Orange Slovensko, A.S

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Price Guide Or Other Legal Document

The prices are stated in SKK and do not include VAT; the prices in SKK including VAT are in square brackets. Individual prices including VAT were calculated from the prices not including VAT and they are accurate to one decimal place pursuant to the legal regulations in force. The total price of performances for one billing period is calculated from the unit and/or partial prices of individual performances excluding VAT; the final total price for the billing period including VAT is calculated from the total price for the billing period excluding VAT (any difference between the total price calculated in the manner specified in this sentence and the total price calculated directly from the partial or unit prices including VAT is caused by rounding up the unit and partial prices including VAT to one decimal place). All phone calls, data and fax transmissions are invoiced by a tariff according to the zone, in which they were initiated, unless otherwise agreed with respect to the concrete service in the Price Guide or other legal document. Calls received in the mobile telecommunication network of the company Orange Slovensko, a.s. are not charged. The stated prices for calls are final, the company Orange Slovensko, a.s. does not invoice any further charges for connection to a different network. The day of issuance of an invoice shall be deemed the day of delivery of a Service. Pursuant to the Contract, the user is obliged to pay for a Service on the day of its delivery. This shall not affect provisions of Items 11.8 and 11.10 of the General Terms and Conditions. -

Termination Rates at European Level January 2021

BoR (21) 71 Termination rates at European level January 2021 10 June 2021 BoR (21) 71 Table of contents 1. Executive Summary ........................................................................................................ 2 2. Fixed networks – voice interconnection ..................................................................... 6 2.1. Assumptions made for the benchmarking ................................................................ 6 2.2. FTR benchmark .......................................................................................................... 6 2.3. Short term evolution of fixed incumbents’ FTRs (from July 2020 to January 2021) ................................................................................................................................... 9 2.4. FTR regulatory model implemented and symmetry overview ............................... 12 2.5. Number of lines and market shares ........................................................................ 13 3. Mobile networks – voice interconnection ................................................................. 14 3.1. Assumptions made for the benchmarking .............................................................. 14 3.2. Average MTR per country: rates per voice minute (as of January 2021) ............ 15 3.3. Average MTR per operator ...................................................................................... 18 3.4. Average MTR: Time series of simple average and weighted average at European level ................................................................................................................. -

Orange Vyrocna Sprava 2016 EN RGB.Indd

2016 Annual Report 2016 Annual Report Table of Contents 1 Orange Slovensko 5 Customer Care 6 – 15 To achieve all of our goals, we strive to keep looking ahead 38 – 43 We grow deep relationships with our customers and we grow together 2 Letter from the CEO 16 – 21 With the right captain at the wheel, the course is always clear 6 Employees 44 – 49 We support team spirit and, individual strength 3 Slovak Telecommunications Market of our employees 22 – 27 With our common effort and perseverance, we can tip the balance of things to our side 7 Corporate Social Responsibility 50 – 61 We feel the need to protect what we care about 4 Orange Slovensko on Telecommunications Market and to develop what is beautiful 28 – 37 By joining forces we can always get to the desired goal 8 Financial Statement 62 – 117 We work to make our results speak for us 4 5 Orange Slovensko To achieve all of our goals, 1we strive to keep looking ahead 2016 Annual Report Chapter 1 Orange Slovensko, a.s., A Member of the Global Orange Group Description of the Company network is now available to more than 80 % of Slovaks. Orange Slovensko, a.s. is the leading telecommu- Registered Office nications company and biggest mobile network Orange Slovensko, a.s. was the fi rst telecom- Metodova 8, 821 08 Bratislava, The Slovak Republic operator in Slovakia. munications operator in Slovakia to launch a state-of-the-art new generation fi xed net- Company Identification Number (IČO) It started its commercial operation on the Slo- work on the basis of FTTH (Fiber To The Home 35697270 vak market in 1997. -

2017 Registration Document

2017 Registration document Annual financial report Table of contents 1. Overview of the Group 5. Corporate, social and and of its business environmental responsibility 1.1 Overview 4 5.1 Social commitments 311 1.2 Market and strategy 7 5.2 Employee information 316 1.3 Operating activities 12 5.3 Environmental information 328 1.4 Networks and real- estate 38 5.4 Duty of care 337 1.5 Innovation at Orange 40 5.5 Report by one of the Statutory Auditors 338 1.6 Regulation of telecom activities 43 6. Shareholder Base 2. Risk factors and activity and Shareholders’ Meeting management framework 6.1 Share capital 342 2.1 Risk factors 64 6.2 Major shareholders 343 2.2 Activity and risk management framework 69 6.3 Draft resolutions to be submitted to the Combined Ordinary and Extraordinary Shareholders’ Meeting of May 4, 2018 345 3. Financial report 6.4 Report of the Board of Directors on the resolutions submitted to the Combined Ordinary and 3.1 Analysis of the Group’s financial position and earnings 78 Extraordinary Shareholders’ Meeting of May 4, 2018 350 3.2 Recent events and Outlook 131 6.5 Statutory Auditors’ report on resolutions 3.3 Consolidated financial statements 133 and related party agreements 357 3.4 Annual financial statements Orange SA 240 3.5 Dividend distribution policy 278 7. Additional information 4. Corporate Governance 7.1 Person responsible 362 7.2 Statutory Auditors 362 4.1 Composition of management and supervisory bodies 280 7.3 Statutory information 363 4.2 Functioning of the management 7.4 Factors that may have an impact in the event and supervisory bodies 290 of a public offer 365 4.3 Reference to a Code of Corporate Governance 298 7.5 Regulated agreements and related party transactions 366 4.4 Compensation and benefits paid to Directors, 7.6 Material contracts 366 Officers and Senior Management 298 8. -

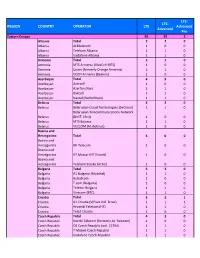

Ready for Upload GCD Wls Networks

LTE‐ LTE‐ REGION COUNTRY OPERATOR LTE Advanced Advanced Pro Eastern Europe 92 55 2 Albania Total 320 Albania ALBtelecom 100 Albania Telekom Albania 110 Albania Vodafone Albania 110 Armenia Total 310 Armenia MTS Armenia (VivaCell‐MTS) 100 Armenia Ucom (formerly Orange Armenia) 110 Armenia VEON Armenia (Beeline) 100 Azerbaijan Total 430 Azerbaijan Azercell 100 Azerbaijan Azerfon (Nar) 110 Azerbaijan Bakcell 110 Azerbaijan Naxtel (Nakhchivan) 110 Belarus Total 420 Belarus Belarusian Cloud Technologies (beCloud) 110 Belarusian Telecommunications Network Belarus (BeST, life:)) 100 Belarus MTS Belarus 110 Belarus VELCOM (A1 Belarus) 100 Bosnia and Herzegovina Total 300 Bosnia and Herzegovina BH Telecom 100 Bosnia and Herzegovina HT Mostar (HT Eronet) 100 Bosnia and Herzegovina Telekom Srpske (m:tel) 100 Bulgaria Total 530 Bulgaria A1 Bulgaria (Mobiltel) 110 Bulgaria Bulsatcom 100 Bulgaria T.com (Bulgaria) 100 Bulgaria Telenor Bulgaria 110 Bulgaria Vivacom (BTC) 110 Croatia Total 321 Croatia A1 Croatia (VIPnet incl. B.net) 111 Croatia Hrvatski Telekom (HT) 110 Croatia Tele2 Croatia 100 Czech Republic Total 430 Czech Republic Nordic Telecom (formerly Air Telecom) 100 Czech Republic O2 Czech Republic (incl. CETIN) 110 Czech Republic T‐Mobile Czech Republic 110 Czech Republic Vodafone Czech Republic 110 Estonia Total 330 Estonia Elisa Eesti (incl. Starman) 110 Estonia Tele2 Eesti 110 Telia Eesti (formerly Eesti Telekom, EMT, Estonia Elion) 110 Georgia Total 630 Georgia A‐Mobile (Abkhazia) 100 Georgia Aquafon GSM (Abkhazia) 110 Georgia MagtiCom -

Mobile Broadband: Pricing and Services

Unclassified DSTI/ICCP/CISP(2008)6/FINAL Organisation de Coopération et de Développement Économiques Organisation for Economic Co-operation and Development 30-Jun-2009 ___________________________________________________________________________________________ English - Or. English DIRECTORATE FOR SCIENCE, TECHNOLOGY AND INDUSTRY COMMITTEE FOR INFORMATION, COMPUTER AND COMMUNICATIONS POLICY Unclassified DSTI/ICCP/CISP(2008)6/FINAL Working Party on Communication Infrastructures and Services Policy MOBILE BROADBAND: PRICING AND SERVICES English - Or. English JT03267481 Document complet disponible sur OLIS dans son format d'origine Complete document available on OLIS in its original format DSTI/ICCP/CISP(2008)6/FINAL FOREWORD This paper was presented to the Working Party on Communication Infrastructures and Services Policy in December 2008. The Working Party agreed to recommend the declassification of the document to the ICCP Committee. The ICCP Committee agreed to declassify the document at its meeting in March 2009. The paper was prepared by Mr. Yasuhiro Otsuka of the OECD’s Directorate for Science, Technology and Industry. It is published under the responsibility of the Secretary-General of the OECD. © OECD/OCDE 2009. 2 DSTI/ICCP/CISP(2008)6/FINAL TABLE OF CONTENTS FOREWORD .................................................................................................................................................. 2 MOBILE BROADBAND: PRICING AND SERVICES .............................................................................. -

APSCC Monthly E-Newsletter

APSCC Monthly e‐Newsletter OCTOBER 2018 The Asia‐Pacific Satellite Communications Council (APSCC) e‐Newsletter is produced on a monthly basis as part of APSCC’s information services for members and professionals in the satellite industry. Subscribe to the APSCC monthly newsletter and be updated with the latest satellite industry news as well as APSCC activities! To renew your subscription, please visit www.apscc.or.kr. To unsubscribe, send an email to [email protected] with a title “Unsubscribe.” News in this issue has been collected from September 1 to September 30. INSIDE APSCC The APSCC 2018 Conference & Exhibition Marks Great Success! The APSCC 2018 Satellite Conference & Exhibition successfully ended on 5 October 2018 in Jakarta after 3 days of in‐depth conference sessions, state‐of‐the‐art technology displayed exhibition, and diverse networking events with more than 400 delegates attending the event. At APSCC 2018, thought leaders covered major issues impacting the Asia‐Pacific satellite industry, including market insight on the latest trends, new applications, and innovative technical solutions throughout the three‐day discussions and presentation sessions. The APSCC‐ISU Youth Development Workshop The 2018 APSCC‐ISU Youth Development Workshop was successfully held on October 5 in Jakarta concurrently with the APSCC 2018. The workshop provided a platform for the brightest up‐and‐coming engineering students and young professionals in Indonesia to connect with leading satellite and space industry experts and learn more about the opportunities in the sector. The 2018 APSCC‐ISU Youth Development provided the students with a deeper understanding of the industry through lectures and case studies. -

Federal Communications Commission DA 12-1334 Before the Federal

Federal Communications Commission DA 12-1334 Before the Federal Communications Commission Washington, D.C. 20554 In the Matter of ) ) International Comparison Requirements Pursuant ) IB Docket No. 10-171 to the Broadband Data Improvement Act ) GN Docket 11-121 ) International Broadband Data Report ) THIRD REPORT Adopted: August 13, 2012 Released: August 21, 2012 By the Chief, International Bureau: I. INTRODUCTION 1. This is the Commission’s third annual International Broadband Data Report (IBDR or Report). The IBDR is required by the Broadband Data Improvement Act (BDIA) and provides comparative international information on broadband services.1 Through the presentation of this data, we have the opportunity to evaluate the United States’ rates of broadband adoption, speeds, and prices in comparison to the international community. International data can serve as useful benchmarks for progress in fixed and mobile broadband accessibility. 2. In the past year, both fixed and mobile broadband providers have made significant progress in their efforts to expand broadband networks and improve service quality. As noted in the Eighth 706 Report released today, the market is responding to the needs of Americans for increased broadband capabilities.2 In 2011, U.S. investment in wired and wireless network infrastructure rose 24%.3 Some recent trends show that providers are offering higher speeds, more data under their usage limits, and more advanced technology in both fixed and mobile broadband. For example, cable operators have increased their deployment of DOCSIS 3.0-based data networks, which are capable of providing 100 megabits per second or faster (Mbps) speeds. In the last three years, the percentage of households passed by DOCSIS 3.0 broadband infrastructure has risen from 20% to 82%.4 Advances in broadband technology and initiatives to promote greater deployment and adoption of broadband services have led to broadband- enabled innovation in other fields such as health care, education, and energy efficiency. -

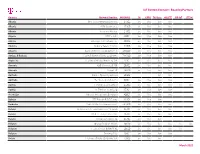

Iot Custom Connect - Roaming Partners

IoT Custom Connect - Roaming Partners Country Column1 Network Provider Column2MCCMNCColumn10 Column32G Column4GPRS Column53G Data Column64G/LTE Column7NB-IoT LTE-M Albania One Telecommunications sh.a 27601 live live live live Albania ALBtelecom sh.a. 27603 live live live live Albania Vodafone Albania 27602 live live live live Algeria ATM Mobilis 60301 live live live live Algeria Wataniya Telecom Algerie 60303 live live live live Andorra Andorra Telecom S.A.U. 21303 live live live live Anguilla Cable and Wireless (Anguilla) Ltd 365840 live live live live Antigua & Barbuda Cable & Wireless (Antigua) Limited 344920 live live live live Argentina Telefónica Móviles Argentina S.A. 72207 live live live live Armenia VEON Armenia CJSC 28301 live live live live Armenia Ucom LLC 28310 live live live live Australia SingTel Optus Pty Limited 50502 live live Australia Telstra Corporation Ltd 50501 live live live live Austria T-Mobile Austria GmbH 23203 live live live live live live Austria A1 Telekom Austria AG 23201 live live live live Azerbaijan Bakcell Limited Liable Company 40002 live live live live Bahrain STC Bahrain B.S.C Closed 42604 live live live Barbados Cable & Wireless Barbados Ltd. 342600 live live live live Belarus Belarusian Telecommunications Network 25704 live live live live Belarus Mobile TeleSystems JLLC 25702 live live live live Belarus Unitary Enterprise A1 25701 live live live Belgium Orange Belgium NV/SA 20610 live live live live live live Belgium Telenet Group BVBA/SPRL 20620 live live live live live Belgium Proximus PLC 20601 live live live live Bolivia Telefonica Celular De Bolivia S.A. 73603 live live live March 2021 IoT Custom Connect - Roaming Partners Country Column1 Network Provider Column2MCCMNCColumn10 Column32G Column4GPRS Column53G Data Column64G/LTE Column7NB-IoT LTE-M Bosnia and Herzegovina PUBLIC ENTERPRISE CROATIAN TELECOM Ltd. -

Data Roaming Rates for Customers Using Old Sim

DATA ROAMING RATES FOR CUSTOMERS USING OLD SIM Country Operator USD Price per MB per 100 kb Afghanistan Telecom Development Company Afghanistan Ltd (TDCA) 16.3650 1.60 Albania Albanian Mobile Communications (A M C MOBIL) 0.2219 0.02 Algeria Orascom Telecom Algerie Spa (Djezzy) 0.3810 0.04 Andorra S.T.A (Mobiland) 17.6222 1.72 Angola Movicel 24.5264 2.40 Anguilla Cable & Wireless (West Indies) Ltd. Anguilla 20.2449 1.98 Antigua & Barbuda Cable & Wireless Caribbean Cellular (Antigua) Limited 18.9231 1.85 Argentina Telecom Personal SA (Personal) 1.7736 0.17 Armenia K-Telecom Vivacel 14.4581 1.41 Australia Singtel Optus Limited (YES OPTUS) 0.1584 0.02 Austria ONE GMBH 0.1400 0.01 Austria Mobilkom Austria AG & Co KG (A1) 0.1400 0.01 Austria T-Mobile + ex Telering 0.1400 0.01 Azerbaijan, Republic of J.V.Bakcell (BAKCELL GSM 2000) 0.2213 0.02 Bahamas The Bahamas Telecommunications Company Ltd 21.0269 2.05 Bahrain Batelco (BHR MOBILE PLUS) 0.4844 0.05 Bangladesh TM Int'l (Bangladesh) Ltd (AKTEL) 15.2073 1.49 Barbados Cable and wireless 18.9183 1.85 Belarus, Republic of Mobile Digital Communications (VELCOM) 22.4973 2.20 Belgium Belgacom Mobile (PROXIMUS) 0.1400 0.01 Belgium BASE NV/SA (KPN group belgium) 0.1400 0.01 Belgium Mobistar S.A. 0.1400 0.01 Belize Belize Telecommunications Ltd 22.5000 2.20 Benin GLOMobile 22.5000 2.20 Bermuda DIGITAL 0.5475 0.05 Bhutan Tashi InfoComm Ltd 37.5000 3.66 Bolivia Nuevatel 2.1692 0.21 Bosnia Herzegovina HT Mobile communication (ex Eronet Mobile) 7.9847 0.78 Botswana Orange Botswana 22.5000 2.20 Brazil Oi (TNL -

Download Throughput Over Its

Volume 11, February, 2020 A SAMENA Telecommunications Council Publication www.samenacouncil.org S AMENA TRENDS FOR SAMENA TELECOMMUNICATIONS COUNCIL'S MEMBERS BUILDING DIGITAL ECONOMIES Distinguished New Leadership of SAMENA Council THIS MONTH NECESSITATING CYBERSECURITY VOLUME 11, FEBRUARY, 2020 Contributing Editors Knowledge Contributions Subscriptions Izhar Ahmad AdaptiveMobile Security [email protected] SAMENA Javaid Akhtar Malik Analysys Mason AT&T Advertising TRENDS CybelAngel [email protected] DT One Editor-in-Chief Zain Group SAMENA TRENDS Bocar A. BA [email protected] Publisher Tel: +971.4.364.2700 SAMENA Telecommunications Council CONTENTS 04 EDITORIAL FEATURED 17 REGIONAL & MEMBERS UPDATES Members News Regional News 89 SATELLITE UPDATES Satellite News 07 SAMENA Council’s New 106 WHOLESALE UPDATES Leadership... Wholesale News 09 New Board Members Speak... 112 TECHNOLOGY UPDATES SAMENA COUNCIL ACTIVITY Technology News The SAMENA TRENDS eMagazine is wholly owned and operated by The SAMENA 120 REGULATORY & POLICY UPDATES Telecommunications Council (SAMENA Regulatory News Council). Information in the eMagazine is not intended as professional services advice, A Snapshot of Regulatory and SAMENA Council disclaims any liability Activities in the SAMENA Region for use of specific information or results thereof. Articles and information contained Regulatory Activities in this publication are the copyright of Beyond the SAMENA Region 12 Convergence to Bahrain 2020: SAMENA Telecommunications Council, 5G & IoT and the Regional (unless otherwise noted, described or stated) ARTICLES Digital Vision and cannot be reproduced, copied or printed in any form without the express written SAMENA Council and TRA permission of the publisher. 62 Recognizing Cybersecurity as an Bahrain Collaborate to Organizational Issue, Not an IT Congregate the Regional ICT The SAMENA Council does not necessarily Industry in Bahrain.. -

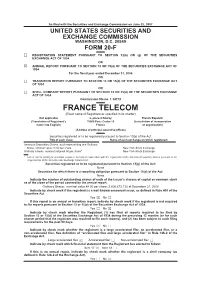

France Telecom

As filed with the Securities and Exchange Commission on June 25, 2007 UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F ‘ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR È ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2006 OR ‘ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ‘ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file no. 1-14712 FRANCE TELECOM (Exact name of Registrant as specified in its charter) Not applicable 6, place d’Alleray French Republic (Translation of Registrant’s 75505 Paris Cedex 15 (Jurisdiction of incorporation name into English) France or organization) (Address of principal executive offices) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of each class: Name of each exchange on which registered: American Depositary Shares, each representing one Ordinary Share, nominal value €4.00 per share New York Stock Exchange Ordinary Shares, nominal value €4.00 per share* New York Stock Exchange * Listed, not for trading or quotation purposes, but only in connection with the registration of the American Depositary Shares pursuant to the requirements of the Securities and Exchange Commission. Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: Ordinary Shares, nominal value €4.00 per share: 2,606,673,130 at December 31, 2006 Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.