Logistics Market Report Norway // Greater Oslo Area // October 2019 PAGE 2 // 66 Mode

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Enebakk Kommune Saksbehandler, Innvalgstelefon Prestegårdsveien 4 Anette Strømme, 22003654 1912 ENEBAKK

Vår dato: Vår ref: 18.05.2020 2020/4174 Deres dato: Deres ref: 28.02.2020 Anne Marie Heidenreich Enebakk kommune Saksbehandler, innvalgstelefon Prestegårdsveien 4 Anette Strømme, 22003654 1912 ENEBAKK Tilbakemelding på egenkontrollrapportering for avløpssektoren rapporteringsåret 2019 – Enebakk kommune Enebakk kommune har avvik fra vilkår i avløpstillatelsen for Flateby og Kirkebygda avløpsrenseanlegg for rapporteringsåret 2019. Vi tar egenkontrollrapporten til etterretning. Rapporteringsskjema for 2020 vil være tilgjengelig for utfylling via Altinn fra februar 2021. Vi viser til egenkontrollrapportene vi har mottatt fra dere for rapporteringsåret 2019. Flateby og Kirkebygda renseanlegg har ikke tilfredsstilt rensekrav for total fosfor satt i tillatelsen datert 20.07.2016. Flateby renseanlegg overholder heller ikke sekundærensekravet. Flateby renseanlegg Dere har rapportert at vannmengder i overløp ved Flateby renseanlegg, trolig er noe høyere enn reelt i 2019 (51 893 m³/år). Overløpet i 2019 utgjorde 12 % av vannmengdene som kom inn til Flateby renseanlegg for rapporteringsåret. Dere har kommentert at dette trolig skyldes at overløpsmåleren ikke har fungert slik den skal og at denne derfor vil bli skiftet snarlig. Flateby renseanlegg klarer ikke rensekravet på total fosfor og heller ikke sekundærrensekravet for BOF 5 og KOFCR Kravet i tillatelsen er minst 90 % årsmidlet rensegrad for total fosfor. I 2019 er rensegraden beregnet til 84,18%. Store overløpsutslipp er medvirkende årsak til at renseeffekten er beregnet så lavt. Kommunen selv oppgir at feil ved pH-måleren er en viktig årsak til at rensekravene ikke er overholdt. Sekundærrensekravet innebærer 70 % renseeffekt på enkeltprøver av BOF5 eller ikke overstige 25 mg O₂/l ved utslipp og 75 % renseeffekt for KOFCR eller ikke overstige 125 mg O₂/l ved utslipp. -

Stability and Water Leakage of Hard Rock Subsea Tunnels

Stability and water leakage of hard rock subsea tunnels B. Nilsen The Norwegian University of Science and Technology, Trondheim, Norway A. Palmstrøm Norconsult as, Sandvika, Norway ABSTRACT: The many undersea tunnels along the coast of Norway offer excellent opportunities to study the key factors determining stability and water leakage in hard rock subsea tunnels. About 30 such tunnels have been constructed in Norway the last 20 years, all of them excavated by drill and blast. The longest tunnel is 7.9 km with its deepest point 260 metres below sea level. Although all tunnels are located in Precambrian or Palaeozoic rocks, some of them have encountered complex faulting or less competent rocks like shale and schist. The severe tunnelling problems met in these tunnels emphasise the need of a better understanding of the key factors determining stability and water leakage of such projects. This has been discussed based on the experience from several completed projects. 1 INTRODUCTION 2 CHARACTERISTICS OF SUBSEA TUNNELS In Norway, about 30 subsea tunnels, comprising Compared to conventional tunnels, subsea tunnels more than 100 km have been built the last 20 years. are quite special in several ways. Concerning Most of these are 2 or 3 lane road tunnels, but some engineering geology and rock engineering, the are also for water, sewage, or oil and gas pipelines. following factors are the most important (see also All tunnels so far are drill and blast. The locations of Figure 4): some key projects, and tunnels being discussed later • Most of the project area is covered by water. in this paper, are shown in Figure 1, and some main Hence, special investigation techniques need to figures concerning length and depth are given in be applied, and interpretation of the investigation Table 1. -

Mal Rapporter

TØI report 1420/2015 Erik Figenbaum Marika Kolbenstvedt Pathways to electromobility - perspectives based on Norwegian experiences TØI Report 1420/2015 Pathways to electromobility - perspectives based on Norwegian experiences Erik Figenbaum Marika Kolbenstvedt This report is covered by the terms and conditions specified by the Norwegian Copyright Act. Contents of the report may be used for referencing or as a source of information. Quotations or references must be attributed to the Institute of Transport Economics (TØI) as the source with specific mention made to the author and report number. For other use, advance permission must be provided by TØI. ISSN 0808-1190 ISBN 978-82-480-1645-8 Paper version ISBN 978-82-480-1643-4 Electronic version Oslo, May 2015 Title: Pathways to electromobility - perspectives based on Tittel: Veier til elektromobilitet - perspektiver basert på norske Norwegian experiences erfaringer Author(s): Erik Figenbaum Forfattere: Erik Figenbaum Marika Kolbenstvedt Marika Kolbenstvedt Date: 05.2015 Dato: 05.2015 TØI report: 1420/2015 TØI rapport: 1420/2015 Pages 65 Sider 65 ISBN Paper: 978-82-480-1645-8 ISBN Papir: 978-82-480-1645-8 ISBN Electronic: 978-82-480-1643-4 ISBN Elektronisk: 978-82-480-1643-4 ISSN 0808-1190 ISSN 0808-1190 Financed by: EU 7th FP (Electromobility+) Finansieringskilde: EU 7th FP (Electromobility+) Institute of Transport Economics Norges forskningsråd The Research Council of Norway Transnova Transnova Transportøkonomisk institutt Project: 3826 - Compett Prosjekt: 3826 - Compett Project manager: Erik Figenbaum Prosjektleder: Erik Figenbaum Quality manager: Terje Assum Kvalitetsansvarlig: Terje Assum Key words: Diffusion Emneord: Brukergrupper Electric Vehicles Diffusjon Multi-Level Perspective Elbil Policy Fler-nivå analyse Regional transition Politikk User groups Regional endring Summary: Sammendrag: The report presents two analyses of the Norwegian Electric Rapporten presenterer to analyser av den norske elbilhistorien. -

Telemark: Ny Reisehverdag Fra Grenland

Oppdatert etter fastsettelse av handlingsprogrammet juli 2018. Jernbanesektorens handlingsprogram: Telemark: Ny reisehverdag fra Grenland Grenlandsregionen med sine over 100.000 innbyggere står foran en helt ny reisehverdag når den nye banen fra Larvik til Porsgrunn åpner til høsten. Sammen med videre dobbeltsporutbygging på Vestfoldbanen de kommende årene vil det bli enda raskere å ta toget fra de befolkningsrike områdene i Telemark. Det er en lenge etterlengtet baneåpning som skal finne sted i september i år. Den utdaterte, svingete og lange omveien langs Farrisvannet kan endelig tas ut av bruk og erstattes av en moderne dobbeltsporet jernbane for hastigheter på 200 km/t. Reisetiden mellom Grenland, Vestfoldbyene og Oslo-området kortes ned med 20 minutter, og det blir togavganger mellom Skien og Larvik hver time. I handlingsprogrammet for jernbanesektoren som Jernbanedirektoratet nå legger fram legges det opp til videre utbygging av Vestfoldbanen, slik at reisetider og kapasitet blir ytterligere forbedret. Disse forbedringene vil også ha stor betydning for passasjerer til og fra Grenlandsregionen. Samarbeid Jernbanedirektoratet legger opp til et tett samarbeid med fylker kommuner, og vil fortsette å delta i arbeidet med byutredning for Grenland. Flere tog Når den 22 kilometer lange banestrekningen Farriseidet–Porsgrunn åpner vil det samtidig bli fast timesintervall til og fra Grenland. Når de nye parsellene Drammen–Kobbervikdalen og Nykirke– Tønsberg ferdigstilles i henholdsvis 2025 og 2024 vil reisetiden gå ned ytterliggere 10-15 minutter. Slik blir Nedre Telemark knyttet stadig tettere sammen med Vestfoldbyene, Drammensregionen og Oslo-området, til et felles bo- og arbeidsmarked. I Skien skal det bygges et nytt hensettingsanlegg for InterCity-togene, som vil gjøre det mulig å kjøre flere avganger med doble togsett og dermed øke ombordkapasiteten. -

Particle Separation

COMPACT, EFFICIENT PARTICLE SEPARATION www.krugerkaldnes.no Unique separation equipment The MUSLING® flotation equipment was developed during the 1980’s originally for removing fat and oil from fish-processing sewage outlets. Now, after more than 20 years experience, the MUSLING® has become synonymous with the treatment for both industrial and communal sewage systems. MUSLING® continually separates particles from all types of flowing liquids. Its unique hydraulic design produces a maximum flotation effect. The MUSLING® flotation efficiency is the result of a hydraulic action that influences the velocity and direction of the liquid so that particle matter becomes separated at the surface. High capacity One of the many advantages of the MUSLING® is that it can handle a large flow of liquid in a relatively small space. It can separate particle matter at surface speeds of up to 15 m/h. The result - equipment that is compact, efficient and extremely cost- effective The MUSLING® can be used for the treatment of all forms of liquid-flow systems including traditional sewage cleaning, drinking water treatment, industrial outlet separation and recycling plants where products can be extracted and returned to the production process. An environmental advantage The MUSLING® can be used as a pure mechanical plant for the removal of fat and oils. On the other hand it can be part of a chemical cleaning system or a biological treatment process. The common factor here is that the MUSLING® is always the particle-removal element. An outside influence on the separation process The flotation particle separation process of is often dependent on what is called “dispersion”. -

Product Manual

PRODUCT MANUAL The Sami of Finnmark. Photo: Terje Rakke/Nordic Life/visitnorway.com. Norwegian Travel Workshop 2014 Alta, 31 March-3 April Sorrisniva Igloo Hotel, Alta. Photo: Terje Rakke/Nordic Life AS/visitnorway.com INDEX - NORWEGIAN SUPPLIERS Stand Page ACTIVITY COMPANIES ARCTIC GUIDE SERVICE AS 40 9 ARCTIC WHALE TOURS 57 10 BARENTS-SAFARI - H.HATLE AS 21 14 NEW! DESTINASJON 71° NORD AS 13 34 FLÅM GUIDESERVICE AS - FJORDSAFARI 200 65 NEW! GAPAHUKEN DRIFT AS 23 70 GEIRANGER FJORDSERVICE AS 239 73 NEW! GLØD EXPLORER AS 7 75 NEW! HOLMEN HUSKY 8 87 JOSTEDALSBREEN & STRYN ADVENTURE 205-206 98 KIRKENES SNOWHOTEL AS 19-20 101 NEW! KONGSHUS JAKT OG FISKECAMP 11 104 LYNGSFJORD ADVENTURE 39 112 NORTHERN LIGHTS HUSKY 6 128 PASVIKTURIST AS 22 136 NEW! PÆSKATUN 4 138 SCAN ADVENTURE 38 149 NEW! SEIL NORGE AS (SAILNORWAY LTD.) 95 152 NEW! SEILAND HOUSE 5 153 SKISTAR NORGE 150 156 SORRISNIVA AS 9-10 160 NEW! STRANDA SKI RESORT 244 168 TROMSØ LAPLAND 73 177 NEW! TROMSØ SAFARI AS 48 178 TROMSØ VILLMARKSSENTER AS 75 179 TRYSILGUIDENE AS 152 180 TURGLEDER AS / ENGHOLM HUSKY 12 183 TYSFJORD TURISTSENTER AS 96 184 WHALESAFARI LTD 54 209 WILD NORWAY 161 211 ATTRACTIONS NEW! ALTA MUSEUM - WORLD HERITAGE ROCK ART 2 5 NEW! ATLANTERHAVSPARKEN 266 11 DALSNIBBA VIEWPOINT 1,500 M.A.S.L 240 32 DESTINATION BRIKSDAL 210 39 FLØIBANEN AS 224 64 FLÅMSBANA - THE FLÅM RAILWAY 229-230 67 HARDANGERVIDDA NATURE CENTRE EIDFJORD 212 82 I Stand Page HURTIGRUTEN 27-28 96 LOFOTR VIKING MUSEUM 64 110 MAIHAUGEN/NORWEGIAN OLYMPIC MUSEUM 190 113 NATIONAL PILGRIM CENTRE 163 120 NEW! NORDKAPPHALLEN 15 123 NORWEGIAN FJORD CENTRE 242 126 NEW! NORSK FOLKEMUSEUM 140 127 NORWEGIAN GLACIER MUSEUM 204 131 STIFTELSEN ALNES FYR 265 164 CARRIERS ACP RAIL INTERNATIONAL 251 2 ARCTIC BUSS LOFOTEN 56 8 AVIS RENT A CAR 103 13 BUSSRING AS 47 24 COLOR LINE 107-108 28 COMINOR AS 29 29 FJORD LINE AS 263-264 59 FJORD1 AS 262 62 NEW! H.M. -

30 November 2017 Fjord Line Ook in Het Succesvolle Derde Kwartaal Op

Persbericht Fjord Line Maastricht, 30 november 2017 Fjord Line ook in het succesvolle derde kwartaal op koers Noorse rederij vervoert van januari tot september 2017 zes procent meer passagiers, vijf procent meer vrachtwagens en 25 procent meer opleggers ten opzichte van dezelfde periode vorig jaar / Omzetstijging van 16 procent in het derde kwartaal van 2017. De Noorse rederij Fjord Line, die van het Deense Hirtshals en het Zweedse Strömstad naar Noorwegen vaart, verwacht in 2017 een nieuw recordjaar te draaien. Groei door volume, omzet en winst kenmerken het derde kwartaal van dit jaar. Zo is het aantal passagiers van januari tot september met zes procent toegenomen ten opzichte van dezelfde periode vorig jaar. Bij het vrachtsegment kon de rederij bij de vrachtwagens een plus van vijf procent en bij de opleggers van 20 procent noteren. De omzet steeg in het derde kwartaal met 16 procent in vergelijking met dezelfde periode vorig jaar. Over het gehele jaar gerekend is er zelfs sprake van een toename van 20 procent. “Fjord Line is op koers om zijn ambitieuze doelstelling voor het boekjaar 2017 te realiseren. We zijn met name verheugd dat de passagiersgroei na het uitstekende zomerseizoen ook in het derde kwartaal doorzet”, aldus Rickard Ternblom, algemeen directeur bij Fjord Line AS. Groei Langesund-route vanuit Duitsland en Denemarken De verbinding Hirtshals-Langesund en Sandefjord-Strömstad laten dit jaar voorlopig de sterkste groei zien van alle vier Fjord Line-routes. Vooral de Duitse en Deense markt zijn daarvoor verantwoordelijk, waarbij Noorwegen steeds meer als een bestemming voor het gehele jaar wordt gezien. “Traditioneel spitste het reizigersvervoer vanuit Duitsland en Denemarken zich vooral toe op de zomermaanden. -

Telemark Cruise Ports Events: See

TELEMARK CRUISE PORTS Events: See www.visittelemark.com. Cruise season: All year. Average temperature: (Celsius) June 16o, July 18o, August 17o, September 15o Useful link: www.visittelemark.com/cruise. Cruise and port information: www.grenland-havn.no The Old Lighthouse at Jomfruland, Kragerø. Photo: Terje Rakke Vrangfoss Locks in the Telemark Canal. Photo: barebilder.no Folk Dancing. Photo: Til Telemark emphasize the importance of the district’s long 2012. Eidsborg Stave Church from 1250, one of the Rjukan – powerful nature and strong war history maritime traditions. The museum is situated on the best preserved examples of the 28 protected stave Duration: 8 hours. Capacity: 150. river bank next to Porsgrunn Town Museum, churches in Norway, is located next to the museum. Distance from port: 155 km. Rjukan is situated by the southern gateway to the Heddal with Norway’s most majestic stave church Morgedal and the history of skiing Hardanger Mountain Plateau, Norway’s largest Duration: 6 hours. Capacity: 180 Duration: 5-6 hours. Distance from port: 117 km. national park, and at the foot of the majestic Distance from port: 106 km Capacity: 300. mountain Gaustatoppen, 1883 m. A major tourist Heddal stave church is Norway’s largest and best The starting-point for a visit to the charming village attraction is the Norwegian Industrial Workers’ preserved stave church, built in the 1200s and still in of Morgedal is a tour of Norsk Skieventyr, a striking Museum at Vemork, where the dramatic Heavy Water use. It was a Catholic church until the reformation in building which houses a multimedia journey through Sabotage actions took place during World War II. -

Fartsgrense 100 Km/T På Motorveg

Kjørefart og personskadeulykker på motorveger med fartsgrense 100 km/t En evaluering av forsøk på E6 og E18 i Akershus, Buskerud og Vestfold Rapport fra Veg- og trafikkavdelingen TS-seksjonen 07/2004 RAPPORT REPORT Tittel Title Kjørefart og personskadeulykker på motorveger Driving speed and personal injury accidents on med fartsgrense 100 km/t – en evaluering av motorways with speed limit 100 km/h – an forsøk på E6 og E18 i Akershus, Buskerud og evaluation of tests on E6 and E18 in the counties Vestfold. of Akershus, Buskerud and Vestfold in Norway Forfattere Authors Finn H Amundsen, Per Ole Roald og Finn H Amundsen, Per Ole Roald and Arild Engebretsen Arild Engebretsen Avdeling/kontor Department/division Veg og trafikkavdelingen Department of Roads and Traffic Trafikksikkerhetsseksjonen Traffic operations and safety section Prosjektnr Project number Internprosjekt No Rapportnr Report number 07/2004 07/2004 Prosjektleder Project manager Finn H Amundsen Finn H Amundsen Etatssatsingsområde/oppdragsgiver Project program/client Vegdirektoratet Norwegian Public Roads Administration Emneord Key words Fartsgrense Speed limit Trafikkulykker Traffic Accidents Dybdeundersøkelse In depth Analysis Kjørefart Driving Speed Sammendrag Summary Fra 2001 – 2003 ble fartsgrensen på noen From 2001 to 2003 the speed limit on 100 km of motorveger hevet til 100 km/t, på seks strekninger motorway in Norway was increased from 90 to med en samlet lengde på ca 100 km. Denne 100 km/h. This study shows that the driving speed undersøkelsen viser hvilke erfaringer som er increased from 3 – 5 km/h, but there were no høstet i denne forbindelse. Generelt sett viser marked significant changes in road accidents or undersøkelsen at kjørefarten økte med 3 – 5 km/t, the severity of the accidents. -

Agenda 2030 in Asker

Agenda 2030 in Asker Voluntary local review 2021 Content Opening Statement by mayor Lene Conradi ....................................4 Highlights........................................................................................5 Introduction ....................................................................................6 Methodology and process for implementing the SDGs ...................8 Incorporation of the Sustainable Development Goals in local and regional frameworks ........................................................8 Institutional mechanisms for sustainable governance ....................... 11 Practical examples ........................................................................20 Sustainability pilots .........................................................................20 FutureBuilt, a collaboration for sustainable buildings and arenas .......20 Model projects in Asker ...................................................................20 Citizenship – evolving as a co-creation municipality ..........................24 Democratic innovation.....................................................................24 Arenas for co-creation and community work ....................................24 Policy and enabling environment ..................................................26 Engagement with the national government on SDG implementation ...26 Cooperation across municipalities and regions ................................26 Creating ownership of the Sustainable Development Goals and the VLR .......................................................................... -

Mulighetsstudie - Evakueringsrom

Mulighetsstudie - Evakueringsrom Ove Njå Rapport - 2017/140 © Kopiering er kun tillatt etter avtale med IRIS eller oppdragsgiver. International Research Institute of Stavanger AS er sertifisert etter et kvalitetssystem basert på NS-EN ISO 9001 og NS-EN ISO 14001:2004 www.iris.no © Kopiering er kun tillatt etter avtale med IRIS eller oppdragsgiver. International Research Institute of Stavanger AS er sertifisert etter et kvalitetssystem basert på NS-EN ISO 9001 og NS-EN ISO 14001:2004 Prosjektnummer: 7351039 Prosjektets tittel: Mulighetsstudie Evakueringsrom Oppdragsgiver(e): VRI Rogaland / Rogaland fylkeskommune og EUREKA/Align ISBN: 978-82-490-0889-6 Gradering: Åpen Kvalitetssikrer: Geir Sverre Braut, SuS Stavanger, 25.08.2017 Ove Njå Einar Leknes Prosjektleder Direktør IRIS Samfunnsforskning Prosjektet er støttet av Norges forskningsråd gjennom programmet Virkemidler for regional FoU og innovasjon – VRI © Kopiering er kun tillatt etter avtale med IRIS eller oppdragsgiver. International Research Institute of Stavanger AS er sertifisert etter et kvalitetssystem basert på NS-EN ISO 9001 og NS-EN ISO 14001:2004 © Kopiering er kun tillatt etter avtale med IRIS eller oppdragsgiver. International Research Institute of Stavanger AS er sertifisert etter et kvalitetssystem basert på NS-EN ISO 9001 og NS-EN ISO 14001:2004 International Research Institute of Stavanger www.iris.no Forord Tunnelsikkerhet har vært viktig i Rogaland siden Arne Rettedal gjennom sitt virke i Rogaland fylkeskommune fikk bygget Rennfast-tunnelene. Det var nybrottsarbeid, hvor tunnelbrann ikke ble ansett som styrende for beredskapen. Ulykker inntraff, men det ble ikke de samme hendelsene som man erfarte i Sør-Europa. En brann i Mastrafjordtunnelen i 2006 kunne fått fatale følger, men heldigvis klarte Kystbussen å snu i en havarinisje like før alle ble innhyllet i røyk. -

PDF-Versjon 12

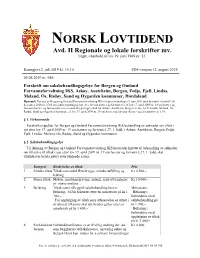

NORSK LOVTIDEND Avd. II Regionale og lokale forskrifter mv. Utgitt i henhold til lov 19. juni 1969 nr. 53. Kunngjort 2. juli 2019 kl. 14.10 PDF-versjon 12. august 2019 05.06.2019 nr. 946 Forskrift om saksbehandlingsgebyr for Bergen og Omland Farvannsforvaltning IKS, Askøy, Austrheim, Bergen, Fedje, Fjell, Lindås, Meland, Os, Radøy, Sund og Øygarden kommuner, Hordaland Hjemmel: Fastsatt av Bergen og Omland Farvannsforvaltning IKS v/representantskapet 5. juni 2019 med hjemmel i forskrift 20. desember 2010 nr. 1760 om saksbehandlingsgebyr etter lov om havner og farvann § 1, jf. lov 17. april 2009 nr. 19 om havner og farvann (havne- og farvannsloven) § 6 samt delegeringsvedtak fra Askøy, Austrheim, Bergen, Fedje, Fjell, Lindås, Meland, Os, Radøy, Sund og Øygarden kommune, jf. lov 17. april 2009 nr. 19 om havner og farvann (havne- og farvannsloven) § 10. § 1. Virkeområde Forskriften gjelder for Bergen og Omland Farvannsforvaltning IKS behandling av søknader om tiltak i sjø etter lov 17. april 2009 nr. 19 om havner og farvann § 27, 1. ledd, i Askøy, Austrheim, Bergen, Fedje, Fjell, Lindås, Meland, Os, Radøy, Sund og Øygarden kommuner. § 2. Saksbehandlingsgebyr Til dekning av Bergen og Omland Farvannsforvaltning IKS kostnader knyttet til behandling av søknader om tillatelse til tiltak i sjø, etter lov 17. april 2009 nr. 19 om havner og farvann § 27, 1. ledd, skal tiltakshaver betale gebyr etter følgende satser: Kategori Beskrivelse av tiltak Pris 1 Mindre tiltak Tiltak som enkel flytebrygge, mindre utfylling og Kr 4 500,– ledning 2 Større tiltak Moloer, mudring/graving, anlegg, samt utbygginger Kr 10 000,– av større omfang 3 Befaring Tiltak som i tillegg til saksbehandling krever Minstesats: befaring, vil bli fakturert etter en minstesats på kr 1 Befaring i 700,–.