Prezentacja Programu Powerpoint

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Initiating Coverage Rating: BUY

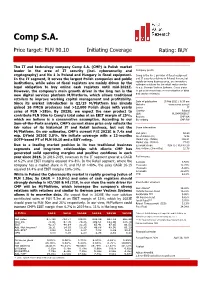

Comp S.A. Price target: PLN 90.10 Initiating Coverage Rating: BUY The IT and technology company Comp S.A. (CMP) is Polish market leader in the area of IT security (incl. cybersecurity and Company profile cryptography) and No 1 in Poland and Hungary in fiscal equipment. Comp is the No 1 provider of fiscal equipment and IT security solutions in Poland. A new, but In the IT segment, it serves the largest Polish companies and public rapidly growing business area, are innovative institutions, while sales of fiscal registers are mainly driven by the software solutions for the retail sector similar legal obligation to buy online cash registers until mid-2021E. to e.g. German Vectron Systems. Comp plans However, the company’s main growth driver in the long run is the to put a stronger focus on monetisation of data and service revenues. new digital services platform M/Platform, which allows traditional retailers to improve working capital management and profitability. Date of publication 15 Feb 2021 / 6:30 am Since its market introduction in Q2/19 M/Platform has already Website www.comp.com.pl gained 16 FMCG producers and >12,000 Polish shops with yearly Sector IT sales of PLN >18bn. By 2023E, we expect the new product to Country Poland ISIN PLCMP0000017 contribute PLN 90m to Comp’s total sales at an EBIT margin of 25%, Reuters CMP.WA which we believe is a conservative assumption. According to our Bloomberg CMP PW Sum-of-the-Parts analysis, CMP’s current share price only reflects the fair value of its historical IT and Retail business, but not the Share information M/Platform. -

Erhalten Sie Unsere Produkte

Hier erhalten Sie unsere Produkte: Produkt Bundesland Markt Der Blaue 200g Berlin/ Brandenburg Kaufland, Rewe, HIT Hessen vereinzelt Edeka, Herkules, Marktkauf Mecklenburg Kaufland, Globus Rostock, HIT Schwerin Sachsen Kaufland, Globus, Metro Leipzig + Chemnitz, Netto, Norma, Edeka, Konsum Leipzig & Dresden, Rewe, Marktkauf, Diska, HIT, Selgros, Nah&Frisch Sachsen-Anhalt Kaufland, Globus, Netto, Edeka, Konsum, Rewe, Marktkauf, Selgros Thüringen Kaufland, Globus, Diska, Rewe, Selgros, Marktkauf, Edeka Weitsch Käse Mecklenburg Globus Rostock, HIT Schwerin Sachsen Kaufland, Globus, Konsum Leipzig Sachsen-Anhalt Globus, Konsum, Edeka Thüringen Globus Der Gelbe Berlin/ Brandenburg HIT, Selgros Hessen vereinzelt Edeka, Herkules, Marktkauf Mecklenburg Globus Rostock, HIT Schwerin Sachsen Globus, Konsum Leipzig, HIT, Selgros, Kaufland Region Leipzig, Metro Leipzig + Chemnitz Sachsen-Anhalt Globus, Selgros, Edeka Thüringen Globus, Selgros, teilweise Edeka & Marktkauf Leipziger Berlin/ Brandenburg Kaufland, Real, Edeka, HIT, Norma, Segros, Rewe Käsesalat Hessen Edeka, Herkules, Marktkauf Mecklenburg Kaufland, Real, Globus Rostock, Rewe, HIT Schwerin, Norma, Famila Sachsen Kaufland, Globus, Real, Edeka, Netto, Konsum Leipzig & Dresden, Rewe, Marktkauf, Diska, Penny, Norma, HIT, Selgros, Lidl, Metro Leipzig + Chemnitz Sachsen-Anhalt Kaufland, Globus, Real, Konsum, Edeka, Marktkauf, Netto, Penny, Norma, Selgros, Lidl Schleswig Holstein Netto Supermarkt Thüringen Kaufland, Globus, Real, Diska, Marktkauf, Edeka, Netto, Rewe, Penny, Norma, Lidl Sächsischer -

European Retail Trends Retailing in Europe and Country Profiles

PRESENTATION FOR PLMA‘s Roundhouse Conference European Retail Trends Retailing in Europe and Country Profiles Nice, 26 February 2015 David Gray Niklas Reinecke 1planetretail.net Retail Analyst Retail Analyst Ageing Society, Single Households, Individualisation, Urbanisation, Mobilisation, Transparency in Production, Loss of Loyalty, Online Shopping, Two Nations Effect, Lifestyle, Situational Usage, Economisation, Cocooning, Smart and Hybrid Shopping, Sustainability, Technological Progress, Energy Saving, Regional Sourcing, Faster Innovation Cycles, Renovation Cycles, Rise of Independent Shopkeepers, Proximity Retailing, Energy Costs, Rising Food Prices, Direct-to-Consumer, Demand for Protection, Verticalisation, Cartel Control, Oligopolisation, Discounting, Multichannel Shopping, Event Shopping, Foodservice, Complexity! Europe from a Macro Perspective Europe from a Macro Perspective - Share of Modern Food Retail Format Sales A few markets in CEE see very high levels of modern food retail similar to Western European markets. Europe: 2014 (%) 4 Source: Planet Retail. Europe from a Macro Perspective – GDP Real Growth Economic recovery is not universal. Markets are in different stages. Europe: GDP Real Growth 2014 (%) +2.1% +1.8% Finland -0.2% Sweden Norway +1.2% +2.7% +0.2% +3.0% Estonia +1.5% Russia + % Latvia 3.6 Denmark +3.2% Lithuania +1.0.% +0.6% +3.2% Belarus Ireland Netherlands +1.4% United +1.0% +2.5% +8.9% Kingdom Poland +2.4% Belgium Germany Czech Rep +2.8% Ukraine +1,2% +1.1% Slovakia +2.4% +0.4% Austria Hungary France Switzerland Slovenia +0.7% Romania Moldova +5.0% Croatia Italy Serbia+3.4% +1.4% -1.1% Bosnia & -0.8% Herzegovina +3.2% -0.2% -0.5% Bulgaria +4.5% +1.3% +2.1% -6.5% +1.0% Macedonia Georgia Spain Albania Armenia Portugal +0.6% Azerbaijan Greece +0.7% Cyprus 5 Source: Planet Retail. -

Case M.7920 - NETTO / J SAINSBURY / DANSK SUPERMARKED / NEW EDLINGTON / HEDON / ROUNDHAY ROAD

EUROPEAN COMMISSION DG Competition Case M.7920 - NETTO / J SAINSBURY / DANSK SUPERMARKED / NEW EDLINGTON / HEDON / ROUNDHAY ROAD Only the English text is available and authentic. REGULATION (EC) No 139/2004 MERGER PROCEDURE Article 4(4) Date: 22.01.2016 EUROPEAN COMMISSION Brussels, 22.1.2016 In the published version of this decision, some C(2016) 433 final information has been omitted pursuant to Article 17(2) of Council Regulation (EC) No 139/2004 concerning non-disclosure of business secrets and other confidential information. The omissions are PUBLIC VERSION shown thus […]. Where possible the information omitted has been replaced by ranges of figures or a general description. MERGER PROCEDURE To the notifying party: To the Competition and Markets Authority: Dear Sirs, Subject: Case M.7920 – NETTO / J SAINSBURY / DANSK SUPERMARKED / NEW EDLINGTON / HEDON / ROUNDHAY Commission decision following a reasoned submission pursuant to Article 4(4) of Regulation No 139/20041 for referral of the case to the United Kingdom and Article 57 of the Agreement on the European Economic Area2. Date of filing: 11.1. 2016 Legal deadline for response of Member States: 1.2.2016 Legal deadline for the Commission decision under Article 4(4): 15.2.2016 I. INTRODUCTION 1. On 11 January 2016, the Commission received by means of a Reasoned Submission a referral request pursuant to Article 4(4) of the Merger Regulation with respect to the transaction in subject, by which Sainsbury plc and Dansk Supermarked A/S, parent companies to Netto Limited, a non-full function joint venture, acquire joint control from the Co-operative Group Limited, within the meaning of Article 3(1)(b) of the 1 OJ L 24, 29.1.2004, p. -

Annual Report

NorgesGruppen ANNUAL REPORT NorgesGruppen’s reporting NorgesGruppen annual report 2016 for the year 2016 k NorgesGruppen CONTENTS ÅRSRAPPORT Annual Report 2016 [Norwegian] contains statutory information related to Page 3 Important events during the past year NorgesGruppen’s annual reporting. Page 4 Key financial figures Page 5 This is NorgesGruppen Matnyttig Page 6 NorgesGruppen’s value creation Et magasin fra NorgesGruppen nr. 1/2016 Handleliste Page 7 Message from the CEO: A look at the industry Kjøleskapstemperatur NorgesGruppen Restemiddag Page 9 Annual results 2016: Financial development ÅRSRESULTAT 2016 Page 11 Our value creation Vinn+ Delta i quiz Page 13 Future outlook og vinn matvarer for kr. 3000,– Gode grep for mindre matsvinn Page 14 Sustainability Spar penger og miljø DAGLIGVAREBRANSJEN FLYKTNINGEN SOM EN HANDLINGENS OG FOLKEHELSEN BLE BUTIKKSJEF KJØPMANN Page 16 Business – Retail Randi Flesland, Wasim Zahid og Møt Ali fra Afghanistan Oppskriften på et Yngve Ekern utfordrer bransjen levende lokalsamfunn Page 18 Business – Brands Page 20 Business – Wholesale Stock Exchange Report 2016 [Norwegian] Page 22 Business – Real estate contains the annual result for 2016. Page 24 Business – Corporate functions and shared services Magasinet «Matnyttig» Page 26 Board of Directors of NorgesGruppen ASA Ambisjon: 1 • Et sunnere Norge Page 28 Annual report 2016 Matnyttig Et magasin fra NorgesGruppen nr. 1/2016 Page 38 Consolidated financial statement 2016 Handleliste Kjøleskapstemperatur NorgesGruppenRestemiddag BÆREKRAFTSRAPPORT Vinn+ Delta -

Dino Trzymaj, 41,00

Dino Bloomberg: DNP PW Equity, Reuters: IPO-DIN.WA Trzymaj, 41,00 PLN 15 maja 2017 r. Inicjacja Wzrostozaurus Rex Rozpoczynamy wydawanie rekomendacji dla spółki Dino od TRZYMAJ z ceną docelową 41 Informacje PLN na akcję. Dino jest drugą pod względem tempa wzrostu siecią detaliczną w Polsce, Kurs akcji (PLN) 38,79 zarówno pod względem dynamiki przychodów ze sprzedaży (2010-2016 +36% CAGR), jak i Upside 6% wzrostu liczby sklepów (2010-2016 +33% CAGR). Na koniec 2016 r. sieć Dino liczyła 628 Liczba akcji (mn) 98,04 sklepów (+117 nowych otwarć netto w 2016 r.), a do końca 2020 r. ich liczba zbliży się do Kapitalizacja (mln PLN) 3 802,97 1,2 tys. Spółka działa w segmencie supermarketów proximity, które wraz z sieciami Free float 49% convenience zwiększają obecnie udział w rynku kosztem sklepów tradycyjnych. Powrót Free float (mln PLN) 1 863,46 inflacji cen żywności, wzrost wolumenów oraz wciąż widoczny efekt programów rządowych Free float (mln USD) 481,78 będą naszym zdaniem wspierać sprzedaż LFL w nadchodzących latach. EV (mln PLN) 4 416,74 Dług netto (mln PLN) 613,76 Wysoka dynamika nowych otwarć i silna sprzedaż LFL Motorem wzrostu wyników Dino będą trzy czynniki: (i) nowe otwarcia (średnioroczny wzrost w latach Dywidenda 2017-2020 na poziomie 135 otwarć), które w drugim roku działalności (dojrzewania) są w stanie Stopa dywidendy (%) 0,0% wygenerować wzrost przychodów o blisko 120-150% w stosunku do 1 roku działalności (mediana otwarć w sierpniu), (ii) wzrost sprzedaży LFL oraz (iii) powrót inflacji. Dino rozwija swoje sklepy na obszarach Odcięcie dywidendy - miejsko-wiejskich, poza centrami dużych miast i stanowi bezpośrednią konkurencję dla Biedronek. -

FRENCH MARKET PRESENTATION for : FEVIA from : Sophie Delcroix – Elise Deroo – Green Seed France Date : 19Th June, 2014

FRENCH MARKET PRESENTATION For : FEVIA From : Sophie Delcroix – Elise Deroo – Green Seed France Date : 19th June, 2014 FEVIA 1 I. GREEN SEED GROUP : WHO WE ARE II. MARKET BACKGROUND AND CONSUMER TRENDS III. THE FRENCH RETAIL SECTOR IV. KEY RETAILERS PROFILES V. FOODSERVICE VI. KEY LEARNINGS VII. CASE STUDIES FEVIA 2 Green Seed Group Having 25 years of experience, the Green Seed Group is a unique international network of 11 offices in Europe, North America and Australia, specializing in the food & beverage sector OUR MISSION Advise both French and foreign food and beverage companies or marketing boards, on how to develop a sustainable and profitable position abroad Green Seed France help you to develop your activity in France using our in-depth knowledge of the local food and beverage market and our established contacts within the trade FEVIA 3 A growing and unique international network Germany (+ A, CH) The Netherlands Scandinavia U.S.A./Canada Great Britain Belgium France Portugal Spain Italy 11 offices covering 18 countries Australasia FEVIA 4 The Green Seed model Over the last decade, one of the most important trends in the French food & drink trade has been for retailers to deal with their suppliers on a direct line. Green Seed France has developed its business model around this trend. We act as business facilitators ensuring that every step of the process is managed with maximum efficiency. From first market visit, to launch as well as the ongoing relationship that follows. We offer a highly cost-effective solution of “flexible local sales and marketing management support” aimed at adding value. -

Structural Changes in Food Retailing: Six Country Case Studies

FSRG Publication Structural Changes in Food Retailing: Six Country Case Studies edited by Kyle W. Stiegert Dong Hwan Kim November 2009 Kyle Stiegert [email protected] Dong Hwan Kim [email protected] The authors thank Kate Hook for her editorial assistance. Any mistakes are those of the authors. Comments are encouraged. Food System Research Group Department of Agricultural and Applied Economics University of Wisconsin-Madison http://www.aae.wisc.edu/fsrg/ All views, interpretations, recommendations, and conclusions expressed in this document are those of the authors and not necessarily those of the supporting or cooperating organizations. Copyright © by the authors. All rights reserved. Readers may make verbatim copies of this document for noncommercial purposes by any means, provided that this copyright notice appears on all such copies. ii Table of Contents Page CHAPTER 1: INTRODUCTION AND LITERATURE REVIEW 1 1. Introduction 1 2. Outline of the Book 1 3. Impact of Dominant Food Retailers: Review of Theories and Empirical Studies 3 3.1. Market Power vs. Efficiency 3 3.2. Vertical Relationship between Food retailers and Food producers: Vertical Restraints, Fees and Services Enforced by Retailers 5 Fees and Services 5 Coalescing Power 8 3.3. Market Power Studies 8 References 17 CHAPTER 2: THE CASE OF AUSTRALIA 21 1. Introduction 21 2. Structure of Food Retailing in Australia 21 2.1 Industry Definition of Food Retailing 21 2.2 Basic Structure of Retail Food Stores 22 2.3 Food Store Formats 24 2.4 Market Share and Foreign Direct Investment 25 3. Effects of Increased Food Retail Concentration on Consumers, Processors and Suppliers 28 4. -

Retail Foods Report Poland

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Voluntary - Public Date: 12/31/2013 GAIN Report Number: PL1343 Poland Post: Warsaw Retail Foods Report Report Categories: Retail Foods Approved By: Michael Henney, Agricultural Attaché Prepared By: Agnieszka Zmudzka, Intern; Jolanta Figurska, Agricultural Marketing Specialist Report Highlights: Poland’s retail market is very dynamic adjusting to the ever changing consumer desire to advance their lifestyle. Discount stores are an important force on the market given the soft economy, while convenience stores, hypermarkets, supermarkets are becoming stronger. U.S suppliers face stiff competition for the consumer’s attention from products of local and other EU countries. U.S. food products holding best near-term prospects include: wines, distilled spirits, seafood, prunes, and cranberries etc. The presented information provides a general overview of the internal retail market and enables analysis of activities of trade entities. Basic information includes economic indicators, retail sales, structure of retail sales, prevailing organizational forms on the market, and major retailers in the market. Data presented in the publication are obtained from credible sources, such as Polish Statistical Office or from prominent press publishers, carrying out their independent researches. Table of Contents Section One: Market Overview ...................................................................................................3 -

Bens Agroalimetares POLONIA

Datos generales POLONIA Datos básicos Datos básicos PIB per cápita (2015) • ALEMANIA: 41.219 USD •PORTUGAL: 19.222 USD • POLAND: 12.450 USD • HUNGRÍA: 12.259 USD • RUMANIA: 8.973 USD Datos básicos Niveles salariales a enero de 2017: • Salario mínimo mensual bruto 2.000 zlotys (476 EUR) • Salario medio interprofesional mensual bruto 4.636 zlotys (1.103 EUR) A destacar: • Polonia se encuentra en pleno desarrollo de infraestructuras. • Es un gran receptor de fondos de la UE. Para el periodo 2014 – 2020 ha recibido 82.500 millones de EUR Datos básicos Datos básicos Datos básicos Recomendaciones de negociación Que hacer: • Fijar las reuniones con antelación • Estar bien preparado para los encuentros (presentación de empresa, catálogos, etc.) • Dar respuestas rápidas, concretas y substanciales. • Mantener contacto regular con los interlocutores polacos. • Ser persistente y profesional al abordar el mercado. Recomendaciones de negociación Que no hacer: • Llegar retrasado. • No existe hábito de tratar a las personas como Señor Doctor o Señor Ingeniero. • Los polacos no les gusta ser considerados como país del Este sino como Europa Central. • En la presentaciones solo dar la mano. No dar besos. Bens agroalimetares POLONIA 2016 Importações de bens agroalimentares na Polónia • 2014-2016 Crecimiento anual del 4,5% • Principales productos importados: • Carne porcina. 1.190 millones EUR • Salmón fresco o refrigerado. 830 millones EUR • Derivados de la extración del aceite de soja. 777 millones EUR • Chocolates i productos de cacao. 585 millones EUR • Cafés y sucedaneos. • Productos de panaderia y pastelería • Queso y requesón • Vino • Bebidas espirituosas Importações de bens agroalimentares provenientes de Portugal • 2014-2016 Crecimiento anual del 26,6 % • 95,1 millones de EUR en 2016 • Principales productos importados de Portugal: • Vino. -

Retail for Netto Marken-Discount

Case Study GK/ Retail for Netto Marken-Discount THE CHALLANGE Netto Marken-Discount is a German discount supermarket chain with headquarters in Maxhütte-Haidhof, Bavaria – in the south-east of _Enterprise-wide workfl ow solution to improve the country. Netto has grown rapidly in recent years and now has more store standards and improve communication than 1,200 stores throughout Germany. An ever-increasing number of between store and head offi ce customers – already in excess of 5 million – shop its food and non-food _Mobile solutions for the store range each week. _State of the art POS touch solution Netto off ers a much wider branded-product range than many of its _Central control of POS systems in all stores rivals, and supplements this with a wide variety of fresh foods such as fruit, vegetables, dairy and meat. Netto carefully selects market-leading THE SOLUTION IT solutions and technologies to stay ahead of its competitors. GK SOFTWARE AG was chosen, by Netto, as its partner for store solutions and _GK/Retail Workfl ow together, signifi cant trading benefi ts have been realised. _GK/Retail Mobile Workfl ow processes have been introduced which have ensured the _GK/Retail Touch POS (native 1024x768) with GUI in Netto Corporate Design highest operational standards are implemented consistently in all stores. _GK/Retail Backoffi ce Merchandise management processes, operating on mobile devices, _GK/Retail Storemanager enable action to be taken, where it matters most – on the shop fl oor – to improve presentation as well as product availability and thus maximise sales opportunities. Customer service at the point of sale has been greatly enhanced with the use of touch terminals – for the fi rst time by any German food retailer. -

DE POOLSE RETAILSECTOR Voeding Publicatiedatum / 25.10.2018

DE RETAILSECTOR IN POLEN FLANDERS INVESTMENT & TRADE MARKTSTUDIE Marktstudie /////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// DE POOLSE RETAILSECTOR Voeding Publicatiedatum / 25.10.2018 //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// Guido Scharpé Vlaams Economisch Vertegenwoordiger Flanders Investment & Trade - Warschau Ambasada Belgii Przedstawicielstwo Ekonomiczne i Handlowe Flandrii Al. Ujazdowskie 51 | 00-536 Warszaw | Poland T: +48 22 584 73 40 | E: [email protected] www.flandersinvestmentandtrade.com INHOUD 1. INLEIDING ................................................................................................................................................................................ 3 1.1 Algemene achtergrondinformatie in verband met de Poolse retailmarkt 3 1.2 Demografische ontwikkeling en koopkracht 3 2. LEVENSMIDDELENHANDEL ........................................................................................................................................... 4 2.1 TRENDS 6 2.1.1 Elektronische handel – e-commerce 6 2.1.2 Huismerken 6 2.1.3 Groeiend bewustzijn en stijgende verwachtingen van de consument 7 2.1.4 Gezondheid en wellness 7 2.1.5 Glutenvrije voeding 7 2.1.6 Convenience/Kant-en-klare maaltijden 8 3. DE BELANGRIJKSTE SPELERS IN POLEN ...............................................................................................................