INSTITUTE of TRANSPORT and LOGISTICS STUDIES WORKING

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report

Annual Report 2019 – 2020 We acknowledge the Traditional Owners and Custodians of country throughout Australia and their continuing connection to the land, water and community. We pay our Respect to Aboriginal and Torres Strait Island Cultures and Elders past, present and emerging. Cover: Sydney, New South Wales This page: Palm Island, Queensland At SeaLink we are dedicated to connecting people, linking communities, sharing experiences, and creating brilliant memories. SeaLink Travel Group 2 Key Results 22 Five Year Financial Highlights 3 Directors’ Report 23 Our Global Operations 4 Financial Report 28 Our Australian Operations 6 Auditor’s Report 75 Community and Sustainability 8 Auditor’s Independence Declaration 81 Chair Report 10 Remuneration Report 82 Review of Operations 12 ASX Additional Information 92 Revenue History 20 Corporate Governance 94 Adelaide, South Australia SEALINK TRAVEL GROUP SeaLink provides innovative SeaLink Travel Group is Australia’s and London underway, an electric bus largest land and marine tourism and trial currently operating in NSW, on and efficient transport public transport service provider with demand services in Sydney, and is part established international operations. of the world’s first hydrogen consortium, the H2OzBus Project. As well as solutions that link people and It is one of Australia’s most experienced operating an eco-tourism resort on and diverse multi-modal transport communities with places and the world heritage listed, Fraser Island businesses, boasting performance-driven and eco experiences -

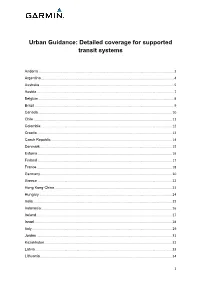

Urban Guidance: Detailed Coverage for Supported Transit Systems

Urban Guidance: Detailed coverage for supported transit systems Andorra .................................................................................................................................................. 3 Argentina ............................................................................................................................................... 4 Australia ................................................................................................................................................. 5 Austria .................................................................................................................................................... 7 Belgium .................................................................................................................................................. 8 Brazil ...................................................................................................................................................... 9 Canada ................................................................................................................................................ 10 Chile ..................................................................................................................................................... 11 Colombia .............................................................................................................................................. 12 Croatia ................................................................................................................................................. -

'We Specialise in Franchising'

interview adam leishman One of 380 buses that Tower Transit Singapore will begin operating later his year ‘We specialise in franchising’ Adam Leishman talks about Tower Transit’s ambitions in Singapore, London and the rest of the UK 2016 will see the 30th If these powers are implemented it will be company as a “franchise specialist”. anniversary of bus a huge change for Britain’s bus sector. Despite The company is a spin-off from Transit deregulation - but will there their opposition to franchising, it seems Systems, a company which won its first tender be a 40th anniversary? For unlikely that the ‘big five’ groups that dominate for bus operation in Perth, Western Australia, the past three decades, the industry will disappear (they’re happy to in 1995. Today the company operates a fleet Robert Jack private operators have operate within the franchised environments of around 1,000 buses in Australia, with Managing Editor played the dominant role of London’s bus market, the railways and contracts across the country. Tower Transit in planning and providing local bus services elsewhere), but could this revolution open up is a separate business, although it does share in England (outside London), Scotland and the market to new entrants? some of the same shareholders as Transit Wales, with local authorities and passenger London-based Tower Transit is one of the Systems. Leishman is one of four Tower transport executives limited to procuring companies that is waiting for this opportunity Transit shareholders, along with chairman Neil ‘non-commercial’ services on the periphery. to emerge. And the group’s Australian chief Smith, who is a co-founder of Transit Systems. -

Annual Report 2018 222 Bus Routes Operated Total

ANNUAL REPORT 2018 CLOSE TO 428 MILLION RAIL PASSENGER TRIPS 222 BUS ROUTES OPERATED TOTAL FLEET OF 192 TRAINS OUR VISION Moving People in a Safe, Reliable and Affordable Way OUR MISSION To achieve excellence for our customers, employees, shareholders and community. To this end, we are committed to delivering safe and reliable services at affordable prices, being an employer of choice, creating significant shareholder value and becoming a socially responsible corporate role model. CORE BELIEFS TO acHIEVE OUR VISION AND MISSION, WE are GUIDED BY THE following BELIEFS: We will: • Be driven by our customers’ needs • Strive for excellence in everything we do • Act with integrity at all times • Treat people with fairness and respect • Maintain safety as a top priority • Collaborate with our partners for a win-win outcome • Give our shareholders a reasonable return Annual Report 2018 01 CONTENTS 02 Chairman’s Statement 60 Financial Statements 06 Group Financial Highlights 61 Directors’ Statement 08 Corporate Information 65 Independent Auditor’s Report 09 Board of Directors 68 Statements of Financial Position 14 Key Management 70 Group Income Statement 18 Operations Review 71 Group Comprehensive Income Statement 24 Sustainability Report 72 Statements of Changes in Equity 30 Corporate Governance 74 Group Cash Flow Statement 50 Directors’ Particulars 75 Notes to the Financial Statements 56 Risk Management 110 Share Price Movement Chart 59 Financial Calendar 111 Shareholding Statistics 112 Notice of Annual General Meeting 116 Additional Information on Directors Seeking Re-Election Proxy Form 02 SBS Transit Ltd IntroDUCTION bus services, of which 12 used to be CHAIRMAN’S under another operator. -

ASX Announcement

ASXMedia Announcement SEALINK TRAVEL GROUP LIMITED Level 3, 26 Flinders Street Adelaide, South Australia 5000 Tel (08) 8202 8688 16 January 2020 www.sealinktravelgroup.com.au SEALINK COMPLETES ACQUISITION OF TRANSIT SYSTEMS GROUP SeaLink’s acquisition of Transit Systems Group was completed today Strategically compelling acquisition creating a leading Australian multi-modal transport provider, with established international operations in Singapore and United Kingdom Transit Systems Group is a highly scalable operating platform, with a strong track record of contract wins and renewals, and an experienced management team operating typically long- term, low-risk, CPI indexed government service contracts Current Transit Systems Group CEO, Clint Feuerherdt, has replaced Jeff Ellison as SeaLink Group CEO SeaLink Travel Group Limited (ASX:SLK) (“SeaLink”) today announced it has completed the acquisition of 100% of Transit Systems Pty Ltd, Tower Transit Group Ltd and their broader group of entities (including trusts) (together the “Transit Systems Group”), Australia’s largest private operator of metropolitan public bus services and an established international bus operator in London and Singapore (the ‘Acquisition’). The SeaLink Board is also pleased to announce that Clint Feuerherdt, the current Group CEO of Transit Systems Group, has replaced Jeff Ellison as SeaLink Group CEO, effective from today. Jeff has agreed to provide support to Clint to ensure a smooth transition of leadership by remaining as an executive director of SeaLink for a short period of time, following which he will remain on the SeaLink Board of Directors as a non-executive director to continue sharing his extensive tourism and transport experience and knowledge. In addition, Neil Smith, one of the founding shareholders and current Chairman of Transit Systems Group, has joined the SeaLink Board of Directors as a non-executive director from today. -

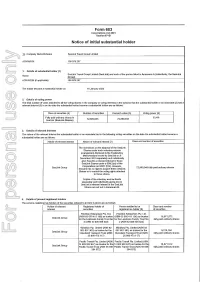

For Personal Use Only

Form 603 Corporations Act 2001 Section 671 B Notice of initial substantial holder To Company Mame/Scheme SeaLink Trave! Group Limited ACN/ARSM 109078257 1. Details of substantial holder (1) SeaLink TraveE Group Limited (SeaLink) and each of the parties iisted in Annexure A (co!lective1y, the SeaLink Name Group) ACN/ARSN(ifappiicable) 109 078 257 The holder became a substantial holder on 16 January 2020 2. Details of voting power The total number of votes attached to al! the voting shares in the company or voting interests in the scheme that the substantial holder or an associate (2) had a relevant interest (3) in on the date the substantial holder became a substantial holder are as follows: Class of securities (4) Number of securities Person's votes (5) Voting power (6) Fuiiy paid ordinary shares in 33.4% SeaLink (SeaLink Shares) 72,569,945 72.869.945 3. Details of relevant interests substantiai holder are as follows: Holder of relevant interest Nature of relevant interest (7) Ciass and number of securities The restrictions on the disposal of the SeaLink Shares under each voluntary escrow arrangement disclosed in the Explanatory Memorandum issued by SeaUnk on 8 November 2019 ssparately and individuaSly give SeaLink a relevant interest in those Seai-ink Shares under s 608(1)(c) of the Corporations Act 2001 (Ctti). However, SeaLink Group 72,869,945 fully paid ordinary shares SeaLink has no right to acquire these SeaLink Shares or to control the voting rights attached to those shares. Copies of the voluntary escrow deeds separately and individually giving rise to SeaLink's relevant interest in the SeaLink Shares are set out in Annexure B. -

Understanding Ridership Drivers for Bus Rapid Transit Systems in Australia Graham Currie

Institute of Transport Studies, Monash University World Transit Research World Transit Research 1-1-2010 Understanding ridership drivers for bus rapid transit systems in Australia Graham Currie Alexa Delbosc Follow this and additional works at: http://www.worldtransitresearch.info/research Recommended Citation Currie, G., & Delbosc, A. (2010). Understanding ridership drivers for bus rapid transit systems in Australia. Paper delivered at the 33rd Australasian Transport Research Forum Conference held in Canberra, on 29 September - 1 October, 2010. This Conference Paper is brought to you for free and open access by World Transit Research. It has been accepted for inclusion in World Transit Research by an authorized administrator of World Transit Research. For more information, please contact [email protected]. Understanding ridership drivers for bus rapid transit systems in Australia Graham Currie1* and Alexa Delbosc2 *Corresponding Author 1*Graham Currie, Professor, Chair of Public Transport, Institute of Transport Studies, Department of Civil Engineering, Building 60, Monash University, Clayton, Victoria 3800, AUSTRALIA. Phone: + 61 3 9905 5574, Fax: +61 3 9905 4944, Email: [email protected] 3Alexa Delbosc, Research Fellow, Institute of Transport Studies, Department of Civil Engineering, Building 60, Monash University, Clayton, Victoria 3800, AUSTRALIA. Phone: + 61 3 9905 5568, Fax: +61 3 9905 4944, Email: [email protected] Abstract Bus Rapid Transit (BRT) systems are an increasingly popular public transport option in Australia and internationally. They provide rail-like quality for bus services for a fraction of the cost of fixed rail. Many claims of high and increasing ridership have resulted from BRT system development; however it is unclear exactly which aspects of BRT system design drive this. -

Inquiry Into the Role of Public Transport in Delivering Productivity Outcomes

Senate Rural and Regional Affairs and Transport References Committee: Inquiry into the role of public transport in delivering productivity outcomes Submission by the Department of Infrastructure and Regional Development January 2014 1. Introduction The Department of Infrastructure and Regional Development (the Department) appreciates the opportunity to comment on the issues identified in this inquiry. The Department is responsible for providing policy advice to Government across a wide range of areas including: • infrastructure planning and coordination; • land transport challenges associated with projected demographic change; and • analysis which informs transport solutions and increases Australia’s productivity. We also play a key role in providing funding for transport infrastructure and promoting a transport system that is accessible, sustainable and environmentally responsible. The matters dealt with in the terms of reference are important to the Department and affect both the overall national prosperity and liveability of our cities. This submission primarily addresses aspects of the terms of reference pertaining to the national significance of public transport (in terms of economic competitiveness, congestion and network integration) and presents some key understandings about the relationships between urban infrastructure, mobility and agglomeration. The submission also highlights the substantial previous work carried out by the Department to develop an evidence based view of trends affecting traffic, urban growth, and patterns of commuting in cities. In particular, the Department has released annual State of the Australian Cities reporting and a series of specific reports by the Bureau of Transport, Infrastructure and Regional Economics (BITRE) investigating spatial patterns of population growth, employment and commuting for Sydney, Melbourne, Brisbane/South East Queensland (SEQ) and Perth. -

Connections Summer 2020

CONNECTIONS Connecting communities through journeys that matter Summer 2020 INSIDE From the GM Training from Guide Dogs Movember Workplace learning Recognition awards Donations From the General Manager In our second quarter of operation, Torrens Connect is a partnership Torrens Connect has really come between UGL, John Holland and into its own as an entity. We’re Transit Systems. We recognise the continually examining processes value that individuals and other and looking for a better way to organisations bring to our busi- do things – and this has great ness. Our new TRACS Awards benefits for our staff and custom- are to publicly acknowledge and ers. Public transport is all about thank those whose above-and-be- people, and people – customers, yond efforts – which also embody employees and stakeholders – are or build our organisational values our greatest asset: their collective – have contributed to Torrens feedback, knowledge, observa- Connect. tions and actions are helping to Our first TRACS Awards were shape our directions and enhanc- presented to the Department for great cooperation to improve ing our culture. Infrastructure and Transport, the Torrens Connect’s operations. In our first quarter, we devel- Traffic Management Centre, and None of us works in isolation oped our organisation’s values; Torrens Connect’s tram operators. and good relationships are essen- these are integral to everything You might wonder: why those tial because we all need to work that Torrens Connect does every groups? Shouldn’t our operators together in order to see the great- day: Teamwork, Respect, Account- embody our values? Shouldn’t est benefit. So: working as a team, ability, Customer driven, Safety Torrens Connect have a close respecting what each is trying (TRACS). -

Re-Imagining Adelaide's Public Transport by Andrew Leunig 28 August 2013

Re-imagining Adelaide's Public Transport By Andrew Leunig 28 August 2013 With some further notes as at 20 March 2015 (at rear) Re-imagining Adelaide's Public Transport Exec Summary I believe that Adelaide could be the most livable and most learning City on the Planet. The “most liveable” city in the world will get the balance between Public and Private transport right. It will be “liveable” for the old and the young, the rich and the poor. Why couldn't Adelaide have the cleverest, most vibrant public transport system for a town of it's size on the planet ? No Reason at all. But we have to want it first. At the moment our Public Transport mode share (9.9%) is about the lowest in Australia and that is our accepted norm. Even our state plan is soft and timid. “Increase the use of public transport to 10% of metropolitan weekday passenger vehicle kilometres travelled by 2018”. I like the old saying "If you shoot for the stars you might not get there but you are less likely to come up with fists full of mud". At the moment our state plan shoots for the mud. The solution ? We need to reimagine our network design. As recommended by leading experts we should toss out our current hub (city) and spoke design and design our Network around the very layout that Adelaide is globally famous for our grid. I propose that we create The Adelaide Metro Grid with buses running frequently in a straight line along our major roads, where transfers are presumed and every major intersection becomes a transfer point. -

Transit Fare Benchmarking | 2019

Transit Fare Benchmarking | 2019 About NineSquared NineSquared is a specialist economic consulting and commercial advisory firm focused on helping governments and companies make great decisions and achieve their goals. Our principals and staff are experienced, senior-level practitioners who have worked in and advised government and private sector clients about a range of commercial and economic issues, primarily relating to transportation. Broadly, our expertise lies in the fields of transport and regulatory economics; policy development and analysis; advising on commercial arrangements between government and the private sector; as well as arrangements between companies operating within regulated environments. Our combined public and private sector experience means that we are well placed to provide our clients with a deep understanding of both the public and private sectors and the interface between them. General information only This report contains general information only and Nine- Squared Pty Ltd (NineSquared) is not by means of this report rendering professional advice or services. While NineSquared has used all reasonable endeavours to ensure the information in this report is as accurate as practicable, NineSquared, its contributors, employees, and Directors shall not be liable whether in contract, tort (including negligence), equity or on any other basis for any loss or damage sustained by any person relying on this document whatever the cause of such loss or damage. www.ninesquared.com.au Introduction This is the fifth annual NineSquared fare benchmarking report. It analyses the fares of select international public transit systems and seeks to initiate public discussion regarding the costs of public transport by informing readers of comparative travel costs in different countries. -

STG Full Year FY21 Investor Presentation

SeaLink Travel Group Limited Investor Presentation – Year Ended 30 June 2021 Clint Feuerherdt – Group Chief Executive Officer & Andrew Muir – Chief Financial Officer TRANSPORT | CRUISES | TOURS | ACCOMMODATION | PACKAGES 25 August 2021 Important notice – disclaimer This document has been prepared by SeaLink Travel Group Limited (ACN 109 078 257) (SeaLink or the Company). No party other than SeaLink has authorised or caused the issue of this document, or takes responsibility for, or makes any statements, representations or undertakings in this document. Presentation of general background: This document contains general background information about SeaLink’s proposed activities current as at the date of this presentation (Information). It is Information in a summary form only and does not contain all the information necessary to fully evaluate any transaction or investment. The material contained in this presentation may include information derived from publicly available sources that have not been independently verified. Not investment advice: The Information provided in this presentation is not intended to be relied upon as advice to investors or potential investors and is not and should not be considered as a recommendation or invitation to invest. To the maximum extent permitted by law, the Company and its Officers do not accept any liability for any loss arising from the use of information contained in this presentation. Financial data: All dollar values are in Australian dollars (A$) unless otherwise stated. Future performance: This presentation may contain certain forward-looking statements. The words ‘anticipate’, ‘believe’, ‘expect’, ‘project’, ‘forecast’, ‘estimate’, ‘likely’, ‘intend’, ‘should’, ‘could’, ‘may’, ‘target’, ‘plan’ and other similar expressions are intended to identify forward- looking statements.