2005 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Cemetery Inscriptions, Stark County, Ohio Are

!!l«^Siii«lii^lM«iil^if^ 0003055 ™ECHURCHoF JESUSCHRIST Permission to Microfilm ofL-MTER-DAY '^^'^ Famny History L.brary of Christ of C 'MN rrc Of The Church Jesus j/\llM I J Latter-aay Saints would iike permission lo preserve your material on microfilm anc make it avaiiabe to our Family History Centers If you agree, piease complete this cara and return it io us. authorize the Family History Library 'o micoiiim "he matenai named below and use this mic'ofilmed record as it seems most benefic a: n compi.ance with the Library s policies and proceoures I warrant that I am fuiiv authcze^ '3 O'cv ae :^ch permission ": e -I ma;e"a. ^^^^^W. 7" U)^ ro// STA/e,\ e^^vr/ c/V/?//-// OGS ll£& U/cr>7)i!t£.<rr yvf. 1- tv state ziD coae Si . ,J, PFGS293I 'p-aB =-'-3c-- -i^/ • CEMETERY INSCRIPTIONS Stark County, Ohio Volume VI CEMETERY INSCRIPTIONS STARK COUNTY. OHIO VOLUME VI INCLUDED IN VOLUME VI IS THE TOWNSHIP OF PERRY DATE MiCROFiCHED MAY I 8 1990 19l PrlOJCGT and G. S. FiGHS I* CALL # PREPARED BY THE MEMBERS OF THE STARK COUNTY CHAPTER THE OHIO GENEALOGICAL SOCIETY (^ OCTOBER 1. 1985 CHURCH , OF LATTER-DAY SA'.lM TS 11 FORWARD The contents of each volume of Cemetery Inscriptions, Stark County, Ohio are: Volume I: Townships of Lexington, Washington, Paris and Marlboro. Volume II: Townships of Nimishillen, Osnaburg, Sandy, Pike, Bethlehem and Sugar Creek. Volume III; Townships of Tuscarawas, Lawrence and Jackson. Volume IV: Lake Township and the cemeteries of Dead Man's Point and Forest Hill in Plain Township. -

The Ears of Hermes

The Ears of Hermes The Ears of Hermes Communication, Images, and Identity in the Classical World Maurizio Bettini Translated by William Michael Short THE OHIO STATE UNIVERSITY PRess • COLUMBUS Copyright © 2000 Giulio Einaudi editore S.p.A. All rights reserved. English translation published 2011 by The Ohio State University Press. Library of Congress Cataloging-in-Publication Data Bettini, Maurizio. [Le orecchie di Hermes. English.] The ears of Hermes : communication, images, and identity in the classical world / Maurizio Bettini ; translated by William Michael Short. p. cm. Includes bibliographical references and index. ISBN-13: 978-0-8142-1170-0 (cloth : alk. paper) ISBN-10: 0-8142-1170-4 (cloth : alk. paper) ISBN-13: 978-0-8142-9271-6 (cd-rom) 1. Classical literature—History and criticism. 2. Literature and anthropology—Greece. 3. Literature and anthropology—Rome. 4. Hermes (Greek deity) in literature. I. Short, William Michael, 1977– II. Title. PA3009.B4813 2011 937—dc23 2011015908 This book is available in the following editions: Cloth (ISBN 978-0-8142-1170-0) CD-ROM (ISBN 978-0-8142-9271-6) Cover design by AuthorSupport.com Text design by Juliet Williams Type set in Adobe Garamond Pro Printed by Thomson-Shore, Inc. The paper used in this publication meets the minimum requirements of the American Na- tional Standard for Information Sciences—Permanence of Paper for Printed Library Materials. ANSI Z39.48–1992. 9 8 7 6 5 4 3 2 1 CONTENTS Translator’s Preface vii Author’s Preface and Acknowledgments xi Part 1. Mythology Chapter 1 Hermes’ Ears: Places and Symbols of Communication in Ancient Culture 3 Chapter 2 Brutus the Fool 40 Part 2. -

Last Name First Name Middle Name City State NPI Amount AARONS

Last Name First Name Middle Name City State NPI Amount AARONS SCOTT PAUL BAYTOWN TX 1841386919 14.64 AARONSON BETH DANBURY CT 1417991456 17.18 ABANG ANTHONY E ELIZABETHTOWN KY 1548250525 15.7 ABBAS HUMAYUN MODESTO CA 1336136548 14.01 ABBAS JALAL M SURPRISE AZ 1205895034 11.55 ABBASINEJAD MEISHA KAMA FAYETTEVILLE NC 1982646352 41.81 ABBEY DAVID MICHAEL FORT COLLINS CO 1568483196 26.17 ABBOTT JOHN THOMAS FAYETTEVILLE GA 1861679805 17.67 ABBOTT LISA G RENO NV 1609883701 6833.69 ABDEL HALIM AYMAN MOHAMED FORT WORTH TX 1093806697 14.23 ABDELHADY MAZEN DETROIT MI 1669771507 36.69 ABDELMESSIH MOURAD NEWARK OH 1184628950 51.33 ABDELMESSIH NIVEEN K GLENDALE CA 1922071059 17.54 ABDELSAYED GEORGE LOS ANGELES CA 1568721843 5600 ABDULIAN MICHAEL H LOS ANGELES CA 1649469628 12.66 ABDULLAH AZRA INDIANAPOLIS IN 1063468916 11.96 ABDULLAH GHAZANFAR SYED BRONX NY 1639108137 18.18 ABDULMASSIH ABDULMASSIH SKOKIE IL 1629045778 10.49 ABDUS-SALAAM SHARIF ASHANTI MEMPHIS TN 1134386592 125 ABDY VICTOR A WAYNE NJ 1164446795 11.47 ABEDMAHMOUD ISSA HERRIN IL 1528042975 25.34 ABELES ARYEH M. MERIDEN CT 1285737155 45.52 ABELES MICHA MERIDEN CT 1497751556 45.52 ABELL BRIAN E AUGUSTA GA 1215081534 18.43 ABERNATHY BRETT B. DENVER CO 1437106028 32.51 ABIDI SAIYID MANZOOR MAPLE SHADE NJ 1508816729 101.65 ABOUHOSSEIN AHMAD DAYTON OH 1487693156 56.07 ABOUMATAR SAMI MOHAMAD AUSTIN TX 1760445407 19.48 ABRAHAM BACHU MOUNT PLEASANT MI 1225045024 10.19 ABRAHAM ROBERT JONESBORO AR 1780641563 15.63 ABRAHAM SUNIL VARKEY SCHENECTADY NY 1801080890 37.03 ABRAHAM WILLIAM L TUCSON AZ -

NAME ADMISSION DATE BAR NUMBER Aamoth, Robert J. 8/26

NAME ADMISSION DATE BAR NUMBER Aamoth, Robert J. 8/26/1999 1072895 Aaron, Alan Hal 1/7/1974 55136 Aaron, Jerome 6/5/1981 31163 Abadia-Munoz, Maressa 11/5/1997 48342 Abarbanel, Stephen J. 3/12/1980 55139 Abarca Schwartz, Ramon J. 2/6/1987 6133 Abbene, Maris Louise 3/11/1988 6912 Abbott, John L. 1/7/1980 55140 Abbott, John W. 2/8/1991 9064 Abbott, Ralph F. 5/4/1978 25924 Abbott, Richard 3/8/1984 21954 Abbott, W. Kirk 12/5/1989 38225 Abdelahad, Arthur Anthony 9/14/1983 55142 Abelman, David 2/6/1986 40436 Abelson, Henry Edward 8/8/1984 55143 Abernathy, Michael J. 10/1/1982 22621 Abilheira, Louis B. 1/9/1996 35487 Abraham, Nicholas A. 11/2/1971 55144 Abrahams, Linda E. 9/9/1986 5569 Abrahamsen, Robert Martin 1/8/1998 48987 Abrams, Floyd 9/6/1972 43052 Abrams, Fred L. 3/6/1997 44466 Abrams, Janet 4/9/1992 18103 Abrams, Richard Bruce Miller 1/7/1982 55260 Abrams, Robert G. 11/6/1979 27711 Abramson, Gilbert B. 9/10/1980 58074 Abramson, Mark A. 11/8/1979 35218 Abrashkin, William H. 3/8/1983 1104919 Abren Sarkis, Nadya 2/6/1987 6134 Abreu Elias, Luis F. 11/18/1971 49258 Abreu Sarkis, Nadya 2/6/1987 58292 Abreu-Garcia, Elsa M. 3/4/1999 62924 Abromovitz, Joseph G. 3/5/1979 22059 Abromowitz, David M. 1/6/1984 55261 Abruzzese, Thomas E. 8/3/1989 7936 Acaron Benn, Noemi E. 3/10/1994 29157 Acaron Montalvo, Oscar 3/2/1989 7692 Accetta, Barbara S. -

The Werewolf in Lore and Legend Plate I

Montague Summers The Werewolf IN Lore and Legend Plate I THE WARLOCKERS’ METAMORPHOSIS By Goya THE WEREWOLF In Lore and Legend Montague Summers Intrabunt lupi rapaces in uos, non parcentes gregi. Actus Apostolorum, XX, 29. DOVER PUBLICATIONS, INC. Mineola New York Bibliographical Note The Werewolf in Lore and Legend, first published in 2003, is an unabridged republication of the work originally published in 1933 by Kegan Paul, Trench, Trubner & Co., Ltd., London, under the title The Werewolf. Library ofCongress Cataloging-in-Publication Data Summers, Montague, 1880-1948. [Werewolf] The werewolf in lore and legend / Montague Summers, p. cm. Originally published: The werewolf. London : K. Paul, Trench, Trubner, 1933. Includes bibliographical references and index. ISBN 0-486-43090-1 (pbk.) 1. Werewolves. I. Title. GR830.W4S8 2003 398'.45—dc22 2003063519 Manufactured in the United States of America Dover Publications, Inc., 3 1 East 2nd Street, Mineola, N.Y. 11501 CONTENTS I. The Werewolf: Lycanthropy II. The Werewolf: His Science and Practice III. The Werewolf in Greece and Italy, Spain and Portugal IV. The Werewolf in England and Wales, Scotland and Ireland V. The Werewolf in France VI. The Werewolf in the North, in Russia and Germany A Note on the Werewolf in Literature Bibliography Witch Ointments. By Dr. H. J. Norman Index LIST OF ILLUSTRATIONS I. The Warlocks’ Metamorphosis. By Goya. Formerly in the Collection of the Duke d’Osuna II. A Werewolf Attacks a Man. From Die Emeis of Johann Geiler von Kaisersberg III. The Transvection of Witches. From Ulrich Molitor’s De Lamiis IV. The Wild Beast of the Gevaudan. -

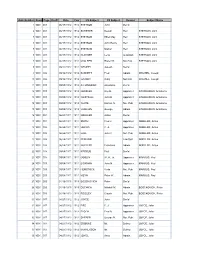

Auto Number Book Page Doc# Date Year LN Subject FN Subject Reason Subject Name 1 1001 001 06/17/1912 1912 STETSON John Dec'd

Auto Number Book Page Doc# Date Year LN Subject FN Subject Reason Subject Name 1 1001 001 06/17/1912 1912 STETSON John Dec'd 2 1001 001 06/17/1912 1912 SCHERER Beulah Heir STETSON, John 3 1001 001 06/17/1912 1912 STETSON Ethel May Heir STETSON, John 4 1001 001 06/17/1912 1912 STETSON John Henry Heir STETSON, John 5 1001 001 06/17/1912 1912 STETSON Marion Heir STETSON, John 6 1001 001 06/17/1912 1912 KLASNER Lena Guardian STETSON, John 7 1001 001 06/17/1912 1912 McALEER Robert B. Not.Pub. STETSON, John 8 1001 002 09/12/1912 1912 WRUHEL Joseph Dec'd 9 1001 002 09/12/1912 1912 BARNETT Fred Admin. WRUHEL, Joseph 10 1001 002 09/12/1912 1912 GADSKY Ruby Not.Pub WRUHEL, Joseph 11 1001 003 09/09/1912 1912 ATHANASIAN Anastacio Dec'd 12 1001 003 09/09/1912 1912 RESSLER Roy E. Appraiser ATHANASIAN, Anastacio 13 1001 003 09/09/1912 1912 WESTFALL John E. Appraiser ATHANASIAN, Anastacio 14 1001 003 09/09/1912 1912 WHITE Emmet N. Not. Pub ATHANASIAN, Anastacio 15 1001 003 09/09/1912 1912 VASILION George Admin. ATHANASIAN, Anastacio 16 1001 004 06/24/1911 1911 NOELLER Anton Dec'd 17 1001 004 06/24/1911 1911 SMITH Fred J. Appraiser NOELLER, Anton 18 1001 004 06/24/1911 1911 HELVIG C. A. Appraiser NOELLER, Anton 19 1001 004 06/24/1911 1911 HALL John C. Not. Pub NOELLER, Anton 20 1001 004 06/24/1911 1911 PENN.RR Law Suit NOELLER, Anton 21 1001 004 06/24/1911 1911 NOELLER Franciska Admin. -

Congregation Gates of Prayer

Congregation Gates of Prayer 4000 West Esplanade Ave., Metairie, LA 70002 www.gatesofprayer.org (504) 885-2600 Volume 52 No. 1 Tammuz/Av 5778 July 2018 Summer am writing this first bulletin article on a laptop in a Worship Inew house, in a new city, surrounded by seemingly endless boxes that are yet to be unpacked. As we are in the middle of a life-changing move, Jewish communities all over the world are in the middle of reading the Book New Orleans Reform of Numbers, or in Hebrew--Bamidbar. Bamidbar doesn’t actually mean “numbers.” It is a Hebrew word that Community Shabbat means “in the wilderness.” When you think about it, the entire Torah could Worship will be held at be titled “Bamidbar.” Despite a clear focus on the Promised Land, nearly Touro Synagogue during the the entire Torah takes place either in the desert or in Egypt. “Bamidbar” month of July. could also be a great title for the history of the Jewish people. Of the Friday night services will be 5778 years of our history, fewer than half have actually been spent in the at 6:00 pm and Promised Land. Saturday morning services While it may seem unfortunate that at times we have gone millenia will be at 10:30 am. without control or access to our homeland, it is actually the secret to our longevity and continued survival. Gates of Prayer will host It wasn’t until we were in the Sinai Desert for forty years following the August Worship. Our first Exodus from Egypt, that God gave us the Torah. -

University Microfilms 300 North Zeeb Road Ann Arbor, Michigan 46106 a Xarox Education Company WALTERS, Everett Garrison 1944- ION C

INFORMATION TO USERS This dissertation was produced from a microfilm copy of the original document. While the most advanced technological means to photograph and reproduce this document have been used, the quality is heavily dependent upon the quality of the original submitted. The following explanation of techniques is provided to help you understand markings or patterns which may appear on this reproduction. 1. The sign or "target" for pages apparently lacking from the document photographed is "Missing Page(s)". If it was possible to obtain the missing page(s) or section, they are spliced into the film along with adjacent pages. This may have necessitated cutting thru an image and duplicating adjacent pages to insure you complete continuity. 2. When an image on the film is obliterated with a large round black mark, it is an indication that the photographer suspected that the copy may have moved during exposure and thus cause a blurred image. You will find a good image of the page in the adjacent frame. 3. When a map, drawing or chart, etc., was part of the material being photographed the photographer followed a definite method in "sectioning" the material. It is customary to begin photoing at the upper left hand corner of a large sheet and to continue photoing from left to right in equal sections with a small overlap. If necessary, sectioning is continued again — beginning below the first row and continuing on until complete. 4. The majority of users indicate that the textual content is of greatest value, however, a somewhat higher quality reproduction could be made from "photographs" if essential to the understanding of the dissertation. -

Index to the Case Files of the AJDC Emigration Service, Prague Office, 1945-1950

Index to the Case Files of the AJDC Emigration Service, Prague Office, 1945-1950 This index provides the names of clients served by the AJDC Emigration Service in Czechoslovakia in the years immediately following the end of World War II. It represents the contents of boxes 1-191 of the AJDC Prague Office Collection, held at the Institute for the Study of Totalitarian Regimes, Prague. The JDC Archives received a set of digital files of this collection in 2019 via the U.S. Holocaust Memorial Museum with the Institute’s agreement. The index was created thanks to a group of JDC Archives Indexing Project volunteers and staff. Users of this index are encouraged to try alternate spellings for names (e.g., Ackerman/Ackermann; Lowy/Loewy; Schwartz/Schwarz/Swarc/Swarz). Note that women’s surnames may or may not include the suffix -ova. The “find” feature (PC: ctrl+F; Mac: command+F) may be used to search for names listed in the Additional Name(s) column that may be separated from their alphabetical order. As case files contain private personal information, they are not open to the public. However, family members may request copies of the documents via our online Request Information form. Client Name Additional Name(s) Folder Client Name Additional Name(s) Folder Abeles, Bedrich Marie Abeles, Jiri Abeles 191_04 Abrahamova, 4_56 Abeles, Bedrich 191_10 Veronika Abrahamovic, David Ruzena Abrahamovic, Arnost 5_02 Abeles, Ernest Regina Abeles 4_13 Abrahamovic Abeles, Karel 1_02 Abeles, Kurt 1_03 Abrahamovic, Evzen 1_17 Abeles, Kurt Alice Abeles, Edith -

Bibliography on Corruption and Anticorruption Professor Matthew C

Bibliography on Corruption and Anticorruption Professor Matthew C. Stephenson Harvard Law School http://www.law.harvard.edu/faculty/mstephenson/ January 2021 Aaken, A., & Voigt, S. (2011). Do individual disclosure rules for parliamentarians improve government effectiveness? Economics of Governance, 12(4), 301–324. https://doi.org/10.1007/s10101-011-0100-8 Aalberts, R. J., & Jennings, M. M. (1999). The Ethics of Slotting: Is this Bribery, Facilitation Marketing or Just Plain Competition? Journal of Business Ethics, 20(3), 207–215. https://doi.org/10.1023/A:1006081311334 Aaronson, S. A. (2011a). Does the WTO Help Member States Clean Up? Available at SSRN 1922190. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1922190 Aaronson, S. A. (2011b). Limited partnership: Business, government, civil society, and the public in the Extractive Industries Transparency Initiative (EITI). Public Administration and Development, 31(1), 50–63. https://doi.org/10.1002/pad.588 Aaronson, S. A., & Abouharb, M. R. (2014). Corruption, Conflicts of Interest and the WTO. In J.-B. Auby, E. Breen, & T. Perroud (Eds.), Corruption and conflicts of interest: A comparative law approach (pp. 183–197). Edward Elgar PubLtd. http://nrs.harvard.edu/urn-3:hul.ebookbatch.GEN_batch:ELGAR01620140507 Ab Lo, A. (2019). Actors, networks and assemblages: Local content, corruption and the politics of SME’s participation in Ghana’s oil and gas industry. International Development Planning Review, 41(2), 193–214. https://doi.org/10.3828/idpr.2018.33 Abada, I., & Ngwu, E. (2019). Corruption, governance, and Nigeria’s uncivil society, 1999-2016. Análise Social, 54(231), 386–408. https://doi.org/10.31447/AS00032573.2019231.07 Abalo, E. -

Newsletter: New Records in the Getty Vocabularies

Newsletter: New records in the Getty Vocabularies For the period January-June 2021 From the Getty Vocabulary Program, we send greetings and are hopeful that you are well. Here in Los Angeles, we are beginning to come back to the Getty offices slowly, after many months working from home. After our work-from-home period, we happily find ourselves at a significant milestone: We have essentially cleared out hundreds of thousands of backlogged contributions to the Vocabularies! With consultants at Ontotext and our colleagues at Getty Digital for technical support, the Vocabulary Program editors focused on pre-processing data in Excel and in Open Refine (https://www.getty.edu/research/tools/vocabularies/obtain/openrefine.html). Details about new data loads to each Vocabulary appear below. While we have had a moratorium on new contributions while working on the backlog, we may now begin to accept proposals for new contributions. Learn about the Letter of Agreement, the scope of each Vocabulary, and procedures for proposing contributions here: https://www.getty.edu/research/tools/vocabularies/contribute.html A primary goal is to make the Getty Vocabularies ever more multicultural, multilingual, and inclusive. We have undertaken a study to identify content lacunae in the Vocabularies, which we will target according to our strategic plan in the coming months. Our user statistics have remained consistently high during this period, making the Getty Vocabularies (https://www.getty.edu/research/tools/vocabularies/index.html) the most used resources on the GRI site. Total searches in FY21, July 2020-June 2021: Q1:566,228, Q2:360,194; Q3 616,048; Q4:612,074 Use of the APIs, LOD, Relational Tables, and XML formats was also high during this period. -

Madoff Affidavit Exhibits SEND for Attorneys 02-03-09.Xlsx

EXHIBIT A Customers A-1 Customers LINE1 LINE2 LINE3 LINE4 LINE5 LINE6 1000 CONNECTICUT AVE ASSOC 1919 M STREET NW #320 WASHINGTON, DC 20036 151797 CANADA INC C/O JUDY PENCER 10 BELLAIR ST, SOUTH PENTHOUSE TORONTO ONTARIO CANADA M5R3T8 1620 K STREET ASSOCIATES LIMITED PARTNER C/O CHARLES E SMITH MANAGEMENT 2345 CRYSTAL DRIVE ARLINGTON, VA 22202 1700 K STREET ASSOCIATES LLC 1919 M STREET NW #320 WASHINGTON, DC 20036 1776 K STREET ASSOC LTD PTR C/O CHARLES E SMITH MGMT INC 2345 CRYSTAL DRIVE ARLINGTON, VA 22202 1919 M STREET ASSOCIATES LP 1919 M STREET NW #320 WASHINGTON, DC 20036 1973 MASTERS VACATION FUND C/O DAVID FRIEHLING FOUR HIGH TOR ROAD NEW CITY, NY 10956 1973 MASTERS VACATION FUND C/O JEROME HOROWITZ 17395 BRIDLEWAY TRAIL BOCA RATON, FL 33496 1987 JIH DECENDENT TRUST #2 NEWTON N MINOW TRUSTEE 200 WEST MADISON SUITE #3800 CHICAGO, IL 60606 1987 JIH DESCENDENTS TRUST #3 DAVID MOORE & DANIEL TISCH TTE ATTN: TERRY LAHENS 220 SUNRISE AVENUE SUITE 210 PALM BEACH, FL 33480 1994 BERNHARD FAMILY PTNRSHIP ATTN: LORA BURGESS C/O KERKERING BARBERIO CPA'S 1990 MAIN STREET SUITE 801 SARASOTA, FL 34236 1994 TRUST FOR THE CHILDREN OF STANLEY AND PAMELA CHAIS AL ANGEL & MARK CHAIS TRUSTEE 4 ROCKY WAY LLEWELLYN PARK WEST ORANGE, NJ 07052 1996 TRUST FOR THE BENEFIT OF THE ISSUE OF ROBIN L SAND C/O DAVID LANCE JR 219 SOUTH STREET NEW PROVIDENCE, NJ 07974 1998 CLUB STEIN FAMILY PARTNERSHIP C/O DONALD O STEIN 100 RING ROAD WEST GARDEN CITY, NY 11530 1999 NADLER FAMILY TRUST EDITH L NADLER AND SIDNEY KAPLAN TSTEES 408 WILSHIRE WALK HOPKINS, MN 55305