Dino: Sell (Maintained) DNP PW; DNPP.WA | Retail, Poland

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Initiating Coverage Rating: BUY

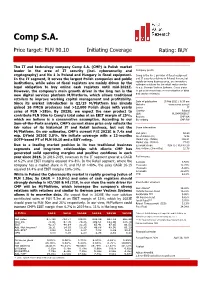

Comp S.A. Price target: PLN 90.10 Initiating Coverage Rating: BUY The IT and technology company Comp S.A. (CMP) is Polish market leader in the area of IT security (incl. cybersecurity and Company profile cryptography) and No 1 in Poland and Hungary in fiscal equipment. Comp is the No 1 provider of fiscal equipment and IT security solutions in Poland. A new, but In the IT segment, it serves the largest Polish companies and public rapidly growing business area, are innovative institutions, while sales of fiscal registers are mainly driven by the software solutions for the retail sector similar legal obligation to buy online cash registers until mid-2021E. to e.g. German Vectron Systems. Comp plans However, the company’s main growth driver in the long run is the to put a stronger focus on monetisation of data and service revenues. new digital services platform M/Platform, which allows traditional retailers to improve working capital management and profitability. Date of publication 15 Feb 2021 / 6:30 am Since its market introduction in Q2/19 M/Platform has already Website www.comp.com.pl gained 16 FMCG producers and >12,000 Polish shops with yearly Sector IT sales of PLN >18bn. By 2023E, we expect the new product to Country Poland ISIN PLCMP0000017 contribute PLN 90m to Comp’s total sales at an EBIT margin of 25%, Reuters CMP.WA which we believe is a conservative assumption. According to our Bloomberg CMP PW Sum-of-the-Parts analysis, CMP’s current share price only reflects the fair value of its historical IT and Retail business, but not the Share information M/Platform. -

European Retail Trends Retailing in Europe and Country Profiles

PRESENTATION FOR PLMA‘s Roundhouse Conference European Retail Trends Retailing in Europe and Country Profiles Nice, 26 February 2015 David Gray Niklas Reinecke 1planetretail.net Retail Analyst Retail Analyst Ageing Society, Single Households, Individualisation, Urbanisation, Mobilisation, Transparency in Production, Loss of Loyalty, Online Shopping, Two Nations Effect, Lifestyle, Situational Usage, Economisation, Cocooning, Smart and Hybrid Shopping, Sustainability, Technological Progress, Energy Saving, Regional Sourcing, Faster Innovation Cycles, Renovation Cycles, Rise of Independent Shopkeepers, Proximity Retailing, Energy Costs, Rising Food Prices, Direct-to-Consumer, Demand for Protection, Verticalisation, Cartel Control, Oligopolisation, Discounting, Multichannel Shopping, Event Shopping, Foodservice, Complexity! Europe from a Macro Perspective Europe from a Macro Perspective - Share of Modern Food Retail Format Sales A few markets in CEE see very high levels of modern food retail similar to Western European markets. Europe: 2014 (%) 4 Source: Planet Retail. Europe from a Macro Perspective – GDP Real Growth Economic recovery is not universal. Markets are in different stages. Europe: GDP Real Growth 2014 (%) +2.1% +1.8% Finland -0.2% Sweden Norway +1.2% +2.7% +0.2% +3.0% Estonia +1.5% Russia + % Latvia 3.6 Denmark +3.2% Lithuania +1.0.% +0.6% +3.2% Belarus Ireland Netherlands +1.4% United +1.0% +2.5% +8.9% Kingdom Poland +2.4% Belgium Germany Czech Rep +2.8% Ukraine +1,2% +1.1% Slovakia +2.4% +0.4% Austria Hungary France Switzerland Slovenia +0.7% Romania Moldova +5.0% Croatia Italy Serbia+3.4% +1.4% -1.1% Bosnia & -0.8% Herzegovina +3.2% -0.2% -0.5% Bulgaria +4.5% +1.3% +2.1% -6.5% +1.0% Macedonia Georgia Spain Albania Armenia Portugal +0.6% Azerbaijan Greece +0.7% Cyprus 5 Source: Planet Retail. -

Annual Report

NorgesGruppen ANNUAL REPORT NorgesGruppen’s reporting NorgesGruppen annual report 2016 for the year 2016 k NorgesGruppen CONTENTS ÅRSRAPPORT Annual Report 2016 [Norwegian] contains statutory information related to Page 3 Important events during the past year NorgesGruppen’s annual reporting. Page 4 Key financial figures Page 5 This is NorgesGruppen Matnyttig Page 6 NorgesGruppen’s value creation Et magasin fra NorgesGruppen nr. 1/2016 Handleliste Page 7 Message from the CEO: A look at the industry Kjøleskapstemperatur NorgesGruppen Restemiddag Page 9 Annual results 2016: Financial development ÅRSRESULTAT 2016 Page 11 Our value creation Vinn+ Delta i quiz Page 13 Future outlook og vinn matvarer for kr. 3000,– Gode grep for mindre matsvinn Page 14 Sustainability Spar penger og miljø DAGLIGVAREBRANSJEN FLYKTNINGEN SOM EN HANDLINGENS OG FOLKEHELSEN BLE BUTIKKSJEF KJØPMANN Page 16 Business – Retail Randi Flesland, Wasim Zahid og Møt Ali fra Afghanistan Oppskriften på et Yngve Ekern utfordrer bransjen levende lokalsamfunn Page 18 Business – Brands Page 20 Business – Wholesale Stock Exchange Report 2016 [Norwegian] Page 22 Business – Real estate contains the annual result for 2016. Page 24 Business – Corporate functions and shared services Magasinet «Matnyttig» Page 26 Board of Directors of NorgesGruppen ASA Ambisjon: 1 • Et sunnere Norge Page 28 Annual report 2016 Matnyttig Et magasin fra NorgesGruppen nr. 1/2016 Page 38 Consolidated financial statement 2016 Handleliste Kjøleskapstemperatur NorgesGruppenRestemiddag BÆREKRAFTSRAPPORT Vinn+ Delta -

Structural Changes in Food Retailing: Six Country Case Studies

FSRG Publication Structural Changes in Food Retailing: Six Country Case Studies edited by Kyle W. Stiegert Dong Hwan Kim November 2009 Kyle Stiegert [email protected] Dong Hwan Kim [email protected] The authors thank Kate Hook for her editorial assistance. Any mistakes are those of the authors. Comments are encouraged. Food System Research Group Department of Agricultural and Applied Economics University of Wisconsin-Madison http://www.aae.wisc.edu/fsrg/ All views, interpretations, recommendations, and conclusions expressed in this document are those of the authors and not necessarily those of the supporting or cooperating organizations. Copyright © by the authors. All rights reserved. Readers may make verbatim copies of this document for noncommercial purposes by any means, provided that this copyright notice appears on all such copies. ii Table of Contents Page CHAPTER 1: INTRODUCTION AND LITERATURE REVIEW 1 1. Introduction 1 2. Outline of the Book 1 3. Impact of Dominant Food Retailers: Review of Theories and Empirical Studies 3 3.1. Market Power vs. Efficiency 3 3.2. Vertical Relationship between Food retailers and Food producers: Vertical Restraints, Fees and Services Enforced by Retailers 5 Fees and Services 5 Coalescing Power 8 3.3. Market Power Studies 8 References 17 CHAPTER 2: THE CASE OF AUSTRALIA 21 1. Introduction 21 2. Structure of Food Retailing in Australia 21 2.1 Industry Definition of Food Retailing 21 2.2 Basic Structure of Retail Food Stores 22 2.3 Food Store Formats 24 2.4 Market Share and Foreign Direct Investment 25 3. Effects of Increased Food Retail Concentration on Consumers, Processors and Suppliers 28 4. -

Bens Agroalimetares POLONIA

Datos generales POLONIA Datos básicos Datos básicos PIB per cápita (2015) • ALEMANIA: 41.219 USD •PORTUGAL: 19.222 USD • POLAND: 12.450 USD • HUNGRÍA: 12.259 USD • RUMANIA: 8.973 USD Datos básicos Niveles salariales a enero de 2017: • Salario mínimo mensual bruto 2.000 zlotys (476 EUR) • Salario medio interprofesional mensual bruto 4.636 zlotys (1.103 EUR) A destacar: • Polonia se encuentra en pleno desarrollo de infraestructuras. • Es un gran receptor de fondos de la UE. Para el periodo 2014 – 2020 ha recibido 82.500 millones de EUR Datos básicos Datos básicos Datos básicos Recomendaciones de negociación Que hacer: • Fijar las reuniones con antelación • Estar bien preparado para los encuentros (presentación de empresa, catálogos, etc.) • Dar respuestas rápidas, concretas y substanciales. • Mantener contacto regular con los interlocutores polacos. • Ser persistente y profesional al abordar el mercado. Recomendaciones de negociación Que no hacer: • Llegar retrasado. • No existe hábito de tratar a las personas como Señor Doctor o Señor Ingeniero. • Los polacos no les gusta ser considerados como país del Este sino como Europa Central. • En la presentaciones solo dar la mano. No dar besos. Bens agroalimetares POLONIA 2016 Importações de bens agroalimentares na Polónia • 2014-2016 Crecimiento anual del 4,5% • Principales productos importados: • Carne porcina. 1.190 millones EUR • Salmón fresco o refrigerado. 830 millones EUR • Derivados de la extración del aceite de soja. 777 millones EUR • Chocolates i productos de cacao. 585 millones EUR • Cafés y sucedaneos. • Productos de panaderia y pastelería • Queso y requesón • Vino • Bebidas espirituosas Importações de bens agroalimentares provenientes de Portugal • 2014-2016 Crecimiento anual del 26,6 % • 95,1 millones de EUR en 2016 • Principales productos importados de Portugal: • Vino. -

Raport Analityczny

The report was prepared by Dom Maklerski BDM at the request of the WSE as part of the Exchange's Analytical Coverage Support Programme EUROCASH ACCUMULATE (PREVIOUS: HOLD) ANALYTICAL REPORT - SUMMARY TARGET PRICE 23,9 PLN We raise our target price to 23,9 PLN/share and rate Accumulate The results of Q3’19 were better than we expected in previous recommendation. The 22 NOVEMBER 2019, 14:00 CEST board standed it’s guidance concerning finalizing integration of retail segment in ’19 and claimed the positive trends are maintained. The process of optimization in EC Distribution and high CPI should support results of ’20 (we estimate growth of EBITDA adj. MSR 17 ca. 9% y/y). The board DCF valuation [PLN] 24,0 announced update of strategy in retail segment at the beginning of ’20. On the other hand, results’ growth may be slown down by challenging labour Peer valuation [PLN] 23,8 market, loss of PKN Orlen contract, possibility of implementation of retail tax Target price [PLN] 23,9 and change of excise tax. Price upside/downside +7,8% Company profile Cost of capital 9,0% Eurocash is a leading wholesale distributor of fast moving consumer goods. It operates in wholesale food distribution (it possesses c.a. 26% market share; it Price [PLN] 22,2 operates through cash & carry and distribution) and in retail segment, in which it develops Delikatesy Centrum markets. In addition to this, the company conducts Market cap [mln PLN] 3 086,6 new projects e.g. Duży Ben and Kontigo. Shares mln. szt.] 139,2 Valuation summary We base our valuation on two methods: discounted cash flows model (70% Max. -

Outlook of Polish Retail Sector

OUTLOOK OF POLISH RETAIL SECTOR April 15th 2015, World Food Warsaw Fair DIFFERENCES BETWEEN POLAND AND OTHER EU COUNTRIES Poland EU countries The largest number of shops per 1000 persons 0,5 per 1000 persons (2,5) 52 % retail is modern trade 75-80 % retail is modern trade 40 % population lives in rural areas majority of population lives in cities and towns 49 % of population lives in small and medium majority of population lives in big cities and cities towns only 11 % of population lives in major cities majority of population lives in big cities and towns 50 % of consumers buy fruits and vagatables in 33 % consumers buy fresh fruits and vegetables markets and bazaars in markets and bazaars April 15th 2015, World Food Warsaw Fair Modern vs. traditional Number of traditional shops 80-100.000 Number of modern shops 6.400 MARKET IS DEVIDED INTO 2 CHANNELS: TRADITIONAL WITH 48% MARKET SHARE AND MODERN 52 % April 15th 2015, World Food Warsaw Fair POLISH FMCG MARKET IS 80000 WORTH 210-25O BILLION 60000 PLN 40000 Market shares 20000 0 RETAIL SALE IS GROWING Number of shops 3-4 % PER YEAR April 15th 2015, World Food Warsaw Fair Brands of discount stores and hypermarkets on the Polish market Biedronka 2600 Lidl 550 Netto 340 Aldi 90 Czerwona Torebka 40 Auchan 76 Tesco 86 Carrefour 96 Kaufland 183 E.Leclerc 43 DISCOUNT STORES: MARKET SHARE 24 %, HYPERMARKETS: 12 % 15 April 2015, World Food Warsaw Fair Brands of supermarkets on the Polish market Piotr i Paweł 120 Stokrotka 275 Mila 170 Polomarket 270 Alma 45 Marcpol 60 Intermarche 220 Tesco Carrefour -

Retail Foods Sector Poland

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Voluntary - Public Date: 1/19/2016 GAIN Report Number: Poland Post: Warsaw Retail Foods Sector Report Categories: Retail Foods Approved By: Russ Nicely, Agricultural Attaché Prepared By: Jolanta Figurska Report Highlights: The Polish retail sector continues to develop registering 4 percent value growth in 2014 with the total number of stores remaining at over 354,000. Price competition remains the most important factor impacting grocery retailers operating in Poland, with discounters constituting as much as 27 percent of value share in 2014. Hypermarkets and supermarkets, with 73 percent value share, remain the dominate categories. While the majority of Polish consumers remain price-sensitive, there is a continuously growing number of end customers willing to pay higher prices for products of superior quality. U.S. exports of agricultural and consumer oriented products to Poland amounted to U.S. $306 million in 2014 and are expected to increase by 20 percent in 2015. U.S. food exports with best sales potential include: tree nuts, wine, distilled spirits, fish and seafood, dried fruit, sauces, spices and snacks. General Information: SECTION I. MARKET SUMMARY During 2014 Poland’s economy recovered from the slowdown of 2012-13, growing by 3.3 percent thanks to continuously increasing domestic demand. A slight slowdown in real GDP growth to 3.2 percent is expected for 2015. The forecast slowdown in 2016-17 will result from unexpected deterioration in economic policy, applied by Poland’s new Government, which was sworn in November 2015, as it tries to deliver on its costly populist election declarations. -

Polish C-Store Sector Booms Consumers in Poland Are Attracted to Small but Frequent Shopping and a Wide Assortment of Fresh Foods

GLOBAL TRENDS Polish C-Store Sector Booms Consumers in Poland are attracted to small but frequent shopping and a wide assortment of fresh foods. oland’s convenience retail market is tipped to grow as Polish consumers show an increased appetite for con- venient, local offers and fresh, quality Pfood and drink products. Attendees to the 2018 NACS Convenience Summit Europe (CSE) can experience firsthand this market’s uniqueness when the event launches in the Polish capital, Warsaw, on Sunday, June 3, before transferring to London for the two key conference days on June 6 and 7. Michael Davis, NACS vice president of mem- ber services, visited Poland in the fall of 2017 on a scouting mission and highlights the market’s appeal. “Warsaw is growing with a strong, fairly When deciding where to shop, Polish consumers consider store location, new convenience market,” he says. “Motorways are the availability of fresh food and attractive promotions. relatively new and the convenience and fuel sites (and travel centers) heading in and out of Warsaw Convenience and discounters are the main have some exciting food and convenience offers beneficiaries of the growth trends in Poland, Milos and were bustling. CSE attendees will have a great Ryba, head of discount and CEE at IGD, reports. deal to see and learn.” “Convenience and discount are the largest chan- The Institute of Grocery Distribution (IGD) nels in Poland and show the most potential for forecasts the grocery retail market in Poland will future growth, with shoppers in towns and cities grow 2.5% annually to reach 312 billion Polish attracted to little and often shopping,” he says. -

Eurocash Group Consolidated Annual Report 2013

EUROCASH GROUP CONSOLIDATED ANNUAL REPORT FOR THE 2013 contents part A EUROCASH S.A. - REPORT OF THE MANAGEMENT BOARD part B SELECTED SEPARATE FINANCIAL DATA part C AUDITOR'S OPINION part D AUDITOR'S REPORT part E SEPARATE FINANCIAL STATEMENTS 1. part A Summary of Eurocash Group Operations in 2013 6 2. Eurocash Group 9 Eurocash S.A. - report of the 3. Eurocash Group Business Overview 13 Management Board 4. Corporate Social Responsibility and stakeholders relations 22 For the period from 1 January 2013 5. to 31 December 2013 Eurocash Group Development Prospects 41 6. NOTE FROM TRANSLATOR: Discussion of Eurocash Group Financial Performance for 2013 46 This document is a translation from Polish. The Polish original is the binding version and shall be referred 7. to in matters of interpretation. Additional Information 63 8. Komorniki, March 28th 2014 Statement on Corporate Governance Rules 71 9. Representations of the Management Board 89 I am pleased to present you with a summary of As I mentioned, 2013 was a key year for us in terms of 2013 at the Eurocash Group. This was without a integrating Tradis into the Eurocash Group. This was a doubt a difcult year, primarily for two reasons. formidable challenge throughout the period, and I On the one hand, we were faced with difcult admit that we had to revise some of our initial market conditions the economic slowdown has objectives. Reorganising the acquired company and translated into a markedly deteriorated situation integrating Eurocash and Tradis cash&carry locations in trade sector. On the other, we went through a weighed on the results of the entire group in 2013, crucial stage of integrating Tradis, which we slowing down our market expansion. -

Prezentacja Programu Powerpoint

2017 Results Presentation SUMMARY OF THE PRESENTATION Part 1. 2017 RESULTS OVERVIEW: TOUGH IN TERMS OF PROFIT – STRONG IN TERMS OF CASH FLOW Part 2. 2023 STRATEGY: FIT FOR THE FUTURE OPTIMIZATION PLAN AND COST SAVINGS IDENTIFIED RETAIL WHOLESALE DRIVER OF GROWTH DRIVER OF CASH 2 5Y OPERATIONAL HIGHLIGHTS EUROCASH FIT FOR THE FUTURE Increased Capex in time of deflation and cost pressure Return to inflation, wage cost pressures and labour shortages. Eurocash solid sales growth with 8.9% 5Y CAGR Short-term EBITDA underperformance overlap the Group's initiatives to boost long-term competitiveness Investment into sales growth Strong Operational Cash Flow (1.67x EBITDA 2017) constantly reinvested into sales growth 3 PART 1 2017 MARKET OUTLOOK AND EUROCASH GROUP RESULTS 4 FMCG MARKET GROWTH Small Format growing 2.5% vs. FMCG market growth of 4.2% in LTM Nov 2017 FMCG market growth by channels Food market growth by channels (YoY, LTM Nov 2017) (YoY, LTM Nov 2017) 10% 9,0% 9,9% 9% 8% 7% 5,1% 6% 5% 3% 3,4% 4% 2,5% 1% 0,1% 2% -1% -3% 0% -5% -2% -1,3% -4,6% Discounters Hypermarkets 2500+ Supermarkets 300-2500 Small Format - Total Specialized & Others Small Grocers -40 Convenience 40-100 Small Supermarkets 100-300 Although inflation supports Large Format, small format stores with growing sales. Small Supermarkets outperform the market. Source: Nielsen; *LTM – Last Twelve Month 5 INFLATION & SALES DYNAMIC BY CATEGORIES Discounters and Supermarkets taking advantage from inflation Food inflation by categories (2017) Estimated* food inflation by channel (LTM Nov 2017) 18% 16,0% 16% 14% 7,0% 6,6% 12% 6,0% 10% 4,4% 4,6% 8,0% 5,0% 3,7% 8% 4,0% 3,6% 3,5% 5,9% 6% 4,8% 4,6% 3,0% 2,2% 3,4% 2,0% 4% 2,9% 2,8% 2,8% 2,5% 2,1% 1,0% 2% 0,2% 0,1% 0,0% 0% Discounters Hypermarkets Supermarkets Small Format Small Convenience Small Grocers 2500+ 300-2500 Supermarkets 40-100 -40 100-300 Source: GUS 2017 inflation (YoY): +2.0% CPI, +4.2% food and non-alcoholic beverages, +1.1% alcohol & tobacco Inflation driven by Large Format categories * Estimation based on Nielsen data. -

Modern Sales Channel on the Example of Eurocash Group - Organizational and Legal Approach

Available online at www.worldscientificnews.com WSN 80 (2017) 77-87 EISSN 2392-2192 Modern sales channel on the example of Eurocash Group - organizational and legal approach Maksymilian Czeczotko1,*, Anna Kudlińska-Chylak1, Agnieszka Warsewicz2 1Department of Organization and Consumption Economics, Faculty of Human Nutrition and Consumer Sciences, Warsaw University of Life Sciences, 166 Nowoursynowska Str., 02-787 Warsaw, Poland 2Faculty of Law and Administration, Warsaw University, 26/28 Krakowskie Przedmiescie Str., 00-927 Warsaw, Poland *E-mail address: [email protected] ABSTRACT The aim of the study was to present the organizational and legal conditions of the Eurocash Group, the market leader in wholesale distribution of FMCG products which also widely operates in retail sales, mainly in the partner and franchise system. The scope of the discussion covered the specificity of retail and wholesale trade and the organizational and legal structure. The paper presents individual sales formats included in the Eurocash Group, i.e. Cash & Carry stores, retail stores, the so- called area of active and specialized distribution. The functioning of modern trade refers to an innovative approach in terms of organizational and legal forms, including operating within capital groups and development through franchise. This allows the complementarity of individual store formats, guaranteeing retail and institutional customers a comprehensive realization of purchase orders. Keywords: Eurocash Group, wholesale and retail trade, capital group 1. INTRODUCTION After 1989 under the influence of political and socio-economic transformations, the market was opened up and we joined the free market economy, whose high absorption caused World Scientific News 80 (2017) 77-87 the influx of many foreign investors.