Less Debt, More Market

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

EPSILON FUND Fondo Comune D'investimento Di Diritto Lussemburghese a Comparti Multipli

EPSILON FUND Fondo comune d'investimento di diritto lussemburghese a Comparti multipli ELENCO DEI SOGGETTI COLLOCATORI IN ITALIA Valido a decorrere dal 20 luglio 2021 Tutti i Soggetti collocatori di seguito indicati (i “Collocatori”) procedono all’offerta su incarico di Eurizon Capital SGR S.p.A. che svolge il ruolo di Distributore Principale (di seguito il “Distributore Principale”) in via esclusiva delle Quote del Fondo in Italia. Ove specificato, i Collocatori hanno, a loro volta, facoltà di avvalersi di sub-collocatori (nel qual caso, i primi sono indicati come “Collocatori primari” e i secondi come “Sub-collocatori”). - INTESA SANPAOLO PRIVATE BANKING S.p.A. - Via Montebello 18 - Milano Il collocamento delle quote dei Comparti commercializzati in Italia è effettuato mediante sportelli bancari. - INTESA SANPAOLO S.p.A. – Piazza San Carlo 156 – Torino Il collocamento delle quote dei Comparti commercializzati in Italia, ad eccezione di Euro Cash e Absolute Q-Multistrategy, è effettuato mediante sportelli bancari, Consulenti finanziari abilitati all’offerta fuori sede nonché tramite tecniche di comunicazione a distanza (Internet). Tramite Internet è possibile effettuare sottoscrizioni in unica soluzione e mediante Piani di Accumulo, conversioni in unica soluzione e rimborsi. Le operazioni di rimborso possono essere effettuate anche tramite banca telefonica. Intesa Sanpaolo S.p.A. è Agente di collocamento autorizzato dal Distributore Principale all’attivazione dei Piani di Accumulo, del Servizio Clessidra nonché dei Passaggi Agevolati. - CRÉDIT AGRICOLE ITALIA S.p.A. (4) - Via Università 1 - Parma Il collocamento delle quote dei Comparti commercializzati in Italia è effettuato mediante sportelli bancari nonché tramite tecniche di comunicazione a distanza (Internet). -

Sanpaolo International Fund

EURIZON MANAGER SELECTION FUND Fondo comune d'investimento di diritto lussemburghese a comparti multipli ELENCO DEI SOGGETTI COLLOCATORI IN ITALIA Valido a decorrere dall’8 marzo 2019 - INTESA SANPAOLO S.p.A. – Piazza San Carlo 156 – Torino Il collocamento delle quote dei comparti commercializzati in Italia è effettuato mediante sportelli bancari, Consulenti finanziari abilitati all’offerta fuori sede nonché tramite tecniche di comunicazione a distanza (Internet). Tramite Internet è possibile effettuare sottoscrizioni in unica soluzione e mediante Piani di Accumulo, conversioni in unica soluzione e rimborsi. Le operazioni di rimborso possono essere effettuate anche tramite banca telefonica. Intesa Sanpaolo S.p.A. è Agente di collocamento autorizzato dalla Società di Gestione all’attivazione dei Piani di Accumulo, del Servizio Clessidra nonché dei Passaggi Agevolati. - BANCA APULIA S.p.A. – Via Tiberio Solis 40 – San Severo (FG) Il collocamento delle quote dei comparti commercializzati in Italia è effettuato mediante sportelli bancari, Consulenti finanziari abilitati all’offerta fuori sede nonché tramite tecniche di comunicazione a distanza (Internet). Tramite Internet è possibile effettuare sottoscrizioni in unica soluzione e mediante Piani di Accumulo, conversioni in unica soluzione e rimborsi. Le operazioni di rimborso possono essere effettuate anche tramite banca telefonica. Banca Apulia S.p.A. è Agente di collocamento autorizzato dalla Società di Gestione all’attivazione dei Piani di Accumulo, del Servizio Clessidra nonché dei Passaggi Agevolati. - BANCA PROSSIMA S.p.A. - Piazza Paolo Ferrari 10 - Milano Il collocamento delle quote dei comparti commercializzati in Italia è effettuato mediante sportelli bancari, Consulenti finanziari abilitati all’offerta fuori sede nonché tramite tecniche di comunicazione a distanza (Internet). -

European Npls - FY18 an Overview of the Non-Performing Loan Market

An Acuris Company Year-End 2018 European NPLs - FY18 An overview of the non-performing loan market Alessia Pirolo Head of NPL Coverage, Debtwire +44 (0) 20 3741 1399 [email protected] Amy Finch Data Journalist, Debtwire +44 (0) 20 3741 1187 [email protected] European NPLs – FY18 An Acuris Company Overview: A Record Year for NPL sales 3-7 Trends by Country Italy 8-13 Spain 14-17 New Entries: Portugal, Greece and Cyprus 18-24 UK and Ireland 25-28 Germany 29-30 Index List of closed deals 31-40 Criteria 41 Authors and contact details 42 2 European NPLs – FY18 An Acuris Company A Record Year for NPL sales The European non-performing loan (NPL) market reached its peak in 2018 with disposal totalling EUR 205.1bn in gross book value (GBV). Debtwire NPL Database tracked 142 transactions. The year just closed has been by far a record, compared with EUR 144bn in 2017 and EUR 107bn in 2016, according to data from Deloitte. The last quarter of 2018 saw a particularly intense pace of activity, given that at the end of the third quarter closed deals totalled EUR 125bn. The most active country was Italy, which totalled half of the total volume of NPL sales. In 2018, 64 NPL sales with a gross book value (GBV) of EUR 103.6bn were tracked in the country, almost half of which were via securitisations within the government’s Garanzia sulla Cartolarizzazione delle Sofferenze (GACS) scheme, which now has only until 6 March 2019 to run. Spain has started to see a slowdown of sales, but still completed a massive EUR 43.2bn in 27 deals. -

Rapporto ANNO 2020 Dati Sui Volumi Di Negoziazione Delle Associate

Rapporto ANNO 2020 Dati sui volumi di negoziazione delle Associate Area Compliance, Markets & Operations 21 GENNAIO 2021 21 gennaio 2021 RAPPORTO ANNO 2020 COMUNICATO STAMPA - RAPPORTO ANNO 2020 Nell’anno del COVID i mercati finanziari hanno dimostrato la propria resilienza Mercato Azionario - La crisi pandemica scatenata dalla diffusione del virus Covid-19 ha inevitabilmente portato Piazza Affari a chiudere l’anno 2020 in territorio negativo con il FTSE Mib che ha perso il 5,40% rispetto alla fine del 2019. Tuttavia, se si considera che alla fine del mese di marzo (durante il lockdown) l’indice perdeva il 27,50% e che alla fine del mese di giugno questa perdita si era ridotta di circa 10 punti percentuali, possiamo concludere che gli investitori, dopo lo shock iniziale, hanno recuperato la fiducia nei mercati finanziari, anche grazie alle misure fiscali e di politica monetaria straordinarie che sono state messe in campo dalle istituzioni europee e dal governo nazionale. Da segnalare, in controtendenza, la performance positiva del FTSE Italia Star che ha guadagnato il 14,10% dalla fine del 2019. Altro aspetto che sarà ricordato dell’anno appena trascorso è sicuramente la crescita del Trading on Line. Dai dati che ASSOSIM ha elaborato per il Sole 24 Ore emerge chiaramente che, rispetto al bimestre gennaio-febbraio 2020, è proseguita nei bimestri successivi la crescita dei controvalori e delle operazioni concluse dagli intermediari specializzati nel TOL. Anche la volatilità mensile, dopo l’impennata d’inizio anno, si è attenuata attestandosi al 14,70% (a dicembre 2019 era al 14,80%). Altra novità rilevante è l’accordo raggiunto tra EU e UK alla fine del periodo transitorio della Brexit. -

Company Presentation

Company Presentation 2008 Hi-MTF Sim S.p.A. | P.IVA 05755500963 | All Rights Reserved Agenda ■ About Hi-MTF ■ Legislation ■ Functions ■ Quote - Driven Hybrid segment ■ Order - Driven segment ■ Fixed-Income ■ Equity ■ RFQ segment ■ Primary Market – Issue ■ Annexes 2 About Hi-MTF General overview and shareholders ▪ Hi-MTF is a Multilateral Trading Facility (MTF) – a MiFID II compliant type of trading venue – oriented to retail clients ▪ Hi-MTF provides investors with the opportunity to trade a wide range of bonds: government, Overview corporate, banking, structured and others ▪ Hi-MTF’s Mission: efficiency and effectiveness in managing a trading platform oriented to non- professional investors and centered on liquidity and transparency ▪ National banks, community (European Union) banks, and SIMs, according to the art. 67 Qualified paragraph 2 of Legislative Decree of 24 February 1998, n. 58 (and its subsequent updates) subjects to ▪ EU investment companies partecipate in ▪ Third country companies authorized to provide services or trading activities on their own the Market account or execution of orders on behalf of clients according to arts. 28 and 29-ter of the Legislative Decree of 24 February 1998, n. 58 (and its subsequent updates) Current shareholders, each holding 25% of capital, are: 3 About Hi-MTF Key milestones ▪ A summary of Hi-MTF’s corporate history : New Equity - Central Counterparty (CCP) Market model Luigi Luzzatti S.p.A. Quote-Driven Order-Driven project start-up with CC&G, RFQ and Issue becomes segment segment regarding -

List of Market Makers and Authorised Primary Dealers Who Are Using the Exemption Under the Regulation on Short Selling and Credit Default Swaps

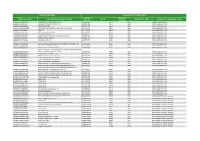

Last update 11 August 2021 List of market makers and authorised primary dealers who are using the exemption under the Regulation on short selling and credit default swaps According to Article 17(13) of Regulation (EU) No 236/2012 of the European Parliament and of the Council of 14 March 2012 on short selling and certain aspects of credit default swaps (the SSR), ESMA shall publish and keep up to date on its website a list of market makers and authorised primary dealers who are using the exemption under the Short Selling Regulation (SSR). The data provided in this list have been compiled from notifications of Member States’ competent authorities to ESMA under Article 17(12) of the SSR. Among the EEA countries, the SSR is applicable in Norway as of 1 January 2017. It will be applicable in the other EEA countries (Iceland and Liechtenstein) upon implementation of the Regulation under the EEA agreement. Austria Italy Belgium Latvia Bulgaria Lithuania Croatia Luxembourg Cyprus Malta Czech Republic The Netherlands Denmark Norway Estonia Poland Finland Portugal France Romania Germany Slovakia Greece Slovenia Hungary Spain Ireland Sweden Last update 11 August 2021 Austria Market makers Name of the notifying Name of the informing CA: ID code* (e.g. BIC): person: FMA ERSTE GROUP BANK AG GIBAATWW FMA OBERBANK AG OBKLAT2L FMA RAIFFEISEN CENTROBANK AG CENBATWW Authorised primary dealers Name of the informing CA: Name of the notifying person: ID code* (e.g. BIC): FMA BARCLAYS BANK PLC BARCGB22 BAWAG P.S.K. BANK FÜR ARBEIT UND WIRTSCHAFT FMA BAWAATWW UND ÖSTERREICHISCHE POSTSPARKASSE AG FMA BNP PARIBAS S.A. -

List of Significant and Less Significant Supervised Institutions

List of supervised entities Cut-off date for changes in group structures: 1 November 2018 Cut-off date for significance decisions: 14 December 2018 Number of significant supervised entities: 119 This list displays the significant (part A) and less significant credit institutions (part B) w hich are supervised entities. The list is compiled on the basis of significance decisions adopted and notified by the ECB that refer to events that became effective up to the cut-off date. A. List of significant supervised entities Country of LEI Type Name establishment Grounds for significance MFI code for branches of group entities Belgium 1 LSGM84136ACA92XCN876 Credit Institution AXA Bank Belgium SA ; AXA Bank Belgium NV Size (total assets EUR 30-50 bn) (**) CVRWQDHDBEPUUVU2FD09 Credit Institution AXA Bank Europe SCF France Banque Degroof Petercam SA ; Bank Degroof 2 549300NBLHT5Z7ZV1241 Credit Institution Significant cross-border assets Petercam NV 54930017BFF0C5RWQ245 Credit Institution Banque Degroof Petercam France S.A. France NCKZJ8T1GQ25CDCFSD44 Credit Institution Banque Degroof Petercam Luxembourg S.A. Luxembourg 95980020140005218292 Credit Institution Bank Degroof Petercam Spain, S.A. Spain Belfius Banque SA ; Belfius Bank NV ; Belfius Bank 3 A5GWLFH3KM7YV2SFQL84 Credit Institution Size (total assets EUR 100-150 bn) SA 4 D3K6HXMBBB6SK9OXH394 Financial Holding Dexia SA Size (total assets EUR 150-300 bn) F4G136OIPBYND1F41110 Credit Institution Dexia Crédit Local France 52990081RTUT3DWKA272 Credit Institution Dexia Kommunalbank Deutschland GmbH -

Spunta Banca Dlt

BANCHE ADERENTI PROGETTO SPUNTA BANCA DLT Data emissione/ultima modifica: 13/05/2021 Si fornisce di seguito la lista ufficiale di tutte le banche – identificate dai Codici ABI – aderenti al Progetto Spunta Banca DLT. Tali banche dovranno adattare i tracciati JSON da inviare via sFTP rispetto alle banche presenti nelle seguenti Tabelle. BANCHE ADERENTI SPUNTA BANCA DLT 01005 Banca Nazionale del Lavoro 01015 Banco di Sardegna 01030 Banca Monte dei Paschi di Siena 02008 UniCredit 03045 Banca Akros 03058 CheBanca! 03062 Banca Mediolanum 03069 Intesa Sanpaolo 03083 IWBank Fusione in Intesa Sanpaolo. Cod. ABI esistente. 03102 Banca Aletti & C Fusione in Intesa Sanpaolo. Cod. ABI non più esi- 03111 UBI Banca stente. 03210 MPS Leasing & Factoring 03211 Banca Patrimoni Sella 03239 Intesa Sanpaolo Private Banking 03268 Banca Sella 03296 Banca Fideuram 03311 Banca Sella Holding 03440 Banco di Desio e della Brianza 03442 Banca Widiba 05000 DepoBank 05034 Banco BPM 05216 Credito Valtellinese 05336 Crédit Agricole Friuladria 05385 Banca Popolare di Puglia e Basilicata 05387 BPER Banca 05676 Banca di Sassari 05696 Banca Popolare di Sondrio 06095 Cassa di Risparmio di BRA Fusione in BPER Banca. Cod. ABI non più esistente. 06230 Crédit Agricole Italia 06295 Cassa di Risparmio di Saluzzo Fusione in BPER Banca. Cod. ABI non più esistente. 08000 Iccrea Banca 10643 MPS Capital Services 03032 Credito Emiliano 03048 Banca del Piemonte LISTA BANCHE ADERENTI pag. 2/4 03075 Banca Generali 03124 Banca del Fucino 03205 Banca IFIS 03242 Banco di Lucca e del Tirreno -

Codice Lei/ Lei Code Ragione Sociale/Company Name Party Bic (Party1) Sac T2s Codice Abi/ Abi Code Codice Lei/ Lei Code Ragione S

INDIRECT PARTICIPANT LIQUIDATORE/SETTLEMENT AGENT PARTY BIC CODICE ABI/ CODICE LEI/ LEI CODE RAGIONE SOCIALE/COMPANY NAME SAC T2S CODICE LEI/ LEI CODE RAGIONE SOCIALE/COMPANY NAME (PARTY1) ABI CODE 95980020140005970915 SANTANDER SECURITIES SERVICES SA BCITITM1T09 60107 3069 INTESA SANPAOLO S.P.A. 95980020140005970915 SANTANDER SECURITIES SERVICES SA BCITITM1T09 60217 3069 INTESA SANPAOLO S.P.A. 95980020140006002537 FIDENTIIS EQUITIES BCITITM1T35 60110 3069 INTESA SANPAOLO S.P.A. 1VUV7VQFKUOQSJ21A208 CREDIT AGRICOLE CORPORATE AND INVESTMENT BANK BCITITM1T12 60211 3069 INTESA SANPAOLO S.P.A. 213800GKIJZVJEKN6E93 ALLX LTD BCITITM1T45 60492 3069 INTESA SANPAOLO S.P.A. 213800J5ITBY3DSPU157 INVICTA SECURITIES LIMITED BCITITM1T48 60115 3069 INTESA SANPAOLO S.P.A. 213800QW6E4NZL29SP43 JCI CAPITAL LIMITED BCITITM1T51 60394 3069 INTESA SANPAOLO S.P.A. 213800TFSEDK4Y98VZ05 AURIGA GLOBAL INVESTORS SOCIEDAD DE VALORES BCITITM1T36 60106 3069 INTESA SANPAOLO S.P.A. 213800VPE6YIJKA66X97 MAGNA CAPITAL LIMITED BCITITM1T37 60409 3069 INTESA SANPAOLO S.P.A. 213800ZUCEFNYC1JAX11 REDHEDGE SICAV P.L.C. BCITITM1T29 60401 3069 INTESA SANPAOLO S.P.A. 529900CAP12S8RQR5F43 CAIXA DE CRÉDITO AGRÍCOLA MÚTUO DO ALENTEJO CENTRAL, CRL BCITITM1T43 60207 3069 INTESA SANPAOLO S.P.A. 529900WSSQ6JIRC66D02 Banco do Brasil Aktiengesellschaft BCITITM1T59 60691 3069 INTESA SANPAOLO S.P.A. 549300035Z3DHK2T4A54 Tradition London Clearing Limited BCITITM1T42 60163 3069 INTESA SANPAOLO S.P.A. BANCA APULIA S.P.A. (C0N POSSIBILITA' DI USARE INDIFFERENTEMENTE 5493002M7EJBVTH8YU65 ANCHE LA DIZIONE BANCAPULIA S.P.A.) BCITITM1T63 60696 3069 INTESA SANPAOLO S.P.A. 549300MZW5O9SIGRBJ12 MEDIOCREDITO ITALIANO S.P.A. BCITITM1T31 60406 3069 INTESA SANPAOLO S.P.A. 549300UYJKOXE3HB8L79 WOOD & Company Financial Services BCITITM1T60 60692 3069 INTESA SANPAOLO S.P.A. 571474TGEMMWANRLN572 State Street Bank and Trust Company BCITITM1T33 60496 3069 INTESA SANPAOLO S.P.A. -

Titolo Documento

Banca Intermobiliare di Investimenti e Gestioni Corporate Finance 2012 Banca Intermobiliare di Investimenti e Gestioni Indice 1. Overview della Banca 3 2. BIM Corporate Finance 11 3. Referenze M&A 19 Consulenza Finanziaria 23 Equity Capital Market 26 4. Contatti 29 BIM Corporate Finance 2 BIM Corporate Finance 1. Overview della Banca Banca Intermobiliare di Investimenti e Gestioni Storia 1. Overview della Banca 2. BIM Corporate Finance 3. Referenze 1981 Nasce a Torino la Commissionaria di Borsa Intermobiliare 4. Contatti 1991 Intermobiliare S.p.A. si quota alla Borsa Valori di Milano 1993 La commissionaria di Borsa si trasforma in Società di Intermediazione Mobiliare (SIM) 1997 Intermobiliare diventa Banca e nasce Banca Intermobiliare di Investimenti e Gestioni S.p.A. 2001 Viene fondata Bim Suisse S.A., banca privata di indirizzo svizzero con sede a Lugano, interamente controllata da BIM 2002 Banca Intermobiliare, in joint venture con il gruppo Fondiaria-SAI, crea BIM Vita, per rispondere alle esigenze dei Clienti nel settore assicurativo 2003 Banca Intermobiliare acquisisce Symphonia SGR, società di gestione del risparmio fondata nel 1994 da Angelo Abbondio 2006 Nasce BIM Insurance Brokers, società partecipata al 51% da Banca Intermobiliare e per la restante parte in capo a professionisti del settore, attiva nel campo del brokeraggio assicurativo 2008 BIM SGR e Symphonia SGR si fondono, dando vita a un’unica realtà operante sotto il nome di “Symphonia SGR” 2009 Banca Intermobiliare sigla un accordo con Veneto Banca Holding S.c.p.A. e amplia le proprie attività nel private banking attraverso l’acquisizione del controllo di Banca IPIBI Financial Advisory, già Intra Private Bank. -

Nominated Advisers

Nominated Advisers Registro Nomad Registro Nomad Alantra Capital Markets SV S.A. BALDI FINANCE S.p.A. Succursale italiana Via San Damiano, 9 Via Borgonuovo, 16 20122 Milano 20121 Milano www.baldifinance.it www.alantra.com Guido Prati Stefano Bellavita [email protected] [email protected] +39 0522.271220 +39 02.63671601 +39 3356058447 Banca Akros S.p.A. Banca Finnat Euramerica S.p.A. Viale Eginardo, 29 Piazza del Gesù, 49 20149 Milano 00186 Roma www.bancaakros.it www.finnat.it Massimo Turcato Giulio Bastia [email protected] [email protected] +39 02.43444053 +39 06.69933343 Banca Intermobiliare di Banca Mediolanum S.p.A. Investimenti e Gestioni S.p.A. Via F. Sforza, 15 Via Gramsci, 7 20080 Basiglio (MI) 10121 Torino www.bancamediolanum.it www.bancaintermobiliare.com Giovanni Reale Gaetano Aliotta [email protected] [email protected] +39 02.90496015 +39 02.99968147 Registro Nomad Banca Profilo S.p.A. BPER Banca S.p.A. Via Cerva, 28 Corso Vittorio Emanuele, 31 20122 Milano 41121 Modena www.bancaprofilo.it www.bper.it Marco Baga Stefano Taioli [email protected] [email protected] +39 02.58408425 +39 059.2022655 CFO SIM S.p.A. EnVent Capital Markets Ltd Via dell’Annunciata, 23/4 25 Savile Row 20121 Milano London W1S2ER www.cfosim.com enventcapitalmarkets.co.uk Luca Di Liddo Franco Gaudenti [email protected] [email protected] +39 02.30343391 +44 203 519 84513 Epic SIM S.p.A. Equita SIM S.p.A. Foro Buonaparte, 12 Via Filippo Turati, 9 20121 Milano 20121 Milano www.epic.it www.equitasim.it Giuliano V. -

On the Verge of a New Recovery?

PRIVATE BANKING THE POTENTIAL On the Verge of MARKET Private banking assets under a new Recovery? management amounted to less than half of the wealth of families The leader by Aum, Intesa PB, posted a 51% increase in profits this year and with more than 0.5 in financial € 4 bn of new money, while the assets on the market grew 8% on average, assets on hold and half a dozen of specialists in the double digits. Is the crisis over or is it the confirmation of a negative trend where the best performer takes all? by Francesca Vercesi Source: AIPB as of November 2012 n the wealthy provinces of Reggio Emilia and Modena, Ithe mechanical excellence of Ferrari and Ducati can be found alongside the best traditional Top 5 players by AuM growth year on year) in the of one advisory guru. A look at Italian food, such as Parmigiano- grimmest 12 months of the market’s big numbers reveals Reggiano cheese and Balsamic 1-yr Ch (%) Aum 30-6-12 the last few years the that this rather scathing verdict is vinegar. In this same area, the 1 BP Emilia Romagna 89.2 4,729 increase was a gift (+€ not too far wide of the mark. Of 2 Banca Generali 47.9 10,500 homey private banking of Banca 1.5 bn in 2012) from a the 606,000 Italian families with 3 Banca Leonardo 40.5 4,600 Popolare dell’Emilia Romagna 4 BNL BNP Paribas 18.9 20,799 network of promoters over € 500,000 in financial assets reigns supreme.