HVS Asia-Pacific Hotel Operator Guide 2014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

HVS Asia-Pacific Hotel Operator Guide Excerpt 2016

2016 EDITION | Price US$800 SUMMARY THE ANNUAL HVS ASIA-PACIFIC HOTEL OPERATOR GUIDE (AS OF 31 DECEMBER 2015) Setthawat Hetrakul Assistant Manager Daniel J Voellm Managing Partner HVS.com HVS | Level 21, The Centre, 99 Queen’s Road Central, Hong Kong The HVS Asia-Pacific Hotel Operator Guide 2016 Foreword It is with great pleasure that I share with you our third annual Asia-Pacific Operator Guide, data as of 31 December 2015. This third edition will continue to serve owners as a reference for which operator has a strong presence in their home market and in potential future markets further ashore as well as key feeder markets across the region. With China rapidly becoming a strong outbound market, brands and operators that are well positioned there are better positioned to welcome Chinese travelers overseas. Branding, anchored by the management expertise and distribution power that operators bring to a hotel property, is becoming more and more critical. In the face of increasing competition, non-branded properties often perform at a discount to their branded peers due to lack of awareness and quality assurance. Running a hotel is no easy task and owners have a tendency to view operators’ fees as unjustified for the value they deliver. It is essential that owner and operator align their interest from very early in the process and work towards a common goal, rather than start their long-term relationship from conflicting standpoints. In this third edition, we have captured close to one million existing and more than half a million pipeline rooms spread over 6,546 properties. -

For Immediate Release WHARF HOTELS FURTHER

For Immediate Release WHARF HOTELS FURTHER STRENGTHENS OPERATIONS AND SALES & MARKETING DIVISIONS WITH APPOINTMENTS OF NEW TEAM MEMBERS Hong Kong SAR, China, 6 July, 2021 – Wharf Hotels today announced that it has appointed Simon Chan as Group Director Technical Service, Antony Wong as Group Director Rooms, and on the Sales and Marketing side – Ilona Yim as Group Director Branding and Communications. The three directors, complement a robust and diverse team of hospitality professionals at the Hong Kong headquartered Wharf Hotels, and, will notably provide strategic guidance to their respective teams to support the group’s 17 Marco Polo Hotels and Niccolo Hotels across Hong Kong, Mainland China and the Philippines. Simon Chan, Group Director Technical Service Simon Chan’s experience as an engineering specialist spans over 20 years. He will be responsible for implementing and executing maintenance strategies and policies to comply with international safety, quality and environmental aspects at each of the Marco Polo Hotels and Niccolo Hotels. Reporting to Thomas Salg, Vice President Operations, Simon will manage a hands-on team to oversee high level technical issues. Prior to joining Wharf Hotels, Simon served at Synergis Management Services Limited. He also previously held a number of leadership roles at property developers, property management companies and hotels, directing new project installation works and operation service contracts for the Hong Kong Jockey Club, ITC Properties Group Limited, as well as other commercial developments in Shanghai and Hong Kong. Antony Wong, Group Director Rooms In Antony Wong’s new role which also reports to Thomas Salg, Vice President Operations, he will lead Wharf Hotel’s rooms division, focusing on operations, brand standards and initiating strategies and programmes to enhance service quality and operations excellence. -

TRAMS Master Vendor ID List 2/27/2007 Air Interface ID Travel

2/27/2007 TRAMS Master Vendor ID List Air Name Airline No. Travel Category Vendor Id Profile No. Interface ID Abx Air 832 Air 2001 5 GB Action Airlines 410 Air 2002 6 XQ Ada Air 121 Air 2003 7 ZY Adria Airways 165 Air 2004 8 JP Aer Arann Teo 684 Air 2005 9 RE Aer Lingus P.l.c. 53 Air 2006 10 EI Aero Asia International (private) Ltd. 532 Air 2007 11 E4 Aero California 78 Air 2008 12 JR Aero Costa Rica Acori S.a. 802 Air 2009 13 ML Aero Lloyd Flugreisen Gmbh And Co. Luftv 633 Air 2010 14 YP Aerocaribe 723 Air 2011 15 QA Aerochago Airlines S.a. 198 Air 2012 16 G3 Aeroejecutivo S.a. De C.v. 456 Air 2013 17 SX Aeroflot-russian International Airlines 555 Air 2014 18 SU Aerolineas Argentinas 44 Air 2015 19 AR Aerolineas Centrales De Colombia (aces) 137 Air 2016 20 VX Aerolineas Dominicanas S.a. (dominair) 725 Air 2017 21 YU Aerolineas Internacionales S.a. De C.v. 440 Air 2018 22 N2 Aeromar C. Por. A. 926 Air 2019 23 BQ Aeromexico-aerovias De Mexico S.a. De C. 139 Air 2020 24 AM Aeromonterrey S.a. De C.v. 722 Air 2021 25 7M Aeroperlas 828 Air 2022 26 WL Aeroperu - Empresa De Transportes Aereos 210 Air 2023 27 PL Aeroservicios Ecuatorianos C.a. 746 Air 2024 28 2A Aerotransportes Mas De Carga S.a. De C. 865 Air 2025 29 MY Aerovias Colombianas Ltd. (arca) 158 Air 2026 30 ZU Aerovias Venezolanas S.a. -

SK MENLH No. 349 Tentang Hasil Penilaian PROPER 2013

SALINAN KEPUTUSAN MENTERI LINGKUNGAN HIDUP REPUBLIK INDONESIA NOMOR 349 TAHUN 2013 TENTANG HASIL PENILAIAN PERINGKAT KINERJA PERUSAHAAN DALAM PENGELOLAAN LINGKUNGAN HIDUP TAHUN 2012-2013 DENGAN RAHMAT TUHAN YANG MAHA ESA MENTERI LINGKUNGAN HIDUP REPUBLIK INDONESIA, Menimbang : a. bahwa berdasarkan ketentuan Pasal 43 ayat (3) huruf h dan Pasal 63 ayat (1) huruf w Undang Undang Nomor 32 Tahun 2009 tentang Perlindungan dan Pengelolaan Lingkungan Hidup, Menteri Lingkungan Hidup berkewajiban dan berwenang untuk memberikan penghargaan kinerja di bidang perlindungan dan pengelolaan lingkungan hidup; b. bahwa sesuai hasil penilaian dan evaluasi Tim Teknis Proper, serta saran masukan dari Dewan Pertimbangan Proper yang didasarkan pada kriteria Proper sebagaimana diatur dalam Peraturan Menteri Lingkungan Hidup Nomor 06 Tahun 2013 tentang Program Penilaian Peringkat Kinerja Perusahaan Dalam Pengelolaan Lingkungan Hidup, perlu ditetapkan peringkat kinerja perusahaan dalam pengelolaan lingkungan hidupwww.benefita.com Tahun 2012-2013; c. bahwa berdasarkan pertimbangan sebagaimana dimaksud dalam huruf a dan huruf b, perlu menetapkan Keputusan Menteri Lingkungan Hidup tentang Hasil Penilaian Peringkat Kinerja Perusahaan Dalam Pengelolaan Lingkungan Hidup Tahun 2012-2013; Mengingat : 1. Undang-Undang Nomor 32 Tahun 2009 tentang Perlindungan dan Pengelolaan Lingkungan Hidup (Lembaran Negara Republik Indonesia Tahun 2009 Nomor 140, Tambahan Lembaran Negara Republik Indonesia Nomor 5059); 2. Peraturan Presiden Nomor 47 Tahun 2009 tentang Pembentukan dan Organisasi Kementerian Negara sebagaimana telah beberapa kali diubah terakhir dengan Peraturan Presiden Nomor 91 Tahun 2011 (Lembaran Negara Republik Indonesia Tahun 2011 Nomor 141); 3. Peraturan Presiden Nomor 24 Tahun 2010 tentang Kedudukan, Tugas, dan Fungsi Kementerian Negara serta Susunan Organisasi, Tugas, dan 1 Fungsi Eselon I Kementerian Negara sebagaimana telah beberapa kali diubah terakhir dengan Peraturan Presiden Nomor 92 Tahun 2011 (Lembaran Negara Republik Indonesia Tahun 2011 Nomor 142); 4. -

Equipment Updates

ASIAN HOTEL & CATERING ASIAN TIMES HOTEL & CATERING PUBLISHED SINCE 1976 Vol 44 April 2016 EQUIPMENT UPDATES What’s hottest F&B PRODUCTS The movers & shakers V OL Hong Kong SAR HK$50 HOSPITALITY 44 April 2016 China RMB50 Singapore S$15 Malaysia RM30 JOB HUNT Thailand Bt300 Rest of Asia US$10 Mobility a must A Vitamix Aha: durability, durability, durability. Its unmatched durability makes Vitamix the industry’s most reliable blender. It’s specially engineered to reduce prep time and improve efficiency— blend after blend after blend. Vitamix. Engineered to change your life. Let us help your business at vitamix.com/commercial. 160366_COM_ASIAN_HOTEL_APR_210x297mm_v1.indd 1 3/10/16 11:56 AM 160366 Vitamix (Commercial) – “Shrimp” – Asian Hotel – April FP ad App: InDesign CC Trim: 210mm (w) x 297mm (h) Pubs: AH&CT Artist: rr Live: not provided Proof #: 1 Bleed: 216mm (w) x 303mm (h) Scale: 100% Color: 4/C Fonts: Gotham pril is always a big month for AHCT! An important time of year for the MANAGING EDITOR Zara Horner hospitality sector and its suppliers, this month the region’s most trusted [email protected] source of industry news is ‘chockablock’ with all the latest research, updates, Art DIRECtor upgrades, launches, innovations, ideas, predictions and information. In Hatsada Tirawutsakul today’s global employment market, how the hospitality industry is tackling COORDINAtor the issues facing recruitment and retention is on page 22 and we discuss the pressure on Wajiraprakan Punyajai Ahoteliers to perform as intensified competition reaches all aspects of an operation. Singapore st CONTRIBUtorS has moved into its 51 year and the hotel industry there is growing robustly, but there’s a Dan Creffield, Michelle Farquhar, noticeable slowdown in manpower growth, and experts are warning there needs to be a Donald Gasper, Robin Lynam, shift towards a more sustainable growth model that is less reliant on additional labour (page Gigi Onag, Jane Ram, Vicki Williams 26). -

For Immediate Release HERITAGE TOURISM BRANDS

For Immediate Release HERITAGE TOURISM BRANDS LAUNCH “OUR HOME” HONG KONG PROMOTIONAL VIDEO - Featuring the song “Touch of Love” performed by Jacky Cheung 8 May 2020 (Hong Kong SAR, China) - The Heritage Tourism Brands group, comprising Hong Kong-based luxury hotel brands including Harilela Hotels, The Langham Hotels & Resorts, Mandarin Oriental Hotel Group, Shangri-La Hotels & Resorts, Swire Hotels, The Peninsula Hotels, and Wharf Hotels, has launched a promotional video to showcase the beauty and diversity of Hong Kong as it emerges from the coronavirus crisis. “Our group, which also includes Cathay Pacific, decided to come together at a time of unprecedented crisis for the travel industry in Hong Kong in the second half of 2019,” said Dr Jennifer Cronin, President of Wharf Hotels and Chair of Heritage Tourism Brands. “We all come from different backgrounds, but we are all hoteliers who share a great love and passion for Hong Kong. It is our desire to do whatever is in our power to revive Hong Kong tourism, at home and overseas at the appropriate time and when people feel safe again. We felt it was time to take fast action, not as competitors, but as a joint force in the private sector, with a common objective which is to restore confidence in the vibrancy and stability of our home, Hong Kong. Now, as we emerge from COVID-19, this objective is even more relevant,” said Dr Cronin. As a first step, the group is launching a video to inspire local Hong Kong people with the objective of showcasing the city in all its beauty and diversity, to encourage people to enjoy their home and appreciate what makes it unique. -

2017Abc Premier Hotel Program

2017 ABC PREMIER HOTEL PROGRAMTM Including: 2017 Participating Hotel Chains | Premier Privileges - Corporate Luxury Program Block Space Program | Loyalty Guide Swissôtel The Stamford The Plaza, New York Singapore Feel Welcome From the elegance of to the legendary opulence of New York’s The Plaza to the magnificent, Swissôtel The Stamford in Singapore, our iconic properties provide unparalleled luxury and superlative service in some of the world’s most celebrated destinations. For reservations, please book your ABC rate code. GDS chain code FW For more information, please visit www.AccorHotels.com Welcome TO THE 2017 ABC PREMIER HOTEL PROGRAM We are pleased to present the 2017 ABC Premier Hotel Program. Our unique program already is the broadest in the industry, but this year it is bigger than ever. Our global hotel network covers 8,800 cities in 163 countries, including 381 participating hotel chains and thousands of independent properties. ABC’s Premier Hotel Program offers more than just volume. Our hotel team has structured programs that equip you to provide value to your clients. More than half of the participating hotels are in our Better Than BAR program, providing a discount off the best available rate when you book using the ABC rate code. Premier Privileges, our corporate luxury program, connects you with over 520 participating 4- and 5-star properties offering high-touch services and amenities to meet the needs of your most demanding corporate and VIP travelers. The Premier Block Space program includes contracted inventory in 173 major business markets, setting aside rooms so you can book them for your clients in sold-out situations. -

CHANGE YOUR WORLD 2021 with Australia’S Best Hotel School (QILT, SES, 2019/18) Ichm.Edu.Au 1 ADELAIDE, One of the World’S 10 Most Liveable Cities

Bachelor of Business (Hospitality Management) Master of International Hotel Management CHANGE YOUR WORLD 2021 With Australia’s Best Hotel School (QILT, SES, 2019/18) ichm.edu.au 1 ADELAIDE, One of the world’s 10 most liveable cities. SA (Economist Intelligence Unit, 2019) AUTUMN March - May WINTER June - August A City Designed For Life SPRING September - November SUMMER December - February ICHM is located in Adelaide, which is routinely voted by the Australia) outdoor eating and a great lifestyle – it is an ideal Economist Intelligence Unit as one of the World’s top ten most place to come and learn the art of hospitality. The city is liveable cities*. With a population of just over 1.3 million people, surrounded by parklands and sandwiched between white sandy Adelaide is the capital city of South Australia and considered to beaches to the west and hills 20 minutes to the east. be the lifestyle capital of Australia. Students will find Adelaide safe, friendly, welcoming and easy Adelaide has world-class art and music and a festival calendar to find their way around. Small enough to provide an ideal study to rival or better that of any other Australian city. environment, but when you’re not studying Adelaide offers all Adelaide also has a reputation as a city of restaurants, quality the attractions of cinemas, restaurants, nightlife, shopping and wine (70% of Australia’s export wine comes from South sightseeing to keep you well entertained. Photo By: Che Chorley 2 ichm.edu.au CONTENTS CHANGE YOUR WORLD HOW TO APPLY 2 ICHM – International -

HVS Asia-Pacific Hotel Operator Guide 2014

2014 EDITION | Price US$1,500 – EXCERPT – THE ANNUAL HVS HOTEL OPERATOR GUIDE ASIA-PACIFIC Setthawat Hetrakul Analyst PuReaNae Jang Senior Analyst Daniel J Voellm Managing Partner PuReaNae Jang 张青川 Analyst 分析师 Daniel J Voellm 丹尼尔•沃伦 Managing Director 董事总经理 HVS .COM HVS | Level 21, The Centre, 99 Queen’s Road Central, Hong Kong The HVS Asia-Pacific Hotel Operator Guide 2014 Foreword It is with great pleasure that I share with you our first annual Asia-Pacific Operator Guide. With the support of many industry participants and after countless working hours, this new benchmarking tool of hotel operator and brand presence is finally released. The report also provides valuable insights into the largest markets and countries with the strongest brand representation. Branding, anchored by the management expertise and distribution power that operators bring to a hotel property, is becoming more and more critical. In the face of increasing competition, non-branded properties often perform at a discount to their branded peers due to lack of awareness and quality assurance. Running a hotel is no easy task and owners have a tendency to view operators’ fees as unjustified for the value they deliver. It is essential that owner and operator align their interest from very early in the process and work towards a common goal, rather than start their long-term relationship from conflicting standpoints. In this first edition, we have captured more than 1.1 million existing and pipeline rooms spread over 4,743 properties. We have only included properties from operators and brands that were willing to contribute to our research. -

Hospitality Industry Hospitality Changing Needs, Changing Times S$15 RM30 Bt300 US$10 HK$50 RMB50

ASIAN HOTEL & CATERING TIMES ASIAN HOTEL & CATERING PUBLISHED SINCE 1976 Volume 42 • Issue 10 • December 2017 MARKET REPORT India in focus DRINK Pouring bubbly TECHNOLOGY Point of sales CHOCOLATE Volume 42 Volume Enduring magic • Issue 10 Hong Kong SAR HK$50 • December 2017 China RMB50 Singapore S$15 HOSPITALITY INDUSTRY Malaysia RM30 Thailand Bt300 Rest of Asia US$10 Changing needs, changing times EDITOR’S NOTE MANAGING EDITOR he hospitality industry is on a learning curve of sorts. Hotels Neetinder Dhillon [email protected] are having to do a quick two step to catch up with the rapidly advancing technology and the increasingly Gen Y workforce Art DIRECtor which consumes and interacts with technology in remarkedly Hatsada Tirawutsakul different ways. While nothing has changed in the core COORDINAtor requirements of a hotel – front desk operations, housekeeping, restaurant Wajiraprakan Punyajai operationsT – the way these operations are carried out require a whole new set CONTRIBUtorS of skills. Modern training practices have been developed to incorporate the Donald Gasper, Zara Horner, all-pervasive role of technology, which is calling the shots. We discuss this with Rebecca Lo, Jane Ram, Michael Taylor, Vicki Williams experts on page 8. While on technology, AHCT takes a look at the latest in Point of ADVertISING SALES MANAGER Virat Schlumberger Sales systems that are transforming food and beverage operations in ways [email protected] unimaginable with the move to the cloud becoming inevitable – a matter of PRODUCTION MANAGER when and not, if. To get up to speed, turn to page 20. Kanda Thanakornwongskul As ‘tis the season to be merry’ everyone in the hospitality industry is gearing up to uncork phenomenal quantities of Champagne – after all no celebration CIRCULATION Yupadee Saebea is complete without it. -

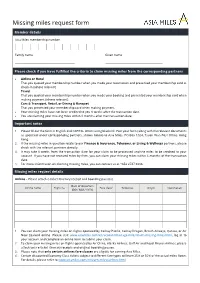

Missing Miles Request Form

Missing miles request form Member details Asia Miles membership number Family name Given name ____________________________________________ __________________________________________ Please check if you have fulfilled the criteria to claim missing miles from the corresponding partners Airline or Hotel That you quoted your membership number when you made your reservation and presented your membership card at check-in (where relevant). Travel That you quoted your membership number when you made your booking and presented your membership card when making payment (where relevant). Cars & Transport, Retail, or Dining & Banquet That you presented your membership card when making payment. Your missing miles have not been credited to you 8 weeks after the transaction date. You are claiming your missing miles within 6 months after the transaction date. Important notes 1. Please fill out the form in English and CAPITAL letters using black ink. Post your form (along with the relevant documents as specified under corresponding partners, shown below) to Asia Miles, PO Box 1024, Tsuen Wan Post Office, Hong Kong. 2. If the missing miles in question relate to our Finance & Insurance, Telecoms, or Living & Wellness partners, please check with the relevant partners directly. 3. It may take 8 weeks from the transaction date for your claim to be processed and the miles to be credited to your account. If you have not received miles by then, you can claim your missing miles within 6 months of the transaction date. 4. For more information on claiming missing miles, you can contact us at +852 2747 3838. Missing miles request details Airline – Please attach e-ticket itinerary receipt and boarding pass(es). -

Chinese Companies Crawl up the Charts

CHINESE COMPANIES CRAWL UP THE CHARTS THE ENORMOUS OPPORTUNITY FOR HOTEL DEVELOPMENT IN China has been the talk of the industry for the better part of the last decade, but 2010 may be remembered as the year when it turned the corner from potential to realization. Fifteen of the top 16 companies in the newest HOTELS’ 325 ranking added net inventory from a year ago, and nearly all posted major gains in China, with many more projects on the way. “All international hotel companies are gaining acquired in May by Home Inns for US$470 traction with Chinese consumers, as they are all million, a merger that will vault the combined signing up hotels in larger and larger numbers company well past 100,000 total guestrooms — it’s every hotel company’s largest market for and could result next year in the first new growth,” says Robert Hecker, the Singapore- addition to the overall top 10 list in a half decade. based managing director for consultancy In all, there are 26 China-based companies in the Horwath HTL. top 300 on this year’s list, up from 24 last year Despite intense ongoing pushes for China and 18 in 2009. expansion by most of the international hotel There was some movement in the top 10 companies in HOTELS’ 325 top 10, however, list this year, with Marriott International Inc. it has been China’s domestic budget brands leapfrogging Wyndham Worldwide and that are dominating investor attention of late. Starwood Hotels & Resorts Worldwide Inc. just Four such brands have already jumped from barely edging past Best Western International.