Botswana Country Profile 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Road Safety Review: Namibia Know Before You Go Driving Culture • Common Causes of Crashes Include Disregard of Driving Is on the Left

Association for Safe International Road Travel Road Safety Review: Namibia Know Before You Go Driving Culture • Common causes of crashes include disregard of Driving is on the left. traffic regulations, speeding, and improperly Travelers staying less than 90 days may use a valid U.S. driver’s license. Travelers staying for more than 90 days, or those whose maintained vehicles. license is not in English, must have an International Driving • High beams: Drivers may flash their high beams as a Permit (IDP). greeting, or to warn of hazards. Siingle-car crashes, many of which are rollovers, occur frequently. • Driving under the influence is a serious problem. Manual and automatic transition vehicles are available for rent. Be especially alert when driving or walking on 4WD is recommended. weekend evenings. There are 25.0 road fatalities per 100,000 people, compared to • Taxi drivers may stop suddenly, run red lights, 10.3 in the US and 2.8 in the UK. speed, neglect to use turn signals or cut off other Resources for consular information and assistance are listed at drivers. asirt.org/citizens. • Pedestrians may unexpectedly cross roads. Road Conditions • Road construction and maintenance meet international standards. About 15% of roads are paved; gravel roads are typically in good to excellent condition. • Main access roads into Windhoek are paved. • Congestion during peak hours in Windhoek is common. • Most roads are undivided and few have shoulders. On gravel roads, it is especially important to maintain safe speeds. • Distances between destinations may be extremely long. Driver fatigue is a concern. • Road signs clearly indicate distances between towns. -

Visa Information for Zambia a Guide on the Requirements

UPDATED 24 JULY 2018 VISA INFORMATION FOR ZAMBIA A GUIDE ON THE REQUIREMENTS GENERAL INFORMATION ENTRY VISA – Please turn overleaf for a list of nationals requiring a visa prior to arrival and those exempt from visa requirements. Nationals not mentioned are eligible for a visa on arrival at our ports of entry. No entry visa required for SADC passports E-VISA APPLICATION – All persons who ordinarily require a visa to come to Zambia are eligible to apply for an e-Visa, LINK HERE ZAMBIAN MISSION ABROAD – Contact your local Zambia Diplomatic Mission to apply for a visa in person, list available HERE Check with your local embassy well before travelling or feel free to ask us and we will do our best to assist COST OF VISAS – Credit card facilities are not guaranteed at all points of entry - please carry sufficient US$’s to pay for visa’s if necessary ZAMBIA VISA COSTS (per passport - subject to change) SINGLE ENTRY $ 50 This visa is required should you wish to see the Falls from the Zimbabwe side or do a Chobe Day DOUBLE | MULTIPLE ENTRY – $ 80 Trip to Botswana – we suggest a multiple entry KAZA UNI-VISA – See further information below $ 50 KAZA UNI-VISA (40 nationalities are eligible) INFORMATION – Valid for 30 days & allows multiple cross-border visits between Zambia & Zimbabwe and one day-trip to Botswana. No overnight stays are allowed and multiple crossings to Botswana are not allowed on the same KAZA Uni-visa (not available online). AVAILABLE ON ARRIVAL – Livingstone International Airport, Victoria Falls International Airport, Harare -

GOVERNMENT of BOTSWANA/UNFPA 5Th COUNTRY PROGRAMME 2010-2016

25 September 2015 GOVERNMENT OF BOTSWANA/UNFPA 5th COUNTRY PROGRAMME 2010-2016 End of Programme Evaluation i Map of Botswana Consultant Team Position and Team Role Name Team Leader, plus Gender Component Helen Jackson Reproductive Health and Rights Component Thabo Phologolo Population and Development Component Enock Ngome ii Acknowledgements The evaluation team would like to thank UNFPA for the opportunity to undertake the GoB/UNFPA 5th Country Programme Evaluation. We would also like to express our great appreciation to all staff who gave generously of their time, both for interview and in providing documents, and in particular the evaluation manager. We greatly appreciate their support and guidance throughout and would also like to acknowledge the very helpful logistics support by administrative staff including the drivers. We also wish to express our gratitude to the members of the Evaluation Reference Group and to the many stakeholders in government, the UN and civil society for their flexibility and willingness to contribute their views, provide further documents, and generally assist the evaluation. The regional office, ESARO is acknowledged for financial and technical support for the evaluation. Last but not least, we appreciate the beneficiaries that we were able to meet who provided valuable insights into the programmes and how they had impacted on their lives. iii TABLE OF CONTENTS ACKNOWLEDGEMENTS .................................................................................................................................. -

Measuring Social Vulnerability to Natural Hazards at the District Level in Botswana

Jàmbá - Journal of Disaster Risk Studies ISSN: (Online) 2072-845X, (Print) 1996-1421 Page 1 of 11 Original Research Measuring social vulnerability to natural hazards at the district level in Botswana Authors: Social vulnerability to natural hazards has become a topical issue in the face of climate change. 1,2 Kakanyo F. Dintwa For disaster risk reduction strategies to be effective, prior assessments of social vulnerability Gobopamang Letamo2 Kannan Navaneetham2 have to be undertaken. This study applies the household social vulnerability methodology to measure social vulnerability to natural hazards in Botswana. A total of 11 indicators were Affiliations: used to develop the District Social Vulnerability Index (DSVI). Literature informed the 1 Environment Statistics Unit, selection of indicators constituting the model. The principal component analysis (PCA) Statistics Botswana, Gaborone, Botswana method was used to calculate indicators’ weights. The results of this study reveal that social vulnerability is mainly driven by size of household, disability, level of education, age, people 2Department of Population receiving social security, employment status, households status and levels of poverty, in that Studies, University of order. The spatial distribution of DSVI scores shows that Ngamiland West, Kweneng West Botswana, Gaborone, and Central Tutume are highly socially vulnerable. A correlation analysis was run between Botswana DSVI scores and the number of households affected by floods, showing a positive linear Corresponding author: correlation. The government, non-governmental organisations and the private sector should Kakanyo Dintwa, appreciate that social vulnerability is differentiated, and intervention programmes should [email protected] take cognisance of this. Dates: Keywords: Botswana; District Social Vulnerability; place vulnerability; natural hazards; Received: 21 Feb. -

Spatial Analysis of HIV Infection and Associated Risk Factors in Botswana

International Journal of Environmental Research and Public Health Article Spatial Analysis of HIV Infection and Associated Risk Factors in Botswana Malebogo Solomon *, Luis Furuya-Kanamori and Kinley Wangdi Department of Global Health, Research School of Population Health, Australian National University, Canberra, ACT 2601, Australia; [email protected] (L.F.-K.); [email protected] (K.W.) * Correspondence: [email protected] Abstract: Botswana has the third highest human immunodeficiency virus (HIV) prevalence globally, and the severity of the epidemic within the country varies considerably between the districts. This study aimed to identify clusters of HIV and associated factors among adults in Botswana. Data from the Botswana Acquired Immunodeficiency Syndrome (AIDS) Impact Survey IV (BIAS IV), a nationally representative household-based survey, were used for this study. Multivariable logistic regression and Kulldorf’s scan statistics were used to identify the risk factors and HIV clusters. Socio-demographic characteristics were compared within and outside the clusters. HIV prevalence among the study participants was 25.1% (95% CI 23.3–26.4). HIV infection was significantly higher among the female gender, those older than 24 years and those reporting the use of condoms, while tertiary education had a protective effect. Two significant HIV clusters were identified, one located between Selibe-Phikwe and Francistown and another in the Central Mahalapye district. Clusters had higher levels of unemployment, less people with tertiary education and more people residing in rural areas compared to regions outside the clusters. Our study identified high-risk populations and regions with a high burden of HIV infection in Botswana. -

38678 10-4 Roadcarrierp Layout 1

Government Gazette Staatskoerant REPUBLIC OF SOUTH AFRICA REPUBLIEK VAN SUID-AFRIKA Vol. 598 Pretoria, 10 April 2015 No. 38678 N.B. The Government Printing Works will not be held responsible for the quality of “Hard Copies” or “Electronic Files” submitted for publication purposes AIDS HELPLINE: 0800-0123-22 Prevention is the cure 501272—A 38678—1 2 No. 38678 GOVERNMENT GAZETTE, 10 APRIL 2015 IMPORTANT NOTICE The Government Printing Works will not be held responsible for faxed documents not received due to errors on the fax machine or faxes received which are unclear or incomplete. Please be advised that an “OK” slip, received from a fax machine, will not be accepted as proof that documents were received by the GPW for printing. If documents are faxed to the GPW it will be the sender’s respon- sibility to phone and confirm that the documents were received in good order. Furthermore the Government Printing Works will also not be held responsible for cancellations and amendments which have not been done on original documents received from clients. CONTENTS INHOUD Page Gazette Bladsy Koerant No. No. No. No. No. No. Transport, Department of Vervoer, Departement van Cross Border Road Transport Agency: Oorgrenspadvervoeragentskap aansoek- Applications for permits:.......................... permitte: .................................................. Menlyn..................................................... 3 38678 Menlyn..................................................... 3 38678 Applications concerning Operating Aansoeke aangaande Bedryfslisensies:. -

Transport & Infrastructure Quarter 1 2021 Stats Brief

TRANSPORT & INFRASTRUCTURE QUARTER 1 2021 STATS BRIEF TRANSPORT & INFRASTRUCTURE, QUARTER 1, 2021 . STATS BRIEF 1 Published by STATISTICS BOTSWANA Private Bag 0024, Gaborone Tel: 3671300 Fax: 3952201 E-mail: [email protected] Website: www.statsbots.org.bw July 2021 Copyright © Statistics Botswana 2021 2 TRANSPORT & INFRASTRUCTURE, QUARTER 1, 2021 . STATS BRIEF TRANSPORT & INFRASTRUCTURE QUARTER 1 2021 STATS BRIEF TRANSPORT & INFRASTRUCTURE, QUARTER 1, 2021 . STATS BRIEF 3 INTRODUCTION This Stats Brief presents a summary of the latest Transport and Infrastructure Statistics for Quarter 1, 2021. It covers statistics relating to Air, Rail and Water Transport as well as Motor Vehicle Registrations. Aircraft movements increased by 3.6 percent in Q1 2021 from 4,306 movements recorded in the previous quarter. Domestic aircraft movements constituted 71.3 percent of the total, while international aircraft movements made up 28.7 percent. The volume of goods transported through rail this quarter went down by 11.6 percent. A total of P55.3 million was generated from the transportation of those goods, resulting in a decline of 12.0 percent from P62.8 million generated in the previous quarter Pontoon passengers increased from 17,268 in Q4 2020 to 19,254 in Q1 2021, registering an increase of 11.5 percent. Vehicles transported by the pontoon decreased by 11.0 percent from 14,308 in Q4 2020 to 10,254 in Q1 2021. For more information and further enquiries, contact the Directorate of Stakeholder Relations on +267 367 1300. This publication, and all other Statistics Botswana outputs/publications are available on the website at (http://www.statsbots.org.bw) and at the Statistics Botswana Information Resource Centre (Head-Office, Gaborone). -

World Bank Document

Public Disclosure Authorized BOTSWANA EMERGENCY WATER SECURITY AND EFFICIENCY PROJECTS UPDATED ENVIRONMENTAL AND SOCIAL IMPACT ASSESSMENT Public Disclosure Authorized FOR THE NORTH EAST DISTRICT AND TUTUME SUB DISTRICT WATER SUPPLY UPGRADING PROJECT Public Disclosure Authorized March 2019 Public Disclosure Authorized Updated Environmental and Social Impact Assessment for the North East District and Tutume Sub District Water Supply Upgrading Project Contents List of Tables ......................................................................................................................................................... v List of Figures ...................................................................................................................................................... vi list of Appendices ................................................................................................................................................ vii ABBREVIATIONS ............................................................................................................. VIII EXECUTIVE SUMMARY ...................................................................................................... X 1 INTRODUCTION ....................................................................................................... 1 1.1 Background to the Project ..................................................................................................................... 1 1.2 Project Rationale/Objective .................................................................................................................. -

Directory of Financial Institutions Operating in Botswana As at December 31, 2019

PAPER 4 BANK OF BOTSWANA DIRECTORY OF FINANCIAL INSTITUTIONS OPERATING IN BOTSWANA AS AT DECEMBER 31, 2019 PREPARED AND DISTRIBUTED BY THE BANKING SUPERVISION DEPARTMENT BANK OF BOTSWANA Foreword This directory is compiled and distributed by the Banking Supervision Department of the Bank of Botswana. While every effort has been made to ensure the accuracy of the information contained in this directory, such information is subject to frequent revision, and thus the Bank accepts no responsibility for the continuing accuracy of the information. Interested parties are advised to contact the respective financial institutions directly for any information they require. This directory excludes collective investment undertakings and International Financial Services Centre non-bank entities, whose regulation and supervision falls within the purview of the Non-Bank Financial Institutions Regulatory Authority. Lesedi S Senatla DIRECTOR BANKING SUPERVISION DEPARTMENT 2 DIRECTORY OF FINANCIAL INSTITUTIONS OPERATING IN BOTSWANA TABLE OF CONTENTS 1. CENTRAL BANK ..................................................................................................................................... 5 2. COMMERCIAL BANKS ........................................................................................................................... 7 2.1 ABSA BANK BOTSWANA LIMITED ........................................................................................................... 7 2.2 AFRICAN BANKING CORPORATION OF BOTSWANA LIMITED .................................................................. -

The Zambezi River Basin a Multi-Sector Investment Opportunities Analysis Public Disclosure Authorized

The Zambezi River Basin A Multi-Sector Investment Opportunities Analysis Public Disclosure Authorized V o l u m e 3 Public Disclosure Authorized State of the Basin Public Disclosure Authorized Public Disclosure Authorized THE WORLD BANK GROUP 1818 H Street, N.W. Washington, D.C. 20433 USA THE WORLD BANK The Zambezi River Basin A Multi-Sector Investment Opportunities Analysis Volume 3 State of the Basin June 2010 THE WORLD BANK Water ResouRces Management AfRicA REgion © 2010 The International Bank for Reconstruction and Development/The World Bank 1818 H Street NW Washington DC 20433 Telephone: 202-473-1000 Internet: www.worldbank.org E-mail: [email protected] All rights reserved The findings, interpretations, and conclusions expressed herein are those of the author(s) and do not necessarily reflect the views of the Executive Directors of the International Bank for Reconstruction and Development/The World Bank or the governments they represent. The World Bank does not guarantee the accuracy of the data included in this work. The boundaries, colors, denominations, and other information shown on any map in this work do not imply any judge- ment on the part of The World Bank concerning the legal status of any territory or the endorsement or acceptance of such boundaries. Rights and Permissions The material in this publication is copyrighted. Copying and/or transmitting portions or all of this work without permission may be a violation of applicable law. The International Bank for Reconstruction and Development/The World Bank encourages dissemination of its work and will normally grant permission to reproduce portions of the work promptly. -

September 2019 Upcoming Events the New School Year Has Started Amid Many Changes

Monthly Newsletter September 2019 Upcoming Events The new school year has started amid many changes. We are hold- ing labs and classes in the new Animal and Plant Sciences Center. The facility is comprised of a central building with seven state-of- ●9/2 Labor Day Holiday the-art labs, including a merchandizing lab, the Purple Tractor. ●9/5 Part Time Job Fair There is 42,000 sq. ft. of covered working space for livestock with pens, scales, working chutes, and an arena for class use that can be ●9/11 Lunch & Learn with Ross divided when the need arises. There are laboratory preparation areas, Veterinary School four greenhouses, and associated covered outdoor work spaces. Our students and faculty are busy making use of the new space. The ●9/16 Summer Camp Job Fair grand opening for the building will be homecoming day, Oct. ●9/18 MMI Workshop for Pre-Vet 19, 2019. We hope you can join us for this landmark occasion. DEAN’S CORNER ●9/20 Family Weekend Additional exciting news from the college is our significant investment in specialized ●9/25 Graduate & Professional technologies providing our faculty and students with the tools for a world-class educa- School Job Fair tion. These range from complex simulators, to drones with advanced capabilities, from robots, to advanced-capability video equipment, from feed analysis equipment, to ●9/26-28 National FFA Officer DNA, RNA, and protein imaging, from game cameras, to tracking collars, and much training more. We will be featuring several of these in the coming weeks on our Facebook page. -

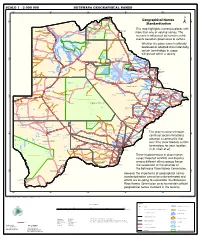

Geographical Names Standardization BOTSWANA GEOGRAPHICAL

SCALE 1 : 2 000 000 BOTSWANA GEOGRAPHICAL NAMES 20°0'0"E 22°0'0"E 24°0'0"E 26°0'0"E 28°0'0"E Kasane e ! ob Ch S Ngoma Bridge S " ! " 0 0 ' ' 0 0 ° Geographical Names ° ! 8 !( 8 1 ! 1 Parakarungu/ Kavimba ti Mbalakalungu ! ± n !( a Kakulwane Pan y K n Ga-Sekao/Kachikaubwe/Kachikabwe Standardization w e a L i/ n d d n o a y ba ! in m Shakawe Ngarange L ! zu ! !(Ghoha/Gcoha Gate we !(! Ng Samochema/Samochima Mpandamatenga/ This map highlights numerous places with Savute/Savuti Chobe National Park !(! Pandamatenga O Gudigwa te ! ! k Savu !( !( a ! v Nxamasere/Ncamasere a n a CHOBE DISTRICT more than one or varying names. The g Zweizwe Pan o an uiq !(! ag ! Sepupa/Sepopa Seronga M ! Savute Marsh Tsodilo !(! Gonutsuga/Gonitsuga scenario is influenced by human-centric Xau dum Nxauxau/Nxaunxau !(! ! Etsha 13 Jao! events based on governance or culture. achira Moan i e a h hw a k K g o n B Cakanaca/Xakanaka Mababe Ta ! u o N r o Moremi Wildlife Reserve Whether the place name is officially X a u ! G Gumare o d o l u OKAVANGO DELTA m m o e ! ti g Sankuyo o bestowed or adopted circumstantially, Qangwa g ! o !(! M Xaxaba/Cacaba B certain terminology in usage Nokaneng ! o r o Nxai National ! e Park n Shorobe a e k n will prevail within a society a Xaxa/Caecae/Xaixai m l e ! C u a n !( a d m a e a a b S c b K h i S " a " e a u T z 0 d ih n D 0 ' u ' m w NGAMILAND DISTRICT y ! Nxai Pan 0 m Tsokotshaa/Tsokatshaa 0 Gcwihabadu C T e Maun ° r ° h e ! 0 0 Ghwihaba/ ! a !( o 2 !( i ata Mmanxotae/Manxotae 2 g Botet N ! Gcwihaba e !( ! Nxharaga/Nxaraga !(! Maitengwe