Structural Changes in Food Retailing: Six Country Case Studies

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Report Name:Retail Foods Bulgaria

Voluntary Report – Voluntary - Public Distribution Date: March 20,2020 Report Number: BU2020-0011 Report Name: Retail Foods Bulgaria Country: Bulgaria Post: Sofia Report Category: Retail Foods Prepared By: Alexander Todorov Approved By: Jonn Slette Report Highlights: Consistent growth in Bulgaria’s food and beverage retail market is driven by increased consumer confidence, declining unemployment, and growing incomes. The total number of retail outlets in Bulgaria in 2019 was 41,306. Modern retail food and beverage sales in 2019 grew by nearly five percent over 2018, and accounted for 55 percent of total food retail in value terms. U.S. exports with strong sales potential in Bulgaria’s food and beverage retail sector are distilled spirits, tree nuts, dried fruits, wine, snacks and cereals, beef meat, fish and seafood, sauces, spices, and pulses. THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Market Fact Sheet: Bulgaria Executive Summary Since 2016, annual Bulgarian GDP growth has Food Retail Industry been over three percent. Exports generate Bulgarian food retail sales reached $6.85 billion in almost 49 percent of Bulgaria’s GDP and are a pillar 2019. Modern retail sales accounted for of the economy. EU Member States are Bulgaria’s $3.77 billion (55 percent) and $3.08 billion in primary trading partners, although there is wide traditional channel. Total retail outlets were 41,306. variation in the balances of trade. In 2019, Bulgaria Food and beverage retail grew in 2019 on improved had a trade deficit in goods of about €1.72 billion consumer confidence and a better labor market. -

SPAR International Annual Review 2018

SPAR International Annual Review 2018 2018 Overview sales 246 105 DISTRIBUTION CENTRES RETAIL & WHOLESALE 48countries PARTNERS €35.8 billion new STORES 2 13,112 m 335 stores 7.4 5.4% MILLION in RETAIL growth SALES AREA m² €4,809 13.5 AVERAGE MILLION ANNUAL SALES SPAR 568 COLLEAGUES per m² AVERAGE CUSTOMERS STORE SIZE PER DAY 350,000 Managing Director’s Report “ SPAR is unique. Our strong network of SPAR Partners across four continents means that we operate in a truly global marketplace whilst being firmly rooted in the local communities we serve.” Tobias Wasmuht, Managing Director, SPAR International Third year of strong and our partners by enhancing the competitiveness, productivity and profitability of our retail and wholesale consistent growth partners worldwide. With the launch of SPAR in four new countries, The strength of our international network allows SPAR combined with a growth of 335 new stores and a to leverage global benefits whilst simultaneously sales increase of 5.4% to €35.8 billion, 2018 has been integrating ourselves in the local communities we another exceptionally strong year for SPAR. serve. This strong network of SPAR Partners and their supply chains across four continents gives SPAR The third year of our five-year SPAR ‘Better Together’ competitive advantages in an increasingly global strategy delivered again for the organisation, our marketplace. partners and our customers. Launched in 2016, the strategy represents SPAR’s core ethos of uniting SPAR’s strong growth and expansion has been driven together the global scale and resources of the SPAR by the responsiveness of our retailers in placing the network so that all shall benefit. -

Prospectus English

Ontex Group NV Korte Keppestraat 21/31, 9320 Erembodegem (Aalst), Belgium Offering of Ordinary Shares (including approximately €325 million of Newly Issued Ordinary Shares (representing a maximum of 19,696,969 Shares based on the low end of the Price Range) and up to 7,000,000 Existing Ordinary Shares) Listing of all Shares on Euronext Brussels This prospectus (the “Prospectus”) relates to the offering (the “Offering”) (i) by Ontex Group NV (the “Company”), a limited liability company organized under the laws of Belgium, of such number of newly issued ordinary shares, with no nominal value, of the Company (the “Shares”) as is necessary to raise gross proceeds of approximately €325 million (the “Primary Tranche”) (representing a maximum of 19,696,969 Shares based on the low end of the Price Range) and (ii) by Whitehaven B S.à r.l. (“Whitehaven B”), an investment vehicle ultimately owned by funds advised by affiliates of TPG Global, LLC (“TPG”) and funds advised by affiliates of The Goldman Sachs Group, Inc. (“GSCP”) and certain members of the previous and current executive management team of the Company (together, the “Selling Shareholders”), of up to 7,000,000 existing Shares (the “Secondary Tranche”). The Shares being offered by the Company and the Selling Shareholders are herein referred to as the “Offer Shares.” The Offering consists of (i) an initial public offering to retail and institutional investors in Belgium (the “Belgian Offering”); (ii) a private placement in the United States to persons who are reasonably believed to be “qualified institutional buyers” or “QIBs” (as defined in Rule 144A (“Rule 144A”) under the U.S. -

Metcash Supermarkets & Convenience Expo and Iga

18 GOLD COAST CONVENTION & EXHIBITION 0 2 CENTRE AND THE STAR GOLD COAST SUNDAY 8TH · MONDAY 9TH · TUESDAY 10TH JULY 2018 Welcome - to the - METCASH SUPERMARKETS & CONVENIENCE EXPO AND IGA NATIONAL CONFERENCE 2018 We continue our “Best Stores in Town” theme, and throughout the Expo and conference sessions we will explore ways that all independents can not only compete, but be “Proudly Independent” and successful in an increasingly tough market. What is it that your store needs to deliver to your community that will make you the best store in town – from barista coffee to fresh flowers, ready-to-eat meals to a gourmet deli offering? All of this layered with the individual character, service, and community involvement that an independent can offer like no one else, will put the heart and soul back into the grocery shopping experience. Proudly Independent 18 GOLD COAST CONVENTION & EXHIBITION 0 2 CENTRE AND THE STAR GOLD COAST SUNDAY 8TH · MONDAY 9TH · TUESDAY 10TH JULY 2018 IGA NATIONAL CONFERENCE SESSION – SUNDAY/MONDAY What a great line-up we have for you this year; the morning conference sessions should not be missed by anyone! We kick off with an opportunity to come together to create something great and a chance to network, so don’t be late. That should get you warmed up for what is to come for the next three days. The business sessions will provide the opportunity to be inspired by leading Australian and international speakers looking at world fads and trends, challenging change, and advocating for a safer social media environment and moving towards equality for women. -

Prezentacja Wyników Za 2017 R

Prezentacja wyników za 2017 r. PODSUMOWANIE PREZENTACJI Część 1. PRZEGLĄD WYNIKÓW 2017: TRUDNY POD WZGLĘDEM ZYSKÓW – MOCNY POD WZGLĘDEM PRZEPŁYWÓW Część 2. STRATEGIA 2023: EUROCASH GOTOWY NA PRZYSZŁOŚĆ PLAN OPTYMALIZACJI - ZIDENTYFIKOWANY POTENCJAŁ SYNERGII KOSZTOWYCH DETAL HURT WZROST PRZEPŁYWY PIENIĘŻNE 2 PODSUMOWANIE OSTATNICH 5 LAT EUROCASH GOTOWY NA PRZYSZŁOŚĆ Zwiększone wydatki inwestycyjne w okresie deflacji i presji kosztowej Powrót do inflacji, presji płacowej i niedoboru siły roboczej Mocny wzrost sprzedaży Eurocash w ciągu 5 lat o 8.9% (CAGR) Krótkoterminowe obniżenie rentowności EBITDA – wpływ inicjatyw Eurocash Capex (mln zł) Dynamika wynagrodzenia brutto Inflacja CPI Grupy mających na celu zwiększenie konkurencyjności w długim Inwestycje we wzrost sprzedaży terminie Silne Operacyjne Przepływy Pieniężne (1,67x EBITDA 2017) - stałe reinwestowanie we wzrost sprzedaży Eurocash sprzedaż (mln zł) Marża EBITDA 3 CZĘŚĆ 1 2017 PERSPEKTYWY RYNKOWE I WYNIKI GRUPY EUROCASH 4 RYNEK FMCG Wzrost Małego Formatu o 2,5% na tle wzrostu całego rynku FMCG o 4,2% (w okresie 12 miesięcy do listopada 2017) Wzrost rynku FMCG wg kanałów dystrybucji Wzrost rynku FMCG wg kanałów dystrybucji (r/r, LTM* Listopad 2017) (r/r, LTM* Listopad 2017) 10% 9,0% 9,9% 9% 8% 7% 5,1% 6% 5% 3% 3,4% 4% 2,5% 1% 0,1% 2% -1% -3% 0% -5% -2% -1,3% -4,6% Dyskonty Hipermarkety 2500+ Supermarkety 300-2500 Mały format - Razem Wsypecjalizowane i Inne Małe sklepy -40 Convenience 40-100 Małe supermarkety 100-300 Pomimo inflacji wspierającej duże formaty, sklepy małoformatowe -

Completed Acquisition by Co-Operative Foodstores Limited of Eight My Local Grocery Stores from ML Convenience Limited and MLCG Limited

Completed acquisition by Co-operative Foodstores Limited of eight My Local grocery stores from ML Convenience Limited and MLCG Limited Decision on relevant merger situation and substantial lessening of competition ME/6625/16 The CMA’s decision on reference under section 22(1) of the Enterprise Act 2002 given on 19 October 2016. Full text of the decision published on 10 November 2016. Please note that [] indicates figures or text which have been deleted or replaced in ranges at the request of the parties for reasons of commercial confidentiality. CONTENTS Page SUMMARY ................................................................................................................. 2 ASSESSMENT ........................................................................................................... 3 Parties ................................................................................................................... 3 Transaction ........................................................................................................... 4 Jurisdiction ............................................................................................................ 4 Counterfactual....................................................................................................... 5 Frame of reference ............................................................................................... 7 Competitive assessment ..................................................................................... 11 Third party views ................................................................................................ -

Attitudes of Consumers, Retailers and Producers to Farm Animal Welfare

Attitudes of Consumers, Retailers and Producers to Farm Animal Welfare edited by Unni Kjærnes, Mara Miele and Joek Roex WELFARE QUALITY REPORTS NO. 2 This report is dedicated to the memory of Jonathan Murdoch. Welfare Quality Reports Edited by Mara Miele and Joek Roex School of City and Regional Planning Cardiff University Glamorgan Building King Edward VII Avenue Cardiff CF10 3WA Wales UK Tel.: +44(0)292087; fax: +44(0)2920874845; e-mail: [email protected] January 2007 The present study is part of the Welfare Quality research project which has been co- financed by the European Commission, within the 6th Framework Programme, contract No. FOOD-CT-2004-506508. The text represents the authors’ views and does not necessarily represent a position of the Commission who will not be liable for the use made of such information. © Copyright is with the authors of the individual contributions. ISBN 1-902647-73-4 ISSN 1749-5164 CONTENTS Preface iii PART I Farm Animal Welfare and Food Consumption Practices: Results from Surveys in Seven Countries (edited by Unni Kjærnes and Randi Lavik) 1 Introduction to Part I 1 2 Background and Research Questions 3 3 Methods 9 4 People Are Interested but Not Necessarily Worried 11 5 Considerations of Animal Friendliness When Purchasing Food 17 6 Availability Is a Bigger Problem Than Price 21 7 The Truth-telling of Institutional Actors 23 8 Concluding Remarks to Part I 29 PART II Analysis of the Retail Survey of Products that Carry Welfare-claims and of Non-retailer Led Assurance Schemes whose Logos Accompany Welfare-claims (edited by Emma Roe and Terry Marsden) 9 Introduction to Part II 33 10 Comparative Overview of Animal Welfare Claims 35 11 Welfare Bundling on Packaging 45 12 Comparative Analysis of Non-retailer Led Schemes of Production 51 13 Comparative Analysis of Marketing Schemes of Non-retailer Led 59 Assurance Schemes 14 Conclusions to Part II 65 PART III Pig Farmers and Animal Welfare: A Study of Beliefs, Attitudes and Behaviour of Pig Producers across Europe (edited by Bettina B. -

Macquarie Graduate School of Management

MACQUARIE GRADUATE SCHOOL OF MANAGEMENT MGSM CASE STUDIES IN MANAGEMENT IGA and the Coles-Shell Alliance Simon Rushworth and Francis Buttle Macquarie Graduate School of Management MGSM Case 2005-6 September 2005 Disclaimer MGSM Case Studies in Management are produced as a means of stimulating discussion amongst management scholars and students. The facts reported are meant for discussion only, and are not be interpreted as imputing any value judgments on management decisions and actions. Copyright © Simon Rushworth and Francis Buttle, 2005 Research Office Macquarie Graduate School of Management Macquarie University Sydney, NSW 2109 Australia Tel 612 9850 9016 Fax 612 9850 9942 Email [email protected] URL http://www.mgsm.edu.au/research Director of Research Associate Professor John Rodwell Manager, Research Office Ms Kelly Callaghan ISSN 1445-3126 Printed copy 1445-3142 Online copy MGSM Case 2005-6 IGA and the Coles-Shell Alliance Simon Rushworth Envisioning – Marketing Consulting 28A Makinson St Gladesville NSW 2111 Australia Tel 61 (0)2 9817 2860 Fax 61 (0)2 9817 2860 Email [email protected] Francis Buttle Macquarie Graduate School of Management Macquarie University Sydney NSW 2109 Australia Tel 61 (0)2 9850 8987 Fax 61 (0)2 9850 9019 Email [email protected] ii Introduction The Executive Management Group at IGA thought this was a serious problem. It was late-2004, and although they were not fuel retailers themselves, they were facing intense competition for the grocery dollar from two retailer/fuel company alliances - the Woolworths-Caltex alliance and the Coles-Shell alliance. IGA (Independent Grocers Alliance) was founded in America in 1926. -

Fire Department's Hartford Fire Station

Major Renovation to Augusta (ME) Fire Department’s Hartford Fire Station The city of Augusta, Maine, had WBRC Architects Engineers and Mitchell Architects design an addition and perform a major renovation of its historic Hartford Fire Station. (Photos courtesy of Mitchell Associates Architects.) By Alan M. Petrillo The Hartford Fire Station was Augusta, Maine’s oldest of five fire stations, being built on a hilltop overlooking the downtown in the early part of the 20th century when firefighters were still using horse-drawn water pumps. But, the station’s infrastructure was failing under the weight of modern fire engines that barely fit through the apparatus bay doors. In 2016, city voters approved $6 million to renovate and add onto the station to bring it up to modern standards. “We did a study that determined the station was in the right location for proper coverage,” says Roger Audette, Augusta Fire Department’s chief. “So, the decision was made to renovate the Hartford station and increase its footprint with an addition. The biggest need we had was for two large truck bays to hold our newer apparatus. A previous ladder tower had to be moved to another station because of the inadequate floor at the Hartford station.” The city hired WBRC Architects Engineers and Mitchell Associates Architects to design a 11,325-square-foot addition, as well as to perform a major renovation of the original 8,800-square- foot Classical Revival style structure. Robert Mitchell, principal architect at Mitchell Associates Architects, says, “The new two-story expansion provides a six-vehicle, drive-through apparatus bay with a tail-pipe exhaust system, decontamination area, and rigorous hot zone/cold zone separation. -

Global Vs. Local-The Hungarian Retail Wars

Journal of Business and Retail Management Research (JBRMR) October 2015 Global Vs. Local-The Hungarian Retail Wars Charles S. Mayer Reza M. Bakhshandeh Central European University, Budapest, Hungary Key Words MNE’s, SME’s, Hungary, FMCG Retailing, Cooperatives, Rivalry Abstract In this paper we explore the impact of the ivasion of large global retailers into the Hungarian FMCG space. As well as giving the historical evolution of the market, we also show a recipe on how the local SME’s can cope with the foreign competition. “If you can’t beat them, at least emulate them well.” 1. Introduction Our research started with a casual observation. There seemed to be too many FMCG (Fast Moving Consumer Goods) stores in Hungary, compared to the population size, and the purchasing power. What was the reason for this proliferation, and what outcomes could be expected from it? Would the winners necessarily be the MNE’s, and the losers the local SME’S? These were the questions that focused our research for this paper. With the opening of the CEE to the West, large multinational retailers moved quickly into the region. This was particularly true for the extended food retailing sector (FMCG’s). Hungary, being very central, and having had good economic relations with the West in the past, was one of the more attractive markets to enter. We will follow the entry of one such multinational, Delhaize (Match), in detail. At the same time, we will note how two independent local chains, CBA and COOP were able to respond to the threat of the invasion of the multinationals. -

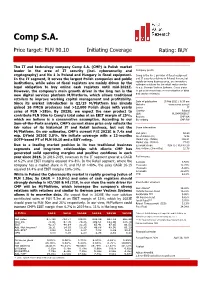

Initiating Coverage Rating: BUY

Comp S.A. Price target: PLN 90.10 Initiating Coverage Rating: BUY The IT and technology company Comp S.A. (CMP) is Polish market leader in the area of IT security (incl. cybersecurity and Company profile cryptography) and No 1 in Poland and Hungary in fiscal equipment. Comp is the No 1 provider of fiscal equipment and IT security solutions in Poland. A new, but In the IT segment, it serves the largest Polish companies and public rapidly growing business area, are innovative institutions, while sales of fiscal registers are mainly driven by the software solutions for the retail sector similar legal obligation to buy online cash registers until mid-2021E. to e.g. German Vectron Systems. Comp plans However, the company’s main growth driver in the long run is the to put a stronger focus on monetisation of data and service revenues. new digital services platform M/Platform, which allows traditional retailers to improve working capital management and profitability. Date of publication 15 Feb 2021 / 6:30 am Since its market introduction in Q2/19 M/Platform has already Website www.comp.com.pl gained 16 FMCG producers and >12,000 Polish shops with yearly Sector IT sales of PLN >18bn. By 2023E, we expect the new product to Country Poland ISIN PLCMP0000017 contribute PLN 90m to Comp’s total sales at an EBIT margin of 25%, Reuters CMP.WA which we believe is a conservative assumption. According to our Bloomberg CMP PW Sum-of-the-Parts analysis, CMP’s current share price only reflects the fair value of its historical IT and Retail business, but not the Share information M/Platform. -

VIANNEY MULLIEZ : C’Est Un Beau Cadeau D’Anniversaire, Pour Les 50 Ans De Notre Entreprise, Que De Constater Combien L’Histoire Nous a Donné Raison

VIANNEY MULLIEZ : C’est un beau cadeau d’anniversaire, pour les 50 ans de notre entreprise, que de constater combien l’Histoire nous a donné raison. Chez Auchan, nous n’en tirons aucune vanité, mais comment ne pas nous réjouir du choix judicieux qu’a fait, en 1961, notre fondateur Gérard Mulliez. D’emblée, il nous a doté d’une vision et d’une identité forte en misant résolument sur les valeurs humaines et en décidant que, chez Auchan, jamais on ne transigerait avec celles-ci. ARNAUD MULLIEZ : Des valeurs si ancrées dans notre culture d’entreprise qu’elles font notre réputation et notre fierté. Pour nous, et dans tous nos métiers, il importe que le « process » soit au service de l’Homme et cela ne doit jamais être l’inverse. Cette approche prend tout son L’EÉDITO DE VIANNEY MULLIEZ ET D’ARNAUD MULLIEZ ème Edito sens, au début de ce XXI siècle, dans un monde économique globalisé que la récente crise a ébranlé dans ses certitudes. Les experts, les observateurs expliquent cette crise, qui est d’abord une crise de confiance, par le fait que nombre de managers auraient trop misé sur le profit et le court terme. VIANNEY MULLIEZ : « Il faut absolument remettre l’homme au cœur de l’entreprise » insiste-t-on aujourd’hui. 19612011 Mais, chez Auchan, l’Homme est depuis toujours « la » priorité pour les dirigeants, dans tous nos différents métiers basés sur notre expertise de la consommation et fédérés au sein de notre groupe. Qu’il s’agisse de la grande distribution, de la banque, de l’immobilier commercial ou d’Internet.