Prospectus and Fund Rules

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

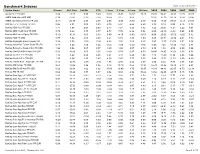

Benchmark Indexes Data As Of: 03/31/2011 Index Name Sharpe Std

Benchmark Indexes Data as of: 03/31/2011 Index Name Sharpe Std. Dev. 1st Qtr YTD 1 Year 3 Year 5 Year 10 Year 2010 2009 2008 2007 2006 Alerian MLP TR USD 0.89 23.25 5.99 5.99 33.02 20.03 16.57 17.25 35.85 76.41 -36.91 12.72 26.07 AMEX Gold Miners PR USD 0.39 47.82 -2.15 -2.15 35.65 8.12 9.68 - 33.94 37.30 -26.79 16.86 21.86 AMEX International Market PR USD -0.13 25.37 2.77 2.77 4.05 -5.95 -0.80 2.17 0.80 17.60 -39.51 16.18 21.51 BarCap 1-5 Yr Treasury TR USD 0.98 2.51 0.00 0.00 2.79 2.91 4.88 4.20 3.73 0.19 8.83 8.16 3.75 BarCap ABS Auto TR USD 1.17 5.68 0.63 0.63 2.47 7.21 6.23 5.12 3.25 26.07 -5.57 5.22 4.61 BarCap ABS Credit Card TR USD 0.79 9.42 0.77 0.77 4.73 7.76 6.86 5.84 6.55 29.89 -9.33 5.45 4.55 BarCap ABS Home Equity TR USD -0.19 16.91 0.00 0.00 0.00 -4.10 -5.80 -0.53 0.00 20.63 -36.00 -8.25 5.32 BarCap ABS TR USD 0.77 6.92 0.64 0.64 4.21 5.74 4.36 4.59 5.85 24.71 -12.72 2.21 4.70 BarCap Aggregate Bond Treasury TR 0.58 5.58 -0.16 -0.16 4.53 3.55 5.69 5.15 5.87 -3.57 13.74 9.01 3.08 BarCap Asian Pac Taiwan Dollar TR JPY 0.78 6.24 1.54 1.54 -2.45 -1.00 -2.50 -0.66 -2.26 7.45 -11.24 -7.52 2.81 BarCap Bellwether Swap 6 Mon TR USD 1.92 0.56 0.07 0.07 0.39 1.50 3.07 2.79 0.38 1.58 4.09 5.39 5.54 BarCap CMBS ERISA Eligible TR USD 0.53 18.46 2.05 2.05 12.62 8.79 6.87 6.53 20.40 28.45 -20.52 5.58 4.72 BarCap Credit 1-3 Yr TR USD 1.16 3.62 0.58 0.58 3.24 4.73 5.29 4.80 4.15 11.59 0.30 5.96 4.66 BarCap Credit 1-5 Yr TR USD 1.06 4.64 0.85 0.85 4.36 5.47 5.77 5.27 5.44 13.52 -1.13 6.09 4.69 BarCap Danish Krone Aggregate TR DKK 0.12 14.76 -

Press Release Paris – June 21St, 2021

Press Release Paris – June 21st, 2021 Europcar Mobility Group rejoins Euronext SBF 120 index Europcar Mobility Group, a major player in mobility markets, is pleased to announce that it has re-entered into the SBF 120 and CAC Mid 60 indices, in accordance with the decision taken by the Euronext Index Steering Committee. This re-entry, which took place after market close on Friday 18 June 2021, is effective from Monday 21 June 2021. The SBF 120 is one of the flagship indices of the Paris Stock Exchange. It includes the first 120 stocks listed on Euronext Paris in terms of liquidity and market capitalization. The CAC Mid 60 index includes 60 companies of national and European importance. It represents the 60 largest French equities beyond the CAC 40 and the CAC Next 20. It includes the 60 most liquid stocks listed in Paris among the 200 first French capitalizations. This total of 120 companies compose the SBF 120. Caroline Parot, CEO of Europcar Mobility Group, said: “Europcar Mobility Group welcomes the re-integration of the SBF 120 and CAC Mid 60. This follows the successful closing of the Group’s financial restructuring during Q1 2021, which allowed the Group to open a new chapter in its history. Europcar Mobility Group re-entry into the SBF 120 and CAC Mid 60 is an important step for our Group and recognizes the fact that we are clearly "back in the game”, in a good position to take full advantage of the progressive recovery of the Travel and Leisure market. In that perspective, our teams are fully mobilized for summer of 2021, in order to meet the demand and expectations of customers who are more than ever eager to travel”. -

Neoen Joins the SBF 120Index

Paris, June 11, 2020 Neoen joins the SBF 120 index Neoen (ISIN: FR0011675362, Ticker: NEOEN), one of the world’s leading and fastest-growing independent producers of exclusively renewable energy, is announcing it is joining the SBF 120 index consisting of the top 120 stocks listed on the Euronext Paris market in term of both liquidity and market capitalization. As part of its quarterly review of the Euronext Paris indices, the Index Committee decided to include Neoen in both the SBF 120 and the CAC Mid 60 indices. This decision will take effect from June 22, 2020. Neoen’s inclusion in these indices is a testament to its good share price performance since its October 2018 IPO. Over the past 20 months, the Company’s market capitalization has more than doubled to almost €3 billion. This strong rise was accompanied by a steady increase in trading volumes. Since its IPO, Neoen has consistently delivered strong earnings growth and expansion in its project portfolio. Assets in operation or under construction have increased from 1.8 GW at June 30, 2018 to 3.1 GW at March 31, 2020, and the target is to have more than 5 GW by year-end 2021. This rapid and profitable growth has been founded on geographical and technological diversification of its asset base. Neoen is present in 14 countries on 4 continents and it develops and operates solar and wind energy generation and storage capacity. Xavier Barbaro, Neoen’s Chairman and Chief Executive Officer, commented: “We are very pleased to be joining this benchmark index, which marks a new important step for Neoen. -

Final Report Amending ITS on Main Indices and Recognised Exchanges

Final Report Amendment to Commission Implementing Regulation (EU) 2016/1646 11 December 2019 | ESMA70-156-1535 Table of Contents 1 Executive Summary ....................................................................................................... 4 2 Introduction .................................................................................................................... 5 3 Main indices ................................................................................................................... 6 3.1 General approach ................................................................................................... 6 3.2 Analysis ................................................................................................................... 7 3.3 Conclusions............................................................................................................. 8 4 Recognised exchanges .................................................................................................. 9 4.1 General approach ................................................................................................... 9 4.2 Conclusions............................................................................................................. 9 4.2.1 Treatment of third-country exchanges .............................................................. 9 4.2.2 Impact of Brexit ...............................................................................................10 5 Annexes ........................................................................................................................12 -

Execution Version GUARANTEED SENIOR SECURED NOTES

Execution Version GUARANTEED SENIOR SECURED NOTES PROGRAMME issued by GOLDMAN SACHS INTERNATIONAL in respect of which the payment and delivery obligations are guaranteed by THE GOLDMAN SACHS GROUP, INC. (the “PROGRAMME”) PRICING SUPPLEMENT DATED 21 DECEMBER 2020 SERIES 2020-20 SENIOR SECURED FIXED RATE NOTES (the “SERIES”) ISIN: XS2277589615 Common Code: 227758961 This document constitutes the Pricing Supplement of the above Series of Secured Notes (the “Secured Notes”) and must be read in conjunction with the Base Listing Particulars dated 25 September 2020, as supplemented and amended by Prospectus Supplement No. 1 dated 20 October 2020, Prospectus Supplement No. 2 dated 2 November 2020 and Prospectus Supplement No. 3 dated 12 November 2020 (as so amended the “Base Listing Particulars”), and in particular, the Base Terms and Conditions of the Secured Notes, as set out therein. Full information on the Issuer, The Goldman Sachs Group. Inc. (the “Guarantor”), and the terms and conditions of the Secured Notes, is only available on the basis of the combination of this Pricing Supplement and the Base Listing Particulars as so supplemented. The Base Listing Particulars has been published at www.ise.ie and is available for viewing during normal business hours at the registered office of the Issuer, and copies may be obtained from the specified office of the listing agent in Ireland. The Issuer accepts responsibility for the information contained in this Pricing Supplement. To the best of the knowledge and belief of the Issuer and the Guarantor the information contained in the Base Listing Particulars, as completed by this Pricing Supplement in relation to the Series of Secured Notes referred to above, is true and accurate in all material respects and, in the context of the issue of this Series, there are no other material facts the omission of which would make any statement in such information misleading. -

Execution Version

Execution Version GUARANTEED SENIOR SECURED NOTES PROGRAMME issued by GOLDMAN SACHS INTERNATIONAL in respect of which the payment and delivery obligations are guaranteed by THE GOLDMAN SACHS GROUP, INC. (the “PROGRAMME”) PRICING SUPPLEMENT DATED 23rd SEPTEMBER 2020 SERIES 2020-12 SENIOR SECURED EXTENDIBLE FIXED RATE NOTES (the “SERIES”) ISIN: XS2233188510 Common Code: 223318851 This document constitutes the Pricing Supplement of the above Series of Secured Notes (the “Secured Notes”) and must be read in conjunction with the Base Listing Particulars dated 25 September 2019, as supplemented from time to time (the “Base Prospectus”), and in particular, the Base Terms and Conditions of the Secured Notes, as set out therein. Full information on the Issuer, The Goldman Sachs Group. Inc. (the “Guarantor”), and the terms and conditions of the Secured Notes, is only available on the basis of the combination of this Pricing Supplement and the Base Listing Particulars as so supplemented. The Base Listing Particulars has been published at www.ise.ie and is available for viewing during normal business hours at the registered office of the Issuer, and copies may be obtained from the specified office of the listing agent in Ireland. The Issuer accepts responsibility for the information contained in this Pricing Supplement. To the best of the knowledge and belief of the Issuer and the Guarantor the information contained in the Base Listing Particulars, as completed by this Pricing Supplement in relation to the Series of Secured Notes referred to above, is true and accurate in all material respects and, in the context of the issue of this Series, there are no other material facts the omission of which would make any statement in such information misleading. -

Lyxor Mergers

Merger of Lyxor funds on 19 April 2018 List of funds identifiers Lyxor CAC 40 Daily (2x) Leveraged UCITS ETF Label Absorbed fund indentifier Absorbing fund identifier Acc Share ISIN Code FR0010592014 No change BBG Ticker - Euronext Paris LVC FP No change Lyxor CAC 40 Daily (-2x) Inverse UCITS ETF Label Absorbed fund indentifier Absorbing fund identifier Acc Share ISIN Code FR0010411884 No change BBG Ticker - Euronext Paris BX4 FP No change Lyxor CAC 40 Daily (-1x) Inverse UCITS ETF Label Absorbed fund indentifier Absorbing fund identifier Acc Share ISIN Code FR0010591362 No change BBG Ticker - Euronext Paris SHC FP No change Lyxor CAC MID 60 UCITS ETF Label Absorbed fund indentifier Absorbing fund identifier Dist Share ISIN Code FR0011041334 No change BBG Ticker - Euronext Paris CACM FP No change Merger of Lyxor funds on 19 April 2018 List of funds identifiers Lyxor IBEX 35 Doble Apalancado Diario UCITS ETF Label Absorbed fund indentifier Absorbing fund identifier Acc Share ISIN Code FR0011042753 No change BBG Ticker - Bolsa de Madrid IBEXA SM No change Lyxor IBEX 35 Inverso Diario UCITS ETF Label Absorbed fund indentifier Absorbing fund identifier Acc Share ISIN Code FR0010762492 No change BBG Ticker - Bolsa de Madrid INVEX SM No change Lyxor IBEX 35 Doble Inverso Diario UCITS ETF Label Absorbed fund indentifier Absorbing fund identifier Acc Share ISIN Code FR0011036268 No change BBG Ticker - Bolsa de Madrid IBEXA SM No change Merger of Lyxor funds on 19 April 2018 List of funds identifiers Lyxor Daily ShortDAX x2 UCITS ETF Label Absorbed -

Carmila Joins the Sbf 120 and Cac Mid 60

PRESS RELEASE Boulogne-Billancourt, 11 December 2020 CARMILA JOINS THE SBF 120 AND CAC MID 60 Carmila is pleased to announce that it has joined the SBF 120 – a flagship Paris stock exchange index listing the top 120 Euronext Paris stocks in terms of liquidity and market capitalisation – as well as the CAC Mid 60. Following the quarterly review of the Euronext Paris indices on 10 December 2020, the Expert Indices Committee (Conseil Scientifique des Indices) decided at its meeting held the same day to include Carmila among the issuers making up the SBF 120 and CAC Mid 60 indices. This decision will take effect on 18 December 2020, after trading. Marie Cheval, Chairman and Chief Executive Officer of Carmila, said: "Carmila's entry in the SBF 120 and CAC Mid 60 represents a milestone in the company's stock market journey and serves to recognise its steady trajectory and solid performance." INVESTOR AND ANALYST CONTACT PRESS CONTACT Florence Lonis – General Secretary Morgan Lavielle - Corporate Communications Director [email protected] [email protected] +33 6 82 80 15 64 +33 6 87 77 48 80 INVESTOR AGENDA 17 February 2021 (after trading): 2020 Annual Results 18 February 2021 (9:00 a.m. Paris time): Investor and Analyst Meeting 22 April 2021 (after trading): First-quarter 2021 Financial Information 28 July 2021 (after trading): 2021 Half-year Results 29 July 2021 (2:30 p.m. Paris time): Investor and Analyst Meeting Visit our website 1 at https://www.carmila.com/en/ PRESS RELEASE ABOUT CARMILA As the third largest listed owner of commercial property in continental Europe, Carmila was founded by Carrefour and large institutional investors in order to transform and enhance the value of shopping centres adjoining Carrefour hypermarkets in France, Spain and Italy. -

Voting Report December 2017

Voting December 2017 Schroders is required to publish records of voting in order to achieve compliance with the UK Stewardship Code. According, voting in accordance with our house policy is set out on the following pages. Vote Summary Report Date range covered: 12/01/2017 to 12/31/2017 Aberdeen Asian Smaller Companies Investment Trust PLC Meeting Date: 12/01/2017 Country: United Kingdom Meeting Type: Annual Ticker: AAS Proposal Vote Number Proposal Text Mgmt Rec Instruction 1 Accept Financial Statements and Statutory For For Reports 2 Approve Remuneration Report For For 3 Approve Remuneration Policy For For 4 Approve Final Dividend For For 5 Approve Special Dividend For For 6 Re-elect Nigel Cayzer as Director For For 7 Re-elect Martin Gilbert as Director For For 8 Re-elect Haruko Fukuda as Director For For 9 Re-elect Chris Maude as Director For For 10 Re-elect Philip Yea as Director For For 11 Reappoint Ernst & Young LLP as Auditors and For For Authorise Their Remuneration 12 Authorise Issue of Equity with Pre-emptive For For Rights 13 Authorise Issue of Equity without Pre-emptive For For Rights 14 Authorise Market Purchase of Ordinary Shares For For 15 Authorise the Company to Call General Meeting For For with Two Weeks' Notice African Rainbow Minerals Ltd Meeting Date: 12/01/2017 Country: South Africa Meeting Type: Annual Ticker: ARI Proposal Vote Number Proposal Text Mgmt Rec Instruction 1 Re-elect Joaquim Chissano as Director For Against Voter Rationale: Has attended less than 75% of his meetings for 2 consecutive years without giving -

Important Information Modification of The

IMPORTANT INFORMATION MODIFICATION OF THE PROSPECTUS OF THE FUNDS MANAGED BY LYXOR INTERNATIONAL ASSET MANAGEMENT ON THE PUBLICATION OF INFORMATION ON SUSTAINABILITY Dear Madam, Dear Sir, In accordance with European Regulation (EU) 2019/2088 on “sustainability‐related disclosures in the financial services sector (the “SFD Regulation”), Lyxor International Asset Management SAS (“LIAM”) acting as management companies for undertakings of the ETFs listed in appendix hereto (hereinafter the "ETFs") would like to inform you that the prospectuses of these ETFs will be amended as of 19th February 2021 to include the following information: • description of the integration and the inclusion of sustainability risks in LIAM and LAM investment process; • possible impact of sustainability risks on the performance of the Funds; • classification of certain Funds under Articles 8 or 9 of SFD Regulation and inclusion of the relevant regulatory disclosure. More information on the integration of sustainability risks in investment process can be found on LIAM website: https://www.lyxor.com/investissement-socialement-responsable. The Fund Prospectuses and Key Information Investor Documents are available on AMF website (www.amf-france.org), on www.lyxoretf.fr or on request from LIAM at [email protected]. Should you require any additional information on your investments we recommend contacting your usual financial advisor. We would like to thank you for the confidence you have placed in LIAM and our products. Sincerely yours. Lionel PAQUIN Chairman of Lyxor International Asset Management Lyxor International Asset Management – S.A.S. au capital de 72 059 696 euros – RCS Nanterre No 419 223 375 – Siège Social : Tours Société Générale -17 cours Valmy. -

Verallia Joins Back the SBF 120

PRESS RELEASE La Défense, Décembre 10, 2020 Verallia joins back the SBF 120 Verallia, the leading European producer of glass packaging for beverages and food, the second largest producer in Latin America and the third largest producer globally, is pleased to announce it is joining back the SBF 120 index. Following the quarterly review of Euronext Paris’ indices, the Euronext Paris Indices Expert Committee decided to include Verallia in one of the key indices of the Paris stock exchange, composed of the 120 largest stocks listed on Euronext Paris in terms of liquidity and market capitalization. This new step in the Group’s stock market life welcomes the increased liquidity in Verallia’s stock as well as its enlarged free float. This decision will take effect on 21 December 2020. About Verallia - Verallia is the leading European and the third largest producer globally of glass containers for food and beverages, and offers innovative, customized and environmentally-friendly solutions. The Group posted €2.6 billion in revenue and produced 16 billion bottles and jars in 2019. Verallia employs around 10,000 people and comprises 32 glass production facilities in 11 countries. Verallia is listed on compartment A of the regulated market of Euronext Paris (Ticker: VRLA – ISIN: FR0013447729) and is included in the following indices: SBF 120, CAC Mid 60, CAC Mid & Small et CAC All-Tradable. For more information: www.verallia.com Press contacts Verallia - Stephanie BIAIS - [email protected] Brunswick - Benoit Grange, Hugues Boëton - [email protected] - +33 1 53 96 83 83 Verallia Investor Relations contact Alexandra Baubigeat Boucheron - [email protected] . -

CAC® Family CAC 40®, CAC Next 20®, CAC® Large 60, CAC® Mid 60, SBF 120®, CAC® Small, CAC® Mid & Small, CAC® All-Tradable

INDEX RULE BOOK CAC® Family CAC 40®, CAC Next 20®, CAC® Large 60, CAC® Mid 60, SBF 120®, CAC® Small, CAC® Mid & Small, CAC® All-Tradable Version 18-01 Effective from 23 November 2018 indices.euronext.com Index 1. Index Summary 1 2. Governance and Disclaimer 4 2.1 Indices 4 2.5 Cases not covered in rules 5 2.6 Rule book changes 5 2.7 Liability 5 2.8 Ownership and trademarks 5 3. Publication 6 3.1 Dissemination of index values 6 3.2 Exceptional market conditions and corrections 6 3.3 Announcement policy 6 4. Calculation 7 4.1 Calculation of the price index 7 4.2 Currency conversion 7 4.3 Total return index calculation 7 5. Index reviews 8 5.1 General aim and frequency of reviews 8 5.2 Eligible Companies and selection 8 5.3 Periodical update of weighting 10 5.4 Adjustments to the outcome of the review 10 6. Corporate Actions 11 6.1 General 11 6.2 Removal of constituents 11 6.3 Split up / spin-off 12 6.4 Early inclusion of non-constituents 12 6.5 Dividends 12 6.6 Rights issues and other rights 12 6.7 Bonus Issues, stock splits and reverse stock splits 13 6.8 Changes in number of shares or Free Float Factors 13 6.9 Partial tender offers on own shares 13 7. Index Calculation Formulas 14 8. Definitions 15 8.1 Free Float Factor 15 8.2 Review Relevant Dates 15 8.3 Regulated Turnover and Regulated Trading Volume 15 1.