Final Report Amending ITS on Main Indices and Recognised Exchanges

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Global Exchange Indices

Global Exchange Indices Country Exchange Index Argentina Buenos MERVAL, BURCAP Aires Stock Exchange Australia Australian S&P/ASX All Ordinaries, S&P/ASX Small Ordinaries, Stock S&P/ASX Small Resources, S&P/ASX Small Exchange Industriials, S&P/ASX 20, S&P/ASX 50, S&P/ASX MIDCAP 50, S&P/ASX MIDCAP 50 Resources, S&P/ASX MIDCAP 50 Industrials, S&P/ASX All Australian 50, S&P/ASX 100, S&P/ASX 100 Resources, S&P/ASX 100 Industrials, S&P/ASX 200, S&P/ASX All Australian 200, S&P/ASX 200 Industrials, S&P/ASX 200 Resources, S&P/ASX 300, S&P/ASX 300 Industrials, S&P/ASX 300 Resources Austria Vienna Stock ATX, ATX Five, ATX Prime, Austrian Traded Index, CECE Exchange Overall Index, CECExt Index, Chinese Traded Index, Czech Traded Index, Hungarian Traded Index, Immobilien ATX, New Europe Blue Chip Index, Polish Traded Index, Romanian Traded Index, Russian Depository Extended Index, Russian Depository Index, Russian Traded Index, SE Europe Traded Index, Serbian Traded Index, Vienna Dynamic Index, Weiner Boerse Index Belgium Euronext Belgium All Share, Belgium BEL20, Belgium Brussels Continuous, Belgium Mid Cap, Belgium Small Cap Brazil Sao Paulo IBOVESPA Stock Exchange Canada Toronto S&P/TSX Capped Equity Index, S&P/TSX Completion Stock Index, S&P/TSX Composite Index, S&P/TSX Equity 60 Exchange Index S&P/TSX 60 Index, S&P/TSX Equity Completion Index, S&P/TSX Equity SmallCap Index, S&P/TSX Global Gold Index, S&P/TSX Global Mining Index, S&P/TSX Income Trust Index, S&P/TSX Preferred Share Index, S&P/TSX SmallCap Index, S&P/TSX Composite GICS Sector Indexes -

ANNA Annual Report.Indd

Association of National Numbering Agencies scrl AAnnualnnual RReporteport 22014013 Contents 3 Chairman’s Report 2014 5 Objectives and mission statements of ANNA 6 General meetings – ANNA administrative review 2014 13 ANNA Service Bureau – report for 2014 14 Securities business and state of ISIN implementation – worldwide 16 Allocation of ISIN for new financial instruments 19 Working Groups, Task Forces and Reginal Groups 25 List of members by COUNTRY as per May 2015 Appendices 29 A ISO 6166 – an outline of the standard 30 B ANNA Guidelines for ISO 6166, Version 12, August 2014 40 C Geographical division of countries among substitute agencies as per May 2015 50 D ISO 10962 – outline of the CFI-(Classification of financial Instruments-) Code 2 www.anna-web.com Chairman’s Report 2014 Dear ANNA Members and Partners, Association strategy, re-evaluating the approved short, medium and long term The year 2014 has been referred to as the direction. Some modifications were made transitionary year from the Age of Recovery to and the Association strategy was presented the Age of Divergence. for validation by the members at the last EGM; Looking at the events of 2014, Central Bank - A growing number of ANNA members actions and divergence have been the under- continued to contribute to the evolution of lying themes. The view remains that these the ISO 17442 – Legal Entity Identifier (LEI) two factors are having and will continue to standard, to promote ANNA’s federated have, significant influence on the global model and the value added benefits of our financial markets and the direction they will model and the National Numbering Agencies take in the near future. -

Tracking Errors of Exchange Traded Funds in Bursa Malaysia

Munich Personal RePEc Archive Tracking Errors of Exchange Traded Funds in Bursa Malaysia Ku, Alfred Ing-Soon and Liew, Venus Khim-Sen and Puah, Chin-Hong RHB Investment Bank Berhad, 102, Pusat Pedada, Jalan Pedada, 96000 Sibu, Sarawak, Malaysia., Faculty of Economics and Business, Universiti Malaysia Sarawak, Jalan Datuk Mohammad Musa, 94300 Kota Samarahan, Sarawak., Faculty of Economics and Business, Universiti Malaysia Sarawak, Jalan Datuk Mohammad Musa, 94300 Kota Samarahan, Sarawak. 2019 Online at https://mpra.ub.uni-muenchen.de/107990/ MPRA Paper No. 107990, posted 27 May 2021 07:20 UTC Tracking Errors of Exchange Traded Funds in Bursa Malaysia Alfred Ing-Soon Ku RHB Investment Bank Berhad, 102, Pusat Pedada, Jalan Pedada, 96000 Sibu, Sarawak, Malaysia. Tel: 6-084-329214 E-mail: [email protected] Venus Khim-Sen Liew Faculty of Economics and Business, Universiti Malaysia Sarawak, Jalan Datuk Mohammad Musa, 94300 Kota Samarahan, Sarawak. Tel: 6-082-584291 (Corresponding Author) E-mail: [email protected] Chin-Hong Puah Faculty of Economics and Business, Universiti Malaysia Sarawak, Jalan Datuk Mohammad Musa, 94300 Kota Samarahan, Sarawak. Tel: 6-082-584294 E-mail: [email protected] Citation: Liew, V.K.-S, Ku, A. I.-S., & Puah, C.-H. 2019. Tracking Errors of Exchange Traded Funds in Bursa Malaysia. Asian Journal of Accounting and Finance, 11(2), 96-109. Abstract This study measures the tracking errors of exchange traded funds (ETFs) listed in Bursa Malaysia. Five measures of tracking errors are estimated in this study for the seven ETFs involved. Overall, the best ETF is METFAPA with the least tracking error. -

Monthly Economic Update

122 Winnebago Street, Decorah, IA 52101 309 HWY 150 N, West Union, IA 52175 1-877-566-9468 Text: 563-412-4770 [email protected] Visit us at www.knoxfin.com In this month’s recap: stocks stay in rally mode, helped by hints that the U.S. and China may be closing in on a phase-one trade deal; hiring bounces back; key real estate indicators look stronger. Monthly Economic Update Presented by Jason Knox, AIF®, CRC®, December 2019 THE MONTH IN BRIEF The S&P 500 rose 3.4% in November and attained a series of record closes in the process. Earnings results helped stocks, as did intermittent signals that the first stage of a U.S.-China trade agreement might be near at hand. Job creation improved, and consumer spending lived up to market expectations; consumer confidence and business activity, not so much. Housing indicators communicated good news, and the rally in stocks made the commodity sector look less attractive. DOMESTIC ECONOMIC HEALTH Were the U.S. and China close to signing off on the first phase of a new trade deal? According to officials from both countries, the answer was yes. When would this phase- one deal be finalized? No definite answer emerged. On November 8, President Donald Trump said that such an agreement was near, and six days later, White House economic advisor Larry Kudlow said that negotiators were “getting close” to an accord. On November 26, China’s commerce ministry announced that trade representatives had “reached a consensus” on remaining issues, and President Trump said that negotiators were in the “final throes of a very important deal.” Still, November ended without any announcement that a phase-one pact had been reached.2,3 The Department of Labor’s latest employment report found that the economy generated 128,000 net new jobs in October. -

Annex A, Information Products

ANNEX A, INFORMATION PRODUCTS OF THE EMDDA (APPLICABLE FROM AUGUST 2019) Annex A outlines the following Information products: ■ Euronext Indices Information Products ■ Euronext Cash Information Products ■ Euronext Derivatives Information Products ■ Other Information Products ■ Euronext Real Time Reference Prices All capitalized terms used but not defined herein will have the meaning as defined in the General Conditions. EURONEXT INDICES INFORMATION PRODUCTS Euronext Global Index Group compiles, calculates and publishes indices and iNAVs. It includes indices such as: the main national market indices such as the AEX®, Bel 20®, CAC 40®, ISEQ20® and PSI 20®, global/European/Euronext indices such as the Euronext 100® and Next 150® and a wide variety of sector and other indices. This also comprises volatility indices computed by Euronext, such as the VCAC and VAEX, and strategy indices. Euronext All Indices This Information product provides information relating to all indices calculated and published by Euronext, except for the ISE Bond Index. It includes real-time index levels, open, high, low and closing level of the indices. EURONEXT CASH INFORMATION PRODUCTS Euronext Cash Information Products comprise the Amsterdam, Brussels, Dublin, Lisbon and Paris regulated cash markets, including its equity markets, its Exchange Traded Funds (ETFs) and funds markets, its warrants and certificates markets and its fixed income markets. Euronext Continental Cash (Consolidated Pack) Last Price This Information product provides information about trades on Euronext’s cash markets in Amsterdam, Brussels, Lisbon and Paris and the ETF(s) traded on Euronext Dublin. It includes traded prices and quantities, open, high, low and closing prices of securities traded on Euronext’s cash markets. -

Are Retail Investors Less Aggressive on Small Price Stocks?

Are retail investors less aggressive on small price stocks? Carole M´etais∗ Tristan Rogery January 13, 2021 Abstract In this paper, we investigate whether number processing impacts the limit orders of retail investors. Building on existing literature in neuropsychology that shows that individuals do not process small numbers and large numbers in the same way, we study the influence of nominal stock price level on order aggressiveness. Using a unique database that allows us to identify order and trade records issued by retail investors on Euronext Paris, we show that retail investors, when posting non-marketable orders, are less aggressive on small price stocks than on large price stocks. This difference in order aggressiveness is not explained by differences in liquidity and other usual drivers of order aggressiveness. We provide additional evidence by showing that no such difference exists for limit orders of high frequency traders (HFTs) over the same period and the same sample of stocks. This finding confirms that our results are driven by a behavioral bias and not by differential market dynamics between small price stocks and large price stocks. ∗LaRGE Research Center, University of Strasbourg { Mailing address: 61 Avenue de la For^etNoire, 67000 Strasbourg FRANCE { Email: [email protected]. I acknowledge support from the French State through the National Agency for Research under the program Investissements d'Avenir ANR-11-EQPX- 006. yDRM Finance, Universit´eParis-Dauphine, PSL Research University { Mailing address: Place du Mar´echal de Lattre de Tassigny, 75775 Paris Cedex 16 FRANCE { Email: [email protected] 1 1 Introduction While conventional finance theory posits that nominal stock prices are irrelevant for firm valuation, a number of papers provide empirical evidence that nominal prices do impact investor behavior. -

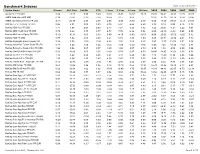

Benchmark Indexes Data As Of: 03/31/2011 Index Name Sharpe Std

Benchmark Indexes Data as of: 03/31/2011 Index Name Sharpe Std. Dev. 1st Qtr YTD 1 Year 3 Year 5 Year 10 Year 2010 2009 2008 2007 2006 Alerian MLP TR USD 0.89 23.25 5.99 5.99 33.02 20.03 16.57 17.25 35.85 76.41 -36.91 12.72 26.07 AMEX Gold Miners PR USD 0.39 47.82 -2.15 -2.15 35.65 8.12 9.68 - 33.94 37.30 -26.79 16.86 21.86 AMEX International Market PR USD -0.13 25.37 2.77 2.77 4.05 -5.95 -0.80 2.17 0.80 17.60 -39.51 16.18 21.51 BarCap 1-5 Yr Treasury TR USD 0.98 2.51 0.00 0.00 2.79 2.91 4.88 4.20 3.73 0.19 8.83 8.16 3.75 BarCap ABS Auto TR USD 1.17 5.68 0.63 0.63 2.47 7.21 6.23 5.12 3.25 26.07 -5.57 5.22 4.61 BarCap ABS Credit Card TR USD 0.79 9.42 0.77 0.77 4.73 7.76 6.86 5.84 6.55 29.89 -9.33 5.45 4.55 BarCap ABS Home Equity TR USD -0.19 16.91 0.00 0.00 0.00 -4.10 -5.80 -0.53 0.00 20.63 -36.00 -8.25 5.32 BarCap ABS TR USD 0.77 6.92 0.64 0.64 4.21 5.74 4.36 4.59 5.85 24.71 -12.72 2.21 4.70 BarCap Aggregate Bond Treasury TR 0.58 5.58 -0.16 -0.16 4.53 3.55 5.69 5.15 5.87 -3.57 13.74 9.01 3.08 BarCap Asian Pac Taiwan Dollar TR JPY 0.78 6.24 1.54 1.54 -2.45 -1.00 -2.50 -0.66 -2.26 7.45 -11.24 -7.52 2.81 BarCap Bellwether Swap 6 Mon TR USD 1.92 0.56 0.07 0.07 0.39 1.50 3.07 2.79 0.38 1.58 4.09 5.39 5.54 BarCap CMBS ERISA Eligible TR USD 0.53 18.46 2.05 2.05 12.62 8.79 6.87 6.53 20.40 28.45 -20.52 5.58 4.72 BarCap Credit 1-3 Yr TR USD 1.16 3.62 0.58 0.58 3.24 4.73 5.29 4.80 4.15 11.59 0.30 5.96 4.66 BarCap Credit 1-5 Yr TR USD 1.06 4.64 0.85 0.85 4.36 5.47 5.77 5.27 5.44 13.52 -1.13 6.09 4.69 BarCap Danish Krone Aggregate TR DKK 0.12 14.76 -

Press Release Paris – June 21St, 2021

Press Release Paris – June 21st, 2021 Europcar Mobility Group rejoins Euronext SBF 120 index Europcar Mobility Group, a major player in mobility markets, is pleased to announce that it has re-entered into the SBF 120 and CAC Mid 60 indices, in accordance with the decision taken by the Euronext Index Steering Committee. This re-entry, which took place after market close on Friday 18 June 2021, is effective from Monday 21 June 2021. The SBF 120 is one of the flagship indices of the Paris Stock Exchange. It includes the first 120 stocks listed on Euronext Paris in terms of liquidity and market capitalization. The CAC Mid 60 index includes 60 companies of national and European importance. It represents the 60 largest French equities beyond the CAC 40 and the CAC Next 20. It includes the 60 most liquid stocks listed in Paris among the 200 first French capitalizations. This total of 120 companies compose the SBF 120. Caroline Parot, CEO of Europcar Mobility Group, said: “Europcar Mobility Group welcomes the re-integration of the SBF 120 and CAC Mid 60. This follows the successful closing of the Group’s financial restructuring during Q1 2021, which allowed the Group to open a new chapter in its history. Europcar Mobility Group re-entry into the SBF 120 and CAC Mid 60 is an important step for our Group and recognizes the fact that we are clearly "back in the game”, in a good position to take full advantage of the progressive recovery of the Travel and Leisure market. In that perspective, our teams are fully mobilized for summer of 2021, in order to meet the demand and expectations of customers who are more than ever eager to travel”. -

Darkest Before Dawn – Shariah Perspective

Malaysia July 29, 2021 Strategy Darkest before dawn – Shariah perspective by Ivy NG Lee Fang, CFA │ T: (60) 3 2261 9073 │ E: [email protected] This report delineates our 2H21F equity strategy outlook from a Shariah perspective. The market was hit by a perfect storm in 1H21 with persistently high Covid-19 cases, multiple lockdowns, ESG concerns and political uncertainty. At the current run rate, we project Malaysia to be on track to inoculate around 70-80% of the population by 4Q21. We expect recovery stocks to see renewed interest in 4Q and the market to re-rate to our KLCI target of 1,604 pts, after an anticipated lacklustre 3Q21. We provide six trading themes for 2H21F in this report; our top Shariah sector picks are Islamic banking, healthcare, media, oil & gas, packaging, semiconductor, EMS, transport and utilities. Our top three Shariah stock picks are Gamuda, Telekom Malaysia and Unisem. IMPORTANT DISCLOSURES, INCLUDING ANY REQUIRED RESEARCH CERTIFICATIONS, ARE PROVIDED AT THE END OF THIS REPORT. IF THIS REPORT IS DISTRIBUTED IN THE UNITED STATES IT IS DISTRIBUTED BY CGS-CIMB SECURITIES (USA), INC. Powered by the EFA AND IS CONSIDERED THIRD-PARTY AFFILIATED RESEARCH. Platform Malaysia │ Strategy │ July 29, 2021 Content Page Key takeaways of our views on the outlook for 2H21F 3 Shariah-compliant investments 4 1H21 review 6 Outlook 17 Malaysian retail investors’ survey 27 ESG ratings from F4GBM index perspective 28 Key trading thematics 29 Risks 37 Market valuations 42 Economic outlook 44 Technical analysis 49 Top picks and sector ratings 51 2 Malaysia │ Strategy │ July 29, 2021 Key takeaways of our views on the outlook for 2H21F The market was hit by a perfect storm in 1H21 with persistently high Covid-19 cases, multiple lockdowns, ESG concerns and political uncertainty. -

Compliance Statement

Compliance Statement Administrator: Euronext Dublin Full name: Euronext Dublin (The Irish Stock Exchange plc) Relevant National Competent Authority: CBI Compliance Statement Euronext Indices Euronext Dublin Version notes latest version February 2020 Version Version notes Euronext Dublin 1 October 2019 Initial version February 2020 Updated version including all new indices since 2 initial version. 3 4 5 6 Note: addition of indices does not lead to a new version of this statement. The lists will be kept up to date.The most recent update of the list was issued 09-Jun-2020. Only changes in significant indices and cessations of indices are marked as new version of the Compliance statement. This publication is for information purposes only and is not a recommendation to engage in investment activities. This publication is provided “as is” without representation or warranty of any kind. Whilst all reasonable care has been taken to ensure the accuracy of the content, Euronext does not guarantee its accuracy or completeness. Euronext will not be held liable for any loss or damages of any nature ensuing from using, trusting or acting on information provided. All proprietary rights and interest in or connected with this publication shall vest in Euronext. No part of it may be redistributed or reproduced in any form without the prior written permission of Euronext. Euronext refers to Euronext N.V. and its affiliates. Information regarding trademarks and intellectual property rights of Euronext is located at terms of use euronext For further information in relation to Euronext Indices please contact: [email protected] (c) 2020 Euronext N.V. -

Financial Market Data for R/Rmetrics

Financial Market Data for R/Rmetrics Diethelm Würtz Andrew Ellis Yohan Chalabi Rmetrics Association & Finance Online R/Rmetrics eBook Series R/Rmetrics eBooks is a series of electronic books and user guides aimed at students and practitioner who use R/Rmetrics to analyze financial markets. A Discussion of Time Series Objects for R in Finance (2009) Diethelm Würtz, Yohan Chalabi, Andrew Ellis R/Rmetrics Meielisalp 2009 Proceedings of the Meielisalp Workshop 2011 Editor Diethelm Würtz Basic R for Finance (2010), Diethelm Würtz, Yohan Chalabi, Longhow Lam, Andrew Ellis Chronological Objects with Rmetrics (2010), Diethelm Würtz, Yohan Chalabi, Andrew Ellis Portfolio Optimization with R/Rmetrics (2010), Diethelm Würtz, William Chen, Yohan Chalabi, Andrew Ellis Financial Market Data for R/Rmetrics (2010) Diethelm W?rtz, Andrew Ellis, Yohan Chalabi Indian Financial Market Data for R/Rmetrics (2010) Diethelm Würtz, Mahendra Mehta, Andrew Ellis, Yohan Chalabi Asian Option Pricing with R/Rmetrics (2010) Diethelm Würtz R/Rmetrics Singapore 2010 Proceedings of the Singapore Workshop 2010 Editors Diethelm Würtz, Mahendra Mehta, David Scott, Juri Hinz R/Rmetrics Meielisalp 2011 Proceedings of the Meielisalp Summer School and Workshop 2011 Editor Diethelm Würtz III tinn-R Editor (2010) José Cláudio Faria, Philippe Grosjean, Enio Galinkin Jelihovschi and Ri- cardo Pietrobon R/Rmetrics Meielisalp 2011 Proceedings of the Meielisalp Summer Scholl and Workshop 2011 Editor Diethelm Würtz R/Rmetrics Meielisalp 2012 Proceedings of the Meielisalp Summer Scholl and Workshop 2012 Editor Diethelm Würtz Topics in Empirical Finance with R and Rmetrics (2013), Patrick Hénaff FINANCIAL MARKET DATA FOR R/RMETRICS DIETHELM WÜRTZ ANDREW ELLIS YOHAN CHALABI RMETRICS ASSOCIATION &FINANCE ONLINE Series Editors: Prof. -

Neoen Joins the SBF 120Index

Paris, June 11, 2020 Neoen joins the SBF 120 index Neoen (ISIN: FR0011675362, Ticker: NEOEN), one of the world’s leading and fastest-growing independent producers of exclusively renewable energy, is announcing it is joining the SBF 120 index consisting of the top 120 stocks listed on the Euronext Paris market in term of both liquidity and market capitalization. As part of its quarterly review of the Euronext Paris indices, the Index Committee decided to include Neoen in both the SBF 120 and the CAC Mid 60 indices. This decision will take effect from June 22, 2020. Neoen’s inclusion in these indices is a testament to its good share price performance since its October 2018 IPO. Over the past 20 months, the Company’s market capitalization has more than doubled to almost €3 billion. This strong rise was accompanied by a steady increase in trading volumes. Since its IPO, Neoen has consistently delivered strong earnings growth and expansion in its project portfolio. Assets in operation or under construction have increased from 1.8 GW at June 30, 2018 to 3.1 GW at March 31, 2020, and the target is to have more than 5 GW by year-end 2021. This rapid and profitable growth has been founded on geographical and technological diversification of its asset base. Neoen is present in 14 countries on 4 continents and it develops and operates solar and wind energy generation and storage capacity. Xavier Barbaro, Neoen’s Chairman and Chief Executive Officer, commented: “We are very pleased to be joining this benchmark index, which marks a new important step for Neoen.