Cma Cgm Canada

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Federal Register/Vol. 83, No. 47/Friday, March 9, 2018/Notices

Federal Register / Vol. 83, No. 47 / Friday, March 9, 2018 / Notices 10481 waiver shall respond to comments Interested parties may submit comments Nippon Yusen Kaisha into a new received and shall provide reasons for on the agreements to the Secretary, company known as Ocean Network the ASC’s finding. The order shall be Federal Maritime Commission, Express Pte. Ltd. effective April 1, 2018. published promptly in the Federal Washington, DC 20573, within twelve Ocean Network Express Pte. Ltd. is Register, though in the case of an order days of the date this notice appears in added as a party. In addition, the granting a waiver, only after approval by the Federal Register. Copies of the Amendment adds Yang Ming (UK) Ltd. the FFIEC. agreements are available through the as a party (operating as a single party Commission’s website (www.fmc.gov) or with Yang Ming Marine Transport II. Request for Temporary Waiver; by contacting the Office of Agreements Corp.). Received Request at (202) 523–5793 or tradeanalysis@ Agreement No.: 012472–001. On November 20, 2017, a letter fmc.gov. Title: Yang Ming/COSCO Shipping requesting consideration of a temporary Agreement No.: 011830–012. Slot Exchange Agreement. waiver was received by the ASC from Title: Indamex Cross Space Charter, Parties: COSCO Shipping Lines Co., TriStar Bank, a state-chartered bank Sailing and Cooperative Working Ltd. and Yang Ming Marine Transport located in Dickson, Tennessee (the Agreement. Corporation. Requester). On November 30, 2017, ASC Parties: CMA CGM S.A.; Hapag-Lloyd Filing Party: Robert Magovern; Cozen staff replied by letter to the Requester, AG; Nippon Yusen Kaisha; and Orient O’Connor; 1200 19th Street NW; in which ASC staff described the Overseas Container Line Limited. -

![Market Position in the Industry[111KB/2Pages]](https://docslib.b-cdn.net/cover/6717/market-position-in-the-industry-111kb-2pages-596717.webp)

Market Position in the Industry[111KB/2Pages]

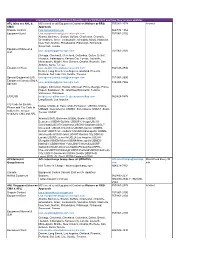

Market Position in the Industry MOL operates a large and balanced oceangoing fl eet. In terms of its total fl eet size and presence in individual market categories, MOL ranks among the world’s largest shipping companies. World Major Carriers’ Fleets (All Vessel Types) (Number of vessels) 0 200 400 600800 1,000 1,200 947 MOL (Japan) 68 NYK (Japan) COSCO (China) K Line (Japan) China Shipping (China) APM-Maersk (Denmark) Oldendorff (Germany) MSC (Switzerland) Swiss Marine (Switzerland) CMA-CGM (France) Fredriksen (Norway) Teekay (Canada) 0 20 40 6080 100 120 (Million deadweight tons (DWT)) ■■ Number of vessels ■■ Million deadweight tons (DWT) Source: MOL internal estimation based on each companies’ published data, Clarkson and Alphaliner (March 2015) World Major Carriers’ Revenue Portfolio by Segment (%) 0 2040608010047 43 10 MOL NYK K Line APM-Maersk COSCO NOL OOIL MISC Frontline Teekay Pacifi c Basin Golar LNG ■ Bulkships ■ Containerships and related business ■ Other businesses Source: MOL calculations based on each company’s fi nancial statements and/or news. MOL’s containerships and related business includes revenue from Containerships, Terminals and Logistics. NYK’s containerships and related business includes revenue from Containerships, Air freighters and Logistics. APM-Maersk’s containerships and related business includes revenue from Terminal business. COSCO’s containerships and related business includes revenue from Terminal business. 38 Mitsui O.S.K. Lines 115mol_英文0723入稿PDF.indd5mol_英文0723入稿PDF.indd 3838 22015/07/23015/07/23 117:337:33 -

APL (Also See ANL & CMA) MC's Need to Call Equipment Control on Waivers Or RRG Approvals 757/961-2574 Dispute Contact PSW

Frequently Called Equipment Providers as of 09/16/2021 and how they receive updates APL (also see ANL & MC’s need to call Equipment Control on Waivers or RRG 757/961-2574 Internet CMA) Approvals Dispute Contact [email protected] 866/574-1364 Equipment East [email protected] 757/961-2102 Atlanta, Baltimore, Boston, Buffalo, Charleston, Charlotte, Greensboro, Greer, Jacksonville, Memphis, Miami, Nashville, New York, Norfolk, Philadelphia, Pittsburgh, Richmond, Savannah, Tampa. Equipment Midwest & [email protected] 757/961-2105 Gulf Chicago, Cincinnati, Cleveland, Columbus, Dallas, Detroit, Houston, Indianapolis, Kansas City, Loredo, Louisville, Minneapolis, Mobile, New Orleans, Omaha, Rochelle, San Antonio, Santa Teresa. Equipment West [email protected] 602/586-4940 Denver, Long Beach, Los Angeles, Oakland, Phoenix, Portland, Salt Lake City, Seattle, Tacoma. Special Equipment (US) [email protected] 757/961-2600 Equipment Canada (Dry & [email protected] 514/908-7866 Special) Calgary, Edmonton, Halifax, Montreal, Prince George, Prince Rupert, Saskatoon, St. John/New Brunswick, Toronto, Vancouver, Winnipeg. LAX/LGB [email protected] Or [email protected] 562/624-5676 Long Beach, Los Angeles. City Code for Emails- Dallas: USDAL-El Paso: USELP-Houston: USHOU- Mobile: Please add City Code to USMOB- New Orleans: USMSY- San Antonio: USSAT- Santa subject line on your Tereas: USSXT emails for CMA and APL Atlanta:USATL-Baltimore:USBAL-Boston:USBOS- Bessemer:USBMV-Buffalo: USBUF-Chicago:USCHI- Cincinnatti:USCVG-Charleston:USCHS-Charlotte:USCLT- Cleveland: USCLE-Columbus:USCMH-Denver:USDEN- Detroit: USDET-Greensboro: USGBO-Indianapolis: USIND- Jacksonville:USJAX-Joliet: USJOT-Kansas City:USKCK- Laredo:USLRD-Louisville:USLUI-Los Angeles:USLAX- Memphis:USMEM-Miami:USMIA-Minneapolis:USMES- Nashville:USBNA-New York:USNYC-Norfolk:USORF- Oakland:USOAK-Omaha:USOMA-Phildelphia:USPHL- Phoenix:USPHX-Pittsburgh:USPIT-Portland:USPDX-Salt Lake City: USSLC-Savannah:USSAV-Seattle:USSEA-St. -

Hapag Lloyd / Hamburg Sud Hapag Lloyd Thea

CONTAINER SERVICES BERTH WINDOW SCHEDULE Last Updated August 3, 2021 Sunday Monday Tuesday Wednesday Thursday Friday Saturday 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30* 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 Berth 5 TP1 TP9 CPNW - OCEAN TP1 WSL CENTERM Berth 6 Barge WSL Barge (2) Sunday Monday Tuesday Wednesday Thursday Friday Saturday 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30* 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 Berth CFNX PNW3 - OCEAN PNW1 - OCEAN CFNX Berth VANTERM Sunday Monday Tuesday Wednesday Thursday Friday Saturday 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30* 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 Berth ZP9 PNW4 - OCEAN ALLIANCE CHIN ZP9 Berth PN4- THEA PN1 - THEA PN4 DELTAPORT Berth PN3 - THEA PN2 - THEA PN3 - THEA Sunday Monday Tuesday Wednesday Thursday Friday Saturday 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30* 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 Berth 7 WSN** AL5 Barge PNS MedPac FRASER FRASER SURREY Berth 8 TP Alaska** TP Alaska** L I N E / C O N S O R T I U M S e r v i c e N a m e HAPAG LLOYD / HAMBURG SUD SM LINE MedPac (Mediterranean Pacific Service) PNS (Pacific Northwest Service) Hapag Lloyd, Hamburg Sud/ Maersk and ZIM SM Line, MSC HAPAG LLOYD THEA - THE (Transport High Efficiency) Alliance WSN (Oceania) PN1 (Pacific Northwest) Hapag Lloyd, Hamburg Sud/ Maersk and CMA-CGM, and MSC Hapag Lloyd, Yang Ming, Ocean Network Express, HMM PN2 (Pacific Northwest) MAERSK Hapag Lloyd, Yang Ming, Ocean -

All Inland Destination (Northern and Midwest) Serviced Via Halifax for Canada

CMA-CGM Group Indian Sub-Continent CMA-CGM Agencies (India) Pvt Ltd. Table of Contents Ports Agencies & Services Logistics Indian Sub-Continent Last update: Jun 25th 2020 Group Applications (LARA, LISA, OCEAN, GAIA, QIRA) 2 Ports DELHI 6 Gateway ports MUNDRA KANDLA HAZIRA KOLKATA PIPAVAV HALDIA DHAMRA Feeder ports PARADIP 9 NHAVA SHEVA VISAKAPATNAM (VIZAG) MORMUGAO KRISHNAPATNAM KATTUPALLI MANGALORE ENNORE Click on the port to access CHENNAI more information. COCHIN TUTICORIN VIZHINJAM COLACHEL Feeder ports Last update: Jun 25th 2020 Gateway ports ↖ Table of Contents CC is not operating Under development Mundra – Adani – Terminal 1 INMUN - Mundra International Container Terminal or CT1 (MICT) Port information MICT • Distance from Pilot station to berth 3 miles • Time from Pilot station to berth 1.50 hour • Min Depth 13.8 meters • Max allowed vessel draft 16.5 meters • Total length of berth 632 meters • Max vessel size 367 m x 48 m AICTPL Quay and Yard equipment • Quay cranes 6 (2 PP + 4 SPP) • Max outreach 19 Rows • SWL Spreader/hook 40-60 / 100 Tons • Stacking area 240,000 Sq. meters • Capacity 1.35 Million TEUs • Utilization % 93.0% (FY 2016-17) Rail Connectivity from ICDs: • Handling equipment type RTG CMA-CGM Services • Reefer plugs 242 plugs KHODIYAR – SACHANA - SANAND – TUGHLAKABAD – MIDAS 2 PATPARGANJ - DADRI – GHARI HARSARU - LONI – PATLI – Out of Gauge (OOG) restrictions Wed 4AM– Wed 7PM PIYALA - MORADABAD – FARIDABAD – KATHUWAS – PANTNAGAR - SONIPAT – SAMALKHA – LUDHIANA (DHANDARIKALANA, SAHNEWAL, KANECH, CHAWA) – • Maximum -

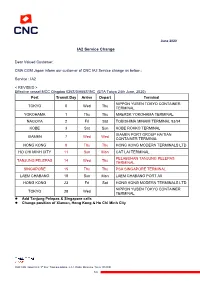

CMA CGM Japan Inform Our Customer of CNC IA2 Service Change As Below ;

June 2020 IA2 Service Change Dear Valued Customer, CMA CGM Japan inform our customer of CNC IA2 Service change as below ; Service : IA2 < REVISED > Effective vessel MCC Qingdao 026S/0IA65S1NC (ETA Tokyo 24th June, 2020) Port Transit Day Arrive Depart Terminal NIPPON YUSEN TOKYO CONTAINER TOKYO 0 Wed Thu TERMINAL YOKOHAMA 1 Thu Thu MAERSK YOKOHAMA TERMINAL NAGOYA 2 Fri Sat TOBISHIMA MINAMI TERMINAL 93/94 KOBE 3 Sat Sun KOBE ROKKO TERMINAL XIAMEN PORT GROUP HAITIAN XIAMEN 7 Wed Wed CONTAINER TERMINAL HONG KONG 8 Thu Thu HONG KONG MODERN TERMINALS LTD HO CHI MINH CITY 11 Sun Mon CAT LAI TERMINAL PELABUHAN TANJUNG PELEPAS TANJUNG PELEPAS 14 Wed Thu TERMINAL SINGAPORE 15 Thu Thu PSA SINGAPORE TERMINAL LAEM CHABANG 18 Sun Mon LAEM CHABANG PORT A0 HONG KONG 23 Fri Sat HONG KONG MODERN TERMINALS LTD NIPPON YUSEN TOKYO CONTAINER TOKYO 28 Wed TERMINAL ⚫ Add Tanjung Pelepas & Singapore calls ⚫ Change position of Xiamen, Hong Kong & Ho Chi Minh City th CMA CGM (Japan) K.K. 9 floor, Tradepia Odaiba, 2-3-1, Daiba, Minato-ku, Tokyo 135-0091 1/2 <ORIGINAL> Transit Port Arrive Depart Terminal Day NIPPON YUSEN TOKYO CONTAINER TOKYO 0 Wed Thu TERMINAL YOKOHAMA 1 Thu Thu MAERSK YOKOHAMA TERMINAL NAGOYA 2 Fri Sat TOBISHIMA MINAMI TERMINAL 93/94 KOBE 3 Sat Sun KOBE ROKKO TERMINAL TAICHUNG 6 Tue Wed CHINA CONTAINER TERMINAL XIAMEN PORT GROUP HAITIAN XIAMEN 8 Thu Thu CONTAINER TERMINAL HONG 9 Fri Sat HONG KONG MODERN TERMINALS LTD KONG YANTIAN INTERNATIONAL CONT YANTIAN 10 Sat Sun TERMINAL HO CHI 14 Wed Thu CAT LAI TERMINAL MINH CITY LAEM 18 Sun Mon LAEM CHABANG PORT A0 CHABANG HONG 23 Fri Sat HONG KONG MODERN TERMINALS LTD KONG NIPPON YUSEN TOKYO CONTAINER TOKYO 28 Wed TERMINAL ⚫ Omit Taichung & Yantian calls We thank you for your business and continued support. -

Cma Cgm Bougainville

Autumn 2015 54 A FRENCHGIANTOFTHESEAS BOUGAINVILLE CMA CGM CMA CGM Editorial and publication Director: Tanya Saadé Zeenny Editors: Marianne Group Magazine Lacroix, Eric Zuber Editing: Hervé Gallet Coordination: Olivia Simonetti Autumn 2015 Graphic Design: Agence La Créa Printing and distribution supervision: Christine Nunes Contributors: Sophie Beau, Isabelle Billet, Francois Friboulet, Mohamed Khouas, Erik Meltzer, Luc Portier, Eric Sagnier, Nicolas Sartini, Emilian Stere, Hillebrand Photo credits: CMA CGM, Shutterstock, Hillebrand, Thierry Dosogne, Philip Plisson Number of issues: 22,000 ISN: 1287-8863 printed on paper manufactured using a minimum of 60% recycled fi bre and 40% virgin pulp from certifi ed sources. CMA CGM Marseilles Head Offi ce 4, quai d’Arenc 13235 Marseille cedex 02 France CONTENT Tel: +33 (0)4 88 91 90 00 - www.cma-cgm.com FOCUS _ 01 CMA CGM BOUGAINVILLE A FRENCH GIANT FOUNDATION _ 02 THE CMA CGM FOUNDATION CELEBRATES TEN YEARS GROUP LIFE _ 03 REACTIVITY AND PRECISION: WATCHWORDS OF A PORT STOPOVER FACE TO FACE _ 04 JF HILLEBRAND GROUP: IN VINO VERITAS THE EXPERTS _ 05 SHIP MANAGER: AT THE HEART OF MARITIME OPERATIONS 2 Autumn 2015 Tanya SAADÉ ZEENNY Executive Offi cer EDITORIAL The inauguration of the CMA CGM Group’s new fl agship CMA CGM BOUGAINVILLE in Le Havre, in the presence of Mr François Hollande, President of the French Republic, is another bold milestone in the history of the Group. This vessel is a symbol for us and for all of our partners. For our customers, it is a symbol of our energy, our boldness and our commitment. -

CMA CGM: Your Shipping Expert in XXL Cargo

Group Corporate Presentation Led by its founder, Mr Jacques R. Saadé, CMA CGM is a leading worldwide shipping group. CMA CGM Group is today a global carrier operating on all the world’s shipping routes and offers the full range of logistics and transportation services to its customers. Founded in 1978 by Jacques R. Saadé, today CMA CGM is the world’s third largest container shipping group and number one in France. CMA CGM is headquartered in Marseille (France), and operates out of over 600 offices and agencies in more than 160 countries. With regular services on over 200 shipping lines, the Group manages a dense network capable of meeting the expectations of its customers all over the world. The CMA CGM Group’s primary objective is to meet the growing needs of its customers from a sustainable development perspective. CMA CGM provides customers with tailor-made solutions to meet all their transport requirements, on land as well as at sea. Our main recent achievements JUNE 2016 APRIL 2016 APRIL 2016 MARCH 2016 MARCH 2016 DECEMBER 2015 CMA CGM signs a CMA CGM Takes CMA CGM, COSCO Launch of the new Financial results 2015: CMA CGM TO ACQUIRE Carbon Pact with DB control of NOL Group Container Lines, Evergreen REEFER advertising CMA CGM has known a NOL Group: If the Schenker, the German and APL Brand on Line and Orient Overseas campaign. The ad strong increase of the acquisition is validated by logistics provider. The June 10th 2016. Container Line to establish highlights the expertise volumes (+6,3%) and a competent authorities, CMA agreement aims to Temasek and its “OCEAN Alliance”. -

NYK/CMA CGM Space Charter Agreement FMC Agreement No. 012464-001 Original First Revised Page No. I TABLE of CONTENTS ARTICLE

NYK/CMA CGM Space Charter Agreement FMC Agreement No. 012464-001 Original First Revised Page No. i TABLE OF CONTENTS ARTICLE NAME OF ARTICLE PAGE NO. Article 1 Name of Agreement 1 Article 2 Purpose of Agreement 1 Article 3 Parties to Agreement 1 Article 4 Geographic Scope 1 Article 5 Authority 1 Article 6 Administration 2 Article 7 Membership 3 Article 8 Voting 3 Article 9 Duration and Resignation 3 Article 10 Non-Assignment 4 Article 11 Law and Arbitration 4 Article 12 Force Majeure 5 Article 13 Compliance with Law 6 Article 14 Notices 6 Article 15 Transition 6 NYK/CMA CGM Space Charter Agreement FMC Agreement No. 012464-001 Original First Revised Page No. 1 ARTICLE 1: NAME OF AGREEMENT The name of this agreement is the NYK/CMA CGM Space Charter Agreement (the “Agreement”). ARTICLE 2: PURPOSE OF AGREEMENT The purpose of this Agreement is to authorize NYK to charter space to CMA CGM and to authorize the Parties (as hereinafter defined) to enter into arrangements related to the chartering of such space. ARTICLE 3: PARTIES TO AGREEMENT The Parties to the Agreement are: 1. Nippon Yusen Kaisha (NYK)(until terminated pursuant to Article 15) 3-2 Marunouchi 2-Chome Chiyoda-ku, Tokyo 100-0005 Japan 2. CMA CGM S.A. (CMA CGM) 4 quai d’ Arenc 13235 Marseille Cedex 02 France 3. Ocean Network Express (“ONE”)(effective as of the Transition Date, as provided for in Article 15) 7 Straits View, Marina One East Tower #16-01/03 and #17/01/06 Singapore 018936 NYK, ONE, and CMA CGM are hereinafter sometimes referred to individually as a “Party” and collectively as the “Parties.” ARTICLE 4: GEOGRAPHIC SCOPE This Agreement covers the trades between ports in Japan on the one hand and U.S. -

A CMA CGM and Hapag-Lloyd Merger - Really?

7/13/2018 A CMA CGM and Hapag-Lloyd merger - really? (/) Home (/) > News > Europe (/news/europe.html) > A CMA CGM and Hapag-Lloyd merger - really? A CMA CGM and Hapag-Lloyd merger - really? (/media/k2/items/cache/a87aa8bc3ee2e8fe8da5fa992c06ee2f_XL.jpg) Photo: CMA CGM A week ago we wrote that the latest round of consolidation in the container shipping sector appeared largely complete with regulatory approval for Cosco Shipping to buy Orient Overseas International Ltd (OOIL), but yesterday up pops the story that CMA CGM had approached rival Hapag- Lloyd on a stock-for-stock merger. The Reuters story quoted financial sources that the idea was for a non-cash merger, as well as quoting a Hapag-Lloyd spokesman that. “These are market rumours without substance”. So is this just another silly season story, or could there be something here that makes a bit more actual sense? http://www.seatrade-maritime.com/news/europe/a-cma-cgm-and-hapag-lloyd-merger-really.html 1/7 7/13/2018 A CMA CGM and Hapag-Lloyd merger - really? The idea that CMA CGM approached Hapag-Lloyd about a merger does not seem out of the realms of possibility. The company has continued to be active consolidation on both a large scale acquiring Neptune Orient Lines (NOL) in 201 and on a smaller, niche scale recently announcing plans to buy Finnish line Containerships. CMA CGM chairman and ceo Rodolphe Saade has also made it clear the company sees a continued role in industry consolidation. Read more: CMA CGM to buy Containerships strengthening its intra-Europe business (http://bit.ly/2NFdM9d) In addition industry sources indicate that over the last couple of years CMA CGM has continued to make approaches to other companies in the sector over possible M&A transactions. -

Original Title Page CMA CGM/COSCO SHIPPING VESSEL

Original Title Page CMA CGM/COSCO SHIPPING VESSEL SHARING AGREEMENT BRAZIL-CARIBBEAN / U.S. GULF FMC Agreement No. _201330______ _ Expiration Date: In accordance with Article 6 hereof CMA CGM/COSCO SHIPPING Vessel Sharing Agreement BRAZIL- CARIBBEAN/ U.S. GULF FMC AGREEMENT NO. ORIGINAL PAGE NO. i TABLE OF CONTENTS 1. Parties ........................................................................................................ 1 2. Definitions .................................................................................................. 1 3. Undertaking and Purpose ........................................................................... 2 4. Scope of the Agreement .............................................................................. 2 5. Containers and Cargo ................................................................................. 3 6. Duration and Termination .......................................................................... 3 7. Vessel sharing arrangement ........................................................................ 4 8. Slot Commitment ........................................................................................ 6 9. Slot Costs ................................................................................................... 7 10. Terminals ................................................................................................ 7 11. Applicable Law and Jurisdiction .............................................................. 7 12. Third Parties ........................................................................................... -

OCEAN ALLIANCE the New Alliance Powered by CMA CGM 57 Winter 2016 / 2017 2 CONTENT WINTER 2016-2017 WINTER 2016-2017 N°57 GROUP MAGAZINE CMA CGM 04 06

OCEAN ALLIANCE The new alliance powered by CMA CGM 57 Winter 2016 / 2017 CMA CGM Editorial and publication Director: Tanya Saadé Zeenny Editor: Marianne Lacroix, Benoit Tournebize GROUP MAGAZINE Coordination: Olivia Simonetti Graphic Design: CMA CGM Studio – Damien Boulanger, Bastien Régis RODOLPHE N°57 Printing and distribution supervision: Christine Nunes, Marianne Zeenny Contributeurs: Simon Delfau, WINTER 2016-2017 Nicolas Sartini, François De Garam, Elie Zeenny, Cécile Ciucci Editing: Julien Thèves Photos credits : CMA SAADÉ CGM, Shutterstock, Thierry Dosogne, Philip Plisson, APL, Melmif Number of issues: 22,000 – quarterly ISN : 1287-8863 Vice-Chairman, CMA CGM Group Printed on paper manufactured using a minimum of 60% recycled bre and 40% virgin pulp from certied souces. CMA CGM Marseille Siège Social 4, quai d'Arenc 13235 Marseille cedex 02 France Tel: +33 (0)4 88 91 90 00 www.cma-cgm.com CONTENT EDITORIAL Major changes are under way in the container shipping sector. The past year has seen the start of an unprecedented wave of consolidation, AROUND THE WORLD leading to a series of takeovers and mergers. We have been one of the _ 04 driving forces behind this consolidation, which I believe will continue. In today’s context, the acquisition of APL is of even greater strategic importance. Its integration is moving forward as planned, combining operational synergies with development into new markets. This industry consolidation has also brought forth new operational alliances. Last November 3rd , for example, our Group announced a new _ 06 FOCUS service oering, OCEAN ALLIANCE, with three Asian partners. CMA CGM OCEAN ALLIANCE is a key player in this alliance, providing 119 ships out of the total 323, for capacity share of 35%.