The BGSA Supply Chain Index

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Top Freight Brokerage Firms

Online Shopping Drives Growth in Demand For Faster, Cheaper Local Delivery Services By Daniel P. Bearth up local hubs to provide one-hour delivery in cities across Senior Features Writer the United States. In the 2016 edition of Transport Topics’ Top 50 s online sales continue to soar, so have Logistics Companies, we explore what the growth the expectations of consumers for goods of online commerce means to some of the largest to be delivered quickly and cheaply. logistics service providers in North America, including Fueling an increase in on-demand top-ranked UPS Inc., which has invested in several delivery services is Amazon.com, the delivery startups, and FedEx Corp., which last year Seattle-basedA online bookseller that has over the past acquired Genco, a distribution firm that handles order two decades morphed into a $100 billion-a-year global fulfillment and manages returned goods for Internet storehouse and potentially a provider of logistics services retailers. in its own right. While the companies have made investments to Since 2014, investors have poured more than $1 billion enhance their package delivery networks to handle into companies, such as California-based Postmates additional online commerce, they don’t yet see enough and Deliv, that use freelance drivers to provide same- demand from consumers to expand same-day or on- day pickup and delivery of merchandise and packages. demand delivery service. At the same time, Google and other high-tech firms On the other hand, the beginnings of a new and are developing driverless trucks and robotic delivery radically different transportation network appear to be vehicles in an effort to lower costs. -

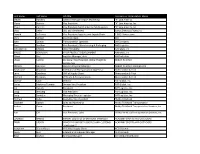

First Name Last Name Job Title Company Bruce Abbe Executive

First Name Last Name Job Title Company Bruce Abbe Executive Director Midwest Shippers Association Randy Abbott Intermodal VP of Sales XPO Logistics Mark Aberle Supply Chain Operations Eddie Bauer John Abisch RCEO Ecu Worldwide Thomas Abramowitz Sr Sales and Marketing Manager JSK Transportation Vice President, Global Sales Brian Abramowitz Division COSCO SHIPPING Lines (North America) Inc. David Adam Chairman & CEO US Maritime Alliance (USMX) Senior Consultant – Global Dustin Adams Logistics Procurement Halyard Health Theresa Adams Lopez Director of Community Relations Port of Los Angeles Frank Adcock AVP Marketing TTX Company Eric Adelstein SVP Supply Chain Bob's Discount Furniture Experiential Marketing and Brand Sandra Aderibigbe Manager Maersk Line David Adney AVP or Transportation Hobby Lobby Stores Inc. Ian Aguilar Sales Manager Shippabo Craig Akers Director of Operations Toy Shippers Association Inc Lisa Akers-Stein Vice President AFMS Global Transportation Consultant Natalie Akiyama Assistant to Division Manager Yamaha Motor Corporation Deniz Akkirman TPEB Tradelane Manager UPS Supply Chain Solutions Tony Alanis Executive Board Member ILWU LOCAL 13 Albanese- Global Forwarding Director of Stefania Monforti Sales XPO Logisitics David Albert COO Libra Director Of Logistics and Trade Alex Albertini Compliance Charlotte Russe Inc. Kenneth Albertson Vice President Sales & Marketing Progressive Transportation Services, LLC. Mark Aldridge Director of Sales NFI Global LLC Edward Aldridge Director, Head of FCL USA DB Schenker Goetz Alebrand VP Seafreight Kuehne + Nagel Raul Alfonso EVP & CCO Port Tampa Bay Stuart Allen EVP Sherwood Global Commerce Steve Alonso Director International Logistics The Home Depot TammyLy nn Alsup Manager Carhartt Beverly Altimore Executive Director USSA Ricardo Alvarez Director of Operations DP World Prince Rupert Roy Amalfitano Vice Chairman Evergreen Shipping Agency (America) Corp. -

2 Million Square Feet of Distribution Center Space

2 MILLION SQUARE FEET P OF DISTRIBUTION CENTER SPACE ORT S READY FOR YOU TORAGE & T RAN SP ORTATION We Offer Our Clients: Foreign Trade Zone, Vendor Compliance Management, Inventory Control, Vendor Managed Inventory, Order Fulfillment and Product Modification. Now what can we do for your business? Givens.com 67 PORT STORAGE & TRANSPORTATION Cold Storage ................................................................. 67 Warehousing ................................................................. 68 Air Services and Airports ...................................................... 77 Motor Carrier Services ........................................................ 82 Passenger Cruise Service ...................................................... 82 Railroad Services ............................................................. 83 Towing and Barge Services .................................................... 87 ORTATION SP RAN T & Beyond Distribution TORAGE S CrossGlobe works in partnership with the Port of Virginia, which handles ORT containerized cargo and break-bulk [notably project cargo, machinery, P pulp and paper, and steel). We provide drayage and local intermodal transportation services to and from all the Port's marine terminal facilities, rail yards, and customs exam stations. CrossGlobe is a premier logistics service provider. We specialize in transportation and warehousing solutions for the mid-Atlantic region. www.logistec.com . · ·I PORT StoragE & Transportation StoragE/WAREHOUSE COLD STORAGE n LINEagE Logistics Lineage Logistics -

Seeking Zen: a Post-Pandemic 3PL Market Latest Third-Party Logistics Market Results and Predictions for 2021 Including Estimates for 190 Countries

Seeking Zen: A Post-Pandemic 3PL Market Latest Third-Party Logistics Market Results and Predictions for 2021 Including Estimates for 190 Countries August 2021 Phone: +1-800-525-3915 Website: www.3PLogistics.com Email: [email protected] ABOUT ARMSTRONG & ASSOCIATES, INC. Armstrong & Associates, Inc. (A&A) was established in 1980 to meet the needs of a newly deregulated domestic transportation market. Since then, through its leading Third-Party Logistics (3PL) market research and history of helping companies outsource logistics functions, A&A has become an internationally recognized key resource for 3PL market information and consulting. A&A’s mission is to have leading proprietary supply chain knowledge and market research not available anywhere else. As proof of our continued work in supporting our mission, A&A’s 3PL market research is frequently cited in media articles, publications, and securities filings by publicly traded 3PLs. In addition, A&A’s email newsletter currently has over 88,000 subscribers globally. A&A’s market research complements its consulting activities by providing continually updated data for analysis. Based upon its unsurpassed knowledge of the 3PL market and the operations of leading 3PLs, A&A has provided strategic planning consulting services to over 30 3PLs, supported 24 closed investment transactions, and provided advice to numerous companies looking to benchmark existing 3PL operations or outsource logistics functions. All Rights Reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form by any means, electronic, mechanical, photocopied, recorded or otherwise, without the prior permission of the publisher, Armstrong & Associates, Inc. -

United States Bankruptcy Court District of Connecticut Hartford Division

Case 21-20111 Doc 862 Filed 06/25/21 Entered 06/25/21 17:48:09 Page 1 of 47 UNITED STATES BANKRUPTCY COURT DISTRICT OF CONNECTICUT HARTFORD DIVISION : In re: : Chapter 11 : CARLA’S PASTA, INC., et al., : Case No. 21-20111 : Debtors.1 : (Jointly Administered) : AFFIDAVIT OF SERVICE I, Geoff Anfuso, depose and say that I am employed by Stretto, the claims and noticing agent for the Debtors in the above-captioned cases. On June 23, 2021, at my direction and under my supervision, employees of Stretto caused the following documents to be served via first-class mail on People’s United Bank, National Association, as Administrative Agent, Attn: Jon J. Gasior at 850 Main Street, RC826, Bridgeport, CT 06604: • First Amended Disclosure Statement for the First Amended Joint Chapter 11 Plan of Liquidation of the Debtors (Docket No. 802) [USB Drive] • Order Approving (I) First Amended Disclosure Statement for the First Amended Joint Chapter 11 Plan of Liquidation of the Debtors; (II) Solicitation, Voting, and Balloting Procedures; (III) Procedures Relating to Plan Confirmation; and (IV) Other Relief Relating to Plan Solicitation and Plan Confirmation Process (Docket No. 835, Pages 1-11) [USB Drive] • Notice of: (A) Approval of Disclosure Statement, (B) Voting Procedures for the Plan, (C) Scheduling of the Confirmation Hearing, and (D) Procedures for Filing Objections and Responses to Confirmation of the Plan (Docket No. 835, Pages 13-16) [USB Drive] • [Customized] [Class 1 Lenders Secured Claims] Ballot for Accepting or Rejecting the Debtors’ Joint Plan of Reorganization (Docket No. 835, Pages 23-26) • Pre-Addressed, Postage Pre-Paid Reply Envelope [SPACE INTENTIONALLY LEFT BLANK] ______________________________ 1 The Debtors in these chapter 11 cases, along with the last four digits of each Debtor’s federal tax identification number, are Carla’s Pasta, Inc. -

Logistics Logistics Logistics Logistics

LOGISTICS LOGISTICS LOGISTICS LOGISTICS TO THE GATEWAY WORLD Georgia.org GLOBAL ACCESS The seamless connection of Georgia’s logistics infrastructure offers businesses a significant competitive advantage. When companies choose Georgia, they can rely on a solid foundation of air, land and sea transportation that sustains business growth in an increasingly globalized economy. Logistics giants such as Delta Air Lines, United Parcel Service (UPS), SAIA and Manhattan Associates are headquartered in Georgia, as well as internationally-recognized brands like The Home Depot, The Coca-Cola Company and Gulfstream Aerospace Corporation. WHY GEORGIA? Page 4 Unmatched, Comprehensive Logistics Ecosystem 11 Industry Expertise 12 Business-Friendly Climate with Competitive Corporate THE HOME DEPOT Tax Structure and Incentives Georgia is our home state and very 14 important to The Home Depot. Top-Ranked Talent and Approximately 20 percent of our imports Free, Customized Workforce enter through the Port of Savannah and Training we leverage that asset every day to bring product to our customers as efficiently as possible.” “Mark Holifield, Executive Vice President, Supply Chain & Product Development The Home Depot GEORGIA’s pORTS SUPPORT MORE THAN 352,000 JOBS ACROSS THE State PROVIDING $18.5 BILLION IN INCOME. 2 Rockford Naperville 90 Cleveland 76 88 Aurora Gary Akron Fort Wayne 75 55 OH 29 MD Columbus 68 70 Dayton 35 Springfield Indianapolis Washington D.C. 95 55 IN Cincinnati Kansas 65 77 City Independence IL 79 WV Charleston 70 64 64 Saint Louis Louisville -

2014 Top 50 Logistics Companies H

Driver Staf ng Solutions Established in 1991, TransForce is the nation’s leading specialty staf ng fi rm devoted exclusively to commercial truck drivers. We believe that safety is a shared commitment among our customers, our drivers and ourselves. Our drivers’ safety is demonstrated by our low DOT accident rate. Not just high standards, higher ones. DOT REPORTABLE ACCIDENTS Our proprietary screening process ensures that our drivers Only 36% exceed FMCSA standards. We make use of cutting-edge are “at-fault” technology to manage our driver qualifi cation (DQ) fi les, enabling TransForce (2008–2013) .34 accidents us to provide customer-specifi c DQ fi les via secure web-enabled Private Fleets (2013) .49 portals. TransForce is an early adopter of driver screening Audited Motor Carriers innovations, including (a) E-Verify, (b) Driver Violation Alerts, (2008–2010, latest published results) .725 and (c) CSA Driver Information Reports, among many others. Accidents/million miles Fair, straightforward pricing is part of our no-surprise service. We believe in long-term relationships with our customers and straightforward pricing is a critical element of our partnerships. On average, our Top 10 customers have been with us for over 15 years. If you share our passion for safety—and the bottom-line benefi ts it brings you— contact TransForce today. TransForce locations www.transforce.com WEST CENTRAL NORTHEAST SOUTHEAST 800-308-6989 » AZ, Phoenix » IL, Chicago » NJ Central/ » AL, Birmingham » CA, Los Angeles » IN, Indianapolis Philadelphia, PA » FL, Jacksonville -

First Name Last Name Job Title Company Or Organization Name

First name Last name Job title Company or Organization Name Steven Hawkins General Manager Import Marketing "K" Line America Maria Bodnar Vice President "K" Line America, Inc. Shaun Gannon Vice President North America Field Logistics "K" Line America, Inc. Chas Deller CEO and CHAIRMAN 10XOCEANSOLUTIONS,INC Donald La France Vice President Logistics and Supply Chain 1-800-Flowers.com Chris McNeil Sourcing Agent 3M John Ladwig Transportation Specialist 3M Company Russ Boullion Vice President - Warehousing & Packaging A&R Logistics XIANGMING CHENG CEO/ PRESIDENT AAmetals, Inc BRUCE FERGUSON VP OF PRODUCT DEVELOPMENT AAmetals, Inc Eileen Wei Logistics Manager, Asia AB Electrolux Ulises Carrillo Divisional Vice President, Global Freight & Abbott Nutrition Distribution William Gaiennie Logistics Program Manager Abbott Nutrition International Sarah Jane Chapman International Transportation Supervisor Abercrombie & Fitch Larry Grischow GVP of Supply Chain Abercrombie & Fitch Michael Sherman VP Trade & Transportation Abercrombie & Fitch Gunnar Gose Director ABF Global, Inc. Carlos Martinez-Tomatis Division Vice President ABF Global, Inc. Jim Ingram President ABF Logistics, Inc. Doug Riesberg Vice President ABF Logistics, Inc. Craig Sandefur Managing Director Logistics ABF Logistics, Inc. Michael Kelso Executive Vice President Ability Tri-Modal Elizabeth Gaston Sales and Marketing Ability Tri-Modal Transportation Joshua Owen President Ability Tri-Modal Transportation Services, Inc. Ron Gill Vice President, Sales Ability/Tri-Modal Transportation Services, -

FLOG 3PL Chart 1-Pg.Pdf

3PL SERVICES COLD STORAGE Inventory/Cost AccountingInventory ManagementMulti-vendor Consolidation Pick/Pack Assembly Public Ref. Whse.Reverse LogisticsUSDA/FDA - Recall Inspection Air Cargo Bulk Continuous MovesCustoms BrokerageDedicated ContractDirect Carriage Store DeliveryDrayage ServicesFleet Leasing Freight ForwardingFuel Savings ProgramFull Service ManagedIntermodal Transportation LTL Multi-vendor ConsolidationOcean Rail Rail/Truck TransloadRefrigerated TruckingTruckload Truckload BrokerageOther Blast Freezing Cross Docking Fulfillment Order Assembly Private Ref. Whse. Vendor ManagedWarehousing/Dist. Inventory Other Mgmt. 1. AFN (www.loadafn.com) • • • • • • • • • • • • • • • 2. Allen Lund Company • • • • (www.allenlund.com) 3. Alliance Shippers Inc. • • • • • • • • • • • • • • • • • • • • • • • (www.alliance.com) 4. Americold (www.americold.com) • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • 5. Atlanta Bonded Warehouse • • • • • • • • • • • • • • • • • • • • • • • • • • • (www.atlantabonded.com) 6. Bay Logistics Services • • • • (www.baylogisticsllc.com) 7. Bolingbrook Cold Storage • • • • • • • • • • • (www.bolingbrookcoldstorage.com) 8. Burris Logistics • • • • • • • • • • • • • • • • • • • • • • (www.burrislogistics.com) 9. C.H. Robinson • • • • • • • • • • • • • • • • • • • • • • • (www.chrobinson.com) 10. Cardinal Logistics Management • • • • • • • • • • • • • • • • • • Corporation (www.cardlog.com) 11. CaseStack (www.casestack.com) • • • • • • • • • • • • • • • • • • • • • • 12. Choptank Transport • • • • • -

Saving Energy with Ammonia/Co

SEPTEMBER 2016 ADVANCING HVAC&R NATURALLY AMERICA Lineage Oversees 46 Low-Charge NH3 Rooftop Units p. 42 Delhaize's Global NatRef Program p. 48 Keith Milligan, JTM Corp. (Piggly Wiggly) Devising Incentives p. 32 For NatRefs in the Pacific Northwest p. 56 SAVING ENERGY WITH AMMONIA/CO2 /Editor's note/ Editor’s note by Michael Garry CHALLENGING THE STATUS QUO here are many reasons why I enjoy covering the natural Another novel refrigeration design, believed to be unique in the Trefrigerants industry. First and foremost, I believe natural world, is the low-charge ammonia system that is just about refrigerant HVAC&R technology is the best replacement for installed on the rooftop of a 248,000-square-foot Baker Cold halocarbon refrigerant systems that harm the ozone layer and/or Storage warehouse in Long Beach, Calif. (page 42). This system, contribute significantly to global warming. which is being managed by another cold-storage operator, Lineage Logistics, comprises no less than 46 NXTCOLD low- But another very exciting aspect of this industry is the almost charge units, which will serve applications ranging from cold non-stop development of innovative natural refrigerant systems storage and blast freezers to railroad/truck docks and produce that are disrupting the marketplace and offering a myriad of new repacking. Rather than the 22,000 lbs. of ammonia originally options to end users. slated for this building, the system contains just 496 pounds for 1,015 TR. In this issue, we have several examples of eye-catching innovation. For example, our cover story (page 32) tells the story Also in this issue we have articles on two refrigeration systems of JTM Corp., a Piggly Wiggly franchise operator, that installed that have yet to hit the marketplace. -

Recent Developments in the California Food and Agricultural Technology Landscape Gordon Rausser, Ben Gordon, and James Davis

Recent Developments in the California Food and Agricultural Technology Landscape Gordon Rausser, Ben Gordon, and James Davis Three years ago, a global Between 2012 and 2017, venture capital include biophysical conditions, water, assessment of all industries funding in FA technology (agtech) pesticides, and other inputs, are used revealed that food and agriculture totaled $22.3 billion, reaching a peak by different farm production methods had dramatically lagged in the of $10.1 billion in 2017, as shown in to generate raw product, which are adoption of digital technologies. Figure 1. Across the United States, the either distributed in fresh or processed Recent emerging trends in venture evolution of this emerging trend is forms. These products are sold and funding for innovative agricultural reaching far beyond Silicon Valley’s distributed by food services, farmers’ technologies hope to change this early interest in agricultural biotech- markets, traditional grocers, and inter- assessment and may well alter nology, with major investments in all net channels direct to final consumers. California’s food and agriculture segments of the FA supply chain. As It is worth noting that while four of technology sector. This article with much of its history, California FA the six areas of innovation focus on investigates those venture-backed, continues to be a leader in U.S. high- input configuration and agricultural California-based companies that tech production and is the leading production, supply chain management are engaged at various points in state by agtech investments, with $2.2 technologies comprise over half of billion in 2017 (22% of total) and a total agtech investments. -

Dynamic Cold Chain Solutions for the Future

THINKING OUTSIDE THE FREEZER: Dynamic Cold Chain Solutions for the Future JULY 2020 Contents Introduction: Connecting People to Food 3 The Challenge: Supply Chain Inefficiency 4 The Solution: Lineage’s End-to-End Solutions Create Efficiency 5 Supply Chain Engineering: Solutions for All, Not One Size Fits All 9 Our Top Priority: Safety and Trust Go Hand in Hand 10 Customer Growth Journey 11 Looking Ahead: A Supply Chain Partner for the Future 13 Introduction: Connecting People to Food The average eater doesn’t spend much time thinking about how the food on the plate in From retail chains to grocery stores to quick service restaurants (QSRs) and beyond, we front of them got there – but there’s an entire industry that does. As consumers around help our customers optimize and protect the integrity of their temperature-controlled the world reach for frozen vegetables or ice cream in their local grocery stores, or order supply chain while maintaining the safety and quality of their products. a hamburger and french fries at a fast-food restaurant, they unknowingly rely on a com- plex network of suppliers that make up what we call “the cold chain” to access the food they’re craving. And at the center of it all is Lineage Logistics. The average relationship with our Supply chain, logistics and technology companies such as Lineage Logistics work every top 10 customers exceeds 20 years. day to ensure food is delivered safely and efficiently from where it is grown, manufac- tured or sourced to its final destination near you. Deep roots in generations of cold storage expertise combined with some of the world’s most cutting-edge innovations enable Lineage to provide a more comprehensive suite of services than what the industry could have imagined.