #729 Shelton, CT Milford-Orange Times Vol. 8 / Issue 15 www.TheOrangeTimes.com December 19, 2019 Transportation Milford Performance Center Boosts Runs Through Charity, Economy Milford And By Brandon T. Bisceglia Orange The Milford Performance Center has made By Brandon T. Bisceglia it through its third year as a venue for the arts in the city. In that time, founder Steve Cooper, Gov. Ned Lamont’s plan to improve a photographer who also takes pictures for the transportation systems in Connecticut runs Milford-Orange Times, has coupled his efforts through Milford and Orange. to bring in first-class entertainment with his The proposal, dubbed CT2030, lays out efforts to give back to the community. a host of specific projects around the state The most recent example of this charity meant to shore up aging infrastructure, was a donation of $31,000 to Rotary District eliminate choke points and shorten 7980, which covers much of southern commute times. Connecticut, for its global polio eradication The total cost, estimated at $19.4 billion, initiative. The money came as a result of the would be paid for through a mix of low- MPC’s final third season show, featuring interest federal grants, money from the famed musician Arlo Guthrie. state’s Special Transportation Fund and – That show attracted over 900 patrons. most controversially – by tolling trucks at The money raised through ticket sales was certain locations throughout the state. -

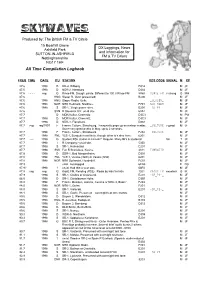

All Time Compilation Logbook by Date/Time

SKYWAVES Produced by: The British FM & TV Circle 15 Boarhill Grove DX Loggings, News Ashfield Park and Information for SUTTON-IN-ASHFIELD FM & TV DXers Nottinghamshire NG17 1HF All Time Compilation Logbook FREQ TIME DATE ITU STATION RDS CODE SIGNAL M RP 87.6 1998 D BR-4, Dillberg. D314 M JF 87.6 1998 D NDR-2, Hamburg. D382 M JF 87.6 - - - - reg G Rinse FM, Slough. pirate. Different to 100.3 Rinse FM 8760 RINSE_FM v strong GMH 87.6 HNG Slager R, Gyor (presumed) B206 M JF 87.6 1998 HNG Slager Radio, Gyšr. _SLAGER_ MJF 87.6 1998 NOR NRK Hedmark, Nordhue. F701 NRK_HEDM MJF 87.6 1998 S SR-1, 3 high power sites. E201 -SR_P1-_ MJF 87.6 SVN R Slovenia 202, un-id site. 63A2 M JF 87.7 D MDR Kultur, Chemnitz D3C3 M PW 87.7 1998 D MDR Kultur, Chemnitz. D3C3 M JF 87.7 1998 D NDR-4, Flensburg. D384 M JF 87.7 reg reg/1997 F France Culture, Strasbourg. Frequently pops up on meteor scatter. _CULTURE v good M JF Some very good peaks in May, up to 2 seconds. 87.7 1998 F France Culture, Strasbourg. F202 _CULTURE MJF 87.7 1998 FNL YLE-1, Eurajoki most likely, though other txÕs also here. 6201 M JF 87.7 ---- 1998 G Student RSL station in Lincoln? Regular. Many ID's & students! fair T JF 87.7 1998 I R Company? un-id site. 5350 M JF 87.7 1998 S SR-1, Halmastad. E201 M JF 87.7 1998 SVK Fun R Bratislava, Kosice. -

Body Curves and Story Arcs

Body Curves and Story Arcs: Weight Loss in Contemporary Television Narratives ! ! ! Thesis submitted to Jawaharlal Nehru University and Università degli Studi di Bergamo, as part of Erasmus Mundus Joint Doctorate Program “Cultural Studies in Literary Interzones,” in partial fulfilment of the requirements for the degree of ! Doctor of Philosophy ! ! by ! ! Margaret Hass ! ! ! Centre for English Studies School of Language, Literature and Culture Studies Jawaharlal Nehru University New Delhi - 110067, India 2016 ! Table of Contents !Acknowledgements !Foreword iii Introduction: Body Curves and Story Arcs Between Fat Shame and Fat Studies 1 Liquid Modernity, Consumer Culture, and Weight Loss 5 Temporality and Makeover Culture in Liquid Modernity 10 The Teleology of Weight Loss, or What Jones and Bauman Miss 13 Fat Studies and the Transformation of Discourse 17 Alternative Paradigms 23 Lessons from Feminism: Pleasure and Danger in Viewing Fat 26 Mediatization and Medicalization 29 Fictional Roles, Real Bodies 33 Weight and Television Narratology 36 Addressing Media Texts 39 Selection of Corpus 43 ! Description of Chapters 45 Part One: Reality! TV Change in “Real” Time: The Teleologies and Temporalities of the Weight Loss Makeover 48 I. Theorizing the Weight Loss Makeover: Means and Ends Paradoxes 52 Labor Revealed: Exercise and Affect 57 ! Health and the Tyranny of Numbers 65 II. The Temporality of Transformation 74 Before/After and During 81 Temporality and Mortality 89 Weight Loss and Becoming an Adult 96 I Used to Be Fat 97 ! Jung und Dick! Eine Generation im Kampf gegen Kilos 102 III. Competition and Bodily Meritocracy 111 The Biggest Loser: Competition, Social Difference, and Redemption 111 Redemption and Difference 117 Gender and Competition 120 Beyond the Telos: Rachel 129 Another Aesthetics of Competition: Dance Your Ass Off 133 ! IV. -

BR IFIC N° 2675 Index/Indice

BR IFIC N° 2675 Index/Indice International Frequency Information Circular (Terrestrial Services) ITU - Radiocommunication Bureau Circular Internacional de Información sobre Frecuencias (Servicios Terrenales) UIT - Oficina de Radiocomunicaciones Circulaire Internationale d'Information sur les Fréquences (Services de Terre) UIT - Bureau des Radiocommunications Part 1 / Partie 1 / Parte 1 Date/Fecha 10.08.2010 Description of Columns Description des colonnes Descripción de columnas No. Sequential number Numéro séquenciel Número sequencial BR Id. BR identification number Numéro d'identification du BR Número de identificación de la BR Adm Notifying Administration Administration notificatrice Administración notificante 1A [MHz] Assigned frequency [MHz] Fréquence assignée [MHz] Frecuencia asignada [MHz] Name of the location of Nom de l'emplacement de Nombre del emplazamiento de 4A/5A transmitting / receiving station la station d'émission / réception estación transmisora / receptora 4B/5B Geographical area Zone géographique Zona geográfica 4C/5C Geographical coordinates Coordonnées géographiques Coordenadas geográficas 6A Class of station Classe de station Clase de estación Purpose of the notification: Objet de la notification: Propósito de la notificación: Intent ADD-addition MOD-modify ADD-ajouter MOD-modifier ADD-añadir MOD-modificar SUP-suppress W/D-withdraw SUP-supprimer W/D-retirer SUP-suprimir W/D-retirar No. BR Id Adm 1A [MHz] 4A/5A 4B/5B 4C/5C 6A Part Intent 1 110073638 ARG 235.7500 PTO IGUAZU ARG 54W34'25'' 25S35'48'' FX 1 ADD 2 110072771 -

Commercial Radio As Music Culture Heikki Uimonen, University Of

This article has been published in a revised form in Popular Music https://doi.org/10.1017/S0261143017000071. This version is free to view and download for private research and study only. Not for re-distribution or re-use. © Cambridge University Press 2017. Beyond the Playlist: Commercial Radio as Music Culture Heikki Uimonen, University of the Arts Helsinki, Sibelius Academy [email protected] Abstract This article presents the historical transformation of Finnish commercial radio popular music policies from 1985–2005 and contemplates the role of terrestrial radio in contemporary digital age. It argues that a sender-centred paradigm of early commercial radio was replaced swiftly by receiver-centered paradigm, which has been applied since the early 1990s. The change of radio music cultures is described in detail by dividing it into three different eras: Block Radio, Format Radio, and Media Convergence. The study draws on the research project consisting of case studies analysing the music content of various radio stations. The primary empirical data is composed of thirty-two interviews of radio personnel and the analysis of 4,500 individual songs broadcast by popular music radio stations with newspaper and journal articles supporting the primary data. Radio music culture is approached theoretically from the ethnomusicological perspective and thus defined as all practices that have an effect on broadcast music, including the processes of acquiring, selecting, and governing music. The empirical results of the study show that the transformation of radio music cultures is affected by economic, technological, legal, organisational, and cultural factors. 1 Introduction In 1985, the first local and commercial radio stations in Finland were granted two-year experimental licences. -

Mythos Bauhaus

Fernsehen 14 Tage TV-Programm 7. bis 20.2.2019 „Lotte am Bauhaus“, 13. Februar, 20.15 in der ARD Mythos Bauhaus Festung zu vermieten? Federico Fellini Feature über das Kreuzberger Zum 25. Todestag: Dragoner-Areal im Kulturradio Zehn Filme in einer DVD-Box tipTV_0419_01_Titel [P]_21041522.indd 1 24.01.19 17:43 FERNSEHEN 7. – 20.2. TELEVISOR Unerwünschte Transparenz VON LUTZ GÖLLNER Seit Juli 2016 vertritt der österreichi- sche Wirtschaftswissenschaftler und Jurist Leonhard Dobusch den Be- STUDIOCANAL reich „Internet“ im Fernsehrat des FOTO ZDF. Fast zeitgleich begann er auf der Plattform Netzpolitik.org und auf Twitter (@leonidobusch) über seine Arbeit dort zu bloggen. Sein Ziel: Transparenz schaffen in einem Gre- mium, das davon lebt, dass Ent- HONZIK STANISLAV / FICTION UFA / MDR scheidungen, die alle Zuschauer FOTO betreffen, unter Ausschluss der Öf- Passt, wackelt und hat Luft: Lotte (Alicia von Rittberg, Foto) beim Bauen fentlichkeit gefällt werden. Eine For- derung, die von einem Urteil des ARBEITSWELT Verfassungsgerichts unterstützt wur- de. Nur einige Mitglieder im Fern- sehrat selber sehen das nicht so ein. Dobuschs Blog ist auch deshalb so Der „Neue Mensch“ lesenswert, weil er immer Ross und Reiter benennt, aber niemanden an- Zum 100. Geburtstag des Bauhauses beleuchtet die ARD das klagt oder denunziert. Natürlich gibt Schicksal der Frauen, die dort studierten und lehrten es auch der Reform des Rates nach wie vor rote und schwarze „Freun- it dem „Tunnel“ entstaubte die jun- Paul Seligmann (Noah Saavedra) – ist eng deskreise“, und Dobusch protokol- M ge Firma teamWorx vor zwei Jahr- an das ihrer Ausbildungsstätte gekettet, liert alles, was in diesen Zirkeln ge- zehnten das deutsche Geschichtsdrama. -

Identity-Related Media Consumption

JENNIINA HALKOAHO Identity-Related Media Consumption A Focus on Consumers' Relationships with Their Favorite TV Programs ACTA WASAENSIA NO 261 ________________________________ BUSINESS ADMINISTRATION 106 MARKETING UNIVERSITAS WASAENSIS 2012 Reviewers Professor Outi Uusitalo Jyväskylä University School of Business and Economics P.O. Box 35 FI–40014 University of Jyväskylä Finland Professor Agneta Marell Umeå University Umeå School of Business SE–90187 Umeå Sweden III Julkaisija Julkaisuajankohta Vaasan yliopisto Toukokuu 2012 Tekijä(t) Julkaisun tyyppi Jenniina Halkoaho Monografia Julkaisusarjan nimi, osan numero Acta Wasaensia, 261 Yhteystiedot ISBN Vaasan yliopisto 978–952–476–396–7 Markkinoinnin yksikkö ISSN PL 700 0355–2667, 1235–7871 65101 VAASA Sivumäärä Kieli 271 englanti Julkaisun nimike Identiteettiä rakentava median kuluttaminen – Tarkastelussa kuluttajien suhteet suosikkitelevisio-ohjelmiinsa Tiivistelmä Mediat nousevat nyky-yhteiskunnassamme merkittävään roolin niin yksittäisinä kulutuk- sen kohteina kuin vaikutusvaltaisina kulttuurisina instituutioina. Tässä kulutustutkimuk- sen alaan sijoittuvassa tutkimuksessa tarkastellaan medioiden kuluttamista symbolisesta, erityisesti kuluttajan identiteetin rakentumisen näkökulmasta. Mediasisältöjä lähestytään tuotteina ja palveluina, joita kuluttajat voivat ostaa ja käyttää. Työn tarkoituksena on valaista kysymystä siitä, miten televisio-ohjelmat ja kuluttajan identiteetin rakentuminen ovat yhteydessä toisiinsa. Tutkielmassa pyritään tunnistamaan ja analysoimaan, millä tavoin kuluttajat -

Tbivision.Com October/November 2017

Formats TBIvision.com October/November 2017 DON’ T SURVIVE. MIPCOM Stand No: P3.C10 @all3media_int all3mediainternational.com FormatspOFC OctNov17.indd 1 02/10/2017 10:24 STARTS WEDNESDAY 4TH OCTOBER AT 9PM ON ITV2 VISIT US AT MIPCOM, STAND R8.C9, RIVIERA 8 Catalogue: www.keshetinternational.com Contact us: [email protected] @KeshetIntl KeshetInternational @KeshetInternational FormatspIFC Keshet Showmance Oct17.indd 1 27/09/2017 16:19 CONTENTS IN THIS ISSUE 6 This issue 8 4 People TBI runs down the latest moves and executive hires in the international formats business 6 Endemol Shine France An exclusive interview with Nicolas Coppermann, the executive charged with leading the merged Endemol Shine France operation. Pascale Paoli-Lebailly reports 8 Hot Picks Formats from the UK, Romania, the US, Israel and Belgium feature in our round up of the best new unscripted projects hitting the international market 16 16 In focus: The Crystal Maze Classic British format The Crystal Maze is headed for MIPCOM and international stage for the first time. Jesse Whittock has the lowdown on the adventure gameshow series 18 Unscripted US: how to pitch Eexecutives repping channels with market-leading unscripted programming reveal the best ways to get content on their desk 20 Last Word Endemol Shine’s Doug Wood on how millennials are driving the boom in nostalgia 18 Editor Jesse Whittock • [email protected] • @TBI_Jesse Television Business International (USPS 003-807) is published bi-monthly (Jan, Mar, Apr, Jun, Aug and Oct) by Informa Telecoms & Media, Maple House, 149 Tottenham Court Road, London, W1T 7AD, United Kingdom. The Deputy editor Kaltrina Bylykbashi • [email protected] • @bylykbashi 2006 US Institutional subscription price is $255. -

Immigrant and Ethnic Entrepreneurship

ascientificquarterly ISSN2353-883X eISSN2353-8821 2015,Vol.3,No.3 ImmigrantandEthnic Entrepreneurship editedby JanBrzozowski CracowUniversityofEconomics FacultyofEconomicsandInternationalRelations CentreforStrategicandInternationalEntrepreneurship a scientific quarterly E B E R Entrepreneurial Business and Economics Review ISSN 2353-883X eISSN 2353-8821 2015, Vol. 3, No. 3 Immigrant and Ethnic Entrepreneurship edited by Jan Brzozowski Cracow University of Economics Faculty of Economics and International Relations Centre for Strategic and International Entrepreneurship Editorial Board Editor -in -Chief Krzysztof WACH Associate Editors Jan BRZOZOWSKI, Marek ĆWIKLICKI, Marek DĄBROWSKI, Remigiusz GAWLIK, Michal GŁUSZAK, Jacek KLICH, Małgorzata KOSAŁA ( Editorial Secretary ), Bartłomiej MARONA ( Online Editor ), Joanna PURGAŁ-POPIELA, Tomasz RACHWAŁ, Radosław RYBKOWSKI, Piotr STANEK, Marek SZARUCKI ( Layout Editor ), Agnieszka WAŁĘGA ( Statistics Editor ), Agnieszka ŻUR Editorial Team Issue Editor : Jan Brzozowski Proofreading : Krzysztof Kwiecień, Agnieszka Żur Cover and DTP : Marek Sieja Original Version The printed journal is the primary and reference version. Both printed and online versions are original and identical. ISSN 2353 -883X (printed version) eISSN 2353 -8821 (online version) ISBN 978 -83 -65262 -03-5 (book) Copyright and License Copyright by Authors and by Cracow University of Economics, CC BY -NC -ND 3.0 License Publisher Cracow University of Economics Faculty of Economics and International Relations Centre for Strategic and