An Overview of Commercial Aircraft 2017 - 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fueling Atrocities Oil and War in South Sudan

Fueling Atrocities Oil and War in South Sudan March 2018 The Sentry is an initiative of the Enough Project and Not On Our Watch (NOOW). 1 The Sentry • TheSentry.org Fueling Atrocities: Oil and War in South Sudan March 2018 Fueling Atrocities South Sudan’s leaders use the country’s oil wealth to get rich and terrorize civilians, according to documents reviewed by The Sentry. The records reviewed by The Sentry describe who is financially benefiting from the conflict itself. Little has been known about the financial machinery that makes South Sudan’s continuing war possible, but these documents appear to shed new light on how the country’s main revenue source—oil—is used to fuel militias and ongoing atrocities, and how a small clique continues to get richer while the majority of South Sudanese suffer or flee their homeland. Documents reviewed by The Sentry purport to describe how funds from South Sudan’s state oil company, Nile Petroleum Corporation (Nilepet), helped fund militias responsible for horrific acts of violence. They also indicate that millions of dollars were paid to several companies partially owned by family members of top officials responsible for funding government-aligned militia or military commanders.1 One key document, part of a collection of material provided to The Sentry by an anonymous source, appears to be an internal log kept by South Sudan’s Ministry of Petroleum and Mining detailing security-related payments made by Nilepet. The document titled, “Security Expenses Summary from Nilepet as from March 2014 to Date” (“the Summary”) lists a total of 84 transactions spanning a 15-month period beginning in March 2014 and ending in June 2015. -

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

G410020002/A N/A Client Ref

Solicitation No. - N° de l'invitation Amd. No. - N° de la modif. Buyer ID - Id de l'acheteur G410020002/A N/A Client Ref. No. - N° de réf. du client File No. - N° du dossier CCC No./N° CCC - FMS No./N° VME G410020002 G410020002 RETURN BIDS TO: Title – Sujet: RETOURNER LES SOUMISSIONS À: PURCHASE OF AIR CARRIER FLIGHT MOVEMENT DATA AND AIR COMPANY PROFILE DATA Bids are to be submitted electronically Solicitation No. – N° de l’invitation Date by e-mail to the following addresses: G410020002 July 8, 2019 Client Reference No. – N° référence du client Attn : [email protected] GETS Reference No. – N° de reference de SEAG Bids will not be accepted by any File No. – N° de dossier CCC No. / N° CCC - FMS No. / N° VME other methods of delivery. G410020002 N/A Time Zone REQUEST FOR PROPOSAL Sollicitation Closes – L’invitation prend fin Fuseau horaire DEMANDE DE PROPOSITION at – à 02 :00 PM Eastern Standard on – le August 19, 2019 Time EST F.O.B. - F.A.B. Proposal To: Plant-Usine: Destination: Other-Autre: Canadian Transportation Agency Address Inquiries to : - Adresser toutes questions à: Email: We hereby offer to sell to Her Majesty the Queen in right [email protected] of Canada, in accordance with the terms and conditions set out herein, referred to herein or attached hereto, the Telephone No. –de téléphone : FAX No. – N° de FAX goods, services, and construction listed herein and on any Destination – of Goods, Services, and Construction: attached sheets at the price(s) set out thereof. -

Aerospace Engine Data

AEROSPACE ENGINE DATA Data for some concrete aerospace engines and their craft ................................................................................. 1 Data on rocket-engine types and comparison with large turbofans ................................................................... 1 Data on some large airliner engines ................................................................................................................... 2 Data on other aircraft engines and manufacturers .......................................................................................... 3 In this Appendix common to Aircraft propulsion and Space propulsion, data for thrust, weight, and specific fuel consumption, are presented for some different types of engines (Table 1), with some values of specific impulse and exit speed (Table 2), a plot of Mach number and specific impulse characteristic of different engine types (Fig. 1), and detailed characteristics of some modern turbofan engines, used in large airplanes (Table 3). DATA FOR SOME CONCRETE AEROSPACE ENGINES AND THEIR CRAFT Table 1. Thrust to weight ratio (F/W), for engines and their crafts, at take-off*, specific fuel consumption (TSFC), and initial and final mass of craft (intermediate values appear in [kN] when forces, and in tonnes [t] when masses). Engine Engine TSFC Whole craft Whole craft Whole craft mass, type thrust/weight (g/s)/kN type thrust/weight mini/mfin Trent 900 350/63=5.5 15.5 A380 4×350/5600=0.25 560/330=1.8 cruise 90/63=1.4 cruise 4×90/5000=0.1 CFM56-5A 110/23=4.8 16 -

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

Facts & Figures & Figures

OCTOBER 2019 FACTS & FIGURES & FIGURES THE STAR ALLIANCE NETWORK RADAR The Star Alliance network was created in 1997 to better meet the needs of the frequent international traveller. MANAGEMENT INFORMATION Combined Total of the current Star Alliance member airlines: FOR ALLIANCE EXECUTIVES Total revenue: 179.04 BUSD Revenue Passenger 1,739,41 bn Km: Daily departures: More than Annual Passengers: 762,27 m 19,000 Countries served: 195 Number of employees: 431,500 Airports served: Over 1,300 Fleet: 5,013 Lounges: More than 1,000 MEMBER AIRLINES Aegean Airlines is Greece’s largest airline providing at its inception in 1999 until today, full service, premium quality short and medium haul services. In 2013, AEGEAN acquired Olympic Air and through the synergies obtained, network, fleet and passenger numbers expanded fast. The Group welcomed 14m passengers onboard its flights in 2018. The Company has been honored with the Skytrax World Airline award, as the best European regional airline in 2018. This was the 9th time AEGEAN received the relevant award. Among other distinctions, AEGEAN captured the 5th place, in the world's 20 best airlines list (outside the U.S.) in 2018 Readers' Choice Awards survey of Condé Nast Traveler. In June 2018 AEGEAN signed a Purchase Agreement with Airbus, for the order of up to 42 new generation aircraft of the 1 MAY 2019 FACTS & FIGURES A320neo family and plans to place additional orders with lessors for up to 20 new A/C of the A320neo family. For more information please visit www.aegeanair.com. Total revenue: USD 1.10 bn Revenue Passenger Km: 11.92 m Daily departures: 139 Annual Passengers: 7.19 m Countries served: 44 Number of employees: 2,498 Airports served: 134 Joined Star Alliance: June 2010 Fleet size: 49 Aircraft Types: A321 – 200, A320 – 200, A319 – 200 Hub Airport: Athens Airport bases: Thessaloniki, Heraklion, Rhodes, Kalamata, Chania, Larnaka Current as of: 14 MAY 19 Air Canada is Canada's largest domestic and international airline serving nearly 220 airports on six continents. -

Prof. Paul Stephen Dempsey

AIRLINE ALLIANCES by Paul Stephen Dempsey Director, Institute of Air & Space Law McGill University Copyright © 2008 by Paul Stephen Dempsey Before Alliances, there was Pan American World Airways . and Trans World Airlines. Before the mega- Alliances, there was interlining, facilitated by IATA Like dogs marking territory, airlines around the world are sniffing each other's tail fins looking for partners." Daniel Riordan “The hardest thing in working on an alliance is to coordinate the activities of people who have different instincts and a different language, and maybe worship slightly different travel gods, to get them to work together in a culture that allows them to respect each other’s habits and convictions, and yet work productively together in an environment in which you can’t specify everything in advance.” Michael E. Levine “Beware a pact with the devil.” Martin Shugrue Airline Motivations For Alliances • the desire to achieve greater economies of scale, scope, and density; • the desire to reduce costs by consolidating redundant operations; • the need to improve revenue by reducing the level of competition wherever possible as markets are liberalized; and • the desire to skirt around the nationality rules which prohibit multinational ownership and cabotage. Intercarrier Agreements · Ticketing-and-Baggage Agreements · Joint-Fare Agreements · Reciprocal Airport Agreements · Blocked Space Relationships · Computer Reservations Systems Joint Ventures · Joint Sales Offices and Telephone Centers · E-Commerce Joint Ventures · Frequent Flyer Program Alliances · Pooling Traffic & Revenue · Code-Sharing Code Sharing The term "code" refers to the identifier used in flight schedule, generally the 2-character IATA carrier designator code and flight number. Thus, XX123, flight 123 operated by the airline XX, might also be sold by airline YY as YY456 and by ZZ as ZZ9876. -

Publications 2019

AAIP Policy Paper No. 2 / 2019 – Reviewing Ownership and Control of the Indonesian Airlines Ridha Aditya Nugraha ASEAN Aviation Integration Platform (AAIP) Policy Paper No. 2 / 2019 Reviewing Ownership and Control of the Indonesian Airlines Ridha Aditya Nugraha Air Power Centre of Indonesia Air and Space Law Studies, International Business Law Program Universitas Prasetiya Mulya Member of German Aviation Research Society The views expressed are those of the author. 2 AAIP Policy Paper No. 2 / 2019 – Reviewing Ownership and Control of the Indonesian Airlines Ridha Aditya Nugraha Contents Executive Summary .............................................................................................................................. 4 1. The Liberalization Progress in Indonesia ................................................................................... 5 2. The State of Play ............................................................................................................................ 6 3. The Current Legal Regime and Its Limits .................................................................................. 9 4. Benefits from Relaxing Ownership and Control of the Indonesian Airlines ...................... 10 5. The Way Forward and Conclusions ......................................................................................... 12 Table 1: Domestic Flights Market Share of Indonesian Airlines, 2017 ........................................... 7 Table 2: International Flights Market Share of Indonesian Airlines, 2017 -

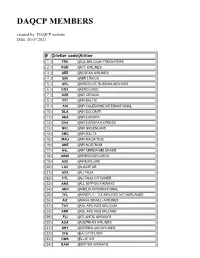

DAQCP MEMBERS Created By: DAQCP Website Date: 20.07.2021

DAQCP MEMBERS created by: DAQCP website Date: 20.07.2021 # 3-letter code Airline 1 FRH ACE BELGIUM FREIGHTERS 2 RUN ACT AIRLINES 3 AEE AEGEAN AIRLINES 4 EIN AER LINGUS 5 AFL AEROFLOT RUSSIAN AIRLINES 6 BOX AEROLOGIC 7 KZR AIR ASTANA 8 BTI AIR BALTIC 9 ACI AIR CALEDONIE INTERNATIONAL 10 DLA AIR DOLOMITI 11 AEA AIR EUROPA 12 OVA AIR EUROPA EXPRESS 13 GRL AIR GREENLAND 14 AMC AIR MALTA 15 MAU AIR MAURITIUS 16 ANE AIR NOSTRUM 17 ASL AIR SERBIA BELGRADE 18 ABW AIRBRIDGECARGO 19 AXE AIREXPLORE 20 LAV ALBASTAR 21 AZA ALITALIA 22 CYL ALITALIA CITYLINER 23 ANA ALL NIPPON AIRWAYS 24 AEH AMELIA INTERNATIONAL 25 TFL ARKEFLY - TUI AIRLINES NETHERLANDS 26 AIZ ARKIA ISRAELI AIRLINES 27 TAY ASL AIRLINES BELGIUM 28 ABR ASL AIRLINES IRELAND 29 FLI ATLANTIC AIRWAYS 30 AUA AUSTRIAN AIRLINES 31 AHY AZERBAIJAN AIRLINES 32 CFE BA CITYFLYER 33 BMS BLUE AIR 34 BAW BRITISH AIRWAYS 35 BEL BRUSSELS AIRLINES 36 GNE BUSINESS AVIATION SERVICES GUERNSEY LTD 37 CLU CARGOLOGICAIR 38 CLX CARGOLUX AIRLINES INTERNATIONAL S.A 39 ICV CARGOLUX ITALIA 40 CEB CEBU PACIFIC 41 BCY CITYJET 42 CFG CONDOR FLUGDIENST GMBH 43 CTN CROATIA AIRLINES 44 CSA CZECH AIRLINES 45 DLH DEUTSCHE LUFTHANSA 46 DHK DHL AIR LTD. 47 EZE EASTERN AIRWAYS 48 EJU EASYJET EUROPE 49 EZS EASYJET SWITZERLAND 50 EZY EASYJET UK 51 EDW EDELWEISS AIR 52 ELY EL AL 53 UAE EMIRATES 54 ETH ETHIOPIAN AIRLINES 55 ETD ETIHAD AIRWAYS 56 MMZ EUROATLANTIC 57 BCS EUROPEAN AIR TRANSPORT 58 EWG EUROWINGS 59 OCN EUROWINGS DISCOVER 60 EWE EUROWINGS EUROPE 61 EVE EVELOP AIRLINES 62 FIN FINNAIR 63 FHY FREEBIRD AIRLINES 64 GJT GETJET AIRLINES 65 GFA GULF AIR 66 OAW HELVETIC AIRWAYS 67 HFY HI FLY 68 HBN HIBERNIAN AIRLINES 69 HOP HOP! 70 IBE IBERIA 71 ICE ICELANDAIR 72 ISR ISRAIR AIRLINES 73 JAL JAPAN AIRLINES CO. -

RASG-PA ESC/29 — WP/04 14/11/17 Twenty

RASG‐PA ESC/29 — WP/04 14/11/17 Twenty ‐ Ninth Regional Aviation Safety Group — Pan America Executive Steering Committee Meeting (RASG‐PA ESC/29) ICAO NACC Regional Office, Mexico City, Mexico, 29‐30 November 2017 Agenda Item 3: Items/Briefings of interest to the RASG‐PA ESC PROPOSAL TO AMEND ICAO FLIGHT DATA ANALYSIS PROGRAMME (FDAP) RECOMMENDATION AND STANDARD TO EXPAND AEROPLANES´ WEIGHT THRESHOLD (Presented by Flight Safety Foundation and supported by Airbus, ATR, Embraer, IATA, Brazil ANAC, ICAO SAM Office, and SRVSOP) EXECUTIVE SUMMARY The Flight Data Analysis Program (FDAP) working group comprised by representatives of Airbus, ATR, Embraer, IATA, Brazil ANAC, ICAO SAM Office, and SRVSOP, is in the process of preparing a proposal to expand the number of functional flight data analysis programs. It is anticipated that a greater number of Flight Data Analysis Programs will lead to significantly greater safety levels through analysis of critical event sets and incidents. Action: The FDAP working group is requesting support for greater implementation of FDAP/FDMP throughout the Pan American Regions and consideration of new ICAO standards through the actions outlined in Section 4 of this working paper. Strategic Safety Objectives: References: Annex 6 ‐ Operation of Aircraft, Part 1 sections as mentioned in this working paper RASG‐PA ESC/28 ‐ WP/09 presented at the ICAO SAM Regional Office, 4 to 5 May 2017. 1. Introduction 1.1 Flight Data Recorders have long been used as one of the most important tools for accident investigations such that the term “black box” and its recovery is well known beyond the aviation industry. -

I Am Writing to Obtain Information About Flights Your Organisation Has Paid for Since 1 January 2015

Uned Rhyddid Gwybodaeth / Freedom of Information Unit Response Date: 20/02/2018 2018/149 – Flights In response to your recent request for information regarding; I am writing to obtain information about flights your organisation has paid for since 1 January 2015. Please include the following information: The name of the airline used The fare paid The class of ticket (eg economy, premium economy, business, first) The date The port of departure The port of arrival Please include flights that have been paid for directly as well as any flights staff or others have been reimbursed for. Please see attached information provided by Capita Travel and Events who book all of our air travel. We didn’t book any flights in 2015 so the information is from 2016 to date. Please note the cost of a return flight is allocated against the outward journey showing the inward journey as zero cost. THIS INFORMATION HAS BEEN PROVIDED IN RESPONSE TO A REQUEST UNDER THE FREEDOM OF INFORMATION ACT 2000, AND IS CORRECT AS AT 13/02/2018 Paid Airline Fare inc Class Date Depart Arrive Tax BMI REGIONAL 84.47 Economy 23/01/2018 INVERNESS MANCHESTER BMI REGIONAL 134.84 Economy 22/01/2018 MANCHESTER INVERNESS BMI REGIONAL 134.84 Economy 22/01/2018 MANCHESTER INVERNESS BMI REGIONAL 84.47 Economy 23/01/2018 INVERNESS MANCHESTER BMI REGIONAL 84.47 Economy 23/01/2018 INVERNESS MANCHESTER SCANDINAVIAN 166.54 Economy 23/01/2018 MANCHESTER COPENHAGEN AIRLINES SCANDINAVIAN 0.00 Economy 23/01/2018 COPENHAGEN GOTHENBURG AIRLINES SCANDINAVIAN 0.00 Economy 23/01/2018 GOTHENBURG -

The Changing Structure of the Global Large Civil Aircraft Industry and Market: Implications for the Competitiveness of the U.S

ABSTRACT On September 23, 1997, at the request of the House Committee on Ways and Means (Committee),1 the United States International Trade Commission (Commission) instituted investigation No. 332-384, The Changing Structure of the Global Large Civil Aircraft Industry and Market: Implications for the Competitiveness of the U.S. Industry, under section 332(g) of the Tariff Act of 1930, for the purpose of exploring recent developments in the global large civil aircraft (LCA) industry and market. As requested by the Committee, the Commission’s report on the investigation is similar in scope to the report submitted to the Senate Committee on Finance by the Commission in August 1993, initiated under section 332(g) of the Tariff Act of 1930 (USITC inv. No. 332-332, Global Competitiveness of U.S. Advanced-Technology Manufacturing Industries: Large Civil Aircraft, Publication 2667) and includes the following information: C A description of changes in the structure of the global LCA industry, including the Boeing-McDonnell Douglas merger, the restructuring of Airbus Industrie, the emergence of Russian producers, and the possibility of Asian parts suppliers forming consortia to manufacture complete airframes; C A description of developments in the global market for aircraft, including the emergence of regional jet aircraft and proposed jumbo jets, and issues involving Open Skies and free flight; C A description of the implementation and status of the 1992 U.S.-EU Large Civil Aircraft Agreement; C A description of other significant developments that affect the competitiveness of the U.S. LCA industry; and C An analysis of the aforementioned structural changes in the LCA industry and market to assess the impact of these changes on the competitiveness of the U.S.