Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Initiating Coverage Rating: BUY

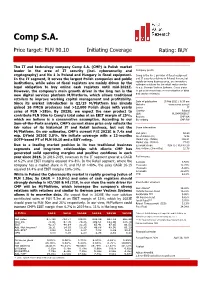

Comp S.A. Price target: PLN 90.10 Initiating Coverage Rating: BUY The IT and technology company Comp S.A. (CMP) is Polish market leader in the area of IT security (incl. cybersecurity and Company profile cryptography) and No 1 in Poland and Hungary in fiscal equipment. Comp is the No 1 provider of fiscal equipment and IT security solutions in Poland. A new, but In the IT segment, it serves the largest Polish companies and public rapidly growing business area, are innovative institutions, while sales of fiscal registers are mainly driven by the software solutions for the retail sector similar legal obligation to buy online cash registers until mid-2021E. to e.g. German Vectron Systems. Comp plans However, the company’s main growth driver in the long run is the to put a stronger focus on monetisation of data and service revenues. new digital services platform M/Platform, which allows traditional retailers to improve working capital management and profitability. Date of publication 15 Feb 2021 / 6:30 am Since its market introduction in Q2/19 M/Platform has already Website www.comp.com.pl gained 16 FMCG producers and >12,000 Polish shops with yearly Sector IT sales of PLN >18bn. By 2023E, we expect the new product to Country Poland ISIN PLCMP0000017 contribute PLN 90m to Comp’s total sales at an EBIT margin of 25%, Reuters CMP.WA which we believe is a conservative assumption. According to our Bloomberg CMP PW Sum-of-the-Parts analysis, CMP’s current share price only reflects the fair value of its historical IT and Retail business, but not the Share information M/Platform. -

European Retail Trends Retailing in Europe and Country Profiles

PRESENTATION FOR PLMA‘s Roundhouse Conference European Retail Trends Retailing in Europe and Country Profiles Nice, 26 February 2015 David Gray Niklas Reinecke 1planetretail.net Retail Analyst Retail Analyst Ageing Society, Single Households, Individualisation, Urbanisation, Mobilisation, Transparency in Production, Loss of Loyalty, Online Shopping, Two Nations Effect, Lifestyle, Situational Usage, Economisation, Cocooning, Smart and Hybrid Shopping, Sustainability, Technological Progress, Energy Saving, Regional Sourcing, Faster Innovation Cycles, Renovation Cycles, Rise of Independent Shopkeepers, Proximity Retailing, Energy Costs, Rising Food Prices, Direct-to-Consumer, Demand for Protection, Verticalisation, Cartel Control, Oligopolisation, Discounting, Multichannel Shopping, Event Shopping, Foodservice, Complexity! Europe from a Macro Perspective Europe from a Macro Perspective - Share of Modern Food Retail Format Sales A few markets in CEE see very high levels of modern food retail similar to Western European markets. Europe: 2014 (%) 4 Source: Planet Retail. Europe from a Macro Perspective – GDP Real Growth Economic recovery is not universal. Markets are in different stages. Europe: GDP Real Growth 2014 (%) +2.1% +1.8% Finland -0.2% Sweden Norway +1.2% +2.7% +0.2% +3.0% Estonia +1.5% Russia + % Latvia 3.6 Denmark +3.2% Lithuania +1.0.% +0.6% +3.2% Belarus Ireland Netherlands +1.4% United +1.0% +2.5% +8.9% Kingdom Poland +2.4% Belgium Germany Czech Rep +2.8% Ukraine +1,2% +1.1% Slovakia +2.4% +0.4% Austria Hungary France Switzerland Slovenia +0.7% Romania Moldova +5.0% Croatia Italy Serbia+3.4% +1.4% -1.1% Bosnia & -0.8% Herzegovina +3.2% -0.2% -0.5% Bulgaria +4.5% +1.3% +2.1% -6.5% +1.0% Macedonia Georgia Spain Albania Armenia Portugal +0.6% Azerbaijan Greece +0.7% Cyprus 5 Source: Planet Retail. -

Bergencard-2019-Folder.Pdf

OFFICIAL CITY CARD FOR BERGEN AND THE REGION 2019 ADVANTAGES Free: Discounts: • Scheduled bus, boat and • On a variety of cultural BERGEN Bergen Light Rail in the and sightseeing attractions city and the region (Skyss), • At restaurants, on parking see map and Bergen Airport • Admission to most Express Coach museums and attractions CARD Prices 2019 24-HOUR 48-HOUR 72-HOUR CARD CARD CARD Buy the Bergen card here Sights Adults NOK 280 NOK 360 NOK 430 Students/Senior citizens* NOK 224 NOK 288 NOK 344 • The Tourist Information in Bergen Children (3-15 year) NOK 100 NOK 130 NOK 160 • Online: visitBergen.com/Bergenskortet • Bergen Airport Flesland: Deli de Luca * Senior citizens over the age of 67 must present ID as valid documentation. Mount Fløyen • Campsites: most campsites in Bergen Other points of sale: Museums • Comfort Hotel Bergen Airport The Bergen Card – all year • Fjord Line: MS Bergenfjord / MS Stavangerfjord • Klosterhagen Hotel The practical and reasonable way to explore • Montana Vandrerhjem Bergen, City of Culture. • Panorama Hotell & Resort Restaurants • Quality Hotel Edvard Grieg With the Bergen Card in your pocket, you travel free on • Radisson Blu Royal Hotel Bergen Light Rail and buses in the city and the region. • Solstrand Hotel & Bad You get free or discounted admission to museums and • Statsraad Lehmkuhl USE OF THE CARD attractions, as well as many cultural events, various • Thon Hotel Bergen Airport For the Bergen Card to be valid, Transport sightseeing tours, restaurants and parking. For more information about the advantages of the the sales outlet must enter an Bergen Card, see visitBergen.com/BergenCard Start the day with one of our sightseeing tours that expiration date and time on the give you an introduction to what Bergen has to offer. -

Structural Changes in Food Retailing: Six Country Case Studies

FSRG Publication Structural Changes in Food Retailing: Six Country Case Studies edited by Kyle W. Stiegert Dong Hwan Kim November 2009 Kyle Stiegert [email protected] Dong Hwan Kim [email protected] The authors thank Kate Hook for her editorial assistance. Any mistakes are those of the authors. Comments are encouraged. Food System Research Group Department of Agricultural and Applied Economics University of Wisconsin-Madison http://www.aae.wisc.edu/fsrg/ All views, interpretations, recommendations, and conclusions expressed in this document are those of the authors and not necessarily those of the supporting or cooperating organizations. Copyright © by the authors. All rights reserved. Readers may make verbatim copies of this document for noncommercial purposes by any means, provided that this copyright notice appears on all such copies. ii Table of Contents Page CHAPTER 1: INTRODUCTION AND LITERATURE REVIEW 1 1. Introduction 1 2. Outline of the Book 1 3. Impact of Dominant Food Retailers: Review of Theories and Empirical Studies 3 3.1. Market Power vs. Efficiency 3 3.2. Vertical Relationship between Food retailers and Food producers: Vertical Restraints, Fees and Services Enforced by Retailers 5 Fees and Services 5 Coalescing Power 8 3.3. Market Power Studies 8 References 17 CHAPTER 2: THE CASE OF AUSTRALIA 21 1. Introduction 21 2. Structure of Food Retailing in Australia 21 2.1 Industry Definition of Food Retailing 21 2.2 Basic Structure of Retail Food Stores 22 2.3 Food Store Formats 24 2.4 Market Share and Foreign Direct Investment 25 3. Effects of Increased Food Retail Concentration on Consumers, Processors and Suppliers 28 4. -

WEB Amherst Sp18.Pdf

ALSO INSIDE Winter–Spring How Catherine 2018 Newman ’90 wrote her way out of a certain kind of stuckness in her novel, and Amherst in her life. HIS BLACK HISTORY The unfinished story of Harold Wade Jr. ’68 XXIN THIS ISSUE: WINTER–SPRING 2018XX 20 30 36 His Black History Start Them Up In Them, We See Our Heartbeat THE STORY OF HAROLD YOUNG, AMHERST- WADE JR. ’68, AUTHOR OF EDUCATED FOR JULI BERWALD ’89, BLACK MEN OF AMHERST ENTREPRENEURS ARE JELLYFISH ARE A SOURCE OF AND NAMESAKE OF FINDING AND CREATING WONDER—AND A REMINDER AN ENDURING OPPORTUNITIES IN THE OF OUR ECOLOGICAL FELLOWSHIP PROGRAM RAPIDLY CHANGING RESPONSIBILITIES. BY KATHARINE CHINESE ECONOMY. INTERVIEW BY WHITTEMORE BY ANJIE ZHENG ’10 MARGARET STOHL ’89 42 Art For Everyone HOW 10 STUDENTS AND DOZENS OF VOTERS CHOSE THREE NEW WORKS FOR THE MEAD ART MUSEUM’S PERMANENT COLLECTION BY MARY ELIZABETH STRUNK Attorney, activist and author Junius Williams ’65 was the second Amherst alum to hold the fellowship named for Harold Wade Jr. ’68. Photograph by BETH PERKINS 2 “We aim to change the First Words reigning paradigm from Catherine Newman ’90 writes what she knows—and what she doesn’t. one of exploiting the 4 Amazon for its resources Voices to taking care of it.” Winning Olympic bronze, leaving Amherst to serve in Vietnam, using an X-ray generator and other Foster “Butch” Brown ’73, about his collaborative reminiscences from readers environmental work in the rainforest. PAGE 18 6 College Row XX ONLINE: AMHERST.EDU/MAGAZINE XX Support for fi rst-generation students, the physics of a Slinky, migration to News Video & Audio Montana and more Poet and activist Sonia Sanchez, In its interdisciplinary exploration 14 the fi rst African-American of the Trump Administration, an The Big Picture woman to serve on the Amherst Amherst course taught by Ilan A contest-winning photo faculty, returned to campus to Stavans held a Trump Point/ from snow-covered Kyoto give the keynote address at the Counterpoint Series featuring Dr. -

Vet DU Hva Som Motiverer Din Servicemedarbeider?

982668 980275 Vet DU hva som motiverer din servicemedarbeider? Bacheloroppgave BCR3100 - HR og Personalledelse Markedshøyskolen 2014 ”Denne bacheloroppgaven er gjennomført som en del av utdannelsen ved Markedshøyskolen. Markedshøyskolen er ikke ansvarlig for oppgavens metoder, resultater, konklusjoner eller anbefalinger”. Sammendrag Denne studien undersøker hva som motiverer servicemedarbeidere og bidrar til at de trives i organisasjonen. For å undersøke hvilke faktorer som påvirker jobbopplevelsen positivt og negativt, tar vi i utgangspunkt i Herzbergs to-faktor-teori. Som forbrukere er vi i kontakt med servicemedarbeidere så å si hver dag. Vi møter dem i kiosken når vi kjøper morgenkaffen, senere på dagen selger de oss lunsj, og ikke overaskende sitter de i kassen når vi handler middag på vei hjem. Vi har ikke lykkes å finne mange relevante forsknings publikasjoner vedrørende servicemedarbeiderens trivsel og motivasjon. Dette gjør det ekstra spennende for oss å gjør en undersøkelse av denne yrkesgruppen. For å komme nært innpå servicemedarbeideren, valgte vi en kvalitativ tilnærming, og foretok dybdeintervjuer av ansatte i Deli de Luca. To-faktor-teorien dannet grunnlaget for undersøkelsen. Spørsmålene hadde til hensikt å kartlegge hva som gjorde at respondentene trivdes og var motiverte, samt hva som eventuelt kunne skape mistrivsel. Vår studie viser at Herzbergs motivasjonsfaktorer i hovedsak kan relateres til servicemedarbeideren. Det som kanskje var det viktigste og mest overraskende funnet i studien, var at enkelte hygienefaktorer kan være en kilde til trivsel, noe som ikke er i tråd med Herzbergs teori. Det er for oss litt dristig å komme med en såpass sterk påstand i en bacheloravhandling. Derfor gjorde vi ytterligere litteratursøk og kom frem til at forskere før oss, har publisert undersøkelser som støtter våre funn. -

Bens Agroalimetares POLONIA

Datos generales POLONIA Datos básicos Datos básicos PIB per cápita (2015) • ALEMANIA: 41.219 USD •PORTUGAL: 19.222 USD • POLAND: 12.450 USD • HUNGRÍA: 12.259 USD • RUMANIA: 8.973 USD Datos básicos Niveles salariales a enero de 2017: • Salario mínimo mensual bruto 2.000 zlotys (476 EUR) • Salario medio interprofesional mensual bruto 4.636 zlotys (1.103 EUR) A destacar: • Polonia se encuentra en pleno desarrollo de infraestructuras. • Es un gran receptor de fondos de la UE. Para el periodo 2014 – 2020 ha recibido 82.500 millones de EUR Datos básicos Datos básicos Datos básicos Recomendaciones de negociación Que hacer: • Fijar las reuniones con antelación • Estar bien preparado para los encuentros (presentación de empresa, catálogos, etc.) • Dar respuestas rápidas, concretas y substanciales. • Mantener contacto regular con los interlocutores polacos. • Ser persistente y profesional al abordar el mercado. Recomendaciones de negociación Que no hacer: • Llegar retrasado. • No existe hábito de tratar a las personas como Señor Doctor o Señor Ingeniero. • Los polacos no les gusta ser considerados como país del Este sino como Europa Central. • En la presentaciones solo dar la mano. No dar besos. Bens agroalimetares POLONIA 2016 Importações de bens agroalimentares na Polónia • 2014-2016 Crecimiento anual del 4,5% • Principales productos importados: • Carne porcina. 1.190 millones EUR • Salmón fresco o refrigerado. 830 millones EUR • Derivados de la extración del aceite de soja. 777 millones EUR • Chocolates i productos de cacao. 585 millones EUR • Cafés y sucedaneos. • Productos de panaderia y pastelería • Queso y requesón • Vino • Bebidas espirituosas Importações de bens agroalimentares provenientes de Portugal • 2014-2016 Crecimiento anual del 26,6 % • 95,1 millones de EUR en 2016 • Principales productos importados de Portugal: • Vino. -

Bakgrunnsinformasjon Om Isklar

Bakgrunnsinformasjon om Isklar Vannet Isklar kommer fra Folgefonna, den 6000 år gamle isbreen i Hardanger i Hordaland. Vannet tappes direkte fra en kilde et par hundre meter under isbreen, på grensen til Folgefonna nasjonalpark. Før vannet dukker opp i Isklar-kildene, er det blitt naturlig filtrert gjennom en rekke harde lag i fjellet under breen. Vannet har et eksepsjonelt lavt innhold av kalk og mineraler, resultatet er et unikt rent og friskt vann. Isklar er klassifisert som et naturlig mineralvann, den høyeste klassifiseringen et flaskevann kan få, blant annet på grunn av sin renhet og konsistente sammensetning. Vannet fra Isklar-kilden holder en konstant temperatur året gjennom på tre-fire grader Celsius. Når vannet sildrer ut fra fjellet, renner det i rør ned til fabrikken hvor det tappes på flasker. Flere andre kildevannsmerker hentes i kontrast til dette ofte opp fra borehull i bakken. Kilden Isklar-kildene har vært benyttet som drikkevannskilde av lokalbefolkningen i generasjoner. Gjennom et av Norges første rettsdokumenter fra 1200-tallet, har de lovfestet rett til å drikke vann fra kilden. Men de er pliktige til å dele vannet med andre. Sagn og mysterier fra Hardanger forteller imidlertid at urgamle troll passer på kilden, og at bare de som har fortjent det får drikke Isklar-vann… Lansering i Norge Isklar lanseres 2. februar 2009 i butikkhyllene hos kjedene Narvesen, 7-Eleven, Zenzi, Ultra og deler av Meny-kjeden. I november 2008 ble vannet prelansert på Deli de Luca i Oslo og Bergen. Under lanseringsukene bidro Isklar til å øke salget i flaskevannkategorien med 90 prosent, og vannet står nå for 40 prosent av salget i samme kategori. -

Wikipedia List of Convenience Stores

List of convenience stores From Wikipedia, the free encyclopedia The following is a list of convenience stores organized by geographical location. Stores are grouped by the lowest heading that contains all locales in which the brands have significant presence. NOTE: These are not ALL the stores that exist, but a good list for potential investors to research which ones are publicly traded and can research stock charts back to 10 years on Nasdaq.com or other related websites. [edit ] Multinational • 7-Eleven • Circle K [edit ] North America Grouping is by country or united States Census Bureau regional division . [edit ] Canada • Alimentation Couche-Tard • Beckers Milk • Circle K • Couch-Tard • Max • Provi-Soir • Needs Convenience • Hasty Market , operates in Ontario, Canada • 7-Eleven • Quickie ( [1] ) [edit ] Mexico • Oxxo • 7-Eleven • Super City (store) • Extra • 7/24 • Farmacias Guadalajara [edit ] United States • 1st Stop at Phillips 66 gas stations • 7-Eleven • Acme Express gas stations/convenience stores • ampm at ARCO gas stations • Albertsons Express gas stations/convenience stores • Allsup's • AmeriStop Food Mart • A-Plus at Sunoco gas stations • A-Z Mart • Bill's Superette • BreakTime former oneer conoco]] gas stations • Cenex /NuWay • Circle K • CoGo's • Convenient Food Marts • Corner Store at Valero and Diamond Shamrock gas stations • Crunch Time • Cumberland Farms • Dari Mart , based in the Willamette Valley, Oregon Dion's Quik Marts (South Florida and the Florida Keys) • Express Mart • Exxon • Express Lane • ExtraMile at -

Raport Analityczny

The report was prepared by Dom Maklerski BDM at the request of the WSE as part of the Exchange's Analytical Coverage Support Programme EUROCASH ACCUMULATE (PREVIOUS: HOLD) ANALYTICAL REPORT - SUMMARY TARGET PRICE 23,9 PLN We raise our target price to 23,9 PLN/share and rate Accumulate The results of Q3’19 were better than we expected in previous recommendation. The 22 NOVEMBER 2019, 14:00 CEST board standed it’s guidance concerning finalizing integration of retail segment in ’19 and claimed the positive trends are maintained. The process of optimization in EC Distribution and high CPI should support results of ’20 (we estimate growth of EBITDA adj. MSR 17 ca. 9% y/y). The board DCF valuation [PLN] 24,0 announced update of strategy in retail segment at the beginning of ’20. On the other hand, results’ growth may be slown down by challenging labour Peer valuation [PLN] 23,8 market, loss of PKN Orlen contract, possibility of implementation of retail tax Target price [PLN] 23,9 and change of excise tax. Price upside/downside +7,8% Company profile Cost of capital 9,0% Eurocash is a leading wholesale distributor of fast moving consumer goods. It operates in wholesale food distribution (it possesses c.a. 26% market share; it Price [PLN] 22,2 operates through cash & carry and distribution) and in retail segment, in which it develops Delikatesy Centrum markets. In addition to this, the company conducts Market cap [mln PLN] 3 086,6 new projects e.g. Duży Ben and Kontigo. Shares mln. szt.] 139,2 Valuation summary We base our valuation on two methods: discounted cash flows model (70% Max. -

Lojalitetsprogram Og Deres Innvirkning På Konkurransen I Drivstoffmarkedet

Lojalitetsprogram og deres innvirkning på konkurransen i drivstoffmarkedet Kristianne Nordeide Havsgård Masteroppgave Masteroppgaven er levert for å fullføre graden Master i samfunnsøkonomi Universitetet i Bergen, Institutt for økonomi [Juni 2019] i Forord Denne masteroppgaven er skrevet som en avsluttende del på mitt femårige profesjonsstudium i Samfunnsøkonomi ved Universitetet i Bergen. Jeg vil gjerne takke mine to flinke veiledere, Frode Meland og Steinar Vagstad, for god hjelp og nyttige innspill i arbeidet med masteroppgaven min. Samtidig vil jeg takke min beste venninne, Susanne Helen Gangstøe; det har vært en stor trygghet å skrive masteroppgave samtidig som deg, takk for gode diskusjoner og kommentarer underveis. Videre ønsker jeg å takke Konkurransetilsynet, som ga meg idé og inspirasjon til oppgaven. Jeg ønsker også å takke Henry Langseth ved bibliotek for samfunnsvitenskap og musikk, som var til stor hjelp da jeg skulle gå i gang med masteroppgaven, og som lærte meg å bruke Endnote. Til slutt vil jeg takke min alltid støttende ektemann, Sveinung Grytøyr, min far, Halldor Havsgård, samt øvrig familie og venner. Takk for at dere har lest, hjulpet og støttet meg, og gitt meg motivasjon og nyttige tilbakemeldinger gjennom hele skriveperioden. Kristianne Nordeide Havsgård, Bergen 1. Juni 2019 ii Sammendrag Masteroppgaven min har en todelt problemstilling. Jeg ønsker først og fremst å undersøke hvordan lojalitetsprogram påvirker konkurransen i drivstoffmarkedet. Samtidig lurer jeg på om disse lojalitetsprogrammene er gunstige for konsumentene, i den forstand at det er lønnsomt å være med i dem. For å svare på problemstillingene bruker jeg teori og modeller som omhandler byttekostnader. Dette gjør jeg fordi lojalitetsprogram skaper byttekostnader. -

9782746985933.Pdf

LA VERSION COMPLETE DE VOTRE GUIDE NORVEGE 2015/2016 en numérique ou en papier en 3 clics à partir de 8.99€ Disponible sur BERGEN La Porte d’Entrée des Fjords de Norvège © BERGEN TOURIST BOARD / ROBIN STRAND – visitBergen.com Chaque année, les visiteurs venus du monde entier regrettent de ne pas avoir pu rester plus longtemps dans « la ville entre les sept montagnes ». Même si Bergen est une ville de taille Avec la rte Bergen en poce, vous modeste, les visiteurs ne tardent pas à voyage gratui tement dans le tram a découvrir toutes ses opportunités pour et les us de Bergen. n plus, vous qui a soif d’aventure ! Ici, des traditions énéficie de la gratuité ou d’une vivaces côtoient une vie culturelle réduction dans des musées et des trépidante. La ville possède un attractions touristiques, des excursions patrimoine passionnant de l’époque et des événements culturels connus, anséatique et a le statut de Ville des restaurants et des parings. européenne de la culture. La carte est en vente au entre d’informations touristiques situé au Bergen mérite une visite quelle que soit dessus du marcé au poissons. la saison. Le printemps et l’automne sont rices en couleurs, l’été offre une vie citadine animée et l’iver permet de conuguer des vacances dans une métropole avec des escapades usqu’à un domaine siale des environs. e manque pas non plus le circuit d’une ournée Nor in nutsell® la orvège en miniature. NORAY IN A NUTSE® Nous contcter © PAAL AUDESTAD – .ortours.com Oice u tourisme e Bergen entre ’inormtions touristiues trandaien LaTh Portee Gatewa d’Entréey Tél.